Paragraph 55(2.1)(b)

See Also

101139810 Saskatchewan Ltd. v. The Queen, 2017 TCC 3

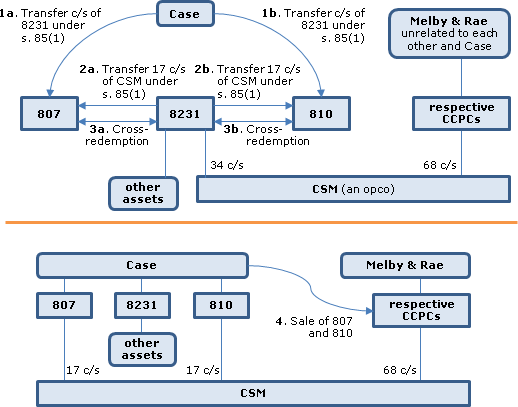

Mr. Case (“Case”), held 34 of the 102 common shares of an operating corporation (“CSM”) through a personal holding company (“8231”), which also held $1.3 million in other assets. In order to accomplish a sale of his indirect CSM shareholding to the other unrelated indirect shareholders of CSM (Messrs. Melby and Rae, each also holding 34 common shares through a personal holding company), that shareholding was split between two new wholly-owned corporations of Case (“807” and “810”), essentially using butterfly mechanics, with Case then selling his shares of 807 and 810 to the personal holding companies of Melby and Rae, respectively. In somewhat greater (but still simplified) detail:

- Case transferred a portion of his shares (having a nominal adjusted cost base) of 8231 to each of the newly incorporated 807 and 810 on an s. 85(1) rollover basis in exchange for treasury shares;

- 8231 transferred 17 common shares of CSM to each of 807 and 810 on an s. 85(1) rollover basis in exchange for treasury shares;

- 807 and 8231 each redeemed the shares in its capital held by the other for a $1.3 million promissory note, and the set-off the two promissory notes; and similarly for 810 and 8231; and

- on the sale of 807 and 810 about three weeks later to the personal holding companies of Melby and Rae, respectively, Case realized capital gains of $2.6 million and, in his return, deducted the remaining amount of his capital gains deduction of $0.24 million.

Initially, CRA reassessed both 807 and 810, and 8231, under s. 55(2) respecting the s. 84(3) deemed dividends reported by them respecting the cross-redemptions in 3 above, but 15 months later, vacated the reassessment of 8231. Furthermore, each of 807 and 810 was allowed a safe income deduction of $564,246.

In dismissing the appeals of 807 and 810, Favreau J rejected their submission (at para. 22) that as the full “unrealized appreciation” in question had been realized by Case, it was contrary to s. 55(2) to also assess 807 and 810 for that gain, stating (at paras. 26, 76):

[I]t is clear from a plain and ordinary reading of subsection 55(2) that this provision is meant to apply to a corporation and not to an individual shareholder and thus, the capital gains realized by Mr. Case has no relevance in the analysis. Furthermore, I do not agree with the appellants’ proposed approach of looking at the transactions in their entirety in determining if the result of a deemed dividend was a reduction in capital gains as it goes beyond the wording of the provision. To accept the Appellants’ approach would be to ignore the reduction of the notional capital gain as a result of an 84(3) deemed dividend, which is contrary to the words of subsection 55(2). …

I am inclined to favour a narrow construction of double taxation such that it arises where the same amount is taxed in the hands of the same person. Mr. Case and the appellants are not the same persons.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(5) - Paragraph 55(5)(f) | 55(5)(f) designation may be made after assessment under s. 55(2) | 278 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(28) | taxation of same appreciation at individual shareholder level and corporate level under s. 55(2) was not double taxation | 295 |

Administrative Policy

3 December 2024 CTF Roundtable Q. 2, 2024-1038191C6 - Subsection 55(2) and Intra-Corporate Dividends

When asked to provide any update on the application of s. 55(2) to ordinary course intra-group dividends, CRA indicated:

- Consistent with 2015-0613821C6, 2016-0627571E5 and 2018-0761561C6, CRA was open to consider a ruling request involving the determination of the purpose where all manifestations of purpose in the circumstances supported the absence of the purposes described in s. 55(2.1)(b) and the taxpayer represents that there is no such purpose.

- Where a taxpayer request relates to safe income (so that reliance is not being placed on the s. 55(2.1)(b) purpose tests), taxpayers have needed to manage the safe income determination time notion (of a series with respect to the safe income exception in 55(2.1)(c).)

2 November 2023 APFF Roundtable Q. 2, 2023-0982751C6 - Meaning of purpose tests in paragraph 55(2.1)

A corporation resident in Canada ("Parent") owning 100% of "Target" accepts an offer from an unrelated third party ("Purchaser") to purchase all of the Target shares for $3 million, with the sale agreement specifying that assets which Purchaser does not wish to acquire ("Excluded Assets") are assigned a value of zero. The ACB of the Target shares is $3 million and the safe income attributable to them is nil.

Immediately prior to its sale to Purchaser, Target pays a dividend in kind of $250,000 (the "Dividend") to Parent by transferring an Excluded Asset to Parent.

CRA rejected a suggestion that since, whether or not the Dividend was paid, the value of the Target shares would be $3 million, and the capital gain would be nil, s. 55 could not apply. It stated:

Considering that the FMV of shares in the capital stock of Target would be reduced as a result of the payment of the Dividend, it is necessary to determine whether one of the purposes for which the Dividend was paid was to significantly decrease the FMV of a share in the capital stock of Target, in light of, among other things, the answers that would be given to the following questions:

- What does Parent intend to accomplish by decreasing the value of shares in the capital stock of Target?

- How does the reduction in the value of the shares of the capital stock of Target benefit Parent?

- What actions has Parent taken in connection with the reduction in value of the shares of the capital stock of Target?

In addition, the CRA generally considers that the Purpose Tests [in ss. 55(2.1)(b)(i) and (ii)] could apply to a dividend paid by an operating company to its corporate shareholder in order to dispose of surplus assets for the purpose of the purification and subsequent sale of [its] shares … 2017-0724021C6 … .

… [T]he payment of the Dividend and the Sale are part of the same series … . In light of the parameters established by the CRA and the applicable approach for purposes of applying the Purpose Tests, it seems difficult to argue that none of the purposes of the payment or receipt of the Dividend is to significantly decrease the FMV of the shares of the capital stock of Target.

Consequently, subsection 55(2) should likely apply … .

7 October 2022 APFF Roundtable Q. 14, 2022-0942191C6 F - Safe-income determination time

A purchaser incorporated a Buyco to acquire the assets of the vendor corporation and then, a few weeks later, the net asset proceeds on the closing of the sale were dividended by the vendor to its corporate shareholders. Did Buyco’s incorporation trigger a "safe-income determination time" such that the taxable income from the sale was not included in computing safe income, thereby resulting in a capital gain on the associated dividend of that taxable income? CRA responded:

Assuming that the incorporation of the corporation is part of the same series of transactions that may create an increase in the total direct interest in a corporation of an unrelated person, we agree that the "safe income determination time" defined in subsection 55(1) could be the time after that first increase in interest.

However, practical solutions to these types of technical issues exist and therefore the CRA does not consider that a flexible approach is necessary in the[se] circumstances … .

As to whether safe income from the sale would be permanently lost, CRA stated:

If the safe income from the sale of the assets is not included in safe income for the purposes of the dividend paid following the sale, this safe income is generally not lost and may be used in the subsequent payment of dividends to the extent that such subsequent dividends are not part of the same series of transactions as the sale of the assets.

CRA further indicated:

[I]n situations of a total sale of assets of a corporation followed by a winding-up dividend pursuant to subsection 88(2), the CRA would be prepared to consider, after a detailed analysis of a file, that the subject matter of the dividend would not fall within paragraph 55(2.1)(b).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(1) - Safe-Income Determination Time | incorporation of Buyco may trigger safe-income determination time | 383 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(10) | safe income arising on a sale and after the safe-income determination time could be used for subsequent dividends not paid as part of the same series | 156 |

2020 Ruling 2020-0840631R3 F - Purpose Test in Subsection 55(2)

Background

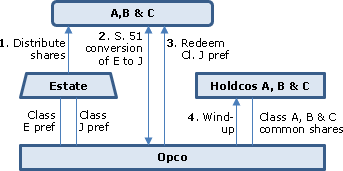

After the death of Father, his estate (whose equal beneficiaries are his surviving children, A, B and C) holds Class E and J preferred shares of Opco (which had recently sold all its marketable securities and holds only cash), whereas Opco’s voting participating Class A, B and C shares are held respectively by Holdcos A, B and C, which are respective Holdcos for A, B and C and their respective family trusts and (in the case of Holdco A) A's children.

Proposed transactions

- The estate will distribute its Class E and J shares equally to A, B and C.

- A, B and C will exchange their Class E shares under s. 51(1) for Class J shares.

- Opco will redeem all the Class J shares for $1.00 per share. No deemed dividend will arise since the PUC will also be $1.00 per share.

- Holdcos A, B and C will pass a special resolution for the winding-up of Opco. On the winding-up, Holdcos A, B and C will be deemed to have received dividends pursuant to ss. 88(2)(b) and 84(2) equaling the excess of the amount distributed on their Class A, B or C shares over those shares’ PUC, which dividends will be designated by Opco under s. 89(14) as eligible dividends.

- Any dividend refund generated by Opco will be distributed equally.

- Thereafter, Articles of Dissolution will be filed.

Additional information

Each s. 84(2) dividend described above will not significantly reduce the capital gain that, but for that taxable dividend, would have been realized on a disposition of a share of Opco at FMV immediately before such dividend.

Rulings

Regarding computation of deemed dividend under ss. 88(2)(b) and 84(2), and non-application of ss. 55(2) and 245(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(2) - Paragraph 88(2)(b) | deemed ss. 88(2)(b) and 84(2) dividends on winding-up into three Holdcos | 116 |

27 October 2020 CTF Roundtable Q. 1, 2020-0860991C6 - ACB increase due to misalignment of ACB

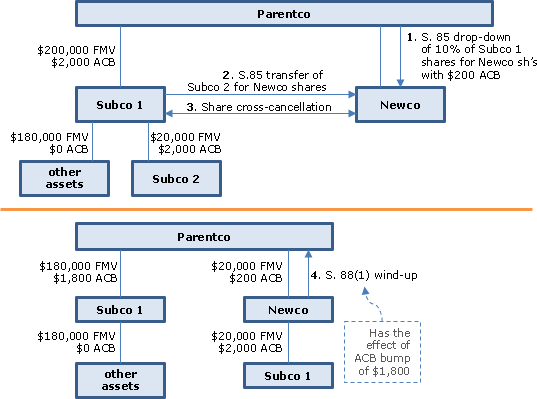

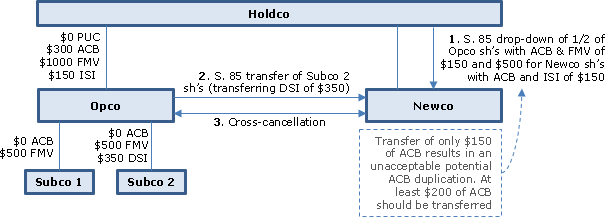

Parentco holds shares of a wholly-owned subsidiary (Subco1) with a fair market value (“FMV”) and adjusted cost base (“ACB”) of $200,000 and $2,000, respectively. Subco1 held a subsidiary (Subco1) whose shares had an FMV and ACB of $20,000 and $2,000, respectively. Subco2 is spun-off to a newly-incorporated subsidiary of Parentco (i.e., Parentco transfers 10% of its shares of Subco1on an s. 85 rollover basis to Newco for Newco shares, Subco1 transfers its Subco2 shares on an s. 85 rollover basis to Newco for Newco shares, and the cross-shareholdings are cross-redeemed) as a result of which Parentco’s shareholding in Newco now had an FMV and ACB of $20,000 and $200, respectively. On an s. 88(1) winding-up of Newco, Parentco acquired the shares of Subco2 at a cost (under s. 88(1)(c)) of $2,000 (i.e., an $1,800 increase over the $200 ACB that it had for its shares of Newco).

Is CRA concerned by this $1,800 increase in the ACB of the assets of Parentco?

CRA indicated that the transfer of the Subco1 shares by Parentco causes a misalignment between outside and inside basis, so that the reorganization, followed by the winding up of Newco, results in what CRA considers as an inappropriate tax benefit.

In situations like the one described, CRA would not rule favourably and would consider applying the GAAR, because there is an undue increase in the hands of Parentco that is contrary to the scheme of the Act, and, more specifically, of s. 55(2).

CRA then referred to an alternative reorganization where, there was an arrangement of the transactions such that, upon the winding-up of Newco into Parentco under s. 88(1), the outside basis in Newco ($2,000) matches the inside basis (a $2,000 ACB of the shares of Subco2 to Newco). In that situation, there could be a favourable ruling because Parentco thus had transferred enough ACB in the shares of Subco 1 to Newco to cover the ACB of the assets that were then transferred by Subco 2 to Newco. This would result in an alignment of the outside and inside basis.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | duplication of ACB is abusive | 217 |

9 May 2018 CPA Roundtable Q. 11, 2018-0765271C6 - Application of 55(2)

What guidance can be provided on the purpose test? Is there a CRA audit manual that could be made available? CRA responded:

A favourable ruling could be provided where all manifestations of purpose and corroborating circumstances support the absence of one of the purposes described in paragraph 55(2.1)(b). The ruling would be conditional on the representation made by the taxpayer that the purposes for which the dividend was paid do not include one of the purposes described in paragraph 55(2.1)(b) and on the completeness of the description of all the manifestations of such purpose and corroborating circumstances. However, other than rulings on loss-consolidation, the CRA has not been deluged by requests for rulings on this topic.

Respecting the second question, CRA stated that the “Manual used … [in] audits of small and medium-sized businesses does not contain any information on the application of subsection 55(2) and the purpose test, in particular.”

5 October 2018 APFF Financial Strategies and Instruments Roundtable Q. 5, 2018-0761561C6 F - Rachat de parts en cas d’invalidité

Messrs. A and B wholly-own Holdco A and B, respectively, each of which, in turn, holds half of the Class B shares of Opco having an FMV of $500,000. Messrs. A and B also each hold half of Opco’s Class A shares having in each case an FMV of $1,000,000. Opco holds an insurance policy that pays out in part in the event of disability. In the case of disability of either individual, Opco will receive the proceeds of the policy covering such event in order to then pay a special dividend of $1,000,000 to the Holdco of the active shareholder to fund the purchase by the latter of the shares held directly by the disabled individual – with Opco then redeeming shares held by the purchased Holdco of the disabled individual for $500,000.

After indicating that there was insufficient information to provide more than a general discussion of the purpose tests in ss. 55(2.1)(b)(i) and (ii), CRA noted that, in 2015-0613821C6, it indicated that it could issue a favourable advance ruling on a determination of purpose “where all manifestations of purpose and corroborating circumstances support the absence of one of the purposes described in subparagraph 55(2.1)(b)(ii) and (ii)” with such determination “conditional on the representation made by the taxpayer that the purposes for which the dividend was paid do not include one of the purposes described in proposed paragraph 55(2.1)(b)(i) and (ii) … .”

CRA then stated:

Although in certain circumstances the dividend paid by Opco to the holding corporation of the active shareholder may not be considered to have any of the purposes described in paragraph 55(2.1)(b), that determination can only be made after a review of all the facts of a particular situation.

2016 Ruling 2016-0652041R3 - Loss consolidation arrangement

Respecting a triangular loss-shifting arrangement for the shift of non-capital losses by Parentco to its wholly-owned Profitco (with Profitco using the proceeds of an interest-bearing loan from Parentco to subscribed for preferred shares of a Newco subsidiary of Parentco, with dividends on such shares being funded with contributions of capital from Parentco), CRA ruled that s. 55(2) would not apply to the dividends paid by Newco to Profitco to fund the interest on the loan by Parentco to Profitco, based on a representation that:

The only purpose of both the payment and the receipt of the dividends on Newco’s Preferred Shares … is to provide a reasonable return on the Newco Preferred Shares issued by Newco to Profitco. More specifically, none of the purposes of the dividends is to reduce the fair market value or capital gain of any share, nor to increase the total cost amounts of properties of Profitco.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 111 - Subsection 111(1) - Paragraph 111(1)(a) | standard triangular loss shift with annual funding of dividends and interest, cashless unwind with set-off and provincial GAAR and s. 55(2) rulings | 250 |

21 November 2017 CTF Roundtable Q. 5, 2017-0726381C6 - 55(5)(f) and 55(2.3) with 55(2.1)

Opco pays a dividend of $1,000 to Holdco. Its shares had a pre-dividend fair market value of $1,500. As the safe income that can reasonably be viewed as contributing to gain on Opco shares was $900, does s. 55(5)(f) deem two separate dividends of $900 and $100? Are both dividends separately tested under s. 55(2.1), so that the $900 is exempt as not exceeding safe income, and the $100 is exempt if its purpose is not to significantly reduce the gain or the value of the shares on which it is paid?

CRA indicated that under the old s. 55(2) regime, it was well understood that the purpose test applied to the whole dividend, so that the s. 55(5)(f) only required the inclusion under s. 55(2) of the portion of the dividend exceeding safe income. The new rules did not change this. The contrary interpretation would results in duplication of the safe income protection, and contrary to the s. 55(5)(f) purpose of bringing into income the amount by which the dividend exceeds safe income.

Under an appropriate purposive reading, the dividend referred to in:

- the s. 55(2.1) preamble and in ss. 55(2.1)(a) and (b) is the whole $1000;

- s. 55(2.1)(c) is the portion exceeding safe income ($100);

- the s. 55(2) preamble is the whole $1000; and

- the s. 55(2) preamble that is deemed not to be a dividend but to be a gain, is the s. 55(2.1)(c) amount ($100).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.3) | dividend bifurcation under s. 55(2.3) does not detract from s. 55(2.1) purpose tests being applied to whole dividend | 160 |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(5) - Paragraph 55(5)(f) | bifurcated dividends are one dividend for s. 55(2.1)(b) purpose test but not under s. 55(2.1)(c) | 102 |

21 November 2017 CTF Roundtable Q. 3, 2017-0724021C6 - Meaning of purpose

2016-0658841E5 indicates that paying a dividend of surplus assets with the goal of purifying the corporation for “qualified small business corporation share” (QSBCS) purposes would be a relevant factor that should be taken into account, but that it should be ensured that the dividend has no other purpose described in paragraph 55(2.1)(b) so that, for example, if the dividend paid to the corporation exceeds the amount that would be required to transfer the surplus assets, this could be a sign that the dividend has another purpose.

Q.(a)

If the dividend’s only purpose is to maintain QSBCS status, the dividend should not have a purpose (but might have the result) of reducing the FMV or the gain on the shares. In this situation, would CRA agree that the purpose tests are not met?

CRA indicated that whether the payment of a dividend can be viewed as having only the purpose of maintaining QSBCS status, but has no purpose of reducing the value of the gain on the share or increasing the cost of property to the dividend-recipient, is a factual determination. It went on to indicate that where the dividend is paid with non-surplus assets, that may signify that it has a purpose referenced in s. 55(2.1)(b), and that another such sign could be where the removal of a surplus asset is made in contemplation of the disposition of the shares of a corporation.

CRA went on to question why on the facts there was no safe income corresponding to the surplus assets.

Q.(b)

Is the test under Ludco the right test to use to determine “purpose” as contrasted to that in Placer Dome?

After quoting the statement in Ludco that “courts should objectively determine the nature of the purpose, guided by both subjective and objective manifestations of purpose,” CRA indicated that Ludco followed the purpose test in Symes, and the Symes/ Ludco test (consistently with many other decisions) constitutes the benchmark of purpose. In both Placer Dome, and McAllister Drilling referenced therein, the Court determined the purpose of the taxpayers by not only listening to their testimony, but also by examining all the facts, so that neither contradicts Ludco and Symes.

6 April 2017 External T.I. 2016-0658841E5 F - Purpose tests and Allocation of safe income

The participating and non-voting Class AA shares of Opco, which were held equally by two unrelated individuals (A and B), were worth $500,000 and had a safe income of $300,000 on January 1, 2016, and had a nominal paid-up capital and adjusted cost base. Nominal-value voting shares of Opco were held by Holdco, which was owned equally by A and B. On January 1, 2016, Holdco also subscribed $100 for 100 Class X shares of Opco, which were entitled to participate annually in Opco’s profits proportionately with the number of issued and outstanding AA and X shares and with the shares' redemption value reflecting the undistributed amount of such profits plus their initial subscription price.

On December 31, 2016, Opco had accumulated $100,000 in after-tax profits and safe income, and on January 1, 2017, Opco paid a dividend of $50,000 to Holdco pursuant to a strategy of eliminating excess liquidity in Opco in order to qualify the Class AA at all times for the capital gains deduction and also for asset protection purposes, thereby causing the Class X shares’ redemption value to decrease to $100.

Q.1:

Would the purpose of the transactions be to reduce a capital gain or reduce the market value of a share as described in s. 55(2.1)(b)? CRA responded:

[P]aying a dividend with the goal of [so] purifying the corporation…would certainly be a relevant factor that should be taken into account. However, it also should be ensured that the dividend has no other purpose described in paragraph 55(2.1)(b). For example, if the dividend paid to the corporation exceeds the amount that would be required to transfer the surplus assets, this could be a sign that the dividend has another purpose, which was one of those referred to in paragraph 55(2.1)(b).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | safe income was allocated between 2 classes of participating shares pro rata to their dividend entitlements | 812 |

13 June 2017 STEP Roundtable Q. 6, 2017-0693411C6 - GAAR on share redemption-55(3)(a)

In 2015-0604521E5, a promissory note issued to Holdco on a share redemption was subsequently transferred to Newco as a capital contribution. Since the amount of the promissory note was higher than the ACB of the redeemed shares and increased Holdco’s ACB of the shares of Newco, CRA indicated that it would seek to apply GAAR to Holdco’s reliance on s. 55(3)(a).

Is a subsequent transaction to use the note (or other property, including cash, received as consideration for a share redemption), such as the above transfer of the note to Newco, a necessary trigger for GAAR to be so applied, i.e., could the receipt of a note with a high ACB in itself cause GAAR to apply?

CRA indicated that where a purpose is to increase the cost amount of property of the dividend recipient, GAAR would be triggered, and it is irrelevant whether the cost amount has been used in a series of transactions that includes the dividend.

13 June 2017 STEP Roundtable Q. 7, 2017-0693421C6 - 55(2) and pipeline planning

On death, an estate receives shares of an investment holding company (H1), and then immediately structures a pipeline under which the H1 shares are transferred to H2 for a note - with the H1 shares of H2 then being redeemed. Could s. 55(2) apply? Would the starting safe income to the estate be nil?

CRA indicated that because there would be no capital gain if those shares were disposed of for fair market value proceeds immediately before the redemption, the redemption of shares of H1 would not result in a reduction of any gain. Also, the purpose test in s. 55(2.1)(b)(ii) does not apply to a dividend that is deemed to be received under s. 84(3). Here, the cost amount of the property is the same before and after the redemption, and the reduction of the fair market value of the shares being redeemed does not result in any deductible loss to H2. The CRA would not seek to apply GAAR in this situation.

Accordingly, the deemed dividend on the redemption would not be subject to s. 55(2) or the application of GAAR - and there is also no carry over of safe income, since the safe income has already been crystallized in the ACB of the shares.

29 November 2016 CTF Roundtable Q. 8, 2016-0671501C6 - 55(2) clause 55(2.1)(b)(ii)(B)

Is cash considered to be property for purposes of the application of s. 55(2.1)(b)(ii)(B)?

CRA indicated that it is contrary to the scheme of the Act to allow for a tax-free increase in costs, and that there is a lack of tax integration where a corporate shareholder receives, as a non-taxable dividend, property whose cost exceeds the amount on which tax has been paid. After also noting that (consistent with the s. 248(1) definition of property) cash, i.e., money, is property , CRA also noted that cash received on a dividend can be used to purchase any other property or even additional shares of the dividend payor, and this results in an increase in the cost amount of the shares of the dividend payor.

Accordingly, cash is property for this purpose.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Property | cash is property for s. 55(2.1)(b) purposes | 57 |

7 October 2016 APFF Roundtable Q. 14, 2016-0655921C6 F - Safe income on hand - Preferred shares

Respecting the payment of a non-participating dividend to a holding company on preferred shares whose paid-up capital and ACB equals their redemption amount, CRA indicated that “the hypothetical capital gain that would have been realized on a FMV disposition of [the] preferred shares immediately before the dividend…would be nil,” so that the dividend would not be considered to come out of safe income on hand. Since the safe income harbour was not available, whether s. 55(2.1)(b) applied was a question of fact.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | fixed dividends on full-ACB prefs did not come out of SIOH | 140 |

23 June 2016 External T.I. 2016-0627571E5 - Application of proposed amendments to section 55

Divco, a Canadian-resident corporation with Canadian corporate shareholders, pays cash dividends from its excess cash-flow to its shareholders whose amount is determined in the Board’s discretion or which exceeds the reasonable dividend return that would be paid on a comparable listed share issued by a comparable corporation in the same industry and which, in either case, will significantly reduce Divco’s fair market value and are not paid out of safe income. Would the dividends’ purpose be as described in s. 55(2.1)(b)? CRA responded:

None of the factors listed [above] would, in and of themselves, be determinative of whether one of the purposes of the payment or receipt of a dividend is described in proposed paragraph 55(2.1)(b). …[T]he safe income of [Divco] would be less than its retained earnings… because [it] was entitled to tax benefits such as accelerated capital cost allowances that significantly reduced its income under the Act. … If corporate income has not previously been taxed, whether because the corporation was entitled to certain tax benefits under the Act or for any other reason, then a dividend paid by the corporation from such income should be subject to subsection 55(2) unless none of the purposes of the dividend is described in proposed paragraph 55(2.1)(b). The same comments would also apply in a situation where a corporation borrows money to pay a dividend or to redeem shares of its capital stock. ...

After also stating respecting dividends paid by Divco subsidiaries that “there is no consolidated approach in determining whether the purpose tests are met,” and that “year-end dividends that are only designed to offset intercorporate advances made under conventional cash pooling arrangements might not be considered to have [such] a purpose,” CRA was then asked about a scenario where Divco regularly or infrequently pays dividends on its non-cumulative preferred shares. CRA responded (before adding cautions):

[W]e assume that the redemption value of the preferred shares of Divco is equal to the fair market value of the consideration received by Divco upon the issuance of the shares. In addition, we assume that the dividend rate on the preferred shares reflects a reasonable dividend income return on equity on a comparable listed share issued by a comparable payer corporation in the same industry as Divco. In this context, it is our view that the terms and conditions of the preferred shares of Divco would generally be considered as an objective manifestation of the absence of purpose in proposed paragraph 55(2.1)(b).

Respecting a redemption of the preferred shares, CRA stated:

[W]e would normally not consider such redemption of shares that have no accrued gain to have such a purpose. Where there is an accrued gain on shares redeemed by a corporation, the absence of a reinvestment of the redemption proceeds in the corporation or of transfer of property to the corporation is not, by itself, conclusive in determining whether none of the purposes described in proposed paragraph 55(2.1)(b) exists.

2015 Ruling 2014-0552871R3 - Split-Up Butterfly

In connection with the butterfly split-up of DC equally between the family holding companies (Shareholder1 and Shareholder2) for two unrelated families, the shares of Subco2, which might be a significant subsidiary of DC, are split 50-50 between the two transferee corporations (TC1 and TC2) on the butterfly, then TC1 sells its shares of Subco2 to TC1 for FMV consideration.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(1) - Distribution | post-butterfly sale of distributed shares by TC1 to TC2/disproportionate split of CDA/assumption of prepaid rent (for which a 20(24) election) treated as boot | 773 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(24) | deferred revenue treated as boot | 53 |

8 June 2016 CTF Technical Seminar: Update on s. 55(2)

Comments of Yves Moreno and Annie Mailhot-Gamelin (both with the Income Tax Rulings Directorate) on the proposed s. 55(2) rules included:

- The integration principle is key to CRA’s thinking about safe income and s. 55(2), (so that the role of s. 55(2) is “is to ensure that corporate tax is paid, but that at the same time that there is no duplication of corporate taxes”) and, conversely, “the concept of safe income is one of the pillars of integration.”

- The changes to s. 55(2) were meant to address the type of planning raised by D & D Livestock, where ACB is created (without being caught by existing s. 55(2) because there was no gain on the shares in question). In particular, new s. 55(2) “now would address circumstances where the purpose of the dividend is to either reduce the value of a share…or to increase the cost of the property in the hands of the dividend recipient…” (with both elements being present in the D&D-style planning).

- For the new rules to apply, there is no requirement that a sale occur as part of the same series of transactions. In this regard, the policy is similar to the boot rules, where excess boot will produce an immediate gain even if there is no plan to use the additional basis.

- CRA previously provided comfort (in 2015-0613821C6) on the non-application of s. 55(2.1)(b) to dividends paid as part of a corporation’s standard practice of paying regular quarterly or annual dividends. CRA now indicated that the rationale is that “it is doubtful that the dividend would significantly reduce the fair market value or the gain on shares,” and that, in any event, “it is difficult to imagine that one of the purposes of the dividends would be to achieve that.” CRA rejected calling this position a “safe harbour,” stating that “the analysis of every dividend will involve its own set of facts and circumstances.” Similarly, there can be no automatic exemptions for other common dividend transactions such as funding general current expenses of a parent or settling intragroup debt resulting from cash pooling arrangements.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | safe income appropriately reduced by incentive reductions | 31 |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(1) - Distribution | butterfly rulings may require amending discretionary shares | 52 |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.5) | significant reduction in value of nominal value share | 90 |

21 December 2015 External T.I. 2015-0617731E5 F - 55(2) and creditor proofing

Holdco holds all the shares of Opco, which have a fair market value (“FMV”) of $1M and an adjusted cost base (“ACB”) of $100. Opco (which carries on a construction business) has retained earnings of $1M and no safe income is attributable to Holdco’s shares of Opco.

“With the sole purpose of protecting its assets from the risks inherent in the construction sector,” Opco paid a $1M dividend to Holdco, which was not subject to Part IV tax and for which Holdco took a $1M s. 112(1) deduction, with Holdco lending the sum back to Opco. Holdco had no intention of selling the Opco shares, and the Opco shares were not redeemed etc. on the dividend payment.

Would s. 55(2) and draft s. 55(2.1)(b)(ii) apply to deem the dividend to be a gain from the disposition of capital property? CRA responded (TaxInterpretations translation):

It appears to us that one of the purposes of the payment of the dividend was to effect a significant reduction in the FMV of a share in the capital of the operating company when the purpose of the transaction was to shelter from creditors the assets of a corporation carrying on a business or to secure those assets by diminishing the total value of the operating corporation and augmenting the value of its shareholder (the holding company)… .

In the facts indicated by you, there was no safe income attributable to the shares in the capital of Opco, held by the holding company, even though the shares in the capital of Opco held by Holdco had an ACB of $100, an FMV of $1M and the retained earnings were $1M. We would have thought that on these assumptions, there would be an amount of safe income on hand which it was reasonable to consider as contributing to a capital gain which would have been realized on a disposition at FMV, made immediately before the dividend, of the shares held by Holdco on which the dividend was received.

However, on the assumption indicated by you respecting safe income, subsection 55(2) would apply to the amount of the dividend. This amount would be deemed not to be a dividend…[and] would be deemed to be a capital gain from the disposition of capital property by virtue of paragraph 55(2)(c).

3 December 2015 External T.I. 2015-0593941E5 F - Allocation of the safe income on hand

CRA declined to express a view as to whether an $8,000 reduction in an accrued capital gain of $120,000 was significant. A $50,000 dividend received by two Holdcos from Opco (with no indication of the total FMV of all the shares) would be considered to be significant.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | flexible allocation of SIOH where discretionary common shares | 1317 |

| Tax Topics - General Concepts - Fair Market Value - Shares | FMV of discretionary share increased at moment of dividend declaration to exclusion of other discretionary shares | 94 |

17 November 2015 Roundtable, 2015-0613821C6 - TEI question on section 55

TEI members remain concerned that, because all dividends result in a reduction of the fair-market value of shares held by the dividend payor and increase the cost of properties held by the dividend recipient, the CRA may try to reassess ordinary course dividends on the basis that a purpose of every dividend is a tainted purpose. Comments? CRA responded:

The "significant" aspect could be measured in terms of an absolute dollar amount or on a percentage basis.

…[A] dividend that is directly or indirectly instrumental in the creation of an accrued loss on any share that may be used, or has the potential to be used, to shelter a gain on some other property provides an indication that the FMV reduction purpose exists (for example, one might consider transferring a property with an accrued income or capital gain to the corporation that issued shares that have an accrued loss). Also, the use or possibility of using an increased cost amount of properties to shelter a gain is an indication that the purpose of the dividend is to increase cost.

Where a dividend is paid pursuant to a well-established policy of paying regular dividends and the amount of the dividend does not exceed the amount that one would normally expect to receive as a reasonable dividend income return on equity on a comparable listed share issued by a comparable payer corporation in the same industry, the CRA would consider that the purpose of the payment of such dividend is not described in proposed paragraph 55(2.1)(b).

24 November 2015 CTF Annual Roundtable, Q.10

Points respecting proposed s. 55(2.1)(b)(ii) included:

- The purpose test in s. 55(2.1)(b)(ii) could apply even if the dividend does not satisfy the purpose in proposed s. 55(2.1)(b)(i) (i.e., there is no gain on the shares)

- “Whether a reduction of value is significant is a question of fact and could be measured in terms of an absolute dollar amount or on a percentage basis.”

- “in-house loss consolidations that were only designed to move losses between related or affiliated corporations and on which we have ruled favourably in the past would not be considered to have a purpose described in proposed subsection 55(2.1). An indication that such purpose is absent in similar loss consolidations is that any ACB that is created in the loss consolidation is eliminated on the unwind of the loss consolidation structure."

- Where a non-participating discretionary shares has no accrued gain, then a dividend paid thereon which violates the purpose test cannot benefit from safe income. However, where this occurs, CRA is prepared to accept that the safe income on the participating shares of the same corporation will not be affected.

- CRA considers it to be offensive to redeem a share for a note in a s. 55(3)(a) reorganization, with the note being used to generates basis in excess of redeemed shares’ ACB.

- Also offensive is "ACB streaming prior to a reorganization under 55(3)(a) or (b), where the redemption would be of low-ACB shares, while the high ACB shares would be preserved."

- Creditor-proofing transactions apparently are considered to per se entail a purpose that engages s. 55(2.1)(b)(ii).

In related oral comments, CRA indicated that "normal course" dividends (albeit with a narrow description of the only clear safe harbour) should not be subject to the new rules and that it is willing to issue opinions (and presumably rulings, once the new rules are enacted) on the non-application of s. 55(2.1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(5) - Outstanding Debts to Specified Non-Residents | foreign-currency debt to Canco translated at historical rate | 36 |

2015 Ruling 2015-0604071R3 - Loss Consolidation Arrangement

Profitco is wholly-owned by Lossco, which is wholly owned by Parent. Profitco borrows from Profitco (at an interest rate reflecting the loan’s subordinated status) and subscribes for non-voting cumulative redeemable retractable preferred shares of Lossco. Parent will agree, in a support agreement with Lossco, to make capital contributions to fund Lossco’s payment of the dividends, which will occur on the unwinding of the transactions.

CRA provided an opinion that, after giving effect the July 31, 2015 draft amendments, s. 55(2) will not apply to this dividend.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 111 - Subsection 111(1) - Paragraph 111(1)(a) | loss shift entailing Profitco subscribing for prefs of its Lossco parent, with dividends paid pursuant to support agreement/prefs redeemed wih note | 254 |

9 October 2015 APFF Roundtable Q. 12, 2015-0595601C6 F - Proposed legislation - subsection 55(2)

Holdco holds shares of Opco with a nominal ACB and no safe income. In a corporate reorganization "aimed at protecting the assets of Opco, whose purpose is to reduce the fair market value (FMV) of Holdco’s shares in Opco," Holdco lends money to Opco equal to the accrued gain on the shares (of $1M), and receives that money back as an actual $1M dividend (targeted to be tax-free). It does not matter if this transaction has no capital gains avoidance purpose. CRA accepted that since the purpose of the creditor-proofing is to reduce the fair market value of the Opco shares, the full amount of the dividend is deemed to be a capital gain.

Under a variation of the first alternative, the shares of Opco have full ACB (of $1M) and also safe income on hand of $1M. CRA indicated that this assumption that the safe income attributable to the shares of Opco held by Holdco was equal to the amouont of the dividend received was "surprising," stating "by way of example, the cost could reflect the accumulated safe income before an acquisition of shares by Holdco and, if Opco had not increased in value since that time, the safe income would be nil after such acquisition of shares by Holdco." However, accepting these assumptions, the dividend here as well of $1M would also be a capital gain, so that the ACB could only be utilized on a future disposition of the Opco shares.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | no relief under new rules where Part IV tax is refunded on payment of dividend to individual shareholder | 183 |

18 October 2011 External T.I. 2011-0422021E5 F - Purpose test - Subsection 55(2) of the Act

Aco held all the shares (having a minimal adjusted cost base) of Holdco (a small business corporation), which held all the shares (being common shares) of Opco. For creditor-proofing reasons, Holdco transferred inventory and other business assets to Opco on a. 85(1) rollover basis and Opco over the next few days paid dividends to Holdco approximating the value of the Opco common shares, with such proceeds then being lent back to Opco under a secured loan. Aco sold 35% of its Holdco shares to an unrelated third party as part of the same series of transactions, thereby realizing a significant capital gain.

In commenting on the purpose test, CRA stated:

[T]he capital gain realized by Aco on the sale of a portion of its interest in Holdco remained the same as if the dividend had not been paid.

… In addition, even though we are dealing with a situation described in subparagraph 55(3)(a)(iv), it should be noted that the main purpose of that subparagraph was to prevent a form of purchase butterfly. … [I]t would seem that we are not in such a circumstance.

Consequently … Holdco would have arguments in favour of concluding that the purpose test in subsection 55(2) would not be satisfied.

Finance

5 October 2018 APFF Financial Strategies and Instruments Roundtable, Finance Response to Q. 5

Opco is held equally by two unrelated individuals directly and through their respective Holdcos and, on the disability of one, Opco receives disability insurance proceeds and pays them as a special dividend to the healthy shareholder’s Holdco to fund the purchase by it of the other’s Holdco. Finance stated:

[A]mounts received by a corporation that are not included in its income, such as the disability insurance proceeds received by the operating corporation, are not included in safe income. …

Where a corporation receives a dividend that is deductible in computing its taxable income and the dividend does not benefit from the safe income exception, the determination of whether the dividend will be recharacterized as a capital gain under subsection 55(2) and the purpose test should be consistent with the tax policy underlying section 55. The purpose of the payment or receipt of a dividend is determined according to the facts relating to the series of transactions or events of which the payment and receipt of the dividend is a part.

Articles

Doron Barkai, Alexander Demner, "Dealing with New Subsection 55(2): Issues and Strategies", 2016 Conference Report (Canadian Tax Foundation), 6:1–56

Possible need for a specific anti-avoidance purpose (p. 6-5)

[C]ertain practitioners have suggested that in the absence of a specific tax-avoidance motive behind a dividend, neither an FMV-reduction purpose nor a cost-increase purpose should be found to exist (fn 20: See Eoin Brady and Gwendolyn Watson, "The 'Purpose' of Subsection 55(2)," in 2015 Ontario Tax Conference (Toronto: Canadian Tax Foundation, 2015), 8:1-16]…

Creditor-proofing transaction: Opco pays dividend to Holdco who makes secured loan to Opco (pp. 6:15-16)

[I]n CPL Holdings…a dividend was paid followed by a loanback of the proceeds of the dividend to the operating corporation. The transactions had the effect of significantly reducing the capital gain that would have been realized on the disposition of shares. The court held that the purpose test in former subsection 55(2) was not satisfied. …

[T]he court did analyze the reduction in the FMV of the shares (which is essentially the new FMV-reduction purpose test) and concluded that such a reduction, in a creditor-proofing transaction, was one of the effects of the transaction, but not one of its purposes…

…However, the CRA could theoretically argue that the cost-increase purpose test is applicable with respect to creditor-proofing transactions. As a result of the creditor-proofing dividend, Holdco has realized a significant increase in the aggregate tax cost of all of its properties because of the secured loan… . However, the same analysis used by the court in CPL Holdings to determine that the FMV-reduction purpose test was not met is applicable in the context of the cost-increase purpose test….

[T]he CRA clearly stated [in 2015-0623551C6] that creditor-proofing transactions offend the new purpose tests… .

[T]he CRA's position that the FMV-reduction purpose test applies to creditor-proofing dividends by default can legitimately be questioned. A creditor-proofing dividend is typically paid solely to create (or enhance) internal security over Opco's assets….

CRA requirement for reversal of basis increase in loss-transfer transaction (p. 6:20)

[I]n a loss-consolidation transaction, the effect of the payment of a dividend on a share may be to increase the aggregate ACB of the dividend recipient's property; however, the CRA does not consider this to be a purpose of the payment or receipt of the dividend because any ACB created is eliminated in the unwinding of the transaction.

Purification of Opco for SBC purposes through dividending excess assets to Holdco: issues (p. 6:21)

[U]nder the current rules the safe income exception may not readily apply. A one-time purification dividend may be substantial and thus may exceed both the FMV and the accrued gain (if any) of the Opco shares held by Holdco. This may be especially problematic if Holdco owns only dividend-sprinkling shares that are redeemable for a nominal amount and have a limited liquidation entitlement (since the FMV of the shares may be nominal).

Furthermore, restructuring a purification dividend as a share redemption or repurchase to gain access to the related-party exception may not be possible. Distributing non-active business assets shortly before a divestiture would likely negate the application of the exception (given the risk of an unrelated party acquiring an interest in the dividend payer as part of the same series of transactions)….

In many circumstances, Holdco would likely be able to convincingly argue that the sole purpose of the purification dividend was to provide the individual shareholders access to their LCGE. and thus no offensive purpose existed….

Rick McLean, "Subsection 55(2): What Is the New Reality?", 2015 CTF Annual Conference paper

Example of planning engaging the introduction of the expanded s. 55(2.1)(b) test respecting increases in cost amount (pp. 22:9-12)

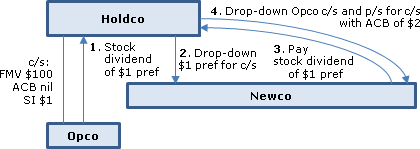

Holdco owns all of the shares of Opco that have an FMV of $10 with an ACB and a PUC if nil. The safe income attributable to the Opco shares held by Holdco is $1.

Opco pays a stock dividend of preferred shares on the common shares. The preferred shares have a redemption amount and an FMV of $1. ... The stated capital of the preferred shares is set at $1. ...

Under paragraph 52(3)(a), the ACB of the preferred shares is equal to $1. …[B]ecause the amount of the dividend does not exceed safe income, the ACB of the preferred shares is equal to the stated capital increase. ...

Holdco incorporates Newco and transfers the Opco preferred shares to Newco for common shares of Newco. At this point, Holdco and Newco could sell the shares of Opco and realize an aggregate capital gain of $9, which is an acceptable result.

Next, Newco declares a dividend of $1 payable to Holdco, which is satisfied by transferring the Opco preferred shares to Holdco. ...

Under the old rules…[t]he dividend reduced the Newco shares' FMV below their ACB, but it did not reduce a capital gain on the Newco shares. That is, the Newco shares had no accrued gain immediately before the dividend because the FMV was equal to the ACB. Accordingly, it cannot be said that the purpose of the dividend was to reduce a capital gain on the Newco shares. ...

Holdco transfers the Opco common shares (electing under subsection 85(1) at a nominal amount) and the Opco preferred shares to Newco for common shares of Newco. The FMV of the common shares of Newco is $10 with an ACB of $2. Holdco created ACB of $1 by capitalizing available safe income of $1 (which is acceptable) but then duplicated that ACB. Holdco can now sell the Newco shares and realize a capital gain of $8 instead of $9.

…[I]n the context of new subsection 55(2.1)…was the purpose of the dividend to increase the total cost amounts of property owned by Holdco? Yes.

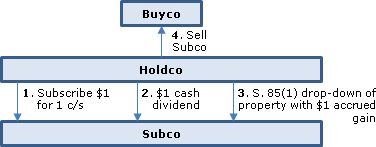

Variant of 2015 Budget Paper example (p. 22:12-13)

- Holdco incorporates Subco and subscribes for one common share of Subco for $1.

- Subco pays a cash dividend of $1 to Holdco.

- Holdco transfers a property that has an accrued gain of $1 to Subco under subsection 85(1) in exchange for common shares of Subco.

- Holdco sells the Subco shares to Buyer.

Under the old rules, subsection 55(2) could not apply because the dividend paid by Subco did not reduce a gain on the Subco shares. New paragraph 55(2.1)(b) should cause subsection 55(2) to apply because one of the purposes of the dividend was to reduce the FMV of the Subco shares below ACB to create a loss share. It could also be said that one of the purposes of the dividend was to increase the total cost amounts of Holdco's property.

Non-application of GAAR to cash s. 55(3)(a) redemptions? (pp. 22:33-34)

[T]he two new purpose tests do not apply to a deemed dividend on a redemption, acquisition , or cancellation of shares under subsection 84(2) or 84(3).…CRA was asked [f.n. 61:…2015-0610681C6] whether share redemptions could be used as an alternative to regular dividends in order to avoid the application of the anti-avoidance rule in subsection 55(2).

…[T]he round-table question was addressing a situation in which a share is redeemed for cash consideration with the objective of using the paragraph 55(3)(a) exception. The CRA...did indicate that when a share is redeemed or cancelled, the ACB in the share is eliminated; therefore, redemption or cancellation would not normally be helpful in creating ACB or reducing FMV. This response appears to assume that the share was redeemed for cash and that there were no steps taken to isolate or preserve ACB. This could suggest that the CRA might not apply GAAR to transactions involving cash share redemptions that are intended to qualify under paragraph 55(3)(a). However, Finance's explanatory notes stated that paragraph 55(3)(a) was not intended to be used to accommodate the payment or receipt of dividends, which means that there is still uncertainty on this point.

Loss of safe-income exception if temporary decline in the FMV of shares (pp. 22:42)

- In the past, Holdco acquired the shares of Opco for $1,000, which reflected the FMV of Opco's assets at that time.

- Since Holdco acquired the shares, Opco has realized after-tax earnings of $10, represented by cash.

- However, owing to market conditions, the FMV of Opco's assets has decreased to $800, resulting in a temporary decline to $810 (including the $10 of cash) in the FMV of the Opco shares. ...

If Opco pays a $10 cash dividend to Holdco, the safe-income exception does not apply even though that amount represents after-tax income earned by Opco. However, the FMV-reduction purpose test could apply. If the FMV of the Opco assets and shares subsequently recovers in value, such that the FMV of the Opco shares exceeds their cost base, then the safe-income exception can apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(1) - Safe-Income Determination Time | 117 | |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.3) | 269 |

Joint Committee, "Re: 2015 Federal Budget -- Amendments to Section 55", 27 May 2015 Joint Committee Submission

Finance intent re s. 55(2.1) and other s. 55 amendments

Based on our telephone conversation, we have been guided in developing our alternative approach by our understanding of the following general principles:

- the proposed amendments to section 55 are, in large part, a response to the planning that is contemplated in the recent decision in D&D Livestock;

- the proposals are not intended to prejudice, or to create uncertainty in respect of, normal cash movements within Canadian corporate groups or conventional loss consolidation structures; and

- section 55 is today, and should continue to be, an anti-avoidance provision that applies to transactions that would otherwise give rise to an inappropriate result; the proposals are not intended to convert section 55 into a general rule of mechanical application.

Resulting uncertainties

However, the amendments as currently proposed may have inadvertently affected routine, every day cash movements within Canadian corporate groups. In particular, the addition of proposed subparagraph 55(2.1)(b)(ii), together with the removal of cash dividends from the exception in paragraph 55(3)(a), has created significant uncertainty in the tax community. These concerns have been expressed to us in relation to a broad spectrum of non-abusive transactions, ranging from small owner-manager situations to transactions involving large, Canadian, public corporations. Absent tax consolidation, the ability to move funds within a corporate group on a tax-free basis is a practical necessity.

Subparagraph 55(2.1)(b)(i)

Administrative Policy

10 October 2014 APFF Roundtable Q. 20, 2014-0534671C6 F - D&D Livestock

What is the CRA position on D & D Livestock? CRA stated (TaxInterpretations translation):

[S]ubsection 245(2) was not applied in this case. However, the CRA would not hesitate to invoke the GAAR in similar files. … The CRA considers among other things that transactions or series of transactions permitting the double utilization of the same amount of safe income in order to reduce a capital gain realized on an ultimate disposition of shares of a corporation are abusive and go against the object of subsection 55(2). Moreover, Justice Graham emphasized at paragraphs 27 and 28 of the decision… that the transactions in the case resulted in stripping of capital gains.

Furthermore, the CRA is also concerned by planning which can result in an unjustified duplication of fiscal attributes, for example, the duplication of the adjusted cost base of a share, regardless of the fact the that adjusted cost base exists by reason of safe income of a corporation. Similar transaction will be contested by the CRA, as appropriate.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | unjustified duplication of fiscal attributes is abusive | 178 |

Subparagraph 55(2.1)(b)(ii)

Administrative Policy

12 May 2017 External T.I. 2017-0683511E5 F - Purpose tests of a dividend or repurchase of share

Holdco holds 100% of Opco’s participating shares, which have a value of $100,000, paid-up capital and adjusted cost base of $1 and safe income attributable thereto of nil. Opco has a cash balance of $100,000, which it would dividend to Holdco to acquire an immovable for leasing to Opco for use in Opco’s business. Would one of the purposes of the dividend be described in s. 55(2.1)(b)(ii)? Alternatively, in order to avoid the potential application of s. 55(2) to the payment of an actual dividend, could Opco purchase for cancellation 99.99% of the participating shares held by Holdco for $99,999?

Respecting the first situation, in the course of noting that determining the purpose of the dividend was a question of fact, as to which CRA noted factors for assessing the motivation behind the purpose, CRA stated:

[T]he payment of a dividend for the purpose of acquiring an immovable must be assessed taking into account that the property could have been purchased by Opco instead of Holdco. There could therefore be a purpose similar to that of protecting the assets from risk inherent in the carrying on of the Opco business, a purpose that we have already characterized as the purpose of reducing the value of shares.

Respecting the second situation, CRA stated:

[T]he utilization of paragraph 55(3)(a)…in order to replace a dividend not coming out of safe income, could be determined to be offensive.

[S.] 55(3)(a) is intended to facilitate corporate reorganizations made in good faith by related persons but is not intended to accommodate the payment or receipt of dividends or transactions or events which seek to increase, manipulate or manufacture tax basis.

Thus, the application of the general anti-avoidance rule in subsection 245(2) should be queried, considering that the money given to Holdco would not come from the income that had already been taxed in Opco and that the adjusted cost base of participating shares in the capital stock of Opco would be nominal.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(a) | using s. 55(3)(a) to distribute cash otherwise than from safe income likely abusive | 193 |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | use of s. 55(3)(a) redemption exception to circumvent safe income limitation could be offensive | 58 |

Paragraph 55(2.1)(c)

Cases

626468 New Brunswick Inc. v. Canada, 2019 FCA 306

Before agreeing to sell an apartment building (the property) owned by him to a third party, Mr. Gillis transferred the property on a s. 85(1) rollover basis to a newly-incorporated corporation (“Tri-Holdings”) in consideration for the assumption of a portion of the mortgage on the property and for the issuance of four common shares (representing all the Tri-Holdings’ shares) with a nominal paid-up capital (“PUC”). Mr. Gillis then transferred those shares on a s. 85(1) rollover basis to a newly-incorporated holding company, 626468 New Brunswick Inc. (“626 NB”), in consideration for shares of 626 NB with a nominal PUC. Tri-Holdings sold the property to the third party, realizing a capital gain and recapture of capital cost allowance. Tri-Holdings then effected successive increases in the PUC of its shares, thereby resulting in successive s. 84(1) deemed dividends to 626 NB (one of which was a capital dividend), which thereby increased the adjusted cost base of 626 NB’s shares of Tri-Holdings. 626 NB sold all its shares in Tri-Holdings to an unrelated corporation for a price based on the cash of Tri-Holdings.

In affirming the finding of the Tax Court that the safe income attributable to 626 NB’s shares of Tri-Holdings was reduced by the corporate income tax that would be payable by Tri-Holdings on the income arising from the sale of the property, Webb JA first stated (at para. 39):

I agree with … Deuce Holdings that it would only be logical that any arm’s length third party purchaser of shares would take into account any existing tax liability of the corporation, even though such liability may not be payable until a later date.

He then stated (at paras. 52-53):

Both the fair market value of the shares and the portion of the resulting capital gain that would be attributable to the income earned or realized would reflect the tax liability that, although not payable immediately, would eventually have to be paid. …

This tax liability would not disappear if, as contemplated by subsection 55(2) … the shares of Tri-Holdings would have been sold immediately before the dividend in question.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | s. 55(2) operated through denying a s. 53(1)(b) ACB bump | 304 |

| Tax Topics - General Concepts - Fair Market Value - Shares | FMV of shares reduced by accrued, but not yet payable, corporate income tax on gains | 263 |

See Also

626468 New Brunswick Inc. v. The Queen, 2018 TCC 100, aff'd 2019 FCA 306

Before agreeing to sell an apartment building (the property) owned by him to a third party, Mr. Gillis transferred the property on a s. 85(1) rollover basis to a newly-incorporated corporation (“Tri-Holdings”) in consideration for the assumption of a portion of the mortgage on the property and for the issuance of four common shares (representing all the Tri-Holdings’ shares) with a nominal paid-up capital (“PUC”). Mr. Gillis then transferred those shares on a s. 85(1) rollover basis to a newly-incorporated holding company (“468”) in consideration for shares of 468 with a nominal PUC. Tri-Holdings sold the property to the third party, realizing a capital gain and recapture of capital cost allowance. Tri-Holdings then effected successive increases in the PUC of its shares, thereby resulting in successive s. 84(1) deemed dividends to 468 (one of which was a capital dividend), which thereby increased the adjusted cost base of 468's shares of Tri-Holdings. 468 sold all its shares in Tri-Holdings to an unrelated corporation for a price based on the cash of Tri-Holdings.

At issue was whether the safe income attributable to 468’s shares of Tri-Holdings was reduced by the corporate income tax borne by Tri-Holdings on the income arising from the sale of the property. After quoting at length from Deuce Holdings. D’Auray J stated (at para. 29):

Justice Noël … in … Kruco … agreed that the words “earned or realized” in subsection 55(2) refer to income after taxes. …

In rejecting the 468’s further submission “that taxes have to be calculated at the end of the year and that at the end of the year Tri-Holdings did not owe any income tax” (para. 30) D’Auray J stated (at paras. 31, 33):

As stated by Justice Sharlow in VIH Logging Ltd., supra, the phrase “income for the year” is not used in subsection 55(2) of the Act. …

[T]he safe income of Tri-Holdings had to be determined immediately before December 13, 2006, namely before the first deemed dividend was generated. This is what the Minister did … .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(5) - Paragraph 55(5)(b) | safe income reduced by corporate income taxes | 201 |

Administrative Policy

9 October 2025 APFF Roundtable Q. 8, 2025-1071501C6 - Application des nouvelles positions de l’ARC concernant le paragraphe 55(2) L.I.R.

In its 2023 Safe Income Paper, CRA indicated that its changes in position would apply prospectively to calculations of safe income for taxation years beginning after November 28, 2023.

CRA now confirmed that this meant that “a corporation's safe income must be calculated for each taxation year in accordance with the CRA positions applicable to that year.” For example, if a corporation, that had been incorporated in 2000 and had calendar taxation years, began a series of transactions in September 2025 that would include the payment of a dividend to which s. 55(2) would apply, it would determine its safe income as of September 2025 by calculating its safe income for each of its 2000 to 2023 taxation years using its old positions and for its 2024 and 2025 taxation years using its new positions.

17 June 2025 STEP Roundtable, Q.12

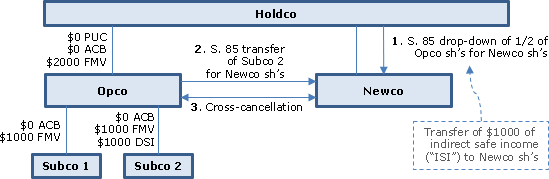

In Example 17 of CRA’s 2023 Safe Income Paper, the entire direct safe income (“DSI”) of a transferor corporation (“Opco”) was allocated to a transferee corporation (“Newco”) on an s. 55(3)(a) spin-out. Specifically, Opco (wholly-owned by Holdco) had DSI of $1,000 and two assets (Asset 1 with a nil ACB and $1,000 FMV, and Asset 2 with an ACB and FMV of $1,000). The DSI of Opco was reflected in Asset 2’s ACB.

Opco spun off, under s. 55(3)(a), Asset 2 to Newco (wholly-owned by Holdco). As part of the spin-out, Holdco transferred Opco shares with a nil ACB and $1,000 FMV to Newco for shares of Newco with a nil PUC and ACB, and $1,000 FMV. Opco then transferred Asset 2 to Newco in consideration for Newco shares with an ACB, PUC and FMV of $1,000. The cross-shareholdings were then redeemed for notes and the notes cross-cancelled, thereby generating a taxable dividend of $1,000 to Newco. CRA concluded that the entire $1,000 DSI of Opco was transferred to the shares of Newco held by Holdco.

In a variant of Example 17, as part of the series the Opco shares were subsequently sold to an unrelated person so that the s. 55(3)(a) exception would be unavailable. Would the entire $1,000 DSI of Opco still shift to Holdco’s shares of Newco, so that the $1,000 deemed dividend would be fully sheltered by the $1,000 DSI of Opco, and s. 55(2) would not apply (even if the redeemed Opco shares only accounted for 50% of the FMV of all of the Opco shares)?

CRA indicated that the entire $1,000 of DSI of Opco would continue to shift to such Newco shares of Holdco. The same analysis applied here as for Example 17: since the $1,000 of DSI of Opco was reflected in the ACB of Asset 2, which was transferred to Newco, it was reasonable to conclude that, after the spin-out, the $1,000 of DSI of Opco contributed to the gain on the shares of Newco held by Holdco and did not contribute to any gain on the shares of Opco retained by Holdco. It followed that immediately prior to the redemption of the shares of Opco held by Newco, the $1,000 in DSI of Opco would reasonably be viewed as contributing to the accrued gain on the shares of Opco held by Newco, so that s. 55(2) should not apply to that deemed dividend.

3 December 2024 CTF Roundtable Q. 1, 2024-1038181C6 - Safe Income and Preferred Shares

The CRA "Update on Subsection 55(2) ..." (Full paper released on 22 December 2023) stated that, where a shareholder acquires preferred shares as consideration for the transfer of property on a tax deferred basis, the accrued gain on the property, when subsequently realized by the corporation, would be viewed as contributing to the gain on the preferred shares, and accordingly would be included in the preferred shares’ safe income. Does this position also apply where the preferred shares are acquired in exchange for common shares, so that the accrued gains on the underlying property held by the corporation and any of its subsidiaries at the time of the share exchange get allocated to the safe income of the preferred shares once realized? For example, if Holdco owns all the common shares of Midco with an FMV and ACB of $1,000 and $1, and MIdco owns all the common shares of Subco with an FMV and ACB of $1,000 and $1, and Holdco exchanges its Midco common shares for Midco preferred shares with a FMV of $1,000 on a tax-deferred basis, will the gain on the property held by Subco when eventually realized be included in the safe income of the Midco preferred shares?

CRA indicated that such extension of its position would not occur, and that the allocation of the safe income to the preferred shares would follow its longstanding position that a portion of the safe income to which the exchanged shares would have been entitled immediately before the exchange simply flows through to the preferred shares. Regarding the safe income realized after the exchange, the preferred shares would generally participate in the safe income of the corporation in accordance with the shares’ dividend entitlement only.

10 October 2024 APFF Roundtable Q. 6, 2024-1028881C6 F - Revenu protégé

Example 12 of the "CRA Update on Subsection 55(2) and Safe Income: Where are we Now?” was essentially as follows:

In Year 1: Holdco1 transferred goodwill with an FMV of $500 and nominal cost amount on a rollover basis to Opco in consideration for preferred shares with a $500 redemption amount and nominal dividend entitlement; and Holdco2 subscribed a nominal amount for Opco common shares. While Holdco2 held its common shares, Opco earned a safe income of $500 that is represented by cash on hand. The preferred shares are redeemed with this cash at a time that the FMV of the common shares is $500.

In this situation, although the cash that has been generated by Opco with its safe income no longer supports the value of the common shares held by Holdco2, the safe income of $500 that is considered to contribute to the gain on the common shares of Opco held by Holdco2 is considered to remain unchanged.

After commenting on the application of s. 55(3)(a) in the context of Example 12 (viewed as “a share redemption that results in a deemed dividend that is supported by little safe income, but where the dividend is technically exempted by paragraph 55(3)(a)”) CRA then returned to Example 12, and stated:

Ultimately, whether or not the exemption in paragraph 55(3)(a) applies will have no impact on the safe income of the common shares in Example 12. In addition, as stated in the Update, the gain realized on the sale of goodwill for $500 or less could not constitute safe income on the common shares because such gain does not contribute to the gain on the common shares, even when the goodwill was sold after the redemption of the preferred shares. If, on the other hand, the goodwill were sold for more than $500, the gain on the excess over $500 would constitute safe income on the common shares.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(a) | GAAR may apply where the purpose of a s. 55(3)(a) redemption for a note is increasing outside basis, but not where freeze shares are redeemed for personal cash needs | 351 |

30 January 2024 External T.I. 2024-1005011E5 - Safe income

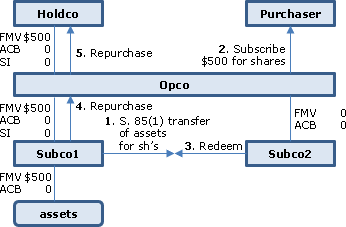

The starting structure in Example 30 of “CRA Update on Subsection 55(2) and Safe Income” is that Holdco owned the shares of Opco with an FMV, ACB and safe income of $500, 0 and 0; and Opco owned Subco1 (whose shares also had an FMV, ACB and safe income of $500, 0 and 0) and Subco2 (whose shares had no value, ACB or safe income). Then:

- Subco1 transfers its assets with an FMV and ACB of $500 and 0 on an s. 85(1) rollover basis to Subco2 for Subco2 shares.

- A third-party purchaser subscribes $500 for Opco shares.

- Subco2 redeems the shares of Subco1, generating a $500 deemed dividend.

- Subco1 repurchases the shares of Opco, then Opco repurchases the shares of Holdco, in each case generating a $500 deemed dividend.

In Example 30, CRA indicated that although the deemed dividend from Subco2 to Subco1 would be exempted under s. 55(3)(a) by virtue of s. 55(3.01)(g), the deemed dividend from Subco1 to Opco, and from Opco to Holdco, would be subject to s. 55(2). In particular, the dividend from Subco2 is not subject to tax in the hands of Subco1 and none of the accrued gain on the assets has been realized, so that such dividend does not result in safe income to Subco1.

In response to a follow-up question, CRA indicated that the purpose of this example was merely “to illustrate the concept that a dividend income that has not been subject to tax should not constitute safe income for the benefit of a shareholder.” CRA went on to indicate that:

The order of transactions described in the example would unlikely be implemented as such in the real world (for example, Subco1 does not need to redeem its shares held by Opco to achieve the results sought by Holdco) and a discussion on possible double-taxation in the scenario described is fruitless.

That issue as to double taxation was that, although “the capital gain realized by Opco on the redemption of shares of Subco1 would be included in the safe income of Opco and would not result in any double-taxation” (presumably because it would be there for potential future use), “[u]nfortunately, the deemed capital gain under subsection 55(2) would not be part of the safe income computed before the safe income determination time if all the transactions described are part of the same series of transactions” so that both Opco and Holdco would realize a capital gain. CRA went on to state:

[W]e understand that transactions can be successfully implemented in a way to attract only one level of taxation if the ordering of transactions is carefully thought out and taxpayers do not attempt to systematically avoid taxes on a disposition.

2023 Ruling 2022-0923451R3 F - 55(3)(a) internal reorganization

There is to be a division of the assets of a family group of corporations among the respective holding companies for the four children of Mr. X, most notably, the holding company (HoldcoF) for Mr. A, who manages a group of companies beneath Dco, and the holding company (HoldcoB) for Mr. B, who manages a group of companies which, as a preliminary matter, are transferred on a rollover basis into a new subsidiary company (PBco1), which issues special voting shares to Mr. X so that he can maintain control (and Mr. X also has held special voting shares in Dco all along.)

Transactions are implemented in reliance on s. 55(3)(a) (and on the absence of the application of s. 55(4) having regard to the continued control by Mr. X of the spun-off companies and of the transferee corporations whose equity ended up being mostly held by HoldcoB or HoldcoF) to effectively spin-off PBco1 to HoldcoB and Dco to HoldcoF (along with further transactions for the benefit of the holding companies of the other two children).

Here, the application of the formula in 2020-0861031C6 for the allocation of direct safe income (DSI) would lead to a disadvantageous result for the taxpayers involved since it would result in an undue loss of ACB/DSI. More specifically, the ACB, to HoldcoB or HoldcoF, of the shares the property (shares of NewAco) transferred to PB1co or Dco will be nominal and the ACB, to the transferor corporation (NewCco) of the shares of PB1co or Dco will be eliminated. To avoid this result, the DSI would be calculated as follows:

A. The DSI of the transferor corporation (“Transferor”) that has accrued on the shares of its capital stock held by shareholders other than the transferee corporation (“Transferee”), determined immediately after the reorganization, will be calculated in accordance with the following formula:

DSI on shares of capital stock of Transferor held by all shareholders immediately after the reorganization = DSI immediately before the reorganization X total net cost amount of property retained by Transferor / total net cost amount of all property of Transferor immediately before the reorganization.

B. The DSI of the shares of capital stock of Transferee held by shareholders immediately prior to the Reorganization shall be increased in accordance with the following formula: