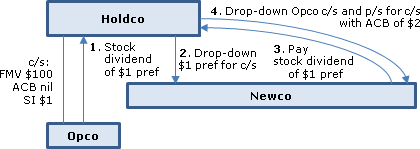

Example of planning engaging the introduction of the expanded s. 55(2.1)(b) test respecting increases in cost amount (pp. 22:9-12)

Holdco owns all of the shares of Opco that have an FMV of $10 with an ACB and a PUC if nil. The safe income attributable to the Opco shares held by Holdco is $1.

Opco pays a stock dividend of preferred shares on the common shares. The preferred shares have a redemption amount and an FMV of $1. ... The stated capital of the preferred shares is set at $1. ...

Under paragraph 52(3)(a), the ACB of the preferred shares is equal to $1. …[B]ecause the amount of the dividend does not exceed safe income, the ACB of the preferred shares is equal to the stated capital increase. ...

Holdco incorporates Newco and transfers the Opco preferred shares to Newco for common shares of Newco. At this point, Holdco and Newco could sell the shares of Opco and realize an aggregate capital gain of $9, which is an acceptable result.

Next, Newco declares a dividend of $1 payable to Holdco, which is satisfied by transferring the Opco preferred shares to Holdco. ...

Under the old rules…[t]he dividend reduced the Newco shares' FMV below their ACB, but it did not reduce a capital gain on the Newco shares. That is, the Newco shares had no accrued gain immediately before the dividend because the FMV was equal to the ACB. Accordingly, it cannot be said that the purpose of the dividend was to reduce a capital gain on the Newco shares. ...

Holdco transfers the Opco common shares (electing under subsection 85(1) at a nominal amount) and the Opco preferred shares to Newco for common shares of Newco. The FMV of the common shares of Newco is $10 with an ACB of $2. Holdco created ACB of $1 by capitalizing available safe income of $1 (which is acceptable) but then duplicated that ACB. Holdco can now sell the Newco shares and realize a capital gain of $8 instead of $9.

…[I]n the context of new subsection 55(2.1)…was the purpose of the dividend to increase the total cost amounts of property owned by Holdco? Yes.

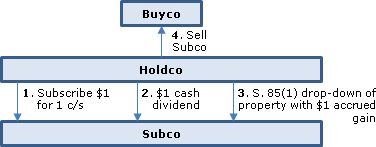

Variant of 2015 Budget Paper example (p. 22:12-13)

- Holdco incorporates Subco and subscribes for one common share of Subco for $1.

- Subco pays a cash dividend of $1 to Holdco.

- Holdco transfers a property that has an accrued gain of $1 to Subco under subsection 85(1) in exchange for common shares of Subco.

- Holdco sells the Subco shares to Buyer.

Under the old rules, subsection 55(2) could not apply because the dividend paid by Subco did not reduce a gain on the Subco shares. New paragraph 55(2.1)(b) should cause subsection 55(2) to apply because one of the purposes of the dividend was to reduce the FMV of the Subco shares below ACB to create a loss share. It could also be said that one of the purposes of the dividend was to increase the total cost amounts of Holdco's property.

Non-application of GAAR to cash s. 55(3)(a) redemptions? (pp. 22:33-34)

[T]he two new purpose tests do not apply to a deemed dividend on a redemption, acquisition , or cancellation of shares under subsection 84(2) or 84(3).…CRA was asked [f.n. 61:…2015-0610681C6] whether share redemptions could be used as an alternative to regular dividends in order to avoid the application of the anti-avoidance rule in subsection 55(2).

…[T]he round-table question was addressing a situation in which a share is redeemed for cash consideration with the objective of using the paragraph 55(3)(a) exception. The CRA...did indicate that when a share is redeemed or cancelled, the ACB in the share is eliminated; therefore, redemption or cancellation would not normally be helpful in creating ACB or reducing FMV. This response appears to assume that the share was redeemed for cash and that there were no steps taken to isolate or preserve ACB. This could suggest that the CRA might not apply GAAR to transactions involving cash share redemptions that are intended to qualify under paragraph 55(3)(a). However, Finance's explanatory notes stated that paragraph 55(3)(a) was not intended to be used to accommodate the payment or receipt of dividends, which means that there is still uncertainty on this point.

Loss of safe-income exception if temporary decline in the FMV of shares (pp. 22:42)

- In the past, Holdco acquired the shares of Opco for $1,000, which reflected the FMV of Opco's assets at that time.

- Since Holdco acquired the shares, Opco has realized after-tax earnings of $10, represented by cash.

- However, owing to market conditions, the FMV of Opco's assets has decreased to $800, resulting in a temporary decline to $810 (including the $10 of cash) in the FMV of the Opco shares. ...

If Opco pays a $10 cash dividend to Holdco, the safe-income exception does not apply even though that amount represents after-tax income earned by Opco. However, the FMV-reduction purpose test could apply. If the FMV of the Opco assets and shares subsequently recovers in value, such that the FMV of the Opco shares exceeds their cost base, then the safe-income exception can apply.

Application of safe-income determination time to annual cash dividends (p. 22:43)

The legislative definition of "safe-income determination time"...was designed...for a share sale transaction...[and] has not been amended to align better with the new rules.

Assume that a corporation establishes a policy to distribute each year's earnings (earnings that would be safe income absent a restriction under the definition of "safe-income determination time"). Given the intent of the safe-income exception, it would be unreasonable if the dividend paid to distribute the first year's earnings triggered a safe-income determination time under paragraph (b) of that definition, such that subsequent years' earnings are not added to safe income.

Potential application of s. 55(2) to stock dividend of high-low shares (pp. 22:63-64)

Holdco owns all of the shares (being common shares) of Opco that have an FMV of $100 and an ACB and PUC of nil and safe income of $30. Opco pays a stock dividend to Holdco, which is satisfied by issuing fixed-value preferred shares that have an FMV of $100 and PUC of $30. ...

Under the old rules, the amount of the dividend for the purposes of subsection 55(2) was equal to the PUC amount of $30. Subsection 55(2) did not apply because the dividend did not exceed safe income. Under paragraph 52(3)(a), the ACB of the preferred shares was $30, equal to the amount of safe income.

Under the new rules, the amount of the dividend for subsection 55(2) is the FMV of the preferred shares of $100. Subsection 55(2.4) causes subsection 55(2.3) to apply because the dividend is a high-low stock dividend. Subsection 55(2.3) separates the $100 dividend into two separate dividends in the amounts of $70 and $30.

If the purpose of the dividend was (for example) to reduce the FMV of the common shares, subsection 55(2) would apply to the $70 dividend.

This example illustrates that the FMV-reduction purpose test can apply in situations where there is a reduction in the FMV of a share that has an accrued gain and not solely in situations where loss share is created. ...

Assuming that subsection 55(2) does apply in example 10, clause 52(3)(a)(ii)(A) would give an ACB addition for the safe income of $30. Clause B would provide an ACB addition for the deemed gain of $70.