Cases

626468 New Brunswick Inc. v. Canada, 2019 FCA 306

An individual rolled his apartment building into a Newco in consideration for a mortgage assumption and shares with nominal paid-up capital, and then rolled those shares into a new Holdco. Following the realization shortly thereafter by Newco of a taxable capital gain and recapture of depreciation on a sale of the building, Newco increased the adjusted cost base to Holdco of its shares by effecting a series of s. 84(1) dividends (including a capital dividend) – following which the individual sold his shares of Holdco to a third party for a sale price based on the amount of cash sitting in Newco.

Webb JA (as did D’Auray J below) agreed with Deuce Holdings finding that the safe income of Newco was reduced by the amount of corporate income tax ultimately payable by it on its gain on the building sale, notwithstanding that at the time of sale, no income taxes had yet become payable (because the income for the year had not yet been determined).

Respecting the mechanics of how the pre-April 20, 2015 version of s. 55(2) operated to generate a capital gain as a result of the denial of safe income, he stated (at para. 74):

Paragraph 55(2)(a) … provides that the amount in issue is deemed to not be a dividend. As a result, there is no addition to the adjusted cost base of the shares for this amount under paragraph 53(1)(b) … . The subsequent sale of the shares for $3,707,165 results in an increased capital gain (because the adjusted cost base of the shares is lower). Since this amount in question is otherwise reflected in the amount paid by the third party, no additional amount would be added to the proceeds under paragraph 55(2)(b)

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | safe income from asset sale was reduced by accrued, but not yet payable, taxes on the gain | 361 |

| Tax Topics - General Concepts - Fair Market Value - Shares | FMV of shares reduced by accrued, but not yet payable, corporate income tax on gains | 263 |

Ottawa Air Cargo Centre Ltd. v. The Queen, 2007 DTC 661, 2007 TCC 193, aff'd 2008 DTC 6177, 2008 FCA 54

Lamarre J. rejected the taxpayer's submission that deemed dividends received by the taxpayer were "subject to" Part IV tax in the sense that the taxpayer could have remitted Part IV tax on those taxable dividends and thus would have been entitled to a refund of Part IV tax. The taxpayer, in fact, did not do this and instead applied non-capital losses against an assessment of Part IV tax when it was made by the Minister on the basis that s. 55(2) did not apply to the deemed dividends. Lamarre J. found (at para. 21) that "the requirement of an actual refund of Part IV is mandatory for the dividend to be re-characterized as a capital gain under subsection 55(2)".

Canada v. VIH Logging Ltd., 2005 DTC 5095, 2005 FCA 36

Cash dividends paid by a corporation ("Old VIH") to its parent (the taxpayer) in February 1993 came out of safe income of Old VIH given that the computation of Old VIH's safe income included significant income that it had earned after its last fiscal year end (March 31, 1992) and before the date of payment of the dividends. Sharlow J.A. stated (at p. 5101) that

"It does no violence to the language of subsection 55(2) to interpret the phrase 'before the commencement of the series of transactions' to mean 'immediately before the commencement of the series of transactions', rather than 'as of the end of the fiscal year ending before the commencement of the series of transactions', as the Crown contends."

In addition, it was open to the trial judge (Woods J, as she then was) to find that a stock dividend paid shortly after the payment of the cash dividends, and which reduced the capital gain on a subsequent sale of the shares Old VIH by approximately $45,000, did not result in a significant reduction of the capital gain realized on such sale in the context of transactions which involved dividends (preponderantly, cash dividends) totaling over $1.7 million.

Canada v. Canadian Utilities Ltd., 2004 DTC 6475, 2004 FCA 234

The two taxpayers, which were subject corporations, indirectly sold their investment in another public corporation ("ATCOR"). This was accomplished by their common shares of ATCOR being exchanged on the amalgamation of ATCOR with a newly incorporated subsidiary of a related corporation for Class A or B non-voting redeemable shares of the amalgamated corporation having a paid-up capital approximating the respective adjusted cost base of their ATCOR common shares, with the special shares then being redeemed. The Part IV tax payable on the deemed dividends arising on this redemption was refunded because of normal-course dividends paid by the taxpayers to their shareholders that year (and, in one case, the following year).

In finding that the subsequent normal course dividends were part of the same common law series of transactions as the amalgamation/redemption transactions, Rothstein, J.A. stated (at para. 67):

The facts that CU and CUH intended to use both the ATCOR/Forest transactions and the normal course dividends to achieve their tax avoidance objective, that they had the ability to ensure that all the transactions would occur, and that all the transactions did indeed occur as intended are sufficient to constitute them all part of a common law series for the purposes of subsection 55(2). It is of no consequence that one or more of the transactions had an independent purpose and existence.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(10) | a transaction with an independent purpose and existence nonetheless can form part of a common law series | 244 |

Lamont Management Ltd. v. The Queen, 2000 DTC 6256 (FCA)

Safe income attributable to shares of a Canadian corporation ("Canpac") that were purchased for cancellation in the hands of the taxpayer included safe income of a foreign corporation in which Canpac had an indirect equity interest of less than 10% and which did not qualify as a foreign affiliate of Canpac. There was no absurdity in safe income attributable to a foreign non-affiliate being calculated without reference to the specific rules applicable to other types of corporations under s. 55(5).

Brelco Drilling Ltd. v. R., 99 DTC 5253, [1999] 3 CTC 95 (FCA)

The U.S. subsidiary of the taxpayer, in turn, owned seven U.S. resident corporations five of whom had exempt deficits and two of whom had exempt surpluses. The trial judge found that the taxpayer was required to deduct the exempt deficits in computing its safe income for purposes of subsection 55(2). Before remitting the matter back to the Tax Court to hear evidence as to whether any factors reduced the safe income on hand, Linden J.A. stated (at p. 5260):

"The literature ... unanimously accepts that section 55(2) requires a calculation of safe income on hand, not exempt income generally ... . It is by definition a net calculation which begins with the deemed income in the section 55(5), but which does not end there." [See also Brelco Drilling Ltd. v. The Queen, 2000 DTC 1482 (TCC).]

Her Majesty the Queen, Appellant v. Nassau Walnut Investments Inc., Respondent, 97 DTC 5051, [1998] 1 CTC 33 (FCA)

Although it had been planned that the portion of deemed dividends received by the taxpayer (arising on the redemption of shares held by it) that did not come out of safe income would be subject to a designation under s. 55(5)(f), all of such amounts were reported by the taxpayer in its return as deemed dividends due to an error by a subsequently-appointed accounting firm. Before going on to find that a late designation under s. 55(5)(f) was available to the taxpayer (or, what might amount to the same thing, that there was a right of the taxpayer to amend its return to reflect the safe income on hand - and noting, at p. 5057, that "the Act itself implicitly recognizes that a designation and an election are not one and the same"), Robertson J.A. found that the assumption of the Minister that the safe income earned by the redeeming corporation should be allocated pro rata amongst all the shares in its capital (with the result that only a pro rata portion of the safe income was applicable to the shares that were redeemed in the hands of the taxpayer) was reasonable.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(5) - Paragraph 55(5)(f) | late s. 55(5)(f) designation available | 162 |

| Tax Topics - Statutory Interpretation - Expressio Unius est Exclusio Alterius | express limited relief does not imply no other relief | 74 |

| Tax Topics - Income Tax Act - Section 165 - Subsection 165(1) | taxpayer can amend return on objection in respects relevant to issues surrounding the reassessment | 112 |

The Queen v. Placer Dome Inc., [1997] 1 CTC 72, 96 DTC 6562 (FCA)

After the taxpayer solicited competing bids for the sale of a significant block of shares it held in another public company ("Falconbridge") both directly and through a holding company ("McIntyre"), it accepted an offer of Falconbridge that required Falconbridge to declare and pay a significant dividend on all the outstanding shares of Falconbridge, and (following the payment of a corresponding dividend by McIntyre) to purchase the shares of Falconbridge and McIntyre held by the taxpayer. The only purpose of the dividends was to permit Falconbridge to make an offer that effectively approximated 118% of the previous market price of the Falconbridge shares (and that exceeded the 115% of the market price which the other bidder could have paid without triggering the statutory requirement for a follow-up offer to the other Falconbridge shareholders). Accordingly, given that the purpose of the transactions was to be determined having regard to the actual state of mind of the taxpayer and Falconbridge, rather than its purpose in some objective sense, s. 55(2) did not apply. Robertson JA stated (at p. 6567):

While there may be instances where the term “purposes” is modified by words or phrases suggesting something other than a subjective understanding, that is not the case with respect to subsection 55(2) ... . [I]t is clear that the use of the term “purpose” in one context and “result” in another requires that a different meaning be attributed to each that is consistent with their use and context within subsection 55(2).

In the Tax Court, Bell TCJ. stated (96 DTC 1787 at 1794) that the taxpayer "had not participated in the creation and structure of the Falconbridge bid" and that "that finding alone renders it impossible to conclude that one of the purposes of the Appellant was to effect a significant reduction of the capital gain to be realized", as to which Robertson JA stated (at p. 6567) that "it remains for future determination whether this reasoning should itself be determinative of the issue."

CPL Holdings Ltd. v. The Queen, 95 DTC 5253, [1995] 1 CTC 447 (FCTD)

The two individual shareholders (Lamothe as to 99% and his wife as to 1%) of a corporation operating a machine shop ("Clem Industrial") transferred all their shares of Clem Industrial to the taxpayer (which was a newly-incorporated holding company) in consideration for high-low shares of the taxpayer. They then caused Clem Industrial to pay a large dividend (virtually equal to the fair market value of its outstanding shares) to the taxpayer, which then lent the proceeds back to Clem Industrial in consideration for a demand debenture.

The taxpayer was able to establish that the purpose of these transactions was to make the taxpayer (and therefore, indirectly, its individual shareholders) secured creditors of Clem Industrial which, at the time, was about to be added as a party to a law suit. Cullen J stated (at p. 5259):

The taxpayer has provided convincing evidence that the purpose of the rollover was to make Lamothe a secured creditor of the corporation. I do not find that the purpose of the transaction was to reduce the fair market value of the shares, although I agree that it was one of the effects of the transaction.

Accordingly, s. 55(2) did not apply notwithstanding that, shortly after the effective date of the completion of the transactions (but before the documents for its implementation were signed), 49% of the shares of Clem Industrial were sold by the taxpayer for a nominal amount to an arm's length individual (the foreman of the machine shop).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Onus | 63 |

See Also

D & D Livestock Ltd. v. The Queen, 2013 DTC 1251 [at at 1412], 2013 TCC 318

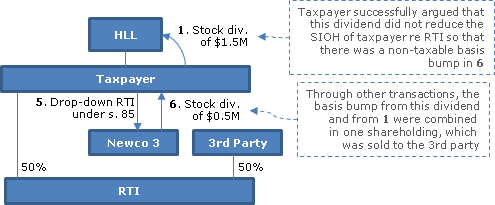

After a preliminary reorganization, all of the shares of the taxpayer (consisting of Class A common shares and Class D preference shares) were owned by another Canadian corporation ("HLL"), whose safe income on hand ("SIOH") respecting the taxpayer was $1.493M, comprised of safe income earned by the taxpayer of $0.976M and safe income of $0.517M in respect of the taxpayer's 50% shareholding of another Canadian corporation ("RTI"). Then:

- The taxpayer paid a stock dividend ("Stock Dividend 1") in the amount of $1.465M to HLL by issuing Class A shares to HLL with a stated capital of that amount in satisfaction of the dividend (thereby increasing the adjusted cost base ("ACB") of HLL's Class A shares of the taxpayer to $2.72M.)

- HLL transferred all its (Class A and D) shares of the taxpayer on a s. 85(1) rollover basis to a newly-incorporated subsidiary (Newco) in consideration for Class A common and Class D preference shares of Newco (so that under s. 85(1)(g) essentially all the ACB of the transferred shares, including the stepped-up ACB of the transferred Class A shares, was allocated to the cost to HLL of the Class D preference shares of Newco, which was $3.47M).

- HLL transferred its Newco Class D preference shares on a s. 85(1) rollover basis to a newly-incorporated subsidiary (Newco 2) in consideration for Class A common shares of Newco 2 ( having a deemed cost under s. 85(1)(h) of $3.47M.)

- Newco 2 satisfied a dividend of $3.47M to HLL by transferring its Class D preference shares of Newco to HLL, thereby creating an accrued loss to HLL on its Newco 2 shares.

- The taxpayer transferred its shares of RTI (with an FMV of $7.05M) on a s. 85(1) rollover basis to a newly-incorporated subsidiary (Newco 3) in consideration for Class A common shares of Newco 3 (having a cost under s. 85(1)(h) of $0.50M.)

- Newco 3 paid a stock dividend ("Stock Dividend 2") in the amount of $0.52M to the taxpayer by issuing Class A shares to the taxpayer (and made s. 55(5)(f) designations for such dividend to be deemed to be 10 separate taxable dividends), thereby increasing the ACB of the taxpayer's Class A shares of Newco 3 to $1.02M.)

- HLL transferred its shares of Newco 3 to Newco 2 on a s. 85(1) rollover basis (so that the accrued gain to it on all its shares of Newco 2 was reduced by the accrued loss arising in 4 above.

- Newco 3 was wound up.

- HLL transferred its Class A common shares of Newco 2 (reported as having an ACB of $4.48M) on a s. 85(1) rollover basis to a special-purpose wholly-owned subsidiary of HLL (HLAL) in consideration for Class A common shares of HLA.

- Newco 2's only asset was its 50% shareholding in RTI. HLAL sold its shares of Newco 2 to the other 50% shareholder of RTI for $7.05M, with a capital gain of $2.566M being reported based on the $4.49M ACB in 9 above (i.e., such capital gain was reduced by the amount of both Stock Dividend 1 and 2).

The parties agreed that Stock Dividend 1 (see 1) reduced the SIOH of HLL in its shares of the taxpayer by $1.465M. At issue was whether Stock Dividend 1 also reduced the SIOH of the taxpayer on its shares of RTI, thereby reducing its SIOH in respect of the Newco 3 shares which were substituted therefor (see 5). CRA considered that such reduction occurred, so that virtually none of Stock Dividend 2 came out of SIOH of the taxpayer respecting its shares of Newco 3 (see 6). The capital gain reported by a successor of the taxpayer on a sale (see 10) of shares of a successor of Newco 3 (namely, shares of Newco 2) was reduced by the bump in the adjusted cost base of the shares of Newco 3 for the amount of Stock Dividend 2, as this bump carried over to the adjusted cost base of such shares of Newco 2– see 7). (The adjusted cost base of such shares of Newco 2 already effectively reflected the basis bump from Stock Dividend 1 as a result of the above series of transactions - see 2 and 3.) Accordingly, CRA had assessed the taxpayer on the basis that s. 55(2) applied to Stock Dividend 2.

In rejecting CRA's position, Graham J stated (at para. 31):

The shares in RTI had value because of the income earned by that company after 1971. That income had not been removed from RTI by way of dividend. The fact that a stock dividend (i.e. Stock Dividend 1) was declared by the [taxpayer] did nothing to change the fact that the shares in RTI obtained their value from the income earned by RTI after 1971.

729658 Alberta Ltd. v. The Queen, 2004 DTC 2909, 2004 TCC 474

Each of the two individual taxpayers, who owned one-half of the shares of a Canadian-controlled private corporation ("Comcare") having an accrued gain of approximately $12.4 million and safe income of approximately $1.9 million, transferred his shares of Comcare to his own newly-incorporated holding company ("Holdco") in consideration for a promissory note and common shares of Holdco, thereby realizing a deemed dividend of approximately $10.4 million. Comcare then paid taxable dividends of $1.9 million to the two Holdcos, and the two Holdcos each sold its shares of Comcare to a third-party purchaser for approximately $10.4 million.

Woods J. accepted the taxpayers position that all of the dividends paid by Comcare to the Holdcos should be considered to come out of safe income and rejected the position of the Minister that only one-sixth of the $1.9 million safe income had been inherited by the Holdco. Woods J. noted (at p. 2913) that "the accepted approach is that gain is first allocated to 'income earned or realized' and, only if dividends exceed this amount, is gain allocated to 'unrealized appreciation in the value of underlying assets'; and in these transactions no tax had been avoided as the individuals had received a deemed dividend equal to the accrued gain on the Comcare shares that was not represented by safe income.

Kruco Inc. v. The Queen, 2001 DTC 668 (TCC), aff'd 2003 FCA 284

The safe income of a corporation ("Kruger") from which the taxpayer received a deemed dividend did not exclude income resulting from investment tax credits (which produced income inclusions under s. 12(1)(t) or reduced capital cost allowance claims by virtue of ss. 13(7.1)(e) and 13(21)(f)(vii)). Regarding the position of the Minister that amounts that do not constitute actual income earned ("phantom income") should not be considered as safe income, Dussault T.C.J. indicated that this position failed to reflect that income for tax purposes is not a logical and coherent concept that reflects reality and that the wording of s. 55(2) (and, in particular, s. 55(5)(c)) "does not permit any such orientation in the name of a perhaps desirable but non-existent realism" (p. 685). Furthermore, the approach of the Minister would result in double taxation (as a capital gain in the hands of the taxpayer) of amounts that had already been taxed to the corporation.

However, the safe income of the corporation was reduced by the excess of the $4 million purchase price for an SRTC debenture over the amount of the debenture. Dussault T.C.J. noted (at p. 686) that this excess was "the equivalent of a non-deductible expense and thus must logically be adjusted".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(1) | 81 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(28) | safe income | 211 |

| Tax Topics - Statutory Interpretation - Interpretation Bulletins, etc. | 81 |

Granite Bay Charters Ltd. v. The Queen, 2001 DTC 615 (TCC)

After the individual shareholders ("Cox") of the taxpayer and a related corporation ("Greenstone") had entered into an agreement for the sale of Greenstone to a third party ("Dougan"), Greenstone transferred its non-logging assets to the taxpayer as redemption proceeds for shares of Greenstone held by the taxpayer. When the sale transaction with Dougan fell through, an agent, who for some time had been informally acting on behalf of Cox to find a buyer for Greenstone, identified another purchaser to whom the shares of Greenstone were sold some months later.

In finding that the deemed dividend arising on the share redemption occurred as part of the series of transactions resulting in the disposition of the Greenstone shares to the ultimate purchaser, Bowie J. stated (at pp. 620-1):

"... a change in the identity of the purchaser, where the intention to sell remained intact throughout and the hiatus is as short as this one, cannot divorce the share redemption from the subsequent sale of the Cox shares. .... To conclude that no nexus existed between the corporate reorganization and the redemption of the Greenstone shares in December or January and the sale of the Cox shares in February would be to ignore the obvious tax-avoidance purpose of subsection 55(2), as well as the words of subsection 248(10)."

Lamont Management Ltd. v. R., 99 DTC 871, [1999] 3 CTC 2576 (TCC)

In light of the specific code provided in s. 55(5), it was found that the safe income attributable to shares redeemed in the hands of the taxpayer did not include safe income earned by a U.S. corporation in which the taxpayer was indirectly invested because that corporation was not a foreign affiliate. This was so notwithstanding that "the word 'any' is all-embracing and ... in its natural meaning it excludes limitations" (p. 877).

943963 Ontario Inc. v. R., 99 DTC 802, [1999] 4 CTC 2119 (TCC)

The taxpayer (a Canadian-controlled private corporation) received $1.2 million upon the purchase for cancellation of shares, having a paid-up capital of $732, of a connected corporation (HSP), thereby realizing a deemed dividend (before any application of s. 55(2)) of $1,199,268 (which it subdivided into 10 separate deemed dividends under s. 55(5)(f), the first eight of which totalled to the estimated applicable safe income on hand of $252,265, and the ninth of which was the $566,920 amount of the dividend subject to Part IV tax). In calculating the portion of the deemed dividend that, in turn, was deemed to be proceeds under s. 55(2), the Minister subtracted the Part IV tax dividend amount of $566,920 from $1,200,000 to arrive at $633,080, so that the taxpayer's capital gain was $303,378 based on its adjusted cost base of $329,702. The Minister (contrary to the taxpayer's approach) did not make a further deduction for the safe income amount as this was included in the dividend subject to Part IV tax.

In rejecting a submission (at para. 19) of the taxpayer "that a taxpayer has the right to designate which portion of a dividend that will or will not be subject to Part IV tax," and in confirming the Minister's calculation, Rip J stated (at para. 29) that "paragraph 55(5)(f) is silent with respect to any allocation of the Part IV tax among the designated dividends" and (at para. 31):

It is readily apparent that Part IV tax is exigible on receipt of the first dollar of dividend, on the facts at bar, on amounts first totalling $566,920. Safe income is not safe from Part IV tax.

Meager Creek Holdings Ltd. v. The Queen, 98 DTC 2073, [1998] 4 CTC 2090 (TCC)

Two Canadian corporations owned by the taxpayer paid significant dividends to the taxpayer shortly before the February 1990 federal Budget on the advice of their accountant who feared the introduction of a tax on intercorporate dividends. Six months later, discussions were held with respect to a potential sale of the corporations, and a sale of one-third of the shares occurred a few months later. In finding that the February 1990 dividends were not part of a series of transactions that included the sale, O'Connor TCJ. stated (at p. 2078) that he could not accept the Crown's submission "that any possible or future sale can suffice to bring subsection 55(2) into play".

Brelco Drilling Ltd. v. R., 98 DTC 1422, [1998] 3 CTC 2208 (TCC), rev'd 99 DTC 5253 (FCA)

The taxpayer, in computing the safe income attributable to its shares of another corporation ("Tricil") was not required to deduct the exempt deficits of various foreign affiliates of Tricil, and was entitled to include the exempt surpluses of other foreign affiliates of Tricil.

Les Placements E&R Simard Inc. v. The Queen, 97 DTC 1328 (TCC)

On September 10, 1988, the taxpayer transferred its assets to a subsidiary ("Alimentation 1988") in consideration for a demand promissory note and 506,125 Class B shares having a redemption value of $1 per share and nominal paid-up capital. 151,125 of the Class B shares were redeemed in the fiscal years of Alimentation 1988 ending on May 31, 1990, 1991 and 1992.

After finding that the redemption of the shares did not occur as part of the same series of transactions that included the September 10, 1988 sale transaction, Tardiff TCJ. found that there was no safe income attributable to the Class B shares because they had a fixed redemption amount, and, accordingly, could not participate in the earnings of Alimentation 1988.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(10) | 152 | |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(1) - Safe-Income Determination Time | subsequent redemption of preferred shares was not assimilated to the series in which they were issued one or more year previously, given different objectives for each and lack of interdependence | 175 |

Deuce Holdings Ltd. v. R., 97 DTC 921, [1998] 1 CTC 2550 (TCC)

Bell TCJ. found that the safe income of the corporation in question should be computed on an after-tax basis, but should not be reduced by a retiring allowance whose payment had not been agreed to by the parties until after the period of time from which safe income was to be computed.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(b) | 69 |

Gestion Jean-Paul Champagne Inc. v. MNR, 97 DTC 155, [1996] 2 CTC 2537 (TCC)

In connection with a buy-out of an individual's interest in a corporation ("Champagne") by his brother, the individual and his wife transferred their shares of Champagne to a newly-incorporated holding company, following which Champagne redeemed the transferred shares.

Lamarre Proulx TCJ. found that considering all the retained earnings of Champagne to be attributable to the redeemed shares ran counter to the corporate law principle of the equality of shares and the purposes of s. 55(2), and found that the safe income of Champagne should be prorated among the shareholdings.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(5) - Paragraph 55(5)(f) | 44 |

454538 Ontario Ltd. v. MNR, 93 DTC 427, [1993] 1 CTC 2746 (TCC)

Two brothers (the "Mazzoccas"), who constituted two of the three equal shareholders of a corporation ("Tri-M"), transferred their shares of Tri-M on a partial rollover basis to two holding companies and caused the two holding companies to purchase the shareholding of the third shareholder ("Manley"). Immediately thereafter, an arm's length purchaser ("461") lent money to Tri-M sufficient for it to pay a dividend to the two holding companies equal to the estimated accounting retained earnings of Tri-M, following which 461 purchased the shares of Tri-M held by the two holding companies for a reduced purchase price.

In confirming reassessments by the Minister which included the amount of the dividends in the proceeds of disposition realized by the holding companies, Sarchuk J. rejected submissions inter alia:

- that the transactions were grandfathered on the basis that they occurred as part of a series of transactions or events which commenced prior to April 22, 1980 the evidence disclosed that "there was no serious intention on the part of the Mazzoccas to dispose of their interest in Tri-M prior to late summer and fall of 1980" (p. 431);

- that the reference to "income earned or realized" was ambiguous and therefore should be interpreted in the taxpayers' favour to refer to accounting retained earnings (it was clear in light of the wording of ss.55(5)(c) and in light of the decision in Mattabi Mines Ltd. v. MNR, [1988] 2 CTC 294, [1988] 2 S.C.R. 175 that "income" referred to income determined in accordance with the Part I of the Act); and

- that s. 55(2) was void for uncertainty (the problems in application of s. 55(2) were "not surprising given the complexity of the subject matter" and it could not be concluded that it was "couched in such vague or general language that it does not contain an intelligible standard" (p. 437)).

Administrative Policy

7 October 2021 APFF Roundtable Q. 9, 2021-0901101C6 F - Part IV tax exception vs eligible and non-eligible

Suppose that Holdco has eligible refundable dividend tax on hand (“ERDTOH”) and non-eligible refundable dividend tax on hand (“NERDTOH”) both of nil, and a general rate income pool (“GRIP”) of $1,000,000, and that its wholly-owned subsidiary, Opco, has ERDTOH, NERDTOH and GRIP of nil, $383,333 and $2,000,000, respectively. There is no safe income attributable to the Opco shares held by Holdco. Opco pays a non-eligible dividend of $1,000,000 to Holdco, and Holdco then pays a $1,000,000 dividend.

On the payment of the Opco dividend, it generates a dividend refund of $383,333, which results in Pt. IV tax payable by Holdco of the same amount, which is added to Holdco’s NERDTOH account. When Holdco in turn pays an eligible dividend of $1,000,000, no dividend refund is generated.

In confirming that even though there is no safe income for the shares held by Holdco, s. 55(2) does not apply, CRA stated:

Opco will, by virtue of paragraph 129(1)(a), be entitled to a dividend refund of its NERDTOH balance of $383,333. Considering that, Holdco will therefore be liable for Part IV tax of $383,333. Consequently, the entirety of that dividend received by Holdco would be subject to Part IV tax and may not be subject to subsection 55(2) by virtue of the exclusion provided for in the preamble to subsection 55(2) to the extent that such Part IV tax is not refunded by reason of the payment of a dividend by Holdco where such payment forms part of the series referred to in subsection 55(2.1).

7 October 2021 APFF Roundtable Q. 5, 2021-0900951C6 F - Safe income and Part IV tax

9711005 indicated, before the bifurcation of RDTOH into the eligible refundable dividend tax on hand (“ERDTOH”) and non-eligible refundable dividend tax on hand (“NERDTOH”) accounts, that it was not possible to use both the Part IV tax exception to s. 55(2) and the safe income exclusion.

Holdco holds all the shares of Opco having attributable safe income of $1,000,000 and a fair market value of $5,000,000. Opco has a general rate income pool (GRIP) of $1,000,000 and a NERDTOH balance of $70,000. Before Holdco’s sale of the Opco shares, Opco first pays a $1,000,000 dividend (designated as an eligible dividend) - and then pays a non-eligible dividend of $182,608, which generates a refund of the $70,000 of NERDTOH, so that Holdco is subject to Part IV tax on that dividend.

Can Holdco take advantage of both the $1,000,000 safe income exclusion and of the Part IV tax exclusion regarding the dividend of $182,608, given that the $1,000,000 dividend is not subject to Part IV tax?

CRA noted that no dividend refund arises to Opco on the $1,000,000 eligible dividend, so that there is no Part IV tax payable by Holdco thereon under s. 186(1)(b) – and that such dividend also is not subject to s. 55(2) as it does not exceed the $1,000,000 of safe income.

Since Opco is entitled to a dividend refund of its $70,000 NERDTOH, Holdco is liable for $70,000 of Part IV tax on that dividend, so that such dividend is not subject to s. 55(2) under the Part IV tax exclusion in the s. 55(2) preamble, to the extent that such Part IV tax is not refunded by reason of the payment of a dividend by Holdco where such payment forms part of the series referred to in s. 55(2.1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | full use can be made of safe income even though there is an immediately subsequent use of Pt. IV tax exclusion | 224 |

18 December 2017 External T.I. 2017-0714971E5 F - Application of subsection 55(2)

Example 1, Scenario 1 is summarized as follows:

Opco, which had refundable dividend tax on hand ("RDTOH") of $383,333 and no safe income paid a $1M dividend to which s. 55(2.1)(b) applied to Holdco (which also had a calendar year). At the time of preparing its original return, the Part IV tax liability and RTDOH of Holdco would be $383,333. An amended return for Holdco would then be prepared to give effect to its deemed capital gain under s. 55(2), but with the Part IV tax paid of Holdco remaining at $383,333. Holdco pays the refundable portion of the Part I tax ("RPPT") on the capital gain in the amount of $153,333, increasing its RDTOH to $536,666. On payment of a $1M dividend, Holdco would receive a DR (38 1/3%) of $383,333, reducing its RDTOH to $153,333 (RDTOH: $536,666 and DR: $383,333). The result in the amended return for Holdco would be that there would be federal tax payable in respect of the application of subsection 55(2) of $193,333 ($1,000,000 * 50% * 38 2/3% , of which $153,333 could be recovered in the event of a possible dividend payment by Holdco of at least $399,999).

CRA then provided two variants of Scenario 1 (in which a smaller or no dividend is paid by Holdco), and two versions of Example 2, under which the starting RDTOH of Opco is smaller.

Respecting the scenarios where smaller Holdco dividends were paid, CRA stated:

[A]ny future payment of a taxable dividend by Holdco that resulted in a refund of Part IV tax could result in the potential application of subsection 55(2) to the extent that this payment was part of the same series of transactions. The CRA would consider any future DR as a result of the payment of a dividend by a corporation, where the payment was part of the same series of transactions, as coming first from the Part IV tax paid on the taxable dividend.

Respecting when the amended return should be filed, CRA stated:

[T]he Act does not provide specific rules as to when the amended T2 return must be filed. However, it would be administratively preferable to wait for the initial notice of assessment to be issued before requesting an amendment to the original T2 return to take into account subsection 55(2).

However, regardless of the filing date of the amended T2, it is possible to avoid interest expenses by paying, by the balance due date that is applicable to the corporation, the tax based on the higher amount the corporation may owe in computing its income based on the application of subsection 55(2) on the amended T2 return. However, there are certain administrative rules that must be followed to ensure that the additional amount is allocated by the Minister to the correct taxation year and not refunded by the Minister on the initial notice of assessment [with such rules then being summarized].

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 186 - Subsection 186(1) - Paragraph 186(1)(b) | s. 55(2) application does not reduce s. 186(1)(b) initially reported Pt IV tax | 297 |

21 November 2017 CTF Roundtable Q. 6, 2017-0724071C6 - Circular calculations Part IV tax

Holdco receives a dividend of $400,000 that is subject to Part IV tax of $153,333 (38.33% of $400,000) equalling the connected payer’s dividend refund and, in turn, pays a dividend to its shareholders resulting in a refund of the Part IV tax – so that the dividend received by Holdco is subject to s. 55(2).

If the dividend received by Holdco was originally taxed as a capital gain to Holdco, the refundable tax on the capital gain would be $61,333 ($400,000 x 50% x 30.66%).

Instead of having to pay the whole amount of $400,000 as a taxable dividend to established that the Part IV tax of $153,333 is fully refunded so that s. 55(2) applies, Holdco would only need to pay an amount of $160,000 as a taxable dividend ($61,333/38.33%) so that, at the same time, a capital dividend of $200,000 can be paid. This result is achieved because of circular calculations whereby the dividend received is deemed to be reduced by the application of s. 55(2) after each calculation, resulting in reduced Part IV tax - whereas the amount of the tax refund remains the same in each calculation. Does CRA agree?

Before concluding that the scheme of s. 55(2) does not support such circular calculations, CRA first noted that the example proposes that there is only a capital gain of $400,000 to be included in the tax return of Holdco, and that the refundable tax on such capital gain is fully refunded by the payment of a taxable dividend by Holdco of $160,000, and indicated that for a dividend to be subject to s. 55(2) based on a Part IV tax refund, such refund must be a real refund of real tax (as per Ottawa Air Cargo). Thus, the application of s. 55(2) does not eliminate the subjecting of the dividend to Part IV tax.

Using the numbers in the example, if Part IV tax of $153,333 is paid or payable, as declared in the initial tax return of Holdco, that Part IV tax is paid or payable for the taxation year. In the second return filed by Holdco, the Part IV tax paid for the taxation year remains unchanged, even though the amount of the dividend received has been reduced by the application of s. 55(2).

A capital dividend of $80,000 could be paid by Holdco after the receipt of the $400,000 dividend, due to the application of s. 55(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 186 - Subsection 186(1) - Paragraph 186(1)(b) | refunded Pt IV tax payable not reduced by application of s. 55(2) | 181 |

29 November 2016 CTF Roundtable Q. 4, 2016-0671491C6 - 55(2) and Part IV Tax

A dividend is received by Holdco from an Opco, which under the new s. 55(2) rules is no longer exempted from s. 55(2) even though the Part IV tax to which it was subjected is refunded on on-payment as a dividend to the individual shareholder. The high rate of resulting combined tax cannot be alleviated by treating such s. 55(2) application as permitting an election to treat the applicable portion of the individual shareholder’s dividend as a capital dividend. Instead, such capital gain only generates capital dividend account for use for future dividends.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 89 - Subsection 89(1) - Capital Dividend Account - Paragraph (a) | s. 55(2) application to dividend as a result of a Pt IV tax refund does not generate CDA for on-payment of that dividend | 283 |

9 October 2015 APFF Roundtable Q. 15, 2015-0595641C6 F - Surplus Stripping and GAAR

Less overall tax is paid if, rather than Opco paying a taxable dividend to one of its shareholders (A, an individual), A rolls his shares into a new Holdco, Opco redeems the shares now held by Holdco (but without any s. 55(5)(f) designation being made by Holdco so that all of the redemption proceeds are subject to capital gains treatment under s. 55(2)), and then Holdco pays a capital dividend to A. CRA commented:

[T]he GAAR committee…recommended that the GAAR not be applied [in a similar file] having regard to the current state of the jurisprudence.

Nonetheless, the CRA is concerned by this type of tax planning, which in particular, is contrary to the integration principle. Accordingly, we have brought our concerns…to…Finance.

[See also 16 June 2014 STEP Roundtable Q. 7, 2014-0522991C6.]

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | GAAR did not apply where a taxpayer deliberately triggered the application of s. 55(2) | 133 |

9 October 2015 APFF Roundtable Q. 12, 2015-0595601C6 F - Proposed legislation - subsection 55(2)

Holdco holds shares of Opco with a nominal ACB and no safe income. In a corporate reorganization "aimed at protecting the assets of Opco, whose purpose is to reduce the fair market value (FMV) of Holdco’s shares in Opco," Holdco lends money to Opco equal to the accrued gain on the shares (of $1M), and receives that money back as an actual $1M dividend. It does not matter if this transaction has no capital gains avoidance purpose. CRA accepted that since the purpose of the creditor-proofing is to reduce the fair market value of the Opco shares, the full amount of the dividend is deemed to be a capital gain. Furthermore, there is no relief if the dividend from Opco is subject to Part IV tax, but this tax is refunded as a result of payment of an equivalent dividend to the individual shareholder of Opco. Under the new rules, it does not matter that the individual is not a corporation eligible for the s. 112(1) deduction, so that the dividend amount will still be deemed to be a capital gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(b) | transaction targeted at reducing FMV of Opco shares for creditor-proofing was caught | 249 |

27 June 2014 External T.I. 2013-0498191E5 F - Interaction entre 55(2) et l'impôt de partie IV

On a cross-share redemption between two connected Canadian-controlled private corporations, neither of which has a refundable dividend tax on hand account account immediately before the redemption, each corporation is deemed to receive a dividend from the other. Does the application of s. 55(2) to the deemed dividend received by each corporation, which generates an addition to its RDTOH account and, therefore, generates a dividend refund to it and associated Part IV tax on the deemed dividend paid by it to the other corporation, engage the exclusion from s. 55(2) for dividends which are subject to Part IV tax – or does the Part IV tax exclusion not apply so that s. 55(2) applies to the full amount of the deemed dividend received by each corporation? CRA stated (TaxInterpretations translation):

[I]n accordance with sections 129 and 186, it is provided that the dividend refund, the RDTOH account and thus the Part IV tax of a given corporation are calculated as a function of all relevant amounts in this regard for the whole taxation year.

Furthermore … in … 943963 Ontario Inc. … the parties … and the Court accepted that there was a given amount subject to Part IV tax by the appellant, the dividend recipient, notwithstanding that a part of the deemed dividend…was deemed to not be a dividend received, by virtue of subsection 55(2). In other words, the part of the dividend giving rise to a capital gain by virtue of subsection 55(2) did not affect the amount of the "assessable dividend" taken into account for calculating the Part IV tax payable… . The application of subsection 55(2) in that case did not engage any circular calculation. …

Moreover, the fact of calculating the RDTOH account at the end of a taxation year of each corporation in such a situation…involving cross redemptions and thus cross dividends, entails circular calculations by them of their respective RDTOH, dividend refunds and Part IV tax. In policy terms, it does not appear acceptable to us that circular calculations could result in a complete reimbursement of the total RDTOH of each corporation in such a situation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 186 - Subsection 186(1) - Paragraph 186(1)(b) | Part IV tax on cross-redemptions takes into account the Part I tax (and RDTOH addition) generated by s. 55(2) application thereto | 352 |

7 October 2013 Internal T.I. 2013-0504081I7 F - Interaction between 55(2) and 40(1)(a)(iii)

Vendor sold blocks of shares in the capital of a corporation (the “Purchaser”) to the Purchaser, with the purchase price being payable over a following number of years based a percentage in each year of the annual consolidated after-tax profits of the Purchaser. The deemed dividend arising in the year of the repurchase under s. 84(3) was deemed by s. 55(2) to be proceeds of disposition. Was the reserve under s. 40(1)(a)(iii) available as a deduction from this capital gain?

After the Directorate confirmed that 1999-0009295 (respecting the availability of a reserve under s. 40(1)(a)(iii) to a capital gain under s. 55(2) where the capital gain arose on the receipt of a promissory note made as a conditional payment) still was valid, and went on to indicate that essentially the same positon applied to the above facts where the unpaid purchase price was not evidenced by a promissory note and was payable on an earnout basis with a prepayment right which had not yet been exercised.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(1) - Paragraph 40(1)(a) - Subparagraph 40(1)(a)(iii) | reserve available for s. 55(2) gain on purchase for cancellation of shares where redemption proceeds payable on an earnout basis | 268 |

| Tax Topics - General Concepts - Payment & Receipt | distinction between promissory note as conditional or absolute payment | 249 |

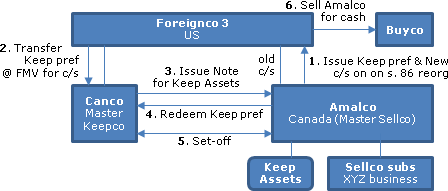

2012 Ruling 2011-0403291R3 - Treaty exempt sale

Following a preliminary reorganization (including an amalgamation of predecessors of Amalco so as to "consolidate the tax attributes"), all the shares of Amalco are held by Foreignco3 (resident in the U.S.) which, in turn, is an indirect wholly-owned subsidiary of Foreign Parent, a listed company. Amalco has various direct or indirect (mostly Canadian) subsidiaries carrying on the XYZ Business and also holds the "Keep Assets," which mostly are non-resident or resident subsidiaries. The following transactions occur in order to accomplish an indirect sale of the XYZ Business by Foreignco3 to Buyer (an arm's length purchaser) after a spin-off of the other "Keep Assets" to a newly-incorporated Canadian spinco whose initial common share is held by Foreignco3 ("Canco"):

- On a s. 86 reorganization Foreignco3 will receive "Keep Shares" (non-voting redeemable retractable preferred shares) and New Common Shares in exchange for its old common shares of Amalco (which are taxable Canadian property).

- Foreignco3 will transfer the Keep Shares to Canco in exchange for additional Canco Shares, electing under s. 85(1) at fair market value.

- Amalco will transfer the Keep Assets to Canco in exchange for the Canco Note and the assumption of the Assumed Debts, with a net taxable capital gain resulting.

- Amalco will purchase the Keep Shares from Canco for cancellation (giving rise to an obligation, but with no note issued).

- The obligations arising in 3 and 4 and other obligations are set-off.

- Foreignco3 will sell the New Common Shares (which now derive their value from the XYZ Assets) to the Buyer for cash.

Rulings include:

- the gain realized by Foreignco3 on the transfer of the Keep Shares to Canco in 2 and on the sale in 6 will be exempt from tax under Art. 13 of the Treaty.

- 55(2) will not apply to the deemed dividends arising in 4.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Disposition | partnership distribution to one of partners not disposition of the partnership interests | 74 |

| Tax Topics - Treaties - Income Tax Conventions - Article 13 | Treaty step-up to avoid the application of s. 55(2) to a spin-off made to effect an arm's length sale of the rump | 337 |

14 March 2014 Internal T.I. 2013-0499141I7 - IRC 338(h)(10), "earnings" and safe income

An indirect wholly-owned foreign affiliate ("FA") of Canco made an arm's length purchase of all the shares of "US Holdco," whose wholly-owned subsidiaries ("US-Opcos") had accrued gains inherent in the appreciated assets of their active businesses including capital property, depreciable property and intangible property such as goodwill.

After noting (para. 33) that the income realized ("Intangible Property Safe Income") by the US-Opcos under former s. 55(5)(d) on the disposition of the intangible properties was in respect of gains that accrued on those intangible properties in the period before FA acquired the US Holdco shares (the "Pre-acquisition period") and that "the Intangible Property Safe Income was reflected in the purchase price and, therefore, the ACB, of the US Holdco shares that FA acquired," and before concluding (para. 36) that "the Intangible Property Safe Income did not contribute to the gains that accrued on FA's US Holdco shares in the Post-acquisition period and, therefore, did not contribute to the gains that accrued on PrivateCo's… Canco common shares immediately before their redemption," CRA stated (at para. 34):

[A]llocating the Intangible Property Safe Income to the gains that accrued on FA's US Holdco shares in the Post-acquisition period would offend the object and spirit of subsection 55(2) because such an allocation would result in "capital gains stripping" which is what subsection 55(2) is designed to prevent. This is because such an allocation would give rise to a "double counting" of FA's ACB of the US Holdco shares as safe income which could then be allocated to a gain that accrued on the US Holdco shares in the Post-acquisition period and that is attributable to the unrealized appreciation in the value of the underlying assets of the US-Opcos.

See also the summary under Reg. 5907(2)(f).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Earnings | "notional" deduction arising from Code s. 338(h)(10) step-up excluded | 137 |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Exempt Earnings | no carve out for goodwill gains | 142 |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(2) - Paragraph 5907(2)(f) | "notional" deduction arising from Code s. 338(h)(10) step-up of non-purchased goodwill reversed under Reg. 5907(2)(f) rather than (b) | 453 |

21 March 2014 External T.I. 2012-0471021E5 - Safe income and section 34.2

The fiscal period of a partnership ends on June 30, 2013 but the taxation year-end of the private corporation which is a member is December 31, 2013, which is also its "safe-income determination time." Should a negative adjustment be made in computing the "safe income on hand" if the corporate partner has an income inclusion under s. 34.2(2) but there is a loss in the partnership for the stub period from July 1, 2013 to December 31, 2013?

After noting that "an adjustment to carve out from 'safe income' any amounts included in income under subsections 34.2(2) and (12) and any amounts claimed under subsections 34.2(4) and (11) would be contrary to the wording of [s. 55(5)(c)]," CRA went on to state that:

a negative adjustment in respect of the loss should be made in determining the "safe income on hand" of the corporation on the basis that the [s. 34.2(2)] amount would not be on hand to contribute to the fair market value or the gain inherent in the shares of the corporation.

16 April 2009 External T.I. 2008-0294631E5 F - Interaction between 55(2) and 186(1)

An individual wholly-owned Holdco, which held all of the preferred shares of Opco (also, with a calendar year end), whereas Opco’s common shares were held by others. In 2008, Opco paid dividends of $2,199,995 and $143,915 to the common shareholders and Holdco, respectively; and also redeemed a portion of Holdco’s preferred shares (which had a nominal PUC and ACB), resulting in a s. 84(3) deemed dividend of $529,785 - so that the 2008 dividends totalled $2,873,695 and Opco received a dividend refund (the "DR") of $131,400. Only the preferred share redemption engaged s. 55(2) (the safe income on hand attributable to the preferred shares was nil). No s. 55(5)(f) designation was made.

How is the Part IV tax payable by Holdco and the portion of the dividend subject to s. 55(2) computed?

After discussion the 943963 Ontario, CRA stated:

It follows, therefore, that the amount of the assessable dividend received for the purposes of subparagraph 186(1)(b)(i) remains the same despite the fact that a portion of the dividend may be deemed not to be a dividend under paragraph 55(2)(a).

In light of that decision, we are of the view that no circular calculation is required to be made to determine the Part IV tax payable by Holdco and the portion of the dividend received that is subject to paragraph 55(2)(a) in the Particular Situation.

Accordingly, s. 55(2) would apply to $457,112. This figure is the s. 84(3) dividend of $529,785 minus $72,673, being the portion of the taxable dividend received from Opco that was computed as being subject to Part IV tax under s. 186(1)(b). This reduction is computed as the pro rata portion of the $131,400 dividend refund applicable to the $529,785 s. 84(3) dividend (i.e., $673,700/$2,873,695 * $131,400 = $30,805), multiplied by the 3X dividend refund rate (to produce $92,415) multiplied in turn by the ratio of the s. 84(3) dividend received (of $529,785) to the total dividends received by Holdco (of $673,700).

Income Tax Technical News, No. 34, 27 April 2006 under "Delaware Revised Uniform Partnership Act"

The Kruco case.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 96 | Delaware LPs with separate personality are not corps | 21 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) | 160 | |

| Tax Topics - Income Tax Act - Section 132 - Subsection 132(6) | majority of subsidiary board not to be MFT trustees/guarantees re non-wholly owned subs scrutinized | 105 |

| Tax Topics - General Concepts - Transitional Provisions and Policies | 0 | |

| Tax Topics - Treaties - Income Tax Conventions - Article 5 | 17 | |

| Tax Topics - Income Tax Act - Section 132 - Subsection 132(6) - Paragraph 132(6)(b) - Subparagraph 132(6)(b)(i) | guarantee must be highly integrated with trust’s core investment undertaking/limited overlap with subsidiaries' boards | 434 |

3 June 2003 External T.I. 2003-0012075 F - Safe Income and 104(13.1) Designation

An amount designated by a personal trust in respect of its corporate beneficiary under s. 104(13.1) would not be included in determining the corporate beneficiary's safe income or safe income on hand.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | income retained by a trust under s. 104(13.1) and then distributed to its corporate beneficiary was not included in the latter’s safe income | 166 |

14 December 2000 Internal T.I. 2000-0034037 - safe income

The safe income on hand of a corporation, is not reduced by non-capital losses of a corporation within the group that is acquired by it, although the amount paid to acquire such loss company will reduce the safe income on hand attributable to its shares as the shares of the loss company disappear on the subsequent amalgamation.

2000 Ruling 2000-0003253 - Safe income

Where a share is exchanged for a second share on a rollover basis, the full safe income on hand attributable to the first share owned by the transferor immediately before the exchange will flow through to the second share on the exchange provided that the fair market value of the second share received on the exchange is not less than the fair market value of the transferred share immediately before the exchange.

Income Tax Technical News, No. 16, 8 March 1999

Reference to Brelco case.

1999 Ruling 9910443 - SAFE-INCOME DETERMINATION TIME

The safe income attributable to shares of a corporation that were sold to an arm's length purchaser included gain arising from an s. 111(4)(e) designation given that no election was made under s. 256(9).

1999 APFF Round Table, Q. 4 (No. 9M19190)

A loss that is denied under s. 40(2)(g)(ii) will be deducted when calculating safe income on hand.

17 September 1997 External T.I. 9721415 - INTERACTION OF SUBSECTION 55(2) & DIVIDEND REFUNDS

The fact that a dividend refund has been received by the payor of a dividend is not normally relevant to consideration of the following expression: "that is not refunded as a consequence of the payment of a dividend to a corporation where the payment is part of the series of transactions or events".

29 August 1997

Confirmation of policy expressed in the Read paper (1988 Conference Report) respecting the redemption of preferred shares which were received as a stock dividend.

26 August 1997 External T.I. 9713655 - SAFE INCOME - INCESTUOUS SHAREHOLDINGS

Where a wholly-owned subsidiary owns shares in the capital of its parent company, an allocation of safe income must be made to the shares of the parent corporation held by the subsidiary.

16 June 1997 External T.I. 9711005 - SAFE INCOME/PART IV TAX

Any dividend paid by a payer corporation is considered to be paid first out of the safe income on hand attributable to the recipient corporation's shares of the payer corporation. Accordingly, the amount of the dividend to which s. 55(2) will not apply is the aggregate of the amount of the dividend subject to Part IV tax and the amount, if any, by which the amount of safe income on hand exceeds the amount of the income subject to Part IV tax. Conversely, the recipient corporation would not have to designate any amount under s. 55(5)(f) in any situation where the portion of the taxable dividend that is subject to Part IV tax exceeds the safe income on hand of the corporation.

17 March 1997 External T.I. 9632725 - SAFE INCOME ENTITLMENTS OF ALPHABET SHARES

Discussion of the safe income entitlement of alphabet shares.

16 July 1996 External T.I. 9604915 - 55(2)-NOT APPLY WHERE SALE & REDMPTION DIFFERENT SERIES.

Where preferred shares issued by Newco on the roll-in to Newco of shares of Opco, have a dividend entitlement equal to dividends received by Newco on the shares of Opco, and to proceeds received by Newco on the sale of shares of Opco to the extent of the gain realized by Newco, but with the redemption amount of the shares being reduced on a dollar-for-dollar basis by the amount of the dividends paid out of such gain. RC will not consider the preferred shares to have a dividend entitlement in respect of the gain because of the corresponding reduction in redemption amount. Accordingly, the safe income attributable to the gain could not be attributed to the preference shares.

6 May 1996 External T.I. 9611245 - SAFE INCOME-PROVISION FOR CAPITAL ITEM, DIVIDENDS

A write- down in the carrying value of a capital asset to reflect an accrued loss inherent in the property, will not reduce safe income on hand because the write-down does not represent an amount of safe income that has been set aside to pay an amount not currently deductible for tax purposes.

Income Tax Technical News, No. 7, 21 February 1996 (cancelled)

After referring to the Clem Industrial case, Mr. Hiltz stated:

"Ordinarily, if an arm's length sale of shares occurs within a short time after a dividend was received on the shares, we will consider this to be strongly indicative that one of the purposes of the dividend was to reduce the capital gain that would otherwise have been realized on the share sale."

1996 Ontario Tax Conference Round Table, "Purpose Test in Subsection 55(2)", 1997 Canadian Tax Journal, Vol. 45, No. 1, pp. 231-214

Discussion of CPL Holdings Ltd. v. The Queen, 95 DTC 5253 (FCTD).

5 July 1995 External T.I. 9416065 - CALCULATION OF SAFE INCOME

Discussion of a situation where a Canadian-controlled private corporation ("Holdco") transfers an asset on a rollover basis to a newly-incorporated subsidiary ("Newco"), following which Newco sells the assets to an unrelated third party and pays the after-tax profit to Holdco giving rise to dividend refund to it and Part IV tax to Holdco, with Holdco paying corresponding taxable dividends to its shareholders that are not liable to Part IV tax.

28 March 1995 External T.I. 9430955 - SAFE INCOME STOCK SPLITS

"Generally, when a portion of the capital gain inherent in the shares of a corporation is crystallized, the Department's approach ... is to apportion the safe income to which the entire gain is attributable proportionately to each part of the gain. A transferee's safe income attributable to the shares received would be computed by multiplying the safe income attributable to the transferred shares immediately before the transfer by the proportion that the transferee's potential gain (immediately after the transfer) is of the transferor's potential gain (immediately before the transfer)."

27 October 1994 External T.I. 9414365 - SAFE INCOME - FOREIGN AFFILIATES (HAA 5102-3)

When computing exempt or taxable surplus of a foreign affiliate for the purpose of determining safe income of a Canadian corporation with a wholly owned U.S. foreign affiliate, the relevant time is that at which the safe income is to be computed (i.e., immediately before the transaction or event, or the commencement of the series of transactions or events).

General discussion of computation of safe income in the context of a foreign affiliate.

94 CPTJ - Q. 1

Because the Alberta royalty tax credit is not included in a corporation's net income for tax purposes, it would not be included in determining the corporation's safe income or safe income on hand.

3 May 1993 External T.I. 9236395 F - Safe Income and Part IV Tax

Where X owns 20% of the shares of Opco having a safe income of $100 and a fair market value of $125, and transfers all of such shares to a new corporation ("Newco") on a rollover basis in exchange for shares of Newco, and Opco then redeems the shares held by Newco for $125 giving rise to a deemed dividend of $125, Newco will not be able to treat itself as having received a safe income dividend of $100 (assuming the appropriate designation under s. 55(5)(f)), and a further separate dividend of$25 subject to Part IV tax, if the payment of the deemed dividend by Opco triggers Part IV tax on $25 of that dividend deemed to be received by Newco:

"It is our view that to the extent that a dividend refund arises in respect of tax paid on the investment income earned by a corporation which pays a dividend (the "payer corporation"), such income would, on an after tax basis, have been included in the calculation of the safe income of the payer corporation. Consequently, when a dividend that gives rise to the dividend refund is paid by the payer corporation, that portion of the dividend [that is sufficient to give rise to the dividend refund would be considered to be paid out of the safe income of the payer corporation ... . Since an amount of $100 (including the $25 dividend subject to tax under Part IV of the Act) which is equal to the total safe income of Opco, is designated as a separate taxable dividend, subsection 55(2) will not apply to this dividend. However, subsection 55(2) will, in our view, apply to the other separate taxable dividend of $25."

20 July 1994 External T.I. 9408795 - 55(2)

The rollover under s. 107(2) is accorded the same treatment for safe income purposes as the rollover under s. 85.

On a wind-up of one company into a second company, the safe income on hand of the second company will be reduced by the amount of the loss realized on the intercompany debt which is deemed to be paid in full by virtue of an s. 80(3) election. In addition, any other liabilities of the first company assumed by the second company that are in excess of the fair market value of the property of the first company distributed to the second company, will also reduce the safe income on hand of the second company.

Losses incurred in a taxation year that have not been deducted in computing income under s. 3 by the corporation, or by any corporation over which it has significant influence, will generally reduce safe income on hand of the corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | flow-through of safe income on s. 107(2) rollover | 23 |

6 April 1994 External T.I. 9331715 - SAFE INCOME AND SRED EXPENDITURES

Current SR & ED expenses must be deducted in computing the corporation's safe income on hand even if such expenses have not yet been deducted for tax purposes. However, SR & ED capital expenditures do not reduce the corporation's safe income on hand until the year that such amounts are claimed as a deduction for tax purposes.

93 C.R. - Q. 15

Safe income on hand will be reduced by large corporations tax.

93 C.R. - Q. 12

Discussion of distinction between "safe income" and "safe income on hand".

3 May 1994 Roundtable Q. 1, 9411620 - SAFE INCOME & ALBERTA ROYALTY TAX CREDITS

Because an Alberta royalty tax credit is not included in a corporation's income for tax purposes, it also is not included in its safe income or safe income on hand.

31 August 1993 Memorandum (Tax Window, No. 33, p. 4, ¶2639)

Impact of investment tax credits and share purchase tax credits on calculation of safe income.

2 February 1993 T.I. (Tax Window, No. 28, p. 5, ¶2414)

Amounts actually expended but not deductible for tax purposes (e.g., 20% of entertainment expenses), and amounts actually expended but deferred or capitalized for tax purposes (e.g., contributions of an employer to an employee benefit plan pursuant to s. 18(1)(o) or amounts capitalized under s. 18(2)) cannot be included in safe income on hand until such time, if any, as they are deducted for tax purposes.

Amounts not yet expended but deducted for accounting purposes but not for tax purposes (e.g., accrued compound interest, provisions for unfunded future employee pension obligations and provisions for future warranty obligations) reduce safe income on hand if safe income has been set aside to pay these amounts or if the future obligations have reduced a gain that would otherwise be realized on a disposition at fair market value of a share of any corporation.

20 October 1992 T.I. 910248 (September 1993 Access Letter, p. 413, ¶C38-174)

The deduction under s. 110(1)(k) has no effect on safe income.

92 C.R. - Q.35

RC response to suggestion that s. 55(2) does not apply to a taxable dividend arising out of transactions that were structured by the corporation rather than the vendor.

92 C.R. - Q.29

Where a deemed dividend arising on the redemption of a portion of the shares of Opco exceeds the safe income attributable to the redeemed shares and no designation under s. 55(5)(f) is made, the safe income that otherwise would be available will be permanently lost. The same result applies where there is a payment of an ordinary dividend.

28 July 1992 External T.I. 5-920803

Where A and B, who are two of the three individual shareholders of OPCO, transfer their common shares of OPCO to separate newly-incorporated holding companies and later, following a conversion of the common shares of OPCO held by the holding companies into preferred shares, have their holding companies receive redemption proceeds of the preference shares out of the capital dividend account of OPCO, the safe income attributable to the common shares of OPCO transferred to their holding companies cannot be attributed to the shares of OPCO held by the third shareholder, even though the subsequent deemed dividend paid out of the capital dividend account of OPCO does not affect its safe income.

Where an amount, otherwise deemed to be a dividend under s. 84(3), is deemed instead to be a capital gain under s. 55(2), it also will not reduce the safe income attributable to the other shares of the corporation.

10 January 1992 Memorandum (Tax Window, No. 17, p. 12, ¶1773)

The reduction in Part I tax caused by the application of available investment tax credits affects the corporation's safe income only in the years following the claim, for example, through a reduction of the amount of CCA or SR&ED expenditures available in those years.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | 19 | |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(a) | 70 |

10 January 1992 Memorandum (Tax Window, No. 17, p. 12, ¶1773)

The corporation to which assets are transferred in a butterfly may not be amalgamated with another corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | 48 | |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(a) | 70 |

24 February 1992 Memorandum (Tax Window, No. 13, p. 13, ¶1630)

Re circumstances where RC is prepared to consider a reassessment of only the excess of deemed proceeds over safe income notwithstanding the failure to make a timely designation under s. 55(5)(f).

23 January 1992 T.I. (Tax Window, No. 12, p. 6, ¶1574)

Where a corporation pays a dividend in kind comprising part of its assets, its safe income must be pro-rated rather than being allocated fully to the dividend.

6 June 1991 T.I. (Tax Window, No. 4, p. 12, ¶1282)

Where shares of Opco are redeemed by Holdco giving rise to a deemed dividend of $2.2 million at a time that the safe income of Opco is $1.8 million, Holdco designates $1.8 million as a separate taxable dividend under s. 55(5)(f) and Opco receives a dividend refund of tax of $100,000, the $400,000 of income earned by Opco on which it paid refundable tax will be considered to be part of the safe income of Opco. Consequently, s. 55(2) will apply to the dividend of $400,000 because it would not be considered to have been paid out of safe income.

15 May 1991 T.I. (Tax Window, No. 3, p. 18, ¶1239)

S.55(2) generally will not apply to a deemed dividend which deliberately has been made subject to Part IV tax in order to avoid the application of s. 55(2).

13 March 1991 T.I. (Tax Window, No. 1, p. 20, ¶1140)

Crown royalties and other amounts representing cash outlays which are non-deductible under s. 18(1)(m) should be included in computing safe income. However, the resource allowance which does not represent an actual outlay, should be excluded.

26 November 1990 T.I. (Tax Window, Prelim. No. 2, p. 7, ¶1037)

Safe income effectively is transferred on an s. 85 rollover or an interspousal rollover under s. 73(1).

90 C.P.T.J. - Q.20

A corporation with safe income of $100 has one shareholder whose shares, all being of one class, have an accrued gain of $200. If the redemption of 1/2 of the shares results in a deemed dividend of $100, it will be unreasonable to conclude that the $100 gain inherent in the shares being redeemed is wholly attributable to the $100 of safe income and that the $100 gain inherent in the remaining shares is attributable to something other than the safe income.

29 June 1990 T.I. (November 1990 Access Letter, ¶1516)

Where the individual shareholders of Opco transfer their common shares of Opco to Holdco on a share-for-share exchange, the common shares held by Holdco are changed into preferred shares under an s. 86 reorganization and a dividend and deemed dividend are paid on the preferred shares held by Holdco, Holdco will receive only a proportionate share of the safe income of Opco. Holdco may avail itself of the election under s. 55(5)(f).

June 1990 Meeting of Alberta Institute of Chartered Accountants (November 1990 Access Letter, ¶1499, Q. 7)

Safe income is attributable to a particular class of shares in the same proportion in which each class of shares will be entitled to earnings of the corporation if they were distributed on a winding-up.

30 April 1990 T.I. (September 1990 Access Letter, ¶1415)

Employees of Opco, who own all its issued shares, transfer those shares to Newco in exchange for shares of Newco, thereby realizing a capital gain. Immediately thereafter, Opco pays a taxable dividend to Newco equal to the full amount of its safe income on hand prior to the share-for-share exchange. Assuming that the full amount of the unrealized gain on the shares of Opco is greater than Opco's safe income, and a portion of that gain is realized, then a proportionate part of this portion is attributable to safe income and the remaining part may be reasonably considered to be attributable to something else. Accordingly, a portion of the supposed safe income dividend also would be attributable to something other than safe income, and s. 55(2) will apply.

23 March 1990 T.I. (August 1990 Access Letter, ¶1376)

In response to a proposal that entailed purifying a corporation for purposes of the exemption for sales of qualified small business corporation shares by paying a large dividend on special shares which had been issued for a nominal amount, RC noted that the provisions of s. 55(2) are always of concern where a class of shares attracts an inordinately large dividend, whether that dividend is paid periodically or arises on the redemption of shares. Because s. 55(2) can apply where a large dividend of one class of shares reduces the accrued capital gain on another class of shares, no comfort can be drawn from the absence of any reduction of a capital gain on the special shares.

23 February 1990 T.I. (July 1990 Access Letter, ¶1322)

If it is known, at the beginning of a series of transactions, that there will be an acquisition of control of the corporation resulting in a deemed capital loss under s. 111(4), the deemed capital loss should be applied to reduce taxable capital gains realized prior to the commencement of the series for the purpose of computing the corporation's safe income.

12 January 1990 External T.I. 59210 - Avoidance of Tax on Capital Gains - Intercorporate Dividends Deemed to be Capital Gain

A sale of an operating division by Opco followed by the payment of a dividend to Holdco equal to the net after tax proceeds of the sale likely would not be regarded as having been carried out for the prohibited purpose.

10 January 1990 T.I. (June 1990 Access Letter, ¶1259)

Where Opco pays a stock dividend of $500,000 in high-low preferred shares, only a pro-rata portion of its safe income is attributable to the preferred shares on the subsequent redemption thereof.

5 December 1989 T.I. (May 1990 Access Letter, ¶1216)

One corporation ("S1") transfers a capital property under s. 85(1) to a sister corporation ("S2") in consideration for redeemable preference shares which are then redeemed following the sale by S2 of the property to an arm's length purchaser. The safe income attributable to the preferred shares is nil because the entire gain on those shares is attributable to the capital gain on the transferred property, and no dividend entitlement accrued on the preferred shares prior to the commencement of the series of transactions.

15 November 89 T.I. (April 90 Access Letter, ¶1187)

A corporation ("Opco") is owned by siblings who wish to transfer their shares to their children. Each sibling would form a holding company into which he would transfer his common shares of Opco pursuant to s. 85(1) in exchange for preference shares having a redemption amount equal to the fair market value of the transferred common shares, and the children would receive common shares from treasury such that they would have an equity percentage equivalent to what the parents had. S.55(2) would apply on the redemption of the preferred shares. S.55(3)(a) would not apply because nephews and nieces do not deal at arm's length with their uncles and aunts.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | 100 |

89 C.R. - Q.12

The shares of Opco whose value essentially is represented by goodwill, are converted (or "frozen") into high-low preferred shares, which then are transferred to Holdco. Common shares of Opco are then sold to a third-party purchaser. Later, Opco sells the goodwill to an arm's length person and all the preferred shares of Opco are redeemed. The safe income of Opco earned subsequent to the freeze transaction is allocable to the preferred shares only to the extent of their dividend entitlement.

October 1989 Revenue Canada Round Table - Q.5 (Jan. 90 Access Letter, ¶1075)

Mr. A is not permitted to extract the safe income of a corporation prior to the sale of its shares, by having that corporation pay a stock dividend of preferred shares to a newly-incorporated holding company of Mr. A, followed by a redemption of those preferred shares. The principle is that the safe income of a corporation should be attributed to each share of its capital stock after payment of the stock dividend (i.e., safe income must also be allocated to the common shares), and safe income cannot be attributed to only one class of shares.

Read, "Section 55: A Review of Current Issues", 88 C.R., c. 18.

88 C.R. - F.Q.36

S.55(2) will apply if as part of the same series Opco transferred assets to Sisterco, for preference shares which were redeemed, and the shares of either Opco or Sisterco were sold to an arm's length purchaser.