Paragraph 55(3)(a)

Administrative Policy

10 October 2024 APFF Roundtable Q. 6, 2024-1028881C6 F - Revenu protégé

CRA, when asked to comment on the application of s. 55(3)(a) to the redemption in Example 12 of the “CRA Update on Subsection 55(2) and Safe Income: Where are we Now?” of a preferred share that was not supported by safe income (as all the safe income instead supported an accrued capital gain on the common shares), stated:

[I]n the context of a share redemption that results in a deemed dividend that is supported by little safe income, but where the dividend is technically exempted by paragraph 55(3)(a), the redemption in question should be analyzed with respect to the purpose of the dividend resulting from the redemption and the GAAR could potentially apply in such a situation. In this regard, see Example 5 in the Update … .

Example 5 may be summarized as follows:

- Parent, which owns shares of Subco with an ACB of $0 and FMV of $1,000 and no safe income, wishes to increase its cost in the shares of Subco or other property held in Subco, so that shares of Subco are redeemed for a note and the note is either held by Parent or subsequently reinvested back in the shares of Subco held by Parent.

- The redemption for a note has no purpose other than to effect an increase in the cost to Parent of any property, which is a circumvention of the restriction in s. 55(2.1), so that CRA would seek to apply GAAR to the redemption.

CRA then stated:

On the other hand, in the context of a share redemption the purpose of which is ultimately to finance the personal needs of a shareholder-individual, for example in a situation involving a redemption of freeze preferred shares of the capital stock of an operating corporation held by a holding company of the shareholder-individual followed by the payment of that amount by the holding company to the shareholder-individual, the CRA would accept that paragraph 55(3)(a) could apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | safe income was not allocable to preferred share issued on s. 85(1) roll-in of goodwill | 336 |

2023 Ruling 2022-0923451R3 F - 55(3)(a) internal reorganization

Background

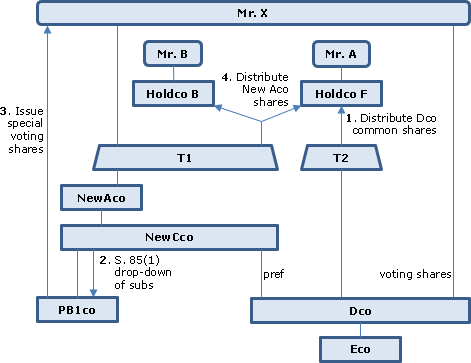

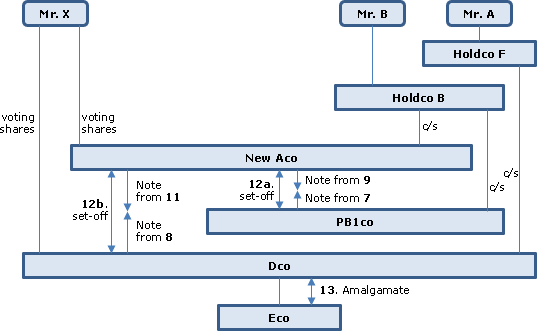

Mr. X and Ms. X are the parents of Messrs. A, B, C and D. Mr. X has direct or indirect voting control of most of the corporations referred to below, generally by virtue of holding voting non-participating shares in them or their direct or indirect parent.

Mr. B and Mr. A work full-time (as president) in managing a group of entities beneath NewCco and Eco, respectively. NewCco (a successor by amalgamation to Cco and its subsidiary, Ico) is wholly-owned by NewAco (a successor by amalgamation to Aco and its subsidiary, Bco) which, in turn, is held as to its preferred shares and its voting non-participating shares, by Mr. X, and as to its Call A voting common shares, by a family trust (T1).

Eco is a wholly-owned subsidiary of Dco. A discretionary family trust (T2) holds Class A shares of Dco, Mr. X holds its voting non-participating shares and its preferred shares (resulting from an estate freeze) are held by NewCco.

Purpose of transactions

It is intended that:

- the participating shares of the entities managed by Messrs. B and A will be transferred to their respective holding companies (HoldcoB and HoldcoF);

- the investments held by NewAco and NewCco will be held directly or indirectly by Mr. X and his children's holding corporations, HoldcoA, HoldcoB, HoldcoF and HoldcoJ; and

- control of the owners of the properties referred to above, namely, NewAco2, AH and JH (see 3 below), NewDco and PB1co (see 5 below) will remain in the hands of Mr. X. and pass to his children on the death of the survivor of him and Ms. X.

Proposed transactions

- Mr. X will exercise his discretion under the trust deed for T2 to distribute Class A shares of Dco to a holding company (HoldcoF) for his son, Mr. A).

- NewAco will declare and pay dividends out of its capital dividend account and the safe income attributable to its shares through issuing notes (NewAco Note1, Note2 and Note 3) to T1.

- T1 will distribute Note1 to Mr. X and Note2 and Note3 to newly-formed holding companies controlled by Mr. X and mostly owned by two of his children (AH for Mr. C, and JH for Mr. D) as a payment of such dividends and make s. 104(19) designations.

- Mr. X will lend the amount so received by him to NewAco.

- NewAco will transfer pursuant to s. 85(1) its shares of various subsidiaries to a wholly-owned subsidiary (PB1co) so that PB1co becomes the parent of that group.

- Mr. X will subscribe for voting shares of PB1co.

- Pursuant to a s. 86 reorganization, T1 will exchange its Class A shares of NewAco for shares of four newly-created classes of common and preferred shares.

- T1 will distribute its entire corpus, being such shares of the four classes, to HoldcoB (a holding company for Mr. X's son, Mr. B), HoldcoF, AH and JH, respectively.

- Each of AH and JH will transfer to NewAco its NewAco Note2 or Note3 in consideration for NewAco preferred shares of separate classes.

- HoldcoB will transfer to PB1co pursuant to s. 85(1) its preferred shares of NewAco in consideration for Class A shares of PB1co.

- HoldcoF will transfer to Dco pursuant to s. 85(1) preferred shares of NewAco in consideration for Class A shares of Dco.

- NewAco will redeem the preferred shares held in it by PB1co, and by Dco, in each case in consideration for a note.

- PB1co will redeem the preferred shares held in it by NewCco in consideration for a note.

- The shares of Dco held by NewCco (a subsidiary of NewAco) will be reduced to a nominal amount.

- Dco will redeem the preferred shares held in it by NewCco in consideration for the Dco Note.

- NewCco will be wound up into NewAco under s. 88(1).

- The notes issued in 12 and 14 will be paid by way of set-off.

- Dco will amalgamate with its subsidiary Eco, to form NewDco.

Rulings

Including that the Proposed Transactions, in and of themselves, will not be considered to result in a disposition of property or a significant increase in interest described in any of ss. 55(3)(a)(i) to (v).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(c) | proration of DSI on s. 55(3)(a) spin-offs based on the net cost amount of the property spun off | 447 |

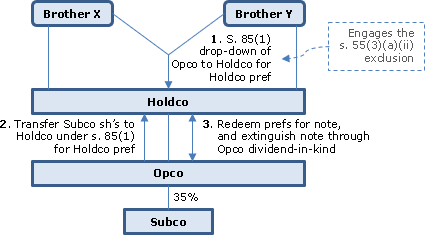

23 March 2022 External T.I. 2021-0921261E5 - Bill C-208 - 55(5)(e)(i)

S. 55(5)(e)(i) deems siblings to deal with each other at arm’s length for s. 55 purposes. Bill C-208 (a Private Member’s bill) amended s. 55(5)(e)(i) to add an exception from this rule effectively “where the dividend was received or paid” as part of a series by a corporation whose shares were qualified small business corporation shares or family farm or fishing corporation shares. Regarding the meaning of the “or” italicized above, CRA stated:

A strict reading of subparagraph 55(5)(e)(i) indicates that either the dividend payer or the dividend recipient has to be a corporation (herein referred to as “such corporation”) the shares of which are qualified small business corporation shares or shares of the capital stock of a family farm or fishing corporation, and not both … .

It is difficult to deduce the rationale that requires only one of the dividend payer or dividend recipient to be such corporation. However a textual, contextual and purposive interpretation of subparagraph 55(5)(e)(i) does not allow us to override its wording … .

CRA added:

[P]aragraph 55(3)(a) is restricted in its application to subsection 84(3) dividends in order to facilitate bona fide internal reorganizations and is not intended to provide taxpayers with a tool to create or multiply ACB ... .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(5) - Paragraph 55(5)(e) - Subparagraph 55(5)(e)(i) | under the s. 55(5)(e)(i) exception (which cannot be used to multiply ACB), only one of dividend recipient and payer is required to be a QSBC | 207 |

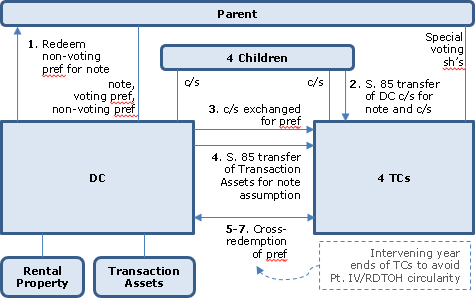

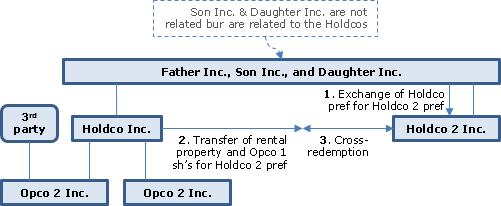

2021 Ruling 2020-0874961R3 - 55(3)(a) Internal Reorganization

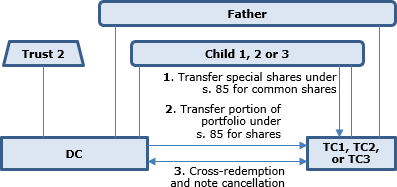

A family company (DC) controlled by father and that engaged in leveraged investing will spin off a portion of its share portfolio to respective transferee corporations (TCs) largely owned by the respective three adult children of father but with father retaining voting control. Largely because all the corporations will be related through the continuing control of father, CRA ruled that the s. 55(3)(a) exception applied, so that there was no need to strictly comply with the butterfly rules. CRA also ruled that s. 55(4) would not apply (which would have applied if it could reasonably be considered that one of the main purposes for father subscribing for special shares of the TCs was to cause them to continue to be related to DC so as to engage the s. 55(3)(a) exception), in light of a representation that father would continue to have high-level involvement in the TCs’ investing activities.

The trustees of a family discretionary trust shareholders of DC had the authority to appoint beneficiaries out of a wide range of persons including persons dealing at arms’ length with father. A representation is given that no such authority had been exercised - and that the trust has not acquired property from any such potential beneficiary or a person with whom such person does not deal at arm’s length.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(4) | spinoff of a portion of portfolio of DC (controlled by father) to father-controlled TCs for the children | 623 |

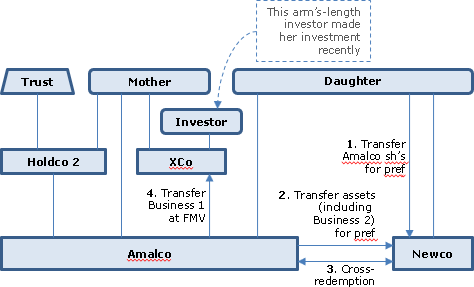

2020 Ruling 2020-0854401R3 - Internal Reorganization 55(3)(a)

Background

Three resident siblings hold the shares of DC directly (in the case of Siblings 1 and 2) and, in the case of all three, through their respective wholly-owned corporations (Parentco1, 2 and 3). DC wholly-owns Opcos 1, 2 and 3 as well as Landco1 and 2, and hold 50% of the shares of Landco3 (with the other half held by arm’s length third parties).

Completed transactions

These included life insurance policies held by DC on the lives of the respective siblings being transferred to the respective Parentcos through dividends-in-kind of such policies, utilizing in part Holdco’s capital dividend account, and declaring and designating the balance as eligible dividends.

Proposed transactions

- The Siblings will incorporate Holdco which, in turn, will incorporate TC.

- Parentco1, 2 and 3 will transfer all of its shares of DC to Holdco on a s. 85(1) rollover basis in consideration for corresponding shares of Holdco – and similarly for Parentco2 and 3.

- Sibling1 and 2, and the Estate for the Siblings’ father, will each transfer all their shares of DC to Holdco on a s. 85(1) rollover basis in consideration for corresponding shares of Holdco.

- Holdco will exchange all of its DC common and special shares pursuant to a s. 86 reorganization for newly issued common shares and Class B Special redeemable shares pursuant to a s. 86(1) reorganization, with the PUC of the exchanged shares allocated between the two classes of new shares based on their proportionate FMV.

- Holdco will transfer all of its DC Class B Special shares to TC on a s. 85(1) rollover basis in consideration for common shares of TC.

- DC will transfer to TC all of its common shares of Landco1, Landco2 and Landco3 on a s. 85(1) rollover basis in consideration for Class A Special shares of TC.

- DC (and TC) will redeem all of its Class B (and Class A) Special shares held by TC (and DC), and the redemption price in each case will be satisfied by a demand non-interest-bearing promissory note.

- The two notes will be set-off.

Additional Information

TC does not intend to sell or otherwise transfer any of the assets it will receive in the course of the Proposed Transactions.

Rulings

Include that the Proposed Transactions will not by themselves be considered to result in a disposition or increase in interest described in subparagraphs 55(3)(a)(i) to (v).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 86 - Subsection 86(1) | s. 55(3)(a) spin-off that includes a s. 86 exchange of identical shares | 123 |

2020 Ruling 2019-0834901R3 - Loss Utilization - Depreciable Property

CRA ruled on transactions for Profitco, which is an indirect wholly-owned Canadian subsidiary of a non-resident parent to utilize the non-capital losses of Lossco, which is a direct wholly-owned Canadian subsidiary of the non-resident parent. Profitco transferred Class 12 property on a s. 85(1) rollover basis to Lossco in consideration for redeemable preferred shares of Lossco, then Lossco transferred the properties back to Profitco in consideration for redeemable preferred shares of Profitco having a paid-up capital equaling their redemption amount, with a joint s. 85(1) election being made at the estimated FMV of the properties, so that Lossco realized recapture of depreciation. The two preferred shareholdings were then redeemed for notes, and the notes set off. Rulings included the application of the s. 55(3)(a) exception to the deemed dividend received by Profitco.

In its summary, the Directorate stated:

The proposed subject transaction conforms with the CRA's policy to not apply subsection 55(2) of the Act to internal reorganizations within a related group for loss consolidation purposes and recognizing that property retains its character on a rollover transaction between related parties is consistent with the CRA’s position in … 2014-0553731I7 that depreciable property should retain its character on wind-up.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 9 - Capital Gain vs. Profit - Machinery and Equipment | depreciable property retained its character in superficial gain transaction | 216 |

| Tax Topics - Income Tax Act - Section 111 - Subsection 111(1) - Paragraph 111(1)(a) | superficial gain transaction to transfer losses to a Profitco that is related through a non-resident parent | 195 |

16 February 2009 External T.I. 2008-0293911E5 F - Application of subsection 55(2).

A and B each hold 50% of the voting common shares of XYZ Inc. (whose assets consist of excess cash of $25 and active business assets of $75, such that those common shares have an FMV of $100) through their respective holding companies (Aco and Bco). An acquisition by Bco of Aco’s XYZ Inc. shares (to be financed with a $25 bank loan or note payable, and a $25 dividend) proceeds as follows under Scenarios 1, 2 or 3:

- Bco acquires such shares from Aco for $50, and thereafter receives a $25 dividend from XYZ Corp.

- XYZ Corp. repurchases a portion of its shares held by Bco for $25, and Bco acquires all of Aco’s XYZ Corp. shares for $50.

- Bco acquires all of Aco’s XYZ Corp. shares for $50, and XYZ Corp. repurchases a portion of its shares held by Bco for their FMV of $25.

As to the application of s. 55(2) in the three scenarios, CRA stated:

Scenario 1

[S]ubsection 55(2) would be applicable in respect of the dividend received by Bco to the extent that (1) the Purpose Test is satisfied (i.e. that one of the purposes of the series of transactions in which the dividend is received by Bco is to significantly reduce the portion of the capital gain that would have been realized on the disposition by Bco of the shares of the capital stock of XYZ Corp. at FMV; (2) it would be reasonable to regard that dividend as being attributable to something other than safe income on hand attributable to the shares of the capital stock of XYZ Corp. held by Bco and before the "safe income determination time" in respect of the series of transactions, and (3) paragraph 55(3)(a) does not apply.

Furthermore … the Purpose Test contained in subsection 55(2) must, as a technical matter, be considered in respect of a disposition of any share of the capital stock of XYZ Corp.

Scenario 2

[S]ubsection 55(2) would apply in respect of the deemed dividend received by Bco … to the extent that the dividend could reasonably be considered to be attributable to something other than safe income on hand, attributable to the shares of the capital stock of XYZ Corp. held by Bco and before the "safe income determination time" … .

[P]aragraph 55(3)(a) would not apply to exempt the dividend … [as] the repurchase by XYZ Corp. … would come within subparagraphs 55(3)(a)(i), (ii), (iii) and (v).

Scenario 3

[S]ubsection 55(2) would apply in respect of the deemed dividend received by Bco … to the extent that (1) the dividend could reasonably be considered to be attributable to something other than safe income on hand attributable to the shares of the capital stock of XYZ Corp. held by Bco and before the "safe income determination time" … and (2) paragraph 55(3)(a) did not apply.

10 September 2018 External T.I. 2018-0772501E5 - Internal spin-off

Holdco A has wholly-owned Opco spin off Opco’s real estate to a newly-formed subsidiary of Holdco A (and sister of Opco), namely, to Realco. The spin-off entails a cross-redemption of shares and resulting s. 84(3) dividends. In the course of the spin-off transactions, an unrelated shareholder of Holdco A (Holdco C) with a direct and indirect equity interest in Holdco A of around 16% sells its interest at fair market value (giving rise to gain) to arm’s length purchasers. Does s. 55(2) apply to the s. 84(3) dividends?

CRA indicated that assuming (as appeared to be the case) that the sale by Holdco C was part of the same series as the spin-off, and that the shares of Opco and Realco represented more than 10% of the value of what Holdco C was selling, then ss. 55(3)(a)(iii)(B) and 55(3)(a)(iv)(B) would “technically apply” to oust the s. 55(3)(a) exemption. Respecting the fact that the deemed dividends at the Opco and Realco level did not affect the capital gains arising on the share sales by Holdco C, CRA stated:

[P]aragraph 55(3)(a) is intended to provide an exemption from the application of subsection 55(2) for certain dividends received in the course of related-party transactions. … [S]ince the other direct or indirect shareholders of Holdco A are not related persons, and the transactions … include a sale of Holdco A shares as part of the same series as the deemed dividends … the application of subsection 55(2) is operating as intended.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(a) - Subparagraph 55(3)(a)(iii) - Clause 55(3)(a)(iii)(B) | s. 55(3)(a)(iii)(B) exclusion applied to lower tier internal spin-off transaction accompanied by an upper-tier sale by an arm’s length shareholder with a direct and indirect 16% shareholding | 490 |

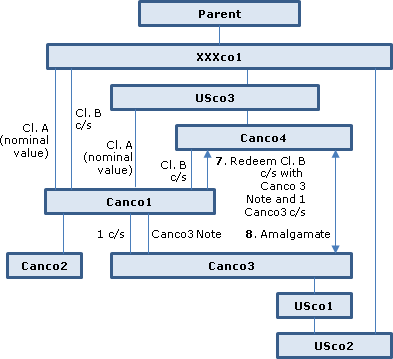

2016 Ruling 2016-0648991R3 - Internal spinoff reorganization of XXXXXXXXXX

Current structure

ParentCo, a taxable Canadian corporation and a public corporation, owns all the common shares of CanSub1 and all the shares of ForSub4. CanSub1 and CanSub2 hold ForSub1 and ForSub2, respectively. ForSub5, which is an indirect wholly-owned subsidiary of ParentCo, wholly owns ForSub3.

Proposed transactions

- ParentCo will transfer its ForSub4 common shares to CanSub2 under s. 85(1) in consideration for common shares.

- CanSub2 will transfer such shares to ForSub2 for common shares.

- CanSub2 will amend its articles to create two new classes of redeemable, retractable non-voting preferred shares (the ForSub1 Transfer and ForSub3 Transfer preferred shares).

- CanSub1 will effect a reorganization of its capital under which it will amend its articles to create new common shares (which will be identical to the existing common shares except for bearing X votes per share) and new redeemable, retractable non-voting preferred shares (the CanSub1 New Preferred Shares), and will issue such shares of two classes in exchange for all of its existing common shares, which will be cancelled. The paid-up capital of the cancelled common shares will be allocated to the shares of the two new classes pro rata to their respective FMVs.

- ParentCo will transfer the CanSub1 New Preferred Shares to CanSub2 under s. 85(1) in consideration for common shares.

- CanSub1 will transfer the common shares of ForSub1 to CanSub2 under s. 85(1) in consideration for ForSub1 Transfer preferred shares.

- There will be a redemption of the preferred shares held by CanSub1 and CanSub2 in each other in consideration for the issuance of notes, with eligible dividend designations being made.

- Such notes will be set off.

- CanSub2 will transfer its common shares of ForSub1 to ForSub2 in consideration for common shares.

- ForSub5 will transfer all of its ForSub3 common shares to CanSub2 in consideration for ForSub3 Transfer preferred shares.

- CanSub2 will transfer all of its ForSub3 common shares to ForSub2 in consideration for common shares.

Additional Information

ParentCo does not intend to make any specific contemporaneous public disclosure of the Proposed Transactions. Management of ParentCo has no reason to believe that: (a) the Proposed Transactions will have any material impact on the trading price of shares in the capital stock of ParentCo; and (b) public trading of shares in the capital stock of ParentCo will in any way be facilitated or motivated by the Proposed Transactions. It is possible that the Proposed Transactions may be disclosed in the ParentCo’s regular disclosure documents… .

Rulings

Including that the transactions will not by themselves be considered to result in any disposition of property to, or increase in interest by, an unrelated person described in any of ss. 55(3)(a)(i) to (v). Respecting the non-application of GAAR, the summary states "there is no creation or streaming of cost base and the preferred shares ... are cross-redeemed for notes that are set-off and cancelled."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 85.1 - Subsection 85.1(3) | a double transfer of shares under s. 85(1) and 85.1(3) would not affect the shares’ capital property status | 179 |

| Tax Topics - Income Tax Act - Section 9 - Capital Gain vs. Profit - Shares | shares did not lose capital property character on internal spin-off transfer with a view to their further dorp-down | 108 |

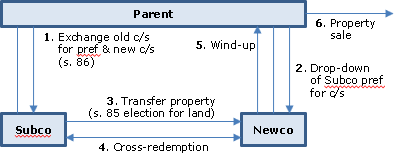

2016 Ruling 2016-0635101R3 - 55(3)(a) Spin-Off to Use Parent Losses

Background

Subco is wholly-owned by Parent, which holds all of its common shares (“Subco Old Common Shares”) and all of its non-voting, redeemable and retractable preferred shares (“Subco Old Preferred Shares”). Subco is the beneficial owner of parcels of land held as capital property together with buildings thereon (collectively, “Property”). Subco has entered into an agreement of purchase and sale (the “Property Sale Agreement”) to sell the Property for its FMV to an arm’s length third party (“Purchaser”). Subco is not prohibited from assigning its rights as vendor under the Property Sale Agreement to Newco and Parent.

Proposed spin-off of Property to Parent before closing of sale

- Parent will transfer all of the Subco Old Preferred Shares to Subco in consideration for one newly issued Subco Old Common Share, electing under s. 85(1) at the nominal ACB of the transferred shares.

- Subco will add Subco A Preferred Shares and Subco A Common Shares to its capital by articles of amendment. In order to distinguish the new shares, the Subco A Preferred Shares will be entitled to a non-cumulative dividend, and the Subco A Common Shares will be entitled to more than one vote per share.

- Pursuant to a share exchange agreement, Parent will exchange all of the Subco Old Common Shares for (a) newly issued Subco A Preferred Shares having an aggregate FMV equal to the FMV of the Property, net of the Assumed Liabilities; and (b) newly issued Subco A Common Shares having an aggregate FMV equal to the balance of the Exchanged Shares’ FMV. No s. 85(1) election will be made. The aggregate amount to be added by Subco to the stated capital accounts for the Subco A Preferred Shares and the Subco A Common Shares issued on the exchange of the Exchanged Shares will be equal to the aggregate PUC of the Exchanged Shares and will be allocated between the two classes based on their relative FMV.

- Parent will transfer its Subco A Preferred Shares to a newly-incorporated subsidiary (“Newco”) in consideration for newly issued common shares of Newco, with the elected amount under s. 85(1) being equal to the transferred shares’ FMV and less than their ACB, thereby resulting in a suspended loss under s. 40(3.4).

- Subco will transfer the Property to Newco in consideration for the assumption of liabilities and the issuance of redeemable Newco Preferred shares. An s. 85(1) election will be made only respecting the Land parcels, with the agreed amount for each parcel equalling its ACB plus the terminal loss that, but for ss. 13(21.1) and (21.2), would be recognized on the disposition of the Building thereon (except that the elected amount will not exceed the parcel’s FMV).

- Newco will redeem all of the Newco Preferred Shares held by Subco and Subco will redeem all of the Subco A Preferred Shares held by Newco, in each case, for a note, and the two notes will be settled by way of set-off.

- Newco will be wound up into Parent.

- Parent will sell the Property to Purchaser and apply a portion of its net capital losses and/or non-capital losses to reduce its taxable income resulting from the sale.

Ruling

The proposed transactions by themselves will not be considered to result in any disposition or increase in interest described in any of ss. 55(3)(a)(i) to (v).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 13 - Subsection 13(21.1) - Paragraph 13(21.1)(a) | where land transferred under s. 85(1) along with terminal loss building, elect high with a view to s. 13(21.1)(a) applying to reduce the land proceeds to ACB | 189 |

| Tax Topics - Income Tax Act - Section 86 - Subsection 86(1) | s. 86(1) applied where “dirty” s. 85 exchange mechanic used, but no s. 85 election made | 93 |

| Tax Topics - Income Tax Act - Section 85 - Subsection 85(1) - Paragraph 85(1)(a) | elected amount deterines proceeds before s. 13(21.1)(a) grind | 203 |

2016 Ruling 2015-0623731R3 - Subsections 55(2) and (2.1)

Background

As described in 2015-0601441R3, Sub1 and Sub2 (both taxable Canadian corporations and wholly-owned subsidiaries of Parent, a public corporation) accomplished a winding-up of a general partnership (“Partnership”) through a transfer by Sub2 of its interest in Partnership to Sub1 in consideration for Sub1 Preferred Shares and for a non-interest bearing demand promissory note (the “Sub1 Note”) with a principal amount equal to the non-interest-bearing demand promissory note (the “Sub2-Partnership Note”) owing by Sub2 to the Partnership, jointly electing under s. 85(1).

Proposed transactions

- The Sub1 Note and the Sub2-Partnership Note will be settled in full by way of set-off.

- Sub1 will redeem the Sub1 Preferred Shares held by Sub2. The redemption amount will be satisfied by the issuance of a non-interest bearing promissory note (the “Sub1 Redemption Note”), whose redemption amount may include an amount respecting accrued and unpaid dividends. Sub1 will designate a portion of the resulting deemed dividend as an eligible dividend per s. 89(14).

- Sub2 and Parent will undertake a s. 86 reorganization of Sub 2’s capital so that, following articles of amendment, Parent will exchange all of the issued and outstanding shares of Sub2 for Sub2 New Common Shares and (non-voting redeemable retractable) Sub2 Preferred Shares. The aggregate redemption amount of the Sub2 Preferred Shares will be equal to the amount owing by Sub1 under the Sub1 Redemption Note, and the aggregate FMV of the Sub2 New Common Shares and Sub2 Preferred Shares will be equal that of the exchanged Sub2 Shares, which will be greater than the FMV of the Sub1 Redemption Note.

- A paragraph (no. 42.1) was added stating: "The agreement described in paragraph 42(b) above will also provide that the aggregate Capital of the newly issued Sub2 New Common Shares and Sub2 Preferred Shares for purposes of Act 2 will be equal to the PUC of the Exchanged Sub2 Shares, immediately before the exchange, and that such Capital will be allocated to the newly issued Sub2 New Common Shares, as a class, and to the newly issued Sub2 Preferred Shares, as a class, proportionately based on each classes respective FMV."

- Parent will transfer to Sub1 all of the Sub2 Preferred Shares (the “Transferred Sub2 Shares”) in consideration for the issuance of Sub1 common shares (the “New Sub1 Shares”), electing under s. 85(1) at Parent’s ACB of the Transferred Sub2 Shares.

- Sub2 will redeem the Transferred Sub2 Shares held by Sub1. The redemption amount will be satisfied by the issuance of a non-interest bearing promissory note (the “Sub2 Redemption Note”), with Sub2 making an s. 89(14) designation.

- The Sub1 Redemption Note and the Sub2 Redemption Note will be settled by way of set-off and cancelled in full satisfaction of the obligations under the Sub1 Redemption Note and the Sub2 Redemption Note.

Ruling

Ss. 55(2) and (2.1) will not apply to the deemed dividends arising in 2 and 6 by virtue of the exception in s. 55(3)(a), provided that, as part of the series of transactions or events as part of which these dividends are received, there is no event described in ss. 55(3)(a)(i) to (v) which has not been described above, and that the transactions and events described in a redacted paragraph were carried out in the manner described.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 80 - Subsection 80(1) - Forgiven Amount | policy on set-off of unequal redemption notes does not extend beyond a butterfly reorg | 433 |

| Tax Topics - Income Tax Act - Section 86 - Subsection 86(1) | stated capital of old shares required to be prorated amongst new classes based on relative FMV | 136 |

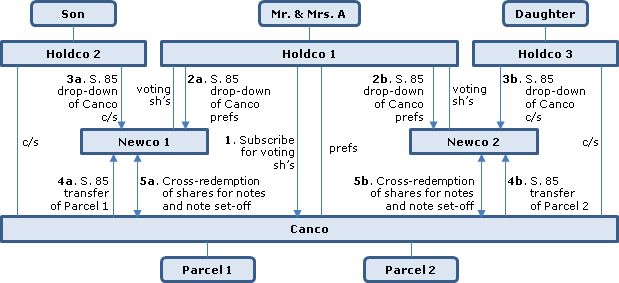

2017 Ruling 2016-0675881R3 - Paragraph 55(3)(a) Internal Reorganization

Current structure

Canco is a Canadian-controlled corporation holding “Parcel One” and “Parcel Two” (consisting in each case of the beneficial ownership of two of the four buildings of Canco, a percentage of Canco’s interest in a rental real estate joint venture, near-cash assets and marketable securities plus, in the case of Parcel Two, the “Equalization Amount,” whose purpose is to equalize the net value of the assets received by each of Newco 1 and Newco 2 from Canco in 5 below, so as to effectively compensate Newco 2 for the excess value so received by Newco 1. Canco’s shareholders are Holdco 1 (whose shareholders are Mr. and Mrs. A, each holding common shares and Class A or Class B preferred shares), Holdco 2 (Holdco 1 Holdco owned by Child 1 (their son) and Holdco 3 (owned by Child 2, their daughter). Canco does not have a material balance of CDA or RDTOH.

Proposed transactions

- Holdco 1 will incorporate Newco 1 and Newco 2 and subscribe (presumably, a nominal amount) for super-voting redeemable retractable non-dividend-bearing shares of each. "The reason that Holdco 1 will acquire super-voting shares and redeemable, preferred shares of Newco 1 and Newco 2 as part of the Proposed Transactions is to preserve Holdco 1’s economic interest in the underlying assets as it was before the Proposed Transactions."

- Following articles of amendment to create Canco Super-Voting Shares (similar to those of Newco 1 and 2), Holdco 1 will subscribe for Canco Super-Voting Shares of Canco.

- Holdco 1 under s. 85(1) will transfer XX% and (100-XX)%) of each of its Class A and Class B preferred shares to Newco 1 and 2, respectively, in consideration for non-voting redeemable and retractable Newco 1 or 2 Class A Preferred Shares.

- Holdco 2 and 3 under s. 85(1) will transfer all of their Canco common shares to Newco 1 and 2, respectively in exchange for Newco 1 or 2 Common Shares.

- Canco will transfer Parcel One and Two to Newco 1 and 2, respectively, in consideration for assumption of liabilities (including mortgages) and for Newco 1 or 2 Class B Preferred Shares. The s. 85(1) elected amounts will be within the permitted range.

- Newco 1 and 2 will redeem all of the Newco 1 and 2 Class B Preferred Shares respectively held by Canco, and issue a demand, non-interest bearing promissory note in full payment of the respective redemption amounts (the “Newco 1 Note” and “Newco 2 Note,” respectively).

- Canco will purchase for cancellation all of the Canco Ordinary Shares, and redeem the Class A and B preferred shares (held by Newco 1 and Newco 2), and issue a demand, non-interest bearing promissory note to each of Newco 1 and 2 in full payment of the respective purchase and redemption amounts (the “Canco 1 Note” and “Canco 2 Note,” respectively).

- The Newco 1 Note and the Canco 1 Note, and the Newco 2 Note and the Canco 2 Note, will be set off.

Rulings

Including re s. 55(3)(a).

For the purposes of determining the elected amount under s. 85(1)(e) in 5 above:

the reference to “the undepreciated capital cost to the taxpayer of all property of that class immediately before the disposition” in subparagraph 85(1)(e)(i) will be read to mean the proportion of the undepreciated capital cost to Canco of all the property of that class that the capital cost of the property so transferred before the disposition is of the capital cost of all property of that class immediately before the disposition.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(4) | s. 55(3)(a) split-up between Newcos for two siblings which were related due to multiple-voting shares held by the father’s and mother’s Holdco | 170 |

| Tax Topics - Income Tax Act - Section 85 - Subsection 85(1) - Paragraph 85(1)(e) | UCC on s. 55(3)(a) spin-off prorated based on relative capital cost rather than FMV | 174 |

| Tax Topics - Income Tax Act - Section 186 - Subsection 186(1) - Paragraph 186(1)(b) | where circular RDTOH calculation arises on spin-off transaction, it is for the TSOs to sort out which corporations should bear Part IV tax | 249 |

12 May 2017 External T.I. 2017-0683511E5 F - Purpose tests of a dividend or repurchase of share

The CRA position on creditor-proofing suggested that if Opco, which has no safe income and whose common shares have a nominal adjusted cost base and paid-up capital, uses cash (or other assets) to pay a dividend to its shareholder (Holdco) to fund Holdco’s purchase of real property to be rented to it, that cash dividend likely would be considered to have a tainting purpose described in s. 55(2.1)(b)(ii). Accordingly, Opco avoids s. 55(2.1)(b) by using the cash to purchase most of its common shares for cancellation. CRA stated:

[S.] 55(3)(a) is intended to facilitate corporate reorganizations made in good faith by related persons but is not intended to accommodate the payment or receipt of dividends or transactions or events which seek to increase, manipulate or manufacture tax basis.

Thus, the application of the general anti-avoidance rule in subsection 245(2) should be queried, considering that the money given to Holdco would not come from the income that had already been taxed in Opco and that the adjusted cost base of participating shares in the capital stock of Opco would be nominal.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(b) - Subparagraph 55(2.1)(b)(ii) | redeeming common shares otherwise than out of safe income may be GAARable | 346 |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | use of s. 55(3)(a) redemption exception to circumvent safe income limitation could be offensive | 58 |

13 January 2016 External T.I. 2015-0604521E5 - ACB increase in paragraph 55(3)(a) reorganization

Parentco owns 100% of Holdco which owns 100% of Opco. There are two alternatives for spinning-off one of Opco’s existing business lines to Newco, a new subsidiary of Holdco:

Alternative 1:

- Holdco transfers shares of Opco (with a value equaling the Opco assets transferred in step 2) to Newco for Newco shares, electing under s. 85(1).

- Opco transfers the relevant assets to Newco for Newco preferred shares, electing under s. 85(1).

- Newco redeems its preferred shares in consideration for the “Newco note”.

- Opco redeems the shares that Newco received in step 2 in consideration for the issuance to Newco of the “Opco note”.

- The two notes are set off.

Alternative 2:

- Opco transfers the relevant assets to Newco for Newco preferred shares, electing under s. 85(1).

- Newco redeems the shares that it issued to Opco in step 1 in consideration for the “Newco note”.

- Opco transfers the Newco note to Holdco in redeeming a portion of its shares (with a value equal to the value of the Opco assets transferred in step 1).

- Holdco transfers the Newco note to Newco as a capital contribution or share subscription.

In either case, the series of transactions does not include a triggering event involving an unrelated person described in s. 55(3)(a). Would either alternative engage s. 55(2) or 245(2)?

Before concluding that GAAR or s. 55(2) would not apply to the first alternative, CRA noted that although the receipt of the Opco or Newco Notes may result in an increase in the ACB of property held by Newco or Opco “both notes are offset and cancelled, eliminating therefore any increase in ACB of property held by either Newco or Opco.”

Respecting the second alternative, CRA noted that as a result of the transactions “the aggregate ACB in all the shares held by Holdco in Opco and Newco…is significantly greater than the ACB of the shares of Opco that were held by Holdco at the beginning of the series,” and that the scheme of s. 55(2) in its proposed form “is to prevent…the creation or multiplication of ACB with the use of tax-free inter-corporate dividends, and concluded that it “would consider the application of GAAR to Alternative 2,” and also would consider arguing that any ultimate disposition of Newco shares to an unrelated person was part of the series.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | objectionable for a s. 55(3)(a) spin-off to result in an increase in the aggregate outside basis | 173 |

| Tax Topics - Income Tax Act - Section 80 - Subsection 80(1) - Forgiven Amount - Element B - Paragraph B(a) | contribution of note by creditor to debtor | 36 |

2015 Ruling 2014-0559181R3 - Internal Reorganization

Current Structure

Parentco (a subsidiary wholly-owned corporation of Ultimate Parentco, which is a listed public corporation) holds all of the common shares of Aco (a CBCA holding corporation), which wholly owns Bco, Cco, Dco and Eco. Bco has four business divisions (Divisions 1, 2, 3 and 4) carried on directly or through subsidiaries.

Proposed transactions

Bco will spin-off Divisions 1, 2 and 3 to what apparently are newly-incorporated subsidiaries of Aco (Cco, Dco and Eco, respectively), using essentially the same spin-off mechanics. For example, under the spin-off to Cco:

- Bco will transfer the Division 1 assets to Cco in consideration for preferred shares, electing under s. 85(1).

- Aco will transfer a proportion of its common shares of Bco (having a fair market value equal to that of the preferred shares issued in 1 to Cco in consideration for Cco common shares, electing under s. 85(1).

- Bco will purchase for cancellation its common shares held by Cco in consideration for issuing a non-interest bearing demand note, with the resulting deemed dividend designated as an eligible dividend.

- Cco will redeem the preferred shares held by Bco in consideration for issuing a non-interest bearing demand note, with the resulting deemed dividend designated as an eligible dividend.

- The two notes will be set off.

Additional information

(transactions kept mum).

Management…has no reason to believe that any person holding, owning or exercising control or direction over any of the shares of the capital stock of Ultimate Parentco is aware of the Proposed Transactions. … [or that the] Proposed Transactions… will have any material impact on the trading price of the shares of the capital stock of Ultimate Parentco or the value of the options held by the Optionholders.

Rulings

Including that "the Proposed Transactions, in and by themselves, will not be considered to result in any disposition of property to, or increase in interest by, an unrelated person described in any of subparagraphs 55(3)(a)(i) to (v)."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 111 - Subsection 111(1) - Paragraph 111(1)(a) | internal spinoff by "profitco" for previous loss transfer rulings will not prejudice those rulings | 171 |

14 April 2015 External T.I. 2015-0570021E5 F - Présomption de gain en capital

S. 55(3.01)(g) generally permitted two unrelated individuals to spin-off real estate from a jointly owned Opco to a newly-incorporated jointly-owned Realtyco, provided that they first interposed a holding company between themselves and their two companies (Opco and Realtyco), so that s. 55(3)(a)(ii) did not apply to the acquisition of their investment in the holdco. See summary under s. 55(3.01)(g).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3.01) - Paragraph 55(3.01)(g) | application of safe harbour where holdco interposed before spin-off transaction | 394 |

11 February 2015 External T.I. 2014-0557251E5 F - paragraph 110.1(1)(c) and clause 55(3)(a)(i)(B)

In the course of a series of transactions including the redemption of shares subject to s. 84(3), a corporation made a gift of cultural property to an unrelated person with the resulting gain being exempted under s. 39(1)(a)(i.1), claimed a deduction for the eligible amount of the gift under s. 110.1(1)(c) and did not elect under s. 110.1(3) to reduce its deemed proceeds. Would it be considered to have disposed of the property for its fair market value for purposes of s. 55(3)(a)(i)(B)? CRA responded (TaxInterpretations translation):

[I]f subparagraph 69(1)(b)(ii) applies to a gift, the CRA will consider, for purposes of clause 55(3)(a)(i)(B), that there has been a disposition of property made for proceeds not less than its fair market value. In such a case, this disposition will not be considered to be an event contemplated under subparagraph 55(3)(a)(i).

10 October 2014 APFF Roundtable Q. 16, 2014-0538031C6 - APFF 2014 Q. 16 - Capital gain

Facts

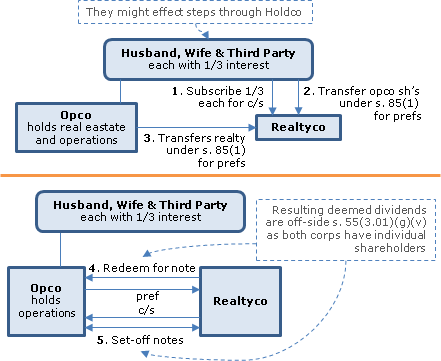

The exception in s. 55(3)(a) would not be available where a new corporation was created in the series. Consider this example:

- Husband, Wife and (unrelated) Third Party each subscribe for 1/3 of the voting common shares of newly-incorporated Realtyco.

- They transfer equal portions of their current equal shareholdings of Opco to Realtyco under s. 85(1) in consideration for preferred shares of equivalent fair market value.

- Opco transfers realty to Realtyco under s. 85(1) in consideration for preferred shares of equivalent FMV.

- The cross-shareholdings between Opco and Realtyco are redeemed for notes, thereby giving rise to deemed dividends.

- The notes are set-off.

Questions

Does s. 55(2) not apply in light of s. 55(3.01)(g)(v)? Would this change if before Step 1 Husband and Wife incorporated Holdco and they and Third Party rolled all their Opco shares into Holdco before Holdco (rather than they) proceeds with Steps 1 to 5?

1st Scenario

In finding that the s. 55(3)(a) exception was not available for the deemed dividends arising in Step 4 under the first Scenario, CRA first indicated (TaxInterpretations translation):

Respecting the issuance of shares on an incorporation…prior to the first issuance…the incorporator controls [the corporation] and consequently…he will be considered as being related to that corporation before the first issuance of shares. …[T]he initial subscriptions by Husband and Wife (the incorporators) would not result in an increase in interest described by subparagraphs 55(3)(a)(iii) to (v).

CRA noted:

- The initial subscription for Realtyco shares by Third Party would result in a s. 55(3)(a)(ii) increase as Third Party was unrelated to the dividend recipients (Opco and Realtyco) as well as s. 55(3)(a)(v) increase of Third Party relevant to the deemed dividend paid by Realtyco to Opco.

- Third Party also would have a s. 55(3)(a)(ii increase of interest from its transfer of Opco shares to Realtyco for preferred shares (Step 2), as well as when the cross-shareholdings were redeemed (Step 4).

CRA then stated:

Furthermore, as regards the dividend deemed to be received by Opco, an increase in interest of Third Party described in subparagraph 55(3)(a)(v) would result from the transfer of the shares of Opco by Third Party to Realtyco in consideration for preferred shares in the capital of Realtyco, as well as on the redemption of the preferred shares in the capital of Realtyco held by Opco. Finally, on the purchase for cancellation of the shares in the capital of Opco held by Realtyco, Third Party increased its interest in Opco, which is a particular described in subparagraph 55(3)(a)(v) regarding the dividend deemed to be received by Realtyco.

Because paragraph 55(3.01)(g) does not exclude an increase in interest described in subparagraph 55(3)(a)(v), the dividend recipients, Opco and Realtyco, would be unable to utilize the exception…provided in paragraph 55(3)(a). ... [In any event] the condition provided in subpargraph 55(3.01)(g)(v) would not be satisfied as the shares of the recipients of the dividends, Opco and Realtyco, were held by individuals at the moment of receipt of the dividends.

2nd Scenario

Respecting the second Scenario, CRA assumed that Holdco and Realtyco were incorporated by Husband or Wife, so that Holdco was related to Realtyco and Opco, and Husband and Wife were related to Realtyco, and that the original investment of Third Party in Opco was not part of the same series of transactions as the receipt of the dividends in Step 4.

CRA then stated:

The disposition of the shares … of Opco by Husband, Wife and Third Party to Holdco would not result in a disposition described in subparagraph 55(3)(a)(i), (ii) or (v) as, immediately before the disposition, Holdco would be related to Opco and Realtyco, the dividend recipients.

However, the investment of Third Party in Holdco … would result in an increase in interest described in subparagraph 55(3)(a)(ii) as Third Party would be…unrelated to Opco and Realtyco, the dividend recipients.

Finally, the investment of Holdco in Opco…would not constitute an increase in interest described in subparagraph 55(3)(a)(ii) and (v) as … Holdco would be related to Opco and Realtyco immediately before the transfer of the shares.

…[T]he "particular corporation" [under s. 55(3.01)(g)] would be Holdco. …[T]he increase in interest of Third Party in Holdco described in subparagraph 55(3)(a)(ii) would be deemed not to be described in that subparagraph [by s. 55(3.01)(g)].

...[T]he other transactions of the series…would occur between persons related to the dividend recipients since Holdco would control both Opco and Realtyco.

Consequently, based on paragraph 55(3.01)(g)…it is possible that Opco and Realtyco could utilize the exception to the application of subsection 55(2) provided in paragraph 55(3)(a).

...[However] it would be important that the transactions respecting the formation of Holdco and Realtyco (the dividend recipients) be properly effected. …For example, the disposition of the shares of Opco by Husband, Wife and Third Party to Holdco could technically be described by subparagraphs 55(3)(a)(iii) and (v) respecting the dividend deemed to be received by Realtyco. In effect, immediately before the disposition, Holdco would be considered to not be related to Realtyco if the latter did not exist at that moment.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(2) - Paragraph 251(2)(b) - Subparagraph 251(2)(b)(i) | incorporator related to corporation | 67 |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3.01) - Paragraph 55(3.01)(g) | interposition of holdco to permit related-person spin-off compliant with s. 55(3)(a)(ii) and (v) | 925 |

2014 Ruling 2013-0505431R3 - XXXXXXXXXX

Existing structure

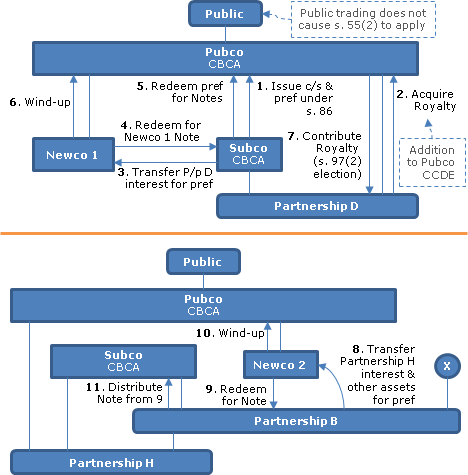

Pubco, a CBCA public corporation, and Subco, its wholly-owned CBCA corporation, are partners, along with GPCo (also wholly-owned by Pubco), of Partnership D. Partnership D has a royalty which represents an interest in XX% of the net profits from the production from a specified property of two other partnerships (Partnership E and LP) and from other cash flows generated in Partnership E (the "Royalty"). The net profits are computed by reference to XX% of the interest that Partnership E owns in a specified property and by reference to XX% of the interest in LP of Partnership E. Subco and XX are members of Partnership B, and Pubco, Subco and Partnership B are members of Partnership H. Partnerships D, B and H are general partnerships.

Proposed transactions

- All the issued shares of Subco will be exchanged by Pubco under s. 86 for one new common share and one new preferred share.

- Pubco will acquire an undivided percentage interest in the Royalty from Partnership D in consideration for the issuance of a demand promissory note (the "Royalty Purchase Note"), with the proceeds being allocated by Partnership D to its partners (Subco and Pubco.)

- Subco will transfer its interests in Partnerships D and H and other "Distributed Assets" to a newly-incorporated subsidiary of Pubco (Newco 1) in consideration for redeemable preferred shares of Newco 1 with a price adjustment clause and with a s. 85(1) election made.

- Newco 1 will redeem such preferred shares for the Newco 1 Note (also subject to a price adjustment clause), and with a contemporaneous notice that the deemed dividend is an eligible dividend.

- Subco will redeem the preferred share issued to Pubco in 1 in consideration for transferring the Newco 1 Note and for issuing a further Note, with a contemporaneous eligible dividend notice.

- Newco 1 will then be wound-up into Pubco. Pubco will elect to have s. 80.01(4) apply to the resulting settlement of the Newco 1 Note.

- Pubco will transfer its undivided interest in the Royalty to Partnership D as a contribution to its capital, with a s. 97(2) election being made.

- Partnership B will transfer its interest in Partnership H and certain shares to a newly-incorporated subsidiary of Pubco (Newco 2) in consideration for redeemable preferred shares of Newco 2 with a price adjustment clause and with a s. 85(2) election made.

- Newco 2 will redeem such preferred shares for the Newco 2 Note (also subject to a price adjustment clause), with a contemporaneous eligible dividend notice.

- Newco 2 will then be wound-up into Pubco, with the obligation to pay the Newco 2 Note assumed by Pubco. Newco 2 will be dissolved, but not before XX months have elapsed.

- After Partnership B's next year-end, Partnership B will distribute the Newco 2 Note to Subco and XX, reducing the ACB of their partnership interests by virtue of s. 53(2)(c)(v) of the Act.

- XX will then distribute to Subco its portion of the Newco 2 Note and the Newco 2 Note owed to Subco will be set-off against the XX Note.

- The Royalty Purchase Note (owing by Pubco to Subco) will be repaid in the ordinary course.

Trading in Pubco shares

27. Dispositions and acquisitions of Pubco shares by members of the public will occur during the same time frame as the Proposed Transactions in the ordinary course of public trading of those shares on the stock exchanges on which they are listed. Dispositions and acquisitions of Pubco shares may also occur by virtue of the exercise of employee stock options or through employee participation and other employee incentive plans. The Proposed Transactions do not, in any manner, facilitate any acquisition or disposition of Pubco's shares as described in this paragraph and are not undertaken with such trading in Pubco shares in mind but, rather, are purely internal transactions.

Purposes

The reorganization, by bringing principal revenue sources together in Pubco (which incurs head office and financing costs), will match operating income with related expenses, and will help Pubco to effect an income tax consolidation within Canada and move some of Subco's CCDE balances to it.

Rulings

Include:

S. 55(2) will not apply to the deemed dividends arising in 4, 5 and 9 above provided that there is not a disposition of property or an increase in interest described in any of ss. 55(3)(a)(i) to (v) which is part of the series of transactions or events that includes the proposed transactions (which, by themselves, will not be considered to result in such a disposition or increase in interest.). "For greater certainty, a disposition of a partnership interest in Partnership B to an unrelated person that is undertaken as part of the series of transactions or events that includes the Proposed Transactions will result in the taxable dividend referred to [above]… being subject to the provisions of subsection 55(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 66.2 - Subsection 66.2(5) - Canadian development expense - Paragraph (e) | transfer of royalty from partly-owned partnership | 464 |

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(1) | delay in filing articles of dissolution | 55 |

| Tax Topics - Income Tax Act - Section 97 - Subsection 97(2) | s. 97(2) applicable to contribution (no equity consideration) | 61 |

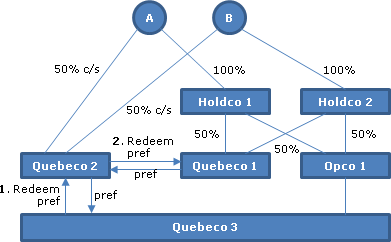

25 April 2014 External T.I. 2014-0528011E5 F - Subsection 55(2) - redemption of shares

A and B each is the sole shareholder of Holdco 1 and Holdco 2, respectively, which each holds 50% of the voting common share of Opco as well as 50% of the voting common shares of Quebeco 1. A and B also each hold 50% of the voting common shares of Quebeco 2. Quebeco 1 holds preferred shares of Quebeco 2 with a redemption amount of $1 million and nominal paid-up capital.

Opco incorporates Quebeco 3 and holds all the voting common shares. Quebeco 2 transfers real property with a fair market value of $100,000 and a nominal cost amount to Quebeco 3 under s. 85(1) in consideration for $100,000 of preferred shares.

Quebeco 3 subsequently redeems the preferred shares held by Quebeco 2 for $100,000 and Quebeco 2 redeems for $1 million the preferred shares held by Quebeco 1.

In finding that s. 55(3)(a)(ii) or (v) could apply to the redemption by Quebeco 2, CRA stated (TaxInterpretations translation):

A or B…would not be related to the recipient of the dividend, Quebeco 1. Furthermore, any increase in the direct interest of A or B in Quebeco 2 would result from the disposition of shares… of Quebeco 2 by Quebeco 1 for proceeds of disposition less than fair market value by virtue of the application of paragraph (j) of the definition of "proceeds of disposition" in section 54… . Therefore, the question becomes whether the direct interest of A and B in Quebeco 2 increases significantly… .

CRA then adverted to a discussion earlier in the letter of "significant increase," including quoting 9725615 and indicating that there would need to be a before and after comparison of the percentage interest of A and B in the shares of Quebeco 2.

Respecting the redemption by Quebeco 3, s. 55(3)(a)(ii) could apply if it occurred as part of the same series as the redemption by Quebeco 2 and the latter redemption resulted in a significant increase, as discussed above.

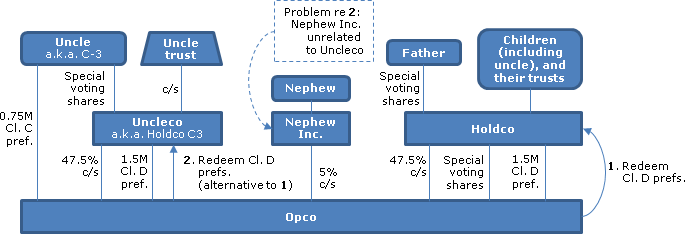

3 January 2014 External T.I. 2013-0514021E5 F - Subsection 55(2) - redemption of shares

Structure

Holdco is controlled by Father through his holding of special voting shares, and its equity is held by his three children (C-1, C-2 and C-3) and the C-1, C-2 and C-3 Trusts. Holdco holds 47.5% of the common shares of Opco and 50% of its Class D preferred shares, along with special voting shares giving it voting control of Opco. HoldcoC3, which is controlled by C-3 and owned by C-3 and the C-3 Trust, holds the other 50% of Opco's Class D preferred shares as well as 47.5% of its common shares. C-3 holds Class C preferred shares of Opco directly (whose number is 25% of the number of Class D preferred shares). Nephew Inc., which is wholly-owned by the son of C-1, holds 5% of the common shares of Opco.

Questions

Would the exemption in s. 55(3)(a) apply to the redemption by Opco of all the Class D preferred shares of Holdco or of HoldcoC3?

Holdco redemption

Respecting the Holdco redemption, CRA stated (TaxInterpretations translation) in finding that the "triggers" in ss. 55(3)(a)(ii) and (v) did not apply:

Despite the increase in the interest of Nephew Inc., Holdco C3 and C-3 resulting from the redemption of the Class D shares of Opco held by Holdco, Nephew Inc., Holdco C3 and C-3 were all related to the dividend recipient, Holdco, immediately before such increase by virtue of subparagraphs 251(2)(b)(iii) and 251(2)(c)(ii), as the case may be, because of F-1’s control of Holdco. … Our conclusion would be the same if the transactions respecting a freeze of Opco in order to introduce Nephew were part of the series of transactions that included the deemed dividend received by Holdco as a result of the redemption of the Class "D" shares of the capital stock of Opco held by Holdco, as Nephew and Nephew Inc. were related to Holdco, the dividend recipient, by virtue of subparagraphs 251(2)(b)(iii) and 251(2)(c)(ii), respectively.

HoldcoC3 redemption

Here, CRA noted that the triggers in s. 55(3)(a)(ii) and (v) would apply, as Nephew Inc. was not related to the deemed dividend recipient (HoldcoC3), unless the increase in interest of Nephew Inc. was not significant. After quoting 9725615 as to the meaning of "significant," CRA noted that an "increase in interest of only a small percentage ["faible pourcentage"] could be considered by the CRA not to be significant." CRA went on to state:

Insofar as Opco's freeze transactions to introduce Nephew were part of a series of transactions that included the deemed dividend received by Holdco C3 due to the redemption of the Class "D" shares of the capital stock of Opco, the acquisition of the common shares of the capital stock of Opco by Nephew Inc. could also be a "trigger" event described in subparagraphs 55(3)(a)(ii) and (v) to the extent that this acquisition would result in a "significant" increase in Nephew Inc.'s interest in Opco, thereby precluding the application of the paragraph 55(3)(a) exemption.

2013 Ruling 2013-0501811R3 - Internal Reorganization - 55(3)(a)

Starting structure

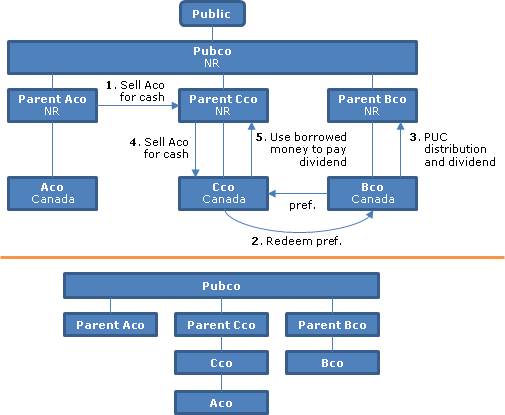

Aco, Bco and Cco are wholly-owned Canadian subsidiaries of non-resident holding companies, namely, ParentAco, ParentBco and ParentCco, except that shares of Cco also are held by Bco, namely, non-voting redeemable and retractable Class B Preferred Shares with a paid-up capital and adjusted cost base lower than their redemption amount. ParentAco, ParentBco and ParentCco are direct or indirect subsidiaries of a non-resident public corporation (Pubco).

Proposed transactions

:

- ParentAco will sell all the Aco shares to ParentCco for fair market value cash consideration.

- Cco will redeem the Class B Preferred Shares for cash.

- Bco will make a cash distribution to ParentBco, first as a PUC distribution, and next as a dividend.

- Cco will acquire all the Aco shares from ParentCco for FMV consideration comprising cash (in excess of the PUC of the Aco shares so that a deemed dividend arises under s. 212.1) and a common share with full stated capital (but whose PUC is ground to nil under s. 212.1(1)(b).)

- Cco will use borrowed money to pay a dividend to ParentCco (subject to Treaty-reduced withholding).

Additional information re s. 55(3)(a)

- No person/group has direction over more than X% of Pubco's shares.

- More than 10% of the FMV of Pubco's shares is derived from the shares of Cco and [of] Bco.

- The proceeds received in 1, 3, 4 and 5 will be used for general business purposes and not distributed up to the shareholders of Pubco.

- "Management is not aware and has no reason to believe[,] that any person holding, owning or exercising control or direction over any of the shares of the capital stock of Pubco is aware of the Proposed Transactions;" nor will they be publicly disclosed; nor does management have any reason to believe they will have any material impact on the Pubco share trading price.

- No party intends as part of the series "to dispose of any property to, or to increase any interest in any corporation of any person or partnership that is an unrelated person to Bco, in any of the ways described in subparagraphs 55(3)(a)(i) to (v)."

Rulings

: Including that "the Proposed Transactions, in and by themselves, will not be considered to result in any disposition to, or increase in interest by, an unrelated person described in subparagraphs 55(3)(a)(i) to (v)."

16 February 2011 External T.I. 2012-0435381E5 - Subsection 55(2) - redemption of shares

A percentage increase of 1.28% or 1.33% could be considered not to be significant for purposes of s. 55(3)(a)(ii) or (v).

10 June 2002 External T.I. 2002-0138885 F - Redemption of Preferred Shares

Opco redeems its preferred shares held by PortfoliocoX (wholly owned by Mr. X) at a time that all the common shares of Opco are owned equally by X’s children (Scenario 1). Alternatively, all the common shares of Opco are owned equally by the personal holding companies of the three children. After noting that in both Scenarios, Opco and PortfoliocoX are related by virtue of s. 251(2)(c)(i) and the children are related to Opco and PortfoliocoX by virtue of s. 251(2)(b)(iii) and that, in Scenario 2, the children’s holding companies are related to PortfoliocoX and Opco by virtue of s. 251(2)(c)(ii), CCRA indicated that s. 55(3)(a) would apply as there would be no transaction described in ss. 55(3)(a)(i) to (v).

12 March 2002 External T.I. 2002-0125885 F - Section 55(3)(a) - Exception55(3)(a)

Holdco A and Holdco B held separate classes of shares of Opco, each with 50% of the votes. Holdco A and B were wholly-owned by a spousal trust and by a child (Mr. B) of the spouse. Opco repurchases all the shares held in it by Holdco A, giving rise to a deemed dividend.

CCRA noted that:

- Mr. B and the trust would be related pursuant to s. 55(5)(e)(ii);

- Accordingly, Holdco A (the dividend recipient) as a corporation controlled by the trust would be related to the trust pursuant to s. 55(5)(e)(iii).

- Holdco A and Holdco B would be related persons since Mr. B would control both.

- Opco and Holdco A, and Opco and Holdco B, would be related persons per s.251(2)(b)(ii).

On this basis, s. 55(3)(a) should apply.

27 January 2000 External T.I. 1999-0009375 - DIVIDENDS SUBJECT TO 55(2)

The exemption in s. 55(3)(a) would not apply to the payment of a dividend by a holding company that was equally owned by two brothers through their own holding companies, where as part of the same series of transactions 25% of its shares (or 50% in total) were acquired by a holding company owned by each brother's daughter.

10 December 2001 External T.I. 2001-0109195 F - Test d'objet à 55(2)

S. 55(3)(a) applied to creditor-proofing transaction in which husband and wife transferred 80% and 20% of the shares of Opco to a new Holdco formed by him, Opco pays a dividend equal to its retained earnings and Holdco lends that amount back to Opco – or the husband transfers 100% of the Opco shares to Holdco for Holdco preferred shares, followed by the dividend and loan-back transaction, and then his wife subscribes a nominal amount for 20% of Holdco’s common shares (or purchases such common shares from him).

1999 APFF Round Table, Q. 15

"The Department considers, however, that there is generally a significant increase in the total direct interest of the common shareholders of a given corporation when preferred shares of the capital stock of the given corporation are redeemed and when these preferred shares were issued in consideration for the common shares of the given corporation's capital stock as part of a reorganization of capital."

3 February 1999 Ruling 971084

Ruling that a normal course issuer bid (which would result in some minority shareholders who do not sell their shares having their percentage interest in the corporation increase) came within the exception in s. 55(3)(a). The "Additional Information" contained a statement that because a holding corporation's interest in the public corporation will be not less than o%, the collective interest of the minority shareholders would not increase by more than o%.

1 December 1998 TEI Conference, Q. XXIII

"In determining whether an increase in interest in a corporation is 'significant' in the context of paragraph 55(3)(a), an analysis of the increase both in terms of an absolute dollar amount and on a percentage basis is required. Whether the dollar amount of the increase is significant depends, in part, on a comparison of the increase in relation to the dollar value of all interests in the corporation. However, we are of the view that a large increase in absolute terms may be significant even if it represents a relatively small portion of the total interests in the corporation. ...

In many situations, there may be no increase in the value of a shareholder's interest in a company as expressed in dollars (for example, where shares owned by another shareholder are redeemed at fair market value); in such circumstances, it is our practice to compare the value of a person's interest in the corporation as a percentage of the value of all interest in the corporation immediately before the cancellation of the shares to the value of that person's interests in the corporation as a percentage of the value of all interests in the corporation immediately after the share cancellation."

7 July 1998 External T.I. 9641165 - EXEMPTION FROM 55(2)

"The issuance of shares does not represent an event described in subparagraph 55(3)(a)(ii)."

3 November 1997 External T.I. 9725615 - INCREASE IN INTEREST

"In circumstances where no person has acquired any shares of the corporation in question, it is our view that for the purposes of determining whether there has been 'a significant increase ... in the total direct interest' of an unrelated person in the corporation for purposes of ... subparagraph 55(3)(a)(ii) and (iv) [sic] of the Act that one must compare the value of a person's interest in the corporation as a percentage of the value of all interests in the corporation immediately before the share redemption to the value of that person's interest in the corporation as a percentage of the value of all interests in the corporation immediately after the share redemption." Accordingly, in a situation where a substantial preferred share interest of one shareholder was redeemed, there was a significant increase in the total direct interests of the other unrelated shareholders of the corporation.

30 November 1996 Ruling 9704023 - SUBSTANTIAL ISSUER BID

Ruling that a substantial issuer bid (effected by way of auction tender) in which a major shareholder of the corporation would have a proportionate number of its shares in the corporation purchased for cancellation and minority shareholders who did not tender to the bid could see their proportionate interest in the corporation increase, came within the exemption in s. 55(3)(a).

20 April 1997 External T.I. 9711155 - 55(3)(A)(I) EXEMPTIONS

"Where a share whose fair market value exceeds its paid-up capital is redeemed for an amount of cash equal to its fair market value, the disposition of the cash to the shareholder on the redemption will ordinarily be described in one or both of clauses 55(3)(a)(i)(A) and (B)."

1996 Ontario Tax Conference Round Table, "Creditor Protection and Butterfly Transactions", 1997 Canadian Tax Journal, Vol. 45, No. 1, pp. 214-215

After it was noted that the exception in s. 55(3)(a) would apply where two individuals hold their investment in Opco through Holdco, and the assets of Opco are spun off to Newco which is a subsidiary of Holdco, whereas that exception would not apply where the two individuals held Opco and Newco directly, RC noted that in the second situation, if Holdco was formed as part of the same series of transactions, the exemption in s. 55(3)(a) also would not be available.

1996 Corporate Management Tax Conference Report, Q. 15

The related-person test should be applied at the time of the relevant disposition of property or increase of interest.

27 June 1995 External T.I. 9425365 - DISPOSITION OF CASH

A payment of cash on the purchase for cancellation of common shares held by an estate would be considered to be a disposition of property by the corporation to the estate.

16 September 1992 T.I. (Tax Window, No. 24, p. 16, ¶2196)

A beneficiary holding a contingent beneficial interest in an estate whose property includes a share of a corporation, has an "interest" in that corporation for purposes of s. 55(3)(a)(ii).

10 January 1992 CGA Roundtable, Q. 19, 7-912224

Where Mr. A and Mr. B, who each own 50% of the shares of A Ltd. and B Ltd., enter into a shareholders' agreement with respect to their shareholdings in both corporations which include clauses that fall under s. 251(5)(b) (for example, the obligation to buy and sell if one withdraws from the business), the two corporations will be related for purposes of the exemption in s. 55(3)(a), unless s. 55(4) applies.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 110.6 - Subsection 110.6(7) | 56 | |

| Tax Topics - Income Tax Act - Section 69 - Subsection 69(1) - Paragraph 69(1)(a) | FMV of debt rather than amount owing | 57 |

| Tax Topics - Income Tax Act - Section 53 - Subsection 53(1) - Paragraph 53(1)(c) | contribution of capital on conversion of debt to lower FMV shares | 204 |

10 January 1992 Memorandum (Tax Window, No. 17, p. 15, ¶1773)

Where a parent, in order to reduce its debt, instructs its subsidiary to sell properties to a third party and use the cash proceeds to pay a dividend on the common shares or redeem the preferred shares, the resulting dividend or deemed dividend may be subject to s. 55(2).

10 January 1992 Memorandum (Tax Window, No. 17, p. 14, ¶1773)

S.55(2) will apply where one wholly-owned subsidiary of a corporation transfers property to another wholly-owned subsidiary of that parent with unused capital losses ("Lossco"), with a view to Lossco immediately reselling the property at a capital gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(e) | 27 |

10 January 1992 Memorandum (Tax Window, No. 17, p. 12, ¶1773)

In order for the exemption in s. 55(3)(a) to apply to a transaction involving a transfer of assets from a corporation owned equally by Messrs. A and B to a second corporation owned equally by them, Mr. A and Mr. B must be acting in concert to control the two corporations not only with respect to the series of transactions in question, but also on a continuing basis.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | 19 | |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | 48 |

24 February 1992 Memorandum (Tax Window, No. 13, p. 13, ¶1627)

A participation in a phantom stock plan may represent an interest in a corporation.

19 December 1990 T.I. (Tax Window, Prelim. No. 2, p. 6, ¶1054)

The exemption in s. 55(3)(a) generally will be available in a reorganization undertaken to facilitate the division of family assets on divorce. This represents a reversal of a previous position that the exemption was not available because the series of transactions included the divorce, after which the couple are not related to each other.

19 March 1990 T.I. (August 1990 Access Letter, ¶1371)

A single-wing butterfly reorganization carried out as part of a divorce settlement whereby property ends up owned by the wife's corporation will be off-side because the subsequent divorce occurs as part of the series of transactions.

29 January 1990 T.I. (June 1990 Access Letter, ¶1268)

If at the time of the preliminary transaction the taxpayer has the intention of implementing subsequent transactions, the subsequent transactions would be part of the series even though at the time of the preliminary transaction all the important elements of the subsequent transactions such as the identity of the other taxpayers involved had not been determined, or the taxpayer lacked the ability to implement the subsequent transactions.

3 November 89 T.I. (April 90 Access Letter, ¶1172)

A U.S. corporation has a wholly-owned Canadian operating subsidiary ("Subco 1") and a newly incorporated wholly-owned Canadian subsidiary ("Subco 2"). Part of the business of Subco 1 is transferred to Subco 2 for business reasons and a deemed dividend is received in the course of the reorganization. If the shares of Subco 2 are sold to an arm's length buyer in a transaction that was not part of the original series of transactions, then the fact that the subsequent sale would not have occurred if the reorganization had not taken place does not establish a sufficient causal connection to say that the restructuring "resulted in" the sale. However, if one of the purposes of the restructuring was to make the business division of Subco 1 that was transferred to Subco 2 saleable to potential buyers, then RC likely would consider the restructuring and the ultimate sale to form part of the same series of transactions or events.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(10) | 109 |

1 November 89 T.I. (April 90 Access Letter, ¶1172)

The exemption will not be available where a corporation transfers property to a related corporation under the rollover in s. 85(1), the transferee corporation sold the property to an arm's length party so that its capital gain offsets its capital loss and the transferee corporation then redeems the shares which it had issued to the transferor corporation.

Articles

David Carolin, Manu Kakkar, Boris Volfovsky, "Tax Alchemy and Paragraph 55(3.01)(g): Converting a 55(3)(b) Divisive Reorganization into a 55(3)(a) Related-Party Butterfly", Tax for the Owner-Manager, Vol. 24, No. 1, January 2024, p. 7

Suppose that Opco is owned on an 85-15 basis by two arm’s-length shareholders, Aco and Bco. If Opco wishes to spin off the real property used in its active business to a Newco owned in the same proportions by Aco and Bco, the s. 55(3)(a) exception will not be available since Bco, which is not related to either Opco or Newco, has a significant increase in its interest in Newco occur contrary to s. 55(3)(a)(ii) and (v).

Instead suppose that there is a preliminary step under which Aco and Bco transfer their shares of Opco to newly-incorporated Middleco on an s. 85(1) rollover basis. Then, Opco spins off the real estate to a Newco incorporated by Middleco. Done this way, the spin-off would come within the s. 55(3)(a) exception given, inter alia, the relieving effect of the rule in s. 55(3.01)(g). See also 2015-0570021E5 F.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3.01) - Paragraph 55(3.01)(g) | 534 |

Doron Barkai, Alexander Demner, "Dealing with New Subsection 55(2): Issues and Strategies", 2016 Conference Report (Canadian Tax Foundation), 6:1–56

Avoidance of s. 55(2) through accessing related party exemption (p. 6:31)

[O]ne strategy to avoid subsection 55(2) is to restructure a dividend as a share redemption or repurchase… .

[A]ssume that Opco is a wholly owned subsidiary of Holdco, which owns 100 common shares of Opco worth $ 1 million (with nil ACB and PUC). Opco wishes to pay a dividend of $100,000 to Holdco….

The optimal approach to restructuring the dividend to satisfy the related-party exception is through an initial share-for-share exchange effected pursuant to subsection 86(1). Holdco first exchanges all of its Opco common shares for (1) preferred shares with a fixed redemption value of $100,000, and (2) common shares with a value equal to the balance ($900,000). The preferred shares are thereafter redeemed.

Provided that the Opco common shares (before the exchange) are worth considerably more than the amount of cash to be distributed to Holdco, no concerns regarding valuation should exist….

Appropriateness of preliminary transactions to stream ACB to non-redeemed shares (pp. 6:32-33)

[I]t appears [having cited 2015-0610681C6] that the CRA would challenge a preliminary transaction segregating pre-existing ACB from shares to be subsequently redeemed … .