Subsection 111(1) - Losses deductible

Paragraph 111(1)(a) - Non-capital losses

Cases

Bank of Nova Scotia v. Canada, 2024 FCA 192, leave granted 22 May 2025 (41643)

In rejecting the taxpayer’s submission (in the context of the Minister having carried back, at the taxpayer’s request, a non-capital loss to offset increased income in an earlier year pursuant to an audit adjustment, “that where the Minister proposes to reassess for her own reasons (i.e., an audit adjustment) … the Minister has no ability to refuse the carryback request in these circumstances because a taxpayer has a statutory right to claim a loss carryback by virtue of paragraph 111(1)(a)” (para. 41), Woods JA stated (at para. 42):

The Minister has the right to reject a taxpayer’s request for a loss carryback. The point was made in Greene … 95 D.T.C. 5684 … that the Minister only has to consider a request, not necessarily issue a reassessment granting the request.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 161 - Subsection 161(7) - Paragraph 161(7)(b) - Subparagraph 161(7)(b)(iv) | interest on an audit adjustment accrued up to the time that the taxpayer, learning of the adjustment, requested a loss carryback to offset it | 408 |

| Tax Topics - Statutory Interpretation - French and English Version | “as a consequence of” interpreted in light of the shared meaning of the French and English versions | 229 |

| Tax Topics - Statutory Interpretation - Certainty | Parliament seeks certainty, predictability and fairness | 112 |

1455257 Ontario Inc. v. Canada, 2021 FCA 142

The validity of a s. 160 assessment of the taxpayer turned in part on whether the affiliate from which the taxpayer had received a transfer of property in 2003 should be regarded as having had its taxable income for 2000 reduced by a portion of its non-capital loss for 2002 that the affiliate had not claimed because the taxpayer and the affiliate had not found out about that additional loss until 2011, when the taxpayer made an ATIP request following the s. 160 assessment of it.

The taxable income of the affiliate for 2000 had arisen as a result of a 2005 settlement which had reduced a 2001 non-capital loss (and, thus, reduced the loss carryback to 2000), thereby leaving 2000 unsheltered. Noël C.J. confirmed the finding below that the affiliate had failed to request the carryback of the 2002 loss on a timely basis. In finding that the Minister had no responsibility to initiate such a carryback, he stated (at para. 33):

Nothing in the carry-back statutory scheme allows the Minister to determine when and how non-capital losses should be applied. This framework effectively grants taxpayers the exclusive right to determine when and how their non-capital losses are to be applied. The wording of paragraph 111(1)(a) and subsection 152(6) is clear to this effect and provides for a result that is consistent with the object of these provisions and the intention of Parliament.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(4) - Paragraph 152(4)(b) - Subparagraph 152(4)(b)(i) | CRA has no arbitrary discretion to reject an s. 152(4)(b)(i) extension request | 315 |

| Tax Topics - Income Tax Act - Section 160 - Subsection 160(1) - Paragraph 160(1)(e) | s. 160 applied to post-transfer interest | 316 |

The Queen v. Merali, 88 DTC 6173, [1988] 1 CTC 320 (FCA)

"There is nothing in the Act to prevent a resident from carrying over non-capital losses incurred when he was a non-resident taxpayer having elected during his non-resident years to be treated as a resident under the terms of subsection 216(1) of the Income Tax Act."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 216 - Subsection 216(1) | 108 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Taxpayer | nexus to Ccn source | 28 |

| Tax Topics - Statutory Interpretation - Ordinary Meaning | 64 |

Oceanspan Carriers Ltd. v. The Queen, 87 DTC 5102, [1987] 1 CTC 210 (FCA)

"A corporation which incurs losses from business activities outside Canada when it is neither a resident nor had income from a source in Canada, and thus is not subject to assessment under the Act, is not entitled to deduct such losses to reduce taxable income to nil on income derived after it becomes a Canadian resident."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 2 - Subsection 2(1) | 77 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Taxpayer | "taxpayer" refers to a person who may become liable to tax | 77 |

See Also

Brookfield Renewable Power Inc. (Corporation Énergie éolienne Brookfield inc.) v. Agence du revenu du Québec, 2025 QCCA 234

Loss consolidation transactions between a “Lossco” in the Brookfield group (“BRPI”) and “Profitcos” resulted, for instance, in BRPI holding $2.3 billion of loans in its Profitco subsidiary, and the Profitco holding $2.3 billion of preferred shares of its parent until this reciprocal arrangement was reversed five months’ later. The ARQ assessed to deny the deduction of the interest in excess of 6%.

The Court of Appeal found no reversible errors by the Court of Quebec, which referred to the Gervais Auto decision, and evidence of the two ARQ experts indicating that BRPI had been borrowing from arm’s length lenders at around that time at rates ranging between 6.00% and 8.75%; and referred the appeal back to the ARQ for reassessment on the basis of allowing the interest deduction at an 8.75% rate.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) - Subparagraph 20(1)(c)(i) | reduction of the deductible interest on loss consolidation loans from 14% to 8.75% based on parent’s borrowing costs | 298 |

Laprairie v. The King, 2024 TCC 149 (Informal Procedure)

A group settlement reached in respect of the appeals of a large group of taxpayers including the taxpayer allowed a deduction of losses in a specified amount for their 1995 and 1996 taxation year, allowed interest expense claims for various periods and allowed “any consequential claims by [the taxpayers] for the carryforward or carryback of any losses resulting from the reassessments set forth above.” Without further communication with the taxpayer, the Minister carried back the resulting non-capital loss of the taxpayer to his 1992 and 1993 taxation years. The taxpayer objected on the basis that this carryback was done without giving him a choice as to the application of the loss, and that he wanted the loss applied to years under appeal, i.e., 1997 and 1998.

In allowing the taxpayer’s appeal, Wong J noted (at para. 18) that “the starting point is that it is the taxpayer’s choice as to the application of available non-capital losses” and found that there was nothing in the wording of the settlement that took away this right of direction of the taxpayer.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 169 - Subsection 169(2.2) | a settlement agreement did not trench on the taxpayer’s right to direct how his non-capital loss should be applied | 266 |

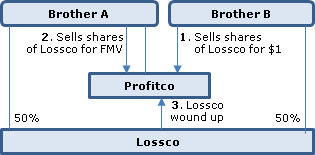

Brookfield Renewable Power Inc. v. Agence du revenu du Québec, 2023 QCCQ 10239, aff'd 2025 QCCA 234

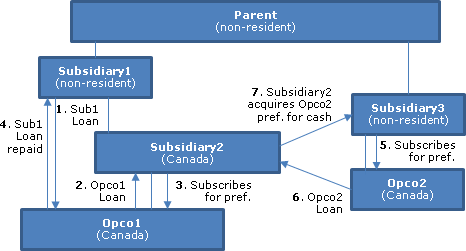

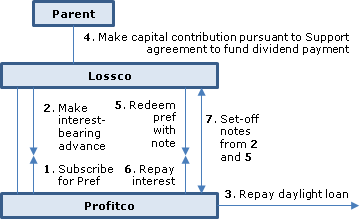

In connection with a September 2009 loss consolidation transaction between a “Lossco” in the Brookfield group (“BRPI”) and its “Profitco” subsidiary (“BEMI”):

- Two Ontario Newcos with nominal share capital were lent $2.25 billion and $0.525 billion by BRPI pursuant to unsecured demand notes bearing interest at 14%;

- Each Newco used the loan proceeds to subscribe for non-cumulative preferred shares of BRPI;

- On the same day, BEMI acquired the Newcos for a nominal amount and they were wound up into BEMI, so that BRPI held $2.275 billion of loans in its subsidiary, and BEMI held $2.275 billion of preferred shares of its parent; and

- The loans were left outstanding for approximately five months, then: BRPI declared and paid a dividend on the preferred shares to fund the payment of all the accrued interest on the loans, and those shares and loans were redeemed and repaid by way of set-off.

The ARQ assessed on the basis that interest in excess of 6% was unreasonable. Lareau JCQ, after a review of the expert evidence, referred the appeal back to the ARQ for reassessment on the basis of allowing the interest deduction at an 8.75% rate.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) - Subparagraph 20(1)(c)(i) | deductible interest on loss consolidation loans reduced from 14% to 8.75% | 325 |

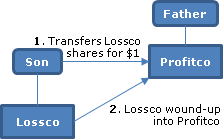

J.D. Irving Limited v. Agence du revenu du Québec, 2020 QCCQ 2423, aff'd 2022 QCCA 241

A loss consolidation transaction involved a company (“IPPL”) in the Irving group of companies transferring, in December, its pollution control equipment on a rollover basis to an affiliated lossco, which then sold the equipment for $120M to the group profitco (“JDI”), which then claimed $120M of CCA and, in January of the next year, transferred the equipment back to IPPL on a rollover basis. The Court rejected an ARQ challenge to this transaction through treating the equipment in JDI's hands as subject to the leasing property restriction rules.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 1100 - Subsection 1100(17) | property serviced by the user was not a leasing property | 416 |

| Tax Topics - General Concepts - Agency | Stubart recognized that business operations can be carried on by an affiliated agent | 231 |

Hatt v. The Queen, 2015 TCC 207 (Informal Procedure)

The taxpayer, who became a non-resident when she went on unpaid leave from her Canadian job in 2003, retired in 2007 and thereupon received $2497.44 in unused annual leave credits (treated by CRA as income from her Canadian employment under s. 115(1)(a)(i)) and a retiring allowance of $43,255 (taxable under Part XIII rather than Part I). She contributed $22,384 to a registered pension plan which, by virtue of its deductibility under s. 147.2(4)(a), gave rise to a 2007 loss from employment under s. 5(2). After her return to Canada in 2010, she deducted this amount from her taxable income as a non-capital loss.

CRA disallowed the carry-forward on the basis that s. 147.2(4) does not allow the carry-forward of RPP contributions but rather requires that the deduction be made "in the year" they are contributed - and this limitation's "purpose would be frustrated by the availability of non-capital losses under section 111" (para. 35).

In allowing the taxpayer's appeal, D'Arcy J stated (at para. 48):

[P]ursuant to the definition in subsection 111(8), the Appellant incurred a non-capital loss from employment of $20,302 in her 2007 taxation year. Pursuant to subsection 111(1)(a), such loss may be carried forward and deducted when determining the Appellant's 2010 taxable income.

Administrative Policy

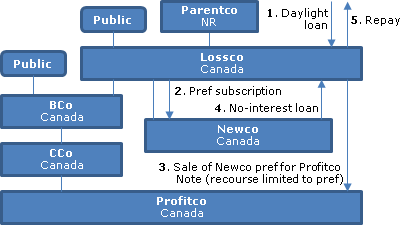

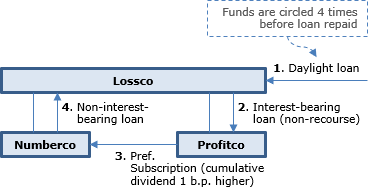

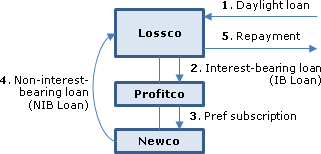

2023 Ruling 2023-0973911R3 - Loss Consolidation Ruling

Background

Aco, a non-resident corporation which is an indirect-wholly owned subsidiary of a public non-resident corporation, and Bco, a Canadian wholly-owned subsidiary of Aco, collectively hold all the shares of Lossco which, in turn, wholly-owns both Numberco, which has unexpired non-capital losses, and Profitco.

Loss consolidation transactions

- Lossco will receive a daylight loan from an arm’s length financial institution.

- Lossco will use the daylight loan proceeds to make an interest bearing loan (evidenced by the “IB Note”) to Profitco.

- Profitco will use all of such proceeds to subscribe for newly-created non-voting redeemable retractable Numberco preferred shares bearing a cumulative dividend equal to the interest rate under the loan from Lossco plus 0.0001% per annum.

- Numberco will use the proceeds from such share issuance to make a non-interest bearing demand loan to Lossco.

- The transactions in 2 to 4 will be repeated an additional three times, interest on the IB Note in 2 will bear simple interest which will be paid on the earlier of the end of Profitco’s second taxation year following the taxation year in which it incurred the interest, and immediately before the unwinding transaction in 8 below. Lossco’s recourse against Profitco to obtain repayment of the amounts due under the IB Note will be limited to the Numberco preferred shares owned by Profitco.

- Lossco will use the proceeds received from the last NIB Loan to repay the daylight loan.

- Immediately before the unwinding transaction in 8 below, Lossco will make a contribution of capital to Numberco, which it will use to pay the accrued dividends on its preferred shares, with Lossco using such proceeds to pay the accrued interest on the IB Note.

- Numberco will redeem its preferred shares in consideration for assigning the non-interest-bearing note to Profitco, which will then be set-off against the IB Note.

- Numberco will be wound up into Lossco pursuant to s. 88(1).

Rulings

Including re s. 20(1)(c), s. 12(1)(x) (re non-application to contribution of capital), s. 55(2), s. 88(1.1), and s. 245(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Payment & Receipt | daylight loan circled 4 times | 71 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) - Subparagraph 20(1)(c)(i) | loan in loss-shifting transaction was limited recourse to the Numberco preferred shares, which had a yield 1 b.p. higher | 89 |

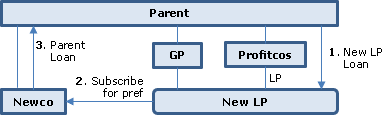

2022 Ruling 2021-0910431R3 - Loss consolidation arrangement

Background

Parent indirectly wholly-owns Profitcos 1, 2 and 3 and itself has non-capital loss carryforwards. The loss consolidation transactions below do not entail loans being made directly to the Profitcos because they are regulated entities which should not incur debt under those transactions.

Proposed transactions

- New LP will be formed with a new subsidiary of Parent as the general partner and the Profitcos as the three limited partners.

- Parent will use the proceeds of the “Daylight Loan” (from an arm’s length financial institution) to make an interest-bearing demand loan to New LP (the "New LP Loan").

- New LP will use the proceeds thereof to subscribe for non-voting redeemable retractable preferred shares (with dividends payable annually) of a newly-incorporated subsidiary of Parent (“Newco”).

- Newco will use such proceeds to make a non-interest-bearing demand loan to Parent (the "Parent Loan").

- Parent will use such proceeds to repay the Daylight Loan.

- Parent and Newco will enter into a capital support agreement pursuant to which Parent will make annual contributions to Newco to fund the annual preferred shares dividends which, in turn, will fund the interest payment by New LP.

- The unwinding of the above loss consolidation arrangements will entail inter alia Newco redeeming its preferred shares with a note, which New LP will use to repay the New LP Loan by assigning it to Parent, with that note then being set off against the Parent Loan – and Newco and New LP being wound up.

Rulings

Including re s. 20(1)(c) interest deduction on the New LP Loan, no income inclusion re the capital contributions, a s. 112(1) deduction to the Profitcos re the dividends allocated to them, non-application of the GAAR rules in agreeing provinces and non-application of s. 245(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 112 - Subsection 112(1) | s. 112(1) deduction to partners on dividend income component of income allocation to them by limited partnership | 114 |

2024 Ruling 2023-0994301R3 F - Loss consolidation arrangement

Background

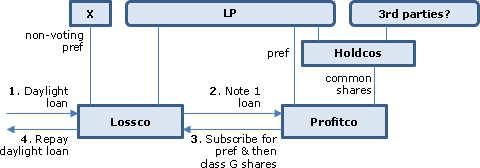

LP, a Canadian limited partnership, holds common shares of Profitco through two Holdcos and holds preference shares of Profitco directly. It is unclear whether Profitco is wholly-owned, directly or indirectly, by LP. LP also holds all the shares of Lossco, which is affiliated and related to Profitco, except that a redacted person holds non-voting preference shares of Lossco.

Proposed transactions

Lossco will use the proceeds of a daylight loan (drawn down under a group credit facility) to subscribe for an interest-bearing note of Profitco, which will use such loan proceeds to subscribe for newly-created non-voting cumulative redeemable retractable preference shares of Lossco, whose proceeds will be used by Lossco to repay the daylight loan. Profitco will also subscribe for Class G preference shares of Lossco.

LP and Lossco will enter into an agreement pursuant to which LP will make an annual non-interest bearing advance to Lossco in an amount equal to the excess of the amount of dividends payable on the Preference Shares over the amount of interest payable on Note 1 on an annual basis (the Annual Advance).

The above loss consolidation arrangement will be terminated, on the earlier of a specified date and the utilization of Lossco’s non-capital losses by the payment of the accrued and unpaid dividends on the preference shares and of the interest on Note 1, followed by Lossco redeeming the Preference Shares through delivery of Note 1 to Profitco, with Note 1 being extinguished by set-off, and Profitco repaying all Annual Advance amounts.

Additional information

The Group's borrowing capacity under the undrawn credit facility will exceed the level required to complete the proposed transactions.

Rulings

Including ruling on s. 20(1)(c) and opinion on Bill C-59 version of s. 245.

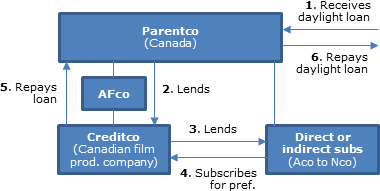

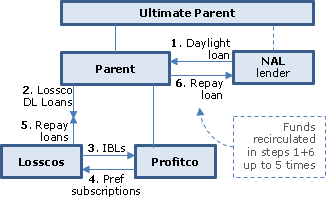

2023 Ruling 2023-0964601R3 - Loss consolidation arrangement

Background

Parentco (along with the other named corporations, a taxable Canadian corporation) wholly-owned two Losscos and a Profitco.

Proposed transactions

- Parentco will borrow a daylight loan from an arm’s length or non-arm’s length lender. This may occur up to five times in quick succession, with the transactions in 1 to 5 being repeated that number of times.

- Parentco will lend the proceeds on arm’s length terms (including interest) to the two Losscos.

- The Losscos will make interest-bearing subordinated loans at a reasonable commercial rate of interest to Profitco (the “IBLs”).

- Profitco will use the proceeds to subscribe for newly-created cumulative non-voting preferred shares of the Losscos.

- The Losscos will use those proceeds to repay the loans from 2, and Parentco will repay its daylight loan.

- Lossco will annually pay the preferred share dividends, which will fund the annual interest payments on the IBLs.

- The unwinding of the transactions, which will occur at the earlier of 3 years from inception and the utilization of the Lossco non-capital losses, will include the Lossco redeeming their preferred shares with notes, and setting those notes off against the IBLs.

Rulings

Including re s. 20(1)(c) deduction on IBLs to Profitco, the carryback of non-capital losses potentially arising from the transactions to Profitco to preceding Profitco taxation years within the s. 111(1)(a) carryback period, and the non-application of s. 55(2) provided that none of the purposes of the dividends is to reduce the FMV or capital gain on any share or to increase the total cost amount of any properties.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Payment & Receipt | in-house re-circulating daylight loan used to fund a loss-shifting transaction | 115 |

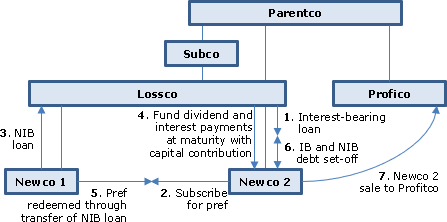

2023 Ruling 2022-0949841R3 - Loss Consolidation Ruling

Background

Parentco (listed on an exchange) holds Lossco directly and through Subco, and also holds Profitco. Lossco holds recently-incorporated Newco 1 and Newco 2. Profitco’s functional currency (as defined in s. 261(1)) and tax reporting currency is other than the Canadian dollar. Lossco has not make an election under s. 261(3), and it (and Newco 1 and 2 referred to below) will not do so, so that their tax reporting currency is the Canadian dollar.

Proposed transactions

- Lossco will use the proceeds of a daylight loan to subscribe for unsecured floating-rate debt (the “IB Debt”) of Newco 2 pursuant to the “IB Credit Facility” and Parentco, Subco and Lossco will enter into the “Support Agreement” regarding the funding of dividend payments referred to in 5 below.

- Newco 2 will use the proceeds of the IB Debt to subscribe for cumulative non-voting redeemable retractable preferred shares of Newco 1 (the “Newco 1 Preferred Shares”) representing a positive spread over the IB Debt.

- Newco 1 will use the proceeds of the Newco 1 Preferred Shares to make a non-interest-bearing loan to Lossco (the “NIB Debt”).

- Lossco will repay the daylight loan.

- Immediately before the annual unwind transactions referred to in 6 below, Lossco will use share subscription proceeds from Subco to make a capital contribution to Newco 1, Newco 1 will pay the accrued dividends on the Newco 1 Preferred Shares, Newco 2 will use such proceeds to pay the interest on the IB Debt to Lossco, which will use such funds to distribute to Subco the PUC received on the previous share subscription.

- Under the annual unwind transactions, Newco 1 will redeem its Newco 1 Preferred Shares by transferring to Newco 2 the NIB Debt in accordance with the terms of the Newco 1 Preferred Shares, with Newco 2 and Lossco then settling the NIB Debt and IB Debt by set-off.

- Lossco will sell all of its shares of Newco 2 to Profitco for FMV cash consideration, and

- Profitco will then immediately authorize the winding-up of Newco 2 into Profitco so that all its assets are distributed to Profitco and any liabilities assumed, and it will then be formally dissolved.

The transactions described above will be repeated with Newco 3 and then with Newco 4. When Lossco’s non-capital losses and investment tax credits are fully utilized, Lossco will wind-up Newco 1.

Other representations

Newco 2’s second fiscal period, which will begin at the first moment of the day of its dissolution and end with that dissolution, will be its first functional currency year.

Proposed s. 18.2(4) will not apply to limit the deductibility of the interest on the IB Debt as Lossco and Newco 2 are eligible group corporations in respect of one another and will elect to treat the interest payment under the IB Debt as excluded interest.

Rulings

Including re ss. 20(1)(c), 88(1.1) and 55(2), re the application of s. 261(16)(a) to the wind-up of Newco into Profitco regarding Newco 2 being deemed to have elected Profitco’s tax reporting currency for its second short taxation year and re the non-application of the avoidance rule in s. 261(18) and the stop-loss rule in s. 262(21).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 261 - Subsection 261(16) - Paragraph 261(16)(a) | transfer of losses to a Profitco with a different functional currency | 124 |

2020 Ruling 2019-0834901R3 - Loss Utilization - Depreciable Property

CRA ruled on transactions for Profitco, which is an indirect wholly-owned Canadian subsidiary of a non-resident parent, to utilize the non-capital losses of Lossco, which is a direct wholly-owned Canadian subsidiary of the non-resident parent. Profitco transferred Class 12 property on a s. 85(1) rollover basis to Lossco in consideration for redeemable preferred shares of Lossco, then Lossco transferred the properties back to Profitco in consideration for redeemable preferred shares of Profitco having a paid-up capital equaling their redemption amount, with a joint s. 85(1) election being made at the estimated FMV of the properties, so that Lossco realized recapture of depreciation. The two preferred shareholdings were then redeemed for notes, and the notes set off. Profitco claimed CCA on its stepped-up Class 12 property.

In its summary, the Directorate stated:

The proposed subject transaction conforms with the CRA's policy to not apply subsection 55(2) of the Act to internal reorganizations within a related group for loss consolidation purposes and recognizing that property retains its character on a rollover transaction between related parties is consistent with the CRA’s position in … 2014-0553731I7 that depreciable property should retain its character on wind-up.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 9 - Capital Gain vs. Profit - Machinery and Equipment | depreciable property retained its character in superficial gain transaction | 216 |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(a) | s. 55(3)(a) application to deemed dividend arising on superficial gain transaction to utilize losses of Lossco | 203 |

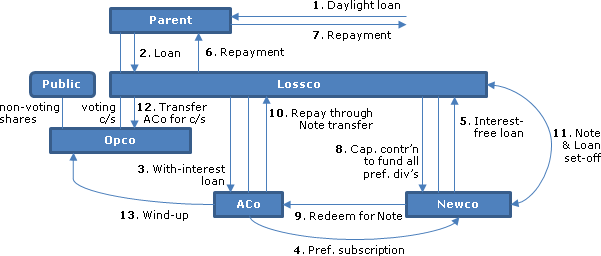

2020 Ruling 2019-0835141R3 - Loss consolidation arrangement

Background

Parent wholly-owns Lossco (a holding company) which, in turn, owns all the issued and outstanding voting common shares of Opco (a public corporation), which has non-voting shares that trade on an exchange.

Proposed transactions

In order to permit Opco to use losses which Lossco is expected to incur:

- Parent will borrow under a daylight loan (Parent Loan).

- Parent will use such proceeds to make a non-interest-bearing loan to Lossco (Loan 1).

- Lossco will use such proceeds to make an interest-bearing loan (Loan 2) to a newly-incorporated subsidiary of Lossco (ACo).

- ACo will use such proceeds to subscribe for redeemable retractable preferred shares (Newco Preferred Shares) of another newly-incorporated subsidiary of Lossco (Newco).

- Newco will use such proceeds to make a non-interest-bearing loan (Loan 3) to Lossco.

- Lossco will repay Loan 1.

- Parent will repay the Parent Loan.

- At a subsequent juncture, Lossco will make a contribution of capital to Newco to fund the payment by it of all the accrued dividends on the Newco Preferred Shares held by ACo., with ACo then paying all accrued and unpaid interest on Loan 2 to Lossco.

- Immediately following the interest payment in 8, and in connection with the unwinding of the loss consolidation arrangement, Newco will redeem the Newco Preferred Shares held by ACo in consideration for its issuance of a non-interest bearing promissory note (the "Newco Note"), then;

- ACo will repay Loan 2 by assigning the Newco Note to Lossco, then;

- Loan 3 and the Newco Note will be repaid by mutual set-off.

- Lossco will transfer all of its ACo Common Shares to Opco in exchange for the "Opco Common Shares," utilizing s. 85(1).

- ACo will be wound up into Opco and Newco wound up into Lossco.

Additional Information

"Loan 2 is being made to ACo, instead of having Lossco make Loan 2 directly to Opco, to ensure that Opco, which is a public corporation, does not incur debt in order to implement the loss utilization."

Lossco will have the borrowing capacity to obtain a daylight loan, in an amount equal to the amount of Loan 1, directly from an arm's length lender. No rep that ACo has stand-alone borrowing capacity.

The Newco Preferred Shares, although term preferred shares, will not be acquired by ACo in the ordinary course of ACo's business.

Rulings

- Including interest deductibility to ACo on Loan 2 and non-application of ss. 9 and 12(1)(c) to capital contributions received by Newco.

- Provided both the payment and the receipt of the dividends on the Newco Preferred shares occurs so as to provide a reasonable return on such shares and to fund the interest payments made by ACo on Loan 2, rather than to reduce the fair market value or capital gain of any share, or to increase the total cost amounts of any properties, s. 55(2) will not apply to dividends received by ACo on the Newco Preferred shares.

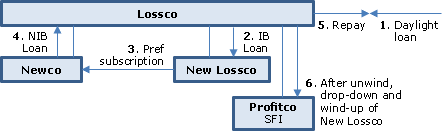

2020 Ruling 2019-0819971R3 - Loss Consolidation Ruling

Background

Lossco, a publicly-traded resident corporation, has non-capital loss carryforward balances all allocable to its only permanent establishment (presumably, its office), and is expected to incur additional annual losses. Profitco is a wholly-owned direct subsidiary of Lossco and a specified financial institution.

Proposed transactions

- Lossco will use the proceeds of a daylight loan to make an interest bearing loan (the “IB Loan”) to a newly-incorporated subsidiary (“NewLossco”).

- NewLossco will use such proceeds to subscribe for Preferred Shares of another newly-incorporated subsidiary of Lossco (“Newco”).

- Newco will use such proceeds to make a non-interest bearing loan (the “NIB Loan”) to Lossco.

- Pursuant to a capital support agreement, Lossco will annually make contributions of capital to Newco to fund the accrued Preferred Share dividends, with NewLossco thereupon paying all the accrued interest on the IB Loan.

- In connection with unwinding the loss consolidation arrangement , Newco will redeem the Newco Preferred Shares held by NewLossco in consideration for a non-interest bearing promissory note (the “Newco Note”), with NewLossco repaying the IB Loan by assigning the Newco Note to Lossco, and with Newco and Lossco will agree to set off the amount due under the NIB Loan against the amount due under the Newco Note.

- Lossco will thereupon transfer all of its NewLossco Common Shares to Profitco under s. 85(1) in exchange for additional common shares of Profitco, and NewLossco will be wound up into Profitco.

Other representations

The Taxpayers will undertake steps to ensure that Lossco’s income as a result of the Proposed Transactions will not exceed an amount that could be fully sheltered with Lossco’s unused losses.

The Newco Preferred Shares and NewLossco Common Shares will be term preferred shares. However, the Newco Preferred Shares that will be acquired by NewLossco will not be acquired in the ordinary course of NewLossco’s business. The NewLossco Common Shares that will be acquired by Lossco will not be acquired in the ordinary course of Lossco’s business.

The Proposed Transactions are not being undertaken to refresh non-capital losses or facilitate the use of such losses in a taxation year after the taxation year in which the losses would have otherwise expired in the hands of Lossco.

Rulings

Standard, including that GAAR provisions of the agreeing provinces would not be applied.

2017 Ruling 2017-0711911R3 - loss consolidation ruling

Background

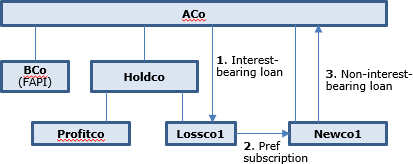

Aco, a holding company which generally does not have taxable income, otherwise than foreign accrual property income (FAPI) from a wholly-owned controlled foreign affiliate (Bco), has been incurring losses as a result of debt issued to the public. Profitco is wholly-owned by Holdco, which is wholly-owned by Aco.

Proposed transactions

- Aco will use the proceeds of a daylight loan (whose amount “will not exceed the borrowing capacity of the Aco group”) to make an interest-bearing loan (the “Lossco1 Loan”) to a newly-incorporated subsidiary of Holdco (“Lossco1”).

- Lossco1 will use such proceeds to subscribe for non-voting cumulative redeemable retractable preferred shares (the “Newco1 Preferred Shares”) of Newco1 (wholly-owned by Aco).

- Newco1 will use such proceeds to make an interest-free loan to Aco (the “Aco Loan”).

- Aco will make periodic contributions of capital to Newco1 to fund the payment of dividends on the Newco1 Preferred Shares, with Lossco1 using those amounts to pay interest to Aco on the Lossco1 Loan.

- To unwind the structure, Aco will use the proceeds of a daylight loan to repay the Aco Loan to Newco1, which will redeem the Newco1 Preferred Shares held by Lossco1, which will repay the Lossco1 Loan, with Aco repaying the daylight loan.

- Holdco will transfer its Lossco1 shares on a s. 85(1) rollover basis to Profitco.

- Lossco1 will be wound-up into Profitco. “Lossco1 will be formally dissolved before the end of the first taxation year of Profitco commencing after the commencement of the winding-up of Lossco1. Lossco1 will file articles of dissolution with the appropriate corporate registry within a reasonable time after the winding-up resolution is passed.”

- Newco1 will be wound-up.

The above transactions will be repeated “in the XXXXXXXXXX taxation year in order to use the portion of the interest expense on the Issued Public Debt that cannot be otherwise sheltered with FAPI from Bco,” with Newco2 and Lossco2 playing the same role as Newco1 and Lossco1, and then being wound-up.

Additional information

“Aco will not claim, at any time, a capital loss in respect of its capital contribution in Lossco1 and Newco1. Also, Lossco1 and Newco1 will never be insolvent.”

Rulings

Standard

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(1.1) | requirement for dissolution of subsidiary before the end of the first taxation year of parent commencing after the commencement of the winding-up | 164 |

2017 Ruling 2017-0706211R3 - Standard Loss Consolidation

Current structure

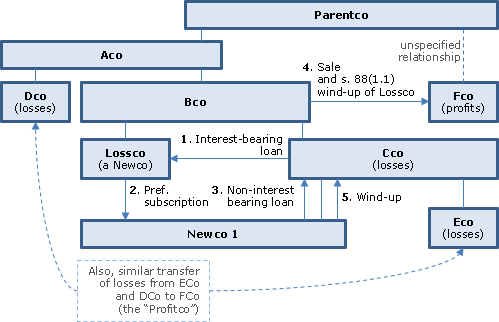

Three corporations within a group wholly-owned by Parentco (Cco, Dco and Eco) have generated non-capital losses. CCo wholly owns Eco and (going up the chain) is wholly-owned by BCo, Aco and Parentco; and Dco is wholly-owned by ACo. Fco, which is generating taxable income, has an undisclosed ownership (perhaps, its direct or indirect ownership by Parentoco is less than 100% but greater than 50%.) “The borrowing capacity of Parentco and its subsidiaries significantly exceeds the maximum amount ... required to complete the Proposed Transactions … .”

Proposed transactions

- Bco will incorporate a new wholly-owned subsidiary (“Lossco”) and subscribe for Lossco common shares for nominal consideration.

- Cco will incorporate a new wholly-owned subsidiary (“Newco 1”) and subscribe for Newco 1 common shares for nominal consideration.

- Cco will use the proceeds of a daylight loan to make an interest-bearing loan (“Lossco Note 1”) to Lossco, with recourse being limited to the Newco 1 Preferred Shares of Lossco described below.

- Lossco will use such proceeds to subscribe for cumulative (with a positive spread) non-voting redeemable retractable preferred shares (the “Newco 1 Preferred Shares”) of Newco 1.

- Newco 1 will use such proceeds to make a non-interest-bearing demand loan to Cco (the “Cco Note”).

- At year end, Cco will use the proceeds of a daylight loan to make a capital contribution to Newco 1, which will be used to fund the dividend payments on the Newco 1 Preferred Shares, with Lossco paying the interest on the Lossco Note 1. Lossco will have the liquidity to service its Notes.

- Also at year end, Cco will use the proceeds of a daylight loan to repay the Cco Note to Newco 1, which will redeem the Newco 1 Preferred Shares, with Lossco repaying the Lossco Note 1 to Cco.

- The transactions in 1 to 7 will be replicated for Eco and Dco (with the respective use of Newco 2 and Newco 3), and with the daylight loan to Cco being repaid as Cco is repaid.

- Bco will sell its Lossco common shares to Fco for their agreed fair market value.

- Lossco will then be wound-up into Fco under s. 88(1.1).

- The transactions described 1 to 10 will be repeated once annually, such that a new Lossco will be formed for each such repetition and the sold one year later, although Newco 1, Newco 2 and Newco 3 will continue to be used rather than fresh Newcos being incorporated.

- Ultimately, Newco 1, Newco 2 and Newco 3 will be wound-up.

Rulings

Standard including provincial GAAR ruling.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) - Subparagraph 20(1)(c)(i) | interest-deductibility on limited-recourse loans | 89 |

2018 Ruling 2018-0742641R3 - Loss consolidation arrangement

Background

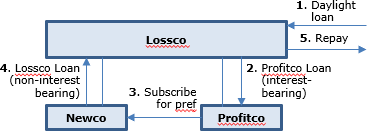

Lossco is the corporate parent of a group of Canadian and non-Canadian corporations. It has non-capital loss carryforwards. Lossco owns all the shares of Profitco. Before giving effect to the proposed transactions, Profitco will become taxable in several years. All of the gross revenue and salaries and wages of Lossco and Profitco are allocated to a particular province.

Proposed transactions

- Lossco will borrow under a daylight loan.

- Lossco will lend the proceeds to Profitco under a subordinated loan (the “Profitco Loan”) bearing interest payable annually in arrears. The interest rate is “based on a comparison to the most recent arm’s length senior secured financing issued in XXXXXXXXXX.” The Profitco Loan may be settled at the option of Profitco at any time in cash or by delivering a financial asset. According to its financial projections, Profitco has the financial capacity to pay the interest on the Profitco Loan from its own cash flow.

- Profitco will use the proceeds of the Profitco Loan to subscribe for non-voting redeemable cumulative retractable Preferred Shares of Newco (newly incorporated by Lossco).

- Newco will lend such subscription proceeds to Lossco on an interest-free demand basis (“Lossco Loan”). The terms of the Lossco Loan will allow Lossco to repay the Lossco Loan by assigning the Profitco Loan to Newco.

- Lossco will use such proceeds to repay the daylight loan.

- Lossco will annually make contributions of capital to Newco (funded out of an independent source of income) equaling the annual dividends to be paid on the Newco Preferred Shares.

On the unwinding transactions, Newco will redeem all its preferred shares by assigning the Profitco Loan to Profitco, and the Lossco Loan and Profitco Loan will be set-off.

Rulings

Including re ss. 20(1)(c), 12(1)(x), and 55(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) - Subparagraph 20(1)(c)(i) | intercompany subordinated loan to bear interest at the rate for a senior secured financing | 82 |

2016 Ruling 2016-0652041R3 - Loss consolidation arrangement

Proposed transactions

In order to effectively shift taxable income from Parentco to its wholly-owned subsidiary, Profitco:

- Parentco will use the proceeds of a daylight loan to make an interest-bearing loan (the “Profitco Loan”) to Profitco.

- Profitco will use such proceeds to subscribe for non-voting redeemable retractable cumulative preferred shares (the “Newco Preferred Shares”), carrying a positive spread, of a newly-incorporated CBCA subsidiary (“Newco”) of Parentco.

- Newco will use such proceeds to make a non-interest-bearing loan to Parentco (the “Parentco Loan”), with Parentco repaying its daylight loan.

- On the anniversaries of the above transactions, Parentco will fund the dividend obligations of Newco (which will be recorded as giving rise to contributed surplus for accounting purposes) with Profitco, in turn, servicing the Profitco Loan.

- At the earlier of X years from the implementation date and the utilization of Parentco’s non-capital losses, the loss consolidation structure will be unwound by Newco delivering the Parentco Loan to Profitco in redemption of its Newco Preferred Shares.

- The Parentco Loan and Profitco Loan are set off and Newco wound-up.

Rulings

Including re s. 20(1)(c), s. 246(1), s. 112(1) and the provincial GAAR. No s. 12(1)(c) or 9 ruling re the funding by Parentco of Newco’s dividend obligations. CRA also provided a s. 55(2) ruling based on a representation that the only purpose “of the dividends on Newco’s Preferred Shares … is to provide a reasonable return… .”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(b) | s. 55(2) ruling re dividends on preferred shares used in loss shift | 159 |

9 August 2016 Internal T.I. 2014-0526171I7 - Resettlement of a Trust

A non-resident common-law commercial trust had been settled with cash and Canadian real estate by two (apparently non-resident) corporations. A subsequent sale of their interests in the trust to a third-party resident purchaser (along with the shares of the corporate trustee) was found to have given rise to a resettlement of the trust, so that losses of the trust disappeared and, thus, were not available to shelter gain on the immediately ensuing sale of the real estate by the trust.

In this regard, the Directorate stated:

[T]he two original beneficiaries were not specifically prohibited from disposing of their capital and income interests in the Trust by selling it to someone else. However, in doing so the intention of the two original settlors is completely set aside. The intention of the settlors, as clearly spelled out in the Trust Deed, was to have the trustee hold and invest the capital of the trust for the benefit of two specific beneficiaries, the two original settlors themselves, and this is no longer the case. … [T]he transaction changed the whole substratum or “raison d’etre” of the Trust.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Disposition | sale of the two interests in a commercial trust to a 3rd party gave rise to a new trust given that this not contemplated when trust settled | 395 |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | sale of trust with losses to 3rd party was abusive | 162 |

2015 Ruling 2015-0582101R3 - loss utilization

Completed transactions

- Lossco (which incurred non-capital losses in a number of taxation years) borrowed (not in excess of its borrowing capacity) under a daylight loan.

- It used the proceeds to make the “IB Loan,” bearing quarterly interest, to its wholly-owned subsidiary, Profitco.

- Profitco used the proceeds to subscribe for non-voting redeemable retractable preferred shares, bearing a quarterly dividend of XX% higher than the interest rate on the IB Loan, of its wholly-owned subsidiary Newco.

- Newco used the proceeds to make a demand non-interest-bearing loan (the “NIB Loan”) to Lossco.

- Lossco repaid the daylight loan.

Proposed transactions

- Lossco will make capital contributions to Newco equal to the dividend payments to be made on the preferred shares, with such dividends being declared and paid by Newco.

- Profitco will pay the accrued interest on the same dates.

- Once Lossco’s non-capital losses are fully utilized and remaining dividends and interest are paid as described above,

- Newco will redeem the preferred shares by delivering the NIB Loan to Profitco.

- The IB Loan will be set-off against the NIB Loan.

Rulings

Including re s. 20(1)(c), s. 12(1)(x) and s. 55(3)(a).

Opinion

Re non-application of s. 55(2) to the dividends in 1 after giving effect to the July 31, 2015 draft legislation.

2015 Ruling 2015-0604071R3 - Loss Consolidation Arrangement

Background

Profitco is wholly-owned by Lossco, which is wholly owned by Parent. Based on Profitco's audited financial information, it would be in a position to borrow on a subordinated basis in an amount up to $XX (the "Profitco Borrowing Capacity").

Proposed transactions

- Profitco will advance the proceeds of a daylight borrowing to subscribe for non-voting cumulative redeemable retractable preferred shares of Lossco. Parent will agree, in a support agreement with Lossco, to make capital contributions to fund Lossco’s payment of the dividends thereon.

- Lossco will use the proceeds received in 1 to make an advance, evidenced by a promissory note (the “Investment Note”), which will bear interest reflecting the advance’s full subordination.

- Profitco will repay the daylight loan.

On the unwinding:

- Parent will make capital contributions to Lossco to allow Lossco to pay the accrued but unpaid dividends;

- Lossco will redeem the preferred shares by issuing a demand non-interest-bearing promissory note (the “Redemption Note”);

- Profitco will pay the accrued interest; and

- the Redemption Note and Investment Note will be paid by set-off.

Rulings

Including re s. 20(1)(c), s. 55(2), s. 80, GAAR for agreeing provinces and s. 245(2).

Opinion

After giving effect the July 31, 2015 draft amendments, s. 55(2) will not apply to the dividend in 4.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(b) | loss shifting transaction not affected | 89 |

19 August 2015 External T.I. 2015-0589611E5 - loss consolidation arrangements

In loss consolidation transactions: are they permitted to occur amongst related parties that are not affiliated? Does it matters whether or not the "lossco" has any source of funds to cover dividend payments other than the interest income paid by a "profitco". Does CRA requires a commitment letter issued by a third party to confirm that the proposed transactions are commercially plausible?

CRA responded:

S3-F6-C1… paragraph… 1.71… indicates that such loss consolidation arrangements could be undertaken by parties that are related but not affiliated (as well as parties that are both related and affiliated and parties that are affiliated but not related).

…[I]n upstream shareholding situations, the CRA will generally ask for a representation that the issuer of the shares will have other assets from which the dividends will be funded.

...[T]ypically the CRA will request a representation relating to borrowing capacity. In some cases, such as situations where the amount of the debt is substantial, CRA may request a signed letter from a director or other documentation.

2015 Ruling 2014-0559181R3 - Internal Reorganization

CRA provided s. 55(3)(a) and other rulings for spinning off various business divisions of an indirect subsidiary (Bco) of a public corporation to newly-incorporated sisters (Cco, Dco and Eco). Bco also was the "profitco" in a loss shifting transaction for which a 2012 ruling letter (2012-0437881R3) was received. Those transactions are described as already having been completed (i.e., their set-up but not their unwinding?) In confirming that the transactions described in the second ruling letter would not cause the 2012 rulings to cease to be binding, CRA stated:

Bco, through its XX, will generate sufficient income to absorb the interest expense resulting from the loss consolidation transactions… . Therefore, no modification is required to any of the loss consolidation transactions.

…[N]o new business activities will be created within the corporate group as only existing operations will be transferred into sister corporations… . Moreover, the Proposed Transactions will be made in a tax-deferred manner and will not have the effect of creating new tax obligations.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(3) - Paragraph 55(3)(a) | business division spin-offs by indirect public corp sub to new sisters | 365 |

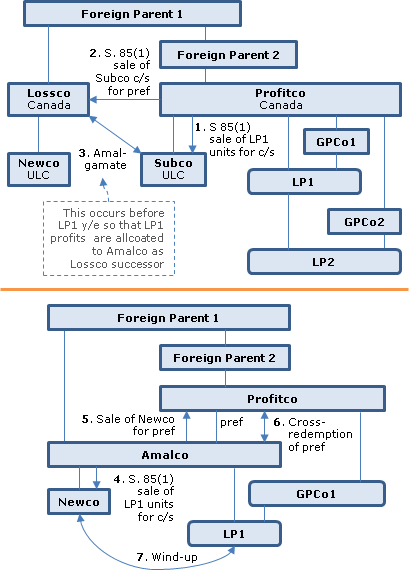

2014 Ruling 2013-0516071R3 - Reorganization

Background

Profitco is wholly-owned by Foreign Parent 2 which, in turn, is indirectly wholly-owned by Foreign Parent 1. Profitco is the limited partner of LP1 and its subsidiary is the GP. LP1 holds all the LP units of LP2, whose GP is another subsidiary of Profitco. Profitco will have positive QTI re LP1. Lossco is wholly-owned by Foreign Parent 1.

Transactions

- Prior to the ruling letter, Profitco transferred its LP1 units to a newly-incorporated unlimited liability company ("Subco") in consideration for Subco common shares, with a joint s. 85(1) election filed. The LP1 partnership agreement will be amended "to clarify that it allocates its income for income tax purposes only to those partners that are partners at the end of its fiscal period."

- Profitco will transfer all its shares of Subco to Lossco under s. 85(1) in consideration for non-voting redeemable retractable preferred shares of Lossco.

- Lossco and Subco will amalgamate, so that XX% of the income of LP1 for its current fiscal period will be allocated to "Amalco."

- After the LP1 year end, Amalco will transfer the LP1 units to a newly-incorporated ULC ("Newco") under s. 85(1) in consideration for common shares.

- Amalco will transfer its common shares of Newco to Profitco under s. 85(1) in consideration for non-voting redeemable retractable preferred shares of Profitco.

- Amalco and Profitco will cross-redeem the two preferred share holdings for notes and set-off the notes.

- Newco will be wound-up.

Rulings

The proposed transactions will not result in any disposition or increase in interest described in ss. 55(3)(a)(i) to (v). S. 34.2(14) will deem Profitco to be a member of LP1 continuously until the end of its XX taxation year for purposes of s. 34.2(13)(a). S. 245(2) will not apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 34.2 - Subsection 34.2(14) | transfer by Profitco of profitable LP to Lossco which is affiliated by virtue of common NR indirect parent | 100 |

| Tax Topics - Income Tax Act - Section 96 - Subsection 96(1) - Paragraph 96(1)(f) | transfer of profitable LP to Lossco followed by allocation of previously-earned profits of LP to Lossco | 95 |

2014 Ruling 2014-0543911R3 - loss consolidation

.

Proposed Transactions

Lossco, which is an indirect subsidiary of Parent and has permanent establishments in various provinces, will make a series of loans, on one or more days, to Parent (also with PEs in various provinces). Parent will use the total proceeds to subscribe for one or more series of redeemable retractable preferred shares of Lossco bearing a cumulative quarterly dividend at a small spread over the interest (payable quarterly) on the loans (with the resulting Lossco losses thereby effectively transferred to Parent in its xx taxation year being less than its income for that year). Prior to the end of that taxation year, Lossco will redeem the preferred shares by delivering the loans to Parent (pusuant to a term in the share terms contemplating such a payment in kind).

Rulings

Standard rulings re ss. 20(1)(c), 112(1), 15(1), 56(2), 246(1) and 245(2) (but no provincial GAAR ruling). The delivery of the loans to Parent will not give rise to a forgiven amount.

2015 Ruling 2014-0563151R3 - Loss consolidation

This is essentially identical to 2014-0518451R3 from a year earlier. Briefly, a lossco parent (Lossco) will not transfer losses to a profitco subsidiary (Opco) under typical triangular loss-shifting techniques, because Opco has public preference shareholders and does not wish to incur debt. Accordingly, Lossco will engage in such techniques to transfer losses to a newco subsidiary (Aco), and then transfer Aco to Opco to be wound-up under s. 88(1.1) (2013-0511991R3 and 2013-0496351R3 are similar). More realistically than 2013-0496351R3, the usual borrowing capacity rep is given in relation to the Lossco rather than Aco. The unwinding of the loss transfer transactions will occur on a cashless basis. The Additional Information states:

It is anticipated that the steps described in the Proposed Transactions will be undertaken at the beginning of each future taxation year of Lossco, with new entities to be created having the same attributes as ACo and Newco.

2013 Ruling 2013-0498551R3 - Loss Consolidation

Lossco, an indirect subsidiary of Parent, will make interest-bearing loans to Parent, and Parent will subscribe for redeemable retractable preferred shares of Lossco ("prefs"). On the unwinding, Lossco will redeem the prefs by delivering the loans which it made to Parent. Rulings include interest-deductibility by Parent, and delivery of the loans on the pref redemption not giving rise to a forgiven amount.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 80 - Subsection 80(1) - Forgiven Amount - Element B - Paragraph B(a) | no forgiven amount on loan transfer to debtor | 72 |

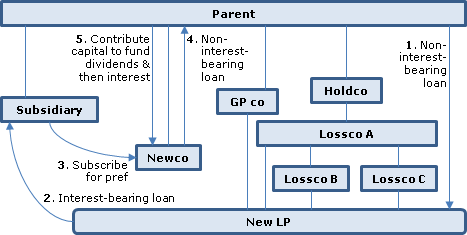

2014 Ruling 2014-0525441R3 - loss consolidation arrangement

Existing structure

Parent holds Subsidiary, which is profitable, directly, and holds Lossco A (which, in turn, holds Lossco B and Lossco C) through Holdco. In a preliminary transaction, the "New LP Partners," (Lossco A, B and C) will become the limited partners of a new LP ("New LP"), with a newly-incorporated subsidiary of Parent ("GP Co") as the general partner.

Proposed transactions

- Parent will make non-interest-bearing demand loans (the "Parent Loans") to New LP.

- New LP will on-lend these funds at interest to Subsidiary under the "Subsidiary Loans."

- Subsidiary will use such proceeds to subscribe for non-voting redeemable "Preferred Shares" of a newly-incorporated subsidiary of Parent ("Newco").

- Newco will use those proceeds to make non-interest-bearing demand loans (the "Newco Loans") to Parent.

- On each monthly interest payment date, Parent will make a contribution of capital to Newco to fund the Newco Preferred Share dividends, and Subsidiary will pay to New LP the interest then due on the Subsidiary Loans.

- Upon generation of interest sufficient to utilize the non-capital losses of Subsidiary (which is anticipated to occur "on or before the month end in which the Proposed Transactions are initiated,") the transactions will be unwound through: Newco redeeming the Preferred Shares by delivering the Newco Loans to Subsidiary; Subsidiary repaying the Subsidiary Loans by delivering the Newco Loans to New LP; and New LP repaying the Parent Loans by set-off against the Newco Loans.

- New LP, Newco and GP Co will be wound-up (with no capital loss being claimed by Parent respecting its investment in Newco).

Newco and the Losscos will satisfy the applicable corporate solvency tests.

Rulings

: Including interest deductibility to Subsidiary, timing of Ne LP income allocation to Losscos and non-application of ss. 9 and 12(1)(c) to capital contributions received by Newco. SS. 56(2), 15(1), 69(11), 246(1) and 245(2) are not applicable. Provincial GAAR ruling.

2 December 2014 CTF Roundtable, Q2(a)

In a loss consolidation arrangement, "Lossco," which has non-capital losses, lends money to Profitco at a reasonable stated rate of interest and Profitco in turn uses the inter-corporate debt to acquire preferred shares of Lossco. Does the CRA require a positive spread between the dividend yield on the preferred shares acquired with inter-corporate debt and the interest rate on that debt, and must the dividend payor have an independent source of income to pay the dividends? CRA stated:

[I]t is the CRA's policy not to provide rulings without a positive spread between the interest paid and the dividends earned. …[I]n circumstances of upstream shareholding in which a subsidiary acquired dividend paying preferred shares of the parent…[o]ur views… expressed in Income Tax Technical News No. 30…[are], "The key criteria to be met in such situations is the existence of other assets in the parent company that can generate sufficient income to pay the dividends on the preferred shares held by the subsidiary."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) | positive spread/independent servicing source in loss consolidations | 171 |

2 December 2014 CTF Roundtable, Q2(b)

Must corporations be affiliated or related or both in a loss consolidation arrangement? CRA responded:

The CRA will consider ruling requests where the corporations are related and affiliated, as well as circumstances in which the corporations are related.

…[W]here the corporations are affiliated but not related…the meaning of affiliated will be determined on the same criteria as stipulated in subsection 69(11)… . In other words, where two corporations are not related, but are affiliated, the CRA would consider a loss consolidation arrangement only if the corporations are affiliated by reason of de jure control.

2 December 2014 CTF Roundtable, Q2(c)

Does the decision in the 2013 Federal Budget not to proceed with a corporate group taxation system impact rulings for loss consolidation arrangements? CRA responded:

The 2013 Federal Budget announcement has not had an impact… .It should be noted, however, that where we consider that one of the main reasons for engaging in a loss consolidation arrangement is for the purposes of shifting income among provinces, the CRA may challenge that loss consolidation under provincial GAAR legislation.

2014 Ruling 2014-0518451R3 - Loss consolidation

Overview

Loan 2 (in step 3 below) is being made by Lossco (the wholly-owned loss subsidiary of Parent) to Aco (so as to generate losses in Aco for later transfer under s. 88(1.1) to Opco), instead of being made directly to Opco, "to ensure that Opco, which is a public corporation, does not incur debt in order to implement the loss utilization." Furthermore, "any shift of income between provinces will be incidental to the Proposed Transactions."

Proposed transactions

- Parent will borrow the Parent Loan.

- Parent will use the proceeds to make Loan 1 to Lossco. "Lossco will have the borrowing capacity to obtain a daylight loan, in an amount equal to the amount of Loan 1, directly from an arm's-length financial institution."

- Lossco will use the total proceeds received under Loan 1 to make Loan 2 (bearing interest) to ACo.

- ACo will use such proceeds to subscribe for Newco Preferred Shares. (Although these shares will be term preferred shares, they not be acquired by ACo "in the ordinary course of ACo's business.")

- Newco will use such proceeds to make Loan 3 (not bearing interest) to Lossco.

- Lossco will repay Loan 1.

- Parent will repay the Parent Loan.

- Lossco will make periodic contributions of capital to Newco to fund accruing dividends on the Newco Preferred Shares, with Aco in turn servicing Loan 2 interest. The contributions will be recorded as contributed surplus under IFRS.

- After generation of the requisite losses in Aco, Newco will redeem the Newco Preferred Shares of ACo in consideration for the Newco Note.

- ACo will repay Loan 2 by assigning the Newco Note to Lossco - and Lossco and Newco will agree to setoff the amount due under Loan 3 against the amount due under the Newco Note.

- Lossco will transfer all of its ACo Common Shares to Opco in exchange for additional common shares of Opco under s. 85(1).

- In the same taxation year, the winding-up of Aco will be commenced, and "ACo will file articles of dissolution with the appropriate Corporate Registry within a reasonable time after the winding-up resolution is passed."

Rulings

: Including interest deductibility to ACo on Loan 2 and non-application of ss. 9 and 12(1)(c) to capital contributions received by Newco. Ss. 56(2), 15(1), 246(1) and 245(2) are not applicable. Provincial GAAR ruling. Dividends received by Aco on its Newco Preferred Shares (which are term preferred shares) will be deductible under s. 112(1).

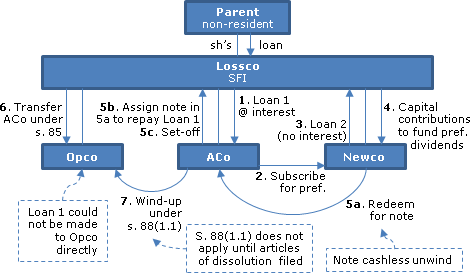

2014 Ruling 2013-0511991R3 - Loss consolidation

Structure

Lossco, which is a specified financial institution with non-capital losses, is a subsidiary of non-resident parent, and serves as the holding company for Opco.

Proposed transactions

- Lossco will use the proceeds of a daylight loan to make Loan 1 to a newly-incorporated special-purpose subsidiary (ACo). Loan 1 will be interest-bearing and its amount "will not exceed the amount that ACo could reasonably be expected to borrow from an arm's-length financial institution."

- ACo will use the total proceeds received from Loan 1 to subscribe for non-voting redeemable retractable preferred shares (the Newco Preferred Shares) of Newco, which is a newly-incorporated subsidiary of Lossco.

- Newco will use such proceeds to make a non-interest-bearing loan to lossco (Loan 2), with Lossco repaying its daylight loan.

- Lossco will annually make contributions of capital to Newco in order that it can pay the accrued dividends on the Newco Preferred Shares which, in turn, will fund th epayment of the accrued interest on Loan 1.

- The unwinding of the transactions will be accomplished by: Newco redeeming the Newco Preferred Shares held by ACo in consideration for a non-interest bearing promissory note (the "Newco Note"); ACo will repaying Loan 1 by assigning the Newco Note to Lossco; and Loan 2 and the Newco Note being set-off.

- Lossco will transfer all its ACo shares to Opco in exchange for Opco common shares, electing under s. 85(1), and Aco will be wound-up into Opco, with articles of dissolution being filed "within a reasonable time after the winding-up resolution is passed."

Reason for Aco

"Due to regulatory constraints and the potential liability issues that may arise with respect to the operations of Opco, it is not feasible from a business perspective to have Lossco make Loan 1 directly to Opco. Instead, Loan 1 is being made to ACo to ensure that Opco does not incur debt in the course of executing the loss consolidation."

Rulings

: Including interest deductibility to Profitco on Profitco Note and non-application of ss. 9 and 12(1)(c) to capital contributions received by Newco. SS. 56(2), 15(1), 246(1) and 245(2) are not applicable. Provincial GAAR ruling.

S. "88(1.1) will apply after the winding up of ACo into Opco….[and] [f]or this purpose, ACo will not be considered to have been wound up until it has been formally dissolved."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(1.1) | s. 88(1.1) loss transfer not effective until articles of dissolution | 134 |

13 June 2014 External T.I. 2014-0522251E5 - Independent source of income for loss utilization

Lossco, which is developing a commercial use building, lends money to Profitco (a related corporation) at interest and Profitco uses the proceeds to invest in preferred shares of Lossco. Lossco does not yet have an independent source of income. How does the CRA policy that the loss corporation have an independent source of income apply? CRA stated:

Income Tax Technical News No. 30 (May 21, 2004) makes the following comment regarding the CRA's views on typical loss utilization structures:

- "While we have not reached the point where we would state that C.R.B. Logging is no longer good law, we have provided rulings on some upstream shareholding situations. The key criteria to be met in such situations is the existence of other assets in the parent company that can generate sufficient income to pay the dividends on the preferred shares held by the subsidiary".

Whether there are assets in the parent company that can generate sufficient income to pay the dividends on preferred shares held by the subsidiary is a question of fact.

2013 Ruling 2013-0512321R3 - Loss Consolidation

Conventional loss shift between two sister corporations (Lossco and Profitco) utilizing preferred shares and interest-bearing loan.

2013 Ruling 2013-0504301R3 - Loss Consolidation

Background

Lossco, which is a Canadian public corporation with a portion of its shares held by Parentco, wishes to transfer losses to Profitco, which is a wholly-owned subsidiary of Cco which in turn, is a wholly-owned subsidiary of Bco, which is a Canadian public corporation whose shares are widely held but which is controlled by Lossco. This will be accomplished by Lossco selling cumulative preferrred shares of a newly-incorporated subsidiary to Profitco in consideration for an interest-bearing note of Profitco. The borrowing capacity of Bco, and of Lossco and its subsidiaries, significantly exceeds the maximum amount required to complete the transactions. losses being transferred to Profitco on a s. 88(1.1) winding-up.

Proposed transactions

- Lossco will borrow under a daylight loan from an arm's length financial institution or a related entity.

- Lossco will use such proceeds to subscribe for non-voting cumulative redeemable retractable preferred shares (the "Newco Preferred Shares") of a newly-incorporated subsidiary ("Newco").

- Lossco will transfer the Newco Preferred Shares to Profitco in consideration for an interest-bearing debenture (the "Profitco Note"), recourse under which will be limited to the Newco Preferred Shares and which will have a security interest in the Newco Preferred Shares.

- Newco will use the proceeds in 2 to make a non-interest-bearing loan to Lossco under the "Lossco Note."

- Lossco will repay the daylight loan.

- At least quarterly, Lossco will make a contribution of capital to Newco to fund the payment by it of accrued dividends on the Newco Preferred Shares held by Lossco, with Profitco then paying all accrued and unpaid interest on the Profitco Note.

- In connection with the unwinding, Newco will redeem the Newco Preferred Shares and deliver the Lossco Note to Profitco as payment of the redemption proceeds, with the Lossco Note and the Profitco Note then set-off.

- Newco will be wound-up into Lossco pursuant to s. 88(1).

Rulings

Including interest deductibility to Profitco on Profitco Note and non-application of ss. 9 and 12(1)(c) to capital contributions received by Newco. SS. 56(2), 15(1),246(1) and 245(2) are not applicable.

The general anti-avoidance provision of a province with which the Government of Canada has entered into a tax collection agreement will not be applied, as a result of the Proposed Transactions, in and by themselves, to determine the tax consequences confirmed in the rulings given above, in respect of a taxation year in respect of which such a tax collection agreement is in effect.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | provincial GAAR ruling re loss shift | 126 |

2014 Ruling 2013-0483491R3 - Loss Consolidation Arrangement

Existing structure/debt indenture

Parentoco, a widely-held non-resident corporation, holds Forco, a non-resident holding company, which holds Holdco 1, which holds Holdco 2, which holds Opco, the latter three subsidiaries being taxable Canadian corporations. In the transactions below, Opco is a limited partner of New LP to limit the potential claims and recourses of creditors of New LP (including Holdco 1) against assets of Opco, so as to comply with the provisions of a Debt Indenture.

Proposed transactions

.

- Holdco 1 borrows on a daylight basis from the Financial Institution.

- Holdco 1 makes the "New LP Loan" to a partnership (New LP) formed by a newly-incorporated subsidiary of Opco, as general partner (Newco 2), and Opco as limited partner. Holdco 1's recourse is limited to the Newco 1 Preferred Shares described in 3 below. "The borrowing capacity of Holdco 2 and its subsidiaries ("Holdco 2 Subsidiary Group Borrowing Capacity") is equal to or exceeds the principal amount of the New LP Loan."

- New LP subscribes for cumulative preferred shares of a newly-incorporated subsidiary of Holdco 1 (Newco 1). The dividends payable on the Newco 1 Preferred Shares will exceed the aggregate of the interest accrued on the New LP Loan and nominal incidental expenses of New LP.

- Newco 1 makes a non-interest-bearing demand loan to Holdco 1 (the "Newco 1 Loan").

- Holdco 1 repays its daylight loan.

- At least annually, Opco and Newco 2 will make pro rata cash capital contributions to New LP to fund interest on the New LP Loan;

- New LP will pay the interest on the New LP Loan.

- Holdco 1 will make contributions of capital to Newco 1 to fund dividends payable on the Newco 1 Preferred Shares held by New LP.

- On unwinding the loss consolidation arrangement, (a) Newco 1 will redeem the Newco 1 Preferred Shares by assigning its Newco 1 Loan receivable to New LP, (b) New LP will repay the New LP Loan by set-off with the Newco 1 Loan, (c) Newco 1 will be wound-up into or amalgamated with Holdco 1; and (d) Newco 2 will be wound-up into or amalgamated with Opco, with the result that New LP will cease to exist.

Rulings

Including re s. 20(1)(c) deductions of New LP, utilization of streamed and non-streamed losses by Losscos and non-application of s. 12(1)(x) re contributions of capital to Newco 1.

2013 Ruling 2012-0458091R3 - XXXXXXXXXX - loss consolidation

Proposed transactions

- Parent borrows on a daylight basis from the Financial Institution.

- Parent makes a daylight loan to a partnership (New LP) formed by the Profitcos (Parent and two wholly-owned subsidiaries – Aco and CCo, with another wholly-owned subsidiary, BCo as the GP).

- New LP subscribes for cumulative preferred shares of the Losscos (DCo, a wholly-owned subsidiary of Parent to and Eco to KCo, wholly-owned subsidiaries of DCo).

- Each Lossco makes a loan to New LP at a commercial rate of interest resulting in New LP earning dividend income somewhat in excess of its interest expense.

- New LP repays its daylight loan.

- Parent repays its daylight loan.

- If a Lossco does not have sufficient cash available to pay dividends on its Preferred Shares, DCo will provide to the Lossco, by way of an interest-free loan (the "PS Dividend Loan"), the amount required for the Lossco to pay the full amount of the dividends on the Preferred Shares.

- New LP will use the proceeds from the Preferred Share dividends to pay the interest on the New LP Loans.

- Each Lossco will repay any PS Dividend Loan out of its interest income. If any balance remains, DCo will, at its discretion, make a contribution of capital to the particular Lossco.

- Once the (post-acquisition of control) non-capital losses of the Losscos have been fully utilized, the transactions will be unwound.

Rulings

Including re s. 20(1)(c) deductions of New LP, utilization of streamed and non-streamed losses by Losscos and non-application of s. 12(1)(x) re DCo contributions of capital.

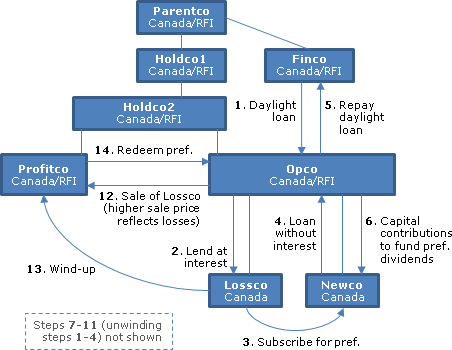

2013 Ruling 2013-0496351R3 - Loss Consolidation

Background

Opco, which has non-capital losses and is a great-grandchild RFI subsidiary of Parentco (also an RFI) and an immediate subsidiary of its RFI parent (Holdco 2), wishes to transfer its non-capital losses to Profitco, another RFI subsidiary of Holdco 2, on a basis that will permit it to be compensated for those losses. A further difference from typical loss-shifting transactions is that in order to not impact its regulatory capital, Profitco does not wish to borrow from Opco. Accordingly, Opco will effectively transfer its losses to a newco (a.k.a. Lossco) and then sell Lossco to Profitco, with the newly-generated Lossco losses being transferred to Profitco on a s. 88(1.1) winding-up.

Proposed transactions

- Opco will borrow under a daylight loan from Finco, a taxable Canadian corporation of which Parentco and XX are members.

- Opco will use such proceeds to make an interest-bearing loan to its newly-incorporated subsidiary, Lossco (Lossco Loan).

- Lossco will use such proceeds to subscribe for redeemable retractable preferred shares of another newly-incorporated subsidiary of Opco (Newco).

- Newco will use such proceeds to make a non-interest-bearing loan (the Interest-free Loan) to Opco.

- Opco will repay the daylight loan.

- At least annually, Opco will make a contribution of capital to Newco to fund the payment by it of accrued dividends on the Newco Preferred Shares held by Lossco, with Lossco then paying all accrued and unpaid interest on the Lossco Loan to Opco.

- In connection with the unwinding, Opco will borrow on a daylight basis from Finco in the amount of the Interest-free Loan, then;

- Opco will repay the Interest-free Loan to Newco, then;

- Newco will redeem its preferred shares issued in 3 above; then

- Lossco will repay the Lossco Loan to Opco; then

- Opco will repay the new daylight loan.

- Opco will transfer all of its Lossco common shares to Profitco in exchange for preferred shares of Profitco with a fair market value and redemption amount equal to the FMV of the transferred Lossco common shares, utilizing s. 85(1).

- Lossco will be wound up into Profitco.

- Profitco will redeem the preferred shares issued in 12 above.

- In a subsequent year, the above transactions will be repeated to use the remaining balance of the Opco non-capital losses.

Reasons for not using a direct loss shift

: "[A] typical loss consolidation arrangement could not be implemented directly with Profitco because the typical loss transfer arrangement does not provide compensation for the transfer of the [Opco non-capital losses]. Moreover, Profitco would need to advise the [financial] Regulator in order to borrow an amount equal to the Daylight Loan and the repayment thereof would require regulatory approval. In addition, such borrowing could impact significantly the regulatory capital that Profitco must maintain in order to satisfy its regulatory and statutory requirements."

Rulings

Including interest deductibility to LosscoA Co on Loan 2 and non-application of ss. 9 and 12(1)(c) to capital contributions received by Newco. SS. 56(2), 15(1),246(1) and 245(2) are not applicable. No explicit s. 55(3)(a) ruling.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(1.1) | Subco "has been wound up" when it is dissolved | 115 |

2013 Ruling 2012-0472291R3 - Loss consolidation

Background

Lossco, which has non-capital losses and is a holding company subsidiary of Parent, holds all the common shares of Opco, which is a public corporation with various classes of non-voting shares which are widely held and traded.

Proposed transactions

In order to permit Opco to use losses which Lossco is expected to incur:

- Parent will borrow under a daylight loan (Parent Loan).

- Parent will use such proceeds to make a non-interest-bearing loan to Lossco (Loan 1).

- Lossco will use such proceeds to make an interest-bearing loan (Loan 2) to a newly-incorporated subsidiary of Lossco (A Co).

- A Co will use such proceeds to subscribe for redeemable retractable preferred shares (Newco Preferred Shares) of another newly-incorporated subsidiary of Lossco (Newco).

- Newco will use such proceeds to make a non-interest-bearing loan (Loan 3) to Lossco.

- Lossco will repay Loan 1.

- Parent will repay the Parent Loan.

- At a subsequent juncture, Lossco will make a contribution of capital to Newco to fund the payment by it of accrued dividends on the Newco Preferred Shares held by A Co., with A Co then paying all accrued and unpaid interest on Loan 2 to Lossco.

- Immediately following the interest payment in 8, and in connection with the unwinding of the loss consolidation arrangement Newco will redeem the Newco Preferred Shares held by A Co in consideration for its issuance of a non-interest bearing promissory note (the "Newco Note"), then;

- A Co will repay Loan 2 by assigning the Newco Note to Lossco, then;

- Loan 3 and the Newco Note will be repaid by mutual set-off.

- Lossco will transfer all of its A Co Common Shares to Opco in exchange for the "Opco Common Shares," utilizing s. 85(1).

- A Co will be wound up into Opco and Newco wound up into Lossco.

Additional information

"Loan 2 is being made to A Co, instead of having Lossco make Loan 2 directly to Opco, to ensure that Opco, which is a public corporation, does not incur debt in order to implement the loss utilization." No rep that A Co has stand-alone borrowing capacity.

Rulings

Including interest deductibility to A Co on Loan 2 and non-application of ss. 9 and 12(1)(c) to capital contributions received by Newco. Opinion that provided draft s. 55(3.01)(h) is enacted, s. 55(2) will not apply to the dividends that ACo will receive from Newco by virtue of s. 55(3)(a).

18 December 2012 Internal T.I. 2012-0461651I7 - Foreign Tax Credits - s. 126 vs. s. 110.5

Canco realized deductible losses on FX hedging instruments due to the strengthening of the U.S. dollar. Accordingly, it engaged in the transactions summarized below ("Project Shift") to shift taxable income from profitable subsidiaries to itself. The intended effect was to allow Canco to claim foreign tax credits, and generate losses in the subsidiaries for carry-back to prior years. However, the hedging losses turned out to be greater than the income which was transferred to it under Project Shift, so that Canco had to make a s. 110.5 election to generate enough taxable income to claim the requisite level of foreign tax credits. Under Project Shift:

- Canco made a demand interest-bearing loan to each of the subsidiaries (without requiring a daylight loan).

- Each of the subsidiaries (which were Canadian) used the borrowed funds to invest in preferred and common shares of new wholly-owned subsidiaries (Newcos).

- Each of the Newcos then lent the proceeds to Canco on a demand, non-interest bearing basis.

- After the income from the subsidiaries were transferred (via interest payments), the structure was unwound.

In noting that Project Shift accorded with CRA's position on acceptable loss consolidation strategies (which it also described in general terms), the Directorate stated: