Subsection 256(1) - Associated corporations

Paragraph 256(1)(a)

Cases

The Queen v. W. Ralston & Co., 96 DTC 6488, [1996] 3 CTC 346 (FCTD)

100 voting common shares of the taxpayer were held by members of the Cohen family, and the 100 voting preferred shares of the taxpayer were held as to 50 shares by the son of the Cohen's solicitor as to the other 50 preferred shares, by the solicitor's secretary. The taxpayer was not controlled by the Cohens, with the result that it was not associated with various corporations that were controlled by the Cohens.

Harvard International Resources Ltd. v. Provincial Treasurer of Alberta, 93 DTC 5254, [1993] 1 CTC 329 (Alta. Q.B.)

The taxpayer held an undivided 99.328% interest in the 100 outstanding common shares of a corporation ("Holdings") and another corporation ("Energy") held all the other outstanding shares including 150 voting preferred shares. In response to a submission of the provincial Crown that the taxpayer was associated with Holdings for purposes of s. 26.1 of the Alberta Corporate Tax Act (which applied the test in s. 256(1) of the federal Act as it then read) on the basis that under the terms of a shareholders agreement the taxpayer effectively had the right to cause Holdings to redeem the shares held by Energy upon the termination by the taxpayer of an agreement for the provision by Energy of certain management services to a partnership, Hutchinson J. found that such rights of the taxpayer were "not to be found within the confines of Holdings' charter and by-laws where the real test of de jure control must be found" (p. 5265). Accordingly, Holdings was controlled by Energy and not by the taxpayer.

The Queen v. Imperial General Properties Ltd., 85 DTC 5500, [1985] 2 CTC 299, [1985] 2 S.C.R. 288

The Wingold group held 90 common shares of the taxpayer and the Gasner group held 10 common shares and 80 voting cumulative preference shares with a nominal par value and the entitlement, upon the winding-up of the taxpayer, to receive that par value plus any accumulated but unpaid dividends. Since the corporate charter also provided that the taxpayer would be wound up upon a resolution for that purpose supported by 50% of the voting rights in the company, and the Wingold group thus had "the right to terminate the corporate existence should the presence of the minority common and preference shareholders become undesirable", the Wingold group controlled the taxpayer.

Allied Farm Equipment Ltd. v. MNR, 73 DTC 5036, [1972] CTC 619 (FCA)

Given that s. 39(4) of the pre-1972 Act applied only for the purposes of s. 39, which provided a reduced rate of tax for certain Canadian corporations, s. 39(4) did not make each of two Canadian-resident corporations associated with a U.S.-resident corporation, with the result that the two Canadian-resident corporations were not deemed by virtue of s. 39(5) to be associated with each other.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1) - Paragraph 256(1)(d) | 129 |

Donald Applicators Ltd. v. MNR, 69 DTC 5122, [1969] CTC 98 (Ex Ct), briefly aff'd 71 DTC 5202, [1971] CTC 402 (SCC)

498 Class B shares in the capital of each of ten companies was held by a corporation ("Saje") and 2 Class A shares were held in each corporation by two unrelated persons who, in each case, were Bahamian lawyers who did not hold shares in any of the other nine companies. The Class B shares carried the right to vote on all questions except the election of directors (who were the relevant Bahamian lawyers) and the Class A shares had full voting rights, including the exclusive right to vote on the election of directors. The net yearly profits of the company were required to be distributed each year in cash, and no shares could be issued by the directors without the unanimous consent of the existing shareholders.

All ten companies were controlled by Saje for purposes of s. 39(4)(a) of the pre-1972 Act in light of the fact that the Class B shareholders had the voting power to change the articles of each company, and thereby had the ultimate power to change the directors. Although in a situation where "the directors had been shorn of authority to make decisions binding upon the company and such decisions had been reserved for the shareholders in general meeting", the ordinary rule, that control resides in the voting power to elect directors, might not apply, here, the dividend and share-issuance restrictions did not constitute a substantial restriction on the powers of the directors.

Minister of National Revenue v. Dworkin Furs (Pembroke) Ltd. et al., 67 DTC 5035, [1967] CTC 50, [1967] S.C.R. 223

Dworkin Furs Ltd. owned 48% of the issued shares of Dworkin Furs (Pembroke) Limited in its own name and 2% in the names of Roy Saipe and Helen Saipe as its nominees, with the other 50% being owned by Sadie Harris. In light of the test of de jure control enunciated in the Buckerfield's case (64 DTC 5301 at 5303), in these circumstances Dworkin Furs (Pembroke) Limited was not controlled by Dworkin Furs Ltd. for purposes of s. 39(4)(a) of the pre-1972 Act.

See Also

Kruger Wayagamack Inc. v. The Queen, 2015 DTC 1112 [at at 667], 2015 TCC 90, aff'd 2016 FCA 192

The taxpayer was capitalized, and its common shares then were held, on a 51-49 basis, by a business corporation ("Kruger") and a Government of Quebec corporation ("SGF") in order to acquire, modernize, and operate a sawmill business. Under a unanimous shareholder agreement ("USA"), Kruger was entitled to elect three of the five directors. The taxpayer was not entitled to refundable investment tax credits if it was associated with Kruger by virtue of s. 256(1)(a).

Jorré J ultimately found that s. 256(1.2)(c) applied so that Kruger was deemed to control the taxpayer for purposes of s. 256(1)(a). However, before so concluding, he found that, under the USA, Kruger had "operational," but not "strategic," control of the taxpayer so that it thus lacked de jure control. The USA required unanimous approval by the board (with at least one of SGF's directors included) or of the shareholders for a wide range of matters – including of the capital and operating budgets and changes thereto, business plans or departures therefrom, the hiring or dismissal of various officers or payment of bonuses, any significant financing or security interest grant, and any entering into or changes in various significant contracts. (On the other hand, decisions on various operations matters could be made by majority decision.)

Kruger's inability to make strategic decisions meant that it did not have a "dominant influence in the direction of the appellant," as per Langlois (paras. 65-66).

In considering whether Kruger had de facto control, reference also could be made to non-USA agreements, namely, for the provision by Kruger of management services, and the marketing by it of the taxpayer's products, including the sale of wood pulp to Kruger itself, as well as to Kruger's specialized industry knowledge. However, these were not enough to establish de facto control, given significant built-in restrictions in those agreements and given the significant role of SGF.

See summary under s.256(1.2)(c).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Fair Market Value - Shares | non-assignable put right ignored | 98 |

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(2) - Paragraph 251(2)(b) - Subparagraph 251(2)(b)(i) | de jure control requires strategic control, not merely operational control | 93 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1.2) - Paragraph 256(1.2)(c) | effect of s. 256(1.2)(g) is as if company were run by 3rd party | 254 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(5.1) | de facto control requires strategic control, not merely operational control | 216 |

Administrative Policy

1 February 1999 External T.I. 9823715 - PERSONAL SERVICES BUSINESS

It is generally the Department's view that a foreign corporation is a 'person' for purposes of the Act unless the context clearly indicates otherwise." Accordingly, for purposes of applying the personal services business rules, a Canadian corporation was found to be associated with a U.S. corporation that it controlled.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 125 - Subsection 125(7) - Personal Services Business | 52 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Person | 52 |

23 June 1995 External T.I. 9510475 - ASSOCIATED CORPORATIONS

Where a corporation ("Supplyco") owns 50% of the shares of another corporation ("Distributorco") which is a franchisee of Supplyco, Supplyco will be considered to control Distributorco where Distributorco is economically dependent on Supplyco as a single supplier.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(5.1) | 137 |

1993 APFF Roundtable, Q.1

Where a wholly-owned subsidiary ("Holdco II") of Holdco I is the sole general partner of three limited partnerships which, in turn, each hold 1/3 of the shares of Opco, Opco will be considered to be controlled by Holdco II (and therefore associated with Holdco I) - even though the general partner interest of Holdco II is not sufficient to deem a sufficient number of Opco shares to be owned by Holdco II so as to give rise to control by Holdco II - given that Holdco II appears to have de jure control of Opco. General partners are the sole persons authorized to administer a limited partnership, and it is assumed that Holdco II is able to vote for the members of Opco's board of directors.

IT-64R3 "Corporations

Paragraph 256(1)(b)

Cases

Southside Car Market Ltd. v. The Queen, 82 DTC 6179, [1982] CTC 214 (FCTD)

"[S]ince the language of paragraph 256(1)(b) sets forth two distinct circumstances when two corporations are associated, namely, when controlled by (1) the same person and (2) by the same group of persons, the two sets of circumstances are mutually exclusive." In other words, the mention of a "person" and a "group of persons" impliedly excludes a combination of the two. Accordingly, S.256(1)(b) does not cover the situation where Corporation A is controlled by an individual and Corporation B is controlled only by a group of which the individual is a member.

The Queen v. Mars Finance Inc., 80 DTC 6207, [1980] CTC 216 (FCTD)

It was stated, obiter, that where the Court has to decide whether two corporations are associated by reason of being controlled by the same persons or same group of persons, who might be complete strangers and not persons all related by blood, it is de facto control that must be considered, i.e., whether control of the two corporations is in fact exercised by the same group.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1) - Paragraph 256(1)(e) | 40 |

H.A. Fawcett & Son, Ltd. v. The Queen, 80 DTC 6195, [1980] CTC 293 (FCA)

A legatee of a control bloc of shares who was also the sole executor of the estate obtained control of the company immediately upon the death of the testator, notwithstanding that the will was not probated until after the end of the company's taxation year, because title to the shares vested in him immediately upon the death by force of the will, and his right to vote the shares was not dependent upon those shares being registered. It was irrelevant that notice requirements precluded him from being able to compel a shareholders' meeting to be held before the end of the taxation year. The company accordingly was associated with other companies that were controlled by him.

International Iron & Metal Co. Ltd. v. Minister of National Revenue, 72 DTC 6205, [1972] CTC 242, [1974] S.C.R. 898, aff'g 69 DTC 5445, [1969] CTC 668 (Ex Ct)

A corporation ("Burland") was owned by nine children of four fathers. The taxpayer ("International Iron") would have been indirectly controlled by the same children through their respective four holding companies but for the possible effect of an agreement among the four holding companies and the four fathers which provided that so long as the fathers were alive, they would be designated and elected as directors of the four holding companies, and the affirmative vote of a majority of those directors would be required for the effecting or validating of any acts of the four holding companies. In the Exchequer Court, Gibson J., in finding that International Iron and Burland were controlled by the same group of persons for purposes of s. 39(4) of the pre-1972 Act, stated (p. 5448):

"The fact that a shareholder in such a corporation may be bound under contract to vote in a particular way regarding the election of Directors (as in this case), is irrelevant to the said meaning of 'control' because the corporation has nothing to do with such a restriction."

In affirming this finding, Hall J. in the Supreme Court stated (p. 6207):

"The meaning of 'control' in s. 39(4)(b) ... means the right of control that is vested in the owners of such a number of shares in a corporation so as to give them the majority of the voting power in the corporation."

Minister of National Revenue v. Consolidated Holding Co., 72 DTC 6007, [1972] CTC 18, [1974] S.C.R. 419

Two individuals (Harold Gavin and Robert Gavin) each owned 50% of the shares of one corporation ("Consolidated") which in turn owned 43.7% of the voting shares of a second corporation ("Martin"). 45.9% of the voting shares of Martin were held by an estate of which the three executors were Harold, Robert and the Montreal Trust Company. Under the terms of the will of the deceased, the shares of Martin could be voted by a majority of the executors. Judson J. stated (p. 6008):

"Here, if one looks at the facts as a whole, one finds that the two Gavins, by combining, controlled the vote of the estate shares. They already controlled the voting of 'Consolidated'. In this case, therefore, both corporations are controlled by the same group of persons, namely, the two Gavins."

Consolidated and Martin accordingly were held to be associated by virtue of s. 39(4)(b) of the pre-1972 Act.

Vina-Rug (Canada) Limited v. Minister of National Revenue, 68 DTC 5021, [1968] CTC 1, [1968] S.C.R. 193

Because John Stradwick, Jr., his brother W.L. Stradwick and H.D. McGilvery, who collectively owned more than 50% of the shares of Stradwick's and Vina-Rug, had at all material times a sufficient interconnection as to be in a position to exercise control over the two corporations, and therefore constituted a 'group of persons' within the meaning of s. 39(4) of the pre-1972 Act, the two corporations were associated. It was irrelevant whether other combinations of majority shareholders could be found.

Vineland Quarries and Crushed Stone Ltd. v. MNR, 66 DTC 5092, [1966] CTC 69 (Ex Ct), briefly aff'd 67 DTC 5283 (SCC)

In finding that under the above arrangement, Vineland and S. & T. "were controlled by the same ... group of persons" (i.e., Saunder and Thornborrow) for purposes of s. 39(4)(b) of the pre-1972 Act, Cattanach J. stated (p. 5098):

"In my view the word 'controlled' in section 39(4)(b) contemplates and includes such a relationship as, in fact, brings about a control by virtue of majority voting power, no matter how that result is effected, that is, either directly or indirectly."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Ownership | 52 |

Yardley Plastics of Canada Ltd. v. MNR, 66 DTC 5183, [1966] CTC 215 (Ex Ct)

Two corporations whose voting shares were held as follows

| Shareholder | Canadian Moldings | Yardley Plastics |

| Hill | 4.6% | 28% |

| Hill III | 18.6% | 22.5% |

| Wycoff | 21.7% | 11% |

| Daymond | 21.7% | 14% |

| Strachan | 21.7% | nil |

| Ebner | nil | 17% |

| Jacobson | 11.7% | 7.5% |

| 100% | 100% |

were found to be controlled by the same group of persons, namely, Hill, his son, Hill III, and three unrelated individuals, namely, Wycoff, Daymond and Jacobson, following the assumption to this effect by the Minister. Although Noël J. rejected a submission of the Minister "that the latter is allowed to choose out of several possible groups any aggregation holding more than 50% of the voting power ... and that such a group then becomes irrebuttably deemed to be the controlling group for purposes of section 39(4) of the [pre-1972] Act as this could lead to an absurd situation where no two large corporations in this country would be safe from being held to be associated" (p. 5188), he went on to indicate that the question whether there is control by a "group of persons" owning a majority of the voting power is a question of fact and, here, the taxpayer had failed to challenge the Minister's assumption of fact (and apparently would have had difficulty doing so in light of the common management of the two corporations). With respect to a submission that Hill and Hill III were a related group which were deemed by s. 139(5d) (now s. 251(5)(a)) to control Yardley Plastics, and that this related group did not control Canadian Moldings, the two corporations could therefore not be held to be associated, Noël J. held that s. 139(5d), although extending the concept of a related group, could not restrict the meeting of s. 39(4)(b) of the pre-1972 Act (subsequently, s. 256(1)(b) of the Act).

See Also

Ferronnex Inc. and Quincaillerie Brassard Inc. v. Minister of National Revenue, 91 DTC 559, [1991] 1 CTC 2330 (TCC)

A corporation ("Fercomat") was found to be controlled by the same group of persons as each of two other corporations ("Quincaillerie" and "Ferronnex") notwithstanding a submission that Fercomat was controlled by one individual alone who owned 44.9% of its voting shares but held a power of attorney (which he exercised) over shares of his children representing a further 39.6% of the votes of Fercomat. Tremblay TCJ. also applied the proposition that (p. 564):

"[W]here several groups could possibly have legal control, the one which has de facto control must be chosen, that is, the one which sets company policy that must be implemented by the board of directors."

Express Cable Television Ltd. v. MNR, 82 DTC 1431, [1982] CTC 2447 (TRB)

A partnership of corporations (variously referred to as "Welsh Antenna" and "Antenna Systems") held a majority of the shares of one corporation ("Victoria") but not of the taxpayer. In finding that Victoria and the taxpayer were both controlled by a group of persons consisting of Welsh Antenna and a former employee of Welsh Antenna who, through a corporation owned by him held shares in both Victoria and the taxpayer, Mr. Cardin stated (at p. 1437) that "the existence of voting trusts, comunity of interest and other common links between the shareholders [is] pertinent in determining which of the majority groups does in fact control two corporations" and found that there was such community of interest between Welsh Antenna and its former employee (notwithstanding that no voting agreement existed) as they were both involved in the business of the taxpayer and Victoria (television production) and they both provided business services to the taxpayer and Victoria (managerial services, in the case of Welsh Antenna, and sales services in the case of the former employee).

King George Hotels Ltd. v. MNR, 68 DTC 635 (TAB)

The taxpayer, which was indirectly controlled by children of the Leier family, was found to be associated with the corporation ("J.P.") that was owned by an incorporated charitable foundation whose trustees were two members of the Leier family and a legal advisor, and with the corporation (Joseph Enterprises) that was owned equally by Mrs. Leier and the foundation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Taxpayer | 25 |

Buckerfield's Ltd. v. MNR, 64 D.T.C 5301, [1964] CTC 504 (Ex Ct)

Two companies that were vigorous competitors (Pioneer and Federal) each owned one-half of the shares of two other companies (Buckerfield's and Green Valley). In finding that Buckerfield's and Green Valley were associated corporations pursuant to s. 39(4)(b) of the pre-1972 Act by virtue of their control by the same group of persons, Jackett P. stated (at p. 5303):

Many approaches might conceivably be adopted in applying the word "control" in a statute such as the Income Tax Act to a corporation. It might, for example, refer to control by "management", where management and the board of directors are separate, or it might refer to control by the board of directors. ... The word "control" might conceivably refer to de facto control by one or more shareholders whether or not they hold a majority of shares. I am of the view, however, that in Section 39 of the Income Tax Act [the former section dealing with associated companies], the word "controlled" contemplates the right of control that rests in ownership of such a number of shares as carries with it the right to a majority of the votes in the election of the board of directors.

Jackett P. further stated (at pp. 5303-5304) that "the word 'group' in its ordinary meaning ... can refer to any number of persons from two to infinity".

Administrative Policy

5 April 1995 External T.I. 9414745 - STOP LOSS

S.256(7)(b) will apply where the same group of unrelated individuals controls an amalgamated corporation as controlled both the predecessors.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(7) - Paragraph 256(7)(b) | 62 |

80 C.R. - Q.25

A person who is the registered and beneficial owner of the shares of one company is the "same person" for purposes of s. 256(1)(b) where he also holds the shares of another company as trustee or executor.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 89 - Subsection 89(1) - Private Corporation | 35 |

IT-64R3 "Corporations

Association and Control - after 1988".

Paragraph 256(1)(c)

Cases

1056 Enterprises Ltd. v. The Queen, 89 DTC 5287, [1989] 2 CTC 1 (FCTD)

The Minister assessed the taxpayer, whose shares were owned 99% by an individual ("John"), on the basis that John's brother ("William"), who was virtually the sole shareholder of another corporation ("Northland"), also had a 50% interest in the taxpayer. Muldoon J. found that although the brothers had an initial oral agreement to this effect, "it ceased before the brothers could carry it into effect", with the result that the taxpayer and Northland were not associated (p. 5293).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Ownership | 76 | |

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(4) - Paragraph 152(4)(a) - Subparagraph 152(4)(a)(i) | honest and diligent view that no association | 146 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1) - Paragraph 256(1)(d) | 84 |

See Also

Disher-Winslow Products Ltd. v. MNR, 52 DTC 27 (TAB)

An individual (Edward) was the holder and beneficial owner of substantially all the shares of the taxpayer and his father (Clarence) was the holder and beneficial owner of a substantial portion of the voting shares of a second corporation ("DeWalt"). In addition, Clarence held one share of the taxpayer on behalf of Edward, and Edward held one share of DeWalt on behalf of Clarence. In finding that Edward and Clarence did not "own" shares of both corporations for purposes of s. 36(4)(b)(iii) of the Act as it then read, Mr. Fordham stated (at p. 28):

"In Stroud's Judicial Dictionary, 2nd Edition Ed., p. 1387, it is stated that the owner of a property is the person in whom (with his or her consent) it is for the time being beneficially vested, and who has the occupation, or control, or usufruct of it. In my view, Clarence ... did not have such an interest in the share of the appellant's stock registered in his name and the real owner was Edward ... ."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Ownership | registered shareholder of share held on behalf of another was not its owner | 174 |

Paragraph 256(1)(d)

Cases

Allied Farm Equipment Ltd. v. MNR, 73 DTC 5036, [1972] CTC 619 (FCA)

Each of three brothers owned and controlled one Canadian corporation and, among the three of them, owned and controlled a U.S. corporation. In finding that the U.S. corporation was associated with each Canadian corporation (with the result that each Canadian corporation was associated with the other two Canadian corporations under the pre-1972 version of s. 256(2)), Jackett C.J. noted (p. 5037) that the rules in s. 39(4) of the pre-1972 Act applied "for the purposes of this section", that those rules determined the amount of tax payable under Part I by associated corporations and that it followed "that section 39(4) has no application to determine whether two corporations are associated unless they are both subject to income tax under Part I of the Income Tax Act".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1) - Paragraph 256(1)(a) | 64 |

1056 Enterprises Ltd. v. The Queen, 89 DTC 5287, [1989] 2 CTC 1 (FCTD)

An individual ("John") was issued 99% of the shares of the appellant ("Cantex") on its incorporation, even though John's brother had provided Cantex with $20,000 in cash and a corporation controlled by the brother ("Northland") had financed the purchase by Cantex of certain equipment on the preliminary verbal understanding (made prior to its incorporation) that when Northland was repaid, John's brother would receive 49% of Cantex's shares. Since no agreement or legal relationship along these lines ever was consumated, Cantex was not associated with Northland.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Ownership | 76 | |

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(4) - Paragraph 152(4)(a) - Subparagraph 152(4)(a)(i) | honest and diligent view that no association | 146 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1) - Paragraph 256(1)(c) | 76 |

Holiday Luggage Mfg. Co. Inc. v. The Queen, 86 DTC 6601, [1987] 1 CTC 23 (FCTD)

Father and son each owned substantially all the shares of a CCPC, and 30% of the shares of a U.S. corporation. Joyal, J. held that the two CCPC's were not associated because foreign corporations were intended to be excluded from the category of corporations for the purposes of that section. The definition of "corporation" in s. 248(1) was not conclusive.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Statutory Interpretation - Interpretation Act - Subsection 15(2) | 64 |

Administrative Policy

31 March 2009 External T.I. 2009-0310821E5 F - Associated Corporations - 256

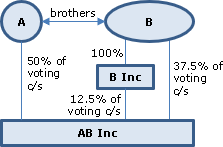

A held 50% of the voting common shares of AB Inc. and his brother (B) held 37.5% of such shares directly and another 12.5% were held by B’s wholly-owned corporation (B Inc.) In finding that the two corporations were associated under s. 256(1)(d), CRA stated:

[T]he person (in the particular situation, B) who controls one of the two corporations (…B Inc.), directly or indirectly, in any manner whatever, was related to each member of the group of persons (…A and B) who control the other corporation (…AB Inc.), directly or indirectly, in any manner whatsoever, and that person (in the particular situation, B) holds at least 25% of the issued shares of a class, other than a specified class, of the capital stock of the other corporation (…AB Inc.).

… [I]n order to determine whether B is related to each member of the group that controls AB Inc., B, as owner of shares of the capital stock of B Inc. and AB Inc., would be deemed, as a shareholder of B Inc., to be related to himself as a shareholder of AB Inc. by virtue of subsection 256(1.5).

4 April 1990 T.I. (September 1990 Access Letter, ¶1439)

Where A is the sole shareholder of A Ltd., and A along with his three brothers are the four trustees, having equal powers, of a testamentary trust holding all the shares of C Ltd., then A Ltd. and C Ltd. will not be associated. The 25% ownership test requires the person to have a beneficial interest in the shares.

IT-64R3 "Corporations

Paragraph 256(1)(e)

Cases

The Queen v. B.B. Fast & Sons Distributors, 86 DTC 6106, [1986] 1 CTC 299 (FCA)

William Fast and his wife each owned 50% of the shares of one corporation ("Willmar"), and William Fast and his 4 siblings each owned 20% of the shares of the taxpayer. The requirement that a related group own a 10% interest in each corporation was interpreted as requiring that two (or more) members of that related group hold a 10% aggregate interest in each corporation. Since Mrs. Fast owned none of the taxpayer's shares, this requirement was not satisfied. "William Fast, the only common relative in each group, could not by himself be a 'group'".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Statutory Interpretation - Interpretation Act - Subsection 45(2) | 40 |

Atomic Truck Cartage Ltd. v. The Queen, 86 DTC 6032, [1985] 2 CTC 21, [1985] DTC 5427 (FCTD)

The common shares of three corporations were held by individuals, all of whom were related to each other, as follows:

| Entreprises: | X - 49.5%; | A - 49.5%; | B - 1% |

| Atomic: | X - 42%; | Y - 42%; | C - 16% |

| Roclar: | D - 49%; | Y - 49%; | E - 2% |

Since no two individuals held, as a group, 10% or more of the shares of two corporations, and since the holdings of a member of such a group of two persons was irrelevant, the three corporations were not associated.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(4) - Related Group | 21 |

The Queen v. Mars Finance Inc., 80 DTC 6207, [1980] CTC 216 (FCTD)

Where the conditions of S.256(1)(e) are met, then it is irrelevant that de facto control of one of the corporations is exercised contrary to the wishes of a distinct group which controls the other corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1) - Paragraph 256(1)(b) | look to whether the mooted group in fact exercises control | 73 |

Administrative Policy

86 C.R. - Q.18 B.B. Fast.

IT-64R3 "Corporations

Subsection 256(1.1)

Administrative Policy

20 February 1996 External T.I. 9605085 - STOCK DIVIDEND SHARES THOSE OF A SPECIFIED CLASS?

Where a share has been issued as a stock dividend, the consideration for which the share was issued would be considered to be nil.

31 October 1991 T.I. (Tax Window, No. 12, p. 13, ¶1560)

The "amount of unpaid dividends" referred to in s. 256(1.1)(e) may include accumulated but unpaid dividends.

3 September 1991 T.I. (Tax Window, No. 8, p. 3, ¶1437)

A share with no entitlement to dividends generally will comply with s. 256(1.1)(c).

If the share terms provide that the shares will become voting under certain circumstances, the test in paragraph (b) will not have been met from the time of issuance of the share.

Paragraph 256(1.1)(b)

Administrative Policy

15 September 2003 External T.I. 2003-0028075 F - Definition of "Specified Class" Sub 256(1.1)

Zco held Class X shares of ABCco, which satisfied all of the conditions for being a “specified class” except that they carried voting rights. A financial institution held the only other class of shares. Under the shareholders' agreement, Zco renounced the exercise of its voting rights for so long as the financial institution was a shareholder. Did the Class X shares qualify as shares of a "specified class" given that their voting rights were restricted by "any agreement in respect thereof"? CCRA responded:

[T]he Class X shares would confer the right to vote according to their attributes under the articles of ABCco. We are therefore of the view that the Class X shares would not meet the condition of paragraph 256(1.1)(b) since they confer the right to vote.

Paragraph 256(1.1)(d)

Administrative Policy

11 January 2010 External T.I. 2009-0340591E5 F - Specified class - 256(1.1) of the Act

Class A shares of the corporation were issued in three different years (Years 1, 4 and 13). The annual rate of dividend on such shares (expressed as a percentage of the consideration for which they were issued) of 6% was higher than the prescribed rate of interest at the time of the issuance of the shares in Years 1 and 4 – although the corporation amended its articles after Year 4 and before Year 13 to reduce the dividend rate to 1%, which was the prescribed rate in Year 13 and less than the prescribed rate in Years 1 and 4.

In finding that this dividend-rate deduction did not satisfy s, 256(1.1)(d), CRA noted that its view is that the condition in paragraph 256(1.1)(d) of the Act must be met throughout the period that the shares in question are issued and outstanding.

Would the situation be remediated if the shareholder effected a s. 51 exchange of such Class A shares for Class B shares with the same attributes except for the fixed annual dividend rate (as a percentage of the fair market value of the consideration for which the shares were issued) equalling the prescribed rate at the time of the exchange? CRA stated:

We understand that the only Class B shares of the capital stock of the particular corporation that would be issued and outstanding would be the shares received by the shareholder on the exchange and that this issuance would take place on the exchange. Thus, depending on the facts, the fixed annual dividend rate, expressed as a percentage of the fair market value of the consideration for the issuance of the Class B shares, would not exceed the prescribed rate of interest on the issuance of the Class B shares. It is our understanding that the condition in paragraph 256(1.1)(d) would then be satisfied in respect of the newly issued Class B shares of the capital stock of the particular corporation. There is no specific provision in the Act, such as a tracking or tracing rule, that would allow the CRA to consider that the Class B shares of the capital stock of the particular corporation do not satisfy the condition in paragraph 256(1.1)(d) because the Class A shares of the capital stock of the particular corporation, exchanged for the Class B shares, did not satisfy the condition in paragraph 256(1.1)(d).

However, at the time of the exchange, the fair market value of the Class A shares and the Class B shares received in exchange should be ascertained in order to determine, inter alia, whether subsection 51(2) applies to the situation or whether the condition in paragraph 256(1.1)(e) is satisfied.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 51 - Subsection 51(1) | s. 51(1) exchange regarded as the new shares having been issued for consideration equalling the FMV of the old shares | 58 |

Subsection 256(1.2) - Control, etc.

Cases

9044 2807 Québec Inc. v. Canada, 2004 DTC 6636, 2004 FCA 23

Noël J.A. indicated (at p. 6639) that in order to avoid any conflict between applying the results of the de jure control and de facto control:

"The Act now provides in subparagraph 256(1.2)(b)(ii) that a corporation may be controlled by a person notwithstanding that the corporation is also controlled or deemed to be controlled by another person. Accordingly, Transport Couture could exercise de facto over MR1 and MR2 although de jure lay elsewhere."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(5.1) | situs of decision-making power | 268 |

Administrative Policy

89 C.R. - Q.14

Where a minor child owns 10% of the common shares of Holdco which owns 100% of the common shares of Opco, s. 256(1.2)(e) will not be applied more than once in respect of the shares of Opco held by Holdco (i.e., once when the parent is deemed to own the shares of Holdco by virtue of s. 256(1.3) and once in respect of the child's actual ownership of Holdco shares). Therefore, the parent would be deemed to own 10% of the shares of Holdco and 10% of the share of Opco.

88 C.R. - Q.39

RC will identify any group of persons, related or unrelated, without considering whether any group acts in concert.

Paragraph 256(1.2)(a)

Administrative Policy

IT-64R3 "Corporations

Paragraph 256(1.2)(b)

Administrative Policy

18 October 89 Meeting with Quebec Accountants, Q.3 (April 90 Access Letter, ¶1166)

Where A owns 95% of the shares of Corporation A and the other 5% are owned by B, and B owns all the shares of Corporation B, and to fund a particular project, Corporation B issues shares to A who then owns 10% of its issued shares, Corporations A and B would be deemed to be controlled by a group (A and B) regardless of the small participation of each individual in their corporations and regardless whether or not A and B have a mutual interest.

IT-64R3 "Corporations

Paragraph 256(1.2)(c)

See Also

Kruger Wayagamack Inc. v. The Queen, 2015 DTC 1112 [at at 667], 2015 TCC 90, aff'd 2016 FCA 192

51% and 49% of the taxpayer's shares (being common shares) were held by a business corporation ("Kruger") and a Government of Quebec corporation ("SGF").

Jorré J found that Kruger's shareholding had a fair market value of over 50% of that of all the shares, so that ss. 256(1.2)(c) and 256(1)(a) applied to deem the taxpayer to be associated with Kruger, stating (at para. 118):

Given the effect of paragraph 256(1.2)(g)… what one has to value is Kruger's holding of 51% of the shares with some expected financial return per share and SGF's holding of 49% of the shares with the same expected financial return per share in circumstances where it is as if a third party ran the appellant without Kruger or SGF having the slightest influence on that third party. In such circumstances, it is hard to imagine why someone would pay a different price per share whether they bought 49 shares, 51 shares or all 100 shares.

A unanimous shareholder agreement gave SGF the right, on its 9th anniversary, to require Kruger to purchase all of its shares for their FMV, determined without minority discount or marketability discount, provided that credit agreement covenants were met. Jorré J accepted that such a right might increase the value of SGF's shares relative to Kruger's. However, since the benefit of this put right could not be assigned to a third-party purchaser of SGF's shares, it did not affect the shares' FMV.

See summary under s. 256(1)(a).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Fair Market Value - Shares | non-assignable put right ignored | 98 |

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(2) - Paragraph 251(2)(b) - Subparagraph 251(2)(b)(i) | de jure control requires strategic control, not merely operational control | 93 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1) - Paragraph 256(1)(a) | de jure or de facto control requires strategic control, not merely operational control | 340 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(5.1) | de facto control requires strategic control, not merely operational control | 216 |

Administrative Policy

30 May 2007 External T.I. 2006-0218101E5 F - Interaction entre 125.4(1) et 256(1.2)c)

CRA noted that the expanded definition of control in s. 256(1.2)(c) applies only for the purposes of the enumerated provision in its preamble and, thus, does not apply for s. 256(5.1) purposes.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 1106 - Subsection 1106(2) | s. 256(1.2)(c) does not inform the definition of prescribed taxable Canadian corporation | 44 |

8 January 2004 External T.I. 2003-0040575 F - Associated Corporations

Although Mr. X held all of the issued and outstanding shares of Opco, an arm’s length lender (“Lendco”) held a debenture which was convertible, in the event of insolvency, into 1000 of such shares. CRA indicated that such right gave the lender deemed de jure control of Opco pursuant to s. 256(1.4)(a), and that the rule in s. 256(1.2)(c) referenced de jure control, not de facto control.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(6) - Paragraph 256(6)(a) | cessation of lender’s right to shares on occurrence of reasonably-expected event must be expressly stated in loan terms | 204 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1.4) - Paragraph 256(1.4)(a) | lender’s right to acquire 99% of shares in event of insolvency engaged s. 256(1.4)(a) | 73 |

29 June 1995 External T.I. 9510645 - COTRUSTEES OF DIFFERENT TRUSTS SAME PERSONS

"Where the co-trustees of two trusts are the same persons and one of the trusts owns shares representing more than 50% of the fair market value of all of the issued and outstanding shares of one corporation (Corporation A) and the other trust owns shares representing more than 50% of the fair market value of all of the issued and outstanding shares of a second corporation (Corporation B), we believe that Corporation A and B would be associated by virtue of paragraph 256(1.2)(c), unless the conditions described in subsection 256(4) of the Act are satisfied."

Paragraph 256(1.2)(d)

Administrative Policy

IT-64R3 "Corporations

Paragraph 256(1.2)(f)

Cases

Canada v. Propep Inc., 2010 DTC 5088 [at at 6882], 2009 FCA 274

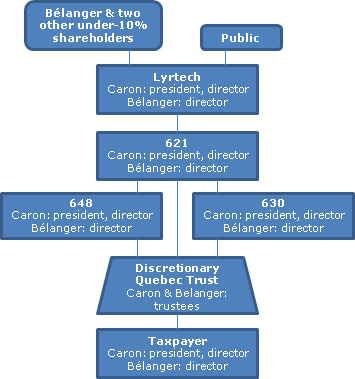

The taxpayer was owned by another corporation (9059) which, in turn, was owned by a Quebec trust whose first-ranking beneficiary was 9059, and second-ranking beneficiary was the son of an individual who controlled two other corporations with which CRA had found the taxpayer was associated. It was accepted that the taxpayer would be so associated if the son was deemed by s. 256(1.2)(f)(ii) to own 9059.

Although the discretion conferred on the trustees to distribute capital to the son could not be exercised before the winding-up of 9059 or the expiration of 100 years, the trustees could in exercising their discretion and at the time of their choosing wind up 9059, thereby making the son the sole beneficiary. Accordingly, the son was deemed by s. 256(1.2)(f)(ii) to own 9059. In addition, he was an income beneficiary, and under the Act an income beneficiary was treated as a beneficiary of the trust. Finally, he was a beneficiary under the expanded definition of "beneficially interested" in s. 248(25). In this regard, Noël JA stated (at paras. 23-24) after referring to s. 248(25)(a):

The TCC judge seems to be of the opinion that this definition does not apply here because the expression "beneficially interested" is not used in either of the provisions dealing with associated corporations (256(1)( c ), 256(1.2) and 256(1.3))... . With respect, the expression "beneficially interested" does not have to be reproduced in each provision where it is likely to be applied. This concept applies each time the question arises whether a person is "beneficially interested" in a particular trust. A person who has a contingent right to the capital or income of a trust is "beneficially interested" for the purposes of the Act.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 108 - Subsection 108(1) - Income Interest | 28 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(25) | potential beneficiary was a beneficiary | 284 |

Administrative Policy

IT-64R3 "Corporations

Articles

Jeffrey T. Love, Kenneth R. Hauser, "How Various Aggregation Rules Apply to Trusts", 2018 Conference Report (Canadian Tax Foundation), 28: 1-79

Uncertainties re scope of ss. 256(1.2)(f)(ii), (iii) and (iv) (pp. 28:62-63)

Subparagraph 256(1.2)(f)(iii) applies when a beneficiary's share of accumulating income and capital is fixed by the terms of the trust and is not dependent on a person exercising (or failing to exercise) a discretionary power. In these situations, the beneficiary is deemed to own the shares comprising the trust's property in proportion to the fair market value of the beneficiary's "beneficial interest" to the fair market value of all beneficial interests in the trust. It is not clear how subparagraphs 256(1.2)(f)(ii) and (iii) apply to a hybrid situation in which a beneficiary's share of accumulating income and capital is discretionary, but the amount that any one beneficiary may receive is capped at a certain amount. …

When subparagraph 256(1.2)(f)(ii), (iii), or (iv) applies to deem a person to own shares owned (or deemed to be owned) by the trust, two uncertainties arise. First, it is unclear whether this deemed ownership is limited in application to the 25 percent cross-ownership provisions in paragraphs 256(1)(c) , (d), and (e) or whether this deemed ownership also provides for deemed control of the voting rights attached to the shares subject to deemed ownership. Second, if the beneficiaries with the deemed ownership of shares also have control over the voting rights attached to the shares, it is unclear whether the trustee no longer controls the shares for the purpose of applying subsection 256(1).

Subparagraph 256(1.2)(f)(ii)

See Also

Moules Industriels (C.H.F.G.) Inc. v. The Queen, 2018 TCC 85

Whether corporations in which two discretionary trusts whose beneficiaries included the children (and their spouses) of Mr. Houle were associated with other corporations held within the Houle family turned on whether such beneficiaries (the “affected beneficiaries”) were deemed by s. 256(1.2)(f)(ii) to own the shares held by such trusts. Clause 4.3 in the deeds of trust provided that the affected beneficiaries could receive no more than 24.99% of the capital or income of either trust.

In rejecting a taxpayer submission that s. 256(1.2)(f)(ii) should be interpreted as providing only that the affected beneficiaries were deemed to hold 24.99% of the shares held by the trusts, and finding that they instead were deemed by s. 256(1.2)(f)(ii) to hold 100% of such shares (so that the appellant corporations were associated), Lamarre ACJ stated (at paras. 54, 56, TaxInterpretations translation):

Nothing indicates that subparagraph 256(1.2)(f)(ii) will not apply if the discretionary share of a beneficiary is limited by the deed of trust … .

If clause 4.3 were to apply, the trustees would still have complete discretion as to distributing to the affected beneficiaries a share of the total capital or income of the trust ranging from 0% to 24.99%. This clause does not have the effect of eliminating the discretionary power contemplated by clause 4.2 of the deeds. This power, despite it being potentially subject to the 24.99% cap, remains fundamentally a discretionary power.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 104 - Subsection 104(1) | Quebec trusts are considered to be owners of their property for ITA purposes | 224 |

Administrative Policy

14 September 2017 External T.I. 2017-0685121E5 F - Associated corporations

Three children each of whom wholly-owns a Childco are also, along with their parent, the discretionary beneficiaries of a family trust owning all the non-voting common shares of Parentco, whose voting shares are held by the parent. Each Childco is associated with Parentco given that s. 256(1.2)(f)(ii) deems a discretionary beneficiary to own the trust shares for association purposes. Accordingly (and absent an s. 256(2)(b)(ii) election), under the “transitivity” rule in s. 256(2)(a), the Childcos are also associated with each other.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(2) - Paragraph 256(2)(b) - Subparagraph 256(2)(b)(ii) | election under s. 256(2)(b)(ii) busts s. 256(2)(a) transitivity but not association with 3rd corporation | 310 |

| Tax Topics - Income Tax Act - Section 125 - Subsection 125(5.1) | making s. 256(2)(b)(ii) election, by eliminating s. 256(2)(a) transitivity, reduces the reduction for taxable capital employed in Canada | 262 |

8 December 2015 External T.I. 2015-0608781E5 F - Associated corporations - discretionary trust

1st Situation: X, who holds all the shares of Newco, and is a beneficiary of a discretionary trust holding all the shares of Opco (so that X is deemed by s. 256(1.2)(f)(ii) to own such shares), renounces all rights as beneficiary. Does this cause Newco and Opco to not be associated? CRA responded (TI translation):

It would be necessary to take into account the rules in subsection 248(25) to determine if X was a beneficiary of the discretionary trust…[and] to determine from our legal Service that the documents signed by X were sufficient to consider that X was not a beneficiary at any particular time in the taxation year of Opco and Newco (taking into account subsection 248(25).

If [so]…subparagraph 256(1.2)(f)(ii) would not apply… .

2nd Situation: Mother controls Opco through holding the preferred shares and a discretionary trust of which Mother and a minor child are the beneficiaries holds all the common shares. The trust deed provides that the trust cannot distribute income or capital to the child before the age of 18. Father holds all the shares of Newco.

Would Opco and Newco be associated under ss. 256(1.2)(f)(ii) and 256(1.3) – and would it make any difference if the trust deed precluded only the distribution of income before 18? CRA responded:

[E]ven if the minor child has no right to income or capital while not having attained the age of 18, part of the accumulated capital is conditional on the fact that a person does or does not exercise a discretionary power.

Consequently, subparagraph 256(1.2)(f)(ii) would apply to deem the minor child to be the owner of the shares in the capital of Opco held by the discretionary trust.

…[W]e assume that the minor child does not manage the affairs of the corporation. In determining whether Newco is associated with Opco, Father would be deemed, by virtue of subsection 256(1.3), to hold the shares held by the discretionary trust in Opco (by reason of the resumption in subparagraph 256(1.2)(f)(ii)…). Thus, Newco and Opco would be associated… .

The answer would not change with the indicated trust deed variations.

3rd Situation: 80% and 20% of the shares of Opco are held, respectively, by: Mother; and a trust (“Trust 1”) of which she and her three minor children are discretionary beneficiaries. 80% and 20% of the shares of Newco are held, respectively, by: Father; and a trust (“Trust 2”) of which he and his three minor children are discretionary beneficiaries. Trusts 1 and 2 have separate trustees. The children do not manage the affairs of the corporations. Would Opco and Newco be associated under ss. 256(1.2)(f)(ii) and 256(1.3)? CRA responded:

[S]ubsection 256(1.3) would apply…to deem Father to hold 20% of the shares in the capital of Opco, being all the shares…held by Trust 1. Furthermore, Mother would be deemed to hold 20% of the shares…of Newco by virtue of subsection 256(1.3), being all the shares…of Newco held by Trust 2. Subparagraph 256(1.2)(f)(ii) and subsection 256(1.3) would apply individually in relation to each beneficiary so that the shares…of Opco or Newco, as the case may be, would not be counted two or more times.

Thus…Newco would not be associated with Opco because Father would not hold or be deemed to hold at least 25% of the shares…of Opco and because Mother would not hold or be deemed to hold at least 25% of the shares…of Newco.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1.3) | no double-counting of shares in applying s. 256(1.3) to shares deemed to be owned by minor trust beneficiaries | 139 |

16 August 2006 External T.I. 2006-0176801E5 F - Subparagraph 256(1.2)(f)(ii)

Mr. X is the beneficiary of a discretionary inter vivos trust. The trust deed provides that when Mr. X dies, his adult son, Mr. Y, will become beneficiary of the trust. The trust holds all the issued and outstanding shares of the capital stock of Xco. Mr. Y holds all the issued and outstanding shares of the capital stock of another corporation, Yco. At the 2004 APFF Roundtable (2004-0086891C6), CRA addressed this situation as follows:

[I]t appears that Mr. Y would be deemed to own Xco shares pursuant to subparagraph 256(1.2)(f)(ii) I.T.A., if Mr. Y's share in the trust's capital depends on the trustee's (or trustees') exercise or failure to exercise any discretionary power in relation to Mr. X.

The response would be the same if the trust deed had provided that the trustee would no longer have any discretionary power after Mr. X's death.

When asked to elaborate on this position, CRA stated:

Our understanding of the situation presented is that Mr. Y is specifically named as a beneficiary in the trust deed, but cannot receive income or capital from the trust until Mr. X dies.

In such a situation, we believe that Mr. Y can be considered a beneficiary under civil law.

In our view, subparagraph 256(1.2)(f)(ii) is broad enough to apply to a person designated as a beneficiary even if the person's entitlement to the income and capital of the trust is triggered by the death of the individual’s father.

… [I]t is clear from the wording of subparagraph 256(1.2)(f)(ii) that Parliament intended this provision to apply where a person is named as a beneficiary in the trust indenture, and the person's share of the trust's income or accumulated capital is conditional on the exercise or non-exercise of discretion in that regard.

6 January 2004 External T.I. 2003-0052261E5 - Subparagraph 256(1.2)(f)(ii)

A discretionary inter vivos personal resident trust (the "Trust") owns all the shares of Opco. Mr. A (a resident), who is not a trustee but is a beneficiary, owns all the shares of another CCPC ("Aco"). Notwithstanding its discretionary nature, the Trust deed stipulates that no beneficiary can receive, own, or otherwise have the use or benefit from more than 24% of the accumulating income or the capital from the shares of Opco. Would Mr. A be considered to own all the shares of Opco under s. 256(1.2)(f)(ii)? CRA responded:

Subparagraph 256(1.2)(f)(ii) provides that where any beneficiary's share of income or capital of a trust is subject to any discretionary power, such beneficiary is deemed to own all the shares of any corporation that are held by the particular trust. Accordingly, in the situation described above, Mr. A would be deemed to own all the shares of Opco that are owned by the Trust for the purposes described in subsection 256(1.2).

16 February 2000 External T.I. 1999-0008435 F - Société associées

Two unrelated individuals, Mr. A and Mr. B, held 66% and 34%, respectively, of the shares of Opco2. Mr. A and Mr. B each held 15% of the shares, being common shares, of Portfolioco, with the balance being held by unrelated individuals. Portfolioco held 70% of the common shares of Opco1, whereas each of two discretionary family trusts—for the wife of Mr. A and their minor child (Trust A), and for Mr. B's wife and their adult children (Trust B)—held the balance of the shares.

S. 256(1.2)(f)(ii) resulted in all the Opco1 shares held by Trust A being deemed to be held by both Mr. A's wife and their minor child; and in all the Opco1 shares of Trust B being deemed to be held by Mr. B's spouse and each of their children.

Subject to the exception in s. 256(1.3) for the child managing the business of the corporation, Mr. A would be deemed, by ss. 256(1.3) and 256(1.2)(f)(ii), to hold the shares held by Trust A.

Mr. A and Mr. B would be deemed, under the look-through rule in ss. 256(1.2)(d) and 256(1.2)(g), to hold 10.5% (15% x 70%) of the Opco1 shares.

CCRA concluded that ss. 256(1.2) and (1.3) did not allow a conclusion that Mr. A and Mr. B formed a group of persons that controlled Opco1, because they were not deemed to hold more than 50% of the Opco1 common shares.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1.3) | application of s. 256(1.3) was insufficient to create a control group | 314 |

Subsection 256(1.3) - Parent deemed to own shares

Administrative Policy

8 December 2015 External T.I. 2015-0608781E5 F - Associated corporations - discretionary trust

Father and Mother each hold 80 shares of Newco and Opco, respectively, and two discretionary trusts, with their three minor children as beneficiaries, hold 20 shares, respectively, of Newco and Opco. S. 256(1.2)(f)(ii) would deem, say, the eldest child to own the 20 share bloc in each corporation and that bloc of shares would then be re-attributed to a parent under s. 256(1.3), so that Newco would be deemed to be owned as to 80 and 20 shares by Father and Mother, respectively, and Opco would be deemed to be owned as to 80 and 20 shares by Mother and Father, respectively.

If the same process were repeated for the other two children, the deemed cross-shareholdings would be increased to 60 shares for each corporation. However, CRA will not do this, stating that the shares “would not be counted two or more times.”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1.2) - Paragraph 256(1.2)(f) - Subparagraph 256(1.2)(f)(ii) | beneficiary includes beneficially entitled/combined application of 256(1.2)(f)(ii) and 256(1.3), but shares attributed only once] | 595 |

8 December 2015 External T.I. 2015-0610921E5 F - Associated corporations - child under 18

On January 1 of a particular year, “Child”, who is 17 years, becomes the shareholder of Opco (a CCPC with a calendar year which is not managed by Child) and on April 1 of that year, Child turns 18. How does s. 256(1.3) apply in that year? CRA responded (TaxInterpretations translation):

At each moment in January, February and March, Child would be a child under 18 years of age who is the owner of the shares of the capital stock of Opco. Consequently, at any time during those three months, the shares in the capital stock of Opco held by Child would be deemed to be owned at that moment by the parent of Child for the purposes provided by subsection 256(1.3).

Given that the months of January, February and March in the particular year would fall in the course of the particular taxation year of Opco, it could be that Opco would be associated with another corporation during that taxation year by reason of one of the paragraphs of subsection 256(1) and of the presumption in subsection 256(1.3).

13 October 2000 External T.I. 2000-0038915 - Double-Counting - Associated Corporations

With respect to a situation where father held, as the sole trustee of a discretionary trust for minor children, 24% of the shares of a corporation, the Agency indicated that ss.256(1.2)(f)(ii) and 256(1.3) would not be double-counted so as to result in father being deemed to own 48% of the shares.

16 February 2000 External T.I. 1999-0008435 F - Société associées

Two unrelated individuals, Mr. A and Mr. B, held 66% and 34%, respectively, of the shares of Opco2. Whether Opco1 was associated with Opco2 turned on whether Mr. A and Mr. B, who were a group controlling Opco2 by virtue of, at the least, s. 256(1.2)(a), (b), or (c), also formed a group controlling Opco1.

Mr. A and Mr. B each held 15% of the shares, being common shares, of Portfolioco, with the balance being held by unrelated individuals. Portfolioco held 70% of the common shares of Opco1, whereas each of two discretionary family trusts—for the wife of Mr. A and their minor child (Trust A), and for Mr. B's wife and their adult children (Trust B)—held the balance of the shares.

S. 256(1.2)(f)(ii) resulted in all the Opco1 shares held by Trust A being deemed to be held by both Mr. A's wife and their minor child; and in all the Opco1 shares of Trust B being deemed to be held by Mr. B's spouse and each of their children.

Subject to the exception in s. 256(1.3) for the child managing the business of the corporation, Mr. A would be deemed, by ss. 256(1.3) and 256(1.2)(f)(ii), to hold the shares held by Trust A.

Mr. A and Mr. B would be deemed, under the look-through rule in ss. 256(1.2)(d) and 256(1.2)(g), to hold 10.5% (15% x 70%) of the Opco1 shares.

CCRA concluded that ss. 256(1.2) and (1.3) did not allow a conclusion that Mr. A and Mr. B formed a group of persons that controlled Opco1, because they were not deemed to hold more than 50% of the Opco1 common shares. However, depending on the circumstances, Mr. A and Mr. B might still constitute a group of persons that controlled Opco1, directly or indirectly in any manner whatever, because of de jure or de facto control of Opco1.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1.2) - Paragraph 256(1.2)(f) - Subparagraph 256(1.2)(f)(ii) | deemed holding of shares of corporation by each beneficiary of a family trust | 238 |

4 March 1994 External T.I. 9328745 F - Associated Corporations

Where 16% of the shares of a corporation are held by a discretionary family trust and three beneficiaries of the trust (being siblings) are under the age of 18, the application of s. 256(1.3) will not result in the parent being deemed to own 48% of the shares. Instead, the application of ss.256(1.2)(f)(ii) and 256(1.3) will be considered from the viewpoint of each of the beneficiaries, on a person-by-person basis, with the result that the shares of the corporation will not be double counted.

21 August 1992 T.I. 921988 (April 1993 Access Letter, p. 155, ¶C248-133)

Where Mr. A. owns all the shares of X Ltd. and Mrs. A, who owned all the shares of Y Ltd., freezes her interest in Y Ltd. in favour of a discretionary trust for her children who are under 18 years of age, X Ltd. and Y Ltd. will be associated corporations.

Subsection 256(1.4) - Options and rights

Administrative Policy

24 July 1998 External T.I. 9807875 - ASSOCIATED CORPORATIONS

Where a corporation and its two 50% shareholders have agreed that the shares held by the shareholder shall be purchased by the corporation in the event that the shareholder ceases to be an employee, s. 256(1.4)(b) may apply in circumstances where the particular shareholder is in a position to trigger the event so as to force the corporation to acquire shares owned by the other shareholder.

18 June 1998 External T.I. 9805705 - ASSOCIATED CORPORATIONS

In indicating that s. 256(1.4)(b) could apply where pursuant to a unanimous shareholders agreement a corporation would automatically acquire the shares of a shareholder where there is a change in control of the shareholder, a receiver of the shareholder was appointed, the shareholder breached specified covenants in the agreement, the shareholder encumbered its shares or they were attached, Revenue Canada stated

"... The wording in subsection 256(1.4)... will not be applied unless both (or all) parties clearly have either a right or an obligation to buy or sell as the case may be. In a situation where a unanimous shareholders agreement provides for an automatic acquisition or redemption of shares of a corporation by the corporation upon the occurrence of a specified triggering event, it is our view that the corporation clearly has an obligation to acquire and the shareholder clearly has an obligation to sell the shares upon the occurrence of the specified triggering event. Consequently, paragraph 256(1.4)(b) will apply when a person or partnership is in a position to cause the occurrence of a specified triggering event referred to in such a unanimous shareholders agreement."

5 February 1993 T.I. (Tax Window, No. 28, p. 3, ¶2411)

S.256(1.4)(a) applies in a situation where the articles of incorporation or a shareholders' agreement for a corporation having three equal common shareholders (one of whom also owns all the preferred shares) provides that in the event a shareholders' meeting is called to consider a reorganization of the share capital, a winding-up of the corporation, or an amendment to the share provisions of the preferred shares, the preferred shares will be given the right to vote, with the result that the preferred shareholder would hold more than 50% of the votes.

S.256(1.4)(a) also would apply where it was provided that if any shareholder failed for a period of greater than one year to attend shareholders' meetings, the remaining shareholders would have the option to acquire the shares of the absent shareholder.

91 C.R. - Q.11

Where parties to a shareholders' agreement have made a bona fide attempt to define "permanent disability", their definition will be given weight by RC.

20 April 1990 T.I. (September 1990 Access Letter, ¶1440)

Permanent disability refers to impairments that are expected to last for continuous periods that will exceed the period provided in s. 118.4(1)(a).

In a situation where no one shareholder alone controls the corporation, the fact that a particular board of directors may cause a corporation to redeem its shares does not in itself cause s. 256(1.4)(b) to apply. If a shareholders' agreement were to provide that should a shareholding employee ceased to be employed by the corporation his shares will automatically be acquired by the corporation, no one would appear to have a right to cause the corporation to acquire the employee's shares.

IT-64R3 "Corporations

Paragraph 256(1.4)(a)

Administrative Policy

7 October 2016 APFF Roundtable Q. 7, 2016-0652971C6 F - Paragraph 251(5)(b) and subsection 256(1.4)

Franchisor and Manager each hold 50% of the shares (being common shares) of Franchisee. The shareholders’ agreement for Franchisee provides, in the event the Manager wishes to depart, a mandate to Franchisor to identify an independent acquiror of the shares of Manager Would this right come within s. 256(1.4)? CRA responded:

[I]t would be reasonable to conclude that the franchisor does not have a right to the shares in the capital stock of the franchisee owned by the manager is the owner nor to acquire them within the meaning of paragraph 256(1.4)(a) by virtue only of the provision granting a mandate to the franchisor to find another independent shareholder to acquire the shares held by the manager in the capital stock of the corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) - Subparagraph 251(5)(b)(ii) | may include right arising after triggering of event over which no control | 274 |

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) - Subparagraph 251(5)(b)(i) | right to find 3rd party purchaser | 72 |

28 September 2006 External T.I. 2006-0197841E5 F - Shareholders agreement & 256(1.4)

Four unrelated individuals (A, B, C and D) each hold 25% of the shares (being common shares) of Opco through their respective wholly-owned holding companies (Aco, Bco, Cco and Dco). The terms of a unanimous shareholders’ agreement provide that in the event that one of them, otherwise than on death or compulsory retirement, wishes to depart, that shareholder may request the others to purchase that shareholder's shares for a price stipulated in the Annex to the USA, but if the other shareholders do not comply, they are bound to seek to procure a third-party buyer for all of Opco's shares at an agreed price or, if that is unsuccessful, Opco shall be wound-up. After referencing IT-64R4, para. 37, CRA stated:

[A]lthough the wording in subsection 256(1.4) may be broad enough to include almost any buy-sell agreement, this subsection will not normally be applied solely because of:

- a “right of first refusal”; or

- a “shotgun arrangement” (i.e., an arrangement under which a shareholder offers to purchase the shares of another shareholder and the other shareholder must either accept the offer or purchase the shares owned by the offering party)

contained in a shareholder agreement.

It appears to us that subsection 256(1.4) would technically apply in the situation described in your letter because of the existence of the unanimous shareholder agreement clause described in paragraph 7 above. Mr. A, Mr. B, Mr. C and Mr. D would each be deemed to control Opco because of the application of paragraph 256(1.4)(a). Consequently, each of Aco, Bco, Cco and Dco would be technically associated with Opco by virtue of paragraph 256(1)(b).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) - Subparagraph 251(5)(b)(i) | technically a contingent right to acquire control where each 25% shareholder has an obligation to acquire shares of another shareholder offering its shares | 127 |

20 April 2005 External T.I. 2005-0119901E5 F - Associated Corporations - Shareholders' Agreement

Two individuals (X and Y) each held all of the shares of Gesco and Holdco, respectively, and each of Gesco and Holdco held ½ of all the shares (being 50 common shares each) of Opco.

CRA rejected a submission that each of Gesco and Holdco was deemed by s. 256(1.4)(a) to hold an additional 50 common shares of Opco, or 100 out of 200 common shares, so that neither was associated with Opco. Instead, each of X and Gesco (and Y and Holdco) controlled Opco, so that Gesco and Opco (and Holdco and Opco) were associated with each other under s. 256(1)(a) or 256(1)(b). CRA stated:

[T]he presumption in paragraph 256(1.4)(a) that shares are deemed to be issued and outstanding is relevant only in respect of new unissued and outstanding shares to which persons would be entitled, not in respect of shares already issued and outstanding.

10 November 2004 External T.I. 2004-0096991E5 F - Shareholders' agreement

Mr. X holds all the shares of Aco and each of Mr. X and Mr. Y holds ½ of the shares (being common shares) of Zco. A shareholders' agreement provides that one shareholder (Mr. X or Mr. Z) has the option to acquire all of the Zco common shares held by the other shareholder, if the latter is unable to carry on his employment for a period of more than 12 months due to a temporary disability. CRA stated:

[P]aragraph 256(1.4)(a) would deem Mr. X to hold the common shares of the capital stock of Zco held by Mr. Y. As a result, Mr. Y would hold all of the common shares of the capital stock of Zco. The fact that Mr. Y would be deemed by virtue of paragraph 256(1.4)(a) to hold the common shares of the capital stock of Zco held by Mr. X would not change the effect of paragraph 256(1.4)(a) for Mr. X.

Therefore … Aco and Zco would be associated with each other pursuant to paragraph 256(1)(b).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) - Subparagraph 251(5)(b)(i) | s. 256(1.4)(a) applied to a right to acquire the other’s shares even though it was reciprocal | 49 |

8 January 2004 External T.I. 2003-0040575 F - Associated Corporations

Although Mr. X held all of the issued and outstanding shares of Opco, an arm’s length lender (“Lendco”) held a debenture which was convertible, in the event of insolvency, into 1000 of such shares. CRA indicated that such right gave the lender deemed de jure control of Opco pursuant to s. 256(1.4)(a), and that the rule in s. 256(1.2)(c) referenced de jure control, not de facto control.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(6) - Paragraph 256(6)(a) | cessation of lender’s right to shares on occurrence of reasonably-expected event must be expressly stated in loan terms | 204 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(1.2) - Paragraph 256(1.2)(c) | rule in s. 256(1.2)(c) references de jure control, not de facto control | 73 |

16 June 2003 External T.I. 2003-0020895 F - Association/Convertible Property

Parent Inc., Invest1 Inc. and Invest2 Inc. hold, respectively, 35, 15 and 15 Class A common shares (being all the issued and outstanding shares) of XYZ Inc. However, each of Invest1 Inc. and Invest2 Inc. also owns a debenture that is convertible into 40 Class A shares, such that if either of them converted, it would hold 52% of the shares of XYZ Inc. (55 out of 105), but if both converted, each would hold 38% of the shares (55 out of 145). Should s. 256(1.4)(a) be interpreted to apply to Invest1 Inc. and Invest2 Inc. individually (the 1st scenario) or in total and simultaneously (the 2nd scenario)?

In favouring the second scenario, CCRA responded:

[P]aragraph 256(1.4)(a) has the effect of deeming each of Invest1 Inc. and Invest2 Inc. to own, simultaneously, a number of additional common shares of XYZ Inc. at any particular time equal to the number of common shares that they may acquire under the convertible debentures, and such shares are deemed to be, simultaneously, issued and outstanding at that time for the purpose of determining whether a corporation is associated with another corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) | where multiple debenture holders hold convertible debentures, s. 256(1.4)(a) is to be applied as if all the debentures were exercised simultaneously | 86 |

29 October 2001 External T.I. 2001-0092035 F - association related persons

When asked to explain the statement in 9820337 F that the position on the application of s. 251(5)(b) in 9421285 E is not relevant in applying s. 256(1.4)(a), CCRA stated:

[T]he important difference in the wording of these two provisions of the Act is that, in the case of paragraph 256(1.4)(a), shares subject to a right of purchase by a person at a particular time are deemed to be issued and outstanding at that time; whereas, for the purposes of subparagraph 251(5)(b)(i), shares subject to a right of purchase by a person at a particular time are not deemed to be issued and outstanding at that time.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) - Subparagraph 251(5)(b)(i) | s. 251(5)(b)(i) applies differently than s. 256(1.4)(a) because it does not deem the subject shares to be outstanding | 100 |

9 March 2000 Internal T.I. 2000-0008257 F - Mandat d'inaptitude

In determining whether two corporations are associated, a mandatary under a power of attorney would be deemed under s. 256(1.4) to be the owner of the shares of a corporation held by the grantor, if the powers of the mandatary include the power to control the voting rights attached to the shares owned by the principal – except that s. 256(1.4)(a) provides an exception if the right to control the voting rights cannot be exercised because its exercise is contingent on the death, bankruptcy or permanent disability of an individual.

Paragraph 256(1.4)(b)

Administrative Policy

16 March 2011 External T.I. 2010-0380571E5 F - Application de 251(5)b)(ii) et 256(1.4)b)

The wording of ss. 251(5)(b)(ii) and 256(1.4)(b) is sufficiently broad to cover a situation where a person does not have control over the triggering event giving him or her the right to cause the corporation to redeem, acquire, or cancel shares in its capital stock held by another person. CRA has ruled that these provisions would not generally apply where a corporation is required to redeem or purchase for cancellation shares held by a shareholder who has been found guilty of fraud in relation to the corporation (see 2002-0172315 and 2006-0167361E5).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) - Subparagraph 251(5)(b)(ii) | s. 251(5)(b)(ii) does not apply where corporation is required to redeem shares of declared fraudster | 148 |

Subsection 256(2) - Corporations associated through a third corporation

Administrative Policy

17 June 2011 Internal T.I. 2011-0394471I7 F - Associated Corporations - 256

In rejecting a taxpayer view that s. 256(2) permits the multiplication of the small business deduction (“SBD”) in the same corporate group in certain situations, CRA stated:

[S]ubsection 256(2) was introduced as a relieving measure to permit, among other things, each of two corporations operating separate businesses, which become associated with each other because of the integration of a third corporation into the group, to claim the entirety of the SBD that it would otherwise have the right to claim.