Cases

EYEBALL NETWORKS INC. v. HER MAJESTY THE QUEEN, 2021 FCA 17

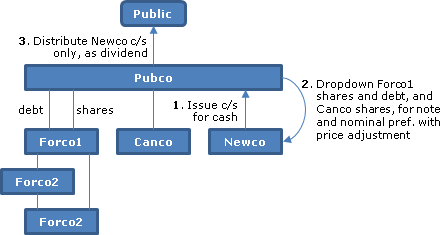

Before finding that s. 160 did not apply to a s. 55(3)(a) spin-off transaction in which each component transaction entailed a value-for-value exchange including the issuance and redemption of preferred shares with a price adjustment clause, Noël CJ noted, in passing, at para. 50:

…160(1)(e)(i) … provides that the consideration is inadequate when the fair market value of the property transferred exceeds the fair market value of the consideration given at the time of the transfer (see Birchcliff Energy Ltd. v. Canada, 2019 FCA 151 at para. 47). As explained by the Tax Court judge, the price adjustment clause eliminated any possible difference between the two in the present case ... .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 160 - Subsection 160(1) | s. 160 did not apply to s. 55(3)(a) where each step involved a value-for-value exchange (including the cross-share redemptions) | 565 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(10) | “series of transactions” requires at least one tax-driven transaction | 284 |

| Tax Topics - Income Tax Act - Section 84 - Subsection 84(9) | a shareholder whose shares have been redeemed has provided valuable consideration therefor by surrendering its shares | 136 |

| Tax Topics - General Concepts - Fair Market Value - Other | note supported only by pref, then note, of a sister had full FMV | 132 |

St-Pierre v. Canada, 2018 FCA 144

A private corporation that sold eligible capital property in 2008 declared a capital dividend in the year in an amount which included the untaxed portion of this sale receipt. This was a mistake, as the addition to the capital dividend account for this amount does not occur until the beginning of the following year. When CRA discovered this mistake a number of years later, it indicated that it would not assess the corporation for Part III tax provided that the mistake was rectified through an order of the Quebec Superior Court.

Only a small portion of the dividend made payable in 2008 was actually paid in 2008, so that the CDA addition from the sale was not needed to cover that dividend payment. Accordingly, all that was necessary to fix the problem was to get the court order to declare the payable date for most of the dividend to be on or after January 1, 2009.

What the corporation instead sought and obtained was a court order dated January 6, 2014 that retroactively annulled the dividend and ordered the individual shareholder to repay the dividend, which he then did in 2015 and with a fresh capital dividend then being declared and paid. When CRA found out that annulment rather than rectification had been requested, and while this annulment order was still being awaited (and the period for making a s. 15(2) assessment was about to run out), it assessed the individual under s. 15(2) on the basis that, as the dividends would be annulled, the payments to the individual instead represented advances (i.e., amounts which he was required to repay, as retaining them would have given rise to unjust enrichment).

Boivin JA found that the s. 15(2) assessment was without foundation, essentially on the basis of his not treating the judgement of the Superior Court as having retroactive effect for ITA purposes. He stated (at para. 36, TaxInterpretations translation):

[I]f restitution was not possible before the date of the declaratory judgment of the Superior Court, it necessarily follows that there was no debt (in this context, an unjustified enrichment), before that date. The appellant could not at the same time be indebted to the Corporation and be legally incapable of repaying that debt to it.

Thus, the CRA assessment could not take an annulling judgment, which had not yet been given, into account. Furthermore, the “enrichment” of the individual taxpayer resulting from the Superior Court judgment was merely “theoretical” given his obligation to make restitution to the corporation, which he did.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(2) | retroactive judgment annulling a dividend did not retroactively give rise to a shareholder debt for the annulled amount | 624 |

Anderson v Benson Trithardt Noren LLP, 2016 SKCA 120, aff'd 2017 SCC CanLii 8568

When CRA gave notice in 2013 of a proposed audit, the taxpayer’s accounting firm realized that it had failed to instruct the taxpayer’s lawyers to prepare the documents to implement a s. 85 transfer of assets to the taxpayer’s corporation, which the taxpayer had agreed to in a June 6, 2011 meeting with them. On this discovery, the requisite documents were promptly prepared and executed. In confirming a decision of the judge below to refuse to declare that the 2013 documents had retroactive effect to June 6, 2011, Lane JA stated:

The Chambers judge...saw the application for a declaration for what it was – an attempt to obtain equitable relief not available from the Tax Court, which is a superior court of record but not a court of inherent jurisdiction, and to thereby attempt to determine the outcome of an assessment appeal by essentially binding the hands of that Court. …

[He] recognized the specialized nature of the Tax Court and its jurisdiction to decide the ultimate issue concerning the tax implications of the rollover. He correctly declined to effectively pronounce on that issue.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Rectification & Rescission | drop-down documents could not be declared retroactive to the previously-agreed effective date, as this would undercut the Tax Court | 286 |

Nussey v. Canada, 2001 DTC 5240, 2001 FCA 99

The two sons of the taxpayer had transferred to him shares of a family corporation. The shareholders' agreement provided that, on the death of a shareholder, his shares were deemed to have been redeemed by the company on the day preceding that of death.

The Court affirmed the finding of the Tax Court Judge that the deemed redemption provisions in the agreement did not effect a retroactive disposition of the shares the day before the taxpayer's death.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Mistake | 160 | |

| Tax Topics - Income Tax Act - Section 70 - Subsection 70(5) | 112 |

Stone's Jewellery Ltd. v. Arora, [2000] GSTC 168 (Alta. Ct. Q.B.)

A transaction in which a company paid for a real estate property but the shareholders (who were not registered for GST purposes and, therefore, were not entitled to input tax credits) took title and, later, transferred the property to a newly incorporated company in reliance on the s. 85(1) rollover, was rectified so that both transfers were void ab initio. The second transaction was done under the mistaken belief that it could be done on a rollover basis whereas the Minister had assessed on the basis that the land was transferred as inventory. Respecting the first transfer, the Court found that the parties shared a mistaken belief based on their professional advice that no adverse tax consequences would result from the transfer.

Sussex Square Apartments Ltd. v. R., 99 DTC 443, [1999] 2 CTC 2143 (TCC), aff'd 2000 DTC 6548, [2000] 4 CTC 203, Docket: A-40-99 (FCA)

After the taxpayer had, for some time, been disposing of apartments suites which it held under a headlease by way of assignment rather than a sublease, it realized that a sublease would give rise to a more favourable income tax result (by accessing the reserve under s. 20(1)(m)). Accordingly, it entered into modification agreements with the bulk of the assignees under which one day of the term covered by the lease was reserved to the taxpayer, thereby effectively converting the assignment into a sublease. When the provincial Land Titles Office declined to register the modification agreements, the taxpayer obtained an order of the Supreme Court of British Columbia declaring that the assignments were so modified. The taxpayer then registered the court-approved modifications and a further 49 modification agreements were registered after the court order without the necessity of an application to the court.

Bowman T.C.J. found that the Dale decision applied to make the court-approved modification agreements effective ab initio but concluded at p. 451 (with respect to the remaining 49 modification agreements) that "it would be pushing the Dale principle too far if I applied it to contractually agreed fiscal revisionism without the benefit of a court order".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 12 - Subsection 12(1) - Paragraph 12(1)(a) | assignment of lease v. rent prepayment | 117 |

| Tax Topics - General Concepts - Stare Decisis | 40 |

Barnabe Estate v. Minister of National Revenue, 99 DTC 5387, [1999] 4 CTC 5 (FCA)

The Court, in reversing a finding of the trial judge, found that the deceased taxpayer had entered into an oral agreement with his corporation (which was the lessee of the assets of a farming business) to transfer to it the ownership of all those assets on the day that he met with his accountant, communicated that intention, and signed a blank election form. The failure to fix, at that time, the fair market value of the assets, and to prepare a schedule specifically listing them, represented a delay in dealing with purely "housekeeping measures"; and given that under Manitoba corporate law, a corporation had the capacity and the powers of a natural person, it was not germane that the purchasing corporation had not ratified the oral contract on that date (nor was it relevant that there was a significant delay before the consideration was paid).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 85 - Subsection 85(1) | 44 |

The Queen v. Larsson, 97 DTC 5425 (FCA)

An order of the British Columbia Supreme Court made in 1993 that mortgage payments made from November 1989 onward by the taxpayer on a house that had been sold prior to 1993 were deemed to be periodic maintenance payments pursuant to s. 60.1(2) of the Act was intended by the Court to have been made nunc pro tunc, with the result that the payments were deemed to be allowances under s. 60.1(2) for the years in question.

Dale v. R., 97 DTC 5252, [1997] 2 CTC 286 (FCA)

Before finding that an order of the Nova Scotia Supreme Court (obtained without the federal Crown being a party to the proceedings) retroactively adding preferred shares to the authorized capital of a corporation and confirming that they had been issued to the taxpayers also had retroactive effect for taxation purposes, Robertson J.A. stated (at pp. 5255-6):

As a matter of law both the Tax Court and this Court are required to give effect to orders issued by the superior courts of the provinces. ...

Wilson v. The Queen, 1983] 2 SCR 594 ... establishes the general rule that an order of a superior court cannot be atacked collaterally unless it is lawfully set aside. ...

It seems only logical that a [superior] court would decline the invitation to grant a retroactive order which has the clear legal effect of rewriting fiscal history. Assuing that such an order were granted, then it would be proper to ask whether the Minister is entitled to ignore it for taxation purposes.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Rectification & Rescission | retroactive effect of nunc pro tunc rectification order | 177 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Dividend | 78 | |

| Tax Topics - Income Tax Act - Section 83 - Subsection 83(2) | 78 | |

| Tax Topics - Income Tax Act - Section 85 - Subsection 85(1) | retroactive validation by Superior Court of preference share issuance was effective for s. 85 purposes | 171 |

| Tax Topics - Statutory Interpretation - Provincial Law | 140 |

Greenway v. Canada, 96 DTC 6529 (FCA)

Various conditions contained in an agreement for the acquisition of a MURB development by co-investors including the contractor's undertaking to obtain zoning and planning permissions, arrange financing, obtain a MURB certificate and convey title, did not represent conditions precedent the non-fulfilment of which would result in nullity of the agreement. Accordingly, various soft costs incurred by the investors after the effective date of the agreement were currently deductible by them.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(a) - Start-Up and Liquidation Costs | 72 | |

| Tax Topics - General Concepts - Ownership | taxpayer was beneficial owner of MURB investment notwithstanding defects in agreement to acquire title from title holder | 142 |

Kettle River Sawmills Ltd. v. The Queen, 92 DTC 6525, [1992] 2 CTC 276 (FCTD)

Timber rights were not acquired on the intended adjustment date of March 26, 1974 but instead were acquired no earlier than the time that the purchaser commenced using the rights and had the other incidents of title.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 13 - Subsection 13(21) - Depreciable Property | status does not turn on whether CCA actually claimed | 69 |

R. v. Hutton, [1990] 2 CTC 258 (Alta. C.A.)

The taxpayer fraudulently caused his employer to pay invoices for work on renovation to his home in 1983 and 1984. After the renovations were completed in 1984, he informed the company vice-president and controller that he had done so, following which it was agreed that the misappropriated funds would be treated as a loan to him. Because this subsequent agreement was in place when he filed his 1984 tax return, there was no failure to report a benefit from employment with respect to the 1984 misappropriation, albeit, not the 1983 misappropriation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 239 - Subsection 239(1) - Paragraph 239(1)(d) | 119 |

Shaw v. The Queen, 89 DTC 5194, [1989] 1 CTC 386 (FCTD), aff'd 93 DTC 5213 (FCA)

The efficacy of a pre-incorporation contract was recognized.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Substance | 35 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Property | 22 | |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(4) | 266 |

Bouchard v. The Queen, 83 DTC 5193, [1983] CTC 173 (FCTD)

Before holding that the Statute of Frauds did not preclude a finding that the taxpayer held land in trust for his son and daughter-in-law, Cattanach J. indicated (p. 5200-5201) that a parol trust operates from the time of its creation even if writings evidencing the existence of the trust do not come into existence until a subsequent date. In particular, he referred with approval to the statement in Rochefoucauld v Boustead (1897) 1 Ch 207 that “it is not necessary that the trust should have been declared by such a writing in the first instance; it is sufficient if the trust can be proved by some writing signed by the defendant, and the date of the writing is immaterial” and to comments therein to the effect that a parol trust over land can be valid notwithstanding that the trustee may (or may not) be able to defeat the trust by invoking the Statute of Frauds.

Scandia Plate Ltd. v. The Queen, 83 DTC 5009, [1982] CTC 431 (FCTD)

Control of a corporation was not acquired until the date for closing the agreement of purchase and sale, when the purchaser acquired ownership of the shares, rather than on the earlier effective date of the agreement when there allegedly was a verbal executory contract in place for the acquisition of the shares. Cattanach J. applied the principle that where a preliminary contract (whether verbal or otherwise) is intended (as was the case here) to be superseded by, and is in fact superseded by, a contract of a superior character (here, the written agreement), then the later contract prevails.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 125 - Subsection 125(1) | 178 | |

| Tax Topics - Income Tax Act - Section 125 - Subsection 125(7) - Canadian-Controlled Private Corporation | 28 |

Perini Estate v. The Queen, 82 DTC 6080, [1982] CTC 74 (FCA)

It was held that "interest" calculated from the closing date of a share purchase on outstanding instalments of a purchase price was taxable as interest rather than being capital receipts notwithstanding that the amount of each instalment of purchase price depended on the amount of after-tax net profits of the borrower earned subsequent to the closing date, with the result that the amount of interest could not be calculated until those earnings were ascertained. Le Dain, J. stated:

"it is my opinion that it was open to the parties to the agreement of sale in this case to treat the occurrence of the contingency as having such effect, insofar as interest was concerned. Cf. Trollope & Colls, Ltd. et al. v.Atomic Power Constructions Ltd., [1962] 3 All E.R. 1035, in which it was held that parties to a contract could give their contract retrospective effect. There is no rule of law that prevented them from treating an additional sum payable on account of the purchase price ... as owing, for the purposes of interest, from the closing date ...."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 12 - Subsection 12(1) - Paragraph 12(1)(c) | parties were entitled to treat conditional interest, when paid, as having retrospective absolute effect | 319 |

Kingsdale Securities Co. Ltd. v. The Queen, 74 DTC 6674, [1975] CTC 10 (FCA)

Since the settlors lacked the requisite intention prior to the execution of settled trusts, the execution of the trust deeds did not have retrospective effect to the time of alleged settlement, notwithstanding a clause in the deed purporting to make the trust effective on a date prior to its execution.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 104 - Subsection 104(2) | 36 | |

| Tax Topics - Income Tax Act - Section 169 | 84 | |

| Tax Topics - Income Tax Act - Section 172 - Subsection 172(2) | 84 | |

| Tax Topics - Income Tax Act - Section 96 | 19 |

Howard v. The Queen, 74 DTC 6607, [1974] CTC 857 (FCTD)

The BC Supreme Court on February 16, 1970 ordered the taxpayer to pay $200 per month to his wife commencing February 1, 1970. On October 22, 1973 the B.C. Supreme Court confirmed a recommendation of the Registrar, dated April 22, 1971, that the support be increased to $270 per month commencing April 1, 1970. Since the second judgment, on a true construction, was a judgment nunc pro tunc the taxpayer was entitled to make a deduction under what now is s. 60(c) at a rate of $270 per month commencing on April 1, 1970.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 60 - Paragraph 60(c) | 85 |

Nelson v. The Queen, 74 DTC 6266, [1974] CTC 360 (FCA)

Although it was the intention of the four related shareholders of a corporation that father hold 100 voting participating shares and each of his three sons hold 100 non-voting participating shares following the incorporation of a partnership in which the four individuals were equal partners, at the time of the payment by the corporation of a $1,000 dividend to each of the four shareholders the three sons (due, in part, to an oversight of the company's solicitor) held one voting participating share of the corporation. It was held (at p. 6268) that "each of the four shareholders was entitled to the $1,000.00 actually paid to him by the company either because the 96 shares issued to the appellant as part of the consideration for the partnership property were held by the appellant on a resulting trust for the members of the partnership in equal shares, or because the agreement between them called for them to have equal equity shareholdings in the company and to share equally in any divisions of the profits of the company". S.56(2) accordingly did not apply to include approximately 97% of the dividend in the income of father.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | 171 |

Guilder News Co. (1963) Ltd. v. MNR, 73 DTC 5048, [1973] CTC 1 (FCA)

The sale in 1964 of shares by a corporation to its sole shareholder at an undervalue gave rise to a benefit to the shareholder notwithstanding that the shares had been purchased at the same undervalue by the corporation from the shareholder two years earlier. "If it had not been for the 1964 resale, the individual would have continued in the relatively impoverished state that resulted from the 1962 sale. As a result of the 1964 resale he was restored to his relatively affluent state at the expense of the company and ... the company thereby conferred a benefit on him." Under the jurisprudence, it was irrelevant that "when an individual benefits a company whose stock is all owned by him or when such a company benefits the individual, the individual's overall net assets may well have neither increased nor diminished ... ."

A price adjustment clause did not negate (although it arguably reduced) the amount of the benefit, given that there was no bona fide attempt to estimate a fair market value sale price. "If, in fact, a company simply sold property to its sole shareholder on expressed terms that the price payable was an amount equal to fair market value and provided a fair manner to determine such value, I would agree ... that there could not, as a matter of law, be a benefit arising out of the sale."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 121 | 13 | |

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | restoration of previous year's detriment was benefit | 231 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Dividend | 70 |

Rose v. MNR, 73 DTC 5083, [1973] CTC 74 (FCA)

It was held that a management services contract between a corporation ("Central Park Estates Limited") and a partnership with an effective date of November 1, 1965 was not executed, and approved by the directors of Central Park Estates Limited, until at least May 31, 1966, with the result that one of the corporate partners could not be said to be carrying on an active business during the interim seven-month period. "It may well be that, after Central Park Estates Limited subsequently executed the back-dated services contract and after the corporate partners accepted payment as though they had performed the services under that contract, the situation was the same, as among the parties, as though everything had been regularly done on November 1, 1965 ... However, in my view, no such back-dating of transactions can affect the fact that, during the period from November 1, 1965 to June, 1966, there was no services contract ..."

Minister of National Revenue v. Lechter, 66 DTC 5300, [1966] CTC 434, [1966] S.C.R. 655

In the taxpayer's 1955 taxation year, he accepted the Department of Transport's formal offer of settlement for compensation in respect of its expropriation of his land inventory, and in his 1956 taxation year, the Treasury Board ratified the agreement and authorized the payment to the taxpayer. Abbott J. found that "in accordance with the ordinary rules of mandate, [the ratification of the Treasury Board] had retroactive effect to [the date of the agreement]", with the effect that the gain of the taxpayer was realized in his 1955 taxation year rather than 1956 taxation year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 9 - Timing | 92 |

Falconer v. Minister of National Revenue, 62 DTC 1247, [1962] CTC 426, [1962] S.C.R. 664

The members of a syndicate that had acquired an oil farm-out agreement incorporated a private company ("Ponder") on June 15, 1951, and Ponder immediately took possession of the syndicate's assets. However, an agreement evidencing the transfer and the consideration therefor (the obligation of Ponder to issue shares to the syndicate members) was not executed until September 25, 1951, by which date the assets had significantly increased in value. Before finding that "the agreements of September 25 did no more than to evidence, in writing, agreements which already existed" (p. 1250), with the result that the taxpayer should not be regarded as having realized a taxable profit by virtue of receiving shares on September 25, 1951 with a value higher than the assets transferred by him to Ponder on June 15, 1951, Martland J. applied (at p. 1250) the principle in Howard v. Patent Ivory Manufacturing Co. (1888), 38 Ch. D. 156 at 163:

"'Where possession has been given upon the faith of an agreement, it is I think the duty of the Court, as far as it is possible to do so, to ascertain the terms of the agreement and to give effect to it.'"

See Also

Corporation immobilière des Laurentides Inc. v. Agence du revenu du Québec, 2024 QCCQ 5297

Two individuals, who wished to acquire a condo unit in a building (“265”) which was still under construction by the taxpayer (“CILI”), agreed with CILI to acquire another unit in an already completed building (“260”) and move there on condition that, when the 265 unit became available, they would acquire the 265 unit at no loss, if a purchaser had not been found for the 260 unit by a specified date. When that date arrived, and the 260 unit had not yet been sold, CILI, and the two individuals, entered into a “deed of retrocession” pursuant to which the original sale was annulled, the purchase price returned to them, and they acquired the 265 unit from CILI.

CILI also entered into a somewhat similar transaction with the son of its principal. In order to meet a bank-imposed sales target, CILI sold the development’s model condo suite to him for rental by him back to it, on the condition that CILI would take back the unit from him once a third-party purchaser had been secured. When this “resolutory” condition was satisfied, the unit was returned to CILI pursuant to a deed or retrocession, and the purchase price refunded.

On both sales, CILI collected the applicable QST, refunded such QST on the retrocession, and claimed a credit for such refunded tax pursuant to the Quebec equivalent of ETA s. 232, which the ARQ refused on the grounds that the retrocessions represented second taxable supplies of the two units, rather than evidencing annulments of the previous sales.

Before allowing CILI’s appeal, Fournier JCQ found (at para. 74, TaxInterpretations translation) that under the Quebec Civil Code:

A resolutory condition has the effect of destroying the contractual link existing between the parties by extinguishing it as if it had never existed. …

Thus, the return of the unit in each case was to reflect that the original taxable supply was nullified, rather than representing a further taxable supply, so that the application of the s. 332 equivalent was confirmed.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 232 - Subsection 232(1) | the satisfaction of a resolutory sales condition nullified the original sale so that reconveyance of the realty to the vendor was not a supply | 572 |

Wise v. The Queen, 2019 TCC 196

An individual leased a building under a 5-year lease with a 5-year renewal option to a corporation (VMS) wholly-owned by her and her son. VMS then paid for substantial renovations to the building.

Smith J referenced the principle in Kennedy that “Where a tenant improves the leased premises, the extent to which, if at all, the improvement confers a benefit on the landlord will depend on the extent to which the improvement increases the value of the reversionary interest,” and then found that, here, no taxable benefit should be recognized until the termination or maturity of the lease, in which event the residual value of the reversionary interest of the taxpayer would have to be valued.

After the completion of the renovations, VMS sold its leasehold improvements to another company that was wholly-owned by the taxpayer, and the taxpayer transferred a 2/3 interest in the building to the same company. In this regard, Smith J stated (at para. 67):

As to the agreements …that were allegedly prepared and intended to mitigate the effect of the reassessments which are the subject of the present appeal, the Court agrees with the Respondent they are best described as an “ex post facto arrangement” which cannot be given any retrospective effect.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | no immediate taxable benefit to a landlord-shareholder from improvements made to the leased building by the tenant-corporation | 363 |

Black v. The Queen, 2019 TCC 135

The taxpayer (“Black”) controlled both Hollinger Inc. (“Inc.”) and Hollinger International Inc. (“International”). In 2004, the Delaware Court of Chancery ordered Black and Inc. jointly to pay to International damages equalling the amount of a “non-compete” payment of U.S$16.6 million that International had paid to Inc., plus interest thereon. Black used money borrowed from a third party (“Quest”) at 12.68% interest to pay all of such damages, but argued that he had advanced such funds on behalf of Inc. in satisfaction of an interest-bearing loan that he had orally agreed to make in the same amount to Inc. Although the Audit Committee of Inc. had approved the receipt of a loan from Black, the relationship between the independent directors of Inc. and Black deteriorated, and the alleged loan by him to Inc. was never formally documented – and following subsequent litigation, all of Black’s alleged rights in that regard were extinguished in a settlement in which he agreed to pay damages to Inc.

Rossiter CJ accepted Black’s position that the borrowed money had been used by Black to make a loan to Inc., so that Black was entitled to an interest deduction on his borrowed funds, stating: (at paras. 114, 128-129):

A reasonable observer would conclude that Black and Inc. intended for there to be a loan agreement, and the key players thought there was a binding loan agreement.

… Black and Inc. had [orally] agreed that the essential terms or repayment would match the Quest Loan so as to ensure Black was not out-of-pocket after stepping up to help Inc.

… Black and Inc. reached an agreement on the essential terms of the loan and left the details to be worked out at a later date. The fact that a formal document outlining those essential terms was to be prepared later on and signed … does not alter the validity of the earlier contract.

Rossiter CJ also found that there was an exchange of legal consideration, stating (at para. 132):

Black’s direct advancement of funds to International on Inc.’s behalf is not a bar to a loan existing between Black and Inc. …[An] advance on another party’s behalf can support a binding loan.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(c) - Subparagraph 20(1)(c)(i) | an ancillary income-earning purpose for making a loan whose terms were never finalized was sufficient to satisfy s. 20(1)(c)(i) | 659 |

| Tax Topics - General Concepts - Payment & Receipt | advance on another party’s behalf established a loan | 141 |

Trower v. The Queen, 2019 TCC 77 (Informal Procedure)

While Ms. Trover was separated from Mr. Trover, their jointly-owned company (Cove) paid amounts into their joint bank account. That same year, she ceased to be a shareholder and director of Cove, and in the subsequent year Mr. Trover, who was now Cove’s sole director and shareholder, purported to sign a resolution that retroactively treated a portion of the amounts paid into their joint bank account as having been a dividend payment by Cove to her. She had not agreed to this treatment.

In finding that Ms. Trover had not received this amount as a dividend (and in reversing the assessment including that amount in her income), Monaghan J stated (at paras 37-38, 46):

I accept that practice in the “real world” does not always conform with best practice. … [and] that directors and/or shareholders may make a decision and act upon it, even though they may not record that decision in writing until a later date. But that cannot be said to have happened here. All of the evidence is that the only two relevant people, Mr. and Ms. Trower, never agreed that the transfers would be dividends. The decision was a unilateral one by Mr. Trower. He did not have that power before he became the sole shareholder and director.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 82 - Subsection 82(1) - Paragraph 82(1)(a) | purported retroactive dividend would not have been agreed to by both directors at the time | 319 |

Bourgault v. The Queen, 2019 TCC 6

The written agreement for the purchase by the taxpayer of shares of a real estate corporation (“Quatre Saisons”) stated that the purchase price was to be satisfied by the payment to the vendor (“Placeval”) of 50%, then 30%, of the sales proceeds of real property of Quatre Saisons, with such proceeds to be paid to Placeval as commissions. Those percentage amounts in fact were paid by Quatre Saisons directly to Placeval and CRA assessed the taxpayer for shareholder benefits under s. 15(1). Two months after this assessment, the Quebec Superior Court issued an order for the rectification of the agreement to change the stated purchase price to $1. Before assessing, CRA was aware of the application for this judgment, but did not see fit to intervene, so that the Crown was not a party to the application.

Before granting the taxpayer’s appeal from the assessment, Favreau J first indicated that the Crown was not bound by the Court order “as neither the Attorney General of Canada nor the Minister was involved in the application” (para. 59), and also found that the judgment was not “res judicata.” He nonetheless found that “The parties justifiably obtained the judgment of the Superior Court to rectify the situation” (para. 62) in light of evidence that from the outset they had been consistently treating (e.g., in their financial statements and in invoicing procedures for services performed) the payments made by Quatre Saisons to Placeval as commissions rather than sales proceeds.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Rectification & Rescission | a rectification judgment was “justifiably obtained” and, therefore, followed for tax purposes | 404 |

De Vries v The Queen, 2018 TCC 166

The two individual shareholders of a corporation (“IPG”) were assessed under s. 160 regarding a dividend they had received from IPG. The validity of this assessment turned on whether an assessment of IPG under s. 224(4) for failure to comply with a demand under s. 224(1) effectively requiring it to pay to CRA a demand loan owing by IPG to a third party (“Houweling”) was valid.

Paris J accepted testimony that Houweling had orally agreed, prior to the receipt by IPG of the s. 224 demand, to postpone his right to receive repayment of the loan until the conclusion of a significant suit brought by IPG against a third party. He further found that “there has been an evolution in the doctrine of consideration in the context of contract modifications,” so that now “when parties to a contract agree to vary its terms, the variation should be enforceable without fresh consideration, absent duress, unconscionability, or other public policy concerns” (para. 57).

As the oral agreement of Houweling to postpone payment was contractually binding, the s. 224(4) assessment of IPG was invalid.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 224 - Subsection 224(1) | a corporate creditor’s oral agreement to postpone collection of his loan defeated a RTP encompassing that loan | 392 |

| Tax Topics - Income Tax Act - Section 160 - Subsection 160(1) | if requirement to pay assessment had been valid, it would have flowed through with a dividend | 302 |

Melançon v. The Queen, 2018 TCC 73

The taxpayer was the sole shareholder of a home construction company. After the CRA auditor noticed that amounts booked as “subcontractor expenses” had been paid to the taxpayer, such amounts were rebooked as shareholder advances. Before finding that these amounts had given rise to a taxable benefit under s. 15(1), Smith J quoted with approval the statement in Bibby v. The Queen, 2009 TCC 588 that:

None of [the cited cases], however, support the appellant’s proposition that adjustments to the expenses of a previous fiscal period, and concomitant changes to the income of the employee for a previous year, may be made on a retroactive basis … . It is, of course, permissible to enter into a second transaction of the kind dealt with by the Board in Brazelot, so long as it is accounted for in the fiscal period when it takes place. What is not permissible is retroactive implementation of tax planning by purporting to undo, or change, transactions that took place in an earlier period.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | failure of a house construction company to charge a mark-up on its costs incurred for shareholder work generated at taxable benefit/rebooking of “expense” as shareholder advance was retroactive tax planning | 348 |

Mammone v. The Queen, 2018 TCC 24, rev'd 2019 FCA 45

The CRA revocation of a registered pension plan (the “New Plan”) was invalid due to inadvertent failure to comply with the 30-day notice requirement in s. 147.1(12). Graham J found that the contemporaneous reassessment of the taxpayer under s. 56(1)(a)(i) for having purportedly transferred the commuted value of his (OMERS) pension plan to the New Plan was valid since the CRA’s subsequent issuance (well beyond the normal reassessment period) of a further retroactive deregistration of the New Plan effectively also retroactively validated such reassessment.

In this regard, he stated (at paras 14, 16, 17, and 19):

The facts necessary to support the reassessment did exist when the reassessment was issued because subsection 147.1(12) caused them to exist retroactively.

… I do not see any practical difference between a law being given retroactive effect and a fact deemed by law to exist retroactively being given retroactive effect.

…Parliament enacted legislation which gave the Minister the power to retroactively change facts. There is no suggestion that Parliament was unaware what it was doing.

…[The taxpayer] tried to distinguish rectification cases from his situation on the basis that rectification occurs as a result of a court order whereas the revocation of the New Plan’s registration occurred as a result of an exercise of the Minister’s power. With respect, I do not see any real difference between the two situations.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(4) | RPP revocation beyond the normal reassessment period retroactively validated an unsupportable reassessment under s. 56(1)(a)(i) | 414 |

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(9) | subsequent retroactive deregistration of RPP also retroactively validated an assessment factually made on basis of plan’s invalidity | 216 |

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(4) - Paragraph 152(4)(a) - Subparagraph 152(4)(a)(i) | subsequent retroactive deregistration of RPP would not establish carelessness in previous return filing | 197 |

| Tax Topics - Income Tax Act - Section 147.1 - Subsection 147.1(12) | subsequent deregistration of RPP beyond normal reassessment period nonetheless retroactively validated reassessment | 95 |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(1) - Paragraph 56(1)(a) - Subparagraph 56(1)(a)(i) | valid assessment for transfer to an RPP that was retroactively deregistered | 85 |

Cook v. The Queen, 2017 TCC 188 (Informal Procedure)

Whether the taxpayer was able to take a deduction for a dependent child depended on whether in the year in question she was considered to have a support obligation to her ex-spouse. They had agreed that she no longer was obligated to pay support, but this was not reflected in a court order until a subsequent year, although the court order was stated to have effect to the date of their support-cessation agreement. After noting conflicting authority on the point, Russell J stated (at para. 17) that he preferred the authority that the retroactive nature of the subsequent court order should be respected.

However, the taxpayer’ claim still failed on the ground that “no statutory language used in or in connection with subsection 118(1) indicates that the deductions may be prorated for a taxation year” (para. 26) – and here, the support obligation had been agreed to be terminated only partway through the year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 118 - Subsection 118(5) | court order retroactively terminating support obligation to the taxpayers’ agreement thereon respected – but s. 118(1) claim denied as entailing proration | 446 |

Gillen v. The Queen, 2017 TCC 163, aff'd 2019 FCA 62

A limited partnership was found to have immediately transferred the beneficial ownership of applications to the Saskatchewan government for potash exploitation rights (the “Purchased Applications and Purchased Permits”) to a corporation (“Devonian”) immediately upon entering into a sale agreement of the Purchased Applications and Purchased Permits with Devonian. In rejecting the taxpayer’s submission that until the subsequent completion of the transfer of the permits to Devonian (on their subsequent grant by the government), the partnership nonetheless was using the Purchased Applications and Purchased Permits in a business carried on by it, as required under s. 110.6(14)(f)(ii), D’Arcy J stated (at para. 122-3):

The Appellant appears to be ignoring the so-called “relation-back” theory. In Clem v. Hants-Kings Business Development Centre Ltd, 2004 NSSC 114 … the Court found (at paragraph 17) that the relation-back theory applied and that the vendor held the land in trust for the purchaser from the date of the agreement: “In other words, while the trust relationship between vendor and purchaser may be dubious before closing, once the agreement is completed the trust relationship is solidified retroactively. …’”.

In the present appeal, the transactions under the Subscription Agreement were closed. Therefore, the trust relationship, in the context of an executory contract, was solidified on the closing date, retroactive to the date the agreement was entered into, i.e. December 7, 2007.

In the FCA, Webb JA stated (at para. 50) that it was unnecessary to address the coments of D'Arcy J on the relation-back theory.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 110.6 - Subsection 110.6(14) - Paragraph 110.6(14)(f) - Subparagraph 110.6(14)(f)(ii) | property was not used in a business for s. 110.6(14)(f)(ii) purposes when it was beneficially acquired and dropped-down on the same day | 364 |

| Tax Topics - General Concepts - Ownership | test of beneficial ownership | 112 |

Deragon v. The Queen, 2015 TCC 294

Vendors agreed to sell shares for a sale price of $16 million, of which $2 million was payable in subsequent years only if an EBITDA condition respecting the sold companies was satisfied. The sales agreements contained a simple price adjustment clause based on the final audited shareholders’ equity of the sold companies. When a substantial deficiency in shareholders’ equity subsequently emerged, a negotiated Settlement Agreement concluded more than a year after the sale reduced the sale price by $0.5 million (to $15.5 million), increased the portion of the sale price payable under the reverse earn-out to $3 million – and provided that the vendors would reimburse a further portion of the sale price out of amounts received by them under the earn-out.

Favreau J respected the retroactive downward adjustment, pursuant to the Settlement Agreement, of the proceeds of disposition by $0.5 million but, by the same token, considered that the reverse earnout amounts of $3 million could not be excluded from the proceeds of disposition notwithstanding their contingent nature. However, he did not permit a downward adjustment to the proceeds of disposition for the contingent obligation to refund the sale price to the purchasers.

See summary under s. 54 – proceeds of disposition – para. (a).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Proceeds of Disposition - Paragraph (a) | sales proceeds reduced by subsequent price adjustment clause but included conditional sales proceeds | 480 |

| Tax Topics - Income Tax Act - Section 12 - Subsection 12(1) - Paragraph 12(1)(g) | reverse earnout amounts included in proceeds | 245 |

Charania v. The Queen, 2015 DTC 1103 [at at 614], 2015 TCC 80 (Informal Procedure)

An individual shareholder of a corporation ("B&N") thought that he was the beneficial owner of his home, but everyone else, including his accountants (and ultimately the Tax Court) considered that it was beneficially owned by B&N. Immediately before his sale of the home at a gain, it was transferred to him by B&N, with the excess of its book value over the outstanding mortgage amount being treated as a shareholder advance to him.

In reversing a shareholder benefit assessment of the taxpayer equal to the excess of the property's fair market value over its book value (and stating an "understanding" that the shareholder loan amount would be increased by this difference), VA Miller J stated (at paras. 40-41):

The Appellant was not aware of the error in this case nor did he sanction the error. He believed that the Declaration of Trust was followed and that he already owned the Property.

It is clear that B&N did not intend to confer a benefit on the Appellant. It transferred the Property to him and included an amount with respect to the Property as a loan receivable from him. The problem was that the amount included was incorrect. This problem arose as a result of an error made by [the accountants] not from any intent of B&N or the Appellant to commit a fraud.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | no shareholder benefit from erroneous property valuation | 314 |

Murphy Estate v. The Queen, 2015 TCC 8

An estate unsuccessfully argued that the effect of the settlement of some estate litigation pursuant to a consent order, which provided for the transfer of the interest in the deceased's RRSPs, by the children who otherwise would have received the RRSP assets, to the deceased's surviving spouse, was to retroactively access the rollover for RRSP transfers to a surviving spouse. In connection with noting that the children had not disclaimed their interests in the RRSPs, V. Miller J stated (at para. 33) that the effect of a disclaimer (being "a refusal to accept an interest which has been bequeathed to a disclaiming party") is "to void the gift as if the disclaiming party never received it."

See detailed summary under s. 146(8.8).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 146 - Subsection 146(8.8) | consent order for settlement of estate litigation did not have retroactive effect | 201 |

Al-Hossain v. The Queen, 2014 TCC 379

To secure mortgage financing for his home purchase, the appellant's friend ("Khandaker") agreed to co-sign the mortgage documents and to be placed on title as a co-owner. Less than three weeks after closing, they signed a statutory declaration stating that the appellant was the 100% beneficial owner and that Khandaker held a 0.01% interest in trust for the appellant. In rejecting a submission that the appellant was the sole beneficial owner (so that the new housing HST rebate was available to him), Lyons J stated (at para. 27):

The creation of a trust must be properly documented containing the requisite elements of a trust, dated, signed and in existence prior to or contemporaneous with the matter that is the subject of the trust arrangement.

See summary under ETA s. 254(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 254 - Subsection 254(2) | co-owner was not occupant and bare trust declaration was too late | 282 |

| Tax Topics - Income Tax Act - Section 104 - Subsection 104(1) | bare trust declaration was too late | 138 |

James v. The Queen, 2013 DTC 1135 [at at 705], 2013 TCC 164

The British Columbia Court of Appeal ordered a retroactive increase in the monthly amount of the support payments the taxpayer paid to his spouse, and was thus made to pay a lump sum equal to the monthly increases. Pursuant to the finding in Dale that retroactive court orders are binding on the Minister for tax purposes, C Miller J found that the lump sum represented payments "on a periodic basis," and were therefore support payments.

The present case was distinguishable from Peterson, in which there was insufficient proof that the lump sum in question represented periodic payments.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 56.1 - Subsection 56.1(4) - Support Amount | retroactive court orders | 113 |

Twomey v. The Queen, 2012 DTC 1255 [at at 3739], 2012 TCC 310

In 2005, the taxpayer sold 78 of his 100 common shares of an Ontario corporation ("115") to the other shareholder ("D.K."), and claimed the capital gains exemption. Both shareholders had believed from the time of the organization of 115 in 1995 that they each held 100 common shares of 115, and this belief was reflected in 115's financial statements and accounting ledgers. However, in connection with the sale in 2005, they discovered that (due to some communication difficulties relating to a change in the taxpayer's counsel) the corporate minute books recorded only one share as having been issued to each of them. A shareholders' resolution was passed "acknowledging the initial intent of the parties and issuing share certificates totaling 99 common shares of 115 to each of the Appellant and D.K. to correct the error without further consideration to be paid for them" (para. 9). CRA denied substantially all of the taxpayer's capital gains exemption claim on the basis that 77 of the 78 shares sold by him had been issued within 24 months of the time of their disposition, contrary to the requirement of para. (b) of the qualified small business corporation share definition.

Pizzitelli J. found that in fact all 200 common shares (including those sold by the taxpayer) had been issued in 1995. He stated (at paras. 19, 24):

We frankly have inconsistent corporate records at best, but the reality is that the correcting resolution quite clearly speaks to the other documents, clearly superseding them for the simple reason of correcting an error. ...

...The correcting resolution resulted in the records being amended to give effect to the true facts.

Accordingly, the taxpayer satisfied the 24-month requirement and was eligible for the capital gains exemption.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 110.6 - Subsection 110.6(1) - Qualified Small Business Corporation Share | records rectified to reflect 24-mo. hold for shares | 282 |

Sommerer v. The Queen, 2011 DTC 1162 [at at 845], 2011 TCC 212, aff'd 2012 FCA 207

In 1996, the taxpayer (a Canadian-resident individual) purported to sell shares of a Canadian company ("Vienna"), while retaining the rights to dividends and the voting rights, to an Austrian private foundation (privatstiftung) which had been contemporaneously formed and funded in Austria by his father, and with family members including the taxpayer named as beneficiaries. The selling price was equal to 1/2 the fair market value of the shares (i.e., 1/2 of $1.33 per share, or $0.665 per share). When the parties subsequently were advised that it was not legally possible to transfer shares excluding certain of the rights attaching to those shares, they amended the agreement (perhaps in 1998, but purportedly on a retroactive basis) so as to provide that the Vienna shares (including all of the rights attached to the shares) had been sold in 1996 at a price of $1.33 per share, and with the voting rights and the dividend rights on the shares then immediately being assigned by the foundation to the taxpayer for $0.665 per share.

C. Miller J found that these amendments were legally effective on a retroactive basis in light inter alia of a clause in the original sale agreement which provided that any parts of the agreement that were found to be unenforceable would be replaced so as to give effect to the business intent. Respecting a submission that the sale agreement instead was void for mistake, he stated (at para. 54);

With respect to the Vienna shares, there was no mistake that Mr. Sommerer owned the Vienna shares, and that he could transfer them; he simply could not carve out certain rights. But the parties could easily rectify the situation, which they did.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 75 - Subsection 75(2) | 233 | |

| Tax Topics - Statutory Interpretation - Treaties | 57 | |

| Tax Topics - Treaties - Income Tax Conventions | 176 |

Gestion Forêt-Dale Inc. v. The Queen, 2009 DTC 1378, 2009 TCC 255

After the accountants, over a year later, realized that a reorganization plan resulted in Part IV tax because two corporations were not connected at the time of the redemption of shares giving rise to a deemed dividend, they had resolutions prepared by a notary dated as of the date of the previous reorganization effective date purporting to issue special voting shares to the corporation receiving the deemed dividend, followed immediately thereafter by the shares' redemption. Favreau, J. interpreted these measures as retroactive tax planning, not the correction of a mistake in the implementation of the plan, and noted, in any event, that under the articles of the corporation issuing the voting shares, such shares were not redeemable, nor did it appear that such shares were validly issued as it appeared that the corporation did not receive the subscription price therefor.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 163 - Subsection 163(2) | 35 |

Gagnon v. The Queen, 2008 DTC 3111, 2006 TCC 194

The taxpayer originally signed an agreement for the sale of his half interest in a business (which was found to be held in a corporation) to his brother. Upon receiving the fifth and final cash instalment payment of the purchase price from the corporation, his brother purported in September 1997 to have the corporation retroactively issue two shares to the taxpayer in May 1995 and got the taxpayer to sign a second agreement providing for the purchase of those two shares by the corporation from the taxpayer in consideration for the four payments that the corporation had in fact made to him.

In finding that the taxpayer had received deemed dividends, Lamarre J. stated (at para. 22) that "a person can be declared a shareholder retroactively" and found that the second agreement was the one that prevailed as it "embodies the legal reality of the parties' contractual intent."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 84 - Subsection 84(3) | 137 |

Avotus Corporation v. The Queen, 2007 DTC 215, 2006 TCC 505

The taxpayer’s foreign affiliate had acted as the taxpayer’s agent for the purpose of carrying on business (and deducting the losses). Among other things, the taxpayer relied upon a retroactive agency agreement that was executed in early 1996 but “made effective as of the 20th day of July, 1994” (para. 13). The Court noted that the Minister had neither pleaded nor argued that the agreement was a sham; consequently, the Minister was deemed to have accepted the validity of the agreement (paras. 52-53). On the strength of the written agency agreement, the Court ruled in favour of the taxpayer.

The decision implicitly approves the validity of late-executed agreements, but the Court did not expressly comment further on that issue.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Evidence | 70 | |

| Tax Topics - Income Tax Act - Section 125 - Subsection 125(7) - Canadian-Controlled Private Corporation | tie-breaking vote of 50% non-resident shareholder | 92 |

| Tax Topics - Income Tax Act - Section 256 - Subsection 256(5.1) | 91 | |

| Tax Topics - Income Tax Act - Section 9 - Agency - Agency | 97 |

Lloyd v. The Queen, 2002 DTC 1493 (TCC)

Although the taxpayer signed an agreement with a holding company for the sale of shares in a company ("READ") to the holding company, Bowman T.C.J. found that the transaction was not completed, so that there was no disposition for purposes of s. 84.1. Among other things, none of the stipulated consideration was ever paid by the holding company and the directors of READ did not approve the transfer as required by the articles.

Bowman A.C.J. stated (at p. 1496):

"If the Minister can attack a transaction in this court or the Federal Court of Appeal on the basis it is legally ineffective or incomplete, so too can the taxpayer. There is no need to wait for a provincial court to set an incomplete or legally invalid transaction aside."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Tax Avoidance | taxapyer can argue legally ineffective transactions | 139 |

| Tax Topics - Income Tax Act - Section 84.1 - Subsection 84.1(1) | 76 | |

| Tax Topics - Income Tax Regulations - Schedules - Schedule II - Class 1 - Paragraph 1(q) | 70 |

Fallis v. The Queen, 2002 DTC 1242 (TCC)

Following an assessment of the taxpayer under s. 160 she alleged that there had been a transfer of a one-half interest in a property to her from her husband in the summer of 1991 when there was a discussion between them that she should receive the equity in the property rather than, as alleged by the Crown, three years later when, on a sale of the property, the husband signed a direction authorizing the purchaser to pay the closing proceeds to her. McArthur T.C.J. stated (at p. 1244):

"It takes more than an intention or uncertain conversation to transfer an interest in real estate. The law of contract requires a clear statement of transfer, acceptance and delivery."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 160 - Subsection 160(1) | 122 |

McAnulty v. The Queen, 2001 DTC 942 (TCC)

The time at which the taxpayer's employer agreed to issue shares to her was the time at which the president called her to his desk and told her that he was going to issue to her 45,000 stock options at a $1.50, rather than at the later date when a written stock option agreement was signed by the president and a related directors' resolution was passed. The president had ostensible authority to commit the company to issue shares to her (notwithstanding that the Board of Directors in fact had not delegated this authority to him as required by the stock option plan), and failure to comply, on the earlier date, with a stipulation in the stock option plan that the options be granted to her pursuant to a written and approved stock option agreement related to failure to comply with administrative rules rather than invalidating the grant.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 110 - Subsection 110(1) - Paragraph 110(1)(d) | unauthorized grant of rights | 200 |

Glassford v. The Queen, 2000 DTC 2531 (TCC)

O'Connor T.C.J. applied s. 8(3) of the Land Act (BC), which provided that "a disposition of Crown land is not binding on the government until the certificate of purchase ... is executed by the government under this Act" to find that the period of ownership of land by the taxpayer did not satisfy the 24-month holding period requirement in the definition of qualified farm property.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 9 - Capital Gain vs. Profit - Real Estate | 83 |

Horkoff v. The Queen, 97 DTC 621, [1996] 3 CTC 2737 (TCC)

Dividends that were purportedly paid to the taxpayers "as of" December 30, 1990 were dividend income to the taxpayers in their 1991 taxation years given that the dividends were not declared until February 13, 1991, the amount of the dividends was not known until that date, and the dividends would not have been declared or paid if a sale of shares of the corporation had not closed on that date.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 82 - Subsection 82(1) - Paragraph 82(1)(a) | back-dated dividend | 67 |

Leung v. MNR, 92 DTC 1090, [1992] 1 CTC 2110 (TCC)

In rejecting a submission of the Crown that the taxpayers were not assisted by a price adjustment clause, Kempo J. noted that they had addressed the fair market value of the shares in question, had noted the historical sales and earnings of the corporation, had considered the effect of a recent material event and had felt at the time that the value fixed by them (which later was established to be excessive) was reasonable.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Fair Market Value - Shares | 177 |

Voukelatos v. MNR, 92 DTC 1076, [1992] 1 CTC 2154 (TCC)

Following the exercise by the taxpayer of a "shot-gun" clause in the shareholders' agreement, it was understood by him and the other shareholder that the corporation would redeem the other shareholder's shares. However, the documents which were drawn up and signed called for the purchase of the other shareholder's shares by the taxpayer. When this was discovered by the taxpayer two years later, an amended agreement effective as of the earlier date was executed by all three parties providing for the transfer of the other shareholder's shares to the corporation for the same price.

Rip J. rejected an argument by the agent for the taxpayer that the defence of non est factum applied given that there was negligence on the part of the taxpayer in not reading the original agreement. The agent apparently did not argue that the subsequent amending agreement was a rectification of the first written agreement.

Seaman v. MNR, 90 DTC 1909, [1990] 2 CTC 2469 (TCC)

The taxpayer sold shares in 1983 to a trust for his children for proceeds of $388,000 paid by way of demand promissory note. After reassessment of the sale in 1988, he accepted the Minister's valuation of the shares at $921,500 and replaced the consideration by promissory notes payable over 10 years in that amount. The Minister appears to have ultimately accepted that the sale was subject to a price adjustment clause as reflected in the instruction leter of the accountants to counsel.

In declining to give retroactive effect to this replacement, as of a previous date, of the original demand promissory notes, Taylor J accepted (at p. 1911) the Minister's position that "the 1988 actions had completely altered a fundamental clause of the 1983 agreement , and an 'on demand' note (1983) could not be transformed into a series of promissory notes payable over ten years."

Amirault v. MNR, 90 DTC 1330, [1990] 1 CTC 2432 (TCC)

An amendment to the terms of a stock option plan that retroactively increased the exercise price of the options in order to satisfy the requirements of s. 110(1)(d) of the Act was held not to result in a rescission.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 110 - Subsection 110(1) - Paragraph 110(1)(d) | Increase to exercise price did not create new option | 159 |

May Estate v. MNR, 89 DTC 534, [1989] 2 CTC 2305 (TCC)

A court order became effective from the date it was pronounced rather than not taking effect until the date of issuance.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 70 - Subsection 70(6) | 64 |

Pellizzari v. MNR, 87 DTC 56, [1987] 1 CTC 2106 (TCC)

After finding that the taxpayer's employer had conferred a benefit on her in 1979 and 1980, Couture C.J. found that at the time of the decision (1986) it was not legally feasible to allow a retroactive deduction of those fees against loans that were outstanding in the books of the corporation. He stated (at. p. 59) "its fiscal years have been closed, and they reflected at the time its financial position as it legally existed then".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | benefit qua employee | 155 |

| Tax Topics - Income Tax Act - Section 6 - Subsection 6(1) - Paragraph 6(1)(a) | 112 |

Robert Bédard Auto Ltée. v. MNR, 85 DTC 643, [1985] 2 CTC 2354 (TCC)

Before going on to find that the taxpayer had disposed of property on the effective date for a lease-purchase agreement in which land and building was leased by the taxpayer to the lessee for five years with an obligation to purchase within that period of time for a specified price, Tremblay T.C.J. found that the date of sale of the land and building was the subsequent date when the lease was terminated by purchase and stated (at p. 648):

"Consequently, where the parties have agreed for a future time, it cannot be decided under civil law that the transaction took place at a time other than the one determined and executed by them. A bi-lateral promise does not have the effect of making the promisor-purchaser an owner; it merely allows him to become one when the contract of sale is executed or when the judgment in lieu of contract is rendered."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 13 - Subsection 13(21) - Disposition of Property | 92 |

Spence v IRC (1941), 24 TC 311 (Ct of Sess (1st Div'n))

The taxpayer sold shares to a third party in 1933 under a contract which he subsequently alleged to have been induced by fraud. In 1939 he obtained a judgment reducing (i.e., setting aside)the contract with effect from the date that it was made, together with orders that the shares be retransferred to him and the dividends which the purchaser had received be paid to him. After the judgment, the Revenue repaid the surtax assessed on the dividends in the hands of the fraudulent purchaser and assessed the taxpayer instead. In finding that the taxpayer was taxable on the dividends when they had been paid by the company, Lord President Normand stated (at p. 317):

In this case the party sued for rescission and in the end of the day he obtained a decree of reduction. The effect of that reduction was to restore things to their position at the date of the transaction reduced, with the result that as at that date and afterwards the successful pursuer in the action fell to be treated as having been the person in titulo of the shares which he had sold to the defender and therefore to have been in right of the dividends. No doubt it is true that in the interval the dividends had to be paid and were paid to the defender because his name stood in the register as the proprietor of the shares and no doubt also they were for the time being treated by the Inland Revenue as his income and while matters stood entire no other person had any right to the shares or to the dividends except the defender, Mr Crawford. But from the moment the reduction took place Mr Spence fell to be treated as having been throughout the proprietor of the shares and equally the person properly entitled to receive the dividends.

Waddington v. O'Callaghan (1931), 16 TC 187 (KBD)

A father instructed his solicitors that it was his intention to take in his son as a partner effective on the date of the instruction and requested them to prepare a deed of partnership. In finding that no partnership was intended to arise before the deed had been executed, Rowlatt J. stated (p. 197):

"When people enter into a deed of partnership and say that they are to be partners as from some date which is prior to the date of the deed, that does not have the effect that they were partners from the beginning of the deed [sic]. It cannot alter the past in that way. What it means is that they begin to be partners at the date of the deed, but then they are to take the accounts back to the date that they mentioned as from which the deed provides that they shall be partners."

Administrative Policy

7 September 2022 Internal T.I. 2022-0931081I7 - Retroactive support payments

A 2018 court order required retroactive child and spousal support payments to be made by an individual to a former spouse on a monthly basis for the period from 2013 until the date of the order but treated various payments previously made by the individual to the former spouse as being in satisfaction of this periodic obligation and also contemplated that such obligation would be satisfied in part by way of set-off against an obligation of the former spouse to pay an equalization amount to the individual respecting a division of matrimonial property.

Regarding whether the retroactive periodic support amounts would be deductible, CRA indicated that although the order, pursuant to the court’s legislative authority to do so, made the amounts payable retroactively on a periodic basis during the stipulated period (2013 to 2018), "payments made before the date of a court order or written agreement cannot be considered to be paid under the order or agreement.”

Regarding the deductibility of amounts paid after the time of the order, the Directorate stated:

[W]here the lump-sum amount is paid pursuant to a court order that establishes a clear obligation to pay retroactive periodic maintenance for a specified period prior to the date of the court order … the lump-sum payment will not, in and of itself, change the nature of the underlying legal obligation of periodic maintenance payments and, if all other requirements are met, the lump-sum amount paid will be deductible to the payer according to the formula in paragraph 60(b) … .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 60.1 - Subsection 60.1(3) | application of s. 60.1(3) to payments already made in the current and preceding year | 388 |

| Tax Topics - Income Tax Act - Section 60 - Paragraph 60(b) | CRA respects the effect of a court order providing that a lump sum payment was in satisfaction of a retroactive periodic support obligation | 276 |

14 January 2022 Internal T.I. 2021-0913891I7 - CERS - Sublease

Although the definition of “qualifying rent expense” for CERS (rent subsidy) purposes generally includes a requirement that the rent be paid “under a written agreement entered into before October 9, 2020,” the definition also clarifies that an assignment of a pre- October 9, 2020 after that date is not problematic. CRA dealt with the situation where a sublease was signed prior to October 9, 2020, but the consent of the landlord was not obtained until later. CRA (citing Sussex Square) noted that the sublease would instead be an assignment of the leasehold interest of the sublessor if the purported sublease was for all of the sublessor’s remaining term as head tenant– so that it would not matter if the assignment was regarded as occurring after October 9, 2020.

On the other hand, if it indeed was a sublease then, given that “the only parties to the sublease are the sublessor and the subtenant” it would be plausible that the sublease took effect before the deadline, unless further considerations were engaged, for example, the sublease contained a condition stipulating that the agreement would not take effect until the signature of the landlord was procured.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 125.7 - Subsection 125.7(1) - Qualifying Rent Expense | sublease is generally between sublessor and subtenant, so that landlord consent generally is not required (unless expressly stipulated) for the sublease to take effect | 253 |

20 January 2022 Internal T.I. 2021-0877511I7 - CERS- Written Agreement

The definition of “qualifying rent expense” for Canada emergency rent subsidy (“CERS”) purposes includes a requirement that the rent be paid “under a written agreement entered into before October 9, 2020” (subject to some accommodation of subsequent renewals or lease assignments). CRA indicated that the requirement for a pre- October 9, 2020 written agreement was met where a letter agreement to lease was entered into before that date, even though the “formal” lease was not executed until subsequently, provided that the letter agreement satisfied requirements that it “show a clear intention to create a binding and enforceable contractual relation, outline all the essential terms and conditions of the agreement, and demonstrate an acceptance in writing by both parties of the terms and conditions.”

That left the requirement that the rents be paid “under” the letter agreement rather than only under the later lease. CRA stated that this was “possible … assuming that the Lease includes the same enforceable and binding rights and obligations, and terms and conditions, as the [letter agreement].”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 125.7 - Subsection 125.7(1) - Qualifying Rent Expense | a lease could constitute a continuation of an agreement to lease | 264 |

GST/HST Notice 312 Proposed GST/HST Treatment of Supplies of Human Ova and In vitro Embryos May 2019

A proposed GST/HST amendment would zero-rate the supply of an ovum – which would have the effect of rendering the importation of an ovum as a non‑taxable importation. A further amendment will add the importation of in vitro embryos to the list of non-taxable importations.

Respecting the application of the ovum amendment, for example, CRA indicates:

[S]uppliers can stop charging GST/HST on supplies of human ova in accordance with the proposed amendment as of March 20, 2019. … [C]onsistent with its standard practice, the CRA is administering this measure on the basis of the proposed amendment [and similarly re

… However, the CRA cannot pay a rebate for an amount paid in error as or on account of tax until the proposed amendment becomes law.

A supplier who has charged or collected GST/HST on human ova supplied after March 19, 2019, must include that amount in the calculation of their net tax on their GST/HST return … .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Schedules - Schedule VI - Part I - Section 6 | 481 | |

| Tax Topics - Excise Tax Act - Schedules - Schedule VII - Section 13 | 390 | |

| Tax Topics - Excise Tax Act - Schedules - Schedule V - Part II - Section 1 - Institutional Health Care Service | assimilation of provision of ovum or embryo to single supply at fertility clinic of institutional health care service | 80 |

27 March 2018 Internal T.I. 2017-0691941I7 F - Investissement frauduleux – Fraudulent Investment

Individuals had “invested” in what turned out to be a Ponzi scheme under which for many years they reported annual income inclusions for interest which they were treated as having reinvested in the scheme. They sought to have their returns for those years adjusted in order to obtain a refund of the taxes they paid on such interest income.

The Directorate indicated that the interest had been required to be recognized in the years in which the individuals received or were entitled to receive it. It noted in passing that:

In the case of fraudulent Ponzi schemes, taxpayers may ask a court to cancel the loan agreement between the parties ab initio.

Because of the ab initio cancellation of the contract, it would be possible to conclude that the taxpayer concerned never received and was never entitled to receive interest income from the said contract. It would then be possible for the Minister to reassess for each taxation year affected by the cancellation of the contract provided that the time limits under paragraph 152(3.1)(b) or subsection 152(4.2) are satisfied.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(4.2) | s. 152(4.2) reversal of Ponzi interest inclusion must be applied for by 10th anniversary of the taxation year | 252 |