Subsection 95(1) - Definitions for this subdivision

Controlled Foreign Affiliate

Administrative Policy

2016 Ruling 2015-0571441R3 - Dutch Cooperative - 93.2 & 95(2)(c)

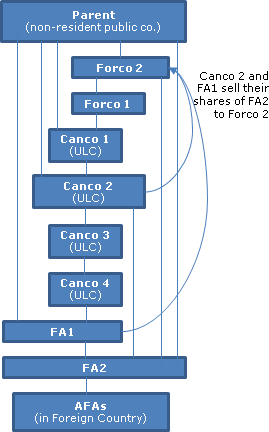

Forco 1 is held through three stacked Canadian partnerships (the bottom one, “CanGP 3”) by two taxable Canadian corporations (Canco 1D and Canco 1A) which, in turn, are indirect wholly-owned subsidiaries of a non-resident parent (“Parent”). Forco 1, which is unlimited liability company resident in Foreign Country 3, wholly owns Forco 2, which is resident in Country 3 and wholly-owns Forco 3, which is a limited liability company resident in Foreign Country 2. Parent wholly owns Forco 4, which is a limited liability company resident in Country 2. Forco 5 is a private limited liability company resident in the Netherlands and is directly owned by Forco 2, Forco 3 and Forco 4.

In the factual description, Forcos 1, 2 3 and 5 are described as a CFA of CanGP 3 and also as a FA of Canco 1A and Canco 1B by virtue of s. 93.1(1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(c) | rollover is available on joint drop-down of shares of a Dutch private limited liability company into a Dutch cooperative in consideration for respective credits to the membership accounts | 502 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Corporation | Dutch cooperative whose articles limited member liability was a corp | 263 |

| Tax Topics - Income Tax Act - Section 93.2 - Subsection 93.2(2) | membership interest in Dutch cooperative ruled to be shares | 92 |

| Tax Topics - Income Tax Act - Section 85.1 - Subsection 85.1(3) | joint contribution of shares of FA to Netherlands co-op in consideration for credits to their respective membership accounts deemed to be for share consideration | 57 |

28 August 2003 Internal T.I. 2003-0019767 F - Investissement dans une société étrangère

All the shares of Foreignco, which made investments in stock market shares, were held by Mr. A (apparently, non-resident). Mr. B (apparently, resident) had invested in Foreignco through his CCPC (“Canco”). However, as the governing legislation did not permit Canco to invest in Foreignco shares, the sums agreed by Canco were agreed, as an informal contractual matter, to be the consideration for “special warrants” to acquire shares of Foreignco, with such warrants being redeemable by the holder for the FMV of the corresponding Foreignco equity.

Before finding that the s. 94.1 rules applied, the Directorate indicated that Foreignco could not be a controlled foreign affiliate given that Canco did not hold any shares of Foreignco, and that s. 17 did not apply since, until such time as the redemption right was exercised, there was no debt owed by Canco.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 17 - Subsection 17(1) | redeemable convertible rights of a Canco investor in Foreignco had not been redeemed, so that they were not debt for s. 17 purposes and Foreignco was not a CFA | 141 |

| Tax Topics - Income Tax Act - Section 94.1 - Subsection 94.1(1) | inferred satisfaction of main reason test where all stock market investment income and gains were reinvested free of local tax | 377 |

22 July 2003 Internal T.I. 2003-0018027 F - Fondation du Liechtenstein

Mr. X formed a foundation (a “sifting”) under the laws of Liechtenstein, of which he was the life beneficiary, and his wife and children were the income and capital beneficiaries upon his death. The Directorate found that the foundation was a corporation for ITA purposes given its separate legal personality and limited liability of its founder and members, and went on to find that it should be treated as a CFA of Mr. X in whose capital stock he held 100 out of the 100 outstanding shares, so that his aggregate participating percentage was 100%, stating:

[A]lthough the Foundation's title to property is not divided into "shares”, we will consider that Foundation has a share capital of 100 issued shares and that each person who owns an interest in Foundation owns a number of shares that is proportionate to that person's interest in the Foundation ... .

[G]iven that Mr. X is the sole beneficiary of the capital and income of Foundation for his lifetime and that, pursuant to paragraphs 251(1)(a), 251(2)(a) and 251(6)(a) and (b), Mr. X does not deal at arm's length with the other beneficiaries of Foundation, namely, his wife and children, we are of the view that Foundation is a "controlled foreign affiliate" of Mr. X within the meaning of subsection 95(1). … It appears to us that in the circumstances you would be justified in considering that Mr. X holds 100% of the shares of the Foundation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Corporation | Liechtenstein sifting was a corporation rather than trust | 60 |

| Tax Topics - Income Tax Act - Section 94 - Subsection 94(3) | Liechtenstein siftung was corporation, not trust | 79 |

93 C.M.T.C - Q.1

It is not necessary to establish that the persons resident in Canada are acting in concert to control the affiliate. The threshold in s. 95(1)(a)(ii) is met if, through their collective holdings, they are in a position to control the affiliate.

Paragraph (b)

Administrative Policy

20 June 2023 STEP Roundtable Q. 7, 2023-0959581C6 - Deemed Resident Trust and the Resident Portion

49% of the shares of a non-resident corporation owned by a non-resident trust which has made a valid s. 94(3)(f) election were included in the resident portion, but the trust held 100% of the shares in all. CRA noted that s. 94(3)(f)(viii) provides that the resident portion trust and the non-resident portion trust are deemed to not deal with each other at arm’s length and s. 94(3)(a)(x) provides that a deemed resident trust is deemed to be resident in Canada throughout the particular tax year for purposes of determining whether a foreign affiliate is a controlled foreign affiliate (CFA) of the taxpayer. Accordingly, in light of s. (b)(ii) of the CFA definition (effectively deeming the resident portion trust to hold the shares of a non-arm’s length person), the corporation would constitute a CFA of the resident portion trust. Accordingly, its FAPI would be computed in the usual way based on its participating percentage (based on its 49% shareholding).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 94 - Subsection 94(1) - Resident Portion | illustration of the resident portion rules for a s. 94 trust that inter alia has lent to a resident beneficiary or earns FAPI | 492 |

| Tax Topics - Income Tax Act - Section 94 - Subsection 94(2) - Paragraph 94(2)(a) | contribution to NR trust where beneficiary pays expenses of trust property | 103 |

| Tax Topics - Income Tax Act - Section 94 - Subsection 94(2) - Paragraph 94(2)(g) - Subparagraph 94(2)(g)(iv) | application where a s. 94 trust lent to a resident beneficiary, and when loan repaid | 177 |

Excluded Property

Administrative Policy

27 March 2018 Internal T.I. 2015-0592551I7 - Excluded property status of partnership interest

Canadian-resident Parent wholly-owned Canco2 and Canco1. Two wholly-owned controlled foreign affiliates of Canco2 (“NR1” and “NR2”) established an Icelandic Sameignarfelag (“FORP”), which was viewed by CRA as a partnership. FORP used capital contributions from NR1 and NR2 to make loans within the affiliated group, with the interest thereon deemed under s. 95(2)(a)(ii) to be active business income to NR1 and NR2.

Next:

- NR1 purchased an additional interest in FORP from NR2,

- FORP disposed of its loans to another group company and

- distributed the cash proceeds thereof as a return of capital,

- NR1 made a dividend and capital distribution to Canco2

- Canco2 sold NR1 and NR2 to a wholly-owned CFA of Canco1 (“NR3”), and a non-resident subsidiary of Parent, respectively.

- All FORP’s remaining assets were distributed to its members

- FORP was dissolved under Icelandic law

- NR1 was liquidated and dissolved into NR3.

The taxpayer took the position that at the time it was disposed of the partnership interest of NR1 in FORP was not excluded property and, therefore, the capital gain or loss from the disposition was included in NR1’s foreign accrual property income (“FAPI”) in respect of CANCO1; and that as such gain was computed under s. 95(2)(f.14) in Canadian currency, therefore, the computation of the ACB of NR1’s partnership interest in FORP pursuant to s. 95(2)(j) and Reg. 5907(12) was to be computed in Canadian currency, including each capital contribution and reduction, earnings pick up, and distribution. Accordingly, NR1 computed a foreign accrual property loss (“FAPL”), which FAPL became a loss of NR3 upon the dissolution of NR1. On this basis, Canco1 has requested that this loss be applied to preceding taxation years.

After noting that the date of disposition of the FORP partnership interest was either 6 above by virtue of s. 98(2), or the dissolution date in 7 above, the Directorate stated:

[A] partnership interest held by a foreign affiliate of a taxpayer will be considered to be excluded property when the partnership would be a foreign affiliate of the taxpayer when the deeming rules in paragraphs (d) and (e) in the definition of “excluded property” are applied and if substantially all of the FMV of the property of the partnership itself satisfies the excluded property definition. …

[I]n determining whether [NR1’s] partnership interest is excluded property … any assets held by the partnership on which income was or would be recharacterized as active would qualify as excluded property under paragraph (c). Therefore, the Loans, while they were held by FORP, would have been excluded property.

The Directorate went on to find that if the partnership interest disposition date was 6, the cash held at that time did not qualify as an active business asset (noting that it “being used in a continuation of the active business activities undertaken by FORP, as it had never carried on an active business”); and that on the dissolution date no property was held – so that, either way, para. (b) of “excluded property” as modified by paras. (d) and (e) was not satisfied.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 5908 - Subsection 5908(10) | partnership interests no longer were excluded property on dissolution given prior disposition of s. 95(2)(a)(ii) loans/potential qualification of partnership interest under para. (c) ignored | 297 |

| Tax Topics - Income Tax Regulations - Regulation 5903 - Subsection 5903(5) - Paragraph 5903(5)(b) | foreign affiliate parent cannot carry back FAPLs generated by wound-up foreign affiliate | 389 |

| Tax Topics - Income Tax Act - Section 96 | Icelandic Sameignarfelag was partnership | 198 |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(f.14) | once partnership interests were no longer excluded property, the components of their ACB calculation was to be translated at the rates when those components first arose | 254 |

| Tax Topics - Income Tax Act - Section 98 - Subsection 98(2) | partnership interest disposition occurred no sooner than final distribution date | 79 |

2015 Ruling 2014-0536661R3 - Disposition of property by a foreign partnership

CRA ruled that a distribution of the assets of a mine held by the partnership did not give rise to foreign accrual property income provided that the assets were excluded property. The mine in question had been previously shut down, but now further reserves had been identified and there was a plan to resume operations. See summary under s. 95(1) – foreign accrual property income.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Foreign Accrual Property Income | reliance on excluded property exclusion on dissolution of Foreign LP as a result of the wind-up of its FA partners | 421 |

6 March 2015 Internal T.I. 2014-0549761I7 - Internally generated goodwill & excluded property

Is internally generated goodwill considered in determining whether shares of a foreign affiliate ("FA2") of a corporation resident in Canada qualify as "excluded property" of another foreign affiliate ("FA1") of the corporation?

CRA referred to the following position taken in 1988 respecting the "small business corporation" definition (after first referring to a similar position respecting s. 149(10)):

[T]he "all or substantially all" test will normally be satisfied if assets representing at least 90 percent of the fair market value of the assets of the corporation are used in an active business carried on by it. The assets of the corporation include goodwill, whether or not such goodwill has been purchased.

CRA then stated:

[I]nternally generated goodwill is property used by FA2 that should be taken into account in determining whether the shares of FA2 are "excluded property" of FA1. However, it must also be determined whether such goodwill is used by FA2 principally for the purpose of gaining or producing income from an active business carried on by FA2. This may, depending on the circumstances, require an apportionment of such use as between the active business of FA2 and the other activities of FA2

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 149 - Subsection 149(10) | unpurchased goodwill is taken into account | 96 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Small Business Corporation | unpurchased goodwill is taken into account | 105 |

15 January 2015 External T.I. 2014-0546581E5 - Partnership interest excluded property

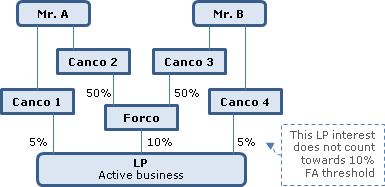

Mr. B wholly-owns Canco 3 and Canco 4, and Mr. A, who is unrelated, wholly-owns Canco 1 and Canco 2. Canco 2 and Canco 3 each holds 50% of Forco, which has a 10% LP interest in foreign LP, whose assets are all used in an active business. Canco 1 and Canco 4 each have direct 5% interest in LP – and the other partners of LP are third parties. Would Forco's partnership interest in LP be excluded property? CRA stated:

[B]y virtue of paragraphs (d) and (e) of the definition "excluded property" in subsection 95(1), LP is deemed to be a non-resident corporation having 100 shares of capital stock of which Forco owns 10%, for the purposes of the definitions "foreign affiliate" and "direct equity percentage". Consequently, the equity percentage of Canco 3 in LP is 5%, thereby satisfying the requirement in paragraph (a) of the definition "foreign affiliate" in subsection 95(1).

However… the requirement in paragraph (b) of the definition "foreign affiliate" is not met… because Canco 4's 5% interest in LP is not to be taken into account. Forco is the only partner of LP that is deemed to hold shares of LP for the purposes of the definition "excluded property". Consequently, LP would not be considered to be a "foreign affiliate" of Canco 3 and Forco's interest in LP would not qualify as "excluded property"… .

1 September 2009 External T.I. 2006-0168571E5 - Excluded property

Canco's wholly-owned subsidiary Forhold 2 has a 30% interest as general partner in LP1 which has a 15% LP interest in LP2 which, in turn, has 75% of the shares of Forco, substantially all of the asets of which are used principally for the purpose of producing income from an active business outside Canada. Cansub, which is wholly-owned by Canco, has a 25% LP interest in LP1. Forhold 1, which also is wholly-owned by Canco, directly holds 25% of Foco's shares. Would LP2 be considered to be a foreign affiliate of Canco for the purposes of the definition of "excluded property"? CRA stated:

LP1 is deemed to be a non-resident corporation under paragraph (d) of the definition of "excluded property" and paragraph (e) of the definition deems Forhold 2 to own 30% of the shares of that deemed corporation for the purposes of the definitions of "foreign affiliate and "direct equity percentage". Canco therefore has an equity percentage in LP1 of 30%, making LP1 a foreign affiliate of Canco for the purposes of the definition of "excluded property". As LP1 is deemed to be a foreign affiliate...LP2 is deemed to be a non-resident corporation under paragraph (d)...; LP1 is deemed to hold 15% of the issued shares of LP2 under paragraph (e).

…LP1 is considered to have a direct equity percentage of 15% in LP2. Accordingly, Canco has an equity percentage in LP2 that is not less than 1%, thereby fulfilling the requirement in paragraph (a) of the definition of "foreign affiliate". However… the requirement in paragraph (b) of the definition of "foreign affiliate" is not met in these circumstances and therefore LP2 cannot be considered a foreign affiliate of Canco. Paragraph (e) of the definition of "excluded property" only deems LP... [and] no other person...to hold shares in LP2... . [I]t follows that LP1 is the only holder of a direct equity percentage in LP2. ...[Respecting] if Canco is related to LP1 for the purposes of the definition of "excluded property" ... the deeming provisions in paragraphs (d) and (e) of the definition of "excluded property" do not speak to the matter of the de jure control of the "deemed corporation" and therefore do not apply to treat a partnership as a corporation for the purposes of determining if a partnership is related to a corporation. Accordingly, Canco would not be considered to be related to LP1 for the purposes of determining whether LP2 is a foreign affiliate of Canco for the purposes of the definition of "excluded property".

Having concluded that LP2 is not a foreign affiliate of Canco for the purposes of the definition of "excluded property", the shares of Forco held by LP2 are not property of a foreign affiliate of Canco and are therefore not excluded property.

21 September 2007 External T.I. 2007-0251651E5 - Excluded property

A Canadian resident individual owns 100% of a corporation ("FA") resident in the Netherlands which, in turn, has an interest in a partnership, all or substantially all of the property of which is used or held principally for the purposes of gaining or producing income from an active business carried on in Canada. FA will immigrate to Canada, resulting in a deemed disposition of the partnership interest under s. 128.1(1)(b). Is the partnership interest excluded property, and would any capital gain resulting from its disposition be disregarded in computing the FAPI of FA? CRA stated:

Pursuant to the definition of "excluded property"…a partnership interest held by a foreign affiliate of a taxpayer…will be considered to be excluded property provided that the fair market value of the partnership interest held by the foreign affiliate is not less than 10% of the fair market value of all interests in the partnership and all or substantially all of the property of the partnership is used or held by the partnership principally for the purpose of gaining or producing income from an active business. The definition does not stipulate that the active business must be carried on outside Canada. Further, a taxable capital gain realized by a foreign affiliate on the disposition of an excluded property would not, subject to certain exceptions that do not appear to be relevant…, be included in a foreign affiliate's FAPI for a taxation year.

1 November 2000 External T.I. 1999-0009725 - Foreign affiliates meaning of group

A foreign affiliate ("Holdco") owns all the shares of a second foreign affiliate ("Subco A") which, in turn, owns all the shares of a third foreign affiliate ("Subco B"). Subco A carries on an active insurance business in a foreign jurisdiction, and some of the investments (e.g., treasury bills) that are required to meet the minimum capital requirements are held in Subco B. The removal of any portion of these investments would have a destabilizing effect on Subco A since it would not meet regulatory and licencing requirements, and on this basis Subco B's income would be deemed to be active under s. 95(2)(a)(i).

The shares of Subco B will be excluded property provided that all or substantially all its assets were used or held by it principally for the purpose of gaining and producing income which by virtue of s. 95(2)(a)(i) was income from an active business.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(a) - Subparagraph 95(2)(a)(ii) - Clause 95(2)(a)(ii)(D) | 101 |

6 January 1999 External T.I. 9829785 - FOREIGN AFFILIATE-ACTIVE BUSINESS INCOME

Where a foreign subsidiary of Canco deposits a sum with a foreign bank to secure its guarantee of a loan made by the foreign bank to another foreign company in which Canco has an indirect 25% interest, with interest on the bank loan exceeding interest on the deposit by 22.5 basis points, income from the deposit will qualify under s. 95(2)(a)(ii)(B), with the deposit qualifying as excluded property.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(a) - Subparagraph 95(2)(a)(ii) - Clause 95(2)(a)(ii)(B) | 70 |

10 March 1998 External T.I. 9804895 - definition of excluded property

Where a grandchild foreign factoring subsidiary acquires substantially all its trade receivables from a foreign subsidiary of the taxpayer that itself carried on an active business, the trade receivables acquired by the factoring subsidiary would be excluded property "as those trade receivables are used principally for the purpose of gaining or producing income which is deemed to be active business income pursuant to subparagraph 95(2)(a)(ii)".

22 December 1997 External T.I. 9709775 - DEFINITION OF EXCLUDED PROPERTY

Intangible property that is capital property and that is used by a controlled foreign affiliate principally in producing deemed active business income under s. 95(2)(a)(ii) where such income is included in its exempt earnings, will qualify as excluded property.

18 June 1996 External T.I. 9523595 - EXCLUDED PROPERTY STATUS - PARTNERSHIP STRUCTURES

Example A

Canco owns 100% of Forhold, which has a 90% interest in a partnership (P1), whose only assets are 25% of the shares of a foreign operating company (Forco) and a 90% interest in a second partnership (P2). Substantially all of the property of Forco and of P2 is used principally for the purposes of producing income from their active businesses. CRA stated:

Any capital gain realized by Forhold on a disposition of its 90% interest in P1 would be excluded from its foreign accrual property income ("FAPI") because the interest in P1 would be considered "excluded property" as defined in subsection 95(1)… . Furthermore, any capital gain realized by P1 on a disposition of its 25% interest in Forco or its 90% interest in P2 would be excluded from the FAPI of Forhold, since its interests in Forco and P2 would also be "excluded property".

As noted at the Round Table session of the 1992 Tax Executive Institute Conference, the definition of excluded property was amended to enable a non-resident corporation in which shares of the capital stock are held by a partnership to qualify as a foreign affiliate of a taxpayer for purposes of the excluded property rules. The Department commented as follows:

This position is consistent with the definition of "excluded property" in paragraph 95(1)(a.1) in that it was considered necessary to enact, for purposes of paragraphs 95(1)(d) and 95(4)(a) as they apply to paragraph 95(1)(a.1), the deeming provisions in subparagraphs 95(1)(a.1)(iv) and (v) in order that where a foreign affiliate had an interest in a partnership and the shares of the capital stock of a corporation in which all or substantially all the assets were used in an active business were partnership property such shares could be considered excluded property.

Example B

Canco 1 owns 100% and 65% of Canco 2 and Canco 3, respectively. Canco 2 and 3 own 100% of Forhold 2, and Forhold 3, respectively. Forhold 2 has an interest of 10% in a partnership (P1), and Canco 3 and Forhold 3 have interests of 65% and 25% respectively in P1. P1's only assets are 25% of the shares of Forco) and a 90% interest in a second partnership (P2), both of whose property is used principally for the purpose of producing income from their foreign active businesses. CRA stated:

For the purpose of the excluded property rules P1 and P2 would be considered non-resident corporations. For the same purpose, in interpreting the definition of foreign affiliate in subsection 95(1) of the Act, Canco 2 has an equity percentage of 2.5% in Forco and 9% in P2 for the purpose of paragraph (a) of that definition, and Canco 2 has an equity percentage of 0% in Forco and 0% in P2 for the purpose of paragraph (b) of that definition. However, P1 which is related to Canco 2 has an equity percentage of 25% in Forco and 90% in P2 for the purpose of paragraph (b) of the definition of foreign affiliate. Therefore, for the purpose of the excluded property definition, Forco and P2 are foreign affiliates of Canco. Accordingly, any capital gain realized by P1 on a disposition of its 25% interest in Forco or its 90% interest in P2 would be excluded from the FAPI of Forhold 2, since its interests in Forco and P2 would be excluded property pursuant to that definition in subsection 95(1) of the Act.

Articles

Paul Barnicke, Melanie Huynh, "FA's LP Interest: Excluded Property?", (2015) vol. 23, no. 4 Canadian Tax Highlights, 4-5

Alternative result in 2014-0546581E5 if additional partnership interest held by related Cdn corp through an FA (p. 5)

If Canco 4 [in 2014-0546581E5] owned its 5 percent interest in the LP through a wholly owned FA, presumably the CRA's answer might be different. If the postamble of the "excluded property" definition is applied to Canco 3 as a taxpayer, on these assumed facts Canco 3 should be able to count the 5 percent owned by Canco 4's FA. This result follows because the postamble in the "excluded property " definition refers to an interest in a partnership that is owned by an FA of a taxpayer, and that taxpayer can be any taxpayer (Canco 4, in this case) and not only the taxpayer (Canco 3) referred to in the preamble.

Shawn D. Porter, David Bunn, "Excluded Property and Foreign Rollovers: Interpretive Issues in the Partnership Context", International Tax Planning (Federated Press), 2010, p.1060

Potential bases for overcoming non-excluded property (“EP”) finding in 2006-0168571E5 re absence of related partnerships concept (p. 1063)

Notwithstanding the position taken by the CRA in the 2009 TI [2006-0168571E5] and the absence of relatedness rules for partnerships in the Act, the EP definition could be interpreted in a manner that better achieves its purpose. Two interpretive approaches are discussed below.

Inferring voting rights (p. 1063)

It is suggested that where a single class of shares is deemed, such class could reasonably be viewed as a class of voting shares. If this is the case, the common law principle of de jure control can be applied to the deemed corporation in determining whether the taxpayer and the deemed corporation are related. The fact that the mid-amble to the EP definition limits the deemed corporate fiction to the definitions of "foreign affiliate" and "direct equity percentage" should not be interpreted restrictively as the concept of related persons is fundamental in determining whether the 10% equity percentage threshold in paragraph (b) of the FA definition is met….

Control through GP (p. 1064)

Alternatively, one could argue that Forhold 2, in its capacity as the General Partner ("GP") of LP1, controls the affairs of LP1. Since paragraph (d) of the EP definition deems LP1 to be a corporation, it is suggested that Forhold 2, and consequently Canco, could be considered to be related to LP1 on the basis that Forhold 2 controls LP1. [fn 17: Paragraph 251(2)(b)] In other words, if the deemed shares of LP1 are not voting shares, then the private law results should govern for purposes of determining whether Forhold 2 controls LP1. a deemed corporation.

Paragraph (a)

Administrative Policy

8 October 2010 Roundtable, 2010-0373531C6 F - Qualification de bien exclu - 95(1)

In a scenario where an FA earns active business income and income other than active business income, how can it be determined whether a licence it uses in the totality of its business is used principally for the purpose of gaining or producing income from an active business carried on by it? CRA responded:

[Under] paragraph (a) … of "excluded property" … [t]here must in particular be income from its business, rather than more generally "income from an active business" as that term is defined in subsection 95(1). …

[T]he following should be considered in particular: the use that is actually made of the property in the course of the various activities of the FA, the income from the use or possession of the property, the intention of the FA with respect to the use and holding of the property, the terms and conditions of ownership of the property, the nature of the activities of the FA and current practices in the particular industrial sector.

Articles

Tina Korovilas, Drew Morier, "Non-Corporate Vehicles in the Foreign Affiliate Context", 2018 Conference Report (Canadian Tax Foundation), 20:1 – 114

Potential qualification of partnership interest under EP – para. (a) if (e) unavailable (p. 20:55)

- CRIC 1 owns 50 percent of the shares of an FA (FA 1);

- FA 1 has a 10 percent interest (by FMV) in a partnership that carries on an active business for the purposes of the FA regime;

- CRIC 2 has a 5 percent interest (by FMV) in the partnership.

FA 1 is disposing of its partnership interest. However, this interest is not EP under paragraph (b), since CRIC 1’s equity percentage in the deemed non-resident corporation is only 5 percent for the purposes of the EP definition. Under the partnership postamble (as noted above), only FA 1 is deemed to own shares of the deemed non-resident corporation. Consequently, the partnership would not be considered an FA of CRIC 1 and FA 1’s interest in the partnership does not qualify as EP.

However, in this scenario, there are good arguments to be made that paragraph (a) of the EP definition should apply to FA 1’s partnership interest, without recourse to paragraph (b) and the deemed non-resident corporation status that arises under the partnership postamble. A partnership interest may qualify as EP under paragraph (a) when the partnership carries on an active business, on the basis that the partnership interest is property held by FA 1 principally for the purpose of gaining or producing income from an active business carried on by FA 1. [fn 165: In…7-2672…the CRA stated that, “in our view a good argument can be made that a partnership interest that does not otherwise qualify as excluded property, say because of the 10 percent limitation, could qualify as excluded property under subparagraph (i).” Subparagraph (i) is now paragraph (a) of the EP definition.] Under partnership law in common-law provinces, all members of a partnership are considered to be carrying on any activity carried on by the partnership [fn 166: Robinson Trust …98 DTC 6065… nos. 9722815…2000-0059145,…2001-0090655;…2002-0149977,…and 2001-0070605,…See also 9636835…confirmed…2012-0453991C6(f)…after this principle was challenged in the case of Quebec civil-law partnerships in Laval (Ville de) c. Polyclinique médicale Fabreville, s.e.c., 2007 QCCA 426; and Ferme CGR enr., s.e.n.c. (Syndic de), 2010 QCCS 2; aff’d 2010 QCCA 719] (including limited partners that do not take part in the management of the business).]

Paragraph (b)

Articles

Raj Juneja, Pierre Bourgeois, "International Tax Issues That Get in the Way of Doing Business", 2019 Conference Report (Canadian Tax Foundation), 36:1 – 42

Circularity element in determining excluded property status where material upstream loans

- Where an acquisition target is a holding company that has numerous operating subsidiaries that have made substantial upstream loans to it, an element of circularity can arise in determining whether the shares of such operating subsidiaries and, thus, the shares of the holding company, are excluded property. (p. 36: 20-21)

Potential multiplier effect of bad assets in a multi-tier structure

- Due to an upward cascading effect in a multi-tier structure of FAs, a non-resident target with non-excluded property of only 3% on a consolidated basis nonetheless might not have its shares qualify as excluded property. It may be possible to engage in purification transactions to achieve excluded property status. (pp. 36: 21-22)

Paragraph (c)

Articles

Tina Korovilas, Drew Morier, "Non-Corporate Vehicles in the Foreign Affiliate Context", 2018 Conference Report (Canadian Tax Foundation), 20:1 – 114

Initial concern re s. 95(1) – EP – para. (c) that property of the partnership could not qualify (pp. 20:56-59)

When the EP definition was first proposed in 1982, the draft provision raised concerns that property of the partnership could not qualify as property of the FA. … The tax community expressed a concern that where an FA has an interest in a partnership that carries on an active business, the partnership interest of the FA could qualify as EP, but partnership property used for the purpose of gaining or producing income from an active business could not so qualify … [so] that where a partnership of which a foreign affiliate is a member disposes of capital property used principally for the purpose of gaining or producing income from an active business, the property does not qualify as excluded property … .

… Although the current definition continues to refer to property “of the” FA, it has been accepted that the partnership postamble resolves the concern that arises where partnership property has been disposed of. The CRA’s approach seems to be that if the gain realized by a partnership from the disposition of property would be EP if the partnership qualified as another FA of the taxpayer (on the basis that the partnership is deemed to be a non-resident corporation and the FA member has the requisite interest in the partnership), the gain’s character as a gain from the disposition of EP is retained when it is allocated to the FA member.

[U]nlike other provisions, the EP definition does not expressly require “ownership” of particular shares. It requires only that property be “of the” FA. Pursuant to Canadian common-law partnership principles, each member is considered to have an undivided interest in the property of the partnership.

Paragraph (e)

Articles

Tina Korovilas, Drew Morier, "Non-Corporate Vehicles in the Foreign Affiliate Context", 2018 Conference Report (Canadian Tax Foundation), 20:1 – 114

Narrowness of the postamble to the excluded property (EP) definition (p. 20:53)

[A]lthough the partnership postamble applies for the purposes of the FA definition as it does for the purposes of the EP definition, it must be recalled that it deems only shares of the deemed non-resident corporation to be owned by a member of the partnership that is an FA of any taxpayer. No other person—including the CRIC itself or a CRIC related to the taxpayer —is deemed to own shares of the deemed non-resident corporation, [fn 163: The CRA has confirmed this interpretation ... 2014-0546581E5 ...] and, without ownership, the “direct equity percentage” definition in subsection 95(4) cannot apply. There does not appear to be a policy reason for the more narrow application, with the result that the implications are incongruous when compared with a scenario in which the partnership is instead a corporation.

This can give rise to unexpected EP issues in split-ownership scenarios.

Foreign Accrual Property Income

Cases

Loblaw Financial Holdings Inc. v. Canada, 2020 FCA 79, aff'd 2021 SCC 51

After noting (at para. 48) that "the exclusions [in the s. 95(1) investment business definition] generally further the fundamental purpose of the FAPI scheme, which is to appy only to passive income," Woods JA went on to find that a regulated Barbados bank subsidiary of the taxpayer, which used equity funds from the taxpayer to invest mostly in short-term debt, came within this exclusion. She further stated (at para. 86):

Finally, the Crown submits that if Loblaw Financial’s position is accepted, the very target of the FAPI legislation, which is an investment portfolio held offshore, would be exempt. The concern is a valid one, but it does not enable a court to give the legislation a broader interpretation than it can reasonably bear. A gap in the legislation is for Parliament to address. It appears that Parliament may have now done so with the addition of subsection 95(2.11) of the ITA, but this is not relevant for purposes of this appeal.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Investment Business - Paragraph (a) | a Barbados bank sub conducted its business of investing in short-term debt principally with arm’s length persons | 602 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Business | receipt of equity funds from parent was not part of Barbados bank’s business | 188 |

| Tax Topics - Statutory Interpretation - Redundancy/ reading in words/ speaking in vain | error to apply an unexpressed intention | 172 |

| Tax Topics - Statutory Interpretation - Drafting Style | no additional requirements should be inferred in legislation drafted with “mind-numbing detail” | 172 |

| Tax Topics - General Concepts - Separate Existence | subsidiary did not manage its funds on behalf of parent | 161 |

See Also

A.G. Canada v. Le Groupe Jean Coutu (PJC) Inc., 2015 QCCA 838, aff'd 2016 SCC 55

The taxpayer implemented a plan, to neutralize the effect of FX fluctuations on its investment in a U.S. sub, that overlooked FAPI considerations – so that interest on a loan made by the sub back to Canada was included in the taxpayer's income. Schrager JA found that rectification was not available. See summary under General Concepts – Rectification.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Rectification & Rescission | transactions achieved purpose of neutralizing FX fluctuations and were not intended to avoid FAPI | 256 |

Rostland Corp. v. The Queen, [1995] 2 CTC 2276, 96 DTC 1973 (TCC)

Two indirect wholly-owned foreign subsidiaries of the taxpayer ("Texas" and "BV") held non-recourse promissory notes of an arm's length partnership that had purchased a hotel previously owned by a third indirect subsidiary ("Arizona"). Mogan TCJ. found that in light of the highly leveraged nature of the purchase by the partnership, the passive character of the partnership's involvement in the hotel (in contrast with the extensive involvement of personnel of Arizona in the continued management of the hotel), and the terms of the note (including, the payment of interest only out of cash flow generated by the hotel in the taxation years in question, and the potential for substantial participation payments in future years), "that Texas and BV (as holders of the notes) were engaged in a kind of joint venture with the Partnership concerning the operation of the hotel business". Accordingly, the interest earned was income from an active business rather than property income.

Canada Trustco Mortgage Co. v. MNR, 91 DTC 1312, [1991] 2 CTC 2728 (TCC)

The taxpayer's Netherlands subsidiary, whose income was derived from Canadian mortgages which it had purchased from, and were administered by, its Canadian affiliates, and from related bank deposits, was found to be engaged in an active business. Although the rebuttable presumption that corporate income is business income had no application, what was done in Canada regarding the mortgages by the affiliates constituted the carrying on by the taxpayer of an active business "through the instrumentality of independent contractors". Searches for new business opportunities also constituted a commercial activity.

Alexander Cole Ltd. v. MNR, 90 DTC 1894, [1990] 2 CTC 2437 (TCC)

A wholly-owned U.S. subsidiary of the taxpayer, which had been engaged (through U.S. limited partnerships) in commercial real estate projects, sold the properties for consideration consisting primarily of long-term wrap-around mortgages. The net interest income derived from the wrap-around mortgages was not income from an active business given that the sales resulted from the decision of the U.S. subsidiary to get out of the active business of owning and managing commercial shopping and office enterprises, and in the absence of any evidence that the U.S. subsidiary was entering into an active investment business. "The active businesses ceased upon the sale of the capital assets. It cannot be said that the mortgages were incidental to the active businesses" (p. 1897).

King George Hotels Ltd. v. The Queen, 81 DTC 5082, [1981] CTC 87 (FCA)

It was "stressed that whether a business is an active or inactive one is ... [a question] of fact dependent on the circumstances of each case ... . It cannot be said ... that income from 'other than an active business' necessarily means that derived from a business that 'is in an absolute state of suspension'". [C.R.: 129(4)(a)(ii)]

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 129 - Subsection 129(4) - Canadian Investment Income | 54 |

Administrative Policy

2015 Ruling 2014-0536661R3 - Disposition of property by a foreign partnership

Current structure

Canco wholly owns Foreign Holdco, which wholly owns Foreign Subco1, the owner and operator of Mine 1 in Country X. Foreign Subco1 holds Foreign LP through two wholly owned subsidiaries: Foreign Subco3 as general partner; and Foreign Subco4 as limited partner. Foreign LP owns Mine 2, which was previously closed, but as a result of exploration and the identification of reserves, it is anticipated that further surface mining will be undertaken (and the relevant mining permits have been issued). Foreign LP also holds Foreign Corp, all or substantially all of whose assets are used in an active business, and a third-party note receivable previously received for a land sale (the "Note").

Proposed transactions

- Foreign LP will distribute Mine 2 to Foreign Subco3 and Foreign Subco4 in proportion to their respective partnership interests.

- Foreign Subco1 will authorize the liquidation and dissolution of Foreign Subco3 and Foreign Subco4, which will distribute all of their assets to Foreign Subco1 as liquidating distributions, and Foreign Subco1 will assume all their obligations and then be dissolved.

- As a result of Foreign Subco1 thereby becoming the sole member of Foreign LP, Foreign LP will effectively be dissolved so that its property will be considered to be distributed to Foreign Subco1, and Foreign Subco1 will assume all the obligations of Foreign LP.

Additional Information

The above steps will be non-taxable transactions under X's tax law. Each liquidations in 2 will be a designated liquidation and dissolution.The shares of Foreign Corp, the partnership interests in Foreign LP and the Mine 2 properties will be excluded property at the relevant times. The Note is not excluded property so that the taxable capital gain from its disposition will be FAPI. The disposition of the partnership interests upon the dissolution of Foreign LP will result in a capital gain determined under s. 95(2)(f). The fair market value of each of the Mine 2 buildings and the shares of Foreign Corp does not exceed their respective adjusted cost base to Foreign LP, so that no capital gain is anticipated on their disposition by Foreign LP.

Ruling

No FAPI will result from the distribution in 1 of Foreign LP's Mine 2 properties and from the disposition of the shares of Foreign Corp upon the dissolution of Foreign LP in 3 provided these properties are excluded property.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Excluded Property | still dormant mine as excluded property | 65 |

30 August 2004 External T.I. 2003-000135

A grandchild foreign subsidiary of Canco ("FA2") is wound-up into an immediate foreign subsidiary of Canco ("FA1") at a time that a note owing by FA2 to FA1 exceeds the asset value of FA2 net of other liabilities. The Directorate commented:

"If the fair market value of the FA1 Note at the time it is settled is less than the lesser of the principal amount of the FA1 Note and the amount for which the FA1 Note was issued, section 80 of the Act could apply if, had interest been paid or payable by FA1 to FA2 in respect of the FA1 Note, clause 95(2)(a)(ii)(D) of the Act would not apply. With respect to the application of section 80 and paragraph 95(2)(g.1) of the Act, it is our view that the FA1 Note is a 'commercial debt obligation' within the meaning assigned under subsection 80(1) of the Act unless, had interest been paid or payable in respect of the FA1 Note, such amount of interest would have been deemed to be nil for the purposes of computing foreign accrual property income ("FAPI") of FA2 under descriptions A and D of the definition of FAPI ...."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | 148 | |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(g.1) | 37 |

26 March 2004 External T.I. 2003-0047061E5 - Foreign currency and FAPI

Where a foreign affiliate earns foreign accrual property income (rental income) of U.S.$50,000 throughout a year, the average exchange rate for the year is 1.5 and the exchange rate the end of the year at the time a dividend of the earnings is paid to the Canadian taxpayer is 1.3, then the "A" amount in the fapi calculation would be Cdn.$75,000, but the fapi for the year would be Cdn.$70,000 due to a capital loss of Cdn.$10,000 (and deduction under "E" of $5,000) determined under s. 39(2).

27 November 1998 External T.I. 9822835 - FOREIGN AFFILIATES - FOREIGN ACCRUAL TAX

Where U.S. taxes are paid by U.S. C.-corp. (which is a foreign affiliate of the Canadian taxpayer) in respect of the investment business of a U.S. LLC in which it has a 90% interest, such taxes will not qualify as foreign accrual tax under subparagraph (a)(ii) of the definition in s. 95(1). However, when the U.S. LLC pays a dividend to the U.S. C.-corp and such dividend is attributable to the income in respect of which the U.S. tax was paid by the U.S. C.-corp., then at the time the dividend is paid the U.S. tax would qualify as foreign accrual tax under subparagraph (a)(ii) of the definition.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Foreign Accrual Tax | US tax paid by USco on income of LLC not FAT unless income distributed to USco | 291 |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Underlying Foreign Tax - A - Subparagraph (iii) | tax paid by C-Corp CFA regarding its share of LLC income is not added to its UFT until that income is dividended to it | 143 |

17 January 1991 T.I. (Tax Window, Prelim. No. 3, p. 2, ¶1094)

The interest income of a controlled foreign affiliate on a foreign currency deposit denominated in a currency which was depreciating rapidly relative to the Canadian dollar was to be measured on the basis of the average exchange rate for the year, without deduction for the accrued foreign exchange loss on the deposit, in light of the fact that s. 39(2) govern the recognition of foreign exchange losses on capital account.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 39 - Subsection 39(2) | 42 |

85 C.R. - Q.15

After the Burri decision, whether income of a foreign affiliate is active business income or property income will continue to be determined by the facts of each case.

Articles

Joint Committee, "Guidance on International Income Tax Issues raised by the COVID-19", 11 June 2020 Joint Committee Submission

COVID 19 relief suggested re FAPI issues

The Guidance on international income tax issues raised by the COVID-19 crisis addresses whether COVID Travel Restrictions could result in a non-resident being considered to carry on business in Canada or have a Canadian permanent establishment, but should also address the following foreign accrual property income (FAPI) issues:

- Income from an active business will be deemed to be FAPI where it is carried on through a permanent establishment in a “non-qualifying country.”

- Furthermore, question as to whether income from an active business carried on by an FA resident in a DTC will be included in its exempt earnings will often depend on whether that income is attributable to business activities carried on in a DTC, which could be affected by the stranding of employees in a non-DTC.

- Similarly, one of the exceptions from the “investment business” definition looks to whether the activities of the foreign affiliate are regulated under the laws of “each country in which the business is carried on through a permanent establishment in that country”. Similar issues may arise under other provisions of the FAPI rules.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Exempt Earnings - Paragraph (d) | 115 | |

| Tax Topics - Treaties - Income Tax Conventions - Article 5 | 93 | |

| Tax Topics - Income Tax Act - Section 153 - Subsection 153(6) | Impact of COVID travel restrictions on day count tests for qualifying non-resident employee status | 67 |

Mark Coleman, Daniel A. Bellefontaine, "Forgiveness, Foreign Affiliates and FAPI: a Framework", Resource Sector Taxation (Federated Press), Vol. X, No. 1, 2015, p.694

Application of forgiven amount only to reduce losses (p. 697)

[O]ne of the main distinctions between the FAPI debt forgiveness regime and the ordinary debt forgiveness regime is that an income inclusion can arise under the ordinary regime where the debtor does not have sufficient attributes to grind in the year. In contrast, under the FAPI regime, if the debtor does not have a sufficient amount of attributes to absorb the forgiven amount in the year the debt is forgiven, the excess will be carried forward indefinitely to reduce attributes that arise in the future.

Ordering of loss application (pp. 697-8)

[T]he FAPI regime does not specify the order in which attributes are reduced in the same way that subsections 80(3) to (12) do. However, this is not to say that FAPLs and FACLs are treated equally with respect to attribute reductions….

Pursuant to the definition of FAPI, the amounts included in elements E and F.l (i.e., an affiliate's FACLs and FACL carryforwards and carrybacks) are limited to the total taxable capital gains included in element B for that year. In other words, if there is no taxable capital gain included in element B for the year, elements E and F. 1 will be equal to nil, even if the affiliate has current or prior year allowable capital losses that are otherwise deductible in computing FAPI. Thus, there is a preference within the FAPI debt forgiveness regime to reduce FAPLs, since only FAPLs will be reduced in a year where no taxable capital gain arises to the affiliate. Moreover, in years where FACLs are available for reduction, there should always be an offsetting taxable capital gain, meaning that the forgiven amount will still absorb the affiliate's FAPLs or result in an unsheltered taxable capital gain.

Immediate FAPI for income account forgiveness (p. 699)

[F]rom the FAPI perspective, it is therefore important to identify income account debts incurred in the course of earning income from property or from a business other than an active business, as the forgiveness of such debts could result in net FAPI as opposed to merely reducing the affiliate's FAPLs or FACLs.

Mitchell Sherman, Kenneth Saddington, "100 1 Damnations!", Corporate Finance, Volume XVIII, No. 3, 2012, p. 2126, at 2129

"Now that the provision [s. 100(1)] applies to dispositions to non-residents, with which a CFA is almost certain to transact, FAPI implications warrant greater consideration."

Gordon Funt, Joel A. Nitikman, "FAPI and Debt Forgiveness - Now You See It, Now You Don't", CCH Tax Topics, No. 1724, 24 March 2005.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | 0 | |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(g.1) | 0 |

Melanie Huynh, Eric Lockwood, "Foreign Accrual Property Income: A Practical Perspective", International Tax Planning, 2000 Canadian Tax Journal, Vol. 48, No. 3, p. 752.

A

Administrative Policy

5 June 2018 External T.I. 2017-0738081E5 - Interest exp of foreign affiliate holding company

The sole activities of FA1, a wholly-owned foreign affiliate of Canco, are to use money borrowed from an arm’s length bank to buy all the shares of a corporation (FA2) carrying on an exclusively active business in a designated treaty country, and use exempt dividends from FA2 to service the bank interest and pay exempt dividends to Canco. CRA confirmed that FA1 would generate foreign accrual property losses equal to the bank interest.

Such FAPLs would generate a taxable deficit. When asked whether Canco could choose to not deduct this interest expenses (so as not to generate FAPLs), CRA responded, yes, the s, 20(1)(c) deduction is discretionary, but added that:

[I]f Canco does not deduct an amount of interest in computing FA1’s FAPI/FAPL for the year in which that interest is paid or payable, that interest may not be deducted in computing FA1’s FAPI/FAPL for any subsequent year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(f) | Canco may choose not to deduct interest expense of a CFA so as not to generate a FAPL | 406 |

31 July 2014 Internal T.I. 2014-0536581I7 - Foreign affiliate fresh start rules

An grandchild FA subsidiary of the taxpayer (FA2), which carried on both an investment business, generated royalties from licensing its IP (which had been stepped up under s. 95(2)(k.1) both to its wholly-owned subsidiary engaged in an active business (which was deemed in FA2’s hands under s. 95(2)(a)(ii)(B)(I) to be active business income) and to third parties (which was FAPI). The Directorate found that the s. 20(1)(b) and other applicable deductions would be made first before determining the allocation of FA2's business income which was recharacterized under s. 95(2)(a)(ii) and that portion which remained as FAPI - so that in effect, only a portion of the s. 20(1)(b) deduction sheltered the FAPI.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Leasing Obligation | licensed IP | 68 |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(a) - Subparagraph 95(2)(a)(ii) - Clause 95(2)(a)(ii)(B) | licensed IP | 101 |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(k) | fresh start rule applies even where the indirectly acquired subsidiary (FA2) carried on a passive IP licensing operation in the preceding year | 637 |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(2) - Paragraph 95(2)(f.1) | deductions taken for whole year before carve-out under para. (f.1) | 165 |

Paragraph (b)

Administrative Policy

5 October 2017 Internal T.I. 2015-0614021I7 - 214(16) deemed dividend

A portion of the interest paid by CanCo to ForCo, which is a controlled foreign affiliate of the Canadian parent of CanCo, is not deductible pursuant to s. 18(4) and is deemed by s. 214(16) to have been paid as a dividend (with CanCo designating under s. 214(16)(b) which particular payment is deemed to be the dividend.)

CRA noted that, as per its preamble, s. 214(16) only applies for Part XIII purposes, so that s. 214(16) would have no effect on CanCo’s LRIP or GRIP balances nor alter the character of the income received by ForCo as interest for foreign accrual property income purposes.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 214 - Subsection 214(16) | Interest that is denied under the thin cap rules and recharacterized as dividends is still interest for FAPI and LRIP/GRIP purposes | 202 |

27 June 2008 External T.I. 2007-0247551E5 - FAPI and Part XIII Tax

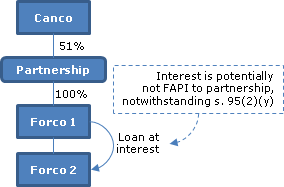

Two wholly-owned U.S.-resident subsidiaries of Canco (CFA1 and CFA2) carry on a U.S. active business through a U.S. general partnership (FP) which, in turn, holds NRCo (U.S.-resident and owning investment property) and Holdco (a taxable Canadian corporation). Periodically, NRco and Holdco pay cash dividends to FP ("Foreign Dividends" and “Canadian Dividends”), which are then distributed by FP to CFA1 and CFA2. All entities have calendar year ends.

After noting that NRCo was a foreign affiliate of Canco for s. 113 purposes, but of FP for s. 91 purposes, and that s. 91 applied to include FAPI in the income of FP and also in the income of Canco in respect of such FAPI when allocated by FP to CFA1 and 2, CRA went on to state:

[S]ince NRco is not a FA of Canco for the purpose of computing the FAPI of CFA1 and CFA2 vis-à-vis Canco, the Foreign Dividends received by CFA1 and CFA2 from NRco through FP would not be excluded from the computation of the FAPI of CFA1 and CFA2 by virtue of item A(b) of the definition of FAPI.

However, after taking into account [Reg.] 5900(3) …, since in computing the income of CFA1 and CFA2 FP is treated as if it were a separate person resident in Canada, subsection 91(5) of the Act would apply to permit a deduction by FP of the Foreign Dividends received by FP with the result that, with respect to such Foreign Dividends, there is no net income from property that would be included in the value of "A" in the definition of FAPI with respect to CFA1 and CFA2.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 96 | DRUPA partnership | 38 |

| Tax Topics - Income Tax Regulations - Regulation 5900 - Subsection 5900(3) | partnership between 2 CFAs was a Cdn-resident person for s. 91(5) purposes | 68 |

| Tax Topics - Income Tax Act - Section 92 - Subsection 92(1) - Paragraph 92(1)(a) | double ACB recognition of FAPI at partnership level and at level of Canco shareholder of CFA partners | 230 |

| Tax Topics - Income Tax Act - Section 91 - Subsection 91(5) | s. 91(5) deduction eliminated net FAPI inclusion to CFA members of foreign partnership receiving foreign dividends from partnership subsidiary | 107 |

Articles

Ian Bradley, Seth Lim, "The Updated Hybrid Mismatch Rules", International Tax Highlights (Canadian Tax Foundation and IFA Canada), Vol. 3, No. 1, February 2024. p. 2

Double taxation under A(b) (p. 3)

- The inclusion in foreign accrual property income (FAPI) of a foreign affiliate (FA) by virtue of A(b) of the FAPI definition of a dividend paid to it by another FA that is deductible under foreign tax laws tends to produce double taxation given that the there is no deduction in the FAPI of the payer FA for the amount of the dividend included in the recipient’s FAPI.

Denial of foreign tax under FTCG rules (pp 3-4)

- Where the hybrid mismatch rules include a payment in an FA’s FAPI or taxable surplus, the foreign tax credit generator rules (set out in ss. 91(4.1) to (4.7) and Regs. 5907(1.03) to (1.07)) will often deny relief for foreign tax on that payment.

- This is so even where relief would be provided in a comparable scenario involving a Canadian recipient (for instance, that of a Canadian corporation which is denied an s. 113 deduction under s. 113(5) for a dividend from an FA because the dividend was deductible under foreign tax law except that it receives a deduction under s. 113(6) for a (relevant tax factor) multiple of any foreign withholding tax on the dividend.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 227 - Subsection 227(6.3) | 168 |

Paragraph (c)

Administrative Policy

2025 Ruling 2024-1030121R3 - FA Inversion

Under a sandwich structure, a Canadian Opco (Cansub) was wholly-owned by Foreign Parentco, which in turn was held by both Canadian shareholders including four Cancos who were unrelated to each other and to whom it was a foreign affiliate, as well as by non-resident shareholders.

The structure was to be unwound essentially by having the shareholders transfer their Foreign Parentco shareholdings to a new Canadian holding company (New Canco). Such a transfer would occur, in the case of the Canadian shareholder transfers, under s. 85(1), with the Cancos electing at an amount that would access the exempt surplus of Foreign Parentco using the s. 93(1) election.

Foreign Parentco would pay a dividend-in-kind of its Cansub shares to New Canco; and New Canco would then transfer its Foreign Parentco shares to Cansub on an s. 85(1) rollover basis.

Rulings included:

- Pursuant to s. 212.1(1.1)(a), Foreign Parentco would be deemed to receive a dividend from CanSub on the payment of the dividend in kind equal to the excess of the FMV of the distributed CanSub shares over their paid-up capital (PUC).

- Such deemed dividend would be excluded from “A” of FAPI by virtue of the para. (c) exclusion for taxable dividends; and would also be excluded from Foreign Parentco’s proceeds of disposition for purposes of “B” of the FAPI definition by virtue of the exclusion in para. (k) of “proceeds of disposition” for taxable dividends.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 212.1 - Subsection 212.1(1.1) - Paragraph 212.1(1.1)(a) | application to dividend-in-kind of Cansub by foreign parent to new Cdn holdco for foreign parent shareholders | 543 |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Foreign Accrual Property Income - B | para. (k) – proceeds of disposition exclusion for a s. 212.1(1.1) deemed dividend received by the FA on paying a dividend-in-kind of its Cansub to its Cdn Holdco | 245 |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Exempt Surplus - A - Subparagraph (v) | A(v) inclusion in exempt surplus for a s. 212.1(1.1) deemed dividend received by the FA (with exempt surplus) on paying a dividend-in-kind of its Cansub to its Cdn Holdco | 233 |

B

Administrative Policy

2025 Ruling 2024-1030121R3 - FA Inversion

Under a sandwich structure, a Canadian Opco (Cansub) was wholly-owned by Foreign Parentco, which in turn was held by both Canadian shareholders including four Cancos who were unrelated to each other and to whom it was a foreign affiliate, as well as by non-resident shareholders.

The structure was to be unwound essentially by having the shareholders transfer their Foreign Parentco shareholdings to a new Canadian holding company (New Canco). Such a transfer would occur, in the case of the Canadian shareholder transfers, under s. 85(1), with the Cancos electing at an amount that would access the exempt surplus of Foreign Parentco using the s. 93(1) election.

Foreign Parentco would pay a dividend-in-kind of its Cansub shares to New Canco; and New Canco would then transfer its Foreign Parentco shares to Cansub on an s. 85(1) rollover basis.

Rulings included:

- Pursuant to s. 212.1(1.1)(a), Foreign Parentco would be deemed to receive a dividend from CanSub on the payment of the dividend in kind equal to the excess of the FMV of the distributed CanSub shares over their paid-up capital (PUC).

- Such deemed dividend would be excluded from “A” of FAPI by virtue of the para. (c) exclusion for taxable dividends; and would also be excluded from Foreign Parentco’s proceeds of disposition for purposes of “B” of the FAPI definition by virtue of the exclusion in para. (k) of “proceeds of disposition” for taxable dividends.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 212.1 - Subsection 212.1(1.1) - Paragraph 212.1(1.1)(a) | application to dividend-in-kind of Cansub by foreign parent to new Cdn holdco for foreign parent shareholders | 543 |

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Foreign Accrual Property Income - A - Paragraph (c) | A(c) exclusion for a s. 212.1(1.1) deemed dividend received by the FA on paying a dividend-in-kind of its Cansub to its Cdn Holdco | 245 |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Exempt Surplus - A - Subparagraph (v) | A(v) inclusion in exempt surplus for a s. 212.1(1.1) deemed dividend received by the FA (with exempt surplus) on paying a dividend-in-kind of its Cansub to its Cdn Holdco | 233 |

C

Administrative Policy

23 August 2023 Internal T.I. 2021-0882371I7 - Dividend payment and 94.1(1)(g)

A wholly-owned non-resident subsidiary (“CFA”) of Canco owned 50% of the common shares of a non-resident corporation (“FA”) which were assumed to constitute offshore investment fund property (“OIFP”). CFA received annual dividend distributions from the OIFP. Headquarters rejected Canco’s argument that a dividend paid by CFA to Canco generated a deduction pursuant to s. 94.1(1)(g) from the imputed income inclusion to Canco under the OIFP rules pursuant to s. 94.1(1)(f). The effect of C of the FAPI formula was that the OIFP rules generated FAPI to CFA, and Canco then picked up its share of such FAPI – and this combined operation of the FAPI and OIFP rules was not affected by dividends paid by FA to the CFA (inter-FA dividends are excluded form FAPI) nor was it affected by any dividends paid by CFA to Canco.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 94.1 - Subsection 94.1(1) - Paragraph 94.1(1)(g) | there is no reduction under s. 94.1(1)(g) for dividends paid by the CFA/ consolidation provided of FAPI – C and s. 94.1(1)(g) language | 317 |

Foreign Accrual Tax

Administrative Policy

28 May 2025 IFA Roundtable Q. 5, 2025-1063771C6 - Computation of FAT

If a foreign affiliate (FA) carries on a business in a foreign county and pays tax to that country on income which the ITA segregates into income from a business other than an active business and active business income, how will the determination of what portion of the foreign tax paid “may reasonably be regarded as applicable to” foreign accrual property income (FAPI) of FA in accordance with the foreign accrual tax (FAT) definition be made?

Would foreign deductible amounts be allocated to the two streams of income on the same basis regardless of whether they arose in the taxation years before FA became a foreign affiliate of Canco (the “pre-acquisition amounts”) or after?

CRA indicated that it would consider it reasonable to compute FAT by multiplying the total amount of foreign tax paid to the foreign jurisdiction by the foreign affiliate for its taxation year by a fraction:

- the numerator of which is the net income of the foreign affiliate for the taxation year computed under the foreign tax laws from the activities that generate FAPI for Canadian income tax purposes (the “FAPI business”); and

- the denominator of which is the total net income of the foreign affiliate computed under the foreign tax law.

Thus, for the purposes of computing the numerator it is necessary to first identify the activities that would form part of FAPI business, and then the gross income under the foreign tax rules from that FAPI business is to be computed, with that amount then being reduced by the total amount of deductions that are allowed under the foreign tax law and claimed by the foreign affiliate in the taxation year that may reasonably be regarded as directly applicable only to the FAPI business; this amount should also be reduced by the prorated amount of deductions (again allowed under the foreign tax law and claimed by the foreign affiliate) that would not reasonably be regarded as applicable to either the FAPI business or any other income-generating activities, such as overhead or head office expenses.

The same approach is applied in respect of amounts which arose prior to foreign affiliate becoming a foreign affiliate of Canco.

If there were any tax credits that reduced the foreign tax liability of FA, the above formula might have to be modified or a case-by-case approach might be required.

2022 Ruling 2020-0859851R3 - Foreign accrual tax and underlying foreign tax

Transactions

Canco (a Canadian-resident subsidiary of a Canadian public company) wholly-owns a US corporation (FA1), which owns some of the limited partnership units of a US limited partnership (USLP1) (with other LP units held by arm’s-length and non-arm’s length investors). Essentially, the only asset of USLP1 is its holding of all of the limited partnership interest in USLP2. USLP2 holds all the common shares of FA2, which is a US private REIT (wholly owned by USLP2 other than a small quantity of preferred shares held by third parties) which fully distributes its taxable income for US tax purposes (“US taxable income”). FA2 invests directly or through intermediate LPs in LPs or LLCs (the “Property Owners”) investing directly in rental properties. Third parties will acquire shares or units in various of the Property Owners.

US taxable income

Where a Property Owner is an LLC (a “Property FA”), it will be disregarded for US tax purposes if wholly owned by an intermediate LP or FA2 or as a partnership if there are also third-party owners. Each directly-owned Property FA of USLP2, or of an intermediate LP, will be a CFA of that partnership. FA1, FA2 and each Property FA carry on an investment business. FA1 will include in its US taxable income its share of the US taxable income of USLP1, which will include the distributions received by it from FA2 (which will distribute all of its US taxable income). In addition to actually distributing US taxable income, FA2 might declare a consent dividend, i.e., a dividend that is not actually paid but is deemed under US tax law to be distributed to shareholders on the last day of the given taxation year and then deemed to be contributed to FA2 (as additional paid-in capital) on the same day.

Dilution of interests in USLP2

The proportionate economic interest of FA1 directly or indirectly in USLP2 is expected to decline over time due to arm’s length investors subscribing for USLP1 or USLP2 units, so that FA2 and the Property FAs will eventually cease to be foreign affiliates of Canco for the purposes of the “specified provisions” described in s. 93.1(1.1). FA2 will remain a foreign affiliate of USLP2.

Rulings

- US income tax paid by FA1 on FA1’s share of the distributions paid by FA2 and on any consent dividends will be “foreign accrual tax” (as defined in s. 95(1)) applicable to amounts that are included in Canco’s income under s. 91(1) in respect of the FA1 shares, to the extent that those distributions and the consent dividends can reasonably be regarded as distributions of amounts that are included, directly or indirectly, in computing income of USLP2 under s. 91(1).

- Provided that, at any time in a particular taxation year, the total equity percentage in FA2 of Canco, and of persons related to Canco taking into account the rules in s. 93.1(1) is at least 10%, such US income taxes paid by FA1 will not be underlying foreign tax of FA1 in respect of Canco by reason of the application of Reg. 5907(1.03).

- Conversely, if this 10% test is not met, such US income tax will be underlying foreign tax of FA1 in respect of Canco to the extent that FA1’s share of the FA2 distributions and of any consent dividends can reasonably be regarded as distributions of amounts that are included, directly or indirectly, in computing income of USLP2 under s. 91(1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1.03) | application of the underlying foreign tax rules to the investment of a CFA in a US private REIT through tiered US partnerships based on equity percentage in that REIT | 420 |

11 June 2013 STEP Roundtable, 2013-0480321C6 - 2013 STEP Question 6 US LLCs - FAPI, FAT and FTCs

Is the US tax paid by a Canadian-resident taxpayer on the income (which also is foreign accrual property income) of an LLC which is owned by it (and is a controlled foreign affiliate) considered to be foreign accrual tax in respect of the LLC?

CRA noted that as the US tax paid is a tax paid by the taxpayer and not by the LLC, it would not qualify as FAT and, furthermore, that arranging for the LLC to actually makes the tax payments to the IRS would not change this result as "it is implicit that any tax paid by the affiliate is, in fact, the affiliate's tax and not simply a payment on behalf of another person… ."

However, any amount included under s. 91(1) in respect of the FAPI would be considered income from sources in the US for purposes of ss. 20(11) and 126(1), so that an individual taxpayer could deduct under s. 20(11) any portion of the US tax paid for the year in excess of 15% of the s. 91(1) income inclusion. "Any excess [i.e., the 1st 15%] will be eligible for a foreign tax credit under subsection 126(1) and any of the excess US tax paid that cannot be utilized by the foreign tax credit may be deducted from income pursuant to subsection 20(12)." If, the taxpayer is a corporation:

any US tax paid in respect of [its] share of the income of the LLC would not be creditable for purposes of subsection 126(1) nor deductible for purposes of subsection 20(12) because the tax would be paid by a corporation in respect of income from a share of the capital stock of a foreign affiliate of the corporation. However…a deduction under paragraph 113(1)(c) would be available in respect of the US tax paid by a corporation resident in Canada in respect of the income of an LLC where a dividend distribution out of taxable surplus is received from the LLC.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 113 - Subsection 113(1) - Paragraph 113(1)(c) | 176 | |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(12) | deduction for US tax on LLC income which also is FAPI | 161 |

5 September 2013 External T.I. 2011-0431031E5 - Guatemala's taxes

A Guatemalan-resdent foreign affiliate paid tax on gross revenue at a rate (for 2013) of 5% up to a low threshold (approx. Cdn. $3,925) and 6% above that. This tax qualified as an "income or profits tax" given that it was imposed under the same "Guatemalan Income Tax Law" which:

...allows the taxpayer to annually choose whether to pay tax on its gross revenue or to pay tax on its net income or profits. ... In this way the amount of tax that would be paid on net income or profits acts as the maximum amount of tax that would be payable in a particular year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 126 - Subsection 126(7) - Business-Income Tax | 130 | |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Earnings | tax imposed on revenue rather than income | 118 |

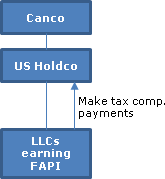

8 April 2004 Internal T.I. 2003-0037291I7 - US LLC and Regulation 5907(1.3)

A wholly-owned US C-corp subsidiary (US Holdco) of a taxable Canadian corporation wholly-owned two LLCs, which earned only foreign accrual property income, with their income being included in that of US Holdco for Code purposes. Under a tax sharing agreement, each group member paid its respective tax costs as if it had filed a separate return, with the amount of this hypothetical tax distributed accordingly - e.g. should an LLC be in a loss position, that LLC would receive compensatory payments from the other group members that represented the hypothetical tax refund.

As all the US tax paid by US Holdco was on its own account and not that of the LLCs (who were flow-through entities), the compensatory payments would not qualify as foreign accrual tax under s. (a)(i) of the FAT definition in s. 95(1), given the requirement that the tax be paid by the particular foreign affiliates (the LLCs). However:

[W]hen the LLCs distribute income to US Holdco such distribution would be characterized as a dividend. The portion of any income or profits tax paid by US Holdco that pertains to the earnings of an LLC which are distributed to US Holdco by way of dividend would, in our view, qualify as FAT under subparagraph (a)(ii)....

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Dividend | 82 | |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1.3) | 260 |

15 December 1998 External T.I. 9819355 - FOREIGN AFFILIATES - FOREIGN ACCRUAL TAX

Usco (100% owned by Canco) realized FAPI on the gain from the disposition in Year 1, of a partnership in which it has a 50% interest, of a rental property. No gain was realized for Code purposes as a replacement property was acquired. In Year 2, the replacement property was sold giving rise to U.S. tax but no further FAPI. CRA stated: