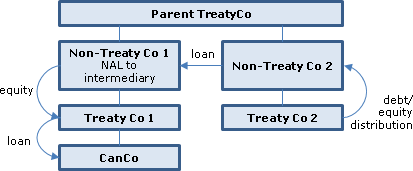

Where CanCo receives an interest-bearing loan from its immediate parent (Treaty Co 1), which is funded by equity from the parent (Non-Treaty Co 1) of Treaty Co 1 residing in a non-Treaty county which, in turn, is funded by a loan from a non-Treaty affiliate of Non-Treaty Co 1, this latter loan will be described in s. 212(3.1)(c)(i)(B) as a loan owing by a person (Non-Treaty Co 1) who does not deal at arm's length with the intermediary (Treaty Co 1).

Non-Treaty Co makes a non-interest-bearing loan to its parent (Treaty Co) to fund an interest-bearing loan to the Canadian-resident parent of Treaty Co (CanCo). The interest on the latter loan will be subject to 25% withholding tax on the basis that it is deemed by s. 212(3.1) to be paid to a non-arm's length person (Non-Treaty Co). The interest received by Treaty Co will be foreign accrual property income to it. Quaere whether CanCo will be entitled to a foreign accrual tax deduction under s. 91(4) for the s. 212(3.1) withholding tax which is factually applicable to the interest received by Treaty Co but which may be considered to be payable by Non-Treaty Co under s. 212(1)(b).

If a loan by U.S. Parent to its "grandchild" Canadian ULC sub (held e.g.,, through a C-Corp sub) is funded by a loan by an LLC sub ("Opco") of U.S. Parent, 25% withholding tax will apply under s. 212(3.1)(d) given that a direct loan by Opco to ULC would be subject to the hybrid entity rule (Art. IV (7) of the Canada- U.S. Treaty).

Non-Treaty Co makes a non-interest-bearing loan to its parent (Treaty Co) to fund an interest-bearing loan to the Canadian-resident parent of Treaty Co (CanCo). The interest on the latter loan will be subject to 25% withholding tax on the basis that it is deemed by s. 212(3.1) to be paid to a non-arm's length person (Non-Treaty Co). The interest received by Treaty Co will be foreign accrual property income to it. Quaere whether CanCo will be entitled to a foreign accrual tax deduction under s. 91(4) for the s. 212(3.1) withholding tax which is factually applicable to the interest received by Treaty Co but which may be considered to be payable by Non-Treaty Co under s. 212(1)(b).