Cases

Tusk Exploration Ltd. v. Canada, 2018 FCA 121

The taxpayer, a Canadian exploration company, unsuccessfully argued that it was not subject to Part XII.6 tax on Canadian exploration expenses (“CEE”) that it had purported to renounce under the look-back rule - but which were now admittedly not eligible for look back because the flow-through share investors were non-arm’s length – because the reference in Part XII.6 to CEE that it “purported” to renounce under the rule referred only to expenses which had been validly rather than invalidly renounced under the look-back rule.

Because the non-arm’s length shareholders were denied the CEE that they had claimed for the previous year, interest was imposed on their resulting increased liability for that year. Since it was also taxed under Part XII.6, the taxpayer submitted that this effectively resulted in double taxation as “interest” (with Part XII.6 tax being viewed as similar to interest) would be collected twice.

In rejecting this further submission, Webb JA stated (at para. 37):

There is also no indication that Parliament intended to put the parties back into the same position that they would have been in if the renunciations to the non-arm’s length shareholders would not have been made. There are other provisions of the ITA dealing with non-arm’s length parties where the result would effectively be double taxation. [Discussing ss. 69(1)(a) and (b) and the stating:] Therefore, the potential for double taxation exists in the ITA when transactions are completed between parties who do not deal with each other at arm’s length. The potential for double taxation in this case could be reduced if Tusk Exploration could benefit from the deduction in computing its income for a particular year provided in paragraph 20(1)(nn) of the ITA for any Part XII.6 tax paid in respect of that year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 211.91 - Subsection 211.91(1) | Part XII.6 tax was payable on CEE purportedly renounced on a look-back basis to NAL shareholders | 515 |

| Tax Topics - Income Tax Act - Section 69 - Subsection 69(1) - Paragraph 69(1)(a) | double taxation can result from non-arm’s length transactions such as under s. 69(1) | 301 |

| Tax Topics - Income Tax Act - Section 66 - Subsection 66(12.6) | only a PBC can renounce | 61 |

Bakorp Management Ltd. v. Canada (National Revenue), 2016 FCA 74

After noting (at para. 23) that the interpretation advanced by the taxpayer would have the effect of generating the accrual of refund interest to the taxpayer (respecting its 1995 taxation year) and eliminating of interest on underpaid tax (respecting its 1993 taxation year) for “a significant overlapping period in relation to the same amount,” Webb JA stated (at para. 23):

It could not have been the intention of Parliament that a single amount could, for the same period of time, give rise to both a reduction of interest payable on overdue taxes for one year and also give rise to refund interest for another year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 187 - Subsection 187(2) | overpayment of Part IV tax for a subsequent year did not cut off interest for its underpayment in the previous year before application of the overpayment by CRA | 395 |

Imperial Oil Ltd. v. Canada, 2004 DTC 6702, 2004 FCA 361, rev'd 2006 SCC 46

After finding that the taxpayer was entitled to deduct 75% of the difference between the Canadian- dollar equivalent of a U.S. dollar debenture at the time of its issuance by the taxpayer, and the Canadian-dollar equivalent of the amount repaid at maturity measured at the exchange date prevailing at the time of repayment under s. 20(1)(f)(ii), Sharlow J.A. found that the taxpayer was prohibited by s. 248(28) from deducting the remaining 25% under s. 39(2), by virtue of s. 248(28).

Holder v. Canada, 2004 DTC 6413, 2004 FCA 188

The taxpayer designated an elected amount of $50,010 in an election under s. 110.6(19) in respect of shares that were non-qualifying real property and whose fair market value was nominal, with the result that there was a deduction of $50,000 under each of s. 110.6(21)(b) and s. 110.6(22). Sharlow J.A. found that as both adjustments were the same in quantum and were the result of the same event, it was appropriate to apply s. 4(4) to provide that only one deduction should be made. She stated (at p. 6415) that "the fact that two statutory provisions have different objectives cannot, by itself, justify an inference that double taxation was intended".

Kruco Inc. v. The Queen, 2001 DTC 668 (TCC), aff'd 2003 FCA 284

A proposed adjustment of the Minister to the safe income of a corporation from which the taxpayer received a deemed dividend, which entailed the exclusion of income inclusions to the corporations resulting from having claimed investment tax credits was found to result in an inappropriate double taxation of the same income first in the hands of the corporation and, second, in the hands of the taxpayer as a capital gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(1) | 81 | |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) | safe income included phantom income mandated to be included in income by the ITA | 208 |

| Tax Topics - Statutory Interpretation - Interpretation Bulletins, etc. | 81 |

MNR v. Chrysler Canada Ltd., 92 DTC 6346, [1992] 2 CTC 95 (FCTD)

S.4(4) precluded the value of shares being taxed as income from employment in both the year of transfer of the shares to a trust (under s. 7(1)) and in the year of transfer of the shares or the proceeds to the employees (under s. 6(1)(g)). Strayer J. stated (p. 6349):

"While subsection 4(4) precludes this kind of double taxation without indicating which rule is to prevail, both paragraphs 7(3)(a) and the canons of interpretation lead us to the conclusion that the special regime provided in section 7 for the calculation and timing of deemed income should govern."

R. v. Inland Revenue Commissioners, ex parte Woolwich Equitable Buildings Society, [1990] BTC 490 (HL)

After referring (p. 500) to the "presumption against double taxation" and the "presumption that income tax, being an annual tax is payable only on the income of a particular year", Lord Oliver went on to state (p. 500) that these presumptions "are clearly rebuttable if sufficiently clear express words are used. But they can also be rebutted, as it seems to me, by circumstances surrounding the enactment of the particular legislation which lead to an inevitable inference that the Parliament intended, in using the words that it did, that these presumptions or principles should not apply."

Robertson v. The Queen, 90 DTC 6070, [1990] 1 CTC 114 (FCA)

Before going on to find that the amount of a non-statutory stock option benefit effectively was taxable at the time of exercise, notwithstanding that a real economic benefit also arose at the time of the granting of the option, Marceau J.A. stated:

"Obviously, double-tier taxation should not be imposed on gains from a single transaction, nor should the same benefit be taxed on two occasions. We certainly cannot have two benefits of the same type, both taxable under paragraph 6(1)(a) of the Act."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 6 - Subsection 6(1) - Paragraph 6(1)(a) | only quantifiable benefit from non-s. 7 option grant arose at exercise time | 218 |

Canadian Pacific Ltd. v. The Queen, 88 DTC 6265, [1988] 1 CTC 429 (FCA)

Mahoney J. suggested that it was contrary to the scheme of the Act for the taxpayer to receive $17.6 million as a tax-free grant toward the cost of restoring railway lines in Western Canada, and at the same time to claim CCA.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 13 - Subsection 13(7.1) | 37 |

The Queen v. Thyssen Canada Ltd., 87 DTC 5038, [1987] 1 CTC 112 (FCA)

The denial (by virtue of s. 18(4)) of the deduction for interest paid by the taxpayer to a non-resident, where that interest was subject to withholding, "did not result in double taxation or in anything resembling double taxation since, as a consequence of that denial, the respondent did not and will not have to pay tax twice on the same income."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 10 - Subsection 10(1) | 54 | |

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(4) | 46 |

Bye v. Coren, [1985] BTC 7 (HC), aff'd [1986] BTC 330 (C.A.)

"There is ... no rule that the same sum cannot be subject to two separate taxes. Whether it is so subject is a matter of construction of the statute or statutes which have imposed the two taxes."

Furniss v. Dawson, [1984] BTC 71 (HL)

An "element of double taxation exists whenever a shareholder sells at a profit his shares in a company which has itself realized a capital asset at a profit. So I do not see any undesirable element of double taxation involved in the revenue's submission [which would potentially lead to that result]." (Lord Brightman)

The Queen v. Robichaud, 83 DTC 5265, [1983] CTC 195 (FCTD)

A husband and wife were unsuccessful in claiming each other as dependants.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 118 - Subsection 118(1) - Paragraph 118(1)(a) | 60 |

Gillespie v. The Queen, 82 DTC 6334, [1982] CTC 378 (FCA)

The purpose of s. 63(4) (since repealed) was found to be preventing both a man and a woman from obtaining deductions from income for the same child care expenses when a child was in the joint custody of both.

Noranda Mines Ltd. v. The Queen, 82 DTC 6212, [1982] CTC 226 (FCTD), aff'd 85 DTC 5001, [1984] CTC 659 (FCA)

An argument that the phrase "taxable income earned in the year" should be interpreted as referring to taxable income before the deduction of any loss carry-backs, thereby permitting a 15% mining tax credit to be calculated on the basis of the larger grossed-up amount, was rejected "for the simple reason that the loss carry-back has already been considered in computing taxable income and failing a very clear provision of the Act to that effect, the same deduction should not be taken into account twice".

IRC v. Garvin, [1981] 1 WLR 793 (HL)

It was stated, obiter, that "I can see a powerful argument being mounted to the effect that, if a receipt falls to be treated as income and taxed as such under one code, it must, by necessary implication, be exempt from liability to taxation as a capital receipt under another code". (Lord Bridge)

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Estoppel | 50 |

R. v. Malloney’s Studio Ltd., 79 DTC 5124, [1979] CTC 206, [1979] 2 S.C.R. 326

"Mutuality of tax treatment of parties to the same transaction, or even the avoidance of double taxation have never been principles with which the draftsmen of taxing statutes have ever regarded themselves as saddled."

Quebec North Shore Paper Co. v. The Queen, 78 DTC 6426, [1978] CTC 628 (FCTD)

The court found that the Crown's method of computing the taxpayer's income during a year in which it changed its method of adjusting for depreciation "would be to compute the same amount twice for income tax purposes," and that method was rejected.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 10 - Subsection 10(2) | 125 |

Perrault v. The Queen, 78 DTC 6272, [1978] CTC 395 (FCA)

The treatment of a single payment under different provisions of the Act as income in the hands of two taxpayers may result from an unfortunate arrangement of the taxpayer's affairs.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | dividend satsified share purchase consideration | 114 |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | 48 | |

| Tax Topics - Income Tax Act - Section 84 - Subsection 84(2) | business continued "on a reduced scale" | 54 |

Denison Mines Ltd. v. Minister of National Revenue, 74 DTC 6525, [1974] CTC 737, [1976] 1 S.C.R. 245

Costs of removing ore were deductible in computing the taxpayer's profit. Since "no single disbursement can be reflected twice in the accounts", those costs could not also be treated as the capital cost of depreciable property.

F.S. Securities, Ltd. v. C.I.R. (1964), 41 TC 688 (HL)

"[D]ouble taxation in itself is not something which is beyond the power of the Legislature to provide for when constructing its tax scheme ... [T]he law approaches the interpretation of the complicated structure of the code with a strong bias against achieving such a result. This, after all, is the general principle upon which rests the particular and well-accepted rule that a form of income which is made the subject of taxation under one of the five Schedules cannot be included, directly or indirectly, as a taxable subject under another Schedule ... Dividends that had borne tax or suffered deductions of tax ... before receipt are ... 'exhausted as a source of income', and the general principle applied to the construction of the provisions of the Income Tax code prevents there being brought in again, directly or indirectly, as a subject of taxation in the form of another class of taxable income" (pp. 697-698).

Minister of National Revenue v. Trans-Canada Investment Corporation Ltd., 55 DTC 1191, [1955] CTC 275, [1956] S.C.R. 49

In his dissenting reasons, Rand J., in finding that the intercorporate dividend deduction in s. 27(1) of the 1948 Act was not available to the taxpayer, stated (p. 1194):

"The deduction claimed is not permitted and it results in what may be called triple taxation. That is a consideration which inclines a court to a rigorous scrutiny of the enactment before it, but it does not permit an interpretation that supplies what Parliament must be taken to have deliberately omitted."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 112 - Subsection 112(1) | dividend-received deduction flowed through an investment trust | 115 |

| Tax Topics - Statutory Interpretation - Expressio Unius est Exclusio Alterius | 39 |

See Also

101139810 Saskatchewan Ltd. v. The Queen, 2017 TCC 3

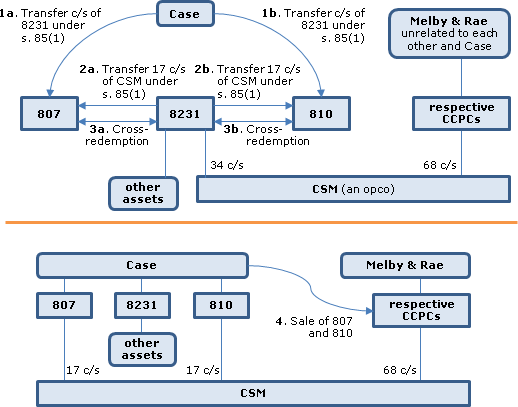

An individual (Case) held his 1/3 shareholding in a small business corporation through a personal holding company (8231) which also held 1/3 of its assets in the form of investment assets. In order to accomplish a sale of the SBC shareholding to the two other SBC shareholders, that shareholding was first split between two new wholly-owned corporations of Case (807 and 810), essentially using butterfly mechanics, with Case then selling his shares of 807 and 810 to the other two shareholders, and applying the capital gains exemption to a modest portion of the resulting gain. This plan did not work because the purchasers were unrelated, thereby precluding access to the butterfly or s. 55(3)(a) spin-off safe harbour.

CRA initially assessed both 8231, and 807 and 810, to convert their s. 84(3) deemed dividends realized on the cross-redemption of the shareholdings between them which arose under the butterfly mechanics, into capital gains (subject to a deductions in the case of 807 and 810 for the safe income of 8231 considered to be received by them.) However 15 months later, CRA vacated the s. 55(2) assessment of 8231 for reasons that are not explained – so that the only outstanding s. 55(2) assessments were of the corporations (807 and 810) acquired by the purchasers.

Case argued that the assessments of 807 and 810 also should be vacated on the grounds that essentially the same gain was reported by him. In addition to noting that this argument was not supported by the wording of s. 55(2), Favreau J stated:

I am inclined to favour a narrow construction of double taxation such that it arises where the same amount is taxed in the hands of the same person. Mr. Case and the appellants are not the same persons.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2.1) - Paragraph 55(2.1)(b) | s. 55(2) assessment of corporate tax on bad butterfly confirmed notwithstanding same accrued gain reported at individual shareholder level | 489 |

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(5) - Paragraph 55(5)(f) | 55(5)(f) designation may be made after assessment under s. 55(2) | 278 |

Létourneau v. The Queen, 2010 DTC 1098 [at 3020], 2009 TCC 614 (Informal Procedure)

By operation of 96(1.1)(b), which applies notwithstanding any other provision of the Act, "allowances" received by a retired partner from his former firm had to be treated as partnership income rather than pension income. Lamarre J. further indicated at para. 28 that, if the income were treated pension income, that would be in addition to its treatment as partnership income - a double-counting of income, prohibited by s. 248(28).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 118 - Subsection 118(7) | 122 |

Beament et al. v. Minister of National Revenue, 70 DTC 6130, [1970] CTC 193, [1970] S.C.R. 680

In finding, in his concurring reasons for judgment, that the contractual right of beneficiaries of an estate to enforce an agreement for the purchase by them of shares of the estate for the shares' par value rather than for the much higher amount that otherwise would have been the shares' fair market value, represented property of the beneficiaries, and therefore should be excluded in the valuation of property of the estate, Pigeon J. stated (at p. 6135) in his concurring reasons for judgment that:

"Parliament cannot have intended that the same value would be included in two separate items of 'property'."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Fair Market Value - Shares | deceased's shares valued based on terms of agreement binding the deceased | 169 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Property | 100 | |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Property | 56 |

Consoltex Inc. v. R., 97 DTC 724, [1997] 2 CTC 2846 (TCC)

Bowman TCJ. found that because the cost of expenditure by the taxpayer on yarn qualified as SR&ED for purposes of s. 37 of the Act, those costs also could not be deducted as cost of sales under s. 9 of the Act, in light of former s. 4(4) of the Act.

Pezzelato v. The Queen, 96 DTC 1285 (TCC)

In obiter dicta, Bowman TCJ. accepted a submission that if the taxpayer were taxable under s. 80.4(1)in its 1988 taxation year in respect of imputed interest on a loan made to him by his employer, he should not also be taxed on a similar benefit under s. 6 for his 1989 taxation year based on an alleged reimbursement by his employer of the interest that accrued in 1988 on that loan.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Res Judicata | 126 | |

| Tax Topics - Income Tax Act - Section 6 - Subsection 6(1) - Paragraph 6(1)(a) | 163 |

Attis v. MNR, 92 DTC 1128, [1992] 1 CTC 2244 (TCC)

The exclusion in s. 15(2) for payments made as part of a series of loans or other transactions and repayments does not apply where there is a series of payments of bonuses and dividends. In light of the presumption against double taxation in s. 4(4), it could not have been intended that such repayments would be included in income both under s. 5 (in the case of bonuses) or s. 12(1)(j) (in the case of dividends), and under s. 15(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(2.6) | no series of loans and repayments where practice of repaying shareholder advances out of dividends and bonuses | 131 |

Pat Marcantonio v. Minister of National Revenue, 91 DTC 917, [1991] 1 CTC 2702 (TCC)

After finding that the Minister had properly reassessed the taxpayer to increase his income pursuant to s. 69(1)(a) by the amount of charges made to him by a related corporation ("Andrea") which were in excess of the fair market value of the goods purchased by him from Andrea, Mogan J. went on to indicate that he assumed that the Minister would attempt, when permitted by law, to reassess Andrea by reducing its income by an equivalent amount.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 69 - Subsection 69(1) - Paragraph 69(1)(a) | 133 |

Administrative Policy

18 July 2018 Internal T.I. 2018-0766441I7 - Article XXIX(5) and 91(5)

A Canadian resident (and US citizen) had an agreement with the Canadian Competent Authority under Art. XXIX(5) of the Canada-US Treaty, by virtue of which he included his share of the S Corporation’s income as FAPI, claimed a s. 126 credit for the US taxes on that income, and added such FAPI to the ACB of his shares. However, before he received any dividend, he revoked the S Corp’s status as a fiscally transparent entity for US purposes, so that the Agreement thereupon terminated.

The S Corp then paid a dividend to him of income that previously had been included in his income as FAPI (and now was included in his income under s. 90(1).)

The Directorate indicated that where the S Corp was a CFA of the individual, he could take a s. 91(5) deduction of the dividend paid after the Agreement invalidation, with a corresponding reduction to the ACB of his shares.

However, where the S Corp was not a FA at the time of the dividend, no s. 91(5) deduction would be available (but with no corresponding ACB reduction) because in such absence of FA status, Reg. 5900(3) would not deem the dividend to come out of taxable surplus.

The Directorate noted that it could be argued that s. 248(28) would apply to exclude the dividend from his income given that “both the dividend and FAPI arise from the same source, namely the shares of S Corporation.” However, the Directorate preferred the double inclusion alternative:

[T]he better view … is that the dividend income and FAPI inclusion are not the same amount …

[T]he dividend income is a cash distribution on the shares of S Corporation while the FAPI is a notional allocation of the income of S Corporation deemed to be FAPI on its shares of S Corporation … [so that] the dividend income and FAPI are separate amounts of a different nature … [which] would preclude the application of subsection 248(28).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 91 - Subsection 91(5) | revocation of a Treaty S Corp. agreement with CASD resulted in double taxation of the S Corp income when now dividended to Canada | 363 |

| Tax Topics - Treaties - Income Tax Conventions - Article 29 | agreement with CASD terminated when S Corp. ceased to be fiscally transparent | 207 |

2016 Ruling 2016-0661071R3 - Whether s. 80 or s. 143.4 applies

CRA found that, given that s. 80 applied in year of forgiveness of unpaid interest under a CCAA Plan, and in light of the rule of statutory construction according prevalence to the more specific provision and the rule against double-taxation in s. 248(28), ss. 143.4(2) and (4) would not also apply to produce an income inclusion from such forgiven interest.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 143.4 - Subsection 143.4(4) | s. 80 rules prevailed in a CCAA compromise over the contingent amount (s. 143.4) rules | 320 |

| Tax Topics - Income Tax Act - Section 143.4 - Subsection 143.4(2) | s. 80 prevailed over s. 143.4 | 110 |

4 March 2015 External T.I. 2014-0562151E5 F - Frais de psychothérapie dépense d'entreprise

After finding that psychotherapy expenses potentially could be deducted in computing income of a professional practice, CRA stated:

The fact that psychotherapy fees could give rise to a credit under the Act does not preclude their deduction in the computation of income from your business. However…[under] subsection 248(28)… it would not be possible to deduct psychotherapy expenses under section 9 and claim a medical expense credit for the same amount under section 118.2. Finally, any personal portion of the psychotherapy expenses that will not be deducted in computing income from a business can give rise to a medical expense tax credit provided that all of the requirements under section 118.2 are met.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(a) - Income-Producing Purpose | “but for” test applied to determine deductibility/potentially creditable item can instead be expense | 188 |

10 October 2014 APFF Roundtable Q. 21, 2014-0538091C6 F - 2014 APFF Roundtable, Q. 21 - Impact of the Descarries Case

CRA indicated respecting any potential double taxation arising from the applicability of both s. 84(2) and (3) to a surplus stripping transaction that, in practice, CRA would avoid double taxation through applying s. 248(28)(a). See summary under s. 84(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | Descarries failed to recognize scheme against indirect surplus stripping | 750 |

| Tax Topics - Income Tax Act - Section 84 - Subsection 84(2) | Descarries failed to recognize breadth of s. 84(2) | 572 |

30 October 2014 External T.I. 2013-0488881E5 - Upstream Loan

As a result of a wind-up of a 2nd tier FA following a s. 90(6) loan to Canco, there technically would be a double income inclusion to Canco under ss. 90(6) and (12). By virtue of s. 248(28)(a), only one of the two amounts would be included in Canco's income. See detailed summary of Scenario 6 under s. 90(9).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(3) | notional s. 40(3) gain does not generate surplus | 70 |

| Tax Topics - Income Tax Act - Section 90 - Subsection 90(6) | no double inclusion following FA creditor wind-up or for 2nd loan in series | 121 |

| Tax Topics - Income Tax Act - Section 90 - Subsection 90(9) | notional election and double taxation issues | 1332 |

| Tax Topics - Income Tax Regulations - Regulation 5901 - Subsection 5901(1.1) | notional Reg. 5901(1.1) election | 30 |

| Tax Topics - Income Tax Regulations - Regulation 5901 - Subsection 5901(2) - Paragraph 5901(2)(a) | 90-day rule unavailable | 28 |

| Tax Topics - Income Tax Regulations - Regulation 5901 - Subsection 5901(2) - Paragraph 5901(2)(b) | notional Reg. 5901(2)(b) election | 31 |

| Tax Topics - Income Tax Regulations - Regulation 5907 - Subsection 5907(1) - Underlying Foreign Tax | notional UFT disproportionate election | 37 |

11 March 2014 Internal T.I. 2013-0513221I7 F - Stock options

Publico determined to grant stock options to its directors and consultants, as a result of which a private corporation ("Corporation"), that had provided consulting services, was entitled to receive a grant of options. However, such options instead were granted directly to Ms. Y, the sole shareholder of Corporation, who subsequently exercised and sold the acquired Publico shares, reporting a capital gain.

After finding that s. 56(4) or 56(2) applied to Corporation, as it could be regarded as assenting to the direct transfer to its shareholder, CRA noted that such income inclusion to Corporation did not detract from there also being a taxable benefit to Mrs. Y under s. 15 (or 6(1)(a), if it was received by virtue of employment - with a potential deduction to Corporation.) As to whether s. 248(28) applied to include only one benefit, being to Ms. X, CRA stated:

We are of the view that nothing precludes the simultaneous application, on the one hand, of subsection 56(4) or 56(2) at the corporate level, and, on the other hand, of subsection 15(1) or paragraph 6(1)(a) to Ms. X. No reference is made to subsection 15(1) or paragraph 6(1)(a) which precludes its application where subsection 56(4) or 56(2) also applies. Subsection 248(28) would not apply in the circumstances since this statutory provision only provides for the double counting of an amount in respect of the same taxpayer.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | double income inclusion under s. 56(2) or (4) to consulting corporation, and under s. 15(1) to its shareholder, where consultant's options issued directly by client to shareholder | 113 |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | s. 56(2) benefit where corporation implicitly consented to consultant's options being issued by client directly to its shareholder | 170 |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(4) | implicit transfer by corporation when stock options earned by it were issued directly by its client to its shareholder | 175 |

| Tax Topics - Income Tax Act - Section 9 - Timing | no s. 9(1) income inclusion from consultant being granted stock options until exercise | 226 |

| Tax Topics - General Concepts - Fair Market Value - Options | stock options with no in-the-money value could have nil FMV | 134 |

| Tax Topics - Income Tax Act - Section 52 - Subsection 52(1) | s. 15 benefit due to shareholder receipt of stock options earned by corporation added to the ACB of the exercised shares | 165 |

31 August 2011 External T.I. 2011-0415891E5 F - Increase in stated capital, stock dividends -55(2)

CRA will construe paragraph 55(2)(c) so that the amount deemed not to be a dividend is not taxed as a capital gain twice. Paragraph 55(2)(c) will be applied in the year of the increase of the stated capital of the shares; when the shares are sold, the capital gain will be reduced by the amount already included in income pursuant to paragraph 55(2)(c).

Respecting the payment of a preferred share stock dividend that is followed by a sale of the preferred shares, CRA quoted with approval its earlier statement in 9830665 that:

If the disposition of the preferred shares occurs in a taxation year subsequent to the year of the payment of the stock dividend and the sale of the common shares, the taxpayer must apply paragraph 55(2)(b) in respect of the stock dividend and not include a taxable capital gain on the sale of the preferred shares in the subsequent taxation year.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 55 - Subsection 55(2) - Paragraph 55(2)(c) | capital gain recognized under s. 55(2)(c) not recognized a second time on sale of the shares | 185 |

23 April 2009 External T.I. 2008-0301241E5 F - Fiducie d'invest. à participation unitaire-75(2)

CRA indicated that, although s. 75(2) technically could apply to a real estate unit trust established on commercial terms, it very well might not apply s. 75(2) in such circumstances. However, if s. 75(2) applied to attribute trust income directly to the unitholders, distributions by the trust to the unitholders would not have the character of income distributions, so that such distributions could reduce the ACB of trust units. CRA then stated:

[A]dministrative relief is provided in paragraph 10 of Interpretation Bulletin IT-369R so that income subject to the application of subsection 75(2) is not otherwise included in the income of a beneficiary or trust, as the case may be.

In a particular case … the CRA could extend this position so that no reduction to the ACB of a beneficiary's capital interest would be made by virtue of subparagraph 53(2)(h)(i.1). …

[W]e have doubts as to whether paragraph 248(28)(a) can be invoked to ensure that no negative adjustment can be made to the ACB of the taxpayer's capital interest to prevent double taxation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 75 - Subsection 75(2) | s. 75(2) generally not applied to commercial unit trust where single class of units subscribed for on FMV terms | 277 |

| Tax Topics - Income Tax Act - Section 53 - Subsection 53(2) - Paragraph 53(2)(h) - Subparagraph 53(2)(h)(i.1) | CRA could extend IT-369R, para. 10 to avoid ACB reductions to unit trust units where s. 75(2) applies | 301 |

29 August 2005 External T.I. 2005-0125811E5 F - Actions prescrites: 6204(1)b) du Règlement

On the day before a third party acquired all of the shares of a Canadian-controlled private corporation (CCPC), two directors of its directors exercised their stock options and then, on the acquisition date, the shares so acquired by them were purchased for cancellation by Opco so to reduce the number of issued and outstanding shares to the number agreed with the third party acquirer. In rejecting a suggestion that s. 248(28) should preclude the application of s. 84(3) to the purchase for cancellation of the directors’ shares since a benefit under s. 7(1) would have already been computed, CRA stated:

[I]t is our position that subsection 248(28) does not apply to a deemed dividend on the redemption, acquisition or cancellation by a corporation of shares of its capital stock for which a section 7 benefit is included in an employee's income. …[T]he section 7 benefit and the dividend computed under subsection 84(3) result from two different events, namely, the exercise of a stock option by the employee and the redemption, acquisition or cancellation of the shares by the corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 6204 - Subsection 6204(1) - Paragraph 6204(1)(b) | likelihood that employees’ stock option shares would be immediately repurchased meant they were not prescribed shares | 124 |

2003 Ruling 2003-0028033 - LEASE-BARGAIN PURCHASE OPTION

A lease is amended to add an option to purchase and to increase the annual lease payment by an amount that would be in excess of the fair market value rent in the absence of the option. The additional lease payment are treated for purposes of s. 49(5) as payments in respect of the extension of the original option, with the result that, for purposes of s. 49(1), such amount are deemed to be proceeds of disposition in respect of the grant of the option at the time of receipt of each such payment.

Upon the exercise of the option, the vendor by virtue of s. 248(28) will not be required to include in its proceeds of disposition the amounts included as capital gains under s. 49(5) and 49(1) except to the extent that pursuant to s. 49(4) it files amended tax return to exclude such amounts from the computation of its income for those taxation years as proceeds of disposition.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 49 - Subsection 49(3) | 159 |

29 April 2003 External T.I. 2003-00646

Allocations made to the spouse of a retired partner pursuant to s. 96(1.1) would, depending on the circumstances, also be included in the income of the retired partner under s. 56(2) or (4). S.248(28) would not prevent this result.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(4) | 38 | |

| Tax Topics - Income Tax Act - Section 96 - Subsection 96(1.1) | 38 |

26 March 2003 External T.I. 2003-0008795 - EMPLOYEE STOCK OPTION DEEMED DIVIDEND

Contrary to a previous position, CCRA has concluded that s. 248(28) does not preclude the application of s. 84(3) on the redemption of shares even where that redemption triggers an employment benefit that was deferred by s. 7(1.1): "The benefit under section 7 of the Act and the dividend computed under subsection 84(3) of the Act are determined as a result of different events and there is no amount that has been included in income under section 7 of the Act that is included a second time contrary to paragraph 248(28)(a) ... a taxpayer will generally have a capital loss on the disposition, which will already account for both the inclusion of the section 7 benefit and the subsection 84(3) dividend. This will mean the taxpayer will only be taxed once on the economic gain received as a result of the exercise of the option and the disposition of the shares."

24 May 2002 External T.I. 2002-0123225 F - REER DONNE EN GARANTIE

After noting that where an RRSP provides a secured guarantee of a loan to the annuitant, the fair market value of the property given as security will be included pursuant to s. 146(10), CCRA went on to note that where a payment is made from the RRSP because of the exercise of a security interest to repay such secured debts, although there is a benefit as per s. 146(1), it is not to be included in the annuitant's income pursuant to s. 146(8) by virtue of s. 248(28)(a) (so as to avoid double taxation under ss. 146(10) and (8)).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 146 - Subsection 146(10) | inclusion under s. 146(10) for secured guarantee not limited to loan value, and ousts application of s. 146(8) if payment made by RRSP pursuant to guarantee | 162 |

| Tax Topics - Income Tax Act - Section 146 - Subsection 146(8) | generally no double taxation under s. 146(8) on payout on guarantee if property’s value previously included under s. 146(10)/ gross-up for source deduction purposes | 190 |

14 May 2002 Internal T.I. 2001-0109517 F - SECTION DE LA LOI248(28)

Holding companies made interest-bearing advances to a partnership (the S.E.N.C.) CRA proposed to disallow the interest deduction to the S.E.N.C. and to include the amount of the advances in the income of the holding companies pursuant to s. 15(2) (on the basis that the S.E.N.C. was connected to the shareholders of the holding companies since each partner was considered not to deal at arm's length with the S.E.N.C.). The taxpayer considered that the disallowance of the interest expense to the S.E.N.C. resulted in additional income allocated to the partners and that the latter must also include the same amount in their income for tax purposes pursuant to s. 15(2), contrary to s. 248(28). The Directorate rejected this position, stating:

[A]n amount that is not deductible pursuant to paragraph 20(1)(c) and an amount included in income pursuant to subsection 15(2) do not refer to the same amount. In our view, these two provisions of the Act apply independently of each other.

11 April 2001 External T.I. 1999-0007005 - DEEMED DIVIDENDS ON MARK-TO-MARKET SHARE

The following example was provided respecting a preferred share held by a financial institution whose paid-up capital (and apparently, redemption amount) was increased:

The Agency commented that "it would have to be established that the increase in fair market value of the shares was solely the result of the increase in paid-up capital". The Agency also noted that "the use of subsection 248(28) in this situation is cumbersome and may not provide an appropriate result in all circumstances".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 142.5 - Subsection 142.5(1) | 57 |

21 November 2000 External T.I. 2000-0056495 - double taxation

A Canadian resident corporation lends money to a foreign affiliate which, in turn, lends money to non-affiliated and non-resident corporations. In these circumstances, s. 248(28) does not affect the application of s. 17, which may cause an income inclusion in respect of the first amount under s. 17(1) and an income inclusion in respect of the second amount under s. 17(2). In these circumstances, "section 17 does not require a particular amount to be included in income more than once. That is, section 17 requires only one income inclusion in respect of any particular amount owing".

10 August 2000 External T.I. 2000-0016875 - SAR DISPOSITION, SHARES

"Where an employee has income from employment under paragraph 7(1)(a) related to the disposition, by virtue of subsection 7(1.1), of shares and a deemed dividend under subsection 84(3) of the Act related to the redemption of shares in the same or a different year, we are of the view that subsection 248(28) of the Act will apply so that there will be no income inclusion under subsection 84(3) of the same amount as a deemed dividend resulting on the redemption of the shares."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 7 - Subsection 7(3) - Paragraph 7(3)(a) | 36 | |

| Tax Topics - Income Tax Act - Section 84 - Subsection 84(3) | 83 |

12 November 1992 Memorandum (Tax Window, No. 27, p. 7, ¶2330)

S.4(4) cannot be invoked to open up a year for reassessments that is statute-barred where an expense that relates to that year was claimed by a taxpayer in a subsequent year (although the fairness package can be utilized to this end where this is to the taxpayer's advantage). However, where a taxpayer has claimed expenses in a year that is statute-barred, the taxpayer will be precluded by s. 4(4) from claiming the same expenses in an open year.

11 June 1991 T.I. (Tax Window, No. 4, p. 8, ¶1297)

Under the proposed version of s. 4(4), interest to which s. 18(4) applied in a previous year will not be required to be included in income under s. 9(1) in the year it is forgiven. Where s. 80 applies, the forgiven interest will not be included in income under s. 9(1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 80 - Subsection 80(4) | 19 |

11 September 89 T.I. (February 1990 Access Letter, ¶1109)

There is no provision in the Act permitting a shareholder/manager to reduce the amount of salary received by him to the extent that such salary is not deductible by virtue of s. 67 to the payor corporation.

86 C.R. - Q.39

In the absence of abuse, RC will not tax the same amount twice.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 67 | 42 |

85 C.R. - Q.6

"Normally it is the Department's practice not to assess the same income twice."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | 17 |

84 C.R. - Q.46

A deemed dividend arising on the redemption of shares that are inventory will be excluded from the shareholder's s. 9 gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Proceeds of Disposition - Paragraph (j) | 17 |

81 C.R. - Q.3

On the conversion of debt of an insolvent corporation into share capital, RC will not apply both ss.69(1)(a) and 80.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 69 - Subsection 69(1) - Paragraph 69(1)(a) | 52 |

IT-369R "Attribution of Trust Income to Settlor"

An amount which has been attributed to a person under s. 75(2) normally will be excluded from the income of the beneficiaries and the trust.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 75 - Subsection 75(2) | 108 |

IT-462 "Payments Based on Production or Use"

In situations where ss.12(1)(a) or (b) can be applied in addition to paragraph 12(1)(g), RC will normally apply only the former provisions to include receipts from the sale of trading property in income, as double taxation is not intended.

Articles

Kevin Kelly, Sona Dhawan, "Share Repurchase Programs", Canadian Tax Highlights, Vol. 26, No. 6, June 2018, p. 9

An investment dealer holds a share of an issuer with a paid-up capital of $15, an original cost to it of $40 and a fair market value of $100. It previously realized $60 of aggregate mark-to-market gains on the share, offset by a $60 loss on a hedge. Under a private agreement with the issuer, it sells its share to the issuer for $95.

In reliance on 980394, its proceeds of disposition exclude its deemed dividend of $80. Old s. 112(5.2) only required these proceeds to be increased to its original cost of $40. Hence, it realized a loss of $60 for ITA purposes. The new s. 112(5.2) instead increases its proceeds by the full deemed dividend amount of $80; hence, no loss.

In January 2018, six financial institutions purchased $1.5B of their own shares held by other financial institutions pursuant to “share repurchase programs” ( “SRPs”) that permitted such private sales to occur for securities law purposes where a normal course issuer bid was in play. Following the February Budget announcement of the new s. 112(5.2) rule, the issuers of outstanding SRPs issued press releases announcing their cancellation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 112 - Subsection 112(5.2) | 352 |