Cases

Gestion M.-A. Roy Inc. v. Canada, 2024 CAF 16

Various whole life policies on the life of a resident individual (Mr. Roy) were owned by (i) a holding company (“Gestion Roy”), controlled by Mr. Roy and which was the majority shareholder of a consulting firm (“R3D”), or by (ii) another holding company (“445 Canada”) which was wholly-owned by Mr. Roy but which was not a shareholder of R3D. However, R3D was the revocable beneficiary of any death benefits under the policies and paid all the premiums.

Boivin JA confirmed the inclusions in Gestion Roy’s income under s. 15(1) of the annual premium amounts paid on Gestion Roy’s policies for the reasons given in the Tax Court. Gestion Roy was the owner of such policies (entitling it to the cash surrender value of the policies at any time), so that it was “enriched” when the premiums were paid by R3D– and it was irrelevant to this point that, in fact, Gestion Roy never received any distribution on its policies. (What in fact occurred a number of years later was that, on the sale of R3D and R3D assets to a third-party purchaser, R3D received the cash surrender value of most of the policies on their termination.)

In also confirming the Tax Court’s finding that it followed from the above that the payment by R3D of the premiums on the policies of 445 Canada resulted in corresponding inclusions under s. 246(1) to 445 Canada, Boivin JA stated (at para. 10, TaxInterpetations translation):

[W]e agree with the TCC's conclusion that the analysis to be performed under subsection 246(1) is substantially the same as that required under subsection 15(1) (see Laliberté).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | s. 15(1) benefit where subsidiary pays premiums on whole life policies owned by the taxpayer | 291 |

Laliberté v. Canada, 2020 FCA 97

The founder and controlling shareholder of Cirque du Soleil, had been found by the Tax Court to have received a taxable benefit under s. 15(1) (or alternatively, under s. 246(1)) equaling approximately 90% of the $41.8 million cost of sending him on a trip to the international space station (ISS) in September and October 2009, given that the cost was borne by his family holding company and then largely passed through to the top operating company (“Créations Méandres “) in the Cirque du Soleil group, but with there being a matching contribution of capital by the holding company to Créations Méandres so that independent shareholders would not bear any of the cost of the trip.

In dismissing the appeal, Gleason JA rejected a submission that the Tax Court had focused insufficiently on whether there had been a corporate intent to impoverish the corporations, stating (at para. 45) that “even if intent to impoverish the corporation were required, such intent cannot be equated with a controlling shareholder’s subjective intent and most especially not with an intent that was formulated [as in the case here] after the corporate expenditure was engaged”.

She also effectively indicated that, consistently with Youngman, it was appropriate for the Tax Court to have “calculated the value of the shareholder benefit at the end of the case based upon all the evidence tendered” rather than there having been a shifting of the burden to the Minister to establish this value once the evidence demonstrated that the Minister’s assumption of a 100% taxable benefit was incorrect.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | any subjective intention of the controlling shareholder not to be enriched did not establish that no taxable benefit | 427 |

| Tax Topics - General Concepts - Onus | Tax Court could determine a taxable benefit percentage (different from that assumed by the Minister) based on all the evidence | 304 |

Consultants Pub Création Inc. v. Canada, 2008 DTC 6610, 2008 FCA 60, aff'g Massicotte v. The Queen, 2006 TCC 618

The taxpayer wholly owned a corporation ("Amadéus") which, in turn, wholly owned another corporation ("Pub Création"), and the taxpayer was also the president and director of Pub Création. He assigned a $240,000 debt to Pub Création in exchange for a $240,000 "employee advance." As the debt which he assigned was essentially worthless, the Minister included $239,000 in the taxpayer's income. By the Tax Court trial, the position of the Minister (consistent with the pleadings, which did not refer to s. 6(1)(a)) was that this amount was included in the taxpayer's income under s. 246(1), on the basis that Amadéus had indirectly conferred a benefit on the taxpayer by arranging for the debt assignment at an inflated value, and such benefit would have been included in the taxpayer's income under s. 15(1) if Amadéus had paid this benefit directly to the taxpayer. The Tax Court found that the amount was included in the taxpayer's income under s. 6(1)(a), but found in the alternative that the Minister's position was correct.

The taxpayer argued that, because the benefit "could" have been included under s. 6(1)(a), the Minister lost the right to include the benefit in income under s. 246(1), which only applies "to the extent that [the benefit] is not otherwise included in the taxpayer's income ... under Part I." Before dismissing the taxpayer's appeal, Noël J.A. stated (at para. 25):

The question the TCC judge should have asked was not whether the benefit "could be included" under paragraph 6(1)(a), but rather whether the value of the benefit was "included" in computing Mr. Massicotte's income under paragraph 6(1)(a) or any other provision in Part I. While subsection 246(1) is generally used as an alternative basis, nothing prevents the Minister from relying on this provision as the sole basis of assessment when the circumstances require.

The Queen v. Kieboom, 92 DTC 6382, [1992] 2 CTC 59 (FCA)

S.245(2)(c) applied where the taxpayer permitted his wife and, later, his children, to subscribe for non-voting common shares of his private company at a nominal price, with the result that he realized a capital gain under s. 69(1)(b)(ii) as a result of a deemed disposition of the appropriate fraction of his common shares in the company.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 74.1 - Subsection 74.1(1) | 105 | |

| Tax Topics - Statutory Interpretation - Interpretation Bulletins, etc. | 73 |

Sweeney v. The Queen, 90 DTC 6507, [1990] 2 CTC 342 (FCTD)

In 1950, a written agreement between the taxpayer's father and the taxpayer provided that the son could purchase his father's shares in a company for a stipulated sum upon the father's death. The price per share was reviewable by the father, gave the son a right of first refusal in the event of a sale of the shares, and was revocable by either party upon 60 days' notice. Following the repudiation of this agreement by the executors of the father's estate following his death in 1983, the taxpayer was paid $625,000 in lieu of damages.

The taxpayer's counsel unsuccessfully submitted that what now is s. 246(1) governed the transaction because the failure of the father to revoke the agreement had the effect of conferring a benefit on the taxpayer.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Fair Market Value - Other | 170 |

Boardman v. The Queen, 85 DTC 5628, [1986] 1 CTC 103 (FCTD)

Since the taxpayer's legal obligations to his divorced wife were met by a court order which ordered the Registrar of Land Titles to transfer title to two houses held by the taxpayer's company to his wife, a benefit was conferred on the taxpayer by his company equal to the fair market value of the equities of redemption of the houses. "Transaction" in s. 245(2) has a broad meaning.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | 148 | |

| Tax Topics - Income Tax Act - Section 69 - Subsection 69(4) | 34 |

Mansfield v. The Queen, 83 DTC 5136, [1983] CTC 97 (FCTD), aff'd 84 DTC 6535, [1984] CTC 547 (FCA)

A company netted no cash from the sale of a $5,000 convertible debenture to its employee because it deposited with a bank an amount equal to the amount of a loan, made by the bank to the employee to finance his purchase of the debenture, in order to partially secure that loan. Nonetheless, there was no conferral of a benefit on the employee: the company "still owed the Plaintiff [employee] $5,000, payable according to its terms. It was no sham".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 7 - Subsection 7(1) - Paragraph 7(1)(a) | 201 |

The Queen v. Immobiliare Canada Ltd., 77 DTC 5332, [1977] CTC 481 (FCTD)

By purchasing debentures of a sister Canadian resident corporation from its non-resident parent the taxpayer eliminated withholding taxes that ultimately would have been exigible on payments of the heretofore unpaid interest on the debentures, and thereby conferred a benefit equal to 15% of the total accrued interest at the time of sale. However, it was found that the accelerated receipt of an amount equal to the interest accrued at the time of the sale did not constitute a benefit: "the benefit must be of a more tangible and identifiable nature".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 212 - Subsection 212(1) | sale of bond with accrued interest did not satisfy interest | 178 |

| Tax Topics - Income Tax Act - Section 212 - Subsection 212(1) - Paragraph 212(1)(b) | sale proceeds allocable to expectancy of interest were not interest receipt | 198 |

| Tax Topics - Income Tax Act - Section 76 | 105 |

The Queen v. Esskay Farms Ltd., 76 DTC 6010, [1976] CTC 24 (FCTD)

The taxpayer, wished to sell land to the City of Calgary in consideration for two annual instalments in order to defer a portion of the gain to its second taxation year, but was informed that the City was precluded by statute from purchasing land over a period of years. As a result: the taxpayer sold the land to a trust company for the same purchase price, but payable in two instalments with the second instalment bearing interest at 7.5% per annum, and with a clause in the purchase agreement that the trust company could elect within 60 days of the date of the agreement of sale to void the agreement; and the trust company sold the land to the City for the same purchase price, paid in cash. Title was transferred directly from the taxpayer to the City.

In finding that the transactions did not entail a conferral of a benefit by the trust company on the taxpayer, Cattanach J. noted (at p. 6018) that the taxpayer acknowledged its obligation to pay income tax on the profit realized by it on the sale of the land when the deferred payments were received by it.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Agency | weight given to written agreement terms in finding that intermediary purchased as principal | 122 |

| Tax Topics - General Concepts - Evidence | 81 | |

| Tax Topics - General Concepts - Sham | no sham if documents describe intended legal rights | 354 |

| Tax Topics - General Concepts - Tax Avoidance | no sham if documents describe intended legal rights | 354 |

| Tax Topics - Income Tax Act - 101-110 - Section 104 - Subsection 104(2) | 143 | |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(n) | 199 | |

| Tax Topics - Income Tax Act - Section 245 - Old | 57 | |

| Tax Topics - Statutory Interpretation - Provincial Law | 58 |

David v. The Queen, 75 DTC 5136, [1975] CTC 197 (FCTD)

As a result of transactions wherein the shares of a company held by the taxpayers were purchased on behalf of a pension plan which then caused the distribution of the company's assets, a benefit was conferred on the taxpayer because "they were able to withdraw the undistributed surplus of the company without paying taxation".

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Evidence | 30 | |

| Tax Topics - Income Tax Act - Section 84 - Subsection 84(2) | proceeds from the sale of cash-rich company to pension fund for wind-up 5 months later were "otherwise appropriated ... on the winding-up" | 321 |

Indalex Ltd. v. The Queen, [1988] 1 CTC 60, 88 DTC 6053 (FCA)

It was found that the taxpayer, by purchasing aluminium from a Bermudan affiliate at a price that was 5% higher than what it would have paid if it had purchased the aluminium directly from the ultimate supplier, had conferred a benefit on the Bermudan affiliate, and withholding taxes were exigible on the amount of the benefit by virtue of s.s.245(2)(b) and 212(1).

Laxton v. The Queen, 88 DTC 6008, [1988] 1 CTC 19 (FCTD), rev'd , in part, 89 DTC 5327 (FCA)

In a joint venture agreement it was agreed that an individual member of the joint venture ("Laxton") would be paid an annual management fee equal to $450,000 minus the product of the Bank of Montreal prime rate and the amount of interest free loans made by the other members of the joint venture to Laxton. Imputed interest on interest-free loans made to Laxton by the joint venture (which previously had borrowed from the Bank) was included in his income as a benefit. Reed, J. stated: "Where an agreement explicitly provides that a taxpayer's remuneration for services is to take the form of an interest free loan, the taxpayer should be required to recognize that remuneration in some form in his taxable income."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Statutory Interpretation - Specific v. General Provisions | 67 |

MNR v. Enjay Chemical Co. Ltd., 71 DTC 5293, [1971] CTC 535 (FCTD)

In finding that a forgiveness of a portion of the trade indebtedness owing by the taxpayer to a U.S. affiliate would have given rise to a taxable benefit under s. 137(2) of the pre-1972 Act, Walsh J. stated (p. 5304):

"I believe that the words 'transactions of any kind whatsoever' are broad enough to cover the forgiveness of debt which took place in this case in that Esso International Inc. therefore conferred a benefit on respondent and this despite the fact that the rebate was made for a legitimate purpose and not with an intention to avoid or evade taxes."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 54 - Adjusted Cost Base | 30 | |

| Tax Topics - Income Tax Act - Section 9 - Forgiveness of Debt | debt forgiveness related to inventory of operations | 186 |

See Also

Gestion M.-A. Roy Inc. v. The King, 2022 CCI 144, aff'd 2024 CAF 16

Various whole life policies on the life of a resident individual (Mr. Roy) were owned by (i) a holding company (“Gestion Roy”), controlled by Mr. Roy and which was the majority shareholder of a consulting firm (“R3D”), or by (ii) another holding company (“445 Canada”) which was wholly-owned by Mr. Roy but which was not a shareholder of R3D. However, R3D was the revocable beneficiary of any death benefits under the policies and paid all the premiums.

Smith J confirmed CRA’s inclusions in Gestion Roy’s income under s. 15(1) of the annual premium amounts paid on Gestion Roy’s policies given that it was the owner of such policies (entitling it to the cash surrender value of the policies at any time), so that it was “enriched” when the premiums were paid by R3D – and indicated that it was irrelevant to this point that, in fact, Gestion Roy never received any distribution on its policies. (What in fact occurred a number of years later was that, on the sale of R3D and R3D assets to a third-party purchaser, R3D received the cash surrender value of most of the policies on their termination.) His reasoning suggests that he could have reached the same conclusion even if the designation of R3D as the beneficiary was irrevocable.

After referring to Consultants Pub Création and Laliberté, he went on to find that it followed from the preceding analysis that the payment by R3D of the premiums on the policies of 445 Canada resulted in corresponding inclusions under s. 246(1) to 445 Canada.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | a company’s payment of the premiums on whole life policies of which it was the beneficiary but not owner triggered ss. 15(1) and 246(1) benefits | 468 |

Laliberté v. The Queen, 2018 TCC 186, aff'd 2020 FCA 97

The founder and controlling shareholder of Cirque du Soleil was found to have received a taxable benefit under s. 15(1) (or alternatively, under s. 246(1)) equal to approximately 90% of the $41.8 million cost of sending him on a trip to the international space station in September and October 2009, given that the cost was borne by his family holding company and then largely passed through to the top operating company in the Cirque du Soleil group (whose CFO refused to deduct it for corporate income tax purposes). Boyle J stated (at paras. 54, 55 and 57):

I do recognize that the Cirque du Soleil promotional business-related activities in which the Appellant participated while on his trip were most probably more valuable having been from space than had they been from anywhere on earth. For that reason I could conclude that an allocation in the range of 0 to 10% of the cost of the space trip would be a reasonable charge to Cirque du Soleil. …

[T]he remaining 90% of the cost of the trip, being $37.6 million, was the amount of the benefit conferred on and enjoyed by M. Laliberté.

…[T]here is a difference between a business trip which involves or includes personal enjoyment aspects, and a personal trip with business aspects, even significant ones, tacked on.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | business benefits from sending shareholder into space were secondary | 491 |

Pelletier v. The Queen, 2004 DTC 3176 (TCC)

Although benefits were conferred on the taxpayers by virtue of their being able to acquire shares of a private company worth $300,000 for a purchase price of $10,000, this essentially was the result of the vendor's decision to accept the lower amount in order to settle a dispute. As the company did not directly or indirectly give shares to the taxpayers, there was no income to them under s. 246(1). It was not relevant that the company had consented to a waiver by the shareholders of the transfer restrictions in the shareholders' agreement.

Husky Oil Ltd. v. The Queen, 95 DTC 316, [1995] 1 CTC 2184 (TCC), aff'd 95 DTC 5244 (FCA)

The taxpayer, which needed to "shelter" a capital gain previously realized by it, purchased from a vendor with which it dealt at arm's length the shares of a holding company whose assets consisted of shares of operating companies whose adjusted cost base substantially exceeded their fair market value, and further agreed that following the winding-up of the holding company it would sell the shares of the operating companies back to the vendor for their respective fair market values.

Kempo TCJ. found that what then was s. 245(2) did not apply to these transactions (and to similar loss utilization transactions) because no "benefit" could arise to the taxpayer from its purchase of the shares of the holding company where it had provided fair market value consideration.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Fair Market Value - Shares | 82 | |

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(1) - Paragraph 251(1)(c) | common interest of the parties did not evince that each was not acting in its own interests | 133 |

Ovis Brooks v. Minister of National Revenue, 91 DTC 639, [1991] 1 CTC 2551 (TCC)

The taxpayer was deemed under former s. 245(2) to have disposed of an "economic interest" in a corporation wholly-owned by him when he caused it to issue shares to his wife and children at a substantial undervalue.

Administrative Policy

7 October 2022 APFF Financial Strategies and Instruments Roundtable Q. 2, 2022-0936281C6 F - police d'assurance-vie & avantage

Suppose that two brothers resident in Canada each have a Holdco owning 50% of Opco and that, in order to fund the buy-sell agreement on the death of an ultimate shareholder, each Holdco has purchased insurance on the life of its sole shareholder, with Opco as the revocable or irrevocable beneficiary of both insurance policies. Suppose further that (a) both Holdcos pay the insurance premiums out of their after-tax accumulated profits without reimbursement by Opco, or (b) that Opco reimbursed the Holdcos for the premiums. Would s. 246(1) apply?

CRA indicated, consistently with 2010-0359421C6, that “subsection 246(1) could apply in the situation where a parent corporation owns and pays the premiums on a life insurance policy and its subsidiary is designated as the beneficiary” so that, here, “the provisions of subsection 246(1) could apply in respect of Opco, subject to a review of the specific facts of a particular situation.” However, if the two brothers dealt with each other at arm’s length, s. 246(1) would not apply if the other conditions in s. 246(2) were satisfied.

CRA further stated:

In the situation where Opco, as (revocable or irrevocable) beneficiary of the life insurance policies, reimburses the Holdcos, the policyholders, for the related premiums, it would be necessary to examine all the relevant facts and documentation to be able to determine whether the reimbursement should be included in the income of the Holdcos pursuant to section 9 or paragraph 12(1)(x).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 9 - Expense Reimbursement | premiums paid by parent on a sub’s life insurance policies are non-deductible even if reimbursed on income account | 192 |

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(b) - Capital Expenditure v. Expense - Financing Expenditures | premiums paid by Holdcos on policies of which their jointly-owned company (Opco) is the beneficiary are non-deductible capital expenditures even if reimbursed by the Opcos | 138 |

2017 Ruling 2016-0660321R3 - Reorg of REIT to simplify multi-tier structure

A Canadian REIT (the “Fund”) holds the units and notes of a subsidiary unit trust (“Sub-Trust”), whose principal asset is most of the partnership interests, other than exchangeable LP units, in a subsidiary LP (“Partnership”) which holds real estate and a corporate subsidiary (“Opco”).

The Fund first eliminates Sub-Trust by setting up a unit trust (“MFT”), transferring its assets to MFT under s. 107.4, distributing just enough units of MFT to its unitholders for MFT to qualify as a mutual fund trust, and then instigating a s. 132.2 merger of MFT into the Fund.

The Fund does not wish for Opco to pay corporate income tax. Had the Fund now held Opco directly, this would have been accomplished by incorporating a subsidiary (“MFC”), distributing relatively modest shareholdings in MFC to its unitholders sufficient to qualify MFC as a mutual fund corporation, amalgamating MFC and Opco so that Amalco MFC also qualifies as a mutual fund corporation, and then instigating the merger of Amalco MFC into the Fund under s. 132.2 – so that the former assets of Opco are now held directly by a REIT (the Fund).

A complicating factor is that Opco is held by the Partnership. Accordingly, the Partnership first transfers its Opco shares to MFC under s. 85(2) in consideration for most of the shares of MFC (so that Opco then can be vertically amalgamated with MFC). On the s.132.2 merger of Amalco MFC into the Fund, the Partnership renounces the receipt of the Fund units that otherwise would be receivable by it on the merger. CRA ruled that the Partnership will not realize any gain or loss on the disposition of its Fund units as a result of the renunciation because their proceeds of disposition should be equal to their ACB pursuant to s. 132.2(3)(g)(vi)(C)(I), and that none of the conferral-of-benefit provisions in the Act would apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 132.2 - Subsection 132.2(1) - Qualifying Exchange | use of the s.132.2 merger and a renunciation of most of the units otherwise issuable on the merger in order to eliminate a REIT corporate subsidiary held through an LP and a sub-trust | 1006 |

| Tax Topics - Income Tax Act - 101-110 - Section 107.4 - Subsection 107.4(2) - Paragraph 107.4(2)(a) | s. 107.4 transfer of sub-trust’s assets to sister MFT trust | 459 |

| Tax Topics - Income Tax Act - Section 98 - Subsection 98(3) | drop down of LP 1 into LP 2 followed by immediate s. 98(3) wind-up of LP 1 into LP 2 and GP of LP1, followed by immediate taxable sale by GP to LP 2 | 146 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Disposition | no disposition on conversion of general to limited partnership or adding right of renunciation of a MFT unitholder | 165 |

| Tax Topics - Income Tax Act - Section 132.2 - Subsection 132.2(3) - Paragraph 132.2(3)(g) - Subaragraph 132.2(3)(g)(vi) - Clause 132.2(3)(g)(vi)(C) - Subclause 132.2(3)(g)(vi)(C)(I) | renunciation by subsidiary partnership of transferee MFT of units that otherwise would be issuable on the redemption of its incestuous holding in transferor MFC | 245 |

6 December 2016 External T.I. 2016-0666841E5 F - Sale of property for POD less than FMV

Opco is held somewhat equally by three holding companies, each wholly-owned by an individual (A, B or C) who is unrelated to the others. Opco sells an asset to B’s child for 1/2 its fair market value. CRA found that:

- If the benefit conferred by Opco on B’s child was not also indirectly conferred by B’s holding company (Holdco B) on B or B’s child, then such benefit would be deemed by s. 15(1.4)(c) to be a benefit conferred on Holdco B by Opco, so that it would be included in Holdco B’s income.

- On the other hand, if the benefit had been indirectly conferred by Holdco B on B or B’s child (which CRA would generally infer if Holdco B influenced Opco’s conferral of the benefit), s. 246(1) could apply to include the benefit in B's income.

- If Holdco B had concurred in the benefit conferral, s. 56(2) could be an alternative basis for including the benefit in Holdco B’s income.

CRA did not discuss what criteria it would apply to determine whether it would assess Holdco B, or B, for the benefit (or even do both).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1.4) - Paragraph 15(1.4)(c) | application to Holdco shareholder of Opco where Opco conferrred a benefit on child of Holdco's shareholder | 210 |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | potential application to immediate shareholder re benefit on indirect shareholder | 207 |

14 March 2016 External T.I. 2016-0626781E5 - Neuman Type Situation

The only issued and outstanding share of Opco (which has retained earnings of $500,000) is 1 Class A common share, with a fair market value of $1,000,000 owned by Mr. A. Opco issues to Mrs. A, for nominal consideration, 1 non-voting Class B preferred share, which is redeemable and retractable “for the fair market value for which it is issued” and entitled to discretionary dividends as and when declared.

In Scenario 1, Opco immediately declares and pays out a $100,000 dividend on the Class B preferred share, which would have the effect of reducing the FMV of Opco and the 1 Class A common share by the same amount.

In Scenario 2, Opco does not declare and pay the $100,000 dividend until after it has earns an additional $100,000 of income, and the FMV of Opco after the dividend is at least $1,000,000.

What would be the consequences for Opco and its shareholders of such issuance and dividend? CRA appeared to indicate that it could be difficult to seek to apply s. 56(2) in light of Neuman, but it was more likely that s. 15(1) could be applied “particularly if the amount that is being paid by Mrs. A as consideration for the share does not represent the fair market value of such share at the time of subscription.” CRA then stated:

Alternatively, it may be possible that the circumstances of a particular situation would suggest that Mr. A rather than Opco is conferring the benefit to Mrs. A. If it could be demonstrated that there was a transfer of economic interest in Opco from Mr. A to Mrs. A similar to the situation...Kieboom...Mr. A would be considered to have disposed of a right, interest or right to dividends in Opco to Mrs. A. Under these circumstances, because Mr. A and Mrs. A are spouses, the automatic rollover provision in subsection 73(1) would apply such that the disposition of Mr. A’s economic interest would be at cost.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | s. 15(1) might apply where spouse subscribes nominal consideration for Opco shares and receives a large discretionary dividend | 226 |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | s. 56(2) likely non-applicable where spouse subscribes nominal consideration for Opco shares and receives a large discretionary dividend | 262 |

| Tax Topics - Income Tax Act - Section 73 - Subsection 73(1) | spousal rollover for Kieboom disposition of economic interest | 82 |

16 April 2012 External T.I. 2011-0411491E5 - Taxation of distributions of a US LLC

In…2011-0411491E5, CRA commented on an interest in a United States Limited Liability Corporation (LLC) held by an Alberta Unlimited Liability Corporation (AULC) owned by a Canadian resident individual. …[T]he individual would be subject to US taxation on…LLC income attributed to the AULC. CRA indicated that payment of these taxes on the individual's behalf would constitute a taxable benefit, either under S 15(1) if paid by AULC or under S 246(1) if paid by LLC. Can CRA explain the economic enrichment of the individual which it perceives to arise through the ownership structure? CRA responded:

[A]n amount paid by a corporation to its individual shareholder as a reimbursement of that shareholder's personal tax liability would result in an impoverishment of the corporation and an enrichment of the shareholder for purposes of subsection 15(1). A similar enrichment would result for purposes of subsection 246(1) where the shares are held by that individual indirectly through another corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | taxable benefit where US taxes on LLC income allocated to indirect Cdn member are paid by LLC or intermediate ULC | 161 |

24 June 2015 External T.I. 2015-0575911E5 F - Benefit to shareholder or conferred on a person

Corporation A, is wholly owned by Holdco, which has equal unrelated Shareholders 1, 2, 3 and 4. Corporation A disposes of a capital property to the spouse (who is not herself a shareholder) of Shareholder 4 at a price which is determined to be less than the property's fair market value. What are the consequences? After discussing the potential application of ss. 15(1.4)(c) and 56(2), CRA stated (TaxInterpretations translation):

…[Respecting s. 246(1)], it appears that if Holdco had made a payment directly to Shareholder 4, such payment would be required to be included in computing the income of Shareholder 4 pursuant to subsection 15(1). Accordingly, to the extent that subsection 246(1) was applicable, the value of the benefit that Holdco indirectly conferred on Shareholder 4 (through Corporation A) would be included in computing the income of the latter pursuant to paragraph 246(1)(a).

See summaries under s. 15(1.4)(c) and s. 56(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1.4) - Paragraph 15(1.4)(c) | benefit only conferred on one shareholder (the husband) if wife of one of four sibling shareholders receives benefit | 333 |

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | benefit conferred on spouse of individual shareholder of parent | 253 |

3 March 2015 Internal T.I. 2014-0527841I7 F - Avantage imposable pour aéronef

In a wholly-owned stacked structure of three Corporations (C holding D, holding E), Corporation E acquired an aircraft for business use but with some percentage use by Mr. A, the sole shareholder of Corporation C, and by his father (Mr. B), who also was the director of Corporations D and E. Was CRA required (as submitted by the taxpayer) to apply IT-160R3 (which was archived for the years under review, and then cancelled in September 2012), under which the taxable benefit to Mr. A was computed on the basis of the cost of a first class ticket for an equivalent trip or should the benefit be based on the quantum of the denied expenses of Corporation E (based on application to those expenses of the personal-use percentage)?

The Directorate stated (TaxInterpretations translation, para. 23) that " we agree with you that section 246(1) applies to your file” (at para. 30), and that "the benefit for the personal use of the Aircraft is conferred on Mr. A in his capacity as shareholder and on Mr. B. in his capacity as being related to shareholder Mr. A.” and that "subsection 15(1) do not apply to a situation where a benefit is conferred…on an indirect shareholder” Although "it does not seem clear … considering that Corporation E conferred the benefit, that it is possible to justify an inclusion in income under subsection 246(1). However, … subsection 246(1) may apply … if it were established that Corporation C conferred the benefit for the personal use of the Aircraft.”(para. 32)." In particular (paras. 33, 34):

… Although it can be shown that Corporation E conferred a benefit on Mr. A, the value of the benefit would not be included in computing Mr. A’s income … if it was a payment made directly to Mr. A, since Mr. A is not a shareholder of Corporation E. From that perspective, subsection 246(1) does not apply to a benefit conferred by Corporation E on Mr. A …

However, in … Masicotte the judge concluded that subsection 246(1) could apply when a corporation confers a benefit on an indirect shareholder.

In order to consider that:

Corporation C confers directly or indirectly a benefit on Mr. A…it imust be shown that Corporation C has an influence on Corporation E. (para. 35)

This condition was satisfied in light of the control of Corporations C and E by Mr. A.

[T]he value of the benefit conferred on Mr. B cannot be included in his income under subsection 246(1), because…if Corporation C had made a payment directly to Mr. B, this payment would not have been included in computing the income of Mr. B by virtue of subsection 15(1) or paragraph 6(1)(a)… .

Under paragraph 15(1.4)(c), the benefit conferred on Mr. B by Corporation B would instead be a benefit conferred on Mr. A, who is a shareholder of Corporation C, since Mr. B is not dealing at arm’s length with Mr. A. Therefore, for this benefit, subsection 246(1) should be applied because Corporation C conferred a benefit on Mr. A.

However, for a benefit conferred on Mr. B before November 1, 2011…it would not be possible to include [it] in the income of Mr. B or Mr. A… (paras. 36-38).

After discussing Youngman, Fingold, Schroter and Anthony (and before discussing Spence to the same effect), the Directorate stated (at para. 57):

[T]he value of the benefit for Mr. A and Mr. B for the personal use of the Aircraft should correspond to the FMV and not to the cost to Corporation E.

These decisions were more authoritative and helpful than decisions dealing specifically with personal aircraft use (paras. 66-67). However (at para. 77):

[T]he aircraft operating costs and the CCA denied to Corporation E can be used to establish the value of the benefit conferred on Mr. A and Mr. B., to the extent that it can be demonstrated that this value approximates the FMV of the benefit received.

Respecting IT-160R3, the Directorate noted that as the personal usage percentage was under 33%, para. 5 thereof did not apply but that, in light of the level of operating expenses, referencing the price of first class tickets for comparable trips would result in too low an estimate of the taxable benefits – so that the guidelines in IT-160R3, paras. 3-5 should not be followed. Instead, the more general guideline in para. 1 “to determine the value of the benefit based on what is reasonable” should be followed, so that “the value of the benefit for the personal use of the Aircraft should be determined based on the FMV of the benefit received.”(para. 91). "[T]he FMV corresponds to the amount the shareholder would have paid under similar circumstances to receive the same benefit from a corporation of which he was not a shareholder.”(para. 99).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 13 - Subsection 13(7) - Paragraph 13(7)(c) | apportionment of aircraft use between business and personal | 74 |

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | benefits from personal use of corporate aircraft based on the cost of similar benefit from arm's length supplier | 174 |

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1.4) - Paragraph 15(1.4)(c) | s. 15(1.4)(c) applied to extend scope of Massicotte indirect benefit doctrine | 170 |

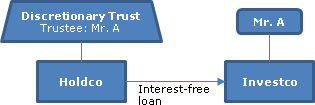

12 December 2012 Internal T.I. 2012-0464411I7 - Indirect Benefit

A taxable Canadian corporation (Holdco) which is wholly-owned by a trust of which Mr. A is the sole trustee and is a discretionary beneficiary, makes an interest-free loan to another taxable Canadian corporation (Investco) of which Mr. A is the sole shareholder. In finding that this did not give rise to a taxable benefit, CRA indicated that:

- "for the purposes of 15(1) we have generally not considered that a benefit is conferred on a shareholder by reason of the making of a loan to that shareholder…[except] where, for example, there is no reasonable expectation of repayment of the loan amount"

- furthermore, applying s. 15(1) also is problematic as the "loan has been made to Investco, which is not, itself, a shareholder of Holdco"

- "since the amount advanced by Holdco to Investco was a "loan", there is no "payment" that would be considered to have been made that would allow the provisions of s. 56(2) to apply to include the loan amount in the income of Mr. A"

- unlike Massicotte, the case "does not involve a holder of shares of a parent corporation obtaining a benefit from a subsidiary corporation"

- s. 246(1) "does not permit characterizing a loan to a corporation as, instead, one made to the individual who controls that corporation in order to then calculate a benefit under paragraph 80.4(2"

- As there have been no relevant changes since Cooper, s. 105(1) "would not be considered favourably as a ground for including a foregone interest benefit in the income of Mr. A"

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - 101-110 - Section 105 - Subsection 105(1) | interest-free loan | 113 |

| Tax Topics - Income Tax Act - Section 20 - Subsection 20(1) - Paragraph 20(1)(e) | fee re distribution borrowing | 159 |

16 April 2012 External T.I. 2011-041149

A Canadian-resident individual owns all the shares of an Alberta unlimited liability company which, in turn, owns a majority of the membership units of a US LLC. As a result of both corporations being fiscally transparent entities under US tax law, the individual is required under US tax law to pay tax on his proportionate share of the income of the LLC.

The determination of the management of the LLC to pay the US tax liability of the individual would result in an income inclusion to the individual under s. 246(1) given that a payment of that amount by the Alberta ULC would have resulted in an income inclusion under s. 15(1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Dividend | 157 |

10 January 2011 Internal T.I. 2009-0344251I7 - Application of subsection 246(1)

In a situation where a second-tier subsidiary provides a benefit to the shareholder of a first-tier corporation, s. 246(1) can be applied on its own to assess the taxpayer for that benefit. (If the first-tier corporation had provided the benefit directly, the benefit would have been taxable under s. 15(1).)

8 October 2010 Roundtable, 2010-0371901C6 F - avantage à l'actionnaire, assurance-vie

Question 2 at the May 4, 2010 CALU Roundtable concerned the situation where (A) Holdco holds an insurance policy on the life of its shareholder, pays the premium and designates its subsidiary as the beneficiary, or (B) the same situation except that the subsidiary is designated as irrevocable beneficiary and reimburses Holdco for the premiums, or (C) there are two sisters (Corporations 1 and Corporation 2) wholly-owned by Mr. A, with Corporation 1 holding an insurance policy on Mr. A's life and paying the premiums, while Corporation 2 is designated as beneficiary and reimburses Corporation 1 for the premiums paid.

CRA confirmed that s. 15(1) would not apply in Situations A and C, but that s. 246(1) could apply in Situation A, i.e., where Holdco designates its subsidiary as beneficiary. Why should the subsidiary be taxable on the amount of the premium, since Holdco could just as readily pay an amount equal to the premium, in the form of a loan or capital injection? CRA responded:

The application of section 9, paragraph 12(1)(x), subsections 15(1), 245(2) and 246(1) is a question of fact and each situation must be examined individually. … [T]he CRA will examine any situation that involves a corporate group and where the life insurance proceeds included in a corporation's capital dividend account is not reduced by the adjusted cost base of the policy. This can occur where a corporate group holds the policy and another corporation in the group is beneficiary.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 12 - Subsection 12(1) - Paragraph 12(1)(x) | reimbursement by sub of premiums potentially includible under s. s. 12(1)(x) where it is the beneficiary of life insurance policy held by parent | 258 |

4 May 2010 CALU Roundtable, 2010-0359421C6 - Shareholder's benefit and life insurance

S. 246(1) could apply where a corporation (Parentco) holds a life insurance policy for which it pays the premiums and designates its subsidiary (Subco) as the beneficiary. It would be necessary to determine, with all the relevant documentation, whether the reimbursement of premiums should be included in the income of the corporate life insurance policyholder (Parentco) under s. 9 or 12(1)(x) where its subsidiary (Subco) was named as the irrevocable beneficiary of the life insurance policy and reimbursed Parentco for the premiums paid by Parentco.

4 December 2009 Internal T.I. 2009-0344991I7 F - Paragraphe 246(1) et le jugement Massicotte

Mr. X, who is the sole shareholder of Holdco, which in turn is the sole shareholder of Opco receives, along with four Opco employees receive reimbursements from Holdco and Opco for personal expenses. Should s. 246(1) be used as the sole basis for assessment? The Directorate responded:

[S]ubsection 246(1) is generally a provision of subsidiary application since it must be shown that the value of the benefit is not otherwise included (for example, by virtue of paragraph 6(1)(a) or subsection 15(1)) in computing the taxpayer's income … . On the other hand … Massicotte … held that the Minister of National Revenue may assess a taxpayer solely on the basis of section 246 despite the fact that paragraph 6(1)(a) could have been argued … .

… Thus, while the Minister may invoke subsection 246(1) as the sole ground for assessment, we believe it is preferable that the assessment refer - if the facts of the situation are appropriate - to the provisions of specific application. … [T]herefore … the assessment should rely on paragraph 6(1)(a) and/or subsection 15(1) as the main grounds … .

2 December 2008 Internal T.I. 2008-0270981I7 F - Entreprise de prestation de services personnels

Mr. A wholly-owned Holdco, which held a minority interest in Opco. The principal residence of Mr. A and Ms. A (spouses), held by Holdco, is transferred to a newly-formed partnership between Holdco, Mr. A and Ms. A holding 98%, 1% and 1% interests, respectively, but with Holdco continuing to be responsible for the mortgage loan. Mr. A who, but for this structure, would reasonably be considered to be an Opco employee, provides services to Opco on behalf of the Partnership. This structure targeted (i) avoiding a taxable benefit to Mr. A from the use of the principal residence, (ii) avoiding source deductions respecting his services to Opco and (iii) generating the small business deduction for Holdco.

Regarding the first benefit, the Directorate stated that it could be argued that a benefit was indirectly conferred on Mr. A pursuant to s. 246(1), as to which it stated:

[CRA] may assess Mr. A solely on the basis of that provision, as determined in Massicotte … . Furthermore, if the residence had been held by Holdco directly, Mr. A would have received a benefit … under subsection 15(1). Thus … although the residence is owned by the Partnership, Holdco, as a partner with a 98% interest in the Partnership, may exercise sufficient influence over the Partnership to be able to confer a benefit indirectly on Mr. A.

25 February 2008 Internal T.I. 2007-0243871I7 F - Avantages imposables

After finding that a corporation’s payment of the personal expenses of an unpaid director gave rise to s. 6(1)(a) inclusions to him, the Directorate stated:

[S]ubsection 246(1) is a provision of subsidiary application since it must be shown that the value of the benefit is not otherwise included (e.g., by virtue of subsection 6(1)(a)) in computing the taxpayer's income under Part I … .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 6 - Subsection 6(1) - Paragraph 6(1)(a) | unpaid director was a deemed employee, so that payment of his personal expenses was a s. 6(1)(a) benefit | 131 |

14 June 2007 External T.I. 2006-0209341E5 F - Utilisation d'un bien d'une société de personnes

A partnership in whose farming business the partners are actively involved owns the residence of one of the partners, who does not pay rent, but pays all the annual expenses of the residence. CRA noted (as per its summary):

Except for paragraph 12(1)(y), there is no statutory provision that would apply to a partner by reason of the partner’s personal use of partnership property.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - 101-110 - Section 103 - Subsection 103(1) | personal use of property is a factor going to the reasonableness of the profit-sharing arrangements | 74 |

| Tax Topics - Income Tax Act - Section 96 - Subsection 96(2.2) - Paragraph 96(2.2)(d) | personal use of property could engage s. 96(2.2)(d) | 104 |

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(a) - Income-Producing Purpose | partner’s use of partnership property is addressed by denying partnership income deductions and under s. 103, rather than through benefit-conferral provisions | 112 |

20 March 2007 External T.I. 2006-0173711E5 F - Paiement des impôts d'une fiducie

Mr. A is one of the two trustees for an inter vivos trust for his minor children that provides for the distribution of all income to the beneficiaries, with the trust electing under s. 104(13.1). Mr. A voluntarily pays the income taxes owed by the trust.

Does s. 105(1) (or any other provision) apply to tax the beneficiaries on the income taxes paid by the trustee personally? After indicating that s. 105(1) did not apply, CRA stated:

[I]t should be noted that the amount of tax paid by Mr. A does not represent income on which a taxpayer would have been taxed if he had received it directly. Therefore, the beneficiaries would not be taxed on the amount of tax paid by Mr. A under subsection 246(1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - 101-110 - Section 105 - Subsection 105(1) | s. 105(1) does not apply where trustee pays trust taxes | 109 |

| Tax Topics - Income Tax Act - Section 74.1 - Subsection 74.1(2) | attribution may apply where father pays income tax liability of trust for his children | 107 |

17 December 2003 Internal T.I. 2003-0047367 F - Benefit Conferred on Non-arm's Length Person

The four equal common shareholders of Opco were X (a director and vice president), his wife ("Y"), Y's sister and the sister's husband, and X and Y also held preferred shares. After Opco, which had been carrying on a business, fell into financial difficulties, it sold the property of that business to X at an undervalue, without any change to Opco’s share capital. After finding that s. 15(1) might apply to the sale, the Directorate stated:

Subsection 246(1) would apply … to the extent that Opco conferred on X, directly or indirectly and in any manner whatever, a benefit and to the extent that the value of that benefit would be included in computing X's income if it were a payment that Opco had made directly to X. In that regard, it appears that if Opco had made a payment directly to X, that payment would, inter alia, have been required to be included in computing X's income pursuant to …, paragraph 6(1)(a). Thus … the value of the benefit that Opco conferred on X would be included in computing X's income under paragraph 246(1)(a).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 84 - Subsection 84(2) | s. 84(2) inapplicable on sale by defunct corporation of its assets at an undervalue to one of its shareholders | 195 |

| Tax Topics - Income Tax Act - Section 52 - Subsection 52(1) | application of s. 15(1) or 246(1) to property distributed by corporation to shareholder would be added to the property’s ACB | 65 |

6 October 2003 External T.I. 2003-0040145 F - TRANSFERT D'UNE POLICE D'ASSURANCE-VIE

A shareholder transferred a universal life insurance policy, that was an exempt policy, on the individual’s life to a wholly-owned corporation for consideration equal to the cash surrender value, which was less than the adjusted cost basis (ACB) of the policy. Following the transfer, the corporation was named as the beneficiary.

After noting that under s. 148(7) the proceeds equaled the cash surrender value, CCRA stated:

The fair market value of a life insurance policy is not necessarily equivalent to its cash surrender value. The age and health of the insured, the value of the accumulation fund, the cash surrender value and the amount of premiums paid at the date of transfer are all factors to be considered when determining the fair market value of a life insurance policy. If, in this case, it appears that the fair market value of the policy is greater than the cash surrender value, there will be a benefit conferred by the shareholder to the corporation since the transfer of the policy will be for consideration equal to the cash surrender value. There is no provision in the Act that taxes such a benefit. This issue is currently under review by the Department of Finance.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 148 - Subsection 148(7) | loss on transfer of universal life policy to wholly-owned subsidiary not recognized | 92 |

| Tax Topics - Income Tax Act - Section 148 - Subsection 148(9) - Adjusted Cost Basis - Element A | no taxable benefit when life insurance policy transferred to wholly-owned corporation at less than its FMV | 209 |

25 March 1994 External T.I. 9335505 - INTEREST REDUCE 15(1) BENEFIT

"It our general position that the term 'shareholder' as used in subsection 15(1) of the Act would not include a person who indirectly controls a corporation through a holding corporation. Although the provisions of subsection 15(1) of the Act would not normally apply in respect of the value of any benefit conferred by a corporation on an indirect shareholder, the provisions of subsection 246(1) of the Act could apply to include the amount of the benefit in the hands of the indirect shareholder."

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(1) | 99 |

93 A.P.F.F. Round Table, Q.17

Where a taxpayer transfers assets to an unrelated corporation applying the s. 85(1) rollover, it is not possible to rule out the application of ss.246(1) and 56(2).

24 March 1993 T.I. (Tax Window, No. 38, p. 1, ¶2490)

Re potential application of s. 246(1) to a holder of common shares where his father exchanges preferred shares of the corporation for preferred shares having a lower redemption amount and for options.

90 C.R. - Q.47

Where a Canadian corporation borrows funds from an arm's length lender and the Canadian corporation's non-resident parent guarantees the loan for no consideration, the Canadian corporation will not be considered to have received a taxable benefit from the parent.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 214 - Subsection 214(15) | 100 |

80 C.R. - Q.55

The listing in IT-453 of conferral-of-benefit situations was not intended to be comprehensive.

IT-239R2 "Deductibility of Capital Losses from Guaranteeing Loans for Inadequate Consideration and from Loaning Funds at less than a Reasonable Rate of Interest in Non-arm's Length Circumstances"

Former s. 245(2) may have been applied in situations where there is a material benefit to other shareholders as a result of a minority shareholder making a loan to, or honouring a guarantee in respect of, a Canadian corporation controlled by him and members of his family.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(2) - Paragraph 40(2)(g) - Subparagraph 40(2)(g)(ii) | 265 |

Paragraph 246(1)(a)

Administrative Policy

15 May 2019 IFA Roundtable Q. 7, 2019-0798821C6 - Subsection 246(1) and Non-Residents

An indirect benefit would be included in computing a non-resident’s income under s. 15(1) if the amount of the benefit were a payment made directly to the non-resident and if the non-resident taxpayer were resident in Canada. Would s. 246(1)(a) include such shareholder’s benefit in the non-resident’s taxable income earned in Canada, even though the benefit is akin to income from property rather than any of the Canadian income sources described in s. 2(3) (employment in Canada, carrying on business in Canada and dispositions of taxable Canadian property)?

CRA indicated that, generally, a non-resident’s Part I tax liability, including from any s. 246(1)(a) benefit, is based on the non-resident’s taxable income earned in Canada under s. 2(3) and Division D (ss. 115-116). To the extent that only s. 15(1) is relevant in the analysis of the s. 246(1)(a) benefit being conferred, such a benefit generally would not be considered taxable income earned in Canada, as it would generally not be included under s. 2(3) or Division D.

Even if the benefit amount were not taxable income earned in Canada, it could still be relevant for certain purposes in computing the non-resident’s income, as provided in s. 250.1(1)(b).

5 November 2003 Internal T.I. 2003-0043277 F - Benefit-Use of Automobiles

The CEO ("X") of an automobile sales company ("Opco"), and X's spouse held 51% and 49% of the shares of a holding company ("HoldcoX"), which held 51% of the shares of Opco. X's mother ("Mother"), who was an Opco director, X and X’s brother ("Y") held 98%, 1% and 1% of the shares of another holding company ("HoldcoParent") holding 25% of the shares of Opco, and Y held directly 24% of the Opco shares.

Automobiles in Opco's inventory were made available to each of Y, Mother and X's daughter ("DaughterX") for personal purposes, a further automobile in Opco's inventory made available to X was used by X partly for personal purposes and partly in connection with X's employment with Opco. They paid no, or inadequate, compensation for such use.

The Directorate indicated that ss. 15(1) and (5) would apply in computing the resulting benefit to Y, so that it would be calculated assuming that ss. 6(1), 1.1), 6(2) and (7) applied.

Regarding DaughterX and Mother, the Directorate indicated that it was unlikely that they received the resulting benefits in their capacity of employees of Opco given the minimal employment income of DaughterX (who was a student) and the minimal involvement of Mother as a director. The Directorate indicated that s. 246(1)(a) could apply to include the benefit in X’s income given that a payment made by Opco directly to X would be included in his income under s. 15(1). However, if it could be demonstrated that HoldcoParent had significant influence over Opco, the preferred approach, in the case of Mother, would be to assess an inclusion in her income under s. 246(1)(a) on the basis that a direct payment by HoldcoParent to Mother would have been included in her income pursuant to s. 15(1).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 15 - Subsection 15(5) | application of s. 15(5) to shareholder’s use of company automobile | 72 |

| Tax Topics - Income Tax Act - Section 10 - Subsection 10(1) | automobiles in car dealer inventory used for employee’s personal use remained in inventory, cf. if converted primarily to personal use of shareholder (which would not be a disposition) | 314 |

| Tax Topics - Income Tax Act - Section 9 - Computation of Profit | conversion of automobile in car inventory to personal use of CEO would not entail its deemed disposition nor would the conversion of car inventory to personal use of shareholders | 267 |