Cases

Bosa v Canada, 2025 BCSC 1284

The petitioners were the beneficiaries of a family trust, who sought to rectify the terms of the Trust Indenture to clarify that the assets of the trust had vested indefeasibly in them on the date defined in the Trust Indenture as the "Distribution Date," which occurred approximately 10 months before the 21st anniversary of the formation of the trust.

Clause 2.03 of the Trust Indenture provided that, on the Distribution Date, the trustees were required to divide the remaining trust property among the beneficiaries. However, apparently, no specific action of the trustees was taken to this effect. The petitioners sought to change a few of the words in Clause 2.04 so that it provided that, in the event of no person becoming entitled to the trust property on the Distribution Date, the trustees were to divide the trust property on that date among those beneficiaries who would have been entitled to share on an intestacy of the family patriarch – as well as seeking some related declarations.

CRA assessed the trust on the basis that its property, being shares of various corporations, had not been distributed on the Distribution Date and, therefore, was deemed to be disposed of under s. 104(4)(b) held by the trust on the 21st anniversary. A six-day trial in the Tax Court to consider an appeal of the trust from such reassessments had been set down for May 2026.

In finding that she lacked the jurisdiction to grant the requested rectification order and related declarations, Shergill J. stated (at paras. 47, 50):

It is an established principle that where a provincial superior court has concurrent jurisdiction with the Tax Court, it should exercise this jurisdiction only over issues that are “ancillary” rather than “fundamental” to the Tax Court proceedings: Sheila Homes Spousal Trust v. Canada … 2013 ABQB 489, at para. 61 . …

The interpretation of the Trust Indenture which they [the petitioners] urge me to adopt is based on the same arguments that the Reassessment officer considered and rejected. Those arguments are the subject of the appeal to the Tax Court … .

In further finding that, even if she had jurisdiction, rectification would not be appropriately granted, she stated (at para. 58) that “[i]t is well established that equitable relief is not available to avoid unanticipated adverse tax consequences which arise from the ordinary operation of the Income Tax Act … Collins Family Trust … .. She further stated (at para. 60):

I consider the declarations that are being sought (particularly the retroactive vesting order), to be an attempt to avoid an unintended tax liability. Equitable relief is not available in such a circumstance.

Agence du revenu du Québec v. Structures GB Ltée, 2025 QCCA 134

The shareholders of a Canadian-controlled private corporation (“Structures”) implemented a reorganization that was intended to crystallize the capital gains deduction (CGD). However, the transactions for first "purifying" Structures of investment assets entailed the issuance of some preferred shares, which caused the shareholding in Structures of three of the holding companies to be diluted from 10% to below 10%, so that Structures was no longer connected to them and so that they were subject to significant Part IV tax on dividends received from Structures. The parties entered into transactions to extensively re-do various of the steps in order to eliminate the Part IV tax, and the Quebec Superior Court issued a rectification order to confirm that these changes had retroactive effect.

In allowing the appeals of the ARQ and the A.G. (Canada), so that the rectification order was reversed, the Court stated (at paras. 25, 29-30, 36, TaxInterpretations translation):

If the agreement is consistent with what the parties agreed to but simply produces unforeseen tax consequences, due to an error by the tax planners in the design of the tax planning, rectification cannot be granted. …

The parties had not planned any specific entitlement [“prestation”] aimed at ensuring that Structures and the holding companies were connected throughout the 31 stages of the corporate reorganization of Structures. …

… Mr. Côté, the tax specialist who conceptualized the reorganization, … affirmed that maintaining connectedness was not the object of the transaction, which was to crystallize as much CGD as possible. ...

With respect, the court of first instance went well beyond what was permissible in the context of an action for rectification. As indicated, the court could not go beyond modifying the written instruments which were supposed to give effect to the common intention and not to implementing retroactive tax planning.

Pyxis Real Estate Equities Inc. v. Canada (Attorney General), 2025 ONCA 65

A plan was implemented for successive capital dividends to be paid up a chain of corporations so that the individual who was the ultimate shareholder could have a tax-free receipt of $1.4 million. However, to accomplish this objective, the successive payments should have started with the payment of a $1.7 million capital dividend by the “bottom” corporation in the chain (which, in fact, had a capital dividend account of $45 million), given that an intermediate corporation in the chain had a CDA deficit (presumably from a prior capital loss) of $0.3 million (which the accountants had overlooked).

In allowing the Attorney General’s appeal from the granting of an order rectifying the corporate documents so as to direct a capital dividend of $1.7 million, Nordheimer JA stated (at para. 16):

At its core, the [Fairmont] test requires that the executed documents fail to accurately record the parties’ agreement. The agreement here was for a $1.4 million tax-free capital dividend to be paid. …The corporate resolutions that were signed … accurately reflect the agreement. The fact that the agreement did not result in the intended fiscal objective of being tax-free, or tax neutral, is not a basis for granting rectification.

Pierre Elliott Trudeau Foundation v. Millenium Golden Eagle International (Canada) Inc., File No. 500-17-125795-230 (Quebec Superior Court)

The plaintiff (the Foundation) received two donations, each of $70,000, from the defendant (Millenium) in July 2016 and July 2017. These amounts were restituted by the Foundation to Millenium through the delivery of a cheque, which was cashed in April 2023. On application of the Foundation for annulment of the two donations, which Millenium did not answer, and the two impleaded parties (the A.G.-Canada and the ARQ) did not contest, Barin JSC ordered that the two donations were resolved and deemed never to have existed.

Evans v. Attorney General of Canada, 2024 ONSC 1955

After a discretionary family trust realized a capital gain from a share sale, the sole trustee passed a resolution in that year providing that “[t]he income of the Trust be allocated to the [three stated] Beneficiaries of the Trust payable by way of demand Promissory Note in such amounts to be determined when the income of the Trust is ascertained … .” Such promissory notes were issued and dated as of March 31 of the following year. CRA denied the s. 104(6) deduction for the amount of the taxable capital gain allocated to the three beneficiaries because the resolution did not specify the amounts to be payable to them.

Rady J found that the evidence established that there was an agreement to allocate at least $375,000 (i.e., ½ of the capital gains amount eligible for the capital gains deduction) to each of the three beneficiaries, although there was insufficient evidence to establish that the entire taxable capital gain was agreed to be so allocated. Accordingly, she granted an order to rectify the resolution so as to provide that $375,000 of the taxable capital gain was to be allocated to each of the three beneficiaries, stating in this regard (at para. 62):

I am satisfied that the applicants are not attempting to retroactively amend their agreement to achieve beneficial tax consequences. Rather, they seek to rectify the resolution itself because it did not sufficiently express the agreement they had reached.

She further indicated that the application should not be dismissed on the basis of the trust having the alternative remedy of suing the professional advisors. She described (at para. 61) as “apt: the statement in the dissenting reasons of Abella J in Fairmont that the court should not force on the parties an alternative that is neither practical nor certain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 104 - Subsection 104(6) | trust allocation resolution rectified to set out specific amounts | 232 |

Williams Moving & Storage (B.C.) Ltd. v. Canada (Minister of National Revenue), 2024 BCCA 160

A drafting error (involving an inappropriate duplication of text) in the proposal which was approved by the creditors of an insolvent company (Williams Moving) and by the B.C. Supreme Court resulted in CRA subsequently concluding that debts owing by Williams Moving to related companies had been forgiven pursuant to the proposal, so that it reassessed to apply s. 80 to Williams Moving. Following the reassessment, Williams Moving applied to correct the errors in the proposal and vary the court order, but did not object to the reassessment (perhaps because it had not yet used its losses).

Wilcock JA, after referring to authorities on the interpretation of “patently inconsistent provision in a contract” (para. 114), concluded (at para. 116) that “the most common‑sense reading of the Proposal, and that which does the least violence to its words, is to read out the duplicated text so as to resolve the inconsistency in the [relevant] definition” thereby excluding the debts owing to the related companies from the debt forgiveness.

In finding that the chambers judge had not erred in denying rectification of the written terms of the proposal, Wilcock JA noted (at para. 68) the finding in Fairmont that “rectification requires the parties to show an antecedent agreement with respect to the term or terms for which rectification is sought” and stated (at paras. 69):

[I]t is difficult to see how it can be said that the creditors would have understood the Proposal to be anything other than what was presented to them. …

There was insufficient evidence of a common understanding amongst the appellant and its creditors on the matter in dispute … .

However, the chamber judge had failed to exercise her discretion under s. 187(5) of the Bankruptcy and Insolvency Act (“BIA”) to vary the court order giving effect to the proposal, even having regard to Rule 92 under the BIA, which provided that “the court may correct any clerical error or omission in it, if the correction does not constitute an alteration in substance.” In finding that it was appropriate on this appeal to now exercise such discretion, Wilcock JA stated (at para. 127):

I am satisfied the duplicated text appeared in the version of the Proposal accepted by creditors as a result of a clerical error which the Court may correct. The correction does not constitute an alteration in substance. It will not prejudice creditors or third parties. While the appellant’s principal objective in seeking to correct the Order approving the Proposal is to contest the CRA re‑assessment, I am satisfied that this is not a collateral attack upon a decision that should be challenged elsewhere.

Slightham et al. v. AGC, 2023 ONSC 6193

The two applicant trusts were formed in order to acquire the common shares of a corporation (“Signature”) in an estate freezing transaction. In order that excess cash assets of Signature could be distributed from time to time so as to permit the shares of Signature to qualify for the lifetime capital gains exemption, the tax plan contemplated that a holding company (“Holdco”) would be a beneficiary of each trust, so that dividends could be received by the trusts and distributed to Holdco on an exempt basis. In order that s. 75(2) would not apply to Holdco, the tax plan contemplated that Holdco would be prohibited under the trust deeds from receiving any income or capital derived from itself. However, due to a drafting error, a reference to “Signature” was mistakenly added as one of the parties from which Holdco could not receive income or capital.

This mistake was discovered when CRA denied the s. 104(6) deduction for dividends from Signature distributed by the trusts to Holdco, on the grounds that such distributions were prohibited by the trust deeds. CRA refused to accept that the trust deeds could be amended pursuant to their amendment provisions to correct this error nunc pro tunc.

After noting that the evidence clearly supported all of the above points, Osborne J allowed this application (which was not opposed by the Attorney General) to amend the declarations of trust to delete the references to Signature, as requested in the applications, stating (at para. 65):

In this case, as in Sleep Country [2022 ONSC 6103], the parties are not changing their antecedent agreement. Rather, they are seeking the assistance of equity to change the written instrument that did not at the time it was executed, and does not now, properly and accurately reflect the agreement of the parties that has remained unchanged throughout.

Les Structures G.B. Inc. v. A.G. Canada, 2023 QCCS 3510, rev'd 2025 QCCA 134

Four individuals held their indirect holdings of 10%, 10%, 5% and 5% of the common shares of a Canadian-controlled private corporation (Structures) through three holding companies (the "Holdcos"). One of them was a joint holding company for the two indirect 5% shareholders. A tax plan drawn up by the tax advisor (Mallette) for the crystallization of the capital gains deduction (CGD) entailed "purification" transactions for first extracting investment assets of Structures as tax-free dividends or deemed dividends. It was the expectation of the shareholders that this reorganization would not trigger significant taxes and that the status of Structures as a connected corporation of the three Holdcos would be maintained. However, the issuance of some Class E shares as part of the implementation of the steps in May 2019 resulted in the three Holdcos' shareholdings in Structures falling below 10%. On December 13, 2019, the parties signed documents to rectify the steps, and on February 7, 2020, brought this application for a judgment of rectification to the implementing documents.

Before granting the requested order, Blanchard J stated (at paras. 66, 70, TaxInterpretations translation):

The de-connection of the corporations prevented the accomplishment of the will of the parties in implementing the reorganization, which was to crystallize the CGD and not pay any tax, other than minimum tax, while benefiting from the CGD. ...

In the circumstances, it is appropriate to grant the request and to correct the documents in order to conform them to what the parties had conceived. This is not the Shareholders attempting to rewrite the tax history of the file.

Agence du revenu du Québec v. Samson, 2023 QCCA 332

The respondent (Samson) and a corporation (Bourgade) implemented a plan set out in a tax-planning memo of a tax advisor that contemplated that they would transfer their shares of a corporation (CRP) in December 2013 after having satisfied the conditions for realizing a business investment loss under s. 50(1)(b)(iii). This result was premised on their having had a November 30, 2013 taxation year – which had occurred for Bourgade, but not for Samson who, as an individual, had a calendar taxation year.

The Quebec Superior Court agreed to rectify the share sale agreement to change its date from December 11, 2013 to the date on which it had actually been signed (April 4, 2014). After quoting from the tax planning memo, and before dismissing the ARQ’s appeal, the Court stated (at paras. 19-21, TaxInterpretations translation):

The judge further concluded that "the Agreement does not reflect the true intention of the parties", in that "its date excluded from the outset any possibility of making the election under ITA subsection 50(1)". … Since the ITA s. 50(1)(b)(iii) election could not be made before December 31, 2013, the December 11, 2013 date of the Agreement does not reflect the parties' intention.

Given this clearly expressed intention, it must be concluded that the respondent's request for rectification simply seeks to correct the date of the Agreement to give effect to that intention. This is consistent with the pronouncements of the Supreme Court in Jean Coutu. This is not a case where the taxpayer is seeking a tax benefit that he did not anticipate at the time of his tax planning.

… The answer might have been different if the rectification had given the taxpayer an additional tax benefit that he had not anticipated at the time of his tax planning. However, that is not the case here.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 50 - Subsection 50(1) - Paragraph 50(1)(b) - Subparagraph 50(1)(b)(iii) | no loss realized under s. 50(1)(b)(iii) unitl year end rectifed | 229 |

Canada (Attorney General) v. Collins Family Trust, 2022 SCC 26

Two operating companies each implemented a plan, suggested by a tax advisor, to protect their assets from creditors. In each case, a holding company was incorporated to purchase shares in an operating company, a family trust was created with the holding company as a beneficiary, and funds were lent to the trust to purchase shares in the operating company. The operating companies paid dividends to the trusts, which were attributed to the holding companies under s. 75(2), with the holding companies, in turn, claiming the intercorporate dividend deduction under s. 112(1). The effect was to move significant sums from the two operating companies to the two family trusts fees of tax. However, Sommerer unexpectedly found that s. 75(2) did not apply to sales of property. CRA assessed the trusts on the basis that distributions from the operating companies were taxable, thereby imposing an unexpected tax liability. The trusts’ petition for the equitable remedy of rescission of the transactions was granted by the chambers judge, whose decision was affirmed in the B.C. Court of Appeal.

Before allowing the appeal and dismissing the trusts’ petition, and in finding that the principle in Fairmont Hotels and Jean Coutu, that a “court may not modify an instrument merely because a party discovered that its operation generates an adverse and unplanned tax liability” (para. 16(d)) was not limited to situations of requested rectification and applied as well to the equitable remedy of rescission, Brown J stated (at para. 22):

I agree with the conclusion in Canada Life that Fairmont Hotels and Jean Coutu bar a taxpayer from resorting to equity in order to undo or alter or in any way modify a concluded transaction or its documentation to avoid a tax liability arising from the ordinary operation of a tax statute. … While a court may exercise its equitable jurisdiction to grant relief against mistakes in appropriate cases, it simply cannot do so to achieve the objective of avoiding an unintended tax liability.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(1) | Minister required to assess based on an unexpected case law development | 365 |

| Tax Topics - Income Tax Act - Section 220 - Subsection 220(1) | s. 220 required the Minister to assess based on new judicial interpretation | 177 |

Mandel v. 1909975 Ontario Inc., 2020 ONSC 5343

In order to avoid a deemed disposition under the s. 104(4) 21-year deemed realization rule, two family trusts for the children of Mr. Mandel or Ms. Pike distributed their shares of a holding company (holding each family’s interest in a steel manufacturing operating company) under s. 107(2) to the respective children beneficiaries, who then transferred those shares on a s. 85(1) rollover basis to a newly-incorporated “Child Corporation” (of which Mr. Mandel or Ms. Pike held special voting shares) in consideration for non-voting common shares of the Child Corporation. However, Mr. Mandel or Ms. Pike then subscribed a nominal amount for a large number of convertible shares of the Child Corporation whose conversion (which they professed might occur only if a divorced spouse of a child received the non-voting common shares) would substantially dilute the entitlements of such non-voting common shares.

CRA reassessed Mr. Mandel and Ms. Pike on the basis that these transactions generated a taxable benefit under s. 15(1) to each of approximately $15 million. Each objected in November 2019, but to date, no appeal to the Tax Court had been launched. “In February 2020, further transactions occurred within each of the Child Corporations pursuant to which each child has become the controlling shareholder and a director of his or her corporation” (para. 27). The applicants brought this application seeking (1) a declaration that they have never been shareholders of the Child Corporations by virtue of OBCA s. 23(3) (providing that a share shall not be issued until it is fully paid) because they never paid for the shares; and (2) rectification of the records of the Child Corporations (pursuant to s. 97 of the Courts of Justice Act - or OBCA s. 250, contemplating “an order requiring the registers or other records of the corporation to be rectified”) to reflect that the applicants never held shares in them.

In declining to assume jurisdiction, Koehnen J stated (at paras 32, 35):

… [T]he Tax Court has jurisdiction to interpret s. 23(3) of the OBCA. …

Parliament has created a specific court with expertise in tax matters and has created a specific process to address tax issues. Given that the raison d’être of this application is the tax assessment, the issues should in my view be determined by the body with specialized expertise in that area.

Koehnen J went on to indicate that, even if he had assumed jurisdiction, he would have declined the application, stating (at paras 64, 65 and 68):

There is no need for intervention on my part to achieve justice here. There is no dispute between shareholders and there is no inability of the Corporation to conduct its affairs. …

… Given the unexplained conflict in the evidence before me about whether the applicants had paid for their shares, the absence of any dispute within the corporations and the potential for unknown consequences in granting a retroactive declaration, I exercise my discretion against awarding such a declaration.

Respecting s. 250, he stated (at paras. 82-83):

In this case, rectification is not appropriate because the corporate records accurately reflect what the parties intended in 2014 and 2015. At that time, the applicants intended to be the controlling shareholders of the Child Corporations. They signed several documents reflecting that intention. They had a specific reason for doing so: to defer the adverse tax consequences of a deemed disposition of the Family Trust assets. The corporate records accurately reflect that intention.

… [T]he applicants do not require a court order to correct the books and records of the Child Corporations. They can and in fact have changed those records to show that the applicants are no longer controlling shareholders.

Collins Family Trust v Canada (Attorney General), 2019 BCSC 1030, aff'd 2020 BCCA 196, rev'd 2022 SCC 26

After noting that the applications before him for the rescission of transactions entailing reliance on an interpretation of s. 75(2) that was established by Sommerer to be incorrect – and that in Pallen “which concerned an almost identical set of facts … rescission was granted” (para. 3), Giaschi J stated (at para. 5):

I agree with the submissions of the respondent that the decisions ... in Fairmont and Jean Coutu have seriously undermined Pallen. However, Pallen has not been expressly overruled and I am bound to follow it. In my view, it is for the British Columbia Court of Appeal to determine whether Pallen remains good law in light of the legal developments since it was rendered.

He went on to state (at paras. 65, 70-71):

The respondent relies heavily on Satoma ... [holding] that a tax plan similar to the ones before me (and therefore also similar to the plan in Pallen) constituted abusive tax avoidance and was subject to GAAR. …

In Satoma the primary purpose was found by the trial judge to be to avoid payment of any tax… .

…The evidence before me does not establish that the primary goal of the petitioners was to avoid payment of any tax. Rather, the evidence before me establishes that the purpose was to shield assets from creditors and to do so in a manner that did not attract tax liability, with both aspects having equal importance.

Crean v Canada (Attorney General), 2019 BCSC 146

Two of the petitioners were two brothers (Thomas and Michael) who each owned 50 of the 100 issued and outstanding common shares of a holding company (Crean Holdings). On May 27, 2016, they entered into an agreement in principle for Michael to purchase all of Thomas’ interests in the Crean Group, “direct or indirect” for the sum of $3,200,000, and providing that “the transaction will be structured, to the extent possible, so that Tom receives capital gains treatment for tax purposes.” Following advice from their tax advisor and on August 31, 2016, Crean Holdings paid capital dividends to them, Michael rolled his shares of Crean Holdings under s. 85 into a new personal holding company (1086881) for common shares, Thomas then sold his 50 common shares of Crean Holdings to 1086881 for a $2.75 million promissory note of 1086881.

The tax advisor subsequently realized that these transactions gave rise to a deemed dividend under s. 84.1 to Thomas, and the parties petitioned to have the sale agreement rectified by adding Michael as a party and providing for a sale of Thomas’ 50 shares directly to Michael in consideration for a $2.75 million promissory note of Michael and for the immediate on-sale by Michael of those shares to 1086881 in consideration for 1086881 assuming the promissory note.

In granting the petition, Burke J accepted the tax advisor’s testimony that, consistent with the agreement in principle, he had been instructed to provide for a direct sale and that the failure of the documents to so provide was an error on his part. She stated (at paras. 73, 85):

Ultimately, the respondent’s position in effect appears to be that the doctrine of rectification is limited to clerical error. I disagree. …

Thomas Crean and Michael Crean had a prior definite and ascertainable agreement. This is unlike Fairmont Hotels and Jean Coutu. The Agreement in Principle is sufficient evidence to grant a rectification remedy.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 84.1 - Subsection 84.1(1) | share sale for Newco note generated s. 84.1 dividend before its rectification | 233 |

Re 5551928 Manitoba Ltd., 2018 BCSC 1482

The petitioner, a Manitoba corporation with 24 shareholders, passed a resolution on November 20, 2015 that recited that “the company has a capital dividend account of the amount of $298,092”, declared a dividend in that amount “from the Company’s Capital Dividend Account pursuant to Subsection 83(2),” and directed the filing of a capital dividend election “in order to have the rules set forth in Subsection 83(2) … apply to the full amount of the dividend.” The $298,092 figure for the capital dividend account (“CDA”) was overstated by $184,880 due to the failure of the petitioner’s accountants to recognize that an addition in that amount to the CDA would only occur at the end of the petitioner’s August 31, 2016 taxation year.

After referring (at para. 11) to the test for rectification in Fairmont as to whether

there was a prior agreement whose terms are definite and ascertainable; that the agreement was still in effect at the time the instrument was executed; that the instrument fails to accurately record the agreement; and that the instrument, if rectified, would carry out the parties’ prior agreement

Branch J found (at para. 16) in light of the resolution’s wording and statements deposed as to the directors’ intentions that

there was a definite and ascertainable agreement between the directors to effectively “clean out” the petitioner’s capital dividend account.

He granted an order to rectify the resolution to reduce the declared dividend by the $184,880 erroneous amount.

Canada Life Insurance Company of Canada v. Canada (Attorney General), 2018 ONCA 562

A Canada Life subsidiary (CLICC) clearly intended to realize an accrued loss on its LP interest in a subsidiary partnership by winding it up. This was accomplished by transferring pro rata interests in the partnership to its two partners (CLICC as to a 99% interest and a wholly-owned subsidiary of CLICC (“CLICC GP”) as to a 1% interest) followed immediately by a winding-up of CLICC GP into CLICC. CRA reassessed to deny the loss on the basis that the s. 98(5) rollover applied.

Pattillo J had issued an order rectifying the transactions in a number of respects, including delaying the date on which CLICC GP was wound-up until after the three month period referred to in s. 98(5). In its cross-appeal, CLICC now sought an order simply cancelling the winding-up of CLICC GP. It argued that Fairmont “left open the ability for a court, in the exercise of its general equitable jurisdiction, to correct a mistake” (para. 32) and, in the alternative, that the requested relief was available on the basis of “the remedy of equitable rescission of voluntary dispositions” (para. 36).

In finding that the requested order was not available, van Rensburg JA stated (at paras 45 and 46):

Rectification is now limited to cases where the written instrument fails to record correctly the parties’ agreement.

In addition, Fairmont Hotels and Jean Coutu also affirm the underlying policy rationale of Bramco; it is not possible to alter corporate transactions on a nunc pro tunc basis to achieve particular tax objectives. In other words, the Supreme Court has signaled that retroactive tax planning by order of the Superior Court exercising its equitable jurisdiction is impermissible.

van Rensburg JA also found that the order could not be made through the equitable remedy of rescission of a voluntary disposition, stating (at paras 89 and 90):

The relief that CLICC seeks is more accurately described as rescission of a contract entered into by mistake. …None of …[the] requirements [set out in Miller Paving Limited v. B. Gottardo Construction Ltd., 2007 ONCA 422, 313 O.A.C. 137] apply in the present case, nor does CLICC attempt to bring itself within the requirements for equitable rescission of a contract.

Another impediment to the relief sought by CLICC is that rescission is an “all or nothing” remedy; partial rescission is not a recognized equitable remedy… . CLICC … does not ask the court to rescind the entire Transaction, and to restore it and its affiliates to their original rights, because to do so would not achieve its objective of triggering a loss to set off against its foreign exchange gains.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 98 - Subsection 98(5) | pro-rata winding-up of partnership followed by winding up of one former partner into the other engaged s. 98(5) per CRA | 92 |

Fournier v. Agence du revenu du Québec, 2018 QCCQ 786

On August 15, 2007, Mr. Fournier sold land to a family corporation (“Canada Inc.”) for a purchase price that was satisfied by the issuance by it of a non-interest-bearing promissory note. Canada Inc. then started work on a condo development on the property. Mr. Fournier and his wife opted to receive a particular condo in the development pursuant to a preliminary purchase agreement dated March 18, 2009, and opted to pay various “extras” for the construction of their unit to an enhanced standard. After taking possession in December 2010 for use of the condo as their personal residence, they paid the condo-related utilities and municipal taxes personally.

Due to lender requirements, it was not possible to transfer legal ownership to Mr. Fournier in 2010, but on July 31, 2013, an executed notarial deed provided for the transfer of ownership of the condo unit by Canada Inc. to him. In 2017, apparently after an ARQ assessment of him for a taxable benefit under the Quebec equivalent of s. 56(2) respecting the rent-free use of the condo unit viewed as a corporate asset (of Canada Inc.) by him and his wife for most of the period between December 2010 and July 2013, the parties amended the July 2013 notarial deed through a deed of correction which indicated that Mr. Fournier became the owner of the condo on December 1, 2010.

Before concluding (at para. 107, TaxInterpretations translation) that “this correcting notarial deed achieved an accurate reflection of what the parties wished to write down from the outset, being that which corresponded to reality,” so that the ARQ’s taxable benefit assessments respecting the December 2010 to July 2013 period were to be vacated, Guénard JCQ noted that the documentary evidence was mixed (a hypothec granted on the property had named Mr. Fournier and his wife as the grantors) and that the credible testimony of Mr. Fournier indicated that the July 31, 2013 deed was prepared in the standard form used in other condo closings rather than to reflect the parties’ intention, as evidenced inter alia by the bearing of the condo expenses from December 2010 onwards personally.

After quoting from Jean Coutu, he stated (at para. 135):

The amended notarial deed in this case did not rewrite history.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 56 - Subsection 56(2) | taxable benefit assessment relied on an inaccurate notarial deed, which could be corrected after the assessment | 218 |

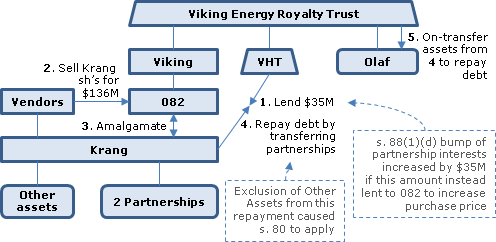

Harvest Operations Corp. v. Attorney General of Canada, 2017 ABCA 393

A last-minute requirement of a lender (“ATB”) to the target corporation (“Krang Energy”) for ATBH’s loan to be repaid on closing resulted in the purchase price being reduced by $35M and that amount being lent by an affiliate of the buyer (a predecessor (“Viking Holdings”) to the appellant in this action) to Krang Energy to fund the loan repayment. That was a mistake. The $35M purchase price reduction reduced the s. 88(1)(d) bump for partnership interests held by Krang Energy when it was amalgamated with Viking Holdings to form Amalco, so that a capital gain was realized when the partnership interests were then transferred to repay debt owing by Amalco to the affiliate. The potential bump problem was identified on the closing date, but the solution was not identified until later.

A second problem was that some assets of Amalco, which should have been transferred by Amalco on the debt repayment to the affiliate, were left behind, so that debt forgiveness applied to Amalco, i.e., its debt to the affiliate was settled for less than full repayment. See the more detailed ABQB summary.

In affirming the denial below of rectification or other equitable relief, the Court stated (at paras 66-67):

Rectification is not available just because the means the parties adopted to execute their business objective had unanticipated adverse tax consequences.

The means that the parties utilized in pursuit of their goal of a tax-neutral transaction – and not the goal of tax neutrality – are the primary focus of a rectification application.

After having noted (at para. 9) that the appellant asked in the alternative that the Court exercise its “general equitable jurisdiction to rectify the errors,” the Court stated (at paras 74-75):

Without commenting on the merits of the assertion that a superior court has “equitable jurisdiction to relieve persons from the effect of their mistakes”, we fail to see how we can do this without undermining the rectification doctrine and ignoring the precedential value of Fairmont Hotels.

There is no principled basis, in the guise of exercising our equitable jurisdiction, to pump theoretical steroids into the rectification doctrine and give it the strength or force that the Supreme Court of Canada recently and consistently has declined to do. …

Greither Estate v. Canada (Attorney General), 2017 BCSC 994

627291 B.C. Ltd., which was jointly owned by two German residents (Karoline Greither and her husband), rented a B.C. property to a related company (“Old Flora”). Following the death of Karoline, and the step-up of the cost of her shares to her estate under s. 70(5), the estate, under advice from a tax lawyer who had forgotten to think about s. 212.1, transferred its shares of 627291 B.C. Ltd. to Old Flora for consideration consisting of a promissory note for $1,951,457 and a Class A Preferred share worth $1. After CRA assessed the estate for non-resident withholding tax under s. 212.1, the estate made an application under s. 229 of the B.C. Business Corporations Act (the “BCA”) to correct this “corporate” mistake by changing the consideration to a promissory note for $1 and Class A Preferred Shares for 1,951,457.

Mayer J dismissed the petition, stating (at paras 36, 37 and 38):

Based on my review of the facts, I am unable to find that any of the triggering events set out in subsection 229(1)(a) through (d) [of the BCA] have occurred. There has not been:

(a) a breach of a provision of the BCA , a former Company Act or the regulations under any of them;

(b) a default in compliance with the memorandum, notice of articles or articles of the company;

and …

(c) none of the following proceedings at or in connection with any of the following have been rendered ineffective:

(i) a meeting of shareholders;

(ii) a meeting of the directors or of a committee of directors;

(iii) any assembly purporting to be a meeting referred to in subparagraph (i) or (ii); and

(d) a consent resolution or records purporting to be a consent resolution has not been rendered ineffective.

… [T]he mistake of not completing the Transaction in the most tax effective manner does not … fall within these subsections. As a result I find that a corporate mistake engaging my discretionary power pursuant to s. 229(2) of the BCA has not occurred.

The Greither Estate did what it planned to do… . There was no omission, defect, error or irregularity resulting in one of the prescribed events. The Transaction simply did not have the desired tax effect.

Mayer J further found (at para 40 and 41):

Even if the Greither Estate was seeking the remedy of equitable rectification, … I am not satisfied that the facts of this case would justify such relief… .

As stated by the majority of Supreme Court of Canada in Fairmont Hotels business and individuals should not be allowed to exploit rectification for the purposes of engaging in retroactive tax planning and as stated by the dissent, “allowing parties to rewrite documents and restructure their affairs based solely on a generalized and all-encompassing preference for paying lower taxes is not consistent with the equitable principles that inform rectification”… .

BC Trust v. Canada (Attorney General), 2017 BCSC 209

The petitioner was a personal trust, with another trust (“Alta Trust”) as its sole income and capital beneficiary. In 2012, CRA made a designation under s. 104(2) (“Designation”) of the petitioner and Alta Trust as one trust, and reassessed the petitioner’s 2008, 2009 and 2010 taxation years, accordingly. For 2012, the trustees decided not to make their customary allocation of income of the petitioner to Alta Trust, as this might be contrary to the provisions of the Act and, hence, a breach of their fiduciary duties. In 2015, the dispute was resolved by CRA agreeing to reverse the Designation. The petitioner sought a declaration that a trust minute to allocate 2012 income of the petitioner to Alta Trust would have retroactive effect.

In finding that the rectification doctrine did not assist the petitioner, Weatherill J stated (at paras 29 and 30):

Fairmont Hotel…made clear that rectification is limited to cases where a written instrument has incorrectly recorded the parties’ antecedent agreement. …

There is no written agreement or other document, including the petitioner’s 2012 T3 tax return, which incorrectly records the petitioner’s intentions at the time that the document was prepared. The doctrine of rectification is not available to the petitioner.

In finding that he also should not exercise the inherent jurisdiction of the Court to grant the requested remedy, he stated (at paras. 31-32) that it was “clear that the Trustees decided, in their absolute discretion, not to allocate the petitioner’s 2012 income to Alta Trust” and that this decision was made after they “had weighed the risks and benefits of whether or not to make the allocation.”

He also stated (at para 35):

…[T]here is nothing prohibiting the Trustees from executing a trust minute in respect of the petitioner’s 2012 income allocation. A court order is not necessary. If the petitioner decides to do so, it will be up to the CRA to decide whether or not to give that allocation retroactive effect.

Canadian Forest Navigation Co. Ltd. v. Canada, 2017 FCA 39

The taxpayer’s Barbados and Cyprus subsidiaries paid amounts to the taxpayer in 2004, 2005 and 2006 as dividends and then, following CRA proposals to assess the dividends, obtained rectification orders from the applicable Barbados and Cyprus courts declaring that the amounts instead were loans to it (or otherwise gave rise to indebtedness). In answer to a Rule 58 question as to whether the Minister was bound to treat these transfers as giving rise to indebtedness by virtue of these rectification orders, Lamarre ACJ had found that the orders did not bind the Minister because they had not been homologated by a Quebec court.

Boivin JA rejected the relevance of homologation, and stated (at paras 15, 17 and 18):

…[P]ursuant to article 2822 C.c.Q. “[a]n act purporting to be issues by a competent foreign public officer makes proof of its content against all persons…”.

…[B]oth orders from Barbados and Cyprus are proof that the corporate resolutions have been rectified to authorize the dividend payments and to transform them into indebtedness, no more, no less.

Moreover, since these foreign orders involve the appellant and its Foreign Affiliates and not the Minister, a third-party to the foreign proceedings, there is nothing to enforce against the Minister; homologation is therefore a non-issue. …

However, Boivin JA further stated (at paras 19-20):

I cannot agree … that pursuant to article 2822 C.c.Q. these foreign orders are dispositive and that the Minister has no choice under the ITA but to accept the dividends are actually loans because the orders from Barbados and Cyprus say so.

…[W]hat remains to be determined is the foreign orders’ effect vis-à-vis the Minister…and the weight ascribed to the foreign orders as facts pursuant to article 2822 C.c.Q. These determinations are for the Tax Court judge to make, with a full evidentiary record at his or her disposal. …

On this basis, he concluded that Lamarre ACJ should not have answered the Rule 58 question, and set aside her judgment and dismissed the Rule 58 motion before the Tax Court.

Jean Coutu Group (PJC) Inc. v. Canada (Attorney General), 2016 SCC 55, [2016] 2 S.C.R. 670

The taxpayer (“PJC Canada”), a Quebec corporation, implemented a plan, to neutralize the effect of FX fluctuations on its investment in a U.S. subsidiary (“PJC USA”), that overlooked foreign accrual property income considerations – so that interest generated to PJC USA on a loan that it made back to PJC Canada was included in PJC Canada’s income. The Court of Appeal had reversed a decision below that the transactions could be rectified in accordance with s. 1425 of the Civil Code (respecting contractual interpretation effecting the common intention of the contracting parties where this differed from their literal expression) to retroactively adopt a revised plan to result in an offsetting interest expense to PJC Canada for the interest on the loan from PJC USA. In affirming the Court of Appeal, Wagner J stated (at para 24-25, 26, 30-31 and 33-34):

[W]hen unintended tax consequences result from a contract whose desired consequences, whether in whole or in part, are tax avoidance, deferral or minimization, amendments to the expression of the agreement in accordance with Art. 1425 CCQ can be available only under two conditions. First, if the unintended tax consequences were originally and specifically sought to be avoided, through sufficiently precise obligations which objects, the prestations to execute [sic, whose objects, being the contracted-for benefits [“prestations”] to be performed], are determinate or determinable; and second, when the obligations, if properly expressed and the corresponding prestations, if properly executed, would have succeeded in doing so. …

Such a reading of arts. 1412 and 1373 C.C.Q. doesn’t mean that amendments to the expression of the agreement in accordance with art. 1425 C.C.Q. can be available only to correct clerical errors. It upholds, however, the requirements stipulated in the C.C.Q. according to which the object of a contract needs to be precise and the object of an obligation sufficiently determinate or determinable to be recognized as the common intention of the parties to be sought when interpreting a contract.

Article 1425 C.C.Q. does not allow PJC Canada and PJC USA to retroactively amend the documents recording and implementing their agreement in the circumstances of this case. …[T]hey did not turn their minds to FAPI or a particular means of avoiding it, but merely had a general intention that their agreement be tax-neutral.

In [ AES and Riopel], the contracting parties had agreed on a particular set of prestations to defer tax payable. The “agreements provided . . . for the establishment of determinate structures that would, had they been drawn up properly, have made it possible to meet the objectives being pursued by the parties”, namely tax deferral on a share exchange using rollover provisions in the tax legislation (AES) and tax deferral on a corporate amalgamation as part of a detailed tax plan, again under particular tax provisions (Riopel): AES, at para. 54 (emphasis added). Because of mistakes in the documents recording and implementing the contracting parties’ agreements, tax was not deferred. In the AES case, the mistake consisted of a miscalculation in the adjusted cost base (“ACB”) of the transferred shares ― the procedure agreed to by the parties required the issuance and delivery of a note for an amount precisely equal to the shares’ ACB. In the Riopel case, the mistake was that the parties’ tax advisors reversed the order of certain transactions, contrary to the detailed tax plan to which the parties had verbally agreed.

[T]here is a fundamental difference between a contract under which one of a party’s prestations ― necessary for obtaining the intended tax result ― is to issue and deliver a note in an objectively calculable amount equal to the ACB of transferred shares, and a contract under which there is no obligation addressing FAPI, and no prestations agreed on that would prevent its fiscal consequences. ….

Although…modifications to written documents expressing parties’ agreement can include the insertion of transactions, this is possible only where doing so would bridge the gap between the contracting parties’ common intention and the written expression thereof

Turning to broader policy considerations, he stated (at paras 41-43):

…[A]ccepting PJC Canada’s position…would… undermine one of the fundamental principles of our tax system: that tax consequences flow from the legal relationships or transactions established by taxpayers. …

[A]lowing the amendment of the written documents … would amount to retroactive tax planning. It would set an undesirable precedent, where taxpayers could point to a common intention to effect their transactions on a tax-neutral basis to immunize themselves from unforeseen tax consequences… .

[T]axpayers [instead] can bring a claim against their advisors… .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Statutory Interpretation - Interpretation Act - Section 8.1 | desriable for convergence of principles and outcomes inside and outside Quebec | 161 |

Canada (Attorney General) v. Fairmont Hotels Inc., 2016 SCC 56, [2016] 2 S.C.R. 720

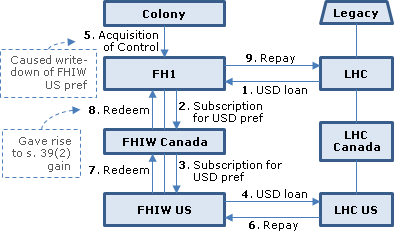

With a goal of ensuring foreign exchange tax neutrality, Fairmont Hotels Inc. (“Fairmont”) entered into a “reciprocal loan arrangement” with a REIT (Legacy REIT) in which it was a minority investor, which entailed back-to-back U.S.-dollar loans and preferred shareholdings between the two groups. However, that intention was frustrated on a subsequent acquisition of control of the Fairmont , which resulted in a write-down under s. 111(4) of the U.S.-dollar preferred shares held by it and a subsidiary (“FHIW”). There was no plan for protecting FHIW from its tax exposure from the write-down, because adopting a plan was deferred. The following year, Fairmont acceded to an urgent Legacy request to unwind the reciprocal loan structure, as a result of which FHIW realized a net FX gain. (The Fairmont officer had incorrectly assumed that the matter of the foreign exchange tax neutrality of FHIW had already been secured.) The rectification order granted below had treated proceeds paid by FHIW to Fairmont as a loan rather than as preference share redemption proceeds.

In finding that this rectification order should not have been given, Brown J stated (at paras 12, 19, 32 and 24):

[R]ectification allows a court to achieve correspondence between the parties’ agreement and the substance of a legal instrument intended to record that agreement, when there is a discrepancy between the two. …

The parties’ mistake in Juliar, however, was not in the recording of their intended agreement to transfer shares for a promissory note, but in selecting that mechanism instead of a shares-for-shares transfer. By granting the sought-after change of mechanism, the Court of Appeal in Juliar purported to “rectify” not merely the instrument recording the parties’ antecedent agreement, but that agreement itself where it failed to achieve the desired result or produced an unanticipated adverse consequence — that is, where it was the product of an error in judgment. …

[T]he party seeking rectification must identify terms which were omitted or recorded incorrectly and which, correctly recorded, are sufficiently precise to constitute the terms of an enforceable agreement.

Juliar also did not account for the direction in Shell that a taxpayer should be taxed “based on what it actually did, not based on what it could have done” (para. 23).

Respecting the applicable standard of proof, Brown J quoted approvingly the statement in Thomas Bates and Son Ltd. v. Wyndman’s (Lingerie) Ltd., [1981] 1 W.L.R. 505 (C.A.), at p. 521 that:

The standard of proof required in an action of rectification to establish the common intention of the parties is, in my view, the civil standard of balance of probability. But as the alleged common intention ex hypothesi contradicts the written instrument, convincing proof is required in order to counteract the cogent evidence of the parties’ intention displayed by the instrument itself.

On the facts, “the respondents’ application for rectification should have been dismissed, since they could not show having reached a prior agreement with definite and ascertainable terms” (para. 39).

In her dissenting reasons, Abella J stated (at para. 85):

Notably, both AES and Riopel involved errors of implementation: the error in AES was a faulty calculation and the error in Riopel was that a complex transaction was conducted in the wrong sequence. The application of rectification in these circumstances clearly confirms that rectification is not confined only to correcting terms that were omitted, accidentally added, or articulated incorrectly in a written document, but is no less available when the parties’ true intention is erroneously implemented.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Statutory Interpretation - Interpretation Act - Section 8.1 | convergence in civil/common law rectification | 95 |

Anderson v Benson Trithardt Noren LLP, 2016 SKCA 120, aff'd 2017 SCC CanLii 8568

The taxpayer’s accountants met with him on October 6, 2011, when it was agreed that he would transfer personally-owned land and equipment on s. 85 rollover basis to his corporation in order to facilitate paying off a loan owing by him to the corporation. The accountants took notes of this decision, but neglected to direct the appellants' law firm to prepare the related documents. The documents were prepared, and then executed on June 6, 2013, shortly following notice of a CRA audit, with the stated effective date of the transfer being January 1, 2011. CRA found that a s. 85 rollover transfer had not been accomplished in 2011, but a proposed reassessment was delayed to allow the taxpayers to seek rectification. The chambers judge rectified the specified effective date from January 1, 2011 to October 6, 2011, but declined to declare the documents to be retroactively effective as of October 6, 2011.

In dismissing the appeal, Lane J. stated (at paras 29, 34):

… The Chambers judge was correct to limit the application of the rectification remedy as he did. He saw the application for a declaration for what it was – an attempt to obtain equitable relief not available from the Tax Court, which is a superior court of record but not a court of inherent jurisdiction, and to thereby attempt to determine the outcome of an assessment appeal by essentially binding the hands of that Court. …

The Chambers judge properly limited his decision to the issue between the appellants themselves. He correctly identified the intended purpose of the application and recognized the specialized nature of the Tax Court and its jurisdiction to decide the ultimate issue concerning the tax implications of the rollover. He correctly declined to effectively pronounce on that issue.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Effective Date | transaction documents not declared effective to date transaction agreed to in principle | 187 |

Slate Management Corporation v Canada (Attorney General), 2016 ONSC 4216

A purchaser (“SCC”) used a newly-formed AcquisitionCo (“GTA”) to acquire a Target (“HCC”). The three corporations then amalgamated. The amalgamated corporation then learned that in order to have accomplished a s. 88(1)(d) bump, there should have been a two stage amalgamation, so that two of the corporations amalgamated, and the amalgamated corporation them amalgamated with the third corporation.

Notwithstanding a Crown submission to the contrary, Hainey J found (at para. 14) “that it is more probable than not that the parties did have a continuing specific intention to achieve the amalgamation in accordance with the tax bump rules,” given KPMG advice suggesting use of the tax bump rules, SCC instructions to KPMG to calculate the bump and an Arrangement Agreement between SCC and HCC in which HCC agreed to avoid any actions which could reduce or eliminate the bump.

Hainey J noted (at para 13):

… [T]his is not a case in which tax planning has been done on a retroactive basis. The parties’ intention from the outset was to structure the transaction to take advantage of the tax bump rules. The single-step amalgamation was mistakenly chosen as a means of effecting the transaction.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(1) - Paragraph 88(1)(d) | three-party non-sequential amalgamation busted bump | 118 |

Non Corp Holdings Corp. v. Canada (Attorney General), 2016 ONSC 2737

The corporate applicant intended to distribute the applicable portion of a “capital gain” (likely, goodwill proceeds) from a business sale as a capital dividend. While the dividend was, in fact, paid on November 1, 2012 (one day after the taxation year end), the directors’ resolution and CRA election form were both dated October 31, 2012, thereby resulting in the imposition of Part III tax on the dividend. CRA considered that a court order was required to rectify the dating of the directors’ resolution, but did not oppose this application.

Before amending the directors’ resolution nunc pro tunc to change its date to November 1, 2012, Dunphy J stated (at paras. 7, 9):

This case is quite unlike…Birch Hill…decided by me…[where] [t]he rectification sought would have materially re-ordered the transaction in ways that nobody had considered at the relevant time.

There was a specific intention to allocate specific proceeds of a specific transaction to a specific tax account – the capital dividend account – to achieve a specific tax goal. A very minor mistake, in human terms at least, was made.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 89 - Subsection 89(1) - Capital Dividend Account - Paragraph (c.1) | capital dividend incorrectly dated before year end | 79 |

Birch Hill Equity Partners Management Inc. v Rogers Communications Inc., 2015 ONSC 7189

The general partner of an Ontario limited partnership (“Atria”) granted stock options on its Class C shares to 10 Atria executives. The partners of Atria agreed to sell the limited partnership units of Atria and the shares of the general partner to a third party (“Rogers”) for $425 million. As provided in the sale agreement (to which the executives were not party), they exercised their options and sold their Class C shares (at a $17.1 million gain over the exercise price) to a major partner (“BHEP Management”), so that such shares were included in what was purchased by Rogers at closing. Four years later, the executives were reassessed to deny the s. 110(1)(d) deduction on the basis that their Class C shares would reasonably have been expected to be acquired by a specified person (BHEP Management).

The executives and the parties to the sale agreement sought rectification so as to have the executive be treated as having sold their shares directly to Rogers for the same proceeds. Although CRA did not contest the rectification application, it also took the position that the shares were not prescribed shares on the basis of not satisfying the Reg. 6204(1)(a)(ii) requirement that their liquidation entitlement not be subject to a minimum nor maximum because the Board on liquidation had the discretion to establish a fixed liquidation amount for the shares - and reserved the right to maintain its denial of the s. 110(1)(d) deduction on this basis as well.

Dunphy J denied relief, stating (at para. 33):

Three observations are sufficient to distinguish this case from the line of cases represented by Juliar (supra) and Fairmont Hotels (supra). Firstly, there is insufficient evidence here of an initial mutual “mistake” as to a dominant or even important issue to the transaction itself that was inaccurately reflected in the documents at the time. Secondly, the criteria for relieving against unilateral mistake are clearly not satisfied. Thirdly, the proposed “fix” for the alleged mistake may or may not be effective.

Respecting the first point, he stated (at para. 37) that “I cannot characterize as a mistake a matter which was simply too insignificant to the parties to make its way on to the radar screen when they were negotiating their $425 million transaction.” Respecting the second point, he stated (at para. 42) before quoting Performance Industries, 2002 SCC 19, at para. 31 that “rectification in cases of unilateral mistake is possible, but the requirements for invoking this doctrine are intentionally much, much narrower and thus more demanding.”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Regulations - Regulation 6204 - Subsection 6204(1) - Paragraph 6204(1)(a) | board had discretion to determine fixed liquidation entitlement | 127 |

Canada Life Insurance Co. of Canada v. A.G of Canada, 2015 DTC 5128 [at at 6378], 2015 ONSC 281, rev'd 2018 ONCA 562

In order that the applicant ("CLICC") could realize an accrued capital loss on its 99% limited partner interest in a subsidiary limited partnership ("MAM LP") (and following preliminary dividends):

- On December 7, 2007, MAM LP distributed an asset to CLICC and a wholly-owned subsidiary of CLICC ("CLICC GP") based on their respective 99% and 1% interests.

- On December 31, 2007, the interests of CLICC and CLICC GP in MAM LP were cancelled and MAM LP distributed all its remaining property (other than $100 of limited partner capital) pro rata to CLICC and CLICC GP.

- One hour later, MAM LP was dissolved and immediately thereafter, the remaining $100 of partnership capital was distributed pro rata to CLICC and CLICC GP.

- At 11:59 p.m., CLICC GP was wound up and its assets and liabilities acquired and assumed by CLICC.

- CLICC GP was formally dissolved on October 14, 2008.

After CRA assessed to deny the loss claimed by CLICC on the basis that the s. 98(5) rollover applied, the applicant applied for the transactions in 2 to 4 to be rectified so that s. 98(5) could not apply (entailing a distribution on December 31 of some of the partnership property to both CLICC and CLICC GP, a transfer of CLICC's LP interest to CLICC GP, a resulting wind-up of MAM LP into CLICC GP also on December 31, 2007 and the wind-up of CLICC GP into CLICC on April 30, 2008 (i.e., more than 3 months after December 31.)

In granting the requested relief, Pattillo J noted (at para. 39) that "at all material times, CLICC and the other parties…had a continuing specific intention…to create a tax loss…of approximately $168 million" and (at para. 38) that the Attorney General's ("AG's") arguments that rectification was restricted to correcting mistakes in the instruments used to implement a definite and ascertainable tax plan had been rejected in Fairmont.

In response to an AG argument that the proposed rectification transactions contained two more transactions than had occurred in December 2007, CLICC had applied after the hearing of the motion to propose alternative rectification transactions whose only change from the original transactions was to defer the winding-up of CLICC GP from December 31, 2007 to April 30, 2008. As the originally requested rectification relief was granted, this amendment motion was dismissed.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 98 - Subsection 98(5) | rectification to avoid s. 98(5) rollover | 255 |

Telus Communications Inc. v. A.G. of Canada, 2015 ONSC 6245

The Telus group had a tiered partnership structure. Its management decided that Telus would make a multi-tier alignment election under s. 249.1(9) so that two subsidiary partnerships ("TCC" and "TMC"), which were believed to be in a qualifying multi-tiered partnership structure would each have a January 31 fiscal period end. 15 months after filing the election on a timely basis, they discovered that a minority interest of TCC in a third partnership ("EnStream") had been overlooked (and not disclosed in the election or in a previous ruling application to CRA), which meant that the election was invalid as EnStream had a different fiscal period end than TCC and TMC.

In granting the applicants' application to correct this error by allowing a retroactive transfer of TCC's interest in EnStream to a wholly-owned corporate subsidiary of TCC (which Telus submitted it would have done at the time if it had remembered the minority interest), and after noting the Crown submission (at par. 17) that "the Applicants are asking the Court to retroactively declare that new transactions…took place when they did not," Hainey J stated (at para. 17):

The Applicants had a specific and continuing intention throughout to file a valid Election. They are not attempting to retroactively avoid an unintended tax disadvantage.

He stated (at para. 20) that in the alternative, and following TCR, he would "rely on the equitable jurisdiction of this court to relieve the Applicants from the effect of their mistake."

Zhang v. The Queen, 2015 DTC 5084 [at at 6035], 2015 BCSC 1256

The taxpayer (Mr. Zhang) briefly sought advice from his tax accountant (Bob) as to how he could extract funds from his Chinese operating company ("LABest"), and was advised that exempt surplus dividends could be paid to Canada if the shares were held by a Canadian holding company. Mr. Zhang incorporated a B.C. company ("Beamtech") and secured approval from a Chinese authority for the transfer of his shares of LABest to Beamtech for cash consideration of U.S.$150,000 – which was effected without further specific advice from Bob.

When CRA assessed Mr. Zhang under s. 69 on the basis that the fair market value of the shares was Cdn.$661,164, so that the transfer had generated a capital gain, Beamtech issued 1,000 common shares to Mr. Zhang as purported additional consideration for the transfer, a joint s. 85(1) election was filed and a rectification order was sought to have the share issue be considered to have occurred on the date of the transfer.

In dismissing the petition, Butler J stated (at para. 39):

To use the language of the Ontario Court of Appeal in Juliar, here, the true agreement between the parties was the acquisition of Mr. Zhang's interest in LABest by Beamtech in a manner that would allow for the distribution of LABest's income in British Columbia on a basis which attracted the minimum amount of income tax. It was not based on Beamtech acquiring the interest in LABest in a manner which would not attract immediate liability for capital gains tax. That was a secondary concern and one which Mr. Zhang asked Bob not to investigate. He did not seek assistance regarding the capital gains issue until long after the transaction concluded… .

Fairmont Hotels Inc. v. A.G. Canada, 2015 ONCA 441, aff'g 2014 ONSC 7302, leave granted, SCC docket 36606

In order to facilitate the acquisition in 2002 of a hotel in Washington by a REIT ("Legacy") of which it was the manager, Fairmont Hotels Inc. ("FHI") borrowed U.S.$67.6 million from a subsidiary of Legacy ("LHC"), subscribed for U.S.$67.6 million of U.S. dollar denominated preference shares of a Canadian subsidiary of FHI ("FHIW Canada"), which subscribed for U.S.$67.6 million of U.S. dollar denominated preference shares of a U.S subsidiary of FHIW Canada ("FHIW US"), which lent U.S.$67.6 million to an indirect U.S. subsidiary of LHC ("LHC US"). As a result of an acquisition of control of FHI in 2006, an accrued FX loss on the preferred shares of FHIW US held by FHIW Canada was extinguished under s. 111(4)(d), so that FHIW Canada was no longer hedged from a Canadian tax standpoint. The Fairmont advisors were aware of this but deferred dealing with this issue to another day.

In 2007, FHI was approached on an urgent basis by Legacy to unwind the above "reciprocal loan arrangement" in connection with an imminent sale of the Washington hotel. In the rush of the moment, the FHI VP of Taxation forgot that FHIW Canada was unhedged, and the structure was unwound through inter alia a redemption of the preference shares of FHIW Canada held by FHI, so that FHIW Canada realized an FX gain under s. 39(2). This mistake was not discovered until a subsequent CRA audit. Essentially the same reciprocal loan structure and mistaken unwinding strategy was used in connection with a Seattle hotel of Legacy.

Simmons JA noted (at para. 5) that, in granting an application to rectify the 2007 unwinding transactions so that the U.S. dollars advanced by FHIW Canada to FHI were a loan rather than redemption proceeds, Newbould J had found that from 2002 on there had been a continuing Fairmont intention for the reciprocal loan arrangement "to be carried out on a tax…neutral basis through a plan whereby any foreign exchange gains would be offset by corresponding foreign exchange losses" and that "the preferred shares of the two relevant companies…would not be redeemed."

In dismissing the crown's appeal, Simmons JA stated (at paras. 10, 12):

Juliar … does not require that the party seeking rectification must have determined the precise mechanics or means by which the party's settled intention to achieve a specific tax outcome would be realized. Juliar holds, in effect, that the critical requirement for rectification is proof of a continuing specific intention to undertake a transaction or transactions on a particular tax basis.

…[I]t was unnecessary that the respondent prove that it had determined to use a specific transactional device - loans - to achieve the intended tax result. That the respondent mistakenly failed to employ an appropriate transactional device to achieve the intended tax result does not alter the nature of the respondent's settled tax plan: tax neutrality in its dealings with Legacy and no redemptions of the preference shares in question.

Harvest Operations Corp v. A.G. (Canada), 2015 DTC 5067 [at at 5904], 2015 ABQB 327

The Bump Mistake

A predecessor in interest of the applicant ("Viking") entered a multi-step acquisition and restructuring transaction to acquire an arm's length corporation ("Krang"). The plan was originally for a sibling unit trust of the taxpayer ("VHT") to lend $35 million to the taxpayer's subsidiary ("082"), which would then acquire all the shares of Krang for $171 million, with 082 and Krang then amalgamating to form "Krang #2".

On the day of closing, a Krang creditor unexpectedly required Krang to repay its revolving credit facilities rather than consenting to the transaction. Consequently, VHT lent the $35 million directly to Krang, thereby reducing the purchase price paid by 082 for the Krang shares by $35 million. This had the effect of reducing the s. 88(1)(d) "bump" of the cost to Krang #2 of partnership interests previously held by Krang by the same amount, thereby resulting in a taxable capital gain on a subsequent transfer of those interests described below.

The taxpayer applied to have the transaction rectified to reflect that the loan was made to 082 instead of Krang, and that those funds were used to subscribe for additional shares of Krang.

Dario J dismissed the taxpayer's application, stating (at paras. 77, 81 and 82):

[T]his is not a case of the parties "wrote it down wrong", but rather the parties got it wrong.

… To the extent we are talking only about the increased bump room due to the Krang Debt, the evidence does not establish that the inability to benefit from this tax treatment would have terminated the acquisition, or that the common intent of the parties that drove them to the formation of the transaction was frustrated.

… The intent to complete a transaction in the most tax efficient manner possible is not sufficiently specific. The Applicant must establish how the parties had intended on achieving this tax objective… .

Cases, such as Fairmont, where courts granted "rectification where there was no ‘particular way' the parties had intended to achieve the tax objective… run contrary to the express views of the Supreme Court of Canada as set out in Performance Industries and others…" (paras. 46, 49).

Here, the taxpayer's tax advisor had listed a number of possible options to deal with the last-minute hurdles in a tax-efficient manner - none of them were taken, and furthermore none of them matched the order being sought.

The Other Assets Mistake

A subsequent leg of the series involved transferring Krang's assets (now Krang #2's assets) to VHT in purported full repayment of debt owing, with VHT then transferring the same assets to a subsidiary partnership ("Olaf"), also as a purported full debt repayment. Approximately $12 million of the $170 million in assets of Krang #2 were not transferred, with the result that both debts had been settled without full repayment, so that the debt forgiveness rules applied to both Krang #2 and VHT.

After concluding that rectification was not available in any event, Dario J stated (at para. 92):

In the present case, where these assets were unknown or forgotten, not specifically referred to in the Step Memorandum, remained (and presumably, with respect to prepaid expenses and depreciable assets, used) in the Krang #2 entity, and subsequently recorded in Krang #2's tax filings (including recording a capital cost allowance on the assets), the Applicant has not met the requisite burden of proof to establish intent.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Estoppel | taxpayer estoppel when it claimed a tax benefit from its mistake rather than promptly seeking rectification | 206 |

| Tax Topics - Income Tax Act - Section 88 - Subsection 88(1) - Paragraph 88(1)(c) | failure to fund debt repayment through increased purchase price | 162 |

Mac's Convenience Stores Inc. v. A.G. of Canada, 2015 QCCA 837

The appellant, which was a wholly-owned Ontario subsidiary of a Quebec corporation ("CTI"), paid a $136 million dividend to CTI in connection with a "Quebec shuffle" transaction. The tax advisor did not focus on the resulting reduction in the appellant's retained earnings which, under the s. 18(4) thin cap rule, caused a substantial portion of the interest on a $185 million loan owing to a related non-resident corporation to become non-deductible.

In finding that the appellant could not retroactively rectify the dividend so as to be a stated capital distribution instead, and after noting (at para. 34) that AES and Riopel dealt with related parties committing an error in giving effect to a "legitimate corporate transaction for the purpose of avoiding, deferring or minimizing tax" and correcting "that error to achieve the tax consequences originally and specifically intended and agreed upon," Schrager JA stated (at para. 43):

The payment of the 136 million dollar dividend to CTI was intended and was effected. … Reduction of capital was not intended. The unintended consequences of the dividend, by ricochet, resulted from the thin capitalization rules and was not part and parcel of the transaction. … There was no common intention of the parties regarding these rules as they were never contemplated and so cannot be the object of a meeting of the minds to which a court can give effect.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(5) - Equity Amount - Paragraph (a) | dividend triggered application of thin cap rules | 65 |

A.G. Canada v. Le Groupe Jean Coutu (PJC) Inc., 2015 QCCA 838, aff'd 2016 SCC 55

The professional advisors of the respondent ("PJC Canada") recommended two alternatives ("Scenarios 1 and 2") for it to neutralize the effect of foreign exchange fluctuations on the value of its investment in its wholly-owned U.S. subsidiary ("PJC USA"). Under the alternative chosen (Scenario 1), PJC Canada lent U.S.$120 million to PJC USA, and PJC USA used U.S.$70 million in share subscription proceeds received by it from PJC Canada to make a loan of U.S.$70 million to PJC Canada. CRA assessed on the basis that the interest on the loan by PJC USA to PJC Canada gave rise to foreign accrual property income ("FAPI") to PJC Canada. PJC Canada and PJC USA then sought to rectify on the basis of having Scenario 2 (under which the FAPI would have been reduced to nil by interest expense) implemented retroactively.

In reversing the finding below that rectification was available, Schrager JA quoted (at para. 32) the statement in Graymar that "rectification is available in order to avoid a tax disadvantage which the parties had originally transacted to avoid, it is not available to avoid an unintended tax disadvantage which the parties had not anticipated," stated (at para. 38) that a "general intent…that their transaction be ‘tax neutral' is not sufficiently determinate" and further stated (at paras. 37, 38):

The parties…achieved their intended purpose of neutralizing the effect of the exchange fluctuations. …They are taxed on that basis even though they did not foresee the [FAPI] tax consequences.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 95 - Subsection 95(1) - Foreign Accrual Property Income | FAPI from loan by CFA to Canco | 59 |

Kaleidescape Inc. v. MNR, 2014 ONSC 4983

The applicant ("K-Can") was intended to qualify as a Canadian-controlled private corporation. Its outstanding shares consisted of 100 Class A non-voting common shares and 100 Class B voting common shares held by a Delaware corporation ("K-US"), and 100 Class C special voting shares held by a trust for K-Can employees whose trustee was a trust company (Computershare) and whose named settlor was K-Can. A unanimous shareholders' agreement ("USA") conferred the powers of the directors on the K-Can shareholders. The Declaration of Trust provided:

5.2 ...Upon the direction of the Settlor, the Trustee shall...exercise any voting rights...

5.9 Where this Deed of Trust requires or authorizes the Settlor to give directions to the Trustee, the Trustee shall accept only a direction in writing from the CEO or President of the Settlor.

CRA concluded that these two provisions gave the non-resident CEO of K-Can the authority to direct Computershare how to vote the Class C shares of K-Can, so that K-US had de jure control of K-Can.