Subsection 74.5(1) - Transfers for fair market consideration

Administrative Policy

29 April 1994 T.I. 933662 (C.T.O. "Attribution Rules")

Where an individual (the transferee) has acquired an income-producing property from his spouse and given to the transferor a demand promissory note bearing interest at the prescribed rate in effect at the time of the transfer, a subsequent lowering of the interest rate to the prescribed rate in effect at the subsequent time would result in the condition in s. 74.5(1)(b)(i) no longer being satisfied. Accordingly, the attribution rules would apply in respect of the property from the time of the resetting of the interest rate.

If, instead, the promissory note was forgiven, the requirement in s. 74.5(1)(b)(i) would no longer be satisfied.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 74.5 - Subsection 74.5(2) | 107 |

15 June 1992 T.I. 921368 (December 1992 Access Letter, p. 18, ¶C56-208)

No payment will be considered to occur pursuant to an agreement between the parties to the effect that interest on a promissory note will be deemed to be paid and then loaned back to the borrower.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Payment & Receipt | 38 |

Articles

Summerville, "Income Splitting may be Implemented by Transferring Residential Property to Spouse", Taxation of Executive Compensation and Retirement, December 1989/January 1990

In a 24 August 89 Technical Interpretation, RC passed favourably on a transaction whereby a high income spouse transfers to his low income spouse an investment portfolio in exchange for a 25% interest in their residence which had been paid for (through contributions to the mortgage) by the low income spouse.

Paragraph 74.5(1)(c)

Administrative Policy

23 June 2010 External T.I. 2010-0365581E5 F - Règles d'attribution de l'article 74.2

An individual disposed of capital property to a discretionary trust (whose beneficiaries were the individual and spouse and their children) in consideration for property (other than a debt obligation) having the same fair market value. One year after the sale, the trust disposed of the capital property to a third party and distributed and allocated the resulting taxable capital gain to the spouse under s. 104(21). How would ss. 74.2(1) and 74.5(1) apply? CRA responded:

In general, the attribution rules in subsection 74.2(1) (taking subsection 74.3(1) into account, if applicable) do not apply to a particular situation where the conditions in subsection 74.5(1) are all satisfied. … [T]he condition in paragraph 74.5(1)(c) would be satisfied … where an individual's capital property is not transferred in the circumstances described in subsection 73(1.01).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 75 - Subsection 75(2) | s. 75(2)(a)(i) is satisfied where a person transferring to a trust holds a capital interest in that trust | 129 |

Subsection 74.5(2) - Loans for value

Administrative Policy

29 April 1994 T.I. 933662 (C.T.O. "Attribution Rules")

Where an individual (the transferee) has acquired an income-producing property from his spouse (the transferor) in consideration for a demand promissory note bearing interest at the prescribed rate in effect at the time of the transfer, a subsequent agreement of the transferor to make a loan to the transferee at the lower prescribed rate prevailing at the time of the loan, with the loan proceeds being used to repay the demand promissory note, would not result in the exception in s. 74.5(2) being applicable because the proceeds of the loan would be used to repay the note rather than to generate any income or produce gain.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 74.5 - Subsection 74.5(1) | 109 |

27 October 2020 CTF Roundtable Q. 11, 2020-0860981C6 - Refinancing Prescribed Rate Loans

An individual, who used a loan ("Loan 1") bearing interest at the prescribed rate (2%) to purchase securities for $100,000, now wishes to refinance the loan at 1%. Accordingly, half the securities (which have doubled in value) are sold for $100,000, which is used to repay Loan 1, and $100,000 is borrowed at the new prescribed rate of 1% ("Loan 2") to purchase new investments.

CRA confirmed that the attribution rules in ss. 74.1 and 74.2 will cease to apply after the repayment of Loan 1, and that the s. 74.5(2) exception from the attribution rules could apply to Loan 2 if the usual conditions were met.

S. 74.1(3) - which CRA described as ensuring that the attribution rules continue to apply where a new loan is used, e.g., to repay an existing loan that was used to acquire property - would not “technically” apply, because the proceeds from Loan 2 were not used to repay Loan 1..

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 74.1 - Subsection 74.1(3) | a 1% prescribed-rate loan can effectively replace a 2% loan if the latter loan is repaid with sales proceeds | 193 |

10 June 2013 STEP Canada Roundtable, 2013-0480271C6 - Prescribed Rate Loan - 2013 STEP Roundtable Q 2

Can the interest rate on a loan to a spouse or other family member remain fixed at the current prescribed rate of 1% (so that there is no income attribution) where the loan is a demand loan with no term, or it has a term of say 20 years? CRA stated:

Income and gains will not be attributed to the transferor (pursuant to subsections 74.1(1) and (2), and section 74.2) if the loan is set at the prescribed rate "at the time the indebtedness was incurred" as stated in subsections 74.5(1) and 74.5(2).

29 April 1994 External T.I. 9336625 F - Attribution Rules

An individual (the Transferee) acquired an income producing property from the Transferee’s spouse (the Transferor) in consideration for a demand promissory note bearing interest at the prescribed rate at that time. Subsequently, the Transferor makes a fresh loan (at a lower prescribed rate) to the Transferee, who uses the proceeds to repay the first loan.

CRA considered that “the exception in 74.5(2) of the Act would cease to be applicable,” so that the attribution rules would commence applying, given that “the proceeds of the [second] loan are used to repay the demand promissory note (i.e., the proceeds would never generate any income or result in a gain),”

21 October 1991 T.I. (Tax Window, No. 12, p. 20, ¶1544)

Where a loan is made on September 30, 1991 with interest payable annually, the exemption will apply only if the interest due on September 30, 1992 is paid within 30 days after the end of the 1992 calendar year.

19 July 1989 T.I. (Dec. 89 Access Letter, ¶1047)

No attribution of income will be made in the situation where father loans a newly-established trust with his minor children as beneficiaries the sum of $100 at a commercial rate of interest, followed by the trust buying common shares of a small business corporation for $100 which then pays a dividend on its common shares which enables the trust to repay the loan plus the accrued interest thereon.

79 C.R. - Q.5

Re criteria for a "genuine" loan.

Articles

Michael Goldberg, Vincent Didkovsky, "Refinancing Prescribed-Rate Loans Used for Income Splitting", Canadian Tax Focus, Vol. 10, No. 3, August 2020, p.2

Objective of refinancing loan to take advantage of lower prescribed rate (p. 2)

[M]any practitioners are likely to consider whether loans in place at higher prescribed interest rates can be refinanced and locked in at the lower 1 percent prescribed rate. Unfortunately, the process … likely require[s] a disposition of the income-producing property acquired with the loan.

Lowering interest rate does not work (p.2)

For [s. 74.5(1) or (2)] to apply, the loan must be made at the prescribed rate that was in place at the time the loan was made. For this reason, amending the terms of an existing loan to reduce the interest rate to the new, lower prescribed rate does not comply … .

Per CRA, refinancing the previous s. 74.5(2) loan does not work (p.2)

[R]epaying the original loan with the proceeds from a new, lower-prescribed-rate loan does not effectively refinance an existing prescribed-rate loan. According to … 9336625 … the new loan would not be used for an income-producing purpose, but rather for the purpose of extinguishing the original loan. …

However, it may be worth considering whether the CRA’s position that a refinancing strategy is ineffective is correct, since it does not reference subsection 20(3).

Sale of property and new loan (p. 3)

[A] prudent method … is for the borrower to dispose of the income-producing property and use the proceeds to repay the original loan. Once the original loan has been repaid, a new, lower-prescribed-rate loan may then be advanced, and the proceeds could be used to acquire income-producing property. To minimize the possibility that subsection 74.1(3) could apply to the new loan … the amount and term of the loan[s] differ and that, if possible, funds other than the proceeds received on repayment of the original loan are used to make the new prescribed-rate loan.

Paragraph 74.5(2)(b)

Administrative Policy

5 October 2018 APFF Financial Strategies and Instruments Roundtable Q. 10, 2018-0761551C6 F - Attribution rules and promissory note

On June 1, 2018, Mrs. B lent $500,000 to Mr. B at the prescribed rate of interest (2%) and, at the beginning of January 2019, Mr. B issued a demand promissory note as absolute payment of the accrued interest of $5,863.01. Banner Pharmacaps stated that “delivery of a promissory note may itself be payment of a particular obligation.” Does the issuance of this note satisfy the requirement in s. 74.5(1)(b) that the 2018 interest on the loan be paid no later than 30 days after the end of 2018?

After noting that since the indebtedness at issue was a loan, the applicable requirement instead was in ss. 74.5(2), CRA stated;

Paragraphs 74.5(2)(b) and (c), as with subparagraphs 74.5(1)(b)(ii) and (iii), are part of a set of rules intended, inter alia, to prevent a taxpayer and the taxpayer’s spouse from sharing income from property (including by means of loans bearing insufficient or no interest) to reduce the total amount of tax payable on that income. In that context, a textual, contextual and purposive interpretation of paragraphs 74.5(2)(b) and (c) and subparagraphs 74.5(1)(b)(ii) and (iii) favours a more restrictive interpretation of the word "paid", according to which the issuance of a note, although irrevocable, unrestricted and payable on demand, does not satisfy the requirement provided for in those paragraphs and subparagraphs.

It follows that … the exception provided for in subsection 74.5(2) could not apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Payment & Receipt | promissory note could not be issued as payment in context of income attribution rules | 83 |

Subsection 74.5(3) - Spouses or common-law partners living apart

Administrative Policy

5 October 2012 Roundtable, 2012-0453201C6 F - Règles d'attribution- séparation & décès

Two common-law partners - within the meaning of s. 248(1) - separated on June 1, 2012 and started living separate and apart because of a breakdown of their common-law relationship. On separation, a rental property was transferred between them for no consideration, and the transferee (the “Transferee”) died on August 14, 2012.

1. Is the 90-day limit stated in the definition of "common-law partner" in subsection 248(1) applicable to subsection 74.5(3)?

2. Which of the transferor ("Transferor") or the Transferee is taxed on the rental income from June 1, 2012 to August 14, 2012, on the taxable capital gain and recapture of depreciation from the deemed disposition on death?

CRA responded:

1. Subsection 74.5(3) does not require a minimum time for individuals to be considered as living separate and apart from one another because of the breakdown of a common-law relationship. Thus, in the particular situation, the two taxpayers could, according to the facts, be considered as living separate and apart from each other for the purposes of subsection 74.5(3), notwithstanding the fact that they are deemed living together in a conjugal relationship for the purposes of the definition of "common-law partner" in subsection 248(1).

Respecting Q.2, CRA noted that, in light of s. 74.5(3)(a), s. 74.1(1) would not apply to the 2 ½ months’ of rental income and the recapture, so that it would be included in the Transferee's income; and that provided a s. 74.5(3)(b) election was made, s. 74.2(1) would not apply to attribute the amount of the taxable capital gain to the Transferor.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 13 - Subsection 13(1) | recapture from rental property is property income from that property | 74 |

24 April 2006 External T.I. 2006-0166041E5 F - Transfert de biens entre époux séparés

In 1991, the spouses jointly purchased an immovable ("Immovable1" located in Canada which was intended to serve as their principal residence upon their return to Canada. Their separation in 1992 did not constitute a judicial separation and was not effected pursuant to a written separation agreement. Upon their return to Canada, the wife bought a house in 1992 ("Immovable2 ") which immediately became her principal residence, but remained as a co-owner of Immovable1. The husband became a co-owner of Immovable2 in order to assist her in securing a mortgage, but did not make any monetary disbursements, nor lived there. Immovable1 has been the husband's principal residence since May 1995;

Between the time of the purchase of Immovable1 and May 1995, Immovable1 was used to earn rental income. The wife has never lived in Immovable1.

Each of the spouses now wishes to sell his or her undivided share of the immovables to the other spouse for $1. CRA assumed that the wife will designate Immovable2 as her principal residence for the years 1995 to 2006 inclusive (as well as 1992, 1993, and 1994) and that, as a result, the husband must designate the same property for the years 1995 to 2006 – in which case, Immovable1 would be treated as a capital property subject to the change-in-use rules.

The transfer by the wife of her interest in Immovable1 to the husband would occur under s. 73(1) at the ACB of her interest (assuming no election under s. 73(1)) and that provided the election under s. 74.5(3) was made jointly by the spouses, there would be no attribution of the capital gain realized on a subsequent sale of Immovable1. Furthermore, these results would not change if the transactions arose from a separation or divorce judgment relating to the division of spousal property.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 40 - Subsection 40(4) | s. 40(4) feeds principal residence claim of spouse after she acquires the co-ownership interest of her separated husband for $1 | 306 |

88 C.R. - Q.54

RC is aware that the provision may not be workable, because spouses typically are unable to settle the terms of their separation agreement in the year of separation, and until then they will not know whether they wish to elect.

Paragraph 74.5(3)(a)

Administrative Policy

13 July 2005 External T.I. 2005-0131351E5 F - Séparation des conjoints de fait

Common-law partners (Monsieur and Madame) had a child of their union, and then lived separate and apart starting on April 15, 2004 (with Monsieur then transferring a rental property to Madame), and then resumed cohabiting on November 1, 2004.

CRA indicated that the income from the rental property will be attributed after their reconciliation to the transferor (Monsieur), stating:

[T]hey ceased to cohabit on April 15, 2004 ("that time" in the definition of "common-law partner"), ending their common-law relationship on that date. …

[I]n the absence of [s. 74.5(3)(a)], the income from the rental property attributable to the period between April 15, 2004 and November 1, 2004 would have been attributed to Monsieur. The effect of this provision is that the income from the building for the period is included in Madame’s income for the year.

[I]f there had been a resumption of their common life within the 90-day period, there would never have been a break down in the common-law partnership and the attribution rules would still have applied during the period in question (from April 15, to November 1, 2004).

… [T]he income from the rental property attributable to the period after November 1, 2004 will … be attributed to Monsieur.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Common-Law Partner | common-law partnership of couple with a child resumed the moment they resumed living together | 109 |

| Tax Topics - Income Tax Act - Section 74.5 - Subsection 74.5(3) - Paragraph 74.5(3)(b) | capital gain is attributed to transferor common-law partner if the property is sold after they resumed their relationship | 121 |

Paragraph 74.5(3)(b)

Administrative Policy

13 July 2005 External T.I. 2005-0131351E5 F - Séparation des conjoints de fait

Common-law partners (Monsieur and Madame) had a child of their union, and then lived separate and apart starting on April 15, 2004 (with Monsieur then transferring a rental property to Madame), and then resumed cohabiting on November 1, 2004.

In indicating that if the rental property is sold after the reconciliation of the couple, the capital gain will be attributed to the transferor (Monsieur), CRA stated:

[T]he property was disposed of after the resumption of the couple's life together, i.e., after November 1, 2004. Since the disposition of the property did not take place at a time when they were living separate and apart because of a breakdown in their common-law relationship … paragraph 74.5(3)(b) does not apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Common-Law Partner | common-law partnership of couple with a child resumed the moment they resumed living together | 109 |

| Tax Topics - Income Tax Act - Section 74.5 - Subsection 74.5(3) - Paragraph 74.5(3)(a) | attribution resumed when cohabitation resumed | 204 |

27 January 2003 Internal T.I. 2002-0177197 F - ATTRIBUTION DU GAIN A UN CONJOINT SEPARE

On the breakdown of their marriage, a couple held various immovable properties in equal co-ownership. Pursuant to a separation agreement, each transferred co-ownership interests to the other so that each became the full owner of properties. The Directorate indicated that, pursuant to s. 74.5(3)(b) of the Act, the attribution rules in s. 74.2(1) do not apply to dispositions of property occurring while they were living separate and apart by reason of their marriage breakdown and before their divorce, provided that they jointly elected pursuant to s. 74.5(3)(b) that s. 74.2 not apply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 56.1 - Subsection 56.1(4) - Support Amount | net rental income on property received by separated spouse to fund support was rental income, not a support amount | 94 |

Subsection 74.5(5)

Administrative Policy

6 October 2017 APFF Roundtable Q. 9, 2017-0709071C6 F - Corporate Attribution Rules

As a result of a previous estate freeze, A holds the voting freeze preferred shares of Opco (which is not a small business corporation) and a discretionary family trust (“Initial Trust”), with spouse and children as beneficiaries, holds the non-voting common shares. Now a further freeze is implemented under which Initial Trust exchanges its shares for preferred shares, and New Trust, with spouse children, grandchildren and family corporations as beneficiaries, subscribes for new non-voting common shares. CRA stated:

[O]nly a person under the age of 18 who does not deal at arm's length with a trust could logically be a designated person in respect of a trust.

In light of the foregoing, Mr. A’s spouse cannot be a designated person in respect of Initial Trust.

After indicating that s. 74.4(2) nonetheless potentially might apply respecting A’s spouse viewed as a designated person in respect of A, on the basis “that the transfer of property made during this [2nd] estate freeze was made indirectly by Mr. A by means of Initial Trust,” CRA also noted:

[A]n unborn child is not a person for the purposes of section 74.4 and subsection 74.5(5) and cannot constitute a designated person under paragraph 74.5(5)(b). In contrast, from birth, a grandchild may be a designated person in respect of an individual.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 74.4 - Subsection 74.4(2) | a second freeze transaction by a family trust could be viewed as an indirect transfer by the original freezor | 416 |

Subsection 74.5(6)

Administrative Policy

10 June 2003 External T.I. 2003-0018915 F - Attribution - Transfers & Loans to Corp.

An individual transferred all the common shares of Cco (which, at no point, was a small business corporation) in a s. 85(1) rollover to a Newco (Bco) in consideration for common shares of Bco (being all its common shares). Two years later, Bco effected a s. 86 exchange of all its common shares of Cco in exchange for preferred shares of Cco, and a discretionary family trust (of which the individual’s wife and minor children were the beneficiaries) then subscribed for common shares of Cco for $100.

The correspondent submitted that even if the main purpose test in s. 74.2(2) was met, s. 74.2(2) would not apply since the transfer of the shares on the s. 86 reorganization “would be made by a corporation (Bco) to another corporation (Cco), and not by an individual to a corporation. CCRA rejected this submission, and indicated that, pursuant to s. 74.5(6), the common shares of Cco transferred by Bco (viewed under the terms of s. 74.5(6) as a “third party”) would be deemed to have been transferred by the individual to Cco.

30 October 2002 Internal T.I. 2002-0134077 F - ATTRIBUTION DES GAINS EN CAPITAL

Two individuals transferred the shares they held of a particular company to their respective holding companies which, in turn, each disposed of a portion of those shares to the individuals’ respective spouses in consideration for non-interest-bearing notes. Following an exchange of such shares for shares of another class, and an amalgamation of the company, the spouses disposed of the shares of Amalco at a gain. After finding that s. 74.2(1) applied, on the basis that there was an indirect transfer of the shares by the individuals to their spouses, the Directorate went on to indicate that this result was reinforced by s. 74.5(6).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 74.2 - Subsection 74.2(1) | indirect transfer where individuals transfer shares to their Holdcos, who transfer such shares to the individuals’ respective spouses | 122 |

Subsection 74.5(7) - Guarantees

Administrative Policy

86 C.R. - Q.44

RC will apply s. 74.5(7) where a third-party lender requires a spouse to guarantee a loan, except where s. 74.5(11) applies.

Subsection 74.5(11) - Artificial transactions

Cases

Swirsky v. The Queen, 2013 TCC 73, 2013 DTC 1078 [at at 431], aff'd 2014 FCA 36

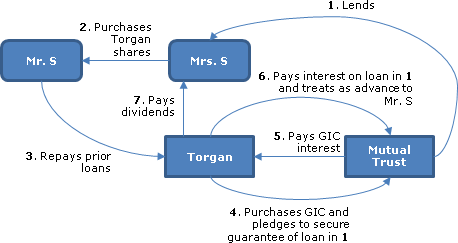

For creditor-proofing reasons, the taxpayer sold shares in a family real estate development company ("Torgan") to his wife, and used the sales proceeds to satisfy shareholder loans owing by him to Torgan. Torgan, in turn, used the proceeds to purchase a GIC, which it pledged (as security for a guarantee) to a trust company which had lent the shares' purchase price to the taxpayer's wife. He sought to have his wife's related losses (mostly due to interest on the loan) attributed to him pursuant to s. 74.1(1).

After finding that the loan interest was not deductible, Paris J. went on to address the Minister's argument that if, in fact, losses had arisen on the wife's share investment, the attribution of such losses should be denied pursuant to s. 74.5(11) as the shares had been transferred in order to reduce the taxes payable on income derived from the Torgan shares. In dismissing this alternative argument, Paris J. (after referring, at para. 52, to the reference in para. 28 of Canada Trustco to an "objective assessment of the relative importance of the driving forces of the transaction") accepted the taxpayer's evidence that the transactions were carried out in order to pay off the shareholder loans to him and for creditor proofing, and that tax reduction was not one of the main reasons for the transactions.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(3) | 232 | |

| Tax Topics - Income Tax Act - Section 245 - Subsection 245(4) | 33 |

See Also

Mady v. The Queen, 2017 TCC 112

As a result of a rule change of the Dental College, it was necessary for ownership of all the voting common shares of the professional corporation through which the taxpayer carried on his dental practice (“MDPC”) to be transferred from a family trust to him. This was accomplished by those shares being distributed out of the trust to his wife qua capital beneficiary in 2002, followed by their immediate gifting to him. Dividends paid by MDPC to the taxpayer in 2010 and 2011 were reported as his wife’s income under s. 74.1(1), but the Minister assessed to include those dividends in his income under s. 74.5(11).

Hogan J first noted (at paras 111-112):

… The Appellant observes that subsection 74.5(11) does not refer to a “series” of transactions ... [and] that subsection 74.5(11) dictates that the purpose of the transfer from Mrs. Mady to Dr. Mady must be determined solely by reference to that transaction. …

[T]he transfer of the shares from her to Dr. Mady could not have been intended to reduce tax payable on the dividends received on the shares. She was already the shareholder and the lower income earner.

In rejecting this argument, he stated (at paras. 114-116):

…[Lehigh Cement] accepts that, even in the absence of a “series of transactions” concept, the entire series of transactions may form part of the relevant circumstances in determining the purpose of the transfer of property.

… The rules of the Royal College of Dental Surgeons prohibited Mrs. Mady from owning the shares. If she could not own the shares she could not receive dividend income thereon. Therefore, dividends could not be subject to tax in her hands at a lower tax rate than that which applied to Dr. Mady. …

… [Per] Groupe Honco … “one of the main purposes” … “…implies that a taxpayer may have more than one main motive in acquiring shares”. Even if I accept that one of the purposes of the transfer from Mrs. Mady to Dr. Mady was to ensure compliance with the new [Dental College] share ownership restriction…, this does not override…that the other main purpose of structuring the transaction … was to trigger the application of the attribution rules… .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Ownership | wife and children did not acquire beneficial interest in shares the taxpayer was to transfer to them, under tax plan, until the share transfer occurred | 263 |

| Tax Topics - Income Tax Act - Section 86 - Subsection 86(2) | family members did not acquire beneficial interest in new shares until after completion of s. 86 reorg | 297 |

| Tax Topics - General Concepts - Fair Market Value - Shares | arm’s length sales price established FMV for closing-date internal transfer of same shares | 482 |

| Tax Topics - Income Tax Act - Section 69 - Subsection 69(1) - Paragraph 69(1)(b) - Subparagraph 69(1)(b)(i) | contemporaneous arm’s length sale price established that shares previously transferred at undervalue | 478 |

| Tax Topics - Income Tax Act - Section 163 - Subsection 163(2) | was not responsible under s. 163(2) for the unbeknownst sharp practice of his tax advisor | 692 |

| Tax Topics - General Concepts - Price Adjustment Clause | no jurisdiction to comment on application of price adjustment clause where the affected taxpayers are not appellants | 233 |

Administrative Policy

24 March 2014 External T.I. 2014-0519661E5 - Subsection 74.5(11) Attribution

A professional who formerly operated an unincorporated professional practice formed a corporation with him and his spouse each subscribing for shares, and her then gifting her shares to him so that he then was able to comply with a requirement that professional corporations be solely owned by professionals. Did s. 74.5(11) prevent attribution of dividend income to her on the shares which she had gifted to him?

After noting the submission that "the sole reason for the transfer of the shares from the spouse to taxpayer was to comply with the requirements of the corporation to qualify as a professional corporation," CRA stated that:

[I]t is possible that subsection 74.5(11) may apply… if one of the main reasons was to reduce the amount of tax that would…be payable under Part I on the income… derived from the property… .

3 May 2001 External T.I. 2001-0069535 F - DEPENSE D'INTERET REGLES D'ATTRIBUTION

A rental apartment building, generating net income after depreciation, was transferred on an s. 73(1) rollover basis for its FMV to the taxpayer's spouse, who financed its acquisition with a loan from an arm's length person. Regarding the deductibility of the interest on such loan, CCRA stated:

[I]nterest on borrowed funds will only be deductible under that paragraph if the funds were used to earn income from a business or property. That question can only be resolved, as regards the spouse who is the recipient of the transfer, after considering all the facts surrounding the transaction. Depending on the circumstances, the provisions of subsections 74.5(11) or 245(2) may apply.

Articles

Kevyn Nightingale, "American Professionals in Canada", Canadian Tax Journal, (2017) 65:4, 893-937

Although there may be significant advantages for a Canadian-resident professional to incorporate, challenges arise where the professional (or a spouse) is also an American citizen. Perhaps the most significant challenges arise where there is a “mixed” marriage between a US citizen and a (Canadian) non-resident “alien.” If the professional is the American, the professional corporation (PC) is a controlled foreign corporation (CFC). If a family member (other than the professional) is an American, the PC may be a passive foreign investment company (PFIC) given its control by the professional. (Medical and legal corporations often qualify as PFICs because they rarely hold much in the way of active business assets.)

Ontario, Alberta and Newfoundland generally prohibit corporate ownership (e.g., through a holding company set up by alien family members) of a PC. In this context, a possibility for dealing with the PFIC issues in the second situation is to issue Neuman (discretionary) shares, having a modest value, to the U.S. spouse, who then gifts them to the professional. From a U.S. perspective, dividends paid on the shares are legally the property of the non-resident alien professional, and thus not subject to U.S. tax.

For Canadian tax purposes, the gift will cause dividends on the shares to be subject to attribution under s. 74.5(1). However (p. 935):

There is a risk that the CRA would see this gifting strategy as abusive, and apply an anti-abuse rule [in s. 74.5(11) that would void the attribution.

…It could be argued [however] that in this case, the family ,member would retain the shares but for the US tax consequences of doing so. The attribution merely puts the family member in the same position as he or she would be absent the gift.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 126 - Subsection 126(1) | 1672 |

Subsection 74.5(12)

Paragraph 74.5(12)(c)

Administrative Policy

23 October 2009 External T.I. 2009-0309861E5 F - Tax-free Savings Accounts

Mr. X makes the only contribution to the TFSA of his wife. After the resulting qualified investment has appreciated, she withdraws all (or a portion) of the amount in the TFSA and invests such proceeds in an income-producing property. CRA stated that the “exception in paragraph 74.5(12)(c) is not applicable” in this scenario but that “It appears to us that subsection 74.1(1) could apply.”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 143.2 - Subsection 143.2(2) - Paragraph 146.2(2)(c) | contribution by spouse causes cessation as TFSA | 84 |