See Also

Lohas Farm Inc. v. The Queen, 2019 TCC 197

A grey marketer (Lohas) of newly-released iPhones purchased them in Vancouver-area Apple stores for export to Hong Kong and Taiwan, where those models were still unavailable. In order to get around Apple’s limit of two iPhones per purchase, Lohas used friends and acquaintances to make the purchases (the “buyers”). As the buyers did not charge GST to Lohas, whether it was entitled to input tax credits (ITCs) for the GST charged on their purchases turned on whether they purchased as its agents and on whether the documentation for their purchases satisfied the Input Tax Credit Information (GST/HST) Regulations.

The Crown’s best argument for the absence of an agency relationship was that “the buyers could not affect the legal position of Lohas, since the principal could not have contracted with Apple.” In rejecting this argument, D’Auray J stated (at para. 129):

… [A]ssuming the buyers purchases were in violation of Apple policy[,] at most this made the purchase contracts voidable and not void. It is clear from the evidence that the contracts were never avoided and remained binding on Lohas.

Although many of the receipts issued by the Apple stores had missing, fictitious or unreadable names for the buyers (as agents of Lohas), D’Auray J found that such deficiencies were cured in the case of purchases for which a “memo prepared by Lohas showed the name of each buyer, the iPhones purchases, the tax and the commissions paid” (para. 147) – so that ITCs were denied only for a relatively small number of purchases where this was not done.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Agency | buyers made purchases of iPhones as agents for a grey market reseller | 450 |

| Tax Topics - General Concepts - Onus | no burden of displacing an assumption as to a factual matter which the taxpayer could not be reasonably expected to know | 286 |

| Tax Topics - Excise Tax Act - Regulations - Input Tax Credit Information (GST/HST) Regulations - Section 3 - Paragraph 3(c) - Subparagraph 3(c)(ii) | missing names in receipts issued by vendor were cured by memo maintained by the purchaser | 205 |

Subsection 169(1) - General Rule for Credits

Cases

Amex Bank of Canada v. Canada, 2026 FCA 31

CRA denied the input tax credit (“ITC”) claims of Amex for its 2002 to 2012 taxation years for GST/HST paid on expenses arising in connection with the administration and operation of Amex’s Membership Rewards Program (“MRP”), including expenses incurred for the purpose of providing its cardholders who were members of the MRP (“Members”) with rewards on the redemption of points earned by them mostly through making purchases on their cards.

Woods JA found no reversible errors in the findings of Hogan J, who in dismissing Amex’s appeal, concluded that “all of the elements and components of the MRP are inherently intertwined and connected with the exempt supply of financial services made by the Appellant to its Members and merchants.” In particular, he found that that Amex incurred such expenses “for the purpose of earning greater [GST/HST-exempt] merchant discount revenue in its credit card business.”

In response to a submission that the $50 enrolment fees to join the MRP were not nominal, so that Amex should be characterized as making separate taxable supplies under the MRP, Woods JA found no error in the finding below that the fee was very low in comparison to the value of the MRP and, thus, insufficient to support a conclusion that Members received anything other than a single composite supply of exempt financial services.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 181 - Subsection 181(5) | no ITC for redemption of travel miles under card program since the redemption payments occurred in the course of a credit-generating activity | 220 |

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(4) | free supply of card loyalty rewards promoted credit supply by card issuer rather than taxable supplies | 193 |

Northbridge Commercial Insurance Corporation v. Canada (the King), 2025 FCA 83

The Federal Court of Appeal had previously allowed the appeal of Northbridge from a Tax Court finding that it was making only exempt supplies in relation to its issuances of around 5,000 insurance policies each year to trucking companies operating in Canada and the US, and referred the matter back to the Tax Court to determine Northbridge's entitlement to input tax credits (ITCs). The Tax Court then decided that Northbridge was not entitled to any ITCs for the GST/HST on its general head office and overhead costs since Northbridge had not determined the extent to which each of its policies was zero-rated pursuant to s. VI-IX-2 and instead only had “global evidence” bearing on its ITC entitlements.

Webb JA stated (at para. 26):

[T]he general head office and overhead costs are incurred as part of the overall business being carried on by Northbridge. Any property or service acquired as part of the general head office and overhead costs is not acquired solely to be consumed in relation to a particular insurance policy, but rather such property or service is acquired to be consumed or used in relation to all insurance policies issued by Northbridge.

Accordingly, Webb JA did not agree that the determination of the Northbridge entitlement to ITCs regarding such costs could only be made if there was a determination to the extent to which each and every policy issued by Northbridge was zero-rated. Webb JA referred the matter back to the Tax Court to determine the amount of ITCs to which Northbridge was entitled in relation to the GST/HST paid by it on the acquisitions of such property and services, in accordance with s. 141.02.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Schedules - Schedule VI - Part IX - Section 2 | zero-rating of insurance supplies under s. VI-IX-2 could be determined on a global basis for ITC purposes | 218 |

| Tax Topics - Excise Tax Act - Section 141.02 - Subsection 141.02(1) - Direct Input | whether head office rent was a direct input or non-attributable input was under dispute/ classification of inputs in hands of Tax Court | 378 |

President's Choice Bank v. Canada (the King), 2024 FCA 135

Goyette JA contrasted s. 169(1) “which provides a formula that only awards ITCs to the extent that a good or service was used in the course of a commercial activity” (para. 40) with s. 181(5), which provided a notional ITC for a loyalty points redemption amount that was paid in the course of a financial services business provided that, at the same time, it was paid in the course of a commercial activity.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 181 - Subsection 181(5) | loyalty point redemption payments made in the course of a financial business could generate ITCs if also in the course of a commercial activity | 562 |

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Commercial Activity | commercial activity of corporation can be at a loss | 144 |

Canada v. General Motors of Canada Limited, [2009] GSTC 64, 2009 FCA 114

The Appellant (a car manufacturer) was the administrator of various defined benefit pension plans for its unionized employees. It was the recipient of portfolio advisory services as it rather than the plans was contractually liable to pay the advisors' fees, and the Crown did not dispute that it also "acquired" those services if s. 167.1 did not apply to deem those services to instead have been acquired by the plans (which it did not).

These services also satisfied the requirement in s. 169(1) that they have been acquired by it in the course of its commercial activities. As noted by the Campbell, J below, its employee compensation program was a necessary adjunct to its making taxable sales, and it was contractually obligated to maintain the plans as part of that program.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 169 - Subsection 169(1) | 99 | |

| Tax Topics - Excise Tax Act - Section 267.1 - Subsection 267.1(2) | administrator of pension trust was not a trustee, and not subject to s. 267.1 | 51 |

| Tax Topics - Income Tax Act - Section 104 - Subsection 104(1) | administrator of pension trust was not a trustee | 41 |

Haggart v. Canada, 2003 FCA 446

GST on legal services supplied to the applicant to enable him and his company to obtain damages from a bank for wrongfully calling in a loan to the company, thereby forcing it out of business, was not eligible for an input tax credit given that the applicant had not established a connection, direct or indirect, between his purchase of the legal services and any ongoing supply of taxable services. This conclusion was supported by the finding made by the Alberta Court of Appeal in upholding the award of damages made to the applicant that the damages were more accurately characterized as compensation for the total destruction of the business, rather than for loss of profit.

London Life Insurance Co. v. Canada, [2000] GSTC 111 (FCA)

Under the terms of its leases, the Appellant, whose principal buisness was providing exempt financial services, undertook leasehold improvements to the leased premises at a cost of about $2.1 million and received tenant improvement allowances from its landlords of approximately $2.2 million.

The availability of an ITC was governed by s. 169(1)-B(c) rather than (b) because (under the definition of "improvement" in s. 123(1)), the cost of the improvements was not included in their adjusted cost base for purposes of the Income Tax Act because an election was made under s. 13(7.4) of the Income Tax Act to reduce the capital cost of the improvements by the amounts paid by the landlords.

Full ITCs were available under s. 169(1)-B(c) because the Appellant was supplying the leasehold improvements to the landlords for the leasehold improvement allowances, which was a commercial activity. Rothstein JA stated (at para. 33):

Certainly, the ultimate purpose of London Life is to lease improved premises for its financial services business of providing exempt supplies. But when the leasing transactions are considered independently, London Life is supplying the leasehold improvements to the landlords for the consideration of the leasehold improvement allowances. In turn, the landlords are providing the improved leased premises to London Life for its financial services business.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Improvement | 108 | |

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(2) | leasehold construction services were acquired for supply of leasehold improvements to landlord | 259 |

| Tax Topics - Statutory Interpretation - Interpretation Bulletins, etc. | 52 |

Canada v. 398722 Alberta Ltd., [2000] GSTC 32 (FCA)

In order to receive approval under the Town of Banff bylaws for the development and operation of a 63-unit hotel in Banff, the respondent was required to build a 4-unit apartment building. In finding that the respondent was not entitled to input tax credit for the GST payable by it upon completion and first leasing of the apartment building Sharlow J.A. noted (at p. 32-8 to 32-9) that the definition of "commercial activity" recognized that a business may consist of a number of components each of which is integral to the business as a whole but nonetheless required "that any part of the business that consists of making exempt supplies be notionally severed", and further stated (at p. 32-9):

"It should not and does not matter whether the acquisition is motivated by the prospect of receiving rent or, as in the respondent's case, is the fulfillment of a legal obligation that must be met in order to accomplish another business objective."

Midland Hutterian Brethren v. Canada, [2000] GSTC 109 (FCA)

In finding that heavy cloth purchased by a Hutterian colony (which was engaged in a farming business) to be made into work clothes for its members was eligible for the ITCs claimed by the colony for 50% of the GST payable on the purchases, Malone J.A. indicated (at para. 25):

Once an item is found to be acquired and used in connection with the commercial activities of a GST registrant and that item directly or indirectly contributes to the production of articles or the provision of services that are taxable, then an ITC is available using the formula in that subsection.

In a dissenting opinion, Evans J.A. agreed with the majority that "for the goods to be acquired for use 'in the course of commercial activities', there must be a functional connection between the needs of the business and the goods" (para. 31), but disagreed as to whether the connection was sufficient on the present facts.

See Also

267 O'Connor Limited v. The King, 2024 TCC 161 (Informal Procedure)

Upon the appellant entering into an agreement in August 2013 to sell a property to a third party (“Starwood”), Starwood took over the carriage of an appeal that the appellant had launched to the OMV (which, if successful, would have enhanced the value of the property). Carriage of the appeal reverted to the appellant when the transaction failed to close. The litigation between the appellant and Starwood in connection with the failure of the sale to close was settled in 2018 by the agreement of the appellant to pay $450,000 to Starwood (plus return the $360,000 deposit) pursuant to a settlement agreement that provided inter alia that Starwood was to assign to the appellant all its rezoning application plans and reports.

MacPhee J found that the $450,000 payment was, for the most part, compensation to Starwood for expenses incurred by it as a result of the failure of its purchase to close so as to restore it to some degree to its position prior to such failure of sale of the property; and that although “certain intellectual property was received pursuant to the settlement agreement” he was unable “to determine what portion of the $450,000 the Appellant paid to Starwood was for the assignment of Starwood’s rights, title and interest to Starwood’s rezoning application plans and reports” (para. 30). Furthermore, s. 182(1) did not apply because the amount was paid by rather than to the supplier under the sale agreement.

In addition, the appellant had not satisfied the Input Tax Credit Information (GST/HST) Regulations.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 169 - Subsection 169(4) | failure of recipient to demonstrate that that it had the supplier’s registration number at the time of its return filing, or to have documentation of an allocation to the alleged taxable supply | 196 |

| Tax Topics - Excise Tax Act - Section 182 - Subsection 182(1) | s. 182(1) inapplicable where damages paid by supplier rather than recipient | 178 |

ONR Limited Partnership v. The King, 2024 TCC 156

The appellant (the “LP”) was a wholly-owned limited partnership of a REIT. The REIT and the LP entered into two successive written forms of agency agreements pursuant to which, in order to raise money for the LP’s real estate business, the REIT was authorized to raise money through REIT unit or debenture offerings and to incur the related costs as agent for the LP. Sommerfeldt J found that the valid execution of one of the two agreements had not been established and that the existence of an agency agreement had not otherwise been established. However, he also found that the offering expenses could not in any event have been incurred by the REIT as agent for the LO, stating (at para. 137):

[T]he LP, being a partnership, did not have the legal capacity to issue units of a real estate investment trust (or of any trust, for that matter). Therefore, the LP did not have the capacity to authorize the REIT to undertake, as the LP’s agent, and on behalf of the LP, the Offerings of REIT Units, or, on the closing of those Offerings, to issue, as the agent, and on behalf, of the LP, the REIT Units to members of the public.

Furthermore, the REIT used the proceeds to subscribe for LP units rather than in the LP’s business. Accordingly, the LP was not entitled to ITCs for various expenses of the offerings, and other “public company” expenses such as of AIFs.

On the other hand, although it was noted (at para. 217) that Telus (2009 FCA 49) had found that “only the person to whom a supply is made can claim the related ITC”, any expenses that related to the acquisition of the real estate properties of the LP or otherwise to those properties “were acquired by the LP for consumption or use in the course of the LP’s commercial activities” (para. 226) and, by virtue of s. 6 of the Partnerships Act (Ontario) (every partner is an agent of the partnership), those expenses were incurred by the REIT on behalf of the LP.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Agency | REIT could not incur expenses for acts (issuing it units) which its alleged principal (its sub LP) lacked the capacity to perform, but it incurred expenses for the LP business as partner-agent | 467 |

| Tax Topics - General Concepts - Evidence | agreement authenticated pursuant to “comparison of hands” method | 137 |

| Tax Topics - Excise Tax Act - Section 272.1 - Subsection 272.1(1) | s. 272,1(1) inapplicable to expenses incurred by REIT to issue REIT units to fund its partnership investment | 142 |

Royal Bank of Canada v. The King, 2024 TCC 125

The appellant (RBC) submitted that it offered loyalty reward points to its cardholders to entice them to use their cards and increase the volume of interchange fee revenues, so that the costs to it of honouring loyalty points when redeemed were a direct input to generating the interchange fee revenues which, in part (regarding cardholder purchases from foreign merchants) were zero-rated. In rejecting this position, so that RBC had no input tax credit (ITC) entitlement regarding its GST/HST incurred in honouring points redemptions, Smith J stated (at para. 109):

[E]xpenses incurred by RBC in the redemption of loyalty reward points were inextricably linked and an integral component of the Appellant’s agreement to extend credit pursuant to the Cardholder Agreement. Although the presentation of the RBC Reward Card triggered the Appellant’s entitlement to the interchange fees, I find that this connection is not sufficient for me to conclude that expenses incurred in the redemption of loyalty reward points earned from transactions involving non-resident merchant–acquirers were part of a taxable or zero-rated supply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 165 - Subsection 165(1.11) | issue should be stated "reasonably" | 131 |

| Tax Topics - Excise Tax Act - Section 141.02 - Subsection 141.02(21) | pre-approval of method for allocating inputs between foreign and domestic supplies did not stop CRA from assessing to deny zero-rating of the foreign supplies | 202 |

| Tax Topics - Excise Tax Act - Section 141.02 - Subsection 141.02(31) - Paragraph 141.02(31)(f) | s. 141.02(31)(f) is merely confirmatory of normal taxpayer onus | 98 |

| Tax Topics - Excise Tax Act - Schedules - Schedule VI - Part IX - Section 1 - Paragraph 1(a) | foreign interchange fees generated by Canadian credit card issuer related to the granting of credit rather than the making of a loan by it, and were not excluded under s. 1(a)(ii) | 445 |

| Tax Topics - Excise Tax Act - Section 141.02 - Subsection 141.02(1) - Direct Input | expenses of redeeming credit card loyalty points were inextricably linked to the issuer’s extension of credit, and only remotely linked to its earning zero-rated interchange fees | 368 |

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Recipient | merchant acquirer was the recipient of credit card interchange services even though it was a conduit to the merchant | 156 |

| Tax Topics - Statutory Interpretation - Exclusionary provisions | exclusionary provisions should be narrowly construed | 267 |

| Tax Topics - Excise Tax Act - Section 301 - Subsection 301(1.2) - Paragraph 301(1.2)(a) | taxpayer not precluded from raising an argument that the Minister was bound by an ITC method that it had described in detail in its pleadings | 175 |

Fiera Foods Company v. The King, 2023 TCC 140

Two bakery plants of the appellant were staffed in significant part by temporary workers (“TWs”), who were sourced from third parties (the “Agencies”), which solicited for the TWs and directed them to the appellant and used part of the payments from the appellant on their invoices to pay the TWs in cash without taking or remitting source deductions. They pocketed rather than remitting the HST collected by them. CRA denied the appellant’s ITC claims.

Owen J found that the appellant “chose to ignore the obvious signs that the Agencies were not treating the TWs as employees and/or were not meeting the obligations of an employer” (para. 215) - but nonetheless concluded that the appellant was entitled to its ITC claims given his finding (at para. 236) that the “Agencies provided a supply to the Appellant that comprised soliciting and directing TWs to the Appellant and paying the TWs for the services provided by those TWs to the Appellant” so that “with respect to the supply provided by each Agency to the Appellant, the Agency was a ‘supplier', and the Appellant was a ‘recipient’.”

Owen J also stated (at para. 253) that the “addition to an input tax credit of amounts that are paid without having become payable captures situations in which a person has paid the tax prior to the time the rules in the ETA cause the amount to become payable (e.g., a prepayment of tax)” and (at para. 259):

[S]ubsection 169(1) does not require that the tax payable by the person that acquires the supply be payable to a particular person. Subsection 169(1) simply requires that the tax in respect of a supply be payable by the person.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Regulations - Input Tax Credit Information (GST/HST) Regulations - Section 2 - Supporting Documentation | registrant not required to demonstrate that invoice received in name of supplier was in fact “issued” by it | 550 |

| Tax Topics - Excise Tax Act - Section 169 - Subsection 169(4) - Paragraph 169(4)(a) | no particular form of supplier documentation is required for ITC purposes | 328 |

Amex Bank of Canada v. The King, 2023 TCC 93, aff'd 2026 FCA 31

The Minister denied the input tax credit (“ITC”) claims of Amex Bank of Canada’s (“Amex”) for its 2002 to 2012 taxation years for GST/HST paid on expenses arising in connection with the administration and operation of Amex’s Membership Rewards Program (“MRP”), including expenses (”Reward Expenses”) incurred for the purpose of providing its cardholders who were members of the MRP (“Members”) with rewards on the redemption of points earned by them mostly through making purchases on their cards.

Hogan J, before dismissing the appeal, stated (at paras. 59) that “all of the elements and components of the MRP are inherently intertwined and connected with the exempt supply of financial services made by the Appellant to its Members and merchants” and noted in this regard (also at para. 59) that the Members accumulated points and obtained rewards through use of their cards and that, conversely, enrolment in the MRP of a cardholder alone offers no benefits by itself and that points could only be earned and redeemed for benefits if the card was used by the Member to pay for goods or services. Furthermore, the facts pointing to “all of the elements and components of the MRP [being] elements of a composite supply also establish that the predominant element of that supply is the extension of credit by Amex to a Member” (an exempt supply) (para. 68). Hogan J further found (at para. 82) that Amex incurred “the Reward Expense for the purpose of earning greater merchant discount revenue in its credit card business.”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(4) | Amex did not make “free” supplies of rewards to credit card holders but instead were made for consideration and for the purpose of facilitating its exempt credit card business | 277 |

Praesto Consulting UK Ltd v HM Revenue and Customs, [2019] EWCA Civ 353

Mr Ranson, a former employee of an information technology consultancy (“CSP”), resigned to set up a competing company ("Praesto"), where he was joined by three other former employees of CSP. CSP commenced action only against Mr Ranson and the other three employees, alleging breach of the terms of his employment and/or fiduciary duties in setting up Praesto and competing with CSP through Praesto, and alleged misuse of a contact list. The law firm acting in defending the CSP action (“Sintons”) addressed the eight invoices in issue to Mr Ranson alone respecting the conduct of the litigation from its commencement of proceedings up to and including the Court of Appeal (which reversed the finding below of liability of Mr Ransom). The invoices were paid by Praesto. Sintons had declined a request to address its invoices to Praesto.

The availability to Praesto of an input tax credit for the VAT included in the Sintons invoices turned on a VAT provision providing such a credit for “VAT on the supply to him [the taxable person] of any goods or services being … goods or services used or to be used for the purpose of any business carried on or to be carried on by him.” HMRC assessed to recover the input tax credit of £79,932 claimed by Praesto.

Hamblen, LJ found no error of law in the FTT’s conclusion that the invoices related to services supplied by Sintons to Praesto, stating (at paras 37, 42, 43, and 45):

[T]here was throughout a joint retainer whereby Sintons was being instructed by and acting on behalf of both Mr Ranson and Praesto. … [B]oth Mr Ranson and Praesto would be entitled to Sintons' services and both would be jointly and severally liable for Sintons' fees. That is a legal relationship involving reciprocal performance.

… The real value of CSP's claim was an account of Praesto's profits. CSP was seeking to put Praesto out of business as its competitor. …

The FTT was satisfied and found that the litigation was effectively being brought against Mr Ranson and Praesto, even though Praesto had not been joined to the proceedings. That reflected the economic reality. It was also borne out by CSP's stated intention to join Praesto if and when Mr Ranson's liability for breach of fiduciary duty was established… .

… It may be that another tribunal might not have reached the same conclusions, but the FTT was clearly entitled to reach the conclusions which it did on the material before it.

LJ Hamblen further found that the FTT made no error of law in concluding that the services supplied by Sintons had a direct and immediate link to Praesto's taxable activities.

In a dissenting reasons, Sir Terence Etherton MR stated (at paras 86 and 88):

The personal belief of Mr Ranson and the understanding of Sintons that CSP was "attacking" Praesto, as well as Mr Ranson, and seeking to put Praesto out of business do not establish the requisite objective direct and immediate link to Praesto's economic activity as a whole. …

… The objective link between those services and the success of Praesto's business was not direct but indirect and was not immediate but consequential. It is well established that payment of costs by the taxpayer for a service provided to a third party instructed by the taxpayer, which is in the economic interests of the taxpayer, may not satisfy the objective direct and immediate link test: Airtours … ..

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(2) | legal fees addressed to executive were paid by company to protect its business | 236 |

International Hi-tech Industries Inc. v. The Queen, 2018 TCC 240

The business of the appellant (“IHI”) included the construction of buildings using prefabricated panels. One of its key shareholders had developed technology relating to a building construction process, with the rights to such technology being acquired by a corporation (“RAR”) initially owned by him and ultimately by other members of his family. RAR applied for and acquired various patents around the world.

In finding that IHI was not entitled to claim input tax credits for the GST on various invoices that it paid but which were addressed to RAR by a patent agent (“Fetherstonhaugh”), Sommerfeldt J stated (at paras. 28-29, 32):

To claim an ITC, a claimant must be contractually liable to pay the supplier for the property or service that is the subject of the particular supply. Furthermore, such contractual liability should be based on a contract between the supplier and the recipient, rather than a contract between the recipient and one of its related corporations.

… IHI did not provide any evidence to establish that IHI (rather than RAR) acquired the services provided by Fetherstonhaugh (so as to come within the wording of subsection 169(1) of the ETA), nor did it provide any evidence of an agreement or other contractual arrangement between IHI and Fetherstonhaugh that required IHI to pay for those services. …

As noted in Garmeco, to qualify for ITCs, a claimant “must demonstrate … that it acquired the goods and services for consumption or use in the course of its own commercial activity [emphasis added].”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 152 - Subsection 152(1) - Paragraph 152(1)(b) | departure of supplier from its usual prompt invoicing | 274 |

| Tax Topics - Excise Tax Act - Regulations - Input Tax Credit Information (GST/HST) Regulations - Section 3 - Paragraph 3(a) - Subparagraph 3(a)(ii) | invoice not issued if not sent | 244 |

| Tax Topics - Excise Tax Act - Section 168 - Subsection 168(9) | possible deposits subsequently may have been applied by agreement as payments on account | 233 |

| Tax Topics - Excise Tax Act - Section 221 - Subsection 221(2) | unregistered purchaser | 35 |

| Tax Topics - Excise Tax Act - Schedules - Schedule V - Part I - Section 9 - Subsection 9(2) | sale by corporation not exempted | 30 |

Thimo v. The Queen, 2017 TCC 164

Operations at an individual’s swimming school were suspended as a result of charges brought against him respecting alleged misconduct with a 15-year old female instructor – and he incurred significant fees in obtaining an acquittal. Although Favreau J accepted that the individual intended to resume the operations of his business when possible, he nonetheless found that, as the legal fees were “incurred to defend the Appellant’s reputation” (para. 28), the legal services did not qualify as being acquired in the course of commercial activities and for the purpose of making taxable supplies, so that no ITCs were available.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(2) | no ITCs respecting services of criminal counsel which permitted an individual to resume a business | 258 |

572256 Ontario Limited v. The Queen, 2017 TCC 108 (Informal Procedure)

Paris J found that, notwithstanding the absence in evidence of a written agency agreement, a corporation (SVO) had purchased property as agent for the taxpayer and others, so that the taxpayer’s pro rata portion of the maintenance and upkeep expenses of SVO entitled it to claim input tax credits. In this regard, Paris J relied on the passage in Scott, The Law of Trusts (also quoted in De Mond) stating:

If [a person] undertakes to act on behalf of the other and subject to his control he is an agent; but if he is vested with the title to property that he holds for his principal, he is also a trustee. In such a case, however, it is the agency relation that predominates, and the principles of agency, rather than the principles of trust, are applicable.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Agency | property found to be held as agent notwithstanding missing written agreement | 316 |

Le Groupe PPP Ltée v. The Queen, 2017 TCC 2, briefly aff'd 2018 FCA 123

A Quebec company (“PPP”) through car dealers offered motor vehicle replacement “warranties,” which, in the event of the loss of the vehicle through accident or theft, would cover the difference between the depreciated value of the vehicle (which was covered by the regular insurer) and the cost of a new replacement vehicle. The consumer who had purchased the PPP warranty was required to acquire the new replacement vehicle from the dealer, and the dealer was paid directly by PPP.

After first finding that PPP was not entitled to input tax credits under s. 175.1 respecting the claims paid by it, Tardif J also found that PPP was not entitled to ITCs under s. 169, stating (at paras. 97, 108, 110 and 120-121 , TaxInterpretations translation):

… [T]he vehicle acquired through the partial disbursement [the other part being covered by the primary insurer] does not profit or benefit the appellant since only the consumer takes advantage of the acquisition of the replaced property. …

[T]he acquiror of the taxable supply is not the appellant but the consumer who benefits from the contract reimbursing for the full price… .

The argument that the dealer must do a lot of work…to prepare and present the claim to the appellant is quite unconvincing… .

… [T]o claim that the payment made by the appellant as a result of a claim is a transaction between the appellant and the dealer and a taxable economic activity is without merit.

In accordance with the FCA's pronouncements, only the person for whose benefit a supply is made may claim and obtain the related ITC…

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 175.1 | “warranties” funding the incremental cost of a new vehicle after complete loss of old vehicle likely were insurance policies and were not re quality, fitness or performance | 345 |

| Tax Topics - General Concepts - Illegality | whether a product was an insurance policy did not turn on whether the provider was a properly licensed insurer | 216 |

Gemeente Woerden (Municipality of Woerden) v. Staatsecretaris van Financiën (Secretary of State for Finance, Netherlands), C:2016:466 (European Court of Justice (10th Chamber) )

The named Netherlands municipality did not provide two buildings constructed by it to the mostly VAT-exempt building users (e.g., schools) directly. Instead, after a newly-formed non-profit foundation was interposed between it and the users, it sold the buildings to the foundation at 10% of its cost and reported VAT on that below-FMV selling price. In finding that the municipality was entitled to essentially full credit for its VAT costs in constructing the buildings. President Biltgen stated:

[I]f the supply price is lower than the cost price, the [input tax] deduction cannot be limited in proportion to the difference between the supply price and the cost price, even if the supply price is considerably lower than the cost price, unless it is purely symbolic. … The fact that that purchaser allows parts of the building…to be used without charge is of no importance… .

B.C. Sky Train is similar.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(1.1) | sale of a building at 10% of cost to an intermediary for 90% non-taxable use entitled the vendor to full ITCs | 417 |

630413NB Inc. v. The Queen, 2016 TCC 156 (Informal Procedure)

A group of four corporations and their ultimate individual shareholder were unsuccessful in generating input tax credits for GST/HST on legal fees by assigning the rights to the proceeds of the actions to a fifth group company in consideration for that company assuming obligations for the legal fees. Ouimet J found the arrangement to be insufficiently business-like to qualify as a business of the fifth company.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Business | alleged business of assuming litigation not caried out in business-like manner | 269 |

Airtours Holidays Transport Ltd. v. HMRC, [2016] UKSC 21

In 2002, the appellant (“Airtours”), which was in financial difficulty, instigated the preparation of a report by an accounting firm (“PwC”) to satisfy around 80 lenders (the “Institutions”) that its proposed restructuring and refinancing proposals were viable. PwC was appointed to produce the report pursuant to an engagement letter (the “Letter”) which was signed both by the “Engaging Institutions” and Airtours. The report was instrumental in securing a successful restructuring.

S. 24(1) of the Value Added Tax Act 1994 defined “input tax” as, inter alia, “VAT on the supply to [a taxable person] of any goods or services” which are “used or to be used” for a business “carried on by him”. Ss. 26(1) and (2) provided that the amount of allowable input tax is that which is “attributable to” taxable “supplies … made or to be made by the taxable person in the course or furtherance of his business.”

The Letter clearly obligated PwC to supply services to the Institutions (at Airtours’ expense). At issue was whether PwC was contractually obligated to Airtours to provide its report and other services to the Institutions, so that the VAT on the PwC fees paid by Airtours qualified under s. 24(1) as “VAT on the supply to [it] of any…services.”

Lord Neuberger found (at para 23) “that PwC’s commitment to provide the services described in the Contract was a contractual commitment to the “Engaging Institutions”, and not to Airtours” on the basis that the Letter was addressed only to the Engaging Institutions (and was signed by Airtours only to be bound by its obligation to pay fees) and it provided that the report was for their sole use (with Airtours only to be provided with potentially redacted copy) and with a duty of care owed by PwC only to the Institutions.

Lord Neuberger stated (at para 50:

[I]t appears clear that, where the person who pays the supplier is not entitled under the contractual documentation to receive any services from the supplier, then, unless the documentation does not reflect the economic reality, the payer has no right to reclaim by way of input tax the VAT in respect of the payment to the supplier.

In his dissenting reasons, Lord Clarke stated (at para. 64) that “two distinct supplies of services were being provided by PwC within the same overall transaction,” (at para. 66) that “Airtours was at least as much a beneficiary of the services provided by PwC as were the Banks,” and that in his view it was agreed in the Letter “that PwC owed a duty of care both to the Banks and to Airtours” (para. 75).

In his concurring dissent, Lord Carnwath stated (at para. 82, citing Loyalty Management [2013] UKSC 15 at para 67) that “the normal expectation is that a commercial business paying a supplier is paying for a right to something, even if that something is a supply to another party,” and (at para.84):

It is legitimate to ask what would have happened if, having paid its £200,000 on 2 November in the expectation of receiving a draft PwC report 13 days later, Airtours had been faced with a failure by PwC to do anything. On Lord Neuberger’s interpretation of the contract it would have had no enforceable right of any kind. I find that impossible to accept, either as a matter of ordinary contractual construction, or still less of economic reality.

Andrei 95 Holdings Ltd. v. The Queen, 2015 TCC 224 (Informal Procedure)

The taxpayer was denied ITCs in respect of legal fees on the basis that it did not incur the legal fees in the course of any commercial activity. It and its 75% shareholder (Mr. Mazilescu) owned between them 50% of the shares of two companies: a manufacturing company (“Waycon”); and a company (“JAV”) which owned the related buildings. An arm’s length individual John O’Connell and entities controlled by him owned the other 50% of the shares of Waycon and JAV. A further company, (“OMH”), which distributed Waycon’s products, was owned equally by O’Connell, Mrs. Mazilescu and a third individual. The taxpayer received management fees of $34,000 and $90,000 in 2008 and 2009 from Waycon, and of $100,000 from OMH in 2010.

After Mr. Mazilescu and O’Connell had been carrying out negotiations to have one of them buy out the other, but in January 2011, O’Connell sued various defendants including the taxpayer and the Mazilescus for breach of a shareholders’ agreement prohibiting competition with Waycon. This litigation was settled with O’Connell buying out Mr. Mazilescu and the taxpayers’s interest in Waycon, JAV and another related company.

In rejecting the taxpayer’s position that its legal fees were incurred in relation to its management services business, Paris J stated (para 21): “The legal fees incurred by the Appellant up to the time O’Connell applied for the Anton Piller Order in January 2011 were incurred for the purpose of negotiating a separation of Mr. Mazilescu’s and O’Connell’s business interests by way of a buyout of one or the other’s shares.” Paris further stated (at paras 22 &23):

Since shares are financial instruments as that term is defined in subsection 123(1) of the Act, and since supplies of financial instruments are exempt supplies under the Act, no ITCs in respect of inputs to supplies of financial instruments are available under subsection 169(1). This is because the making of exempt supplies is excluded from the definition of “commercial activities” …

Also, I find that the legal fees incurred by the Appellant in the course of litigation commenced in January 2011 have not been shown to have been related to or connected with any commercial activity carried on by the Appellant.

Bijouterie Almar Inc. v. The Queen, 2010 TCC 618, [2010] GSTC 181

The Minister disallowed the ITCs claimed for $15 million of gold jewellery purchases made over four years on the grounds inter alia that the appellant had not purchased the gold jewellery. Lamarre J. fouind that the appellant had displaced the Ministere's assumption by demonstrating that the supplier had sufficient inventory to supply the appellant.

| Other locations for this summary | |

|---|---|

| Tax Topics - Excise Tax Act - Regulations - Input Tax Credit Information (GST/HST) Regulations - Section 3 - Paragraph 3(c) - Subparagraph 3(c)(iv) | "assorted gold jewellery" was sufficient description of bulk purchase |

Lavoie v. The Queen, 2014 DTC 1104 [at at 3218], 2014 TCC 68

The taxpayer's uncontradicted evidence was that his cottage in PEI was used approximately 170 days in a given year, only 10 of which were solely for personal use. C Miller J found that the cottage was used primarily for business purposes and, having no evidence as to how the losses were calculated, allowed them in full (para. 28).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 163 - Subsection 163(2) | deducting home renovations tenuously related to home office was not grossly negligent | 196 |

| Tax Topics - Income Tax Act - Section 18 - Subsection 18(1) - Paragraph 18(1)(h) | cottage used 10 days for personal use and 160 days for business was primarily for business use | 57 |

PDM Royalties Limited Partnership v. The Queen, 2013 TCC 270

The limited partnership units of the appellant were held by a sub-trust (the "Trust") of an income fund (the "Fund"). Unit subscription proceeds received by the Fund on its initial public offering ("IPO") and on a subsequent private placement of Fund units were used to acquire debt and units of the Trust, which in turn subscribed for LP units of the appellant. The appellant used those proceeds to acquire intellectual property and related rights to be used by it in a pizza franchising business.

Before completion of the IPO, the Fund, Trust, appellant and its general partner entered into a "Financing Agreement" in which they agreed that all financing expense in connection with the IPO, other than the underwriters' fee, were to be incurred on behalf of the appellant; and at the same time the appellant entered into an "Administration Agreement" with the Fund in which it agreed to administer the Fund and "as agent of the Fund" to pay for all outlays and expenses incurred by it in such administration.

V. Miller J found that, as pursuant to the Administration Agreement, various expenses (principally relating to the IPO and private placement) were incurred by the appellant as agent for the Fund, the appellant was not the recipient of the related services and was not entitled to input tax credits therefor (para. 31). The Financing Agreement did not render the appellant the recipient of such supplies as the supplies were not made pursuant to that agreement (para. 26), nor could it be construed as causing there to be a re-supply of the services by the Fund to the appellant, as the services were consumed by the Fund (para. 32).

Furthermore, even if the appellant was the recipient of the supplies, the expenses would have been incurred by it so that it could receive money from the Trust in exchange for issuing LP units, which constituted the making of an exempt supply (para. 42).

There also were various deficiencies in the invoices of the suppliers. V. Miller J stated (para. 51):

[W]here an invoice represented services to both the Appellant and the Fund and I could not ascertain the portion payable by the Appellant, I did not allow the ITC involved.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Regulations - Input Tax Credit Information (GST/HST) Regulations - Section 2 - Intermediary | no allocation on invoices | 129 |

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Recipient | intragroup expense-bearing agreement did not change the recipient of services rendered on IPO | 280 |

WHA Ltd. v. Revenue and Customs Commissioners, [2013] UKSC 24, [2013] 2 All ER 908

The appellant (WHA) was an affiliate of an English company (NIG) which issued motor breakdown insurance to car owners. The NIG policies indicated that "the insurer is undertaking to meet the cost of repairs…:it is not undertaking responsibility for the repairs themselves" (para. 27). The role of WHA encompassed "the negotiation, investigation, adjustment, settlement and payment of claims…[and not] the carrying out of repairs" (para. 33). When there was a claim, there was an implied agreement between the garage and WHA under which WHA agreed to pay for the repair work insofar as it was covered by the policy and authorized by WHA; and there was an implied agreement between the insured and the garage under which the insured: authorized the garage to examine the vehicle; and agreed to pay for the work insofar as it was not covered by the policy (para. 38).

WHA had taken the position that it was receiving a supply of repair services from the garage (with a view to deducting input tax on the basis that it was receiving such repair services for the purpose of making supplies to a Gibralter affiliate). In rejecting this position (so that WHA was not entitled to such deductions), Lord Reed stated (at para. 56-57):

If NIG were to perform the contract by itself paying the garage, that would be an example of third party consideration….[T]he garage supplies a service to the insured by repairing his or her vehicle, and NIG meets the cost of that supply because it has undertaken to the insured that it will do so….

WHA's role …is to act as the paymaster of costs falling within the cover provided by the policies. The interposition of WHA does not, by some alchemy, transmute the discharge of the insurer's obligation to the insured into the consideration for a service provided to the reinsurer's agent.

HMRC v. Aimia Loyalty UK Ltd, [2013] UKSC 15

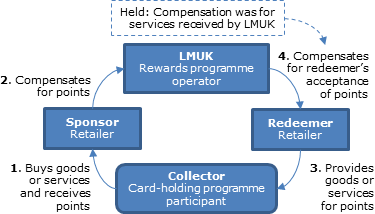

The appellant ("LMUK" ) operated a loyalty card programme. Card-holding customers ("collectors") would swipe LMUK's card during purchases at participating retailers ("sponsors") and receive points which could be redeemed at participating businesses ("the redeemers") for goods or services, or for a price reduction in goods or services. Whenever a redeemer accepted loyalty points, it became entitled to payment from LMUK for accepting those points. Those payments were less than the compensation paid to LMUK by the sponsors for issuing points to the collectors as customers of the sponsors.

The Court found that the payment of LMUK to a redeemer was consideration for a supply of services by the redeemer to LMUK itself, rather than representing third-party consideration for a supply of goods or services by the redeemer to the collector. Accordingly, LMUK was entitled to a deduction of input VAT (the British equivalent of an ITC) on the payments made by it to the redeemer. Lord Reed SCJ stated (at paras. 80-81):

In accepting points, which have no inherent value, in exchange for goods or services, the redeemer is acting in a manner which is only explicable because of its agreement with LMUK, under which LMUK will pay it for doing so. LMUK pays it for doing so because its business is dependent on redeemers accepting points in exchange for the provision of goods and services. The only economically realistic explanation of LMUK's behaviour is the value to LMUK itself of the redeemers' acceptance of points in exchange for the provision of goods and services.

Reluxicorp Inc. v. The Queen, [2011] GSTC 138, 2011 TCC 336

The registrant was a hotel company that paid franchise fees to a hotel franchise ("Marriott") in the United States. Marriott's fees were based on gross room revenues. Lamarre J. found that, because 30% of the registrant's revenue was from exempt stays (i.e. exceeding one month), 30% of the franchise fees were not incurred in respect of a "commercial activity" as defined in s. 123(1). Accordingly, she affirmed the Minister's assessment, which was made on the basis that the provision by Marriott of franchise rights was an "imported taxable supply" under s. 217, for which the registrant was liable to pay GST on the consideration paid on the basis that 30% of the franchise fees was not eligible for an input tax credit. The registrant was unable to demonstrate that the franchise fees pertained only to the short-term stays.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Exclusive | 75% was not substantially all | 261 |

| Tax Topics - Excise Tax Act - Section 217 - Imported Taxable Supply | 173 | |

| Tax Topics - Excise Tax Act - Section 298 - Subsection 298(4) - Paragraph 298(4)(a) | 116 |

Lyncorp International Ltd. v. The Queen, 2010 DTC 1351 [at at 4335], 2010 TCC 532, aff'd 2012 DTC 5032 [at 6684], 2011 FCA 352

The taxpayer, owned and operated by Mr. Mullen, invested in shares and made non-interest bearing loans to a number of corporate ventures to which Mr. Mullen provided management services free of charge by him or the taxpayer. The taxpayer claimed input tax credits on expenses relating to the operation of a private jet, which were incurred primarily in connection with Mr. Mullen making visits to the offices of these ventures.

V. Miller J. found that the taxpayer could not claim input tax credits on the flight expenses that related to the business ventures rather than any business carried on directly by the taxpayer. She stated at para. 81:

This is a unique situation of a company incurring costs (inputs) to provide free services for its business ventures. In such circumstances, the company can best be viewed as the ultimate consumer - the end of the line: no [input tax credits] are available, as there is no further commercial activity of the company.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 3 | 153 |

General Motors of Canada Limited v. The Queen, [2008] GSTC 41, 2008 TCC 117, aff'd [2009] GSTC 64, 2009 FCA 114

The Appellant (a car manufacturer) was the administrator of various defined benefit pension plans for its employees. It directed the trustee of the plans to pay the fees of third party portfolio advisors out of the trust assets. As it was the Appellant who was contractually obligated to pay those fees, and as s. 267.1 did not deem the portfolio advisory services to have been acquired by the trust, the Appellant was the recipient of those services. Campbell J stated (at paras. 50-52):

It appears that, where a person is the recipient of the supply, the Act expressly contemplates that GST is payable by that person.

…[S]ection 168 provides that:

Tax … is payable by the recipient on … the day the consideration for the supply becomes due.

While the amendment to subsection 169(1) in April 1997 replaced the phrase “supplied to” with the term “acquires”, a determination as to who is the recipient of the supply remains directly relevant in dealing with the question “was GST payable by GMCL?” I do not believe that the 1997 amendment replaced the focus on the central determination in this appeal of which party is contractually liable to pay GST pursuant to the Agreements.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Financial Service | 95 | |

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Recipient | employer was contractually obligated for, and the recipient of portfolio advisory fees for employees' pension fund | 78 |

Y S I's Yacht Sales International Ltd v. The Queen, 2007 TCC 306

Woods, J. accepted that an agreement pursuant to which the appellant ("YSI") agreed to contract with suppliers in connection with refurbishing a yacht and to charge the other party to the contract ("Platinum") a 5% mark-up on some of the purchases, did not establish an agency relationship between YSI and Platinum. Woods, J. noted (at para. 35) that whether YSI acquired goods and services on its own behalf on behalf of Platinum depended on the parties' mutual intention and that, accordingly, the essential question was whether Platinum agreed to be bound by YSI's agreements with suppliers. Accordingly, YSI was entitled to claim input tax credits respecting GST on purchases made by it in reconditioning the yacht.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Agency | 93 |

Kretztechnik AG v Finanzamt Linz, [2005] EUECJ C-465/03, [2006] BVC 66 (ECJ (1st Chamber))

Kretztechnik raised capital through a share issue. The issue of shares did not constitute a supply of services, but it was held that the cost of supplies acquired in connection with the raising of the capital formed part of its general overheads and, therefore, were component parts of the price of its products. On that basis, the supplies had a direct and immediate link with the whole economic activity of the taxpayer, and VAT on those supplies was deductible. The Court stated (paras. 34 et seq):

[34] The deduction system is meant to relieve the trader entirely of the burden of the VAT payable or paid in the course of all his economic activities. The common system of VAT consequently ensures complete neutrality of taxation of all economic activities, whatever their purpose or results, provided that they are themselves subject in principle to VAT ...

[35] It is clear from the last-mention condition that, for VAT to be deductible, the input transactions must have a direct and immediate link with the output transactions giving rise to a right of deduction. Thus, the right to deduct VAT charged on the acquisition of input goods or services presupposes that the expenditure incurred in acquiring them was a component of the cost of the output transactions that gave rise to the right to deduct …

[36] In this case, in view of the fact that, first, a share issue is an operation not falling within the scope of the [Directive] and, second, that operation was carried out by Kretztechnik in order to increase its capital for the benefit of its economic activity in general, it must be considered that the costs of the supplies acquired by that company in connection with the operation concerned form part of its overheads and are therefore, as such, component parts of the price of its products. Those supplies have a direct and immediate link with the whole economic activity of the taxable person ...

[37] It follows that ... Kretztechnik is entitled to deduct all the VAT charged on the expenses incurred by that company for the various supplies which it acquired in the context of the share issue carried out by it, provided, however, that all the transactions carried out by that company in the context of its economic activity constitute taxed transactions. A taxable person who effects both transactions in respect of which VAT is deductible and transactions of which it is not may ... deduct only that proportion of the VAT which is attributable to the former transactions'.

A & W TradeMarks Inc. v. The Queen, 2005 TCC 493 (Informal Procedure)

The appellant, which became a wholly-owned subsidiary of a new income fund (the “Fund”), incurred $78,000 in fees directly to an investment dealer, law firms and a printing company in connection with the IPO of the Fund. The $83M proceeds of the IPO were used by the Fund to subscribe for debt and equity of the appellant which, in turn, used those proceeds to acquire trade marks from another A & W company for licensing back to that company. In finding that the GST on these fees was eligible for input tax credits, Little J stated (at para. 11):

[T]he Appellant acquired the goods and services to enable it to borrow money in order to carry on its commercial activities. I have therefore concluded that the goods and services were acquired by the Appellant for use in its commercial activities.

Edible What Candy Corp. v. R., [2002] GSTC 33 (TCC)

The taxpayer was found to have made a misrepresentation attributable to neglect when it claimed input tax credits for GST incurred before it became registered for GST purposes notwithstanding professed confusion over the interpretation of s. 171 of the ETA.

BJ Services Co. Canada v. The Queen, [2002] GSTC 124 (TCC)

A Canadian public company ("Nowsco") that was engaged in the provision of oil field services incurred significant fees for services rendered by financial advisors and a law firm in connection with seeking a "white knight" following the commencement of a takeover bid for its shares, as a result of which it was able to secure a higher price for its shares from the original bidder. Miller J. found that even if he considered that the primary purpose of Nowsco in incurring these fees was to maximize shareholder value, this purpose did not take the inputs outside the realm of commercial activity for purposes of s. 169 given that a public company will suffer adverse financial consequences if it does not behave as commercially expected, and there was a secondary purpose of maintaining the ongoing viability and economic health of the company.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(2) | s. 141.01 was apportionment provision not applying where registrant only making taxable supplies | 181 |

Customs and Excise Commissioners v. Redrow Group plc, [1999] UKHL 4, [1999] 2 All ER 13, [1999] 1 WLR 408

As an incentive to purchasers of its new homes, a residential home developer entered into agreements with prospective purchasers and real estate agents selected by it under which it agreed to pay the agent's fee plus VAT in connection with a sale of the existing purchaser's home, provided that the purchaser completed a purchase of a new home. In finding that the VAT paid on the agent's fee qualified for deduction as input tax in respect of the supply to the developer of services, Lord Hope indicated (at p. 6) that the matter was to be looked at from the standpoint of the person who is claiming the deduction by way of input tax and, that the relevant question was:

"Was something being done for him for which, in the course of furtherance of the business carried on by him, he has had to pay a consideration which has attracted VAT? The fact that someone else, in this case, the prospective purchaser, also received a service as part of the same transaction does not deprive the person who instructed the service and who has had to pay for it of the benefit of the deduction."

Similarly, Lord Millet stated (at 418 WLR):

Once the taxpayer has identified the payment the question to be asked is: did he obtain anything - anything at all – used or to be used for the purposes of his business in return for that payment? This will normally consist of the supply of goods or services to the taxpayer. But it may equally well consist of the right to have goods delivered or services rendered to a third party. The grant of such a right is itself a supply of services.

Hleck, Kanuka, Thuringer v. The Queen, [1994] GSTC 46 (TCC)

In finding that GST on an airline ticket purchased by a law firm in order for the wife of one of its partners to attend a conference with him, was creditable, Bell TCJ. stated (at p. 46-7):

"The test set out under the Act is more liberal that the test for deductibility of a business expense under the Income Tax Act. Expenditures made for the purpose of gaining or producing income from a business are, by definition, made in the course of commercial activity. However, those made in the course of commercial activity are not, necessarily, made for the purpose of gaining or producing income from a business."

P & O (Dover) Ltd. v. Commissioners of Customs and Excise, [1992] V.A.T.T.R. 221

The appellant along with seven individual employees was charged with manslaughter in connection with the sinking of its vessel. The appellant's own counsel formed the view that the success or failure of the prosecution of the appellant depended largely on the success of the prosecution of the individual employees. It was found that the legal services of the separate counsel representing the employees were used for the purpose of the appellant's business for purposes of s. 14(3) of the Value Added Tax Act 1985 given the various business benefits that the appellant derived from its successful defence of the charges against it.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Recipient | employer the recipient of criminal counsel services | 156 |

Turner v. Customs and Excise Commissioners, [1992] BTC 5082 (Q.B.D.)

The appellant, who was ordered to pay the costs of the winning side in an unsuccessful lawsuit including VAT, was not entitled to a credit for input tax under s. 14 of the Value Added Tax Act 1983 because there were no "goods or services used or to be used for the purpose of any business carried on or to be carried on by him" for the purposes of that provision.

Administrative Policy

GST/HST Notice 339, “Input Tax Credits Related to Dental Practices,” October 2024

- Davis Dentistry confirmed input tax credit (ITC) claims of a professional practice on the basis that a portion of its supplies to each orthodontic patient was of a zero-rated supply of the orthodontic appliance, and that only the balance of what was supplied was an exempt healthcare service.

- Under CRA’s arrangement made in 1991 with the Canadian Dental Association, a dentist registrant could, for each reporting period in a fiscal year, use an estimate up to a maximum of 35% of the total consideration charged for orthodontic treatments to represent the consideration for the supply of orthodontic appliances, and claim ITCs on that basis – but then, at the end of the fiscal year, was required to perform a reconciliation based on the actual amounts charged for orthodontic appliances, and adjust the ITC claims for the year accordingly (keeping in mind that charges for cosmetic services also generated ITCs).

- CRA has now announced that this arrangement is revoked effective for any fiscal year of a dentist (who had been relying on this arrangement) that begins on or after January 1, 2025. Dentists will now be expected to claim ITCs throughout the year based on their actual eligibility to do so without making estimates, i.e., on the basis of the extent that the input was acquired for consumption or use in the course of their commercial activities.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Schedules - Schedule VI - Part II - Section 11.1 | 235 |

25 April 2023 GST/HST Ruling 202403 - Eligibility for employer to claim ITCs on amounts related to investment management services for pooled funds of an insurer

The Employer, as administrator for pension plans for its employees, contracted with the Insurer for the Insurer to provide certain pension benefits out of the Insurer’s funds (that the Insurer invested and managed), and to provide policy-related administration in respect of two of the Employer’s pension plans. Under the two insurance policies, the Employer agreed to pay certain premiums, and, in exchange, the Insurer agreed to pay the Employer sums of money upon specified events, typically, the retirement or death of a Member (generally, an employee).

The Insurer agreed under the policies to invest the premiums received in accordance with instructions from the Employer, which resulted in their investment in funds whose value fluctuated with the market value of a specified group of assets (“Pooled Funds”). The policies provided that the Pooled Funds assets were subdivided into notional fund units that were attributable to specific policies.

Amounts in respect of annual investment management fees (“IMFs”) were deducted from the unit values of Pooled Funds. The Insurer did not issue any invoices to the Employer or its Members for the IMFs.

CRA indicated that although there was an exempt supply of an insurance policy to the Employer by the Insurer, there was no indication within either Policy that the Insurer was supplying investment management services to the Employer. CRA noted that there was insufficient information to determine whether the deduction of the IMFs represented the payment of charges by the pooled funds (viewed as segregated funds that were deemed to be separate trusts by s. 131) to the Insurer (in which event such charges would be subject to GST’HST pursuant to s. 131(1)(c)(i)), or whether the IMFs were merely an element in computing the unit value of the pooled funds, so that they were not consideration for any supply.

However, under either interpretation, the Employer has not acquired investment management services under the Policies, nor paid GST/HST on the value of the consideration for such services, so that no input tax credits were available to it.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 131 - Subsection 131(1) - Paragraph 131(1)(c) - Subparagraph 131(1)(c)(i) | s. 131(1)(c) could deem management fees of insurer to segregated funds to be taxable consideration | 361 |

May 2019 CPA Alberta CRA Roundtable, GST Session – Q.8

Can input tax credits be claimed by a builder where invoices are issued subsequent to the date of self assessment on substantial completion and first occupancy of a multiple unit residential complex (a “MURC”), e.g., for (i) work done by suppliers for goods and services sold/installed performed prior to the first tenant move-in or (ii) additional construction work required after that time to correct previously-undetected flaws?

In finding that ITCs generally were available for the first, but not the second, type of invoice, CRA stated:

Under section 133, a supply of property or a service is generally considered to be made at the time that the agreement to provide the property or service is entered into. Therefore, where a builder of a MURC agrees to acquire property or a service for consumption or use in constructing the MURC, the supply of the property or service is generally considered to be made to the builder at the time that the agreement is entered into (that is, the builder is considered to be the recipient of the supply at that time). ...

Conversely, where a registrant that is a builder of a MURC has accounted for a self-supply of the MURC under subsection 191(3) and has begun to use the MURC exclusively in making exempt supplies (generally, long-term residential rentals), and the registrant acquires property or a service for consumption or use in repairing the MURC (for example, in correcting flaws or deficiencies in construction) after the time of the self-supply, the registrant is not generally eligible to claim an ITC in respect of the property or service. The eligibility for ITCs in respect of property or services acquired for consumption or use in constructing or repairing a MURC … is not specifically determined based on whether the cost of the property or services is reflected in the FMV of the MURC that is used for a self-supply under subsection 191(3).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 133 | s. 133 determines time of acquisition for ITC purposes | 209 |

| Tax Topics - Excise Tax Act - Section 191 - Subsection 191(3) | supplies acquired prior to self-supply time generate ITCs even if only invoiced later | 125 |

| Tax Topics - Excise Tax Act - Section 141.01 - Subsection 141.01(2) | purpose of acquisition is assessed at time agreement is entered into | 214 |

17 May 2017 Interpretation 174642

Shortly before the occupancy of a newly constructed apartment complex (expected to be predominantly occupied by students), LP#1 purchases the building from the developer. As this taxable sale occurs before any unit is occupied, and LP#1 acquired the building for the purpose of leasing it to another partnership (LP#2) rather than an individual, LP#1 will qualify as a builder for GST/HST purposes. That “headlease” will not be exempt because more that 10% of the units will be occupied for short-term stays (under the month) during the regular academic year, and with over 90% short-term occupancy in the summer months.

Given the taxability of its supplies to LP#2 “LP#1 may also be eligible to claim ITCs in respect of the tax paid or payable on property or services acquired for consumption, use or supply in the course of making these taxable supplies of the Residence to LP#2.” In this regard, CRA stated

[A]lthough LP#2 may be making some supplies of apartment units within the Residence that may be exempt under section 6 of Part I of Schedule V to the ETA, this will not affect LP#1’s eligibility for a full ITC on the acquisition of the Residence in this circumstance.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 191 - Subsection 191(3) | headlease structure of a student residence avoided triggering self-supply rule | 483 |

| Tax Topics - Excise Tax Act - Schedules - Schedule V - Part I - Section 6.11 | headlease of MURC not exempt where used by lessee more than 10% in short-term rentals | 128 |

| Tax Topics - Excise Tax Act - Schedules - Schedule V - Part I - Section 5 | claiming of ITC generated subsequent taxable sale | 154 |

13 December 2017 Interpretation 187306

Before going on to reject the proposition that an ITA s. 16.1 election had the effect of deeming the lessee to have acquired the leased property as capital property, CRA stated:

In general, in order for property to have been acquired by a person, there must have been a sale of the property to the person. … If there is no transfer of ownership of a particular property, we do not consider a supplier to have sold, and a recipient to have purchased, the property. …

Accordingly, property leased from a lessor is generally not considered to have been acquired for income tax purposes and, as such, is not treated as capital property for purposes of the ITA or, by extension, the ETA.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 225.1 - Subsection 225.1(2) - B | s. 16.1 election does not cause a leased property to be a capital property | 310 |

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Capital Property | s. 16.1 election did not deem leased property to be capital property | 55 |

2 August 2017 Ruling 182285

The Ontario Rebate for Electricity Consumers Act, 2016 (Ontario Rebate Act), provides financial assistance to certain Ontario electricity recipients by means of an 8% reduction in the amount payable for electricity. The 8% rebate amount is shown as a separate line item that reduces the total amount payable for electricity after the HST has been calculated and applied. How does the rebate impact input tax credits and recaptured ITCs?

After ruling that the rebate “has no impact on claiming ITCs recapturing ITCs,” CRA stated:

The rebate amount is not a reduction in the consideration charged by the supplier for the supply of electricity. The supplier retains the full amount of the consideration charged in respect of the supply. The 13% HST is still payable on the invoice amount, and as such is required to be remitted by the supplier.

Therefore, where a person is eligible to claim an ITC in respect of the HST paid or payable, to the extent that the electricity is acquired in the course of the person’s commercial activities, the person may claim the full amount of tax charged. Furthermore, where a person is required to recapture ITCs, the amount subject to recapture is the provincial portion of the tax charged.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Consideration | Ontario electricity rebate does not reduce the consideration for the supply | 75 |

28 April 2017 Interpretation 154249

An ATM provider (the Vendor) agreed that X’s acquisition of the Vendor's ATMs would be financed by Vendor selling the ATMs to Lessor, with Lessor then leasing the ATMs to X. Lessor was not licensed the related software by Vendor but nonetheless agreed to pay the software licence fees of the Vendor. CRA stated:

In determining who the recipient of a supply is, and who may therefore be entitled to an ITC for any tax payable on the supply, it is necessary to determine whether the supply is acquired by a person on its own behalf or as an agent on behalf of another person. The [recipient] definition refers to ‘consideration for the supply’. However, in the present case, the [Lessor] has not acquired any supply of software licences, and is therefore not entitled to claim any ITC for the tax paid for them.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Recipient | failure of person contractually liable to pay software licence fees to acquire a licence indicated it was an agent rather than recipient | 355 |

10 February 2017 GST/HST Ruling 162056 - Application of the GST/HST to an investment transaction

A Canadian registrant (Investor) enters into an agreement with a Canadian corporation (Corporation 1) under which it pays lump sums in consideration for the right to receive monthly royalties calculated as a percentage of intellectual property (IP) related revenue streams of Corporation 1. CRA ruled that the lump sums so paid are consideration for the taxable supply to Investor of intangible personal property (the right to the royalty payments).

However, when Corporation 1 makes the subsequent Royalty Payments to Investor pursuant to the right that Investor has acquired, Investor is not considered to be making a taxable supply in exchange for those payments. Since Investor is not making supplies under the agreement, it would not be entitled to claim ITCs for GST/HST paid or payable on related inputs.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Debt Security | royalty agreement is not a debt security unless a minimum royalty is specified | 267 |

| Tax Topics - Excise Tax Act - Section 182 - Subsection 182(1) | buyout of royalty agreement not subject to s. 182 | 185 |

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Commercial Activity | receipt of royalty not considertion for a taxable supply | 121 |

14 October 2016 Interpretation 170549

ACo and BCo, which were co-tenants of a property in construction held through a Nominee, signed an agency agreement in which Nominee was designated as the agent of ACo and BCo and which provided that the Nominee was the authorized agent and representative of ACo and BCo including for the claiming of input tax credits – and the Nominee made such claims prior to the end of the period of administrative tolerance expressed in GST/HST Notice 284. In rejecting this approach, CRA stated: