Subsection 182(1) - Forfeiture, Extinguished Debt, Etc.

Cases

Agence du revenu du Québec v. FTI Consulting Canada Inc., 2022 QCCA 1740

The appellants (the “ARQ”) were owed approximately $13.4 million of tax by a corporation (“CQIM”) immediately before it was placed into protection under the CCAA. Over three years later, the monitor for CQIM made interim distributions including the partial payment of damages claims which generated input tax credit claims (the “ITC claims”) of approximately $7.5 million as a result of the deemed supplies occurring to CQIM pursuant to ETA s. 182 and QSTA s. 318 (the “Tax provisions”). Whether the ARQ could set off the ITC claims against the amount of tax owing to it (which clearly was a pre-CCAA filing claim) turned principally on whether the ITC claims were pre-filing claims (set-off available) or post-filing claims (set-off likely unavailable).

In summarizing an ARQ submission, Kalichman JA stated (at para. 24):

The ARQ places particular emphasis on s. 32(7) of the CCAA, which provides that parties, like the Suppliers, who suffer a loss in relation to disclaimed contracts, are considered to have provable claims. Since, according to s. 19(1)(b) of the CCAA, a provable claim is one that relates to debts or liabilities incurred before the initial order (i.e., pre-filing claims) and since CQIM’s contracts with the Suppliers were all entered into before the initial order, the judge erred in concluding that the Damage Claims were post-filing claims.

In rejecting this and other ARQ submissions and in finding that the ITC claims were post-filing claims, Kalichman JA stated (at paras. 29-30):

[I]t was only when the interim distribution was made three years after the initial CCAA filing, that payment for the supply of a taxable service was deemed to have been made and the taxes due in respect of that payment were deemed to have been collected. …

The taxable supply that triggers payment (and the duty to pay tax) was never provided because the agreement that contemplated it was disclaimed. The Tax provisions create a fiction for the purpose of collecting the tax that would have been paid at some point in the future had the agreement not been disclaimed and the services continued to be provided. While the Tax provisions are based on a fiction, their logic is sound. If payment must be deemed to have been made and taxes collected, it stands to reason that the triggering event be the payment of the damages that replace what would otherwise have been paid. … Conversely, what the ARQ proposes – that the payment be deemed to have been paid years before - would create a fiction that is entirely arbitrary.

In also finding that the Court below had not erred in declining to exercise its residual discretion to permit the ITC claims (viewed as a post-filing claim) against the tax owing, he stated (at para. 48) that this would have been “inconsistent with the remedial objectives of the CCAA, regardless of whether the focus is on restructuring the debtor’s affairs or on liquidation.”

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Other Legislation/Constitution - Federal - Companies' Creditors Arrangement Act - Section 32 - Subsection 32(7) | CCAA did not establish that deemed GST payment under ETA s. 182 arose when the underlying contract was engaged | 363 |

| Tax Topics - Statutory Interpretation - Similar Statutes/ in pari materia | CCAA not in pari materia with ETA provisions | 173 |

Automodular Corporation v. General Motors of Canada Limited, 2018 ONSC 1640

The plaintiff (“Automodular”) brought an action against General Motors of Canada Limited and General Motors Company (collectively, “GM”) following the termination of its long-term contract to supply parts to them. A few days before trial, they agreed through an exchange of emails that there would be payment by GM to Automodular of $7 million (inclusive of interest and costs, including disbursements), and that the action would be dismissed with prejudice. Subsequently, Automodular sought a declaration that there was an implied term of the settlement that the $7 million payment from GM should be grossed up by $910,000 to account for HST which Automodular was required to remit pursuant to ETA s. 182.

After distinguishing Ravelston on the basis that the amount there was essentially the payment of a pre-agreed fee, Dunphy J noted inter alia that here “the claim settled included heads of damages that are very clearly non-taxable” (e.g., interest, tort claims (inducing breach of contract) and punitive damages), and before the termination of the supply arrangement, their ordinary course of dealings included both HST-inclusive and HST-extra invoicing that disclosed the precise amount of HST billed. Before dismissing Automodular’s motion, he stated (at paras. 36-37):

It cannot be said here that the agreement lacks commercial efficacy without the implied term. It cannot be said that term the plaintiff seeks was so obvious as to “go without saying” in the eyes of an objective person. There is no commercial custom or usage in settlement agreements generally or in the settlement of supply arrangements in particular that can be appealed to here by the plaintiff.

The simple fact of the matter is that the plaintiff stipulated the sum it was prepared to accept and did not seek to allocate it in any way. It was implicitly an “all in” negotiation and the language used was strongly indicative of that common assumption.

Re Ravelston, [2006] GSTC 124, 2006 CanLII 32429 (Ont Sup Ct J)

A Canadian registrant (RCL) provided management services under a management services agreement (the "MSA") with another Canadian registrant (CanWest) for a monthly fee. RCL purported to terminate the MSA by notice given one day before it was granted protection under the CCAA, thereby purportedly becoming entitled to a "termination fee" under the terms of the MSA (of $22.5 million together with $3 million of fees over the six month notice period), and CanWest purported to cancel the MSA on the day such protection was granted. They then reached a negotiated settlement in which RCL was paid the sum of $12,750,000 (calculated as 50% of $25.5 million) upon giving a release in full satisfaction of all its claims. CRA assessed RCL on the basis that s. 182 deemed RCL to have collected 7/107 of the settlement amount as GST.

In finding that there was an implied contractual term in the Settlement Agreement that CanWest would bear any GST obligation in addition to the stipulated settlement amount, Cumming J noted that CanWest had consistently paid GST on all the monthly fees notwithstanding that the MSA was silent as to the payment of GST, and that the intent of the Settlement Agreement was for CanWest to pay 50% of its termination liability, and not the lower net amount that would be borne by CanWest (taking into account an input tax credit for the GST) if the settlement payment were interpreted in light of s. 182 as being a GST-inclusive amount . Furthermore, Cumming J had previously (at para. 32) interpreted the termination fee that allegedly was payable under the MSA as "notionally and legally part of the overall 'consideration for the supply' of services under the MSA," so that the Settlement Agreement represented an agreement "to pay 50% of the 'consideration for the supply' asserted as being payable under the MSA" (para. 28) rather than to pay an amount described in s. 182. Accordingly, the settlement amount was required to be grossed-up for GST.

See Also

British Columbia Hydro and Power Authority v. The King, 2025 TCC 61

BC Hydro, which had entered into an electricity purchase agreement (EPA) with an independent power producer for the supply of electricity at a particular project in BC, agreed with that supplier that the EPA would be amended to provide, inter alia, that in consideration for the payment by BC Hydro of the sum of $8.5 million by the date 30 days after the project became operational, BC Hydro would have the option to extend the term of the EPA by a further 16 years.

BC Hydro submitted that s. 182 applied to the $8.5 million sum as being an amount paid by it as a consequence of the modification of the EPA. In rejecting this submission, Bocock J found that the payment was consideration for the optional term extension and therefore was consideration for a "taxable supply per se" (para. 73). The documents framed the optional term extension “as a separate pursuit … separate and distinct from the electricity supply contract” (para. 93).

Since the payment was made for such taxable supply, it was not made as a consequence of any modification of the electricity supply agreement (the EPA) as required by s. 182. However, Bocock J. further indicated obiter that he would have considered the payment to have been paid otherwise than as consideration for "the supply" under the EPA, i.e., it was not consideration for the supply thereunder of electricity.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - General Concepts - Evidence | parol evidence could not be used to bifurcate a payment | 252 |

267 O'Connor Limited v. The King, 2024 TCC 161 (Informal Procedure)

In the settlement of an action against it by a third party (“Starwood”) for a failure of a property sale agreement to Starwood to close, the appellant agreed to pay $450,000 to Starwood and Starwood agreed to provide a release and to hand over all its rezoning application plans and reports (reflecting that between the signing of the purchase agreement and the scheduled closing date, it had taken over the carriage of an OMB appeal regarding the property).

MacPhee J found that the $450,000 payment was, for the most part, compensation to Starwood for expenses incurred by it as a result of the failure of its purchase to close and that although “certain intellectual property was received pursuant to the settlement agreement” he was unable “to determine what portion of the $450,000 the Appellant paid to Starwood was for the assignment of Starwood’s rights, title and interest to Starwood’s rezoning application plans and reports” (para. 30). Furthermore, s. 182(1) did not apply because the amount was paid by rather than to the supplier under the sale agreement.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 169 - Subsection 169(1) | damages paid by the vendor under a failed realty sale did not generate ITCs notwithstanding some IP transferred to it | 257 |

| Tax Topics - Excise Tax Act - Section 169 - Subsection 169(4) | failure of recipient to demonstrate that that it had the supplier’s registration number at the time of its return filing, or to have documentation of an allocation to the alleged taxable supply | 196 |

Autonum, Solutions de financement aux consommateurs inc. v. Agence du revenu du Québec, 2024 QCCQ 1195

An ARQ request to change the pleaded basis of the ARQ assessments from the QSTA equivalent of s. 168(9) to that of s. 182 was rejected in light inter alia of the auditor having affirmed “that the foundations underlying [the two sections] are conceptually different and lead to different results” (para. 49, TaxInterpretations translation).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 152 - Subsection 152(9) | ARQ request to change the sales tax provision on which its assessment was founded was rejected | 394 |

| Tax Topics - Excise Tax Act - Section 298 - Subsection 298(6.1) | request to change the basis of the ARQ assessments from s. 168(9) to s. 182 (ETA equivalents) was rejected | 314 |

BH Parkway Place Ltd. v. The Queen, 2019 TCC 7 (Informal Procedure)

Following the vacating by a tenant (“Trillium College”) of shopping-mall premises of the appellant (“BH Parkway”) in breach of the terms of the lease, a settlement agreement of an action between BH Parkway and Trillium College was reached pursuant to which Trillium College agreed to pay $260,000 to BH Parkway, of which $100,000 was received during the reporting periods under appeal. The heads of claimed damages of BH Parkway that were settled included $500,000 for the value of the goods removed by Trillium College. This sum equaled the actual value of such goods of at least $250,000, plus a penalty pursuant to s. 50 of the Commercial Tenancies Act equal to 100% of such value. The penalty was intended to penalize in the situation of “’a tenant in removing its goods from a premise to defeat a landlord’s ability to distrain them’” (para. 26).

D'Auray J found (at para. 27) that such a penalty was paid “as a consequence of the operation of a provincial statute rather than as a consequence of the breach of the lease.” Since the $250,000 penalty claimed represented 33% of the total amount claimed, on a pro rata basis, s. 182 applied only to 67% of the $100,000 received, so that BH Parkway was deemed under s. 182 to have collected only 13/113 of this lesser amount rather than of the full $100,000.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 201 | $74K SUV used for transporting goods was not subject to $30K cap | 233 |

| Tax Topics - Income Tax Act - Section 248 - Subsection 248(1) - Automobile - Paragraph (e) - Subparagraph (e)(ii) | a Mercedes SUV used in transporting goods was not an automobile | 107 |

THD Inc. v. The Queen, 2018 TCC 147

The appellant, which had a trucking business, had a contract with a customer (“McKesson”) for the delivery of pharmaceutical products to various locations. After McKesson eliminated various of the routes and forced a renegotiation of the rates, the appellant brought an action, which was settled for $727,934 (plus interest). After the potential application of s. 182 to this amount was brought to its attention by Revenu Québec, the appellant claimed GST calculated on this amount from McKesson, but McKesson refused to pay.

In finding that this amount was deemed by s. 182 to include GST, Favreau J stated (at paras. 65-67, TaxInterpretations translation):

[T]he conditions for the application of section 182 … are met in this case. There was a modification of an agreement for the making of a taxable supply in Canada to a person and an amount was paid to the registrant otherwise than as consideration for the supply. …

Unfortunately for the appellant, the rules provided under paragraph 182(1)(b) … applied irrespective whether McKesson had claimed an input tax credit respecting the damages paid.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Regulations - Input Tax Credit Information (GST/HST) Regulations - Section 3 - Paragraph 3(b) - Subparagraph 3(b)(i) | requirement to obtain required information at time of ITC claim | 200 |

MEO — Serviços de Comunicações e Multimédia SA v. Autoridade Tributária e Aduaneira (2018), ECLI:EU:C:2018:942 (ECJ (5th Chamber))

Subscribers to the services of a Portuguese telecommunications company (“MEO”) agreed to pay for a minimum subscription period, and when they discontinued service before the end of that guaranteed period they were required under the terms of their contracts to pay a lump sum equal to their monthly subscription fee multiplied by the number of remaining months in the guaranteed period. The ECJ found that this lump sum was taxable “consideration” received by MEO for its services on ordinary principles, stating (para. 45):

[I]t must be held that the consideration for the amount paid by the customer to MEO is constituted by the customer’s right to benefit from the fulfilment, by MEO, of the obligations under the services contract, even if the customer does not wish to avail himself or cannot avail himself of that right for a reason attributable to him.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Consideration | payments pursuant to contract for remaining minimum service term were consideration | 463 |

Simon Fraser University v. The Queen, [2013] GSTC 57, 2013 TCC 121 (Informal Procedure)

The appellant, a university, maintained parking spaces around campus and imposed parking fines pursuant to special statutory authority. The signs setting out the parking rates did not describe the fines other than to say "vehicles not displaying valid receipts are subject to ticketing." The Minister argued that the fines were consideration for a taxable supply (being the provision of parking services) and therefore were subject to GST or, in the alternative, that they were subject to GST under s. 182 on the basis of a breach of contract for those parking services.

C Miller J granted the university's appeal. The fines were pure fines rather than consideration for parking services. They were imposed pursuant to the university's mandate to conduct university business rather than a profit motive, and the obligation to pay was based on the university's statutory powers rather than contract. These two factors distinguished the present case from Imperial Parking. C Miller J stated (at para. 26):

I have found that the contractual terms of the contract between a non‑paying driver and Simon Fraser University do not provide for consideration for a parking spot, but an agreement by the non-paying driver to run the risk of having to pay a fine. There is not an intention to breach an agreement to pay for the taxable supply of parking; the agreement is not to pay consideration for the supply of the parking spot: the agreement is basically, if I get caught I pay a fine. I agree that seems a somewhat, dare I say it, "fine" distinction, but it does recognize the fine, in this case, is indeed just that, a fine, pure and simple, and if there is no term in the agreement for the taxable supply to a non-paying driver other than to be subjected to a fine, there is no breach that would invoke section 182 of the ETA.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 165 - Subsection 165(1) | 198 |

Surrey City Centre Mall Ltd. v. The Queen, 2012 TCC 346

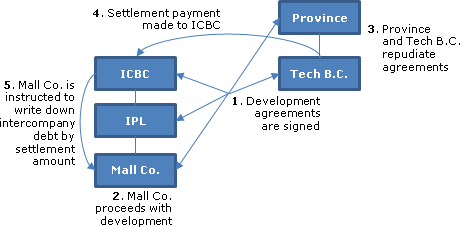

The appellant ("Mall Co"), its parent ("IPL"), which was the master real estate subsidiary of The Insurance Corporation of British Columbia ("ICBC"), and ICBC itself, entered into a complex of agreements (including an agreement to enter into a lease with a formula rent) with a start-up university ("Tech BC") and the Province of B.C., which contemplated that Mall Co would be funded by ICBC (through IPL) in order to construct facilities, including facilities that would be occupied by Tech BC and rented to it. Approximately half way through construction, the Province decided that there would not be a new university, the agreements were terminated, and (after negotiations) a settlement agreement was entered into among the five parties in which Tech BC agreed on behalf of itself and the Province to pay $41.1M to ICBC in consideration for ICBC, IPL and Mall Co releasing Tech BC and the Province from all obligations under the project agreements. The settlement agreement did not address GST, and CRA assessed Mall Co on the basis that Mall Co had failed to remit GST of $2.4M which it was deemed by s. 182 to have received as part of the settlement payment.

Hershfield J found that ICBC received the settlement payment on its own account (as was in fact recognized in the settlement agreement) rather than on behalf of Mall Co in light inter alia of its own entitlements under the project agreements, including the right to require Tech BC to enter into the lease, and the fact that it had funded a substantial investment in IPL in connection with the project work for which it was being compensated.

Although the above analysis by itself would indicate that Mall Co did not receive a payment as a consequence of the project agreement terminations, upon receipt of the settlement amount, ICBC instructed IPL and Mall Co to write down an equivalent amount of intercompany debt owing to their respective parents. Hershfield J referred (at para. 91) to this being from the perspective of Mall Co a "quid pro quo from ICBC to forego its entitlement against Tech BC." Accordingly, there was a sufficient "causal link" to conclude that the debt of Mall Co had been reduced as a consequence of the termination of the project agreements so that, subject to the final finding below, the assessment of Mall Co was correct.

However, the settlement payment was not subject to GST, on the basis that the primary obligor (the Province) was exempt under s. 125 of the Constitution Act. Furthermore (viewing Tech BC as the deemed recipient), Tech BC was stated in its governing Act to "not be liable to taxation except to the extent the government is liable," which effectively was "the voice of the province claiming immunity for Tech BC" (para. 112). Hershfield J also noted (at para. 112) that although there was no documentary evidence of the type stipulated by CRA of the exempt character of the deemed supply, "any failure to comply with such evidentiary requirements cannot deny a province that [exemption] right where in fact it, a province, has been found by this Court to be the recipient of the supply in respect of the payment."

Mall Co's appeal was allowed.

Société en commandite Sigma-Lamaque v. The Queen, 2010 TCC 415

The appellant (“SL”) leased construction equipment (worth approximately $9 million) from Caterpillar for five years and provided Caterpillar with a $425,000 letter of credit as security. After default by SL, Caterpillar, proceeded to cash the letter of credit and seize the equipment, which it sold for $7.5 million (plus taxes) to a third party (Acton). SL, as recipient, attempted to claim an ITC on for the GST paid to Caterpillar by Acton, on the basis that s. 182 does not require that the recipient must pay the amount to the supplier, only that the supplier must have received an amount “as a consequence of” the breach of contract.

In rejecting this submission, Lamarre J stated (at para. 81):

In view of the wording of the Act, I do not think that this part of section 182 of the ETA can be said to apply to Acton’s payment. Indeed, according to the Act, it is true that anyone can pay the registrant (in this case, Caterpillar), but on the condition that this payment is not made as consideration for the supply (the units, in the case before us). By using the units seized by Caterpillar, Acton paid Caterpillar the asking price for disposing of these units. Although it was in consequence of the breach of the lease that Caterpillar seized the units in question, Acton required these units in a completely independent context, not in itself related to the breach of the lease. Acton paid Caterpillar in consideration for the units it acquired as part of its business operations.

Mi Sask Industries Ltd. v. The Queen, 2007 TCC 73 (Informal Procedure)

Under a contract of Mi Sask with the City of Medicine Hat for the construction of pipeline river crossings, the City was required to maintain construction insurance, which it failed to do. During the construction, ice jams damaged Mi Sask’s construction site and, as there was no insurance coverage, Mi Sask reached a settlement with the City under which it was paid $200,000.

Beaubier J held (at paras. 10-11):

The result is that the payment to the appellant of the $200,000 in question was a payment for breach of the contract which arose when the City did not insure with a third party pursuant to subparagraph 11.2(c).

Thus, the $200,000 falls within the provisions of subsection 182(1).

Extendicare International Inc. v. Minister of Revenue, 2000 CanLII 5653 (Ont CA)

The appellant, which had been leasing computer equipment, notified the lessor that it would no longer be making the agreed monthly payments nor using the equipment. Following negotiations, the lessor agreed to release the appellant from any further obligation to make monthly lease payments upon payment of a fixed amount of compensation. At issue was whether such payments were subject to Ontario retail sales tax, which turned on whether such payments were for the consumption or use of the equipment.

In finding that no retail sales tax was applicable, Macpherson J.A. stated (at para. 57):

The appellant defaulted under the lease. After the appellant breached and repudiated the lease, C Ltd. could have terminated it immediately and repossessed the leased computer equipment. In addition, or in the alternative, it could have commenced an action against the appellant for damages. The appellant and C Ltd. entered into negotiations against the backdrop of those two options, not against a backdrop of the continuation of the operation of the lease. The compensation payments constituted settlement payments, not payments made under the lease. The effect of s. 2(1) and (6) of the Retail Sales Tax Act is that sales tax must be paid only with respect to each rental payment while the lease is still in operation. Sales tax was not payable on the compensation payments.

Low Cost Furniture Ltd. v. The Queen, [1997] GSTC 77 (TCC)

A $15,000 lump sum payment made by the registrant to its landlord in order to terminate its lease was found not to give rise to an input tax credit to the registrant in the absence of any evidence that the $15,000 sum was a GST-included amount and given that the payment gave the registrant no rights to occupy and use the premises. Section 182 was not referred to in argument.

Administrative Policy

18 April 2023 GST/HST Interpretation 245056 - Application of the GST/HST on a rescission fee

S. 42(1) of the Property Law Act (B.C.) provides that a purchaser of residential real property generally may rescind the contract of purchase and sale for the property by serving written notice of rescission on the seller within three days after the date that the acceptance of the offer was signed. S. 6 requires the rescinding purchaser to promptly pay to the seller an amount equal to 0.25% of the purchase price. CRA stated:

[S]ubsection 182(1) may apply to a rescission fee that is paid by a purchaser of residential real property to the seller in order to rescind the contract of purchase and sale for the property in specific situations – i.e., the rescission (termination) of the contract of purchase and sale of a taxable supply of real property that was made by a registrant.

The payment of a rescission fee on the termination of a contract of purchase and sale for an exempt supply of real property or a taxable supply of real property made by a non-registrant would not fall within subsection 182(1).

Where subsection 182(1) does not apply, generally a damage or penalty payment is not consideration for a supply, as it is compensatory or punitive in nature, and not given in exchange for a supply of property or services by another party. Such a payment would not be subject to GST/HST, even if the payee agrees to release the payer from further liability.

26 July 2022 GST/HST Ruling 232189 - [Amounts charged as] […] Damages

The City’s construction agreements contained a liquidated damages clause, which required the contractor to compensate the City when work is not completed within specified timelines through the payment of “Damages” at a specified per diem rate per calendar day of the delay. The Damages are paid through the City reducing its payments for amounts that are invoiced by the contractor.

CRA ruled that GST/HST did not apply to amounts of the Damages used to offset amounts otherwise payable by the City in respect of the work performed by the contractor or, after any adjudication of the amount of the Damages, to any resulting amounts returned by the City to the contractor. In this regard, CRA stated:

[T]he … Damages are compensatory; they represent compensation paid by a contractor for lost revenue that would be incurred as a result of a project’s delays and are meant to restore, to some degree, the City to the position it would be in if the project had not been delayed.

Subsection 182(1) … does not apply … [since] they are paid by the supplier (i.e., the contractor) to the City.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Supply | per diem damages received by a construction-services recipient for construction delays were free of HST | 161 |

25 March 2021 CBA Commodity Taxes Roundtable, Q.18

Aco (a resident registered corporation) agreed to make taxable supplies in Canada of tangible personal property to Bco (a resident registered partnership). A corporation resident in Canada that is a partner of Bco (Cco) agreed to guarantee the obligations of B under the contract.

If, as a result of Bco’s default on its obligations, Cco is required to pay liquidated damages to Aco, who can recover the ITC for the tax deemed paid under s. 182: Bco under s. 182; or Cco under s. 272.1(2)?

CRA responded:

Notwithstanding the actual payer, [s. 182] deems the recipient of the supply to have paid and the supplier to have collected GST/HST on that deemed consideration at the time the amount is paid.

Therefore, Aco would be deemed to have collected the GST/HST on the deemed consideration for the cancellation compensation and Bco would be deemed to have paid the GST/HST. Bco will be able to claim an ITC for the portion of GST/HST paid or payable if all the conditions in section 169 are satisfied.

10 February 2017 GST/HST Ruling 162056 - Application of the GST/HST to an investment transaction

A Canadian registrant (Investor) enters into “Agreement 1” with a Canadian corporation (Corporation 1) under which it pays lump sums in consideration for the right to receive monthly royalties calculated as a percentage of intellectual property (IP) related revenue streams of Corporation 1. Corporation 1 has the right to fully extinguish its royalty obligations under a "Buyout Option." CRA ruled that the lump sums so paid are consideration for the taxable supply to Investor of intangible personal property (the right to the royalty payments).

However, when Corporation 1 makes the subsequent Royalty Payments to Investor pursuant to the right that Investor has acquired, Investor is not considered to be making a taxable supply in exchange for those payments. Since Investor is not making supplies under Agreement 1, it would not be entitled to claim ITCs for GST/HST paid or payable on related inputs.

As the registrant making the taxable supply under Agreement 1 is Corporation 1 and the payment made pursuant to the Buyout Option is paid to Investor and not to Corporation 1, s. 182(1) will not apply when the Buyout Option is exercised.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Debt Security | royalty agreement is not a debt security unless a minimum royalty is specified | 267 |

| Tax Topics - Excise Tax Act - Section 169 - Subsection 169(1) | the purchase of an IP royalty gives rise to non-creditable GST/HST to the investor | 130 |

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Commercial Activity | receipt of royalty not considertion for a taxable supply | 121 |

7 December 2016 Ruling 158637

A registered charity which is also registered for GST/HST purposes charges employers or sponsors fees for providing training to apprentices and also charges a cancellation fee if the apprentice withdraws from training during a specified time period. After finding that the training charge was consideration for a single supply that was exempted under Sched. V, Pt, V.1, s. 1, CRA went on to state:

The [cancellation fee] is not made in respect of any supply. Rather, it is required to be made by the employer/sponsor as compensation or indemnification for damages (e.g., loss of income from the [third party] for services rendered, inconvenience). Although the ETA does provide for special rules (section 182) where there is compensation or indemnification for damages, these rules only apply when the original agreement was for a taxable supply. As these rules do not apply, and the [cancellation fee] is not consideration for a supply, no GST/HST is applicable.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Supply | contract cancellation fee not consideration for a supply | 117 |

| Tax Topics - Excise Tax Act - Schedules - Schedule V - Part V.1 - Section 1 | educational services not excluded | 25 |

| Tax Topics - Excise Tax Act - Section 232 - Subsection 232(1) | choice between supplier refund or recipient rebate | 108 |

B-109 "Application of the GST/HST to the Practice of Naturopathic Doctors" 31 July 2015

Other Charges

...A cancellation fee paid by a patient for a missed or cancelled appointment is treated as payment for the intended supply (i.e., treatment or other naturopathic service). Where the naturopathic service is taxable, the GST/HST will apply to the cancellation fee.

CBAO National Commodity Tax, Customs and Trade Section – 2014 GST/HST Questions for Revenue Canada, Q. 30.

Supplier agrees to deliver 100 widgets to the Recipient at $10 per widget, but is only able to obtain 20 widgets. An action of the Recipient is settled by Recipient agreeing to release Supplier from all damages in exchange for a payment of $100 and for the provision by the Supplier of 20 widgets at no cost. CRA agreed that s. 182 would not apply, and that (under "general taxing concepts"), as the damages payment "appears to be entirely compensatory and is not linked to a supply of property or services," it would not be subject to GST/HST, regardless of it being made partly in kind (i.e., widgets valued at $200).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Supply | settlement of right to receive full widget shipment not a taxable supply | 108 |

8 March 2012 Ruling Case No. 137942 [payment, following breach by purchaser, for assignment of purchaser's rights in purchased equipment]

Company X agrees to supply and deliver equipment to Company Y under the "Supply Agreement," with title to pass to Company Y when the stipulated payments are all received, and in the meantime invoices and is paid by Company Y as various construction milestones are reached. As a result of an event which is redacted from the ruling, Company X files a claim against Company Y "as a result of [Company Y's] failure to fulfill its obligations under the Supply Agreement."

While Company X is still in possession of the equipment, they then enter into a termination agreement in which Company Y makes a termination payment to Company X and is released of all it obligations under the Supply Agreement, and assigns to Company X all its right, title and interest in the equipment.

CRA rules "that [Company X] is not entitled to claim an ITC on the payment made to [Company Y] under the Termination Agreement," because

Subsection 182(1) does not apply to the payment made under the Termination Agreement as the payment was not paid or forfeited to a registrant as a consequence of a breach, modification or termination of an agreement for the making of a taxable supply by the registrant.

Based on the facts set out above, we rule that [Company X] is not entitled to claim an ITC on the payment made to [Company Y] under the Termination Agreement.

Policy Statement P-218R "Tax Status of Damage Payments not Within Section 182 of the Excise Tax Act", August 10, 2007.

Exclusion of certain damages

[S]ituations where one or more of the conditions in subsection 182(1) are not met ... include:

- no prior agreement for the making of a supply existed between the parties;

- the original agreement was for the making of an exempt or a zero-rated supply;

- the amount is not paid or forfeited to the person making the original supply, or used to reduce or extinguish a debt of the supplier, e.g., where the person making the payment is the supplier of the original supply;

- the original agreement was for the making of a supply by a person who was not a registrant;

- the payment is consideration for the supply under the agreement; or

- the amount is paid otherwise than as a consequence of the breach, modification or termination of the agreement for the making of a supply.

... There are situations where one person makes a payment to another person as compensation for damages and the payment is not subject to GST/HST. However, there are also situations where a payment is made in the context of a claim for damages, but the payment can be linked to the provision of a taxable supply of property or a service made by the payee in return for the payment, and for which purpose the payment is being made. This type of payment would be subject to GST/HST.

Example No. 3

- The lessee of leased equipment agrees to pay the lessor, a registrant, damages for damage to the leased equipment due to improper use.

- Result: s. 182(1) applies and the payment and 6/106 or 14/114 of the payment is deemed to be GST or HST.

Example No. 4

- The purchaser of software services agrees to release the software service supplier from its contractual obligations.

- Result: s. 182 does not apply because the payment was not made under the original agreement, and the payment is not subject to GST/HST.

Example No. 7

- An amount received by a registrant (Qco), following trade name and logo infringement by Rco and upon a court settlement, in exchange for Qco’s agreement to change its name to Zco, is not subject to s. 182(1 and is consideration for a taxable supply.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Supply | 0 |

12 August 2003 Ruling Case No. 36831 [no-show charges]

Fees for "no shows" charged by a registrant in the business of conducting independent medical examinations for use by insurance companies and lawyers would be deemed to include GST.

31 March 2000 HQ Letter 25522

A break-up fee (referred to as a "non-completion fee") paid in connection with an aborted merger of two companies did not represent consideration for a supply, nor was it governed by subsection 182(1) as the agreement to which the fee related was an agreement for the making of an exempt financial service. Accordingly, no GST was payable on the fee.

4 December 1998 Interpretation file no. 11585-1

A Canadian law firm was successfully sued for damages respecting its negligent advice on pension matters to a Canadian corporation that also was a registrant. Does s. 182(1) or s. 165(1) apply? Would the answer change if the law firm agreed to make the damage payment pursuant to a settlement agreement? CRA responded:

- Although the settlement may have been made as a consequence of the breach of an agreement for the making of a taxable supply, subsection 182(1) does not apply, because the payment at issue is made to the recipient by the supplier. ...

- Subsection 165(1) does not apply to the situation, because the damage payments are not consideration for a supply. The law firm does not receive property or a service in return for making the payments. It is merely providing compensation for the damages that the corporation has suffered. ...

- The GST/HST status of the settlement payment does not depend on whether the settlement occurs as a result of a court decision or a voluntary agreement, but on whether property or service are given in exchange for the payments.

13 March 1997 Interpretation 11735-1, 11720-1

A rented car is damaged, the car rental company pays a body shop for repairs plus GST, claims an ITC for such GST and then obtains recovery from the customer for its repaid cost excluding the GST. CRA stated:

The payment is an indemnification under the terms of the car rental agreement, of the cost incurred by the car rental company to repair the car. … If the car is not damaged during the rental period, no additional payment is required even though the taxable supply of the rental of the car has still been made by the car rental company and consumed by the renter. It would therefore not be correct to categorize any additional payment that may be required, as consideration for the taxable supply of the rental of the car because the additional payment is not always required.

21 December 1995 Ruling 940411 [tenant pays for improvements on lease termination]

An amount payable by a tenant on the termination of a lease, equal to the amortized value of leasehold improvements, would not be considered to be subject to s. 182 but, instead, would be regarded as consideration for a supply by the tenant of such improvements.