Subsection 128(1) - Closely Related Corporation

See Also

9331-0688 Québec Inc. v. The King, 2023 TCC 173 (Informal Procedure)

Jorré J found that three corporations were ineligible to make the s. 156(2) nil consideration election because they were not “closely related,” i.e., their mutual shareholder was an individual rather than a corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 156 - Subsection 156(1) - Qualifying Group | three corporations wholly-owned by an individual could not make a s. 156 election | 115 |

Administrative Policy

5 July 2012 Interpretation Case No. 119159

Incorporated societies which had the same board members and, therefore, were controlled by the same group of persons did not qualify as closely related (so that the s. 156 election was unavailable) becasue they did not have share capital.

Paragraph 128(1)(a)

Administrative Policy

GST/HST Memorandum 14-7 Closely Related Corporations June 2023

S. 128(1) rule generally does not apply where shareholder is non-corporate

25. In general, subsections 128(1) and (2) do not apply where a person other than a corporation, such as an individual, a partnership [footnote regarding exception pursuant to s. 156(1.1)] or a trust, holds the voting control and owns the shares of the corporation. For example, where an individual (other than as a result of their employment) holds qualifying voting control and owns all of the shares, having full voting rights, of the capital stock of Corporation A and Corporation B, these two corporations would not be closely related for GST/HST purposes since they are owned and controlled by an individual rather than by a corporation.

26 February 2015 CBA Roundtable, Q. 20

Does the 90% test in s. 128(1)(a) only take into consideration shares that have “full voting rights under all circumstances” in both the numerator and the denominator? For example, Corporation A holds 100% of Corporation C’s class A shares, and Corporation B holds 100% of Corporation C’s class B shares. If the class B shares do not have full voting rights under all circumstances, are Corporation A and Corporation C closely related? CRA responded:

Assuming that the class B shares have no voting rights and that there are no other issued and outstanding shares, it appears that Company A and Company C are closely related as it owns 90% or more of the value and number of the issued and outstanding shares of the capital stock of Company C having full voting rights under all circumstances. It is important to note that the explanatory notes to section 128… refer to a degree of common ownership of at least 90%. Furthermore, the determination of “closely related” is relevant for purposes of the elections under sections 150 and 156… . The explanatory notes to these provisions refer to wholly-owned corporations. Any application of the provisions of section 128… to a particular fact situation should be consistent with the policy intent of the provision.

11 October 2017 Interpretation 181628

A parent corporation (Corporation A) wholly owns three subsidiaries (Corporations B, D, and G) that in turn wholly own qualifying subsidiaries (Corporations C, E and H, respectively). Two of the subsidiaries (Corporations C and E) collectively (50% each) wholly own another corporation (Corporation F). Is Corporation F is closely related to Corporation A under s. 128(1)(a)(v) or 128(2); and is Corporation F closely related to Corporations G and H?

After noting that Corporations A, B, C, D, E, G and H would be closely related to each other under ss. 128(1)(a)(i) to 128(1)(a)(iv) where the voting rights requirements in s. 128(1.1) were met, CRA stated:

[W]here all such conditions are met, Corporation F would be closely related to Corporation A under subparagraph 128(1)(a)(v) as Corporation F is owned by a combination of qualifying subsidiaries referred to in subparagraph 128(1)(a)(ii); that is, a combination of qualifying subsidiaries (namely Corporation C and Corporation E) of the particular corporation (Corporation A).

Further, where the conditions relating to qualifying voting control and required share ownership are met, Corporation G (the particular corporation) would be closely related to Corporation F under subparagraph 128(1)(a)(v) as Corporation F is owned by a combination of qualifying subsidiaries referred to in subparagraph 128(1)(a)(iv); that is, a combination of qualifying subsidiaries (namely Corporation C and Corporation E) of a corporation (Corporation A) of which the particular corporation (Corporation G) is a qualifying subsidiary.

Corporation H (the particular corporation) would be closely related to Corporation F based on the same analysis.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Qualifying Subsidiary | great-grandchild held on a 50-50 basis | 35 |

26 February 2015 CBA Roundtable, Q. 20

Does the 90% test in s. 128(1)(a) only take into consideration shares that have “full voting rights under all circumstances” in both the numerator and the denominator? For example, Corporation A holds 100% of Corporation C’s class A shares, and Corporation B holds 100% of Corporation C’s class B shares. If the class B shares do not have full voting rights under all circumstances, are Corporation A and Corporation C closely related? CRA responded:

Assuming that the class B shares have no voting rights and that there are no other issued and outstanding shares, it appears that Company A and Company C are closely related as it owns 90% or more of the value and number of the issued and outstanding shares of the capital stock of Company C having full voting rights under all circumstances. It is important to note that the explanatory notes to section 128… refer to a degree of common ownership of at least 90%. Furthermore, the determination of “closely related” is relevant for purposes of the elections under sections 150 and 156… . The explanatory notes to these provisions refer to wholly-owned corporations. Any application of the provisions of section 128… to a particular fact situation should be consistent with the policy intent of the provision.

Subparagraph 128(1)(a)(i)

Administrative Policy

18 November 2021 GST/HST Interpretation 232687 - Application of the election under section 150 of the Excise Tax Act to a closely related group

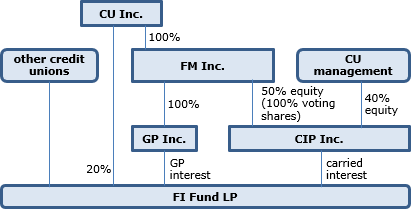

A credit union (“CU Inc.”) has a 20% ownership interest in a limited partnership fund (“FI Fund LP”), with the balance held by other credit unions, except that “GP Inc.” and “CIP Inc.” hold a GP interest and carried interest, respectively, and receive management and carried interest fees, respectively, from FI Fund LP. A wholly-owned subsidiary of CU Inc., “FM Inc.” (which receives management fees from GP Inc. and CIP Inc.) wholly-owns GP Inc. and has a 50% equity interest (with 100% of the voting shares) of by CIP Inc. 40% of the CIP Inc. equity is owned by the senior management team of FM Inc., who acquired those shares in respect of their employment with CU Inc. CU Inc. provides management services to FM Inc.

Which of the above persons are eligible to make the s. 150 election?

CRA indicated that to the extent CU Inc. (and FM Inc.) had qualifying voting control (as defined in s. 128(1.1) in respect of FM Inc. (and GP Inc.), and CU Inc. (and FM Inc.) held all of the value and number of the issued and outstanding shares, having full voting rights under all circumstances, of FM Inc. (and GP Inc.), CU Inc. and FM Inc. ((and FM Inc. and GP Inc.) would be closely related to each other under s. 128(1)(a)(i). On this basis, GP Inc. would be a qualifying subsidiary of CU Inc. as was a qualifying subsidiary of FM Inc., which was a qualifying subsidiary of CU Inc. Therefore, CU Inc. and GP Inc. would be closely related to each other under s. 128(1)(a)(ii).

In the case of CIP Inc., if the only voting shares were held by FM Inc., CIP Inc. would be a qualifying subsidiary of FM Inc. and of CU Inc, so that CU Inc., FM Inc., and CIP Inc. would all be closely related under ss. 128(1)(a)(i) and (ii). CIP Inc. would also be closely related to GP Inc. under subparagraph 128(1)(a)(iii), as they would both be qualifying subsidiaries of FM Inc., and under s. 128(2).

CRA further noted that even if FM Inc. held as few as 50% of the voting shares of CIP Inc. but at least 90% of the total value and number of the issued and outstanding shares of CIP Inc., having full voting rights under all circumstances, were owned by FM Inc. and the CU Inc. employees collectively, FM Inc. (and, thus, CU Inc.) and CIP Inc. would be closely related pursuant to s. 128(1)(b) and s. 3(a of the Closely Related Corporations (GST) Regulations.

Respecting FI Fund LP, CRA indicated:

[T]he definition of a closely related group is restricted to a group of corporations. As a partnership, FI Fund LP cannot be a member of a closely related group for the purposes of the election under section 150.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Regulations - Closely Related Corporations (GST) Regulations - Section 3 - Paragraph 3(a) | s. 3(a) can accommodate minority employee incentive shares | 218 |

| Tax Topics - Excise Tax Act - Section 150 - Subsection 150(6) | credit union need not file the s. 150 election | 41 |

Subsection 128(1.1)

Administrative Policy

GST/HST Memorandum 14-7 Closely Related Corporations June 2023

Recap of s. 128(1.1)

29. In other words, in order for a person (or a group of persons) to be considered to hold qualifying voting control of a corporation, 90% or more of shareholder votes in respect of all corporate matters must be held and controlled by the person (or by the group of persons) with limited exceptions. Only where a particular person (or a particular group of persons) has a high degree of both ownership and control of the corporation will the person (or the group of persons) and the corporation be considered to be closely related for GST/HST purposes.

Paragraph 128(1.1)(a)

Subparagraph 128(1.1)(a)(i)

Administrative Policy

GST/HST Notice No. 303 - Changes to the Closely-related Test

Exception for special voting matters provided by statute, or where a statute provides a special class vote

Thus, in order for a person (or group of persons) to be considered to hold qualifying voting control of another corporation, 90% or more of shareholder votes in respect of all corporate matters must be held and controlled by the person, with limited exceptions. Where there are any matters in respect of which a statute of a country, state, province, or other political subdivision of a country, that applies to the corporation provides that the votes of the shareholders of the corporation in respect of the matter are different from the voting rights that the shareholders would otherwise have pursuant to the corporation’s constating documents, then that matter is not considered for the purposes of determining whether a particular person holds qualifying voting control in respect of the corporation.

CBCA examples

For example, subsection 183(3) of the Canada Business Corporations Act provides that “each share of an amalgamating corporation carries the right to vote in respect of an amalgamation agreement whether or not it otherwise carries the right to vote.” Therefore, the distribution of voting rights in respect of the shareholders vote on an amalgamation agreement is not considered when determining whether a person holds qualifying voting control of a corporation. …

[T]he matters listed in subsection 176(1) of the Canada Business Corporations Act entitling the holders of shares of a class or series to vote separately as a class or series are not considered for purposes of determining whether a person holds qualifying voting control of the corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 156 - Subsection 156(1.1) - Paragraph 156(1.1)(b) | examples of CBCA exceptions | 108 |

| Tax Topics - Excise Tax Act - Section 150 - Subsection 150(2) - Paragraph 150(2)(b.1) | example of substantially all test not satisfied | 174 |

Clause 128.1(1.1)(a)(i)(B)

Administrative Policy

GST/HST Memorandum 14-7 Closely Related Corporations June 2023

Separate class vote accorded by CBCA not taken into account

31. [C]ertain matters listed in subsection 176(1) of the Canada Business Corporations Act entitling the holders of shares of a class or series to vote separately as a class or series are not considered for purposes of determining whether a person holds qualifying voting control of the corporation.

Subsection 128(2)

Administrative Policy

GST/HST Memorandum 14-7 Closely Related Corporations June 2023

Example 10

- A and B (a qualifying subsidiary of A) each hold 50% of the full voting rights and 50% of the ownership for the shares of C, so that A and C are closely related under s. 128(1)(a)(v).

- C and D are closely related under s. 128(1)(a)(i) because C owns 90% of the shares, and has qualifying voting control (as described in s. 128(1.1)) of D.

- Consequently, A and D are closely related under s. 128(2).

19 June 2015 Interpretation 167422

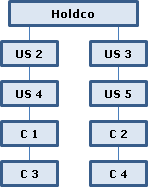

Holdco, a non-resident corporation, holds two stacks of wholly-owned Canadian and US corporations: US 2 holding US4, holding C 1, holding C 3; and US 3 holding US 5, holding C 2, holding C 4. Which of the Canadian corporations are closely related? CRA responded:

…Hold Co., US2, US4 and C1 are closely related…under either subparagraph 128(1)(a)(i) or (ii) and the same can be determined on the right side… . C1 and C2 are closely related under subsection 128(2) as both are closely related under subsection 128(1) to common parent Hold Co.

…C1 and C2 are closely related to Hold Co. under subparagraph 128(1)(a)(ii) since 100% of the required shares of each (i.e., C1 and C2) are owned by a qualifying subsidiary…of Hold Co.

C1 and C4 are closely related under subsection 128(2) since, based on the definition of qualifying subsidiary in subsection 123(1) and subsection 128(1), both are closely related to common corporation US3… . C1 is closely related to US3 under subparagraph 128(1)(a)(iv) as 100% of the required shares of C1 are owned by (a qualifying subsidiary of) a qualifying subsidiary of Hold Co. of which US3 is a qualifying subsidiary. C4 is closely related to US3, based on the same definition and subparagraph 128(1)(a)(ii), since 100% of the required shares of C4 are owned by (a qualifying subsidiary of) a qualifying subsidiary of US3.

A similar analysis on the opposite side of the ownership structure establishes that C2 and C3 are closely related under subsection 128(2)… .

However C3 and C4 are not closely related to each other since they are both closely related to common parent Hold Co. under subsection 128(2) rather than under subsection 128(1).

[Therefore] the following entities are closely related and eligible to make an election under section 156:

- C1 with C2

- C1 with C4

- C2 with C3

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 156 - Subsection 156(1) - Qualifying Group | limitations on stacking | 56 |

Subsection 128(4)

Administrative Policy

GST/HST Memorandum 14-7 Closely Related Corporations June 2023

Example 4

- A and B each owns 50% of the shares of C, which wholly-owns D, but all of the voting rights attached to the shares of D are held by A.

Results

- Since A and B are not closely-related, C is not a qualifying subsidiary of either.

- Since C is not closely related to A, C is not deemed to own the shares of D for s. 128 purposes, and C and D are not closely related.

7 October 2020 APFF Roundtable Q. 14, 2020-0852261C6 F - Section 128 E.T.A.

In 18 March 2019 Interpretation 186839, all the shareholders of a corporation (the “Corporation”) entered into a unanimous shareholders agreement (USA) that stripped away all the management powers of the board of the Corporation, with all those powers instead exercised by majority vote of the shareholders. CRA accepted that included in the powers taken away from the Corporation’s board under the USA was the right to exercise the voting rights attached to the shares of the wholly-owned subsidiaries of the Corporation.

In CRA’s view, this then engaged ETA s. 128(4), which provides that for qualifying voting control purposes, a person is not considered to own shares if another person (other than a closely-related person) has voting rights over those shares described in similar terms to ITA s. 251(5)((b)(i), e.g., a “right under a contract … to control the voting rights attached to the share.” Since the corporation (which was not closely related to any of its shareholders) thus was deemed not to have voting control of its subsidiaries, they were not closely related to it.

CRA was now asked to consider the effect a variation of the above structure under which the USA, as before, removed all powers of the directors of the Corporation with respect to the management of the business and affairs of the Corporation in favour of its Shareholders, but did not remove the power of the directors of the Subsidiaries with respect to the management of their business and affairs, so that the Shareholders will act as if they were the directors of the Corporation only and the decisions of the Corporation will therefore be approved by a majority of the votes of Shareholders holding voting shares. Those decisions include the exercise of the voting rights attached to the shares held by the Corporation in its Subsidiaries for the purpose of, inter alia, appointing the directors of the Subsidiaries.

In finding that this variation would not make a difference, CRA stated:

Since the voting rights attached to the shares of the Subsidiaries held by the Corporation are subject to the control of the Shareholders of the Corporation, the Shareholders of the Corporation retain control of those voting rights, and it would appear that ETA subsection 128(4) would apply to deem that the Corporation does not hold the shares of the Subsidiaries. Consequently, the Corporation would not have qualifying voting control over the Subsidiaries, as defined in ETA subsection 128(1.1), and the Corporation and its Subsidiaries would not be considered closely related for GST/HST purposes.

18 March 2019 GST/HST Interpretation 186839 - Personnes morales étroitement liées

The Shareholders (who are not closely-related to each other) of the Corporation have entered into a unanimous shareholders agreement with the Corporation pursuant to the Quebec Business Corporations Act that took away the management powers of the directors of the Corporation and of each of the wholly-owned subsidiaries (the “Subsidiaries”) of the Corporation, with the Shareholders deciding such matters by majority vote. In finding that the Subsidiaries were not closely related to the Corporation, CRA first reviewed ss. 128(1)(a), 128(1.1) and 128(4), and then stated (TaxInterpretations translation):

The Unanimous Shareholders Agreement did not only limit the powers of the board of directors of the Corporation to manage the business and affairs of the Corporation, but also applied to the voting rights of the Corporation attached to the shares of the Subsidiaries belonging to the Corporation. Furthermore, the voting rights of the shareholders attached to the shares of the Subsidiaries of the Corporation were under the control of the Shareholders.

Pursuant to subsection 128(4), the Corporation was deemed not to own the shares of the Subsidiaries as the voting rights attached to those shares were subject to the control of another person who was not closely related to the Corporation, namely, the Shareholders. Consequently, the requirements for qualifying voting control were not satisfied regarding the Corporation and the Subsidiaries. As a result, the Corporation and the Subsidiaries are not considered to be closely related … .

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Income Tax Act - Section 251 - Subsection 251(5) - Paragraph 251(5)(b) - Subparagraph 251(5)(b)(i) | a USA stripped away voting control of a parent over its wholly-owned subs | 173 |