Subsection 156(1) - Definitions

Qualifying Group

See Also

9331-0688 Québec Inc. v. The King, 2023 TCC 173 (Informal Procedure)

In finding that three corporations which had the same individual as their sole shareholder did not qualify as specified members of a qualifying group, so that they were ineligible to make the joint election pursuant to s. 156(2), Jorré J noted that, in the case of corporations, the “qualifying group” definition referred to ”a group of corporations, each member of which is closely related … [per s. 128] to each other member of the group,” and then stated (at paras. 17-18, TaxInterpretations translation):

In accordance with section 128, only corporations controlled by a corporation may be closely related.

The owner of the [three corporations] is an individual and not a corporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 128 - Subsection 128(1) | controlling shareholder of a corporate closely-related group must itself be a corporation | 35 |

Administrative Policy

12 February 2018 interpretation 167422R

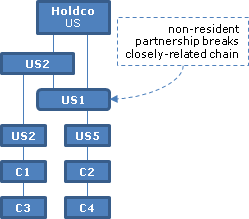

In the original version of this Interpretation (see 167422), CRA found that, in the structure depicted immediately below (involving a non-resident parent (Hold Co) holding two chains of subsidiaries with US corporations above Canadian corporations, C3 was not closely related to C4.

CRA in this revised interpretation concluded that, in fact, C3 and C4 were closely related. Given that a qualifying subsidiary of a qualifying subsidiary of the particular corporation is also a qualifying subsidiary of the particular corporation, C3 (applying this rule iteratively) is considered to be a qualifying subsidiary of Hold Co, as is C4. CRA then stated:

It follows that C3 and C4 are closely related under subparagraph 128(1)(a)(iv) since qualifying voting control of C4 is held by, and the required shares of C4 are owned by, a qualifying subsidiary (that is, C2) of a corporation (that is, Hold Co.) of which C3 is a qualifying subsidiary. Since C3 and C4 are closely related to each other they are members of the same qualifying group (consisting of C3 and C4). The same analysis may be used for C1 with C2, C2 with C3 and C1 with C4. Since it has been demonstrated that C1, C2, C3 and C4 are a group of corporations, each member of which is closely related under section 128 to each other, they are members of the same single qualifying group.

CRA also stated:

Although corporations that are non-residents may be closely related to one another or to corporations that are resident in Canada, only those corporations that are both resident in Canada and registrants may be party to an election under section 156.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 123 - Subsection 123(1) - Qualifying Subsidiary | qualifying subsidiary definition can be applied iteratively | 63 |

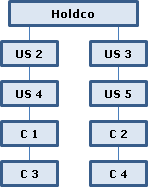

19 June 2015 Interpretation 167422

In a wholly-owned group, there are two stacks of four corporations beneath a common Holdco. The two bottom (Canadian) corporations will not be able to elect with each other as they are two remote from the Holdco to be closely related to each other under s. 128(2). See summary under s. 128(2).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 128 - Subsection 128(2) | limitations on stacking | 328 |

4 February 2014 Interpretation 159039

Holdco and its wholly-owned sub (US2) are the two partners of US1. US2 and US1 wholly-own US4 and US5, respectively, which in turn wholly-own C1 and C2, respectively, which wholly own C3 and C4 respectively. C1 to C4 are Canadian resident and the other entities are U.S.-resident. In finding that C1 or C2 would not be eligible to make the s. 156 election with C2 or C4, CRA stated:

It can be established that corporations consisting of Hold Co, US2, US3, US5, C2 and C4 are closely related under section 128 and members of the same qualifying group. However, neither C1 nor C3 are closely related to members of that group under section 128 and, therefore, are not part of the same qualifying group as US1 intervenes in the ownership structure.

GST/HST Memorandum 14-5, Election to Deem Supplies to be Made for Nil Consideration, June 2023

Example 1

Where OpCo (a registrant substantially all of whose preoperty was acquired for use or supply exclusively in commercial activities) establishes NewCo, which performs activities in connection with the establishment of the commercial activity which it plans to carry out "and therefore becomes a registrant." The s. 156 election is available for a transfer of electronic equipment from OpCo to NewCo.

Various charted examples are given of closely related Canadian partnerships (Examples 2 to 5) and closely related Canadian partnerships and corporations (Examples 7 to 9).

Example 10

In the structure below, U and V are closely related to each other because they both are closely related to T:

Example 11

Notes that the s. 156 election does not apply to butterflied real estate (s. 156(2.1)(a).

30. The election has no effect on the ability of the electing specified members to claim ...ITCs...in accordance with the general rules found in sections 169 and 141.01. In this regard, subsection 141.01(7) ensures that any provision deeming a supply to be made for no consideration does not apply for the purposes of determining the extent to which inputs used in making the supply are acquired, imported, used or consumed by the person for the purpose of making taxable supplies for consideration in the course of an endeavour of the person.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 175.1 | 168 | |

| Tax Topics - Excise Tax Act - Section 272 | 182 |

Guide for Providers of Financial Services under "Special Provisions" - "Election for Nil Consideration for Closely Related Corporations"

General discussion.

Qualifying Member

Administrative Policy

27 February 2020 CBA Roundtable, Q.5

In CIBC World Markets, the Federal Court of Appeal found that a non-resident permanent establishment of CIBC had deemed separate person status sufficient to enjoy zero-rating on services supplied to it by CIBC World Markets, notwithstanding an ETA s. 150 election between the two Canadian affiliates. When asked as to whether it considered this decision to be portable to the situation where a non-resident person with a branch in Canada wishes that branch to be treated as resident in Canada for purposes of the ETA s. 156 election (presumably to be made with a Canadian corporate affiliate), CRA responded that it was considering the decision’s “impact on section 132,” but that:

Subsection 132(2) deems a non-resident person with a permanent establishment in Canada to be resident in Canada “in respect of, but only in respect of activities of the person carried on through that establishment”. Based on the clear legislative wording, it has been the CRA’s position that subsection 132(2) does not deem a non-resident person as a whole to be resident in Canada for purposes of the Part IX of the ETA. It has therefore been the CRA’s view that the non-resident person in your scenario would not be eligible to make the section 156 election.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 132 - Subsection 132(2) | s. 132(2) does not deem a non-resident person to be a resident | 159 |

26 February 2015 CBA Roundtable, Q.21

CRA indicated that s. 186(1) applied “only for the purpose of ITC calculations” and does not have the effect of deeming the holding company to be engaged in commercial activity – so that it would generally not qualify for the purposes of making a s. 156 election with a subsidiary so as to avoid having to charge GST on management fees.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 186 - Subsection 186(1) | s. 186(1) does not help a parent to qualify for a s.156 election | 147 |

26 February 2015 CBA Roundtable, Q.22

Black’s Law Dictionary (9th ed.) defines "nominal" as "trifling, especially as compared to what would be expected (lamp sold for a nominal price of ten cents)." How does CRA intend to interpret "nominal" in para. (c) of “qualifying member”? CRA responded:

Whether property is considered to be of nominal value for purposes of the definition of “qualifying member” in paragraph 156(1)(c)...will be determined on a case by case basis. Generally, this determination will be made with reference to the value of the property and its significance relative to the commercial activity in question.

24 April 2015 Interpretation 166609

In interpreting "property having a nominal value" in para. (c) of "qualifying member," should the value of the property be compared with the value of all the properties that the person acquires (or intends to acquire) so that, for example, a $100,000 item of equipment could have a nominal value for a large manufacturing business that requires $500M of equipment to operate? Also, how is the requirement that the registrant will be making taxable supplies throughout the next 12 months be applied?

Generally, this determination will be made with reference to the value of the property and its significance, relative to the commercial activity in question. For example, whether a $300 computer is of nominal value would depend on its relative value to the commercial activities for which it is acquired. Assuming that a subsequent acquisition of $1 billion in assets is for consumption, use or supply exclusively in the commercial activities of the registrant, it would appear that the computer would be of nominal value. …

The CRA would generally review available documentation such as business plans or input tax credit claims and activities undertaken by the registrant to make taxable supplies such as research and marketing that support the expectation that the registrant will be making taxable supplies throughout the twelve months and that property acquired by the registrant within the twelve months is for use exclusively in its commercial activities.

Where a registrant meeting the conditions of subparagraph (c)(iii)… makes an election and subsequently acquires certain property for consumption, use or supply exclusively in its commercial activities, the registrant may now meet the conditions of subparagraph (c)(i).

14 January 2015 Interpretation 165076

In commenting on the "it is reasonable to expect" test in (c)(iii), CRA stated:

The CRA would generally review available documentation such as business plans or input tax credit claims and the activities undertaken by the registrant to make taxable supplies, such as research and marketing that support the expectation that the registrant will be making taxable supplies throughout the twelve months.

Whether an election made under those circumstances would remain in effect where taxable supplies have not been made depends on the particular circumstances, for example, whether the registrant has since acquired property other than financial instruments or property having other than nominal value. Where a registrant meeting the conditions of subparagraph (c)(iii) of the definition of "qualifying member" makes an election and subsequently acquires certain property for consumption, use or supply exclusively in its commercial activities, the registrant may now meet the conditions of subparagraph (c)(i). Provided the registrant had not ceased to be a qualifying member prior to the acquisition of the property, the election would remain in effect. … [W]here subparagraphs (c)(i) and (c)(ii) do not apply, a registrant would cease to be a specified member of the qualifying group where the registrant would no longer have a reasonable expectation of making taxable supplies.

10 February 2014 Interpretation 154536

FinanceCo, which was a de minimis financial institution, held both equipment used in leasing and loans. In the course of a general discussion, CRA stated:

A registrant may determine that all or substantially all (90% or more) of its property (other than financial instruments) was last manufactured, produced, acquired or imported for consumption, use or supply exclusively in the course of its commercial activities by dividing the value (e.g., book value) of property (other than financial instruments) for use in commercial activity by the value of all property (other than financial instruments) held by the registrant. Any such determination must take into account all the relevant facts and circumstances… .

Subsection 156(1.1)

Paragraph 156(1.1)(a)

Subparagraph 156(1.1)(a)(i)

Clause 156(1.1)(a)(i)(C)

Administrative Policy

GST/HST Memorandum 14-8 Closely Related Canadian Partnerships and Corporations for Purposes of Section 156 June 2023

3 stacked Canadian partnerships, which thus form a closely related group, are closely related to a 4th Canadian partnership jointly owned by them

Example 3

- By virtue of A holding substantially all of the interest in B (also a Canadian partnership), A and B are closely related under s. 156(1.1)(a)(i)(A) and form a qualifying group. On essentially the same basis, B is closely related to C (in which it has a 95% partnership interest).

- Since substantially all of the interest in C, as set out in s. 156(1.3), is held by a Canadian partnership (B) that is a member of a qualifying group of which A is a member, A and C are closely related under s. 156(1.1)(a)(i)(B). Accordingly, A, B and C constitute a qualifying group under s. 156)(1)(b).

- A, B and C hold respective 60%, 20% and 20% interests in D (also a Canadian partnership). Since the qualifying group of A, B and C holds substantially all of the interest in D as per s. 156(1.3)(b), D is closely related to A, B and C under s. 156(1.1)(a)(i)(C).

Paragraph 156(1.1)(b)

Administrative Policy

GST/HST Notice No. 303 - Changes to the Closely-related Test

The revised ETA closely-related person test requires that 90% or more of shareholder votes in respect of all corporate matters must be held and controlled by the tested person, with the exception inter alia of special voting matters provided by statute, or where a statute provides a special class vote. For an example of the first exception, CRA refers to the special voting right accorded by s. 183(3) of the CBCA to minority shareholders to approve an amalgamation. As an example of the second, it refers to the special class vote accorded by s. 176(1) of the CBCA to approve major amendments to the articles of incorporation.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 128 - Subsection 128(1.1) - Paragraph 128(1.1)(a) - Subparagraph 128(1.1)(a)(i) | exception for special voting matters provided by statute, or where a statute provides a special class vote | 286 |

| Tax Topics - Excise Tax Act - Section 150 - Subsection 150(2) - Paragraph 150(2)(b.1) | example of substantially all test not satisfied | 174 |

Subparagraph 156(1.1)(b)(iii)

Clause 156(1.1)(b)(iii)(C)

Administrative Policy

GST/HST Memorandum 14-8 Closely Related Canadian Partnerships and Corporations for Purposes of Section 156 June 2023

Where 2 grandchildren of AB Corp each hold a 50% partnership interest in XY, each corporation in that chain, as well as each corporation in another wholly-owned stack, is closely related to XY under s. 156(1.1)(b)(iii)(C)

Example 9

- AB (a corporation) wholly-owns (including having all the voting rights of the shares of) Holdco A and Holdco B. Holdco A so wholly-owns A Co, and Holdco B so wholly-owns X Co and Y Co. These six corporations form a “qualifying group” under para. (a) of the definition.

- X Co and Y Co. each hold a 50% partnership interest in XY.

- XY and A Co are closely related under s. 156(1.1)(b)(iii)(C) since, as per s. 156(1.3), all of the interest in XY is held by a combination of corporations (X Co and Y Co) that are members of a qualifying group of which A Co is a member. Thus, XY is closely related to A Co under s. 156(1.1)(b)(iii)(C), as are the other corporations in the group.

Subsection 156(1.2)

Administrative Policy

GST/HST Memorandum 14-8 Closely Related Canadian Partnerships and Corporations for Purposes of Section 156 June 2023

By virtue of a qualifying group – consisting of a holding partnership (X) holding 90% of a partnership (Y) and 90% of a corporation (Z) – each holding 1/3 of Corporation L, X and Y are closely related to L, so that Z and L are closely related under s. 156(1.2)

Example 7

- X is closely related to Y (also a Canadian partnership) under s. 156(1.1)(b)(i)(A), so that they form a qualifying group. by virtue of X holding substantially all of the interest in Y.

- Y and Z (a corporation) are closely related under s. 156(1.1)(b)(i)(B) as qualifying voting control and 90% of the shares of Z are owned by a Canadian partnership (namely, X) that is a member of a qualifying group of which Y is a member. Thus, X, Y and Z form a “qualifying group” under para. (b) of the definition.

- X, Y and Z hold 33%, 34% and 33%, respectively, of the shares of L. X (the particular partnership) and L are closely related under s. 156(1.1)(b)(i)(C) because qualifying voting control is held by, and all of the shares of L are owned by, a combination of corporations and Canadian partnerships referred to in ss. 156(1.1)(b)(i)(A) and (B) (i.e., X and members of the qualifying group of which it is a member).

- Similarly, Y also is closely related to L.

- Since Z and L are both closely related to X, they are also closely related to each other under s. 156(1.2).

Subsection 156(1.3)

Paragraph 156(1.3)(b)

Subparagraph 156(1.3)(b)(i)

Administrative Policy

GST/HST Memorandum 14-8 Closely Related Canadian Partnerships and Corporations for Purposes of Section 156 June 2023

S. 156(1.3)(b)(i) tests applied on a source-by-source basis

9. The income entitlement part [in s. 156(1.3)(b)(i)] recognizes the fact that a partnership can have a different income sharing arrangement for each source of income of the partnership.

Subparagraph 156(1.3)(b)(iii)

Administrative Policy

GST/HST Memorandum 14-8 Closely Related Canadian Partnerships and Corporations for Purposes of Section 156 June 2023

Test in s. 156(1.3)(b)(iii) precludes a limited partner as such being closely related to the partnership

12. In a limited partnership, the limited partners typically do not manage or exert control over the partnership. Instead, it is the general partner that directs the business and affairs of a limited partnership and has control over the partnership’s property and business. A limited partner that is not able to direct the business and affairs of a limited partnership cannot hold all or substantially all of the interest in the partnership for purposes of section 156. Therefore, such a limited partner would not be closely related to the limited partnership for purposes of subsection 156(1.1) and thus not a specified member of a qualifying group, even if it were entitled to 90% or more of the limited partnership’s income and were entitled to receive 90% or more of the total amount that would be paid to all members of the partnership on the winding-up of the partnership.

Subsection 156(2) - Election for Nil Consideration

Administrative Policy

21 December 2017 Interpretation 164739

Although ETA s. 173(1) often imputes a taxable supply by an employer based on the amount of taxable benefits conferred by it under ITA s. 6(1)(a), s. 173(1)(d)(i) provides that this rule does not apply where the employer was denied an input tax credit under s. 170 on its acquisition of the property or service that, in turn, was provided to the employee. S. 170(1)(b) generally denies the ITC where such property was acquired for the exclusive personal consumption of an employee so as to engage s. 6(1)(a).

CRA found that this s. 173(1)(d)(i) exclusion did not apply where the property in question (an automobile) was acquired by a closely-related corporation and then leased to the employer with the benefit of the s. 156 nil-consideration election, with the automobile being provided for the exclusive personal benefit of an employee. CRA reasoned that as there was no GST/HST payable by the employer on its lease payments, it should not be said that it was being denied ITCs under the s. 170 rule. CRA implicitly accepted that the automobile was being acquired by the employer exclusively for commercial use notwithstanding the personal use of the automobile by its employee.

Although not discussed by CRA, the above result appears to be anomalous. If the s. 156 election had not been made, the employer would have claimed ITCs on the lease payments made by it to its affiliate, so that the net additional amount required to be remitted by it under s. 173 might be small or minimal. As a result of making the election, it must still compute the same imputed GST/HST s. 173 benefit amount, but without getting a somewhat offsetting ITC.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 173 - Subsection 173(1) - Paragraph 173(1)(d) - Paragraph 173(1)(d) | no denial under s. 170 where employer acquisition "benefited" from s. 156 election: imputed s. 173 tax even though no ITC | 178 |

Excise and GST/HST News - No. 95 under "

//www.cra-arc.gc.ca/E/pbg/gf/rc4616/README.html">Form RC4616 – Simplified filing procedures concerning existing elections for nil consideration" 8 April 2015

Specified members of a qualifying group that have existing elections, each with a different effective date that is before January 1, 2015, have the following two options for filing Form RC4616:

- Under simplified procedures developed by the CRA, specified members of a qualifying group that have existing elections, each with a different effective date that is before January 1, 2015, now only need to file one Form RC4616 indicating December 31, 2014 as the effective date (covering all members instead of each filing separately). Each Form GST25 that was completed when each election was made should be kept with the electing members' books and records and reflect the original effective date of the election. The common effective date of December 31, 2014, specified on Form RC4616, will be recorded in the CRA's systems and will not invalidate the application of the election for supplies made before that date.

- Alternatively, specified members of a qualifying group that have existing elections, each with a different effective date that is before January 1, 2015, could file a separate Form RC4616 for each (original) effective date. In this case, the different effective dates will be recorded in the CRA's systems.

In either case, Form RC4616 must be completed and filed with the CRA before January 1, 2016.

Excise and GST/HST News - No. 94 14 January 2015

Effective January 1, 2015, an election (or revocation of an election) must be made jointly by a particular specified member of a qualifying group and another specified member of the same group by completing and filing Form RC4616...which is replacing Form GST25. ...

...Parties to a new election must complete Form RC4616 and file it by the earliest day on which the electing members are required to file a GST/HST return for the reporting period that includes the effective date of the election specified on the form.

Parties to an existing election in effect before January 1, 2015, which is still in effect on that date, will also be required to complete Form RC4616 and file it with the CRA after 2014 and before January 1, 2016. In this case, the election remains the original election and, as a result, the effective date specified on the form should be the original effective date of the election.

While an election is between two members, Form RC4616 permits multiple combinations. Every combination of eligible corporations or eligible Canadian partnerships whose names appear in Part A of the form (and on any attached page) is considered to have made the election. Form RC4616 will permit the first specified member to file the election on behalf of the specified members identified in Part A (and on any attached page). Only the signature of the first specified member is required.

Excise and GST/HST News – No. 91 under "GST/HST election for closely related persons" May 2014

[E]ffective January 1, 2015, parties to a new election or revocation will be required to file Form RC4616, (replacing Form GST25…) with the CRA. Generally, the election or revocation will have to be filed by the earliest date on which any of the parties is required to file a return for the period that includes the day on which the election or revocation becomes effective.

Parties to an existing election with an effective date before January 1, 2015 that is still in effect on January 1, 2015, will also be required to file Form RC4616 to treat certain supplies made between them after 2014 as having been deemed to be made for nil consideration. Form RC4616 will be required to be filed after 2014 and before January 1, 2016.

...Example 3:

Corporation A and Corporation B are specified members of the same qualifying group and they have an existing election under subsection 156(2) in effect before 2015. Even though Corporation A and Corporation B have an existing election still in effect on January 1, 2015, they will, nevertheless, be required to file a new election form for supplies made after 2014; the new election form will have to be filed after 2014 and before January 1, 2016.

91 CPTJ - Q.10

The election under s. 156 is not intended to apply to butterfly transactions. Because a newly-created corporation will usually only make exempt supplies and is unlikely to make any taxable supplies, it cannot qualify as a "specified member."

Subsection 156(2.01)

Articles

John Bassindale, Robert G. Kreklewetz, "Budget 2014: Changes for Section 156 and Closely Related Persons", Sales and Use Tax, Federated Press, Volume XII, No. 4, 2014, p. 659

Brief refiling deadline (pp. 659-660)

[E]xisting section 156 elections [must] be filed during the calendar year 2015 - a relatively brief one-year window, which could easily be missed by inattentive taxpayers….[S]ubsection 156(2.01) deems any section 156 election filed before January 1, 2015 "never to have been filed."

Policy reasons for filing (p. 660)

The policy reasons for this brief filing period are not entirely clear, particularly in light of the potential negative repercussions if the deadline is missed, nor does one fully understand why prior elections were deemed never to have been filed.

One suspects that these provisions relate to the fact that the last time that section 156 elections were required to be filed was for a brief period in 1991-1992; our theory is that the CRA has likely lost track of the section 156 elections that were filed in those years, and that Finance believes that the section 156 election system needs a complete "reboot" in order to protect its integrity.

Subsection 156(3) - Cessation

Administrative Policy

29 January 2015 Interpretation 167061

In the course of a general discussion on completion, filing and revocation of form RC4616, CRA stated:

[Effect of disqualification]

[I]n the event that a particular specified member of a qualifying group no longer meets the qualifications of the election, an election made with that particular member is no longer in effect. Any elections made between other specified members listed on that form (i.e., not made with the particular member) would not be affected. There is no requirement to advise the CRA or modify a previously filed Form RC4616 where a person no longer qualifies… .

[Avoiding inadvertent revocation]

In the event that a particular specified member of a qualifying group wishes to revoke an existing election...care must be taken in filing the revocation to ensure that the elections between the other specified members remain in effect. Every pair combination of members whose names appear in Part A of the Form RC4616 (and on any attached page) would be considered to have revoked their election. Consider the following example[:] ...

[U]sing MyBA or the paper Form RC4616:...an election is made between Parent Co and Subco 1; ...between Parent Co and Subco 2; and...between Subco 1 and Subco 2. Parent Co wishes to revoke both (i) the election made with Subco 1 and (ii) the election it made with Subco 2; however, Subco 1 and Subco 2 do not wish to revoke the election made between them. Since every pair combination of members whose names appear on the form (and on any attached page) would be considered to have revoked their election, two separate Forms RC4616 should be filed either electronically or on paper: (i) a revocation of the election between Parent Co and Subco 1; and (ii) a revocation of the election between Parent Co and Subco 2.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 156 - Subsection 156(4) | one signing member/MyBA filing | 309 |

Subsection 156(4) - Form of Election and Revocation

Administrative Policy

May 2019 CPA Alberta CRA Roundtable, GST Session – Q.20

Closely related Company A and Company B (monthly filers) made an election under Company A's My Business account with an effective date of October 1, 2019. On December 1, 2019, closely related Company C wishes to jointly file the RC4616 online with Company A and Company B. For this to occur, must Company A and Company B revoke their existing election effective November 30, 2019, so that all three companies can file new RC4616 elections (presumably under the My Business account of one of them) effective December 1, 2019? CRA responded:

…Company C can be added without revoking the original election between Company A and B. Company C would simply file a new election naming Company A and B as closely related members, with an effective date of December 1, 2019. This will establish two new elections (A with C, and B with C) with the December 1, 2019 effective date. The original election between Company A and B will remain unchanged, with the original effective date of October 1, 2019.

Revocations work a bit differently. For example, if Company A elects to leave the group they would need to submit a revocation request naming only Company B, and then a separate revocation request naming only Company C. However, if the entire group is to be dissolved (i.e. all combinations, namely A with B, A with C, and B with C), then only one revocation request is needed, naming Company A, B and C.

26 February 2015 CBA Roundtable, Q. 15

Before responding to a question on backdated s. 273 elections, CRA did not demur when the questioner noted that CRA had indicated that a s. 156 election could be made retroactively if the parties had conducted themselves as if an election were in place (and the other conditions for the election were satisfied).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 273 - Subsection 273(4) | backdated election for valid JV permissible/co-ownership not co-terminous with JV | 198 |

29 January 2015 Interpretation 167061

In the course of a general discussion on completion and filing of form RC4616, CRA stated:

[Filing by one specified member]

[T]he first specified member identified in Part A on the paper Form RC4616 may file the form on behalf of all specified members wanting to make or to revoke an election. That is, where there are more than two specified members of a qualifying group making an election or revocation of an election, only one Form RC4616 is required where all of the pair combinations of specified members whose names are listed in Part A (and on any attached page) are making the election or revocation.

[Quebec form]

...If the same members of the qualifying group also want similar relief from the...QST...they would be required to elect...by filing with Revenu Québec (provided they are not selected listed financial institutions) the Form FP-4616... .

[MyBA filing/viewing/amendment]

...[E]lectronic filing of the election or revocation...is expected to be available through My Business Account (MyBA) in mid April 2015. Once electronic filing is available, registrants will be able to view, through MyBA, section 156 elections that they have filed, either electronically or by using the paper Form RC4616, as well as those filed by another specified member on their behalf.

...[Once] a section 156 election has been filed either electronically or on paper, the election can be modified through MyBA. In the case of a particular specified member of a qualifying group wishing to elect with another specified member (or members) of that group after 2014, the response provided to question 1.e applies whether the election was filed electronically using MyBA or the paper Form RC4616.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 156 - Subsection 156(3) | disqualification does not affect non-paired members/avoiding inadvertent revocation | 316 |

28 August 2000 Headquarters Letter Case 30915

"If the parties have conducted themselves as if an election were in place (and if the conditions for making the election are met at all relevant times), then it is possible that a valid election may be made which would apply to a transaction which has already occurred, if the election form specifies an effective date that is prior to the date of the transaction."

GST25 "Closely Related Corporations and Canadian Partnerships - Election or Revocation of the Election to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration"

All or substantially all generally means 90% or more. ... You do not have to file this form with the Canada Revenue Agency.

Forms

RC4616 "Election or Revocation of an Election for Closely Related Corporations and/or Canadian Partnerships to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration for GST/HST Purposes" 9 April 2015

Every combination of eligible corporations and eligible Canadian partnerships whose names appear in Part A of this form (and on any attached page) is considered to have made an election. For example, a form having three electing members numbered as 1, 2, and 3, would have the following combinations: •1 and 2; • 1 and 3; and • 2 and 3

...Parties to an existing election with an effective date before January 1, 2015, that is still in effect on January 1, 2015, will also be required to file the election form. However, they will be required to file the election form after 2014 and before January 1, 2016.

Paragraph 156(4)(b)

Subparagraph 156(4)(b)(ii)

Cases

Castle Building Group Ltd. v. Canada (National Revenue), 2021 FC 947

The Applicants were Castle, a registrant which purchased building materials for resale, and was the exclusive supplier of building materials to its wholly-owned subsidiary (“CBS”), a distributor. Castle also acted as billing agent for, and provided management and administrative services, to CBS. CBS had not registered for GST/HST purposes (although it was a registrant) or filed GST/HST returns, and if it had, it nonetheless would have had no GST/HST remittances to report because of a “Billing Agent Election” (pursuant to ss. 171(1.1) and 1.11)) between Castle and CBS, which rendered Castle responsible for reporting and remitting such amounts.

As a result of January 2015 amendments to s. 156, continued access to that provision required the filing of a new election. This was done on a timely basis for the period from December 1, 2016 onwards. However, a further election (the “2017 Election”) to cover the period back to January 1, 2015 was late-filed, and rejected by CRA (confirmed by a second decision) on the grounds (quoted at para. 15) that:

CBS, as a specified member of the qualifying group, was not compliant at the time the election was filed on February 22, 2017. CBS had outstanding returns on the date that the election was filed.

Subsequently to the late-filing of the 2017 Election, CBS registered and filed a series of nil returns (except that one return claimed an ITC further to the CRA’s disallowance of Castle’s ITC claim for the item on the basis that it should have been claimed by CBS).

In declining the Applicants’ request for judicial review, Walker J paraphrased (at para. 32) the Guidelines in Policy Statement P-255 on accepting late-election, including a requirement that “both corporations must have filed all GST/HST returns as required,” noted (at para. 33) that “[a]s long as the Minister does not fetter her discretion and improperly limit the scope of her analysis, she may rely on the factors identified in the Guidelines in making her decision,” and then stated (at paras. 40, 58):

[S]ubsection 238(1) provides that all registrants (registered or not) “shall file a return with the Minister for each reporting period …”. The fact that a registrant may have a nil return does not exempt them from the requirement to file returns.

… The filing of the Billing Agent Election and the assumption by Castle of the administrative tasks of collection, reporting and remittance of CBS’s GST/HST does not affect the status of CBS as the supplier of the goods and services in respect of which the tax is collectible. Subsection 177(1.1) does not deem Castle to be the supplier, it states only that all GST/HST exigible on supplies made by CBS is “deemed to be collectible, charged and collected” by Castle. Therefore, the existence of the Billing Agent Election did not negate CBS’s obligation under subsection 238(1) of the ETA to file returns or its obligation to register in accordance with subsection 240(1).

She concluded (at para. 88):

The [CRA] Decision is reasonable when read within the Vavilov framework for intelligibility and justification, taking into account “the evidence before the decision maker, the submissions of the parties [and] publicly available policies or guidelines that informed the decision maker’s work […]” (Vavilov at para 94).

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Excise Tax Act - Section 171 - Subsection 171(1) | billing election did not subtract from the principal making taxable supplies and being a registrant | 346 |

Denso Manufacturing Canada Inc. v. Canada (National Revenue), 2020 FC 360, aff'd 2021 FCA 236

Following the commencement of an audit in November 2015, in February 2016 a CRA auditor asked the applicant (Denso Manufacturing), which was closely related to another corporation (Denso Sales), to file a s. 156 election with Denso Sales. After consulting with their tax advisor, on February 22, 2016, the Denso companies (Denso) faxed the election form (Form RC4616) to CRA indicating that the election was effective from January 1, 2016 (based on a mistaken belief that their previous election was valid for 2015). In fact, due to a change in law, a new election form was required to be filed effective January 1, 2015, subject to a published CRA policy that the election with a stated effective date of January 1, 2015 could be made before January 1, 2016. No adjustments to the 2015 year were made as a result of that CRA examination.

When this mistake was identified as a result of a subsequent CRA audit, Denso then sent a letter and Form RC4616 (in November 2017) indicating an effective date of Jan 1, 2015 and requesting the late filing of the form. The Minister refused to accept the late filing, and proposed an adjustment of $30,098,952.56 for Denso Manufacturing and $308,617.34 for Denso Sales, both with interest, for calendar year 2015.

In finding that the Minister’s discretionary decision to not accept the late-filed RC4616 was reasonable, Zinn J stated (at paras 40, 42, 43 and 44):

… [T]here is no evidence supporting the submission that the [January 1, 2016] date was placed there in error. … [T]he form filed in February 2016 was not a “late-filed election” as is suggested. It was a timely election filed in February 2016, the month following the January 2016 GST/HST reporting period of the Denso Companies and was stated to be effective January 1, 2016.

… Denso Companies… admitted that they “were not aware of the new RC4616 regulation.” …

The 2015 amendments were … referenced in a number of CRA publications and in the statute itself.

The Denso Companies say that their actions were not negligent nor careless given they had hired and relied on the advice of tax consultants who provided them erroneous advice. … [T]he consultant was contacted after a well-published deadline had already passed, and only after the Denso Companies were alerted to the need by the review officer in February 2016. It was open to the Minister to conclude, as was done, that the Denso Companies had not taken adequate precautions to keep abreast of their compliance obligations, actions that amount to carelessness and negligence. …

Administrative Policy

May 2019 CPA Alberta CRA Roundtable, GST Session – Q.4

Respecting a query on late-filed ETA s. 156 elections, CRA stated:

Under administrative tolerance, the CRA may consider a request to accept a late-filed election. These requests will be considered on a case-by-case basis. As a condition, Paragraph 4 of policy statement P-255 specifies that all GST/HST returns must be filed by all parties to the election, and, that the parties must be fully compliant with the GST/HST legislation. Where GST/HST returns are outstanding, or a registrant is non-compliant, the request to accept this election will be denied. The CRA encourages you to file your outstanding GST/HST returns (if any) in order to meet this condition. Registrants filing this election must also meet all other conditions outlined in GST Policy Statement P-255.

May 2017 Alberta CPA Roundtable, GST/HST Q.5

When will CRA will accept a late-filed s. 156 election (form RC4616)? CRA responded:

CRA normally accepts these when the registrant is eligible, compliant and there is some sort of evidence that the registrant has been applying these rules consistently. This evidence could be a note in the file that says election GST25 in use.

23 March 2017 CBA Commodity Taxes Roundtable, Q.11

How can registrants obtain permission pursuant to s. 156(4)(b)(ii) to file an election after the dates in s. 156(4)(b)(i) have passed? CRA responded:

At the end of January 2017, a memorandum to introduce new internal procedures for the review and processing of requests received by tax services offices to accept late-filed Form RC4616 was issued to the field offices. As a result of these new procedures, all requests should now be reviewed by audit staff to determine if the parties listed on Form RC4616 meet all of the legislated eligibility conditions for making or revoking the section 156 election and if the late-filed Form RC4616 should be accepted based upon the guidelines listed in GST/HST Policy Statement P-255.

GST/HST Policy Statement P-255 Late-filed Section 156 Elections and Revocations July 2015

A request to accept a late-filed section 156 election or revocation of the election will be considered...within the context of the following guidelines. …

- A written request to have the election or revocation of an election filed late must be submitted to the Assistant Director of Audit of the tax services office of the first specified member making or revoking the election as identified on the Form RC4616. …

- The written request must provide a clear explanation as to why the specified members have filed the election or revocation late… . The request must also… include an undertaking that the first specified member will notify the other specified member whether or not the late-filed election or revocation is accepted… .

- [T]he written request must indicate that both specified members meet all of the conditions for making the election as of the requested effective date… .

- As of the requested effective date for the election, both parties to the election must have consistently treated the applicable supplies made between them as having been made for no consideration… .

- [And conversely re revocation]

- The requested effective date of a late-filed election or revocation must relate to a reporting period that is not statute barred.

- The parties to the late-filed election or revocation must not have been negligent or careless in complying with the provisions of section 156… .

- Both parties making the late-filed election or revocation must not have filed an objection or appeal relating to an assessment for a reporting period that is within the retroactive period… .

CRA concluded an example with the statement:

The request would generally be accepted where the explanation as to why the election was filed late demonstrates that the parties were not negligent or careless in complying with the election provisions.