Submit your application

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

Submit your application

Important notice

On June 23, 2022, Budget Implementation Act, 2022, No. 1, received Royal Assent. This change in legislation includes new rules that allow charities to make grants to non-qualified donees. As a result, some of the information on this page could change.

On December 19, 2023, following a public feedback period, the Canada Revenue Agency (CRA) posted the guidance document CG-032, Registered charities making grants to non-qualified donees. This document explains how the CRA will administer the recent changes to the Income Tax Act.

The CRA is in the process of reviewing and updating all related guidance products and web pages to ensure they are consistent with the new rules.

To apply

Complete the online form available through My Business Account to apply to become a registered charity.

Is this your first time signing in to My Business Account (MyBA)?

For information on how to sign up for MyBA, go to Access our online services for charities.

If you have difficulty accessing the digital services, or have questions regarding the application, you can contact the Charities Directorate.

Authorized representatives can use Represent a Client to apply on behalf of their client organization.

Tips about the online form

- The online form walks you through the application process. You will only be asked for additional information on certain items depending on whether you say yes or no to previous questions, or check certain items on a list.

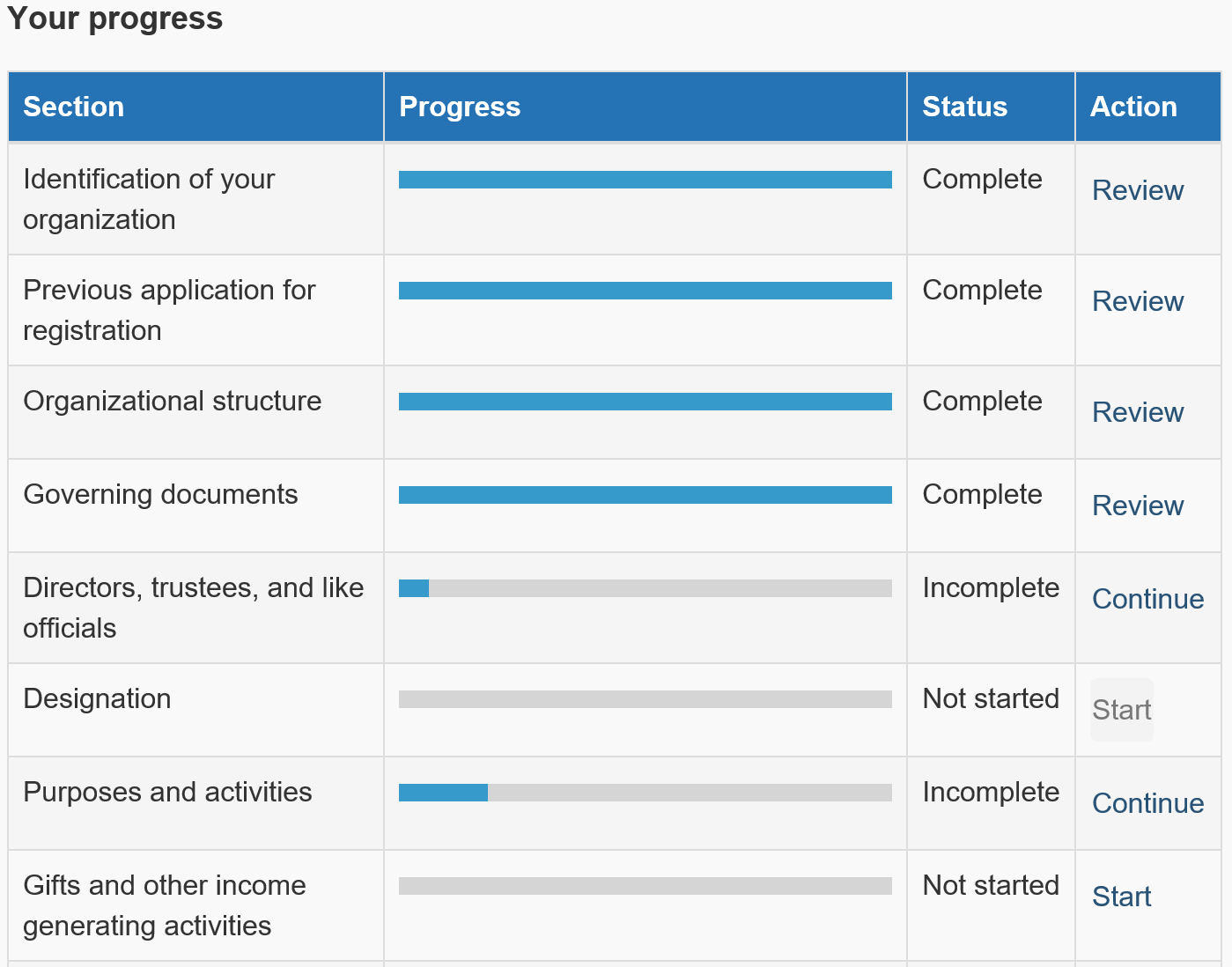

- Progress bars and status indicate which sections you’ve completed, started, or haven’t started yet.

- You can review and make changes to a section at any time.

- Be ready to provide detailed information for each charitable activity your charity currently carries out or proposes to carry out. For tips, see Describing your activities.

- Start and stop the form at any time. Clicking “next” saves the information up to that point.

- Multiple individuals can take turns and log into MyBA to complete different sections of the form.

- At the end of the application you will be asked to upload all required documentation, such as governing documents, pamphlets, agreements, and financial statements.

- You can only submit your application once you have answered all mandatory questions and uploaded all mandatory documents.

- You can view and print a summary of your application.

- Once you have submitted your online application, you can track your application status by logging into MyBA, and selecting “View application status” under your RR account.

A screenshot from the application Overview page on My Business Account showing the application’s progress table. This table lists all the sections that a charity needs to complete online. Each line of the table includes the title of the section, the progress bar, the status, and an action link.

Each progress bar fills up as you answer the questions in the section.

The status shows whether the section is Not started, Incomplete, or Complete.

The action link is used to enter each section. It is clickable only for those sections that the charity has to complete. The text of the action link changes as you answer questions in the application. It says Start if you haven’t started the section yet, Continue if you have started but have not completed it, and Review once it is completed. You can still go back to make revisions when you click the Review link.

Tips for avoiding delays

Missing information causes delays. To avoid delays:

- answer all questions on the application

- include all required documents

- provide all details and specific information requested

Common delays occur when an applicant fails to provide:

- a complete list of the directors, trustees, or like officials (with each person's address, telephone number, and date of birth)

- a complete set of certified** governing documents (including any bylaws and amendments, if applicable)

**For incorporated organizations (examples include organizations established by letters patent, a memorandum of association, or an Application to Form a Society), certified means that the documents have an effective date and are stamped or signed by the appropriate incorporating authority.

For organizations created by a constitution, certified means that the constitution contains the signatures of at least three current directors/trustees or like officials of the organization and has an effective date.

For trust documents, certified means that the document contains the signature of at least one trustee and has an effective date.

- a certificate of good standing or similar document from the appropriate registrar (if the organization has been incorporated for five years or more, or if the organization is incorporated and applying for re-registration)

- complete financial information about the organization (this includes completing section Financial information on the application form, as well as providing the organization's latest financial statements, if applicable)

- a complete description of the organization's activities to show that they are charitable and fulfill the organization's purposes, as stated in its governing documents

- copies of any agreements or contracts the organization has with representatives carrying out the organization's activities inside or outside Canada (if applicable) and complete details about these arrangements. For more information, see CG-004, Using an intermediary to carry on a charity's activities within Canada, and CG-002, Canadian registered charities carrying on activities outside Canada

For more information about the documents you must submit with your application, we encourage you to use our application document checklist tool.

Related links

Page details

2018-10-05