Walking eligibility - Disability tax credit (DTC)

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

Walking eligibility - Disability tax credit (DTC)

Disability tax credit (DTC)

- What is the DTC

- Who is eligible

- How to apply

- Our review and decision

- Claiming the credit

- Contact the CRA

Walking eligibility

On this page

Overview

For some people, walking can be a challenge even with the help of appropriate therapy, medication, and devices. The DTC aims to offset some of the costs related to an impairment by reducing the amount of income tax you may have to pay.

Eligibility for the DTC is based on the effects of the impairment, not a diagnosis or the presence of a medical condition.

Transcript and alternative formats

Transcript

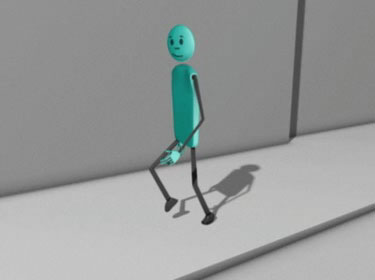

For some people, it may be that mobility poses a significant challenge: for instance, the ability to walk even a short distance like one city block.

The first example shows a person with no apparent mobility impairment, walking a city block without any issues.

In this example, the individual would not qualify for the disability tax credit (DTC).

The second example shows a person using a cane that assists the person in walking at a similar pace to an individual walking without the use of an aid.

In this example, the individual would not qualify for the DTC because the individual is able to walk the city block with the use of an aid, without taking an inordinate amount of time.

The third example shows a person attempting to walk a city block, however this individual has to stop frequently to rest, because of shortness of breath or pain.

In this third example, the individual would qualify for the DTC.

Alternative formats

Example of someone who may be eligible

Marie injured her leg and has to use a wheelchair

Marie and Joe are both retired.

Marie fell off a ladder 10 years ago and injured her right leg. She now has to use a wheelchair to get around even for short distances.

Marie applied for the DTC. As a result of the information provided by the medical practitioner on the application form, she is now eligible for the tax credit.

Marie also got a big income tax refund for the last 10 years because her medical practitioner was able to certify that her inability to walk started 10 years ago.

Eligibility criteria checklist

Start of question

-

If you’re not sure you qualify

Even if your answers indicate that you may not be eligible, you can still send in an application. CRA will determine your eligibility based on the information given by your medical practitioner.

If you have impairments in 2 categories

You may be eligible for the DTC under the cumulative effect of significant limitations. This combines the effects of 2 limitations to be equivalent to a marked restriction in 1 category (does not include life-sustaining therapy).

Section navigation

Page details

2024-01-23