Get ready to file a tax return - Personal income tax

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

Personal income tax

Get ready to file a tax return

To receive the benefit and credit payments you may be eligible for, you need to file your income tax and benefit return every year.

Start by gathering your documents to report income and claim deductions, and choose how you want to file and send your completed tax return to the CRA.

Steps to get ready for 2025 taxes

-

Find out who should file a tax return

Determine if you need to file a tax return and your obligations based on your tax situation.

-

Learn what's new for 2025

Changes to benefits, credits, and expenses for individuals and families, and updates to the income tax package.

-

Be aware of key dates

Filing and payment due dates for taxes, instalment payments, and any amounts you may owe.

Filing dates for 2025 taxes

- February 23, 2026: Earliest day to file your taxes online

- April 30, 2026: Deadline to file your taxes

- June 15, 2026: Deadline to file your taxes if you or your spouse or common-law partner were self-employed in 2025

Payment due date for 2025 taxes

- April 30, 2026: Deadline to pay your taxes

-

Get tax slips

Understand your tax information slips, such as the T4 and T4A, when you will receive them from the issuer, and how to get a copy.

-

Keep information up-to-date with the CRA

Notify the CRA about changes to a mailing or email address, phone number, name, or marital status.

Update direct deposit details for payments and refunds, language and mail preferences to receive CRA mail.

-

Choose how to file a tax return

-

You can file your own tax return using:

- Tax software

- SimpleFile

- A paper tax return

-

You can have someone else file your tax return, such as:

- A professional tax preparer

- A volunteer at a free tax clinic

-

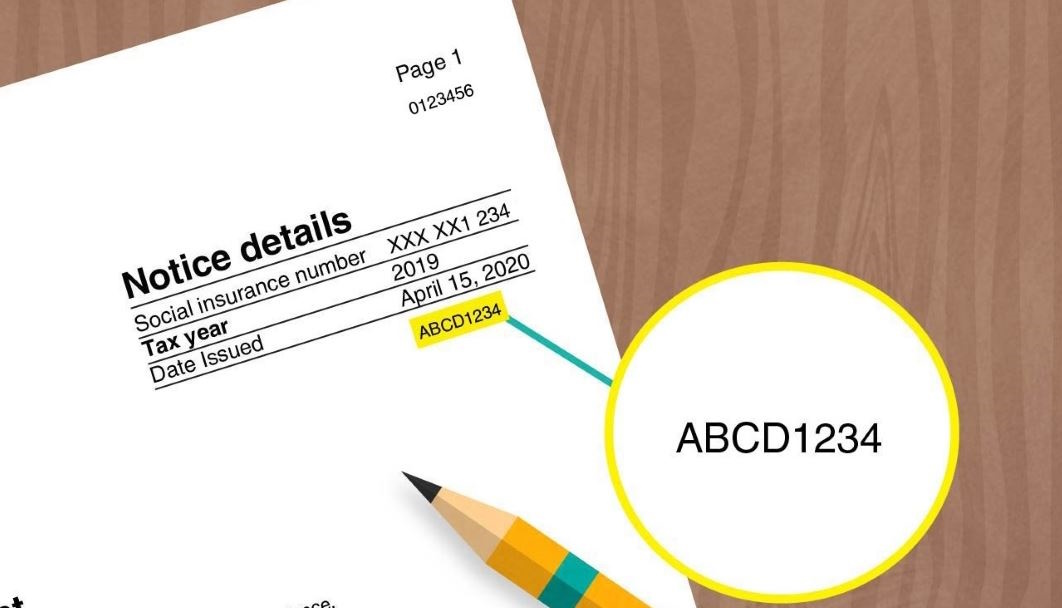

Get your NETFILE access code

If you plan to file a return electronically with tax software, you may be asked for a NETFILE access code. The 8-character access code (numbers and letters) is found on your Notice of Assessment (NOA). Only the access code on your most recent NOA is valid.

To find your most recent NOA, sign in to your CRA account and go to Tax returns.

If you already have a copy of your most recent NOA, the access code is located on the right side.

Image of where to find the access code on your Notice of Assessment

The access code is not mandatory. If you are filing a tax return for the first time, you will not have an access code.

If you do not provide the access code

While this access code is not mandatory, if you do not enter the access code:

- You will not be able to use any information from your most recent tax return to confirm your identity with the CRA

- The CRA will have to use other information for authentication purposes

-

Features

Page details

- Date modified:

- 2026-02-23