Golf tournaments

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

Golf tournaments

On this page:

Hosting a golf tournament? (PDF)

Hosting a golf tournament?

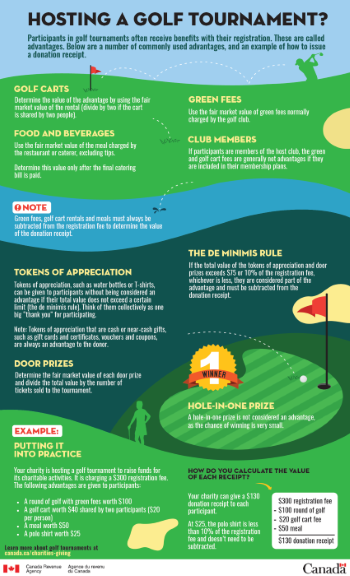

Participants in golf tournaments often receive benefits with their registration. These are called advantages. Below are a number of commonly used advantages, and an example of how to issue a donation receipt.

Golf carts

Determine the value of the advantage by using the fair market value of the rental (divide by two if the cart is shared by two people).

Green fees

Use the fair market value of green fees normally charged by the golf club.

Food and beverages

Use the fair market value of the meal charged by the restaurant or caterer, excluding tips.

Determine this value only after the final catering bill is paid.

Club members

If participants are members of the host club, the green and golf cart fees are generally not advantages if they are included in their membership plans.

Note

Green fees, golf cart rentals and meals must always be subtracted from the registration fee to determine the value of the donation receipt.

The de minimis rule

If the total value of the tokens of appreciation and door prizes exceeds $75 or 10% of the registration fee, whichever is less, they are considered part of the advantage and must be subtracted from the donation receipt.

Tokens of appreciation

Tokens of appreciation, such as water bottles or T-shirts, can be given to participants without being considered an advantage if their total value does not exceed a certain limit (the de minimis rule). Think of them collectively as one big “thank you” for participating.

Note

Tokens of appreciation that are cash or near-cash gifts, such as gift cards and certificates, vouchers and coupons, are always an advantage to the donor.

Door prizes

Determine the fair market value of each door prize and divide the total value by the number of tickets sold to the tournament.

Hole-in-one prize

A hole-in-one prize is not considered an advantage, as the chance of winning is very small.

Example: putting it into practice

Your charity is hosting a golf tournament to raise funds for its charitable activities. It is charging a $300 registration fee. The following advantages are given to participants:

- a round of golf with green fees worth $100

- a golf cart worth $40 shared by two participants ($20 per person)

- a meal worth $50

- a polo shirt worth $25

How do you calculate the value of each receipt?

Your charity can give a $130 donation receipt to each participant. At $25, the polo shirt is less than 10% of the registration fee and doesn’t need to be subtracted.

$300 registration fee

- $100 round of golf

- $20 golf cart fee

- $50 meal

= $130 donation receipt

For more information about golf tournaments, visit canada.ca/charities-giving

General information and example

- Green fees are calculated at the rate (group or individual) normally charged to non-members playing the course at the time of the event. However, no amount is allocated to members if they are not normally required to pay green fees.

- Cart rentals are valued at their regular cost.

- Meals are valued at the price (group or individual) normally charged if the meals were purchased separately at the course.

- Complimentary items are valued at the amount that would normally be paid for the merchandise at a retail outlet.

- Door and achievement prizes are valued at their retail value, totalled, and prorated per ticket sold.

- Hole-in-one prizes can be excluded. The Canada Revenue Agency (CRA) accepts that the chance of winning a hole-in-one prize is nominal.

- Raffle tickets – if they are included in the participation fee, the prizes are treated as door prizes and must be taken into account in determining the amount of the advantage. However, if the raffle is conducted separately, this is essentially a lottery, and the cost of the raffle tickets is not considered a gift. You should not take into account the value of the various prizes that could be won when determining the amount of the advantage.

Note

It is the CRA’s view that the purchase of a lottery ticket is not a gift; therefore, you cannot issue a receipt for the cost of the ticket.

Example

A charity holds a fundraising golf tournament and sells 100 tickets for $200 each.

- Some of the participants are members of the golf course and do not have to pay green fees.

- The regular green fee for non-members on that day is $50.

- The cart rental (included in the participation fee) is normally $20.

- The retail value of supplied food and beverages (excluding GST/HST, PST and gratuities) is $30.

- Each participant receives golf balls with a retail value of $15.

- The retail value of door and achievement prizes is $2,000 ($2,000/100 or $20 per ticket sold).

- Raffle tickets for a chance to win a number of other prizes are sold separately.

- The hole-in-one prize is the use of an automobile for one year.

| Participation fee (the gift) | $200 |

|

Less advantage: Green fee Cart rent Food and beverage Complimentary items (golf balls, door and achievement prizes) Hole-in-one prize |

$50 $20 $30 $35 $ 0 |

| Total advantage | $135 |

| Eligible amount (non-members) | $65 |

For non-members, the amount of the advantage is $135 and a receipt may be issued for the eligible amount of $65.

For members who do not have to pay green fees, the green fee of $50 can be excluded from the advantage and a receipt may be issued for the eligible amount of $115.

The De minimis threshold is $20 (the lesser of $75 or 10% of the $200 participation fee). Since the total value of the complimentary items and the door and achievement prizes to each participant ($35) exceeds the De minimis threshold, you must include these items in the total amount of the advantage.

If the total advantage had exceeded $160 (80% of the $200 participation fee), it would not have met the intention to make a gift threshold, and a receipt could not have been issued.

- If a private foundation holds an annual golf tournament, is it considered to be carrying on a business?

No. An annual golf tournament held by a charity is considered a fundraising event.

- When calculating the eligible amount of the gift for participants at a golf tournament, is the calculation based on the number of participants or the number of tickets sold?

The calculation is based on the number of tickets sold.

- If a company sponsors a hole by making a donation to a charity, is this considered a gift?

This depends on whether the company receives an advantage as a result of the donation. If the company receives nothing in return, it has made a gift and you can issue a receipt. However, when a company sponsors a hole, it is the CRA’s experience that this generally involves some form of recognition of that gift.

Providing simple recognition of the gift will not, generally, constitute an advantage to the company (for example, naming a hole after the company and placing a small, discreet sign at the hole). However, as the level of recognition increases, it is likely that the company is receiving a benefit in the form of advertising. For more information, go to Sponsorship.

- If a business buys a block of tickets to a charity golf tournament, should the charity issue the receipt(s) in the name of the golfers who use the tickets or in the name of the business?

The charity must issue the receipt in the name of the true donor(s) of the gift. If the business is the true donor of the funds, the receipt must be issued in the name of the business. If the employees buy tickets for the tournament by giving the money to the business, and the business issues a cheque for the tickets, the employees are the true donors. In this case, the charity should ask the business for documents showing that the individuals bought the tickets before issuing receipts in the name of each golfer. For more information, see Policy commentary CPC-010, Issuing a receipt in a name other than the donor’s.

- Can a charity have an organization hold a golf tournament on its behalf?

Yes. A charity can hire a third-party organization or retain the services of a fundraiser as an agent or other contractor to organize the golf tournament. However, the charity should maintain control over all the funds received from the event and over any receipts issued. For more information, see Policy commentary CPC-026, Third-party fundraisers.

- If an organization advises a charity that they held a golf tournament on its behalf, can the charity issue receipts to the attendees?

No. When an activity is carried on that a charity is not aware of, it is not an activity of the charity, so the charity cannot issue receipts. However, as mentioned above, a charity can hire a third-party organization as an agent to carry on activities on its behalf.

Related links

References

Page details

2021-05-05