Reporting social assistance income

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

Reporting social assistance income

Pre-test question

Sorry, that is incorrect

Although these payments are not taxable, they must be reported on a tax return because they help determine an individual’s eligibility for certain benefits such as the guaranteed income supplement (GIS), the goods and services tax/harmonized sales tax (GST/HST) credit and the Canada child benefit (CCB).

That is correct

Although these payments are not taxable, they must be reported on a tax return because they help determine an individual’s eligibility for certain benefits such as the guaranteed income supplement (GIS), the goods and services tax/harmonized sales tax (GST/HST) credit and the Canada child benefit (CCB).

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Nathan and Sophia are common-law partners who live together and received social assistance payments in 2025. Nathan also has an interest payment to report.

| Category | Information |

|---|---|

| Name | Nathan Kearns |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth (DOB) | September 21, 1989 |

| Marital status |

Common-law with: |

Required slips

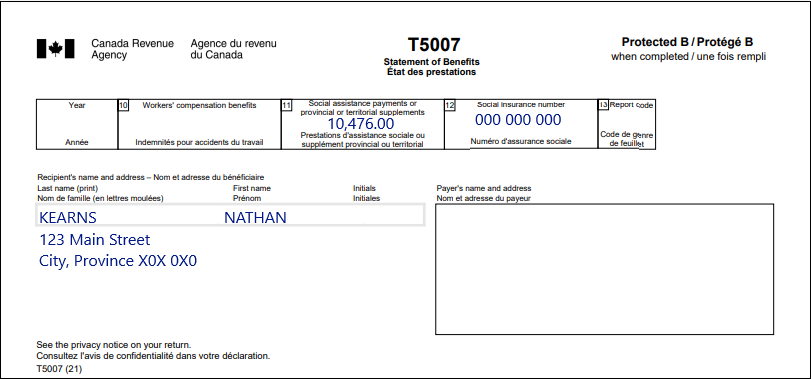

T5007 – Statement of Benefits (for Nathan)

T5007 – Statement of benefits

Protected B

Recipient’s name and address:

Last name: Kearns

First name: Nathan

123 Main Street

City, Province X0X 0X0

Box 11: Social assistance payments or provincial or territorial supplements: 10,476.00

Box 12: Social insurance number: 000 000 000

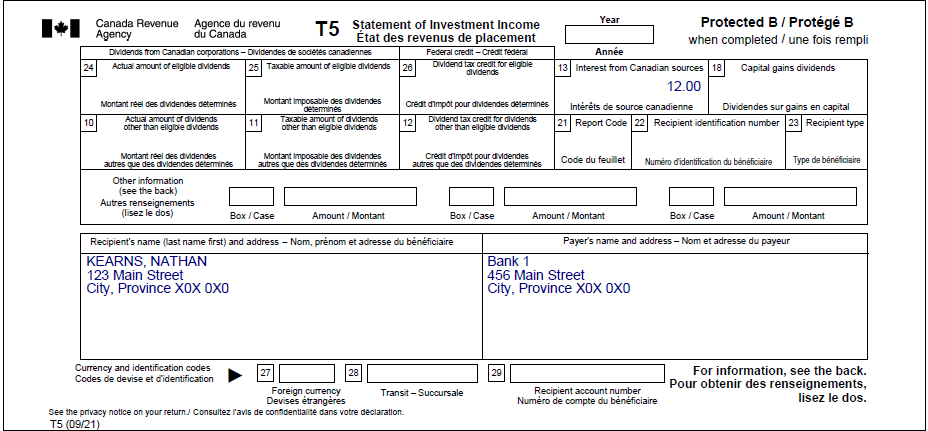

T5 – Statement of Investment Income (for Nathan)

T5 – Statement of Investment Income

Protected B

Recipient’s name and address:

Kearns, Nathan

123 Main Street

City, Province X0X 0X0

Payer’s name and address:

Bank 1

456 Main Street

City, Province X0X 0X0

Box 13: Interest from Canadian sources: 12.00

T5007 – Statement of Benefits (for Sophia)

T5007 – Statement of Benefits

Protected B

Recipient’s name and address:

Last name: Kearns

First name: Sophia

123 Main Street

City, Province X0X 0X0

Box 11: Social assistance payments or provincial or territorial supplements: 9,120.00

Box 12: Social insurance number: 000 000 000

Review your results

Solution to Reporting social assistance income.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Social assistance payments (T5007)

- Click Interview setup in the left-side menu

- Tick the box next to Social assistance, worker’s compensation (T5007/RL-5) in the Employment and other benefits section

- Click Social assistance, worker’s compensation in the left-side menu

- Click the + sign next to T5007 – Workers’ compensation benefits, social assistance, etc. (federal lines 14400, 14500, 14600)

- Enter the amounts from the tax slip

- Select Yes for the question Did you live with your spouse or common-law partner when you received the social assistance benefits?

- Select Family head from the Select the person whose name appears on the slip drop-down menu

Interest and other investment income (T5)

- Click Interest, investment income and carrying charges in the left-side menu

- Click the + sign next to T5 – Investment income in the Income from a T-Slip section

- Enter the amounts from the tax slip

Social assistance payments (T5007)

- Repeat the same steps you did for Nathan except:

- Select Spouse of family head from the Select the person whose name appears on the slip drop-down menu

Takeaway points

- Social assistance payments are non-taxable. They are entered as income on the tax return but are subsequently deducted

- For common-law or married couples who are living together and receiving social assistance payments, the individual with the higher net income must report all of the payments

- the net income calculation does not include the social assistance payments (line 14500), child care expenses (line 21400) or social benefit payments (line 23500)

- since Nathan’s net income before the social assistance payments is $12 and Sophia’s is $0, the software automatically reports each individual’s social assistance payments on Nathan’s tax return

- if both individuals have the same net income, the amounts are reported on the tax return for the individual whose name is on the tax slip

Page details

2025-09-26