ISG

Overview

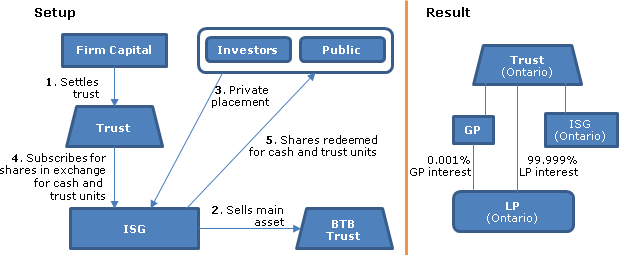

With a view to all the common shareholders of ISG becoming the unitholders of the Trust, which is expected to be a REIT, ISG will sell its sole real estate asset and then, under a CBCA Plan of Arrangement, each ISG common shareholder will have the option of redeeming its shares for cash or for units of the Trust, so that following the Plan of Arrangement, ISG will be wholly-owned by the Trust.

Sale and Funding of ISG and Trust

TSXV-listed ISG will sell its property to BTB Acquisition and Operating Trust for a purchase price of $10.3M to be satisfied by the assumption of a $6.5M mortgage, and cash as to the balance. Immediately before the effective time of the Plan of Arrangement, a private placement of common shares of ISG will close, raising between $4M and $15M. Firm Capital Asset Management will capitalize the Trust immediately before the Plan of Arrangement by subscribing for units at $5.00 per unit. In addition, ISG reduces its stated capital so as to be able to satisfy the CBCA solvency test.

Arrangement

Under the Plan of Arrangement:

- ISG's management incentive pool will be terminated through cash payments or common share issuances

- the Trust will subscribe for common shares of ISG. The subscribed property will be cash and Trust units so as to satisfy the redemptions of ISG common shares for cash and Trust units described below

- each ISG common share (other than private placement shares and any dissenters' shares - and presumably also excluding common shares held by the Trust, although the Plan does not say this) will be redeemed in exchange for one of two options at the shareholder's election: (i) cash (estimated at $0.170 per share); or (ii) Trust Units based on an exchange ratio of 0.035 Trust units for each common share (thereby valuing the units at $5.00 per unit and the redeemed common shares at $0.175 per share - i.e., $0.005 more than the cash redemption price)

- the private placement common shares of ISG will be redeemed by it for Trust units, using the same exchange ratio

- each outstanding option under ISG's stock option plan will be exchanged for a fully-vested replacement option to purchase Trust units, whose number is reduced to reflect the exchange ratio, and at an exercise price that is correspondingly increased

- dissenters' ISG common shares will be transferred to the Trust

The cash redemption price represents an estimated 283% premium to the pre-announcment trading price.

The Trust

The Trust is intended as a new real estate venture that, for tax purposes, will be an open-ended mutual fund trust that is listed on the TSXV and that will acquire a diversified portfolio of commercial assets (with target leverage of 60% to 65% of gross book value). It has an option to acquire five retail properties located in Ontario and Nova Scotia.

Management

The Trust will be managed by Firm Capital Realty Partners Inc., as asset manager, and Firm Capital Properties Inc., as property manager. The property manager will receive a management fee ranging from 2% to 4.25% of gross revenue, and commercial leasing fees and commercial leasing renewal fees ranging from 0.5% to 3% of net rental payments; and a tenant improvement fee of 5% of the related cost. The asset manager will be entitled to management fees ranging from 0.50% to 0.75% of gross book value; acquisition fees ranging from 0.50% to 0.75% of the properties' cost; performance incentive fees equal to 15% of distributable income once distributable income exceeds $0.36 per Trust unit; and a 0.25% financing fees.

Distributions

Monthly, at 85% to 95% of distributable income.

Canadian tax consequences

No deemed dividend is expected based on the paid-up capital per ISG common share exceeding the cash or Trust unit redemption amounts. The superficial or suspended loss rules may apply to capital losses otherwise arising to shareholders on the redemption of their ISG common shares.

The Trust is intended to qualify as a REIT.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Offerings - REIT, Trust and LP Offerings - Domestic REITs | Conversion of ISG to a REIT (Firm Capital Property Trust): s. 84(3) redemption of shares for cash or REIT units | 100 |