First Capital

Overview

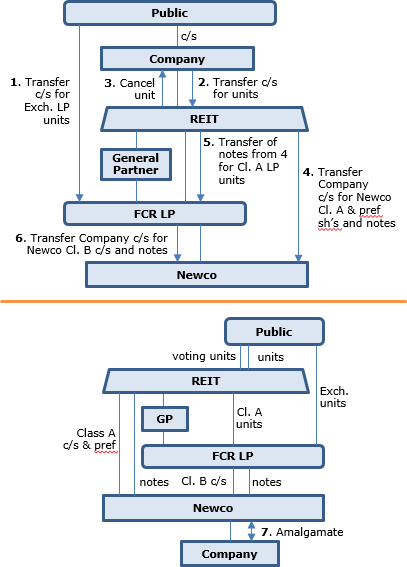

The Company will be converted into a REIT, scheduled to occur on December 30, 2019 under a Plan of Arrangement. The shareholders will transfer their shares of the Company on a taxable basis in exchange for units of a newly-formed Ontario unit trust (the REIT) – except that those who legitimately seek rollover treatment under s. 97(2) can elect to receive exchangeable units of a newly-formed subsidiary Ontario LP of the REIT (FCR LP). The number of exchangeable LP units that may be issued is capped at 20% of the currently outstanding number of common shares of the Company. The REIT and FCR LP then transfer (under s. 85(2) in the case of FCR LP) their common shares of FCR to a Newco in consideration for notes and shares of Newco. In addition to other tidying-up steps, Newco then amalgamates with FCR.

The final structure portrayed in the Circular is of the REIT holding Amalco directly and through FCR LP. The exchangeable units of FCR LP must be exchanged by December 23, 2023.

As part of the steps, the REIT will become bound by the terms of the Company’s Debenture Indenture, with the Company (then Amalco) remaining as a co-principal debtor, but being released from numerous covenants. The common shares held by FCR LP and the REIT in Amalco will be retractable.

The Company

The Company, an OBCA corporation listed on the TSX, is one of Canada’s leading developers, owners and operators of mixed-use urban real estate located in Canada’s most densely populated centres. The Company currently owns interests in 166 properties, totaling approximately 25.1 million square feet of gross leasable area. The Company has one principal subsidiary, First Capital Holdings Trust, a 100% owned trust established under the laws of the Province of Ontario, which had total assets amounting to more than 10% of the consolidated assets of the Company as at June 30, 2019 or total revenues amounting to more than 10% of the consolidated revenues of the Company as at June 30, 2019. Gazit-Globe Ltd. and affiliates reduced its interest in the Company in April 2019 from 31.3% to 9.9% through a secondary offering of 22 million instalment receipts, and from there to 6.7% in December 2019.

The REIT

The REIT is an unincorporated, open-ended real estate investment trust established pursuant to the REIT Declaration of Trust under the laws of the Province of Ontario in order to succeed to the business of the Company following the Arrangement. The Company has formed the REIT and has subscribed for one REIT Unit for $10.

FCR LP and Newco

In order to effect the Arrangement, the REIT incorporated the General Partner of FCR LP, the General Partner and the REIT formed FCR LP (an Ontario limited partnership); and FCR LP formed Newco. The FCR LP Agreement provides for Class A LP Units, which are held by the REIT, and Exchangeable LP Units, which are exchangeable for and intended to be economically equivalent to REIT Units.

Exchangeable LP Units

Any Exchangeable LP Units outstanding on December 29, 2023 will be automatically exchanged for REIT Units, unless the exchange would jeopardize the REIT’s status as a “mutual fund trust” or “real estate investment trust” under the Tax Act or cause or create significant risk that the REIT would be caused to be subject to tax under s. 122(1)(b).

Special Voting Units

Special Voting Units are only issued in tandem with Exchangeable LP Units and are not transferable separately from the Exchangeable LP Units to which they relate, and, upon any valid transfer of Exchangeable LP Units, such Special Voting Units will automatically be transferred to the transferee of the Exchangeable LP Units. As Exchangeable LP Units are exchanged for REIT Units or redeemed or purchased for cancellation by FCR LP, the corresponding Special Voting Units will be cancelled for no consideration.

Ancillary Rights and Exchange and Support Agreement

Ancillary Rights means, in respect of an Exchangeable LP Unit, the rights to exchange that unit under the Exchange and Support Agreement with inter alia the REIT.

Election to receive Exchangeable LP Units

Shareholders (other than Excluded Shareholders and Dissenting Shareholders) may elect, subject to Election Deadline of 5:00 p.m. (Toronto Time) on December 6, 2019 and other limitations, to receive Exchangeable LP Units as consideration for all or a portion of their Common Shares. An Excluded Shareholder is a Shareholder (a) that is not a “taxable Canadian corporation” under the Tax Act; or (b) that would acquire Exchangeable LP Units as a “tax shelter investment” for the purposes of the Tax Act; or (c) an interest in which is a “tax shelter investment” for the purposes of the Tax Act. If the total number of Exchangeable LP Units elected is greater than the Maximum Number of Exchangeable LP Units (of 20% of the number of outstanding Company Common Shares), Exchangeable LP Units will be allocated on a pro rata basis. Any Common Shares not transferred in consideration for Exchangeable LP Units will be transferred to the REIT in consideration for REIT Units.

Distribution policy

The REIT intends to make monthly cash distributions to Unitholders and, through FCR LP, holders of Exchangeable LP Units, initially equal to, on an annual basis, $0.86 per REIT Unit, which is the same annual dividend currently paid by the Company.

Plan of Arrangement steps

- The Common Shares held by Dissenting Shareholders shall be transferred to the Company.

- Common Shares of the Company in respect of which an Electing Shareholder has validly elected to receive an Exchangeable LP Unit (except any such Common Shares exceeding the Shareholder’s pro rata allocation of the Maximum Number of Exchangeable LP Units of 20% if the outstanding Common Shares) will be transferred to FCR LP in consideration for Exchangeable LP Units and related Ancillary Rights based on the Exchange Ratio.

- Common Shares not transferred to the Company or FCR LP above will be transferred to the REIT in exchange for REIT Units issued by the REIT based on the Exchange Ratio of 1-for1.

- Upon the transfer of Common Shares to FCR LP, the former Electing Shareholder will be deemed to enter into the Exchange and Support Agreement among the REIT, the General Partner, FCR LP and each such owner of Exchangeable LP Units.

- The REIT will become bound by the terms of the Company’s Debenture Indenture, with the Company remaining as a co-principal debtor, but being released from numerous covenants.

- The one REIT Unit initially issued by the REIT to the Company will be cancelled for $10.

- The REIT will transfer all of the Common Shares held by the REIT to Newco in consideration for Newco Preferred Shares, subordinated non-interest-bearing promissory notes (the REIT NIB Note 1 and REIT NIB Note 2), and a number of Class A voting retractable common shares (“Newco Class A Common Shares”).

- FCR LP will transfer all of the Common Shares held by FCR LP to Newco in consideration for a subordinated non-interest-bearing note (the LP NIB Note), and a number of class B non-voting retractable common shares (“Newco Class B Common Shares”).

- The REIT will transfer REIT NIB Note 1 to FCR LP in consideration for Class A LP Units.

- The Deferred Share Unit Plan and each DSU shall be amended to remove the Company’s right to require the cash settlement of a DSU.

- Each Company Option will be exchanged for one Replacement Option of the REIT, and each DSU, RSU and PSU will be exchanged for one replacement unit.

- The stated capital of the Common Shares will be reduced to $1.

- Newco and the Company shall be amalgamated to form FCR Amalco. FCR Amalco’s share capital will be comprised of (A) Class A voting common shares that are retractable at the option of the shareholder, (B) Class B non-voting common shares that are retractable at the option of the shareholder, and (C) non-voting preferred shares redeemable and retractable at $1,000 per share having discretionary non-cumulative preferential dividends. On the amalgamation, each issued and outstanding share in the capital of the Company immediately prior to the amalgamation will be cancelled, and all of the Newco Class A and B Common Shares and Preferred Shares will become FCR Amalco Class A Common Shares, FCR Amalco Class B Common Shares and FCR Amalco Preferred Shares, respectively.

Canadian tax consequences

Ancillary Rights

A Holder that validly elects to receive Exchangeable LP Units in exchange for Common Shares under the Arrangement will also receive the Ancillary Rights. Such Holder will be required to account for these Ancillary Rights in determining the proceeds of disposition of such Common Shares and, where the Electing Shareholder files a s. 97(2) Tax Election Form, the cost under the Tax Act of the Exchangeable LP Units received in consideration therefor. The Company is of the view that the Ancillary Rights have a nominal fair market value.

S. 97(2) Tax Election

A Holder that validly elects to receive Exchangeable LP Units and the Ancillary Rights in exchange for Common Shares will, unless such Holder files a Tax Election Form under Subsection 97(2) of the Tax Act be considered to have disposed of such Common Shares for proceeds of disposition equal to the aggregate of (i) the fair market value at the Effective Time of any Exchangeable LP Units received by the Holder on the exchange, and (ii) the fair market value at the Effective Time of the Ancillary Rights received by the Holder on the exchange. A Holder that validly elects to receive Exchangeable LP Units and the Ancillary Rights in exchange for Common Shares, and that files a valid Tax Election Form pursuant to Subsection 97(2) of the Tax Act (and any corresponding form under provincial or territorial tax legislation), may thereby obtain a full or partial deferral of a capital gain otherwise arising on the exchange. FCR LP will sign such duly completed forms received from an Electing Shareholder within 30 days after the Effective Date and return them by mail to the Electing Shareholder for filing.

REIT status

Management has advised counsel that, beginning in its 2019 taxation year, the REIT will qualify for the REIT exception and, as currently structured, should qualify for the REIT exception for that taxation year and for each subsequent year.

Minto

Overview

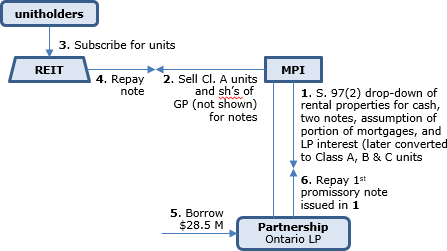

On July 3, 2018, the REIT completed an initial public offering in which unitholders are investing in a portfolio of rental properties formerly held by Minto Properties (MPI). This is being accomplished first by MPI transferring the portfolio (appraised at $1.179 billion) to a newly-formed wholly-owned LP (the Partnership) in consideration for cash, the assumption of a portion of the related secured debt, the issuance of two promissory notes and for a partnership interest that then will be converted into “common” Class A units, exchangeable Class B units and “preferred” Class C units, with MPI then selling its Class A units to the REIT for a note that is repaid out of the IPO proceeds. The Class C units (valued at $233 million) are intended to service the secured debt that was retained by MPI. This approach to deal with excess boot issues was also used in the Melcor and CT REIT IPOs.

The REIT and Initial Properties

The REIT has been formed as an Ontario unit trust to own and operate, through an Ontario limited partnership (the ‘‘Partnership’’), a portfolio of income-producing multi-residential rental properties located in urban markets in Canada.

Initial Properties

The REIT will initially indirectly acquire a portfolio of 22 multi-residential rental properties, comprising an aggregate of 4,279 suites, located in Toronto, Ottawa, Calgary and Edmonton (collectively, the ‘‘Initial Properties’’). Altus Group Limited has estimated the aggregate market value of the Initial Properties on a portfolio basis to be $1.179 billion, including a portfolio premium of 5%.

Minto

The Initial Properties are currently owned and operated by Minto Properties Inc. (‘‘MPI’’) which is part of the Minto Group of companies (collectively, ‘‘Minto’’), Since its inception in 1955, Minto has built more than 85,000 new homes, and it currently manages over 13,000 residential suites and a commercial portfolio of more than 2.5 million square feet of office and retail space; and it has more than 1,100 full-time employees in Canada and the U.S.. Minto also has a current development pipeline of approximately $800 million and approximately 1,500 residential rental suites.

Retained Interest Holder

Minto Partnership B LPO, an Ontario LP wholly-owned by MPI.

Management

The REIT will, through the Partnership, employ an experienced executive and operational team of real estate professionals, comprised of former Minto employees and employees who will be dually employed by the REIT and Minto.

Distributions

The REIT intends to pay predictable and sustainable monthly cash distributions at an initial estimated annual amount of $0.41 per Unit, which will provide Unitholders with an approximate cash distribution yield ranging from approximately 2.83% and a payout ratio of approximately 65% of forecast AFFO of the REIT for the Forecasted Period.

Further acquisitions of Minto properties

Pursuant to the Strategic Alliance Agreement, the REIT will have a right of first opportunity (the ‘‘ROFO’’) on multi-residential acquisition and investment opportunities identified by Minto (other than Excluded Opportunities) as well as on any after-acquired opportunity of Minto declined by the REIT pursuant to the ROFO (each, a ‘‘Subsequently Owned Property’’) that is wholly owned directly or indirectly by Minto and that Minto desires to sell, as it is Minto’s intention to have the REIT be the sole vehicle for all of its Canadian income producing multi-residential holdings over time, pursuant to the Strategic Alliance Agreement Minto will endeavour to facilitate an acquisition by the REIT of the Existing Interests or any Subsequently Owned Property that is not subject to a ROFO (collectively, the ‘‘Minto Interests’’). In addition, given Minto’s long-standing relationship with its institutional partners, the REIT also may have a competitive advantage in acquiring the interests of Minto’s institutional partners in co-owned and partnership assets in the future as third party institutional investors periodically review their liquidity alternatives.

Retained Debt and matching Class C Units

MPI will retain a portion of the debt in an approximate amount of $229.8 million (the ‘‘Retained Debt’’). The Retained Debt is secured by a charge on certain of the Initial Properties. The Retained Debt will not be assumed by the Partnership and will remain as indebtedness of MPI. In respect of the Retained Debt, an entity wholly-owned and controlled by MPI will hold Class C Units of the Partnership on which it will receive priority distributions. The Class C Units have been designed to provide MPI with an indirect interest in the Partnership that will entitle the holder of the Class C Units to distributions, in priority to distributions to holders of the Class A Units, Class B Units or GP Interest in an amount, if paid, expected to be sufficient (without any additional amounts) to permit MPI to satisfy amounts payable in respect of principal, interest or any other amount owing under the Retained Debt. As additional security for the Retained Debt, the holder of the Class C Units may pledge the Class C Units to the lenders of the Retained Debt.

Class B Units

The Retained Interest Holder will own, in the aggregate, approximately 22.9 million Class B Units, representing an aggregate approximate 62.4% ownership interest in the REIT or approximately 56.8% if the Over-Allotment Option is exercised in full (in each case, determined as if all Class B Units are exchanged for Units). The Class B Units will be economically equivalent to and exchangeable for Units of the REIT (on a one-for-one basis subject to customary anti-dilution adjustments). The REIT will issue Special Voting Units in connection with the issuance of the Class B Units, each of which will carry one vote per Special Voting Unit. The Retained Interest Holder will therefore be entitled to nominate three of the seven Trustees of the REIT. For so long as Michael Waters is the Chief Executive Officer of the REIT, he will comprise one of the Retained Interest Holder’s nominees.

Capitalization

Immediately following Closing, the Debt to Gross Book Value Ratio of the REIT is expected to be as follows:

Assumed Debt . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 239,145

Class C Units. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 233,282

Unsecured promissory note . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,797

Principal amounts outstanding under the Credit Facility . . . . . . . . . . . . . . . .. . . . . 28,458

Indebtedness . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 526,682

Gross Book Value . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,128,955

Debt to Gross Book Value Ratio (inclusive of mark-to-market) . . . . . . . . . . . . . . . . 46.7%

Transaction steps

Prior to Closing

- MPI formed a number of wholly-owned entities, including Minto Apartment GP Inc. (the ‘‘General Partner’’), pursuant to the laws of Ontario, and the Partnership.

- MPI will transfer its beneficial interest in the Initial Properties to the Partnership in consideration for the Partnership assuming certain existing debt on the Initial Properties (but not the Retained Debt), paying cash of approximately $65.5 million (which the Partnership will obtain from refinancing certain of the Initial Properties), issuing two promissory notes in favour of MPI in the principal amount of $28.5 million and $25.7 million, respectively, and crediting the capital account of MPI’s limited partner interest.

- The General Partner will acquire legal title to the Initial Properties, either directly or indirectly through the acquisition of shares of a title nominee.

- MPI will complete the refinancing of the Retained Debt.

- The REIT’s initial declaration of trust will be amended and restated. The capital of the REIT will be comprised of Units and Special Voting Units (which Special Voting Units will be issued to the holder of Class B Units of the Partnership on a one-to-one basis).

- The limited partnership agreement of the Partnership will be amended and restated pursuant to which the limited partner capital of the Partnership will be restated to consist of Class A Units, Class B Units and Class C Units.

- In connection with the amendment and restatement of the Partnership limited partnership agreement), MPI will exchange its limited partner interest in the Partnership for Class A Units, Class B Units and Class C Units. Special Voting Units will be issued by the REIT to MPI in connection with the issuance of the Class B Units. MPI will transfer all of its Class B Units and Class C Units to entities wholly-owned and controlled by MPI.

- On the day prior to Closing, MPI will sell all of its Class A Units in the Partnership and the shares of the General Partner to the REIT for a non-interest bearing promissory note (the ‘‘Acquisition Note’’), and a further non-interest-bearing promissory note whose amount is equal to the purchase price for some of the Initial Properties that have not yet been leased up of $8.356.000, subject to downward adjustment based on the appraisal-based capitalization of the income generated on lease-up.

The Offering

- The REIT will complete the Offering.

- The REIT will use the net proceeds from the Offering to repay the Acquisition Note in full.

- The two Units held by the initial Unitholder of the REIT will be redeemed for $20.

- The Partnership will draw on the Credit Facility to pay the $28.5 million note issued in ii.

Exchange Agreement

In connection with Closing, the REIT, the Partnership and the Retained Interest Holder will enter into the pursuant to which the Retained Interest Holder will be granted the right to require the REIT to exchange each Class B Unit held by the Retained Interest Holder for one Unit, subject to customary anti-dilution adjustments. Upon an exchange, the corresponding number of Special Voting Units will be cancelled.

Unit redemption rights

Upon receipt of the Redemption Notice by the REIT, all rights to and under the Units tendered for redemption shall be surrendered and the holder thereof will be entitled to receive a price per Unit (the ‘‘Redemption Price’’) equal to the lesser of:

(a) 90% of the ‘‘Market Price’’ of a Unit calculated as of the date on which the Units were surrendered for redemption (the ‘‘Redemption Date’’); and

(b) 100% of the ‘‘Closing Market Price’’ on the Redemption Date.

Cash payable on redemptions will be paid pro rata to all Unitholders tendering Units for redemption in any month. To the extent a Unitholder is not entitled to receive cash upon the redemption of Units as a result of any of the foregoing limitations, then the balance of the Redemption Price for such Units will, subject to any applicable regulatory approvals, be paid and satisfied by way of a distribution in specie to such Unitholder of Redemption Notes or securities of a REIT subsidiary or other property of the REIT, as determined by the Trustees in their sole discretion.

Canadian tax consequences

An executive officer of the REIT has advised counsel that the REIT expects to qualify for the REIT Exception in 2018 and future years. The Partnership is expected to qualify as an “excluded subsidiary entity” at all relevant times.

Killam

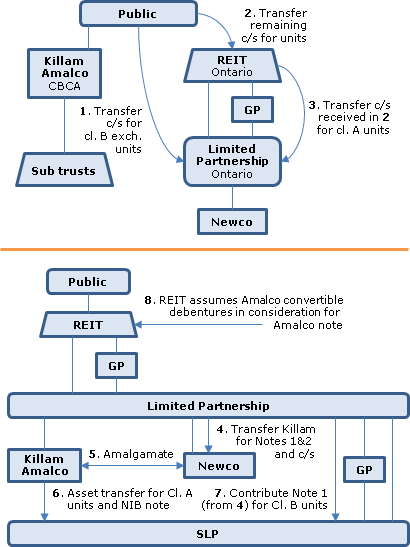

Overview. Killam will effectively be converted to a REIT. Most of its shareholders will exchange their shares for units of the REIT on a taxable basis. However, up to 20% of the shares may instead be exchanged on a s. 97(2) rollover basis for exchangeable units of a subsidiary LP into which Killam will be dropped, with the REIT backstopping the exchange obligations of the LP under an Exchange Agreement. In order that the subsidiary LP will be an "excluded subsidiary" (i.e., within a safe harbour from the SIFT rules), those electing rollover treatment must be taxable Canadian corporations (or certain other qualifying entities) - so that individuals wishing to elect would need to transfer their shares first to a holding company. Killam will then be transferred to a Newco for consideration including an interest-bearing note, followed by their amalgamation, in order to shelter the rental income of the properties now held by Killam through a lower-tier LP. Convertible debentures of Killam (bearing interest of around 5.5%) will be assumed by the REIT in consideration for the issuance of a note to it by Killam.

Killam. A TSX-listed CBCA corporation and one of Canada's largest residential landlords, owning, operating and developing multi-family apartments and manufactured home communities. It has issued two sets of convertible debentures bearing interest at 5.65% and 5.45%. It holds properties directly (registered in nominees) and through sub trusts.

The REIT. An Ontario unit trust.

Limited Partnership. Killam Apartment Subsidiary Limited Partnership, a subsidiary Ontario LP of the REIT of which it is a limited partner and a wholly-owned subsidiary (Killam Apartment General Partner Ltd.) is the general partner.

Newco. Killam SLP Acquisition Inc., a corporation to be incorporated under the CBCA.

SLP. Killam Apartment Subsidiary Limited Partnership, which will become an indirect subsidiary LP of Limited Partnership, with SLP GP as its general partner.

CBCA Plan of Arrangement.

- Each of Killam, Killam KFH (180 Mill St.) Inc., Killam KFH (Kanata Lakes) Inc., Killam KFH (1355 Silver Spear Road) Inc. and Redwood Cable Corp. will be amalgamated under the CBCA to form Killam Amalco.

- Each Common Share held by a validly dissenting shareholder will cease to have any rights as a Shareholder other than the right to be paid its fair value.

- Each Common Share held by an Shareholder who has validly elected to receive Exchangeable Units will be transferred to the Limited Partnership in consideration for one Exchangeable Unit of the Limited Partnership, and for the “Ancillary Rights” attached to such Exchangeable Units (mostly the embedded right granted to the holders of the Exchangeable Units to cause the Limited Partnership to exchange each Exchangeable Unit for one REIT Unit as supported by the Exchange Agreement, as well as special voting units of the REIT with no economic entitlement); a maximum of 20% of all Common Shares outstanding may be exchanged for Exchangeable Units, with pro ration occurring if this limit is engaged, and shareholders excluded from making the election include individuals, corporations other than taxable Canadian corporations and non-residents.

- Each remaining Common Share will be deemed to be transferred to the REIT in consideration for one REIT Unit.

- The REIT Unit held by the initial Unitholder will be cancelled for $10.00.

- Each Common Share held by the REIT will be transferred to the Limited Partnership in consideration for Class A LP Units valued at $1.00 per unit.

- The Limited Partnership's Common Shares will be transferred to Newco in consideration for an interest-bearing 10-year subordinated note and a non-interest-bearing subordinated note (Newco Note 2 and 1, respectively) and Newco common shares.

- Killam Amalco and Newco will be amalgamated under the CBCA to form Killam Amalco 2.

- Killam Amalco 2 will transfer its assets to SLP in consideration for Class A SLP Units (valued at $1.00 per unit), the assumption of liabilities and a subordinated, non-interest bearing, demand promissory note issued by SLP to Killam with a principal amount equal to the amount obtained (if positive) when the aggregate principal amount of the assumed liabilities is deducted from the aggregate cost amount of the transferred assets.

- The Limited Partnership shall subscribe for Class B SLP Units valued at $1.00 per unit, and in satisfaction of the aggregate subscription price, the Limited Partnership will contribute the Newco Note 1 to SLP.

- The initial Class A SLP Unit that was issued to Killam will be redeemed by SLP for $1.00.

- The REIT will assume all of the obligations under the Convertible Debentures in consideration for the issuance by Killam Amalco 2 to it of a subordinated note with equivalent principal and with other terms to be agreed.

- Each RSU will be continued.

Exchange Agreement. On Closing, the REIT, the Limited Partnership and the General Partner will enter into the Exchange Agreement, pursuant to which each holder of Exchangeable Units will be granted the right to require the Limited Partnership to exchange each Exchangeable Unit for one REIT Unit, subject to customary anti-dilution adjustments. In accordance with the Exchange Agreement, the REIT is required to deliver REIT Units to the Limited Partnership to assist the Limited Partnership in satisfying its obligations to the holders of Exchangeable Units.

Compulsory Exchange Right. The REIT and the Limited Partnership each have the right to compel an exchange (generally on a one-for-one basis) of all of the Exchangeable Units held at any time for REIT Units (or, at the option of the REIT, the cash equivalent thereof, based on the current market price), and with the corresonding Special Voting Units being cancelled.

Unit redemption feature. Upon receipt of the redemption notice by the REIT, all rights the REIT Units tendered for redemption shall be surrendered and the holder thereof will be entitled to receive a price per REIT Unit (the "Redemption Price") equal to the lesser of: (a) 90% of the "Market Price" of a REIT Unit calculated as of the date on which the Units were surrendered for redemption (the "Redemption Date"), being the weighted average trading price of a REIT Unit on its principal exchange during the period of 10 consecutive trading days ending on such date; and (b) 100% of the "Closing Market Price" on the Redemption Date, being an amount equal to the weighted average trading price of a REIT Unit on the principal exchange on that date. To the extent a Unitholder is not entitled to receive cash upon the redemption of REIT Units in light of a $50,000 monthly cap, the balance of the Redemption Price for such REIT Units will be paid and satisfied by way of the issuance to such Unitholder of "Redemption Notes."

DRIP. Upon Closing, Killam's current DRIP will be amended and restated to become the "New DRIP"), with the REIT assuming all of Killam's obligations under the DRIP. Pursuant to the New DRIP, Unitholders may elect to have all cash distributions of the REIT automatically reinvested in additional REIT Units at a price per REIT Unit calculated by reference to the weighted average of the closing price of REIT Units on the TSX for the five trading days immediately preceding the relevant Distribution Date. Unitholders who so elect will receive a further distribution of REIT Units equal in value to 3% of each distribution that was reinvested by the Unitholder.

Canadian tax consequences. Taxable exchange. A Shareholder who exchanges Common Shares for REIT Units pursuant to the Arrangement will be considered to have disposed of such Common Shares for proceeds of disposition equal to the fair market value at the Effective Time of such REIT Units acquired by the Shareholder.

Rollover exchange. An Electing Shareholder who elects to receive Exchangeable Units in exchange for Common Shares under the Arrangement will also receive the Ancillary Rights. Such Electing Shareholder will be required to account for these Ancillary Rights in determining the proceeds of disposition of such Common Shares and, where the Electing Shareholder files a Tax Election Form, the cost under the Tax Act of the Exchangeable Units received in consideration therefor. Killam is of the view that the Ancillary Rights have a nominal fair market value. There can be no assurance that the derivative exchange rules will apply to the exchangeable units. It will be the sole responsibility of each Electing Shareholder who wishes to make such an election to obtain the appropriate federal, provincial or territorial election forms and to duly complete and submit such forms to the Limited Partnership by the Election Deadline which is three business days prior to the shareholders' meeting and to subsequently file such elections. Detailed information regarding the filing deadlines will be posted on Killam's website at www.killamproperties.com/investorrelations/reit-information.

REIT/SIFT rules. It is assumed that each direct and indirect subsidiary of the REIT will be an excluded subsidiary entity and that the REIT will qualify under the REIT rules.

Automotive Properties

Overview

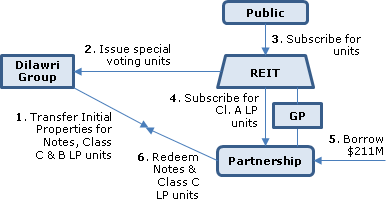

The Dilawri Group will transfer a portion of their Canadian automobile dealership properties (subject to leases back to them) to a subsidiary LP (the Partnership) of the REIT for Notes and Class C LP units (to be redeemed for cash shortly thereafter) and for Class B exchangeable LP units (which will be treated as debt for accounting purposes), with a s. 97(2) election being made. The public then will subscribe for conventional (s. 108(2)(a)) REIT units and the REIT will subscribe for (conventional) Class A LP units of the Partnership (which will be an excluded subsidiary partnership). Through their Class B LP Units (and corresponding special voting units of the REIT) the Dilawri Group initially will have a 60% interest in the REIT. The exchange right for their Class B LP units will be buttressed by a conventional exchange agreement between them, the Partnership and the REIT.

Dilawri Group

The largest automotive dealership group in Canada with revenues of $1.6 billion and owning 57 dealerships.

Partnership

Automotive Properties Limited Partnership

Initial Properties

26 commercial properties located in Ontario, Saskatchewan, Alberta and B.C. totaling approximately 958,000 square feet of gross leasable area. 24 are exclusively occupied by the Dilawri Group for use as automotive dealerships or, in one case, an automotive repair facility, while the other two properties are jointly occupied by the Dilawri Group (for use as automotive dealerships) and one or more third parties (for use as automotive dealerships or complementary uses, including restaurants). Full value of the Initial Properties on an "as completed" basis is between approximately $364.3 million and $371.3 million.

Leases

The Partnership will lease each Initial Property to the applicable member which, in the case of two of the properties will sublease the applicable portions to third parties. The rent from the portions of the Initial Properties occupied by the Dilawri Group will represent approximately 88% of the REIT's Cash NOI over the Forecast Period, with the portions of the Initial Properties occupied by the sublessees accounting for the remainder. The initial terms of the Dilawri Leases will range from 11 to 19 years, with a Cash NOI weighted average lease term of 15 years.

ROFO

Dilawri will be required to offer to sell to the REIT any property that is acquired or developed by a group member that is determined by Dilawri, acting reasonably, to be a "REIT-Suitable Property" (i.e., according with the REIT's investment guidelines). The Dilawri Group has, on average, opened or acquired five new automotive dealerships in each year for the last five years, including, on average, two to three automotive dealership properties.

Distributions

Monthly cash distributions, initially expected to provide Unitholders with an annual yield ranging from approximately 7.5% to 8.0% based on an AFFO payout ratio of approximately 90%. Approximately 100% of the monthly cash distributions in 2015 estimated to be tax-deferred.

Debt financing

The REIT anticipates having an Indebtedness to GBV ratio of approximately 56% immediately following Closing, bearing interest at a weighted average effective rate of approximately 3.2% (all of which will be fixed), with a weighted average term to maturity of approximately 5.1 years.

Administration Agreement

Dilawri will provide (subject to Board direction) the REIT with the REIT's President and Chief Executive Officer and Chief Financial Officer, as approved by the REIT, and other support services, including assisting the President and Chief Executive Officer and Chief Financial Officer with the standard functions of a public company. Dilawri will provide these services on a cost-recovery basis (or for a fixed fee of $700,000 during the Forecast Period.)IPO of Automotive Properties REIT

Transaction steps

Property transfer. On or before the day of Closing, the (Dilawri) Transferors will transfer their beneficial interests in the Initial Properties to the Partnership in consideration for a combination of Transferor Notes, Class B LP Units (with an equivalent number of Special Voting Units in the REIT) at the Offering Price of $10 or, in certain cases, other redeemable (Class C) partnership units in the Partnership at a price of $10.00 per such unit.

Use of proceeds

The REIT will use the Offering proceeds of approximately $__ million to pay some Offering expenses and to subscribe for Class A LP Units. The Partnership will use such proceeds together with advances of approximately $210.8 million under Credit Facilities, to pay the remaining Offering expenses, repay the Transferor Notes, redeem all of the Class C redeemable partnership units and redeem certain of the Class B LP Units from one or more of the Transferors at the Offering Price.

Resulting capitalization

Immediately following Closing, Unitholders' equity of the REIT (including the Partnership) is expected to be as follows:

Units $K

Unitholders Equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,500,000 65,180

Class B LP Units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9,872,200 98,720

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17,372,200 163,900

LTT

Deferred land transfer taxes are estimated at $1.8 million.

Class B and C LP Units

Each will be exchangeable at the holder's option for one REIT Unit, will be accompanied by a Special Voting Unit of the REIT, and will receive distributions of cash from the Partnership equivalent to those on the REIT Units. Each Class B LP Unitholder will enter into a voting trust agreement pursuant to which Dilawri will be granted sole voting control over the Class B LP Units and the associated Special Voting Units. The Class C limited partnership units of the Partnership can be redeemed by the holders or by the REIT LP at any time for a fixed amount of $10.00 per unit. The limited IAS 32 exception for presentation as equity does not extend to the Class B and C LP Units. As a result, they will be classified as financial liabilities.

Exchange Agreement

The REIT will agree with the Partnership and the Class B LP Unitholders to issue Units upon the exchange of Class B LP Units in accordance with their terms.

Canadian tax consequences

The REIT believes that it will meet the REIT Exception. The Partnership is expected to qualify as an "excluded subsidiary entity" at all relevant times. The UCC of the Initial Properties will be equal to the amounts jointly elected by the Partnership and the Dilawri Group and will be less its fair market value of such property.

CT/Canadian Tire

Overview

Offering to the public of 26.35M units by the REIT at $10 per unit (30.302M units with over-allotment). The REIT, an Ontario unit trust and s. 108(2)(b) closed end fund, will indirectly acquire the beneficial ownership of a Canadian real estate portfolio (43.3% in Ontario) by investing in a newly-formed Ontario limited partnership (the "Partnership") formed by three Canadian subsidiaries of Canadian Tire Corporation, Limited ("CT"), namely, Canadian Tire Real Estate Limited ("CTREL") and two LPs (such three subsidiaries, collectively "CTC"). The portfolio transferred by CTC to the Partnership (the "Initial Properties") will consist of 255 Canadian retail properties and one distribution centre, whose aggregate purchase price will be $3.53B and has been independently appraised at between $3.745B and $3.818B (corresponding to cap rates of 6.20% to 6.08%). CTC will hold (exchangeable) Class B LP Units and (preferred) Class C LP Units of the Partnership, as well as units of the REIT.

Canadian Tire

CT, which is TSX-listed, has a market cap of $7.6B. The Initial Properties represent approximately 72% (by square footage) of the real estate of CT.

CT-group tenants will generate 95.7% of rents. CTREL (and CT re the distribution centre) will enter into leases with the Partnership with staggered initial terms of 10 to 21 years (and with multiple options to extend the terms), and weighted average escalations of 1.5% p.a. At closing, the REIT will enter into a right of first offer agreement, and development agreement, with CT.

Structure

CT will hold an approximate 83.1% effective interest (assuming exercise of the over-allotment option) in the REIT, directly, and through the holding by CTC of Class B LP Units of the Partnership (and a matching number of special voting units of the REIT with nominal economic attributes), with CTC also holding Class C LP Units (see below). The Class B LP Units will be exchangeable on a one-for-one basis for REIT units, whose economics they will track. The REIT will hold Class A LP Units of the Partnership, together with the GP thereof, which will have a 0.001% profits interest.

Class C LP Units

The (non-voting) Class C LP Units of the Partnership will consist of nine series, each with a par value of $200M and with an aggregate par value of $1.8B and with distribution rates during their initial fixed rate period ranging from 3.5% (for the Series 1 and 2 maturing on 31 May 2015 and 2016) to 5.0% for the Series 6 to 9 (maturing between 31 May 2031 and 2038). The distribution entitlements are cumulative and have priority over the other classes of units. After each initial fixed rate period and every five year period thereafter, the holder of the series may elect a fixed rate (based on 5-year Canadian government yields plus a spread) or floating rate (a T-Bill yield plus 1/12 of the foregoing spread). At the end of each 5-year period the Class C LP Units are redeemable and retractable for their redemption amount (i.e., par value plus any unpaid distributions) and are also redeemable by the Partnership at any time after January 1, 2019 at the "Canada Call Price" (i) out of property sales proceeds, provided that the Series 1 shares are redeemed first (or that right is waived), or (ii) on a specified REIT change-of-control event. Such redemptions of Class C LP Units (other than upon a change of control at the REIT) can be settled at the option of the Partnership, in cash or an equivalent number of Class B LP Units.

Closing transactions

At closing:

- CTC will transfer its beneficial interest in the Initial Properties to the Partnership in exchange for (i) $263.5M, $597.1M, $409.4 and $200M of Class A LP Notes, Class B1 LP Notes, Class B2 LP Notes and Class C LP Notes, respectively, (ii) 48.6M Class B LP Units (accompanied by an equivalent number of Special Voting Units of the REIT) and (iii) 1.6M Class C LP Units

- The Partnership will repay (in sequence) its Class C LP Notes, Class B2 LP Notes and Class B1 LP Notes by issuing 0.2M Class C LP Units (resulting in 1,800,000 Class C LP Units being outstanding), 40.9M Class B LP Units with an equivalent number of Special Voting Units (resulting in $895.598M of Class B LP Units being outstanding) and 86.1M Class A LP Units to CTC, respectively

- CTC will then transfer its 86.1M Class A LP units to the REIT in exchange for a promissory note

- The REIT will issue 26.35M units under the offering for gross proceeds of approximately $263.5B units (reduced by costs estimated at $22.3M); (the underwriters have agreed that no units will be offered in the U.S. except under Rule 144A)

- The REIT will use $241.2M of the offering proceeds and issue 59.7M units in order to repay the promissory note owing to CTC (see two steps above), with the prospectus also qualifying such units

The Partnership will not own the shares of four nominee companies holding title to Initial Properties in Quebec.

Distributions

Monthly, of $0.054167 per unit ($0.65 per annum), estimated to be 90% of AFFO. Estimated tax deferred percentage of 23% for 2014 (per preliminary prospectus). DRIP with 3% bonus distribution. Upon conversion of the request of Class B LP unitholders, the Partnership will adopt a similar DRIP for them (and they also may elect to receive distributions on the Class B LP Units in the form of REIT units).

Management

The REIT will have internal management. It will receive CTC services on a cost recovery basis, and CTREL will be the property manager.

Canadian tax disclosure

SIFT status. Management believes that the REIT will satisfy the REIT exception (per p.142), "throughout 2013 and beyond". The Partnership is expected to qualify as an excluded subsidiary entity. Management intends to ensure that the REIT satisfies the s. 108(2)(b) tests (p. 142).

Preferred units

In the event the REIT wishes to issue preferred units, it will seek a CRA ruling (p. 100).

Reduced UCC under s. 97(2)

Certain of the Initial Properties will be acquired on a rollover basis.

Choice/Loblaw

Overview

Offering of 60M units by the REIT at $10 per unit. The REIT, an Ontario trust and s. 108(2)(a) unit trust, will indirectly acquire the beneficial ownership of a Canadian real estate portfolio (38% in Ontario) by acquiring a newly-formed Ontario limited partnership (the "Partnership") from Canadian subsidiaries (the "Transferors") of Loblaw Companies Limited ("Loblaw"). The portfolio (the "Initial Properties") will consist of 425 properties, including 415 retail properties, with an appraised value (including a portfolio premium of 2% to 4%) of $7.25B to $7.40B (reflecting a cap rate of 5.92% to 6.04%). The Transferors will hold Class B exchangeable LP units and preferred Class C LP units of the Partnership. The parent of Loblaw, George Weston Limited ("GWL"), will hold 20M units of the REIT.

Loblaw

Loblaw, which is TSX-listed, has a market cap of $14.0B. Its majority shareholder is GWL, which is a Canadian public company. The Initial Properties represent approximately 75% of the real estate of the Transferors.

Loblaw-group tenants will generate 91% of rents. Loblaw will enter into a Strategic Alliance Agreement with the REIT for an initial term of 10 year (e.g., REIT right of 1st offer, REIT responsibility for expansion costs, Loblaw right of 1st lease, no supermarket leasing to competitors).

Structure

Loblaw (i.e., ignoring the 20M units of GWL) will hold an approximate 81.7% effective interest (assuming exercise of the over-allotment option) in the REIT, directly, and through the holding by the Transferors of Class B LP units of the Partnership (and a matching number of special voting units of the REIT with nominal economic attributes), with the Transferors also holding Class C LP units (see below). The Class B LP units will be exchangeable on a one-for-one basis for REIT units, whose economics they will track. The REIT will hold Class A LP units of the Partnership, together with the GP thereof, which will hold Class A GP units (representing a 0.001% profits interest).

Class C LP units

Class C LP units of the Partnership will be entitled to a fixed priority draw of 5% of their $925M value, distributed monthly and will have priority over the other clases of units. Upon the request of the Transferors, the Partnership will be obligated to redeem up to $300M, $330M and $325M, of the outstanding Class C LP units in 2027, 2028 and 2029. Both the Class C LP units and Class B LP units are treated as debt under IFRS.

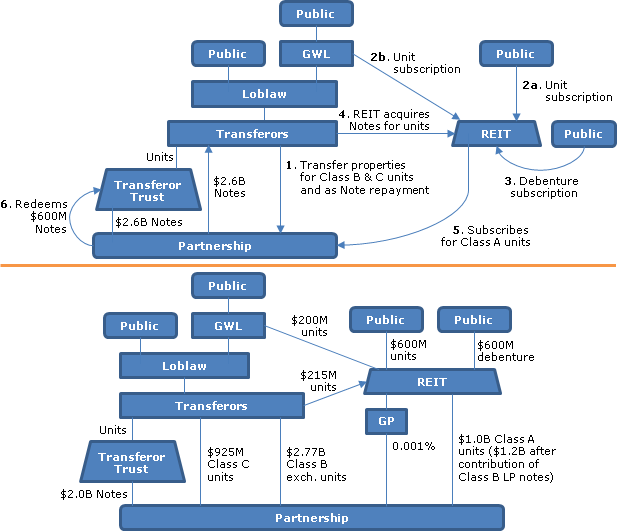

Closing transactions

At closing:

- The Transferors will subscribe for $2.6B of units of a new trust (the Transferor Trust) in exchange for the issuance by the Transferors to the Transferor Trust of $2.6B of "Transferor Trust Notes"

- The Partnership will acquire the Transferor Trust Notes from the Transferor Trust in consideration for the issuance by it of $2.6B of "Transferor Notes" (bearing interest at 3.24%) to the Transferor Trust

- The Transferors will transfer their beneficial interest in the Initial Properties to the Partnership "in exchange for the assignment" (i.e., as repayment) by them of the $2.6B of Transferor Trust Notes and in exchange for the issuance to them of $600M of Class A LP Notes, $215M of Class B LP Notes, 272M Class B LP units (accompanied on a one-for-one basis by Special Voting Units of the REIT) with a value of $2.72B, and 92.5M Class C LP units, with a value of $925M

- The REIT will issue 40M units under the offering, and 20M units to GWL, for gross proceeds of $600M; (the underwriters have agreed that no units will be offered in the U.S. except under Rule 144A)

- The REIT will issue (pursuant to a separate prospectus offering) $400M of Series A, and $200M of Series B, debentures bearing interest at 3.554% and 4.903%, respectively

- The REIT will acquire all the outstanding Class B LP Notes in exchange for 21.5M REIT units

- The REIT will transfer all the proceeds of the offering and of the 20M units issued to GWL, and contribute the Class B LP Notes, to the Partnership as subscription consideration for Class A LP units of the Partnership

- The Partnership will use $600M of the subscription proceeds received by it to redeem the Class A LP Notes

- The REIT will lend the $600M debenture proceeds to the Partnership, which will repay $600M of the Transferor Notes (with those proceeds presumably being distributed by the Transferor Trust to the Transferors)

Distributions

Monthly, of $0.054 per unit ($0.65 per annum), estimated to be 90% of AFFO. No estimate of tax deferred percentage. DRIP with 3% bonus distribution. Upon the request of a Class B LP unitholder, the Partnership will adopt a similar DRIP for them (and they also may elect to receive distributions on the Class B LP units in the form of REIT units).

Management

The REIT will have internal management. It will receive Loblaw services on a cost recovery basis, and Arcturus Realty Corporation initially will be the property manager for 150 of the properties.

Canadian tax disclosure

SIFT status. Per the Forecast, the REIT believes that it will satisfy the REIT exception for 2013 ("counsel will not review the REIT's compliance.") The Partnership is expected to qualify as an excluded subsidiary entity.

Reduced UCC under s. 97(2)

Per Risk Factors, the Initial Properties will be acquired on a rollover basis.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Other - DRIPs - Bonus Unit Plans | IPO of Choice Properties REIT (Loblaws real estate) | 268 |

Melcor

Overview

Offering of 8.3M units by the REIT at $10 per unit. The REIT, an Alberta unit trust, will acquire interests in a real estate portfolio by acquiring the Class A units of a subsidiary limited partnership (the "Partnership"). The portfolio (the "Initial Properties") will consist of 27 western-Canadian rental properties - mostly office (65%) and retail (31%) - with appraised and market values of $393M (reflecting a cap rate of 6.43%) and $407M, respectively. Melcor's current intention is offer to sell further properties to the REIT: nine rental "Retained Commercial Properties;" eight "Properties Currently Under Development," following stabilization; and properties that may be developed in the future. The REIT will be granted a related right of first offer and an acquisition option, including a right to purchase Melcor development properties at a 5% discount to appraised fair market value where it has provided mezzanine financing.

Melcor

Melcor, which is TSX-listed, had a market cap of $565 million on March 1, 2013. It apparently will maintain its listing. The Initial Properties represent the majority of the investment properties of Melcor, so that in effect it will mostly be a development company and an investor in the REIT.

Structure

Melcor will hold an approximate 55.5% (majority) interest (51.1% after any exercise of the over-allotment option) in the REIT through ownership (by a subsidiary LP – "Holdings LP") of all the Class B LP units of the Partnership (as well as an equivalent number of special voting units of the REIT with no economic attributes). It will also hold Class C LP units of the Partnership, which will track debt retained by it respecting some of the Initial Properties. The REIT will hold Class A LP units of the Partnership, together with the GP thereof, which will hold Class A GP units (representing a 0.001% profits interest).

Retained Debt/Class C units deferral structure

The consolidated indebtedness of $187M of the REIT at closing will include debt of $95M (the "Retained Debt") that is secured on some of the Initial Properties, but which will remain as Melcor debt rather than being assumed by the Partnership. Instead, Melcor will receive Class C LP units on the transfer of the Initial Properties to the Partnership, with preferred payments on the Class C LP units being in the amount of required interest and principal payments of Melcor on the Retained Debt. The Partnership will guarantee the Retained Debt; and Melcor will indemnify the Partnership and the REIT for any losses suffered by them if payments are not made on the Retained Debt (provided the Partnership services the Class C LP units).

Class C structure tax indemnity

The Class C LP units "achieve a deferral of certain income tax consequences" to Melcor (p. 53). In the event that capital gains are triggered on the (low basis) Class C LP units held by Holdings LP as a result of a distribution of sale proceeds of the Initial Properties (or a determination of the Partnership to reduce the level of Retained Debt), the Partnership will be required to make an additional distribution on the Class C LP units in an amount equal to the difference between (i) Melcor's estimated tax liability at the date of sale (or refinancing), and (ii) the net present value of the tax liability assuming such property had been held to the maturity of the existing mortgage (or that the Retained Debt had been held to maturity). (There is no disclosure of an existing arrangement to extend the Class C LP units structure beyond the maturity of the Retained Debt.)

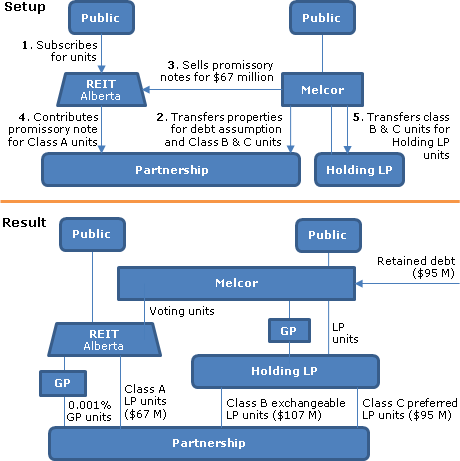

Closing transactions

At closing:

- The unit public offering will close for estimated gross proceeds of $83M

- Melcor and its subsidiaries will transfer the Initial Properties to the Partnership for the assumption of mortgages (excluding the Retained Debt) in the amount of $92.4M, Class B units (accompanied by the equivalent number of special voting units in the REIT), estimated in the forecast to have a value of $103.6M, Class C LP units in respect of the Retained Debt with a fair value of $96.5M, and a non-interest bearing demand promissory note for $63.7M (p. F-4).

- The REIT will use a portion of the proceeds of the public offering to purchase the promissory note, and then will contribute the promissory note to the Partnership in exchange for its Class A LP units

- Melcor will contribute its Class B and C LP units to Holdings LP under s. 97(2) in exchange for Holdings LP units

Subsidies

The purchase price otherwise payable by the REIT for the Initial Properties will be reduced by $3.6M, and the REIT will retain such amount to subsidize its interest payments on any debt with a coupon rate in excess of 4.0%. The purchase price will be further reduced by $0.8M and $1.7M, respectively, in order for the REIT to retain such amounts to subsidize (i) capital expenditures, and (ii) tenant improvements and lease costs.

Distributions

Monthly, of $0.05625 per unit, estimated to be 93% of AFFO. Estimated 25% tax deferred percentage for 2013.

Management

The REIT will be externally managed by Melcor.

Canadian tax disclosure

SIFT status. The REIT believes "based on the advice of one of its other external advisors" that it will satisfy the REIT exception for 2013. The Partnership is expected to qualify as an excluded subsidiary entity.

Reduced UCC under s. 97(2)

Because the Initial Properties will be acquired on a rollover basis, the initial tax deferred percentage will only be 25% notwithstanding distributions of 93% of AFFO (p. 138).

Withholding

Part XIII and XIII.2 withholding on distributions to non-residents.

FAM

Overview

The REIT, which initially will indirectly hold a portfolio of industrial, office and retail rental properties mostly in western Canada (23 out of 27) will acquire its initial properties through the acquisition of a property LP ("FAM LP") from Huntingdon Capital Corp. (Huntingdon"), which will hold an approximate 18% indirect interest in the REIT through exchangeable units in FAM LP, and also will be the manager.

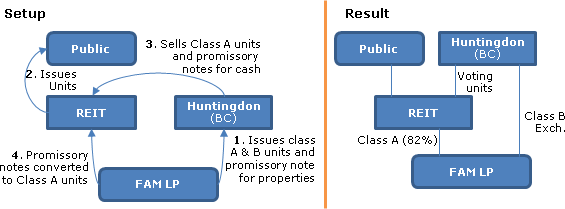

Structuring steps

- Huntingdon will directly or indirectly contribute its interests in the initial properties to FAM LP in consideration for Class A and B units, the assumption of $99.2M of mortgages and the issuance of a non-interest bearing promissory note of $9.2M

- The REIT will issue units under the offering for gross proceeds of $58.8M (before over-allotment) and use a portion of the proceeds to purchase Huntingdon's Class A units and promissory note - and will also issue special voting units to Huntingdon

- The Class B units will be amended to be exchangeable units (representing an approximate 27% interest if the over-allotment option is exercised) with the same economic entitlements as REIT units

- The REIT will contribute the promissory note to FAM LP in consideration for the issuance of additional Class A LP units

Distributions

Monthly distributions approximating 95% of AFFO (a yield of 7.5%). An optional DRIP with a 3% bonus distribution. Tax deferral percentage for 2013 is estimated to be 100%.

Management fees

Base management fee of 0.3% of gross book value; property management fees of 5% of gross revenues collected; acquisition fees of 1.0% ranging down to 0.50%; financing fees of 0.25%; leasing fees of 5.0% of base rent for all new leases and 2.0% for renewed leases; construction management fee of 5%

Tax disclosure

The REIT is expected to qualify as a REIT under both the current and proposed rules.

ISG

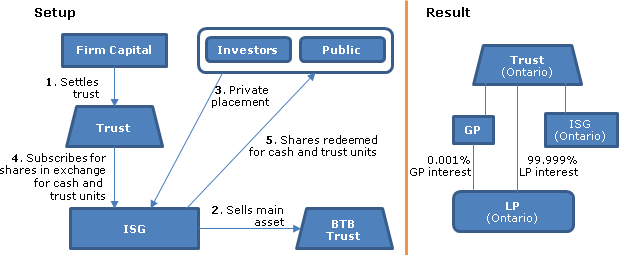

Overview

With a view to all the common shareholders of ISG becoming the unitholders of the Trust, which is expected to be a REIT, ISG will sell its sole real estate asset and then, under a CBCA Plan of Arrangement, each ISG common shareholder will have the option of redeeming its shares for cash or for units of the Trust, so that following the Plan of Arrangement, ISG will be wholly-owned by the Trust.

For further details

see the more detailed discussion under Spin-offs - S. 84(3) Redemption Spin-offs.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Spin-Offs & Distributions - S. 84(3) redemption spin-offs | Conversion of ISG to a REIT (Firm Capital Property Trust): s. 84(3) redemption of shares for cash or REIT units | 686 |

Dundee Industrial (Dream)

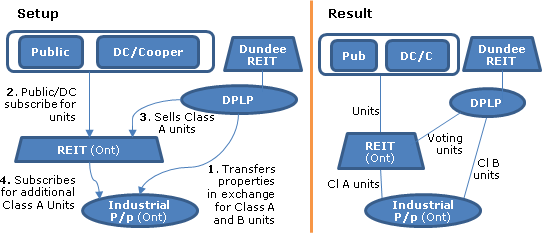

Open-end REIT/Exchangeable unit structure

The Toronto-headquartered REIT, which will be intended to qualify as an open-ended unit trust (so that its units will have conventionally market-discounted retraction rights) will hold the Class A units of a subsidiary LP ("Industrial Partnership"). Industrial Partnership, while owned by the vendors described below, will acquire direct or indirect interests in 86 light industrial rental properties located in Alberta and six other provinces, with an s. 97(2) election being made, in consideration for the issuance of Class A units and Class B exchangeable units to the vendors and the assumption of $295 million of mortgages. The Class A units then will be sold to the REIT (presumably relying on the Ontario land transfer tax 5% de minimis exemption).

In addition to their Class B exchangeable units, the vendors also will hold the equivalent number of special voting units directly in the REIT. The vendors are Dundee Properties LP ("DPLP"), which is the subsidiary LP of Dundee REIT, and direct or indirect subsidiary entities of DPLP. There is apparently no "sunset" provision on the exchange rights set out in the Exchange Agreement, except where the outstanding Class B unit fall below 1% of the initial number (or an extraordinary reorganization etc. event occurs which renders it impracticable to replicate the exchangeable structure). Certain "Piggy-Back Distribution" and "Tag/Drag" rights also are specified (p. 44).

Other funding/acquisitions

Dundee Corporation ("DC") and Michael Cooper will purchase 2,100,000 and 900,000 units, respectively, at the closing of the offering at the offering price of $10 per units. Cash raised from this source and from a credit facility will be used to purchase properties from LPs affiliated with Return on Innovation Capital Ltd. ("ROI"), as well as assuming $86 million in mortgages, for a total purchase price of $160 million.

Distributions

Based on an anticipated AFFO payout ratio of 90%, it is anticipated that 100% and 55% of 2012 and 2013 monthly distributions, respectively, will be tax deferred. Participants electing to receive cash distributions in units under the distribution reivestment and unit purchase plan will receive a further "bonus" distribution equal to 3% of the amount of each reinvested distribution - which also will be reinvested.

Management

A subsidiary LP of DPLP ("Management LP") will be the property manager and Dundee Realty Corporation ("DRC"), which is the asset manager for Dundee REIT and Dundee International REIT, will provide "overall" asset management services as well as strategic advice and administrative services. Six REIT trustees (all independent other than Cooper). Senior REIT management will be employees of DRC. A Deferred Unit Incentive Plan.

Canadian taxation

Management expects the REIT to qualify as a REIT for Canadian income tax purposes for 2012 and subsequently. Each direct or indirect subsidiary entity is expected to be an "excluded subsidiary entity" (and, therefore, not subject to SIFT tax).

As a result of the acquisition by Industrial Partnership of some of its buildings on a rollover basis, the undepreciated capital cost of such properities will be lower than fair market value, and potential recapture of depreciation will be increased.

Amounts received in excess of REIT income, including the further bonus distribution received under the DRIP, will not be included in a unitholder's income.

Income and capital gains distributions to non-residents will be subject to Part XIII withholding; and other distributions will be subject to Part XIII.2 withholding of 15%.

Brookfield Office

Overview

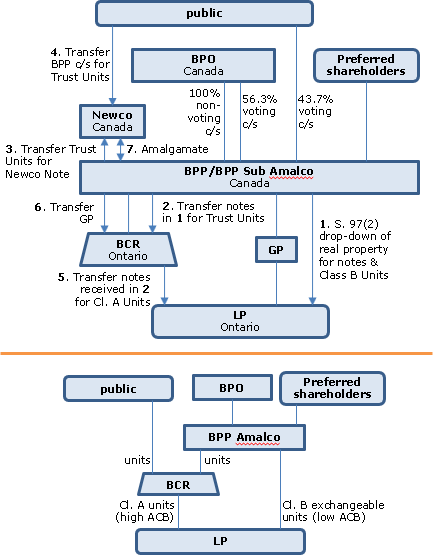

BPP and BPP Sub Amalco will effectively turn the cost amount of their realty assets into high basis notes and low basis Class B units of a newly-formed LP to which they drop-down those properties, and then exchange those notes for units of a newly-formed REIT (BCR). BCR, in turn, transfers its notes to the new LP for high basis Class A LP units. BPP Sub Amalco transfers its BCR units to a new indirect sub (Newco) of the majority shareholder of BPP (BPO), and Newco acquires the BPP shares of the public in exchange for BCR units. Newco and BPP then amalgamate.

These mechanics require that the notes equla the FMV of the purblic's BPP shares. Perhaps in order to ensure that having LP issue notes in this amount does not generate gain, there is a preliminary transfer of a significant asset (Brookfield Place) to a predecessor of BPP Sub Amalco. Since these mechanics also entail an exchange with a sub of BPO (Newco) rathr than a distribution by BPP, there are no deemed dividend issues. There is no indication that BCR is first seeded with 150 small investors in order to reduce Ontario LTT issues.

Current structure

Brookfield Properties Corporation (“BPO”) holds 56.3% of the common shares and 100% of the non-voting equity shares of BPP, the public held 43.7% of the common shares of BPP (representing approximately 10.3% of its equity) and preferred shareholders of BPP held various series of preferred shares. Certain of BPP’s subsidiaries amalgamated to form BPP Sub Amalco.

Preliminary transactions

Substantially all of BPP’s existing subsidiaries will be amalgamated with the indirect wholly-owned subsidiary of BPO owning a major real estate asset (Brookfield Place) to form a new entity (“BPP Sub Amalco”).

The “BPP Entities,” including BPP and BPP Sub Amalco, transferred real property assets (including real estate partnership interests) on a s. 97(2) rollover basis to a newly-formed LP (Brookfield Office Properties Canada LP) for interest-bearing demand promissory notes of such LP, and Class B LP Units of such LP, and for the assumption of liabilities and Special Voting Units of BCR. ON completion of the Arrangement, the Class B LP Units are exchangeable for Trust Units.

CBCA Plan of Arrangement steps

- The BPP Entities will transfer the LP notes to BCR in exchange for Trust Units.

- BPP Sub Amalco will transfer the Trust Units (to be distributed to the public in 3 below) to a newly-incorporated indirect CBCA subsidiary of BPO (“Newco”) in exchange for a demand interest-bearing note of Newco (the “Newco Note”).

- Each BPP common share held by the public will be acquired by Newco for one Trust Unit.

- BCR will transfer the notes received in 1 to Brookfield Office Properties Canada LP in exchange for Class A LP Units.

- Brookfield Office Properties Canada LP will redeem the initial 100 Class A LP Units held by BPP Sub Amalco for $100.

- BPP will transfer the shares of the general partner of Brookfield Office Properties Canada LP to BCR for cash consideration.

- Newco and BPP will amalgamate, with each common and non-voting equity share (other than the common shares held by Newco) being converted into one common share of BPP Amalco, and each of the preferred shares being converted into the same number of preferred shares of the same series of BPP Amalco.

Canadian tax consequences

A resident shareholder of BPP disposing of BPP common shares will realize a capital gain or loss based on the FMV of the Trust Units received in exchange. BCR is expected to qualify as a REIT.

RESREIT

Overview

Offering of 14.72M instalment receipt units ("Receipt Units") to be distributed to the public and of 4.95M (fully-paid) "LT/Greenwin Units" described below. A portion of the proceeds will be used to prepay $175M of rent under 35 year leases of eight apartment buildings to RESREIT.

Receipt Units

The initial instalment payable at closing is $6.00 per unit and the fianl instalment is $4.00 per unit payable on or before the first anniversary of closing. The Receipt Units will be pledged to secure the final instalment.

LT/Greenwin Units

Will be issued on closing to member of the Greenwin Properties Group and the Lehndorff Tandem Properties Group in partial payment for the initial portfolio.

RESREIT

Will be a closed-end mutual fund trust.

Purchase/Lease of Properties

The REIT will acquire 32 apartment buildings and one townhouse complex, for a total amount payable of $366M including assumed mortgages. For eight of the properties, RESREIT will acquire a leasehold interest and prepay rent (of $175.5M) at closing under a long-term lease (35-year term).

Distributions

$0.66 p.a. per Receipt Unit distributed monthly, estimated to be 78% tax-deferred for 1998.

Canadian tax consequences

The prepaid rent (totalling $127.5M will be deducted on a straight-line basis (an annualized deduction of $3.6M). RESREIT is of the view that rights under the Rights Plan have no value., so that no amount should be allocated to it.