Please note that the following document, although believed to be correct at the time of issue, may not represent the current position of the CRA.

Prenez note que ce document, bien qu'exact au moment émis, peut ne pas représenter la position actuelle de l'ARC.

Prinicipal Issues: CRA's guidance on impact of reorganization on safe income.

Position: See below.

Reasons: See below.

2020 CTF Annual Conference

CRA Roundtable

Question 3: Safe Income on Reorganization

Question 3: Safe Income on Reorganization

What guidance can the CRA provide regarding the impact of reorganizations on safe income?

CRA Response

This is a very complex issue that has not been addressed before. Since the legislation on safe income is relatively minimal, the CRA recognizes its stewardship role in this area, as it is essential to provide taxpayers and their advisors with guidance and tools to better fulfill their tax obligations.

The entitlement to safe income hinges on whether the income earned or realized could “reasonably” be considered to contribute to the accrued gain on the shares, the theory being that the income earned or realized by the corporation could somehow contribute to the increase in the value of the shares and, since such income earned or realized has already been subject to tax, a dividend paid by the corporation that reduces the portion of a capital gain on a share that represents such increase should not be subject to additional tax.

The concept of safe income is paramount because the safe income allows for tax-free distributions between corporations since income already subject to tax inside a corporation should not again be subject to tax upon distribution. Furthermore, corporations should not be allowed to make tax-free distributions that have a purpose of reducing value or increasing cost when the money used for such distribution or the money received on such distribution, has not been or will not be subject to tax anywhere. So, a proper calculation of safe income would help avoid double taxation as well as non-taxation. It is recognized by Kruco that

[45] It is apparent from this brief analysis that Brown and McDonnell correctly identified the intent behind subsection 55(2) when they wrote the passage quoted by the Tax Court Judge at paragraph 82 of his reasons: The intent of subsection 55(2) is to permit a tax-free, inter-corporate dividend to be paid to reduce a potential capital gain to the extent that the gain is attributable to the retention of post-1971 income. Conversely, it is intended to block a dividend payment that goes beyond this amount to reduce capital gains attributable to anything other than retained post-1971 income.

To repeat, the main crux of the safe income determination is contained in two words of paragraph 55(2.1)(c): “reasonably” and “contribute.” A proper understanding of those two words, based on the respect of the scheme of subsection 55(2), is therefore crucial.

The CRA views on safe income follow the textual, contextual and purposive interpretation principles. They are not just a one-sided and self-serving interpretation of the rules. In the examples provided below, the CRA strives to be balanced and reasonable in its approach, in accordance with the corporate tax integration scheme, the concept of cost and the scheme of subsection 55(2) that prevents artificial creation or duplication of cost, and its willingness to consider solutions that avoid the loss of safe income to a taxpayer. The approach is based on the same principles that guided the response to Question 1 and the reasoning previously provided in documents 2016-0671501C6 and 2018-0780071C6.

As discussed in Question 2, the safe income can be consolidated. Safe income realized by a corporation will be referred to as “direct safe income” (“DSI”) while safe income consolidated from another corporation will be referred to as “indirect safe income” (“ISI”).

As a summary of the examples provided below, where an internal reorganization is effected on a pure rollover basis (i.e., all the properties are transferred at cost amount), the principles to be retained are the following:

- DSI of a transferor or a transferee is to be determined based on the proportion of cost amount of property retained by the transferor or transferred to the transferee and not based on the proportion of shares or accrued gain on the shares transferred.

- ISI of a transferor or a transferee is to be determined based on the proportion of ISI retained by the transferor or transferred to the transferee. The ISI retained or transferred is based on the subsidiaries that are retained or transferred.

- In certain circumstances as illustrated in Examples 3 and 4, it would be appropriate to stream the ACB of the shares held by a shareholder in a transferor corporation into shares that are to be transferred to a transferee corporation although, as a general rule, ACB should not be streamed prior to an internal reorganization since streaming could be abusive in certain circumstances and could be challenged by the CRA.

Where a transfer of shares is made at an elected amount higher than cost amount, the DSI and ISI that are to be transferred to the transferee corporation may be viewed as having been capitalized in the adjusted cost base of the shares transferred and would have to be reduced accordingly.

Example 1 [basic example that illustrates split of DSI]

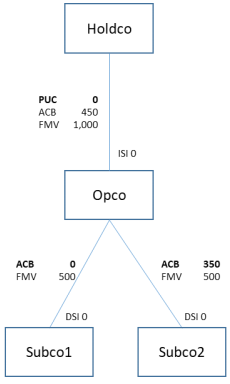

In this situation, Opco was wholly-owned by Holdco.

Opco realized an after-tax income of $1,000. The income is reflected in the cost of Asset 2 owned by Opco (i.e., Opco purchased the Asset 2 with the income realized, after tax). Thus, the DSI of Opco to Holdco was $1,000. The DSI of Opco contributed to the gain on the shares of Opco. There was an accrued gain of $2,000 on the shares of Opco held by Holdco.

Opco proceeded to spin out Asset 2 to Newco, a corporation that is wholly-owned by Holdco, in a reorganization that qualified for the paragraph 55(3)(a) exemption. To effect the spin-off, Holdco transferred shares of Opco with an ACB of nil and a FMV of $1,000 to Newco in consideration for shares of Newco. Opco then transferred Asset 2 to Newco in consideration for shares of Newco. The shares held by Newco in Opco and by Opco in Newco are redeemed for a note and the notes are cross-cancelled.

After the spin-off, Holdco owned shares of Opco with an ACB of nil and a FMV of $1,000 and Opco owned Asset 1 with an ACB of nil and a FMV of $1,000. Holdco also owned shares of Newco with an ACB of nil and a FMV of $1,000 and Newco owned Asset 2 with an ACB of $1,000 and a FMV of $1,000.

How should the safe income of Opco be allocated after the reorganization?

In this scenario, the Asset 2 with the ACB of $1,000 was transferred to Newco. The DSI of Opco was used to acquire the ACB in Asset 2. It would not be appropriate that the DSI of $1,000 or a portion thereof remains with the shares of Opco held by Holdco.

In this scenario, although 50% of the shares of Opco are transferred to Newco to achieve the reorganization, all the DSI of Opco held by Holdco has been transferred over to Newco because it is reasonable to view that the DSI of $1,000 contributes to the gain on the shares of Newco held by Holdco after the reorg and that the DSI of $1,000 does not contribute to any gain on the shares of Opco retained by Holdco since the unrealized gain remains in the assets retained by Opco. Therefore, the DSI of Opco held by Holdco is not prorated based on the accrued gain on the shares of Opco and Newco after the reorganization.

The formula to do the allocation of DSI would be as follows:

DSI on the shares of Newco: DSI of Opco prior to reorg X cost amount of assets transferred to Newco / total cost amount of assets of Opco prior to reorg

DSI on the shares of Opco after reorg: DSI of Opco prior to reorg X cost amount of assets retained by Opco / total cost amount of assets of Opco prior to reorg

Example 2 [basic example that illustrates split of ISI]

In this situation, Opco did not realize any income. The income was realized in Subco2. Thus, the DSI of Subco2 held by Opco was $1,000 and Holdco had an ISI of $1,000 in Opco (due to the DSI of $1,000 in Subco2 held by Opco).

Opco transferred Subco2 to Newco in a reorganization that qualifies for an exemption under paragraph 55(3)(a). To effect the spin-off, Holdco transferred shares of Opco with an ACB of nil and a FMV of $1,000 to Newco in consideration for shares of Newco. Opco then transferred the shares of Subco2 with an ACB of nil and a FMV of $1,000 to Newco in consideration for shares of Newco. The shares held by Newco in Opco and by Opco in Newco are redeemed for a note and the notes are cross-cancelled.

In this scenario, Subco2 was transferred over to Newco with an ACB of nil.

Since the shares of Subco2 are transferred to Newco on a rollover basis, the DSI of $1,000 that Opco had in Subco2 is transferred over to Newco. Newco will have DSI of $1,000 on the shares of Subco2.

On a consolidated basis, the shares of Newco held by Holdco have an ISI of $1,000. Since the ISI of Holdco in Opco is now fully transferred over to Newco, Holdco should no longer have ISI in the remaining shares owned in Opco. The unrealized gain on the remaining Opco shares held by Holdco is supported by the unrealized value of the shares in Subco1, with no underlying safe income. In contrast, the unrealized gain on the Newco shares is fully supported by the DSI in the Subco2 shares. Note that we do not consider that the ISI of Holdco in Opco is prorated based on the accrued gain on the shares of Opco and Newco after the reorganization.

The formula for calculating ISI (below the Newco level) should be as follows:

ISI on the shares of Newco: ISI to Holdco on the shares of Opco (that excludes the DSI of Opco) prior to reorg X ISI to Holdco of entities held by Opco that are transferred over to Newco / total ISI to Holdco of all entities held by Opco prior to reorg

ISI on the shares of Opco after reorg: ISI to Holdco on the shares of Opco prior to reorg X ISI to Holdco of entities held by Opco that are retained by Opco / total ISI to Holdco of all entities held by Opco prior to reorg

Example 3 [example that shows the interaction of outside ACB and inside ACB]

In this scenario, Holdco acquired Opco for $300 a few years ago. At that time, the DSI that Opco had was 0 and the DSI of Subco2 was $200 (Subco2 had a value of $300 and Subco1 had no value and no DSI at that time). Subco2 realized an additional DSI of $150 since the acquisition of Opco by Holdco and its value increased to $500. Subco1 realized no additional DSI after the acquisition of Opco by Holdco and its value increased to $500.

Therefore, even though the shares of Subco2 owned by Opco now have a DSI of $350, the ISI of Opco with respect to the shares of Subco2 is $150. The DSI of $200 of Subco2 pre-acquisition of control is reflected in the ACB of the Opco shares held by Holdco.

The shares of Opco held by Holdco have an ACB of $300 and a FMV of $1,000.

The shares of each of Subco1 and Subco2 held by Opco have an ACB of nil and a FMV of $500.

If safe income were to be capitalized before the reorganization, Subco2 would be able to pay a DSI of $350 to Opco and Opco would be able to pay an ISI of $150 to Holdco. Therefore, after capitalization of safe income, the situation would be as follows:

In this situation, Holdco has an ACB of $450 in the shares of Opco and, if Opco were to be wound-up, Holdco would directly own shares of Subco1 and Subco2 with an aggregate ACB of $350. Therefore, in this situation, the maximum ACB that Holdco could have in its subsidiaries does not exceed $450.

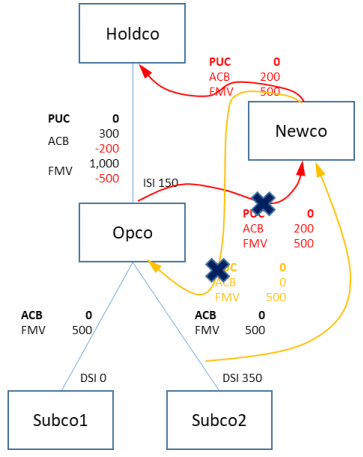

First reorganization possibility

Without going through the capitalization of safe income, Opco transferred Subco2 to Newco in a reorganization that qualified for the exemption under paragraph 55(3)(a). To effect the spin-off, Holdco transferred shares of Opco having an ACB of $150 and a FMV of $500 to Newco in consideration for shares of Newco. Opco then transferred shares of Subco2 having an ACB of nil and a FMV of $500 to Newco in consideration for shares of Newco. The shares held by Newco in Opco and by Opco in Newco are redeemed for a note and the notes are crosscancelled.

Since the shares of Subco2 are transferred to Newco on a rollover basis, the DSI of $350 that Opco had in Subco2 is transferred over to Newco. Newco will have DSI of $350 on the shares of Subco2.

On a consolidated basis, the shares of Newco held by Holdco have an ISI of $150 since it represents the ISI of Opco that was transferred over to Newco.

Since ISI of Holdco in Opco is now fully transferred over to Newco, Holdco should no longer have ISI in the remaining shares owned in Opco. The unrealized gain on the remaining Opco shares held by Holdco is supported by the unrealized value of the shares in Subco1, with no underlying safe income.

However, the reorganization results in an inappropriate duplication of ACB because of the misalignment of outside and inside ACB as illustrated in Question1. If the ISI that Holdco has in the shares of Newco and the DSI that Newco had in the shares of Subco2 were to be capitalized after the reorganization, Holdco would have an ACB of $300 in the shares of Newco and Newco would have an ACB of $350 in the shares of Subco2. On a possible wind-up of Newco, Holdco would own shares of Subco2 with an ACB of $350. Holdco would have an aggregate ACB of $500 in the shares of Opco and Subco2 after the wind-up of Newco. This situation would not be acceptable.

Second reorganization possibility

Instead of transferring to Newco shares of Opco having an ACB of $150, Holdco should transfer to Newco shares of Opco having a FMV of $500 and an ACB of at least $200 to avoid the misalignment of outside and inside ACB. A transfer of the full $300 of ACB of the shares of Opco held by Holdco to Newco is also acceptable since the ACB reflects the cost of indirect acquisition of the shares of Subco2.

Since the shares of Subco2 are transferred to Newco on a rollover basis, the DSI of $350 that Opco had in Subco2 is transferred over to Newco. Newco will have DSI of $350 on the shares of Subco2.

On a consolidated basis, the shares of Newco held by Holdco have an ISI of $150 since it represents the ISI of Opco that was transferred over to Newco.

Since ISI of Holdco in Opco is now fully transferred over to Newco, Holdco should no longer have ISI in the remaining shares owned in Opco. This is logical since the underlying value in Subco1 is unrealized and Subco1 has no DSI.

The formula for calculating ISI (below the Newco level) as reflected in slide #2 should still be valid and the calculation would be as follows:

ISI on the shares of Newco: ISI of Opco (that excludes the DSI of Opco) prior to reorg X ISI of entities transferred over to Newco / total ISI of all entities held by Opco prior to reorg

ISI on the shares of Opco after reorg: ISI of Opco prior to reorg X ISI of entities retained by Opco / total ISI of all entities held by Opco prior to reorg

Example 4

This is the same as Example 3, except that Subco1 has realized DSI of $500 after the acquisition of Opco by Holdco.

Opco would therefore have a total ISI of $650, being $500 in the shares of Subco1 and $150 in the shares of Subco2 (post-acquisition of Opco by Holdco). Note that the DSI of $200 of Subco2 pre-acquisition of control is reflected in the ACB of the Opco shares held by Holdco. The FMV of Subco1 was $500 and the FMV of Subco2 was also $500 prior to the reorganization.

If safe income were to be capitalized prior to the reorganization, Subco1 would pay a safe income dividend of $500 to Opco, Subco2 would pay a safe income dividend of $350 to Opco and Opco would pay a safe income dividend of $650 to Holdco. After capitalization of safe income, the situation would be as follows:

In this situation, Holdco has an ACB of $950 in the shares of Opco and, if Opco were to be wound-up, Holdco would directly own shares of Subco1 and Subco2 with an aggregate ACB of $850. Therefore, in this situation, the maximum ACB that Holdco could have in its subsidiaries does not exceed $950.

Reorganization possibility

Without going through the capitalization of safe income, Opco transferred Subco2 to Newco in a reorganization that qualified for the exemption under paragraph 55(3)(a). To effect the spin-off, Holdco transferred shares of Opco having an ACB of $150 and a FMV of $500 to Newco in consideration for shares of Newco. Opco then transferred shares of Subco2 having an ACB of nil and a FMV of $500 to Newco in consideration for shares of Newco. The shares held by Newco in Opco and by Opco in Newco are redeemed for a note and the notes are cross-cancelled.

Since the shares of Subco2 are transferred to Newco on a rollover basis, the DSI of $350 that Opco had in Subco2 is transferred over to Newco. Newco will have DSI of $350 on the shares of Subco2.

On a consolidated basis, the shares of Newco held by Holdco have an ISI of $150 since it represents the ISI of Opco that was transferred over to Newco.

Since $150 of ISI of Holdco in Opco is now transferred over to Newco, Holdco should have ISI of $500 in the remaining shares owned in Opco, which reflects the DSI of $500 of Subco1. The formula for calculating ISI (below the Newco level) would be as follows:

ISI on the shares of Newco: ISI to Holdco on the shares of Opco (that excludes the DSI of Opco) prior to reorg X ISI to Holdco of entities held by Opco that are transferred over to Newco / total ISI to Holdco of all entities held by Opco prior to reorg

ISI on the shares of Opco after reorg: ISI to Holdco on the shares of Opco prior to reorg X ISI to Holdco of entities held by Opco that are retained by Opco / total ISI to Holdco of all entities held by Opco prior to reorg

The situation after the reorganization would be as follows:

If safe income at all levels were to be capitalized after the reorganization, Holdco would have an ACB of $650 in the shares of Opco and an ACB of $300 in the shares of Newco. Opco would have an ACB of $500 in the shares of Subco1 and Newco would have an ACB of $350 in the shares of Subco2.

A subsequent disposition of the shares of Opco by Holdco after the dividend would result in a loss, but such loss is denied under subsection 112(3). On the other hand, if a safe income dividend of only $350 is subsequently paid on the shares of Opco held by Holdco, a disposition of the shares of Opco by Holdco would not result in a loss, but the portion of $150 of safe income has been lost.

This result is caused by the fact that only $150 of ACB of Opco has been transferred to Newco on the reorganization. If the ACB of Opco held by Holdco was streamed and transferred over to Newco for purposes of the reorganization, there would be no loss of ACB.

In this situation, it would be appropriate to stream the ACB of Opco and transfer the whole ACB of Opco to Newco in the course of the reorganization. The result would be as illustrated below:

Marc Ton-That

2020-086103

October 27, 2020

All rights reserved. Permission is granted to electronically copy and to print in hard copy for internal use only. No part of this information may be reproduced, modified, transmitted or redistributed in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, or stored in a retrieval system for any purpose other than noted above (including sales), without prior written permission of Canada Revenue Agency, Ottawa, Ontario K1A 0L5

© Her Majesty the Queen in Right of Canada, 2020

Tous droits réservés. Il est permis de copier sous forme électronique ou d'imprimer pour un usage interne seulement. Toutefois, il est interdit de reproduire, de modifier, de transmettre ou de redistributer de l'information, sous quelque forme ou par quelque moyen que ce soit, de facon électronique, méchanique, photocopies ou autre, ou par stockage dans des systèmes d'extraction ou pour tout usage autre que ceux susmentionnés (incluant pour fin commerciale), sans l'autorisation écrite préalable de l'Agence du revenu du Canada, Ottawa, Ontario K1A 0L5.

© Sa Majesté la Reine du Chef du Canada, 2020