Please note that the following document, although believed to be correct at the time of issue, may not represent the current position of the CRA.

Prenez note que ce document, bien qu'exact au moment émis, peut ne pas représenter la position actuelle de l'ARC.

PRINCIPAL ISSUES: An estate freeze would happen when the safe income on hand is $700,000. Freeze preferred shares would be issued and their redemption value would be $1,000,000. The ACB of the freeze preferred shares would be $100. Each year, a dividend would be paid on the freeze preferred shares. What would be the safe income on hand that contributes to the capital gain of the freeze preferred shares immediately before the annual dividend?

POSITION: The safe income on hand of the corporation at the time of the estate freeze would be transferred to the freeze preferred shares. With respect to additional safe income on hand, it would depend, inter alia, on the value of the freeze preferred shares immediately before the dividend as computed pursuant to paragraph 55(2.1)(c) and on the safe income accumulated by the corporation since the estate freeze, if any. If the hypothetical capital gain is $999,900 ($1,000,000 - $100), that may mean that the safe income accumulated by the corporation since the estate freeze would not contribute to the hypothetical capital gain on the freeze preferred shares. Therefore, the safe income on hand of $700,000 less any previous reduction would contribute to the hypothetical capital gain. In such a case, the annual dividend would reduce the amount of $700,000 less any previous reduction. If the annual dividend is greater than $700,000 less any previous reduction, subsection 55(2) may apply if the other conditions are met.

If the hypothetical capital gain was equal to an amount of $999,900 + the annual dividend, it would be necessary to determine the safe income on hand accumulated since the estate freeze. If such an amount of safe income on hand was equal to or greater than the annual dividend on the freeze preferred shares, the amount of the annual dividend would not be greater than the safe income on hand that contributes to the hypothetical capital gain. Subsection 55(2) would not apply. In such a case, the safe income accumulated by the corporation since the estate freeze would be reduced by the annual dividend on the freeze preferred shares.

REASONS: Wording of the Act.

TABLE RONDE SUR LA FISCALITÉ FÉDÉRALE DU 7 OCTOBRE 2016 APFF - CONGRÈS 2016

QUESTION 16

INTERRELATION ENTRE LE REVENU PROTÉGÉ SUR DES ACTIONS DE GEL ET LE PARAGRAPHE 55(2) L.I.R.

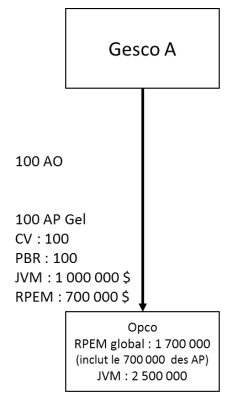

Opco est une société résidente du Canada. Les actions d’Opco ont une JVM de 2 500 000 $ et un revenu protégé global de 1 700 000 $. Ce revenu protégé global comprend le revenu protégé de 700 000 $ attribuable aux actions privilégiées de gel détenues par Gesco A.

Gesco A détiendrait 100 actions ordinaires dont le CV et le PBR seraient de 100 $. Les actions ordinaires comporteraient des droits de vote et seraient participantes.

Gesco A détiendrait aussi 100 actions privilégiées de gel dont le CV et le PBR sont de 100 $. La JVM (valeur de rachat) de ces actions privilégiées de gel est de 1 000 000 $ et le revenu protégé des actions échangées au moment du gel était de 700 000 $. Les actions privilégiées de gel ne comporteraient pas de droit à un dividende discrétionnaire. Les caractéristiques des actions privilégiées de gel seraient les suivantes :

- Non participantes

- Sans droit de vote

- Dividende prédéterminé (8 % de la valeur de rachat)

- Valeur prédéterminée (1 000 000 $, soit la contrepartie reçue à l’émission + dividende impayé)

Questions à l’ARC

a) Si Opco génère du revenu protégé dans l’année de 150 000 $ et déclare un dividende de 80 000 $ sur les actions privilégiées de gel : - Quelle sera la portion du dividende couvert par le revenu protégé global?

- Quel sera le revenu protégé des actions privilégiées de gel après le versement du dividende?

- Quel sera le revenu protégé global d’Opco après le versement du dividende?

b) Si Opco génère un revenu protégé nul dans l’année et déclare un dividende de 80 000 $ sur les actions privilégiées de gel :

- Quelle sera la portion du dividende couvert par le revenu protégé global?

- Quel sera le revenu protégé des actions privilégiées de gel après le versement du dividende?

- Quel sera le revenu protégé global d’Opco après le versement du dividende?

Réponse de l’ARC

La réponse à vos questions dépendra de la JVM qui pourrait être attribuée aux actions privilégiées de gel du capital-actions d’Opco détenues par Gesco A. Cette JVM sera établie immédiatement avant le paiement du dividende mais en sachant que lesdites actions auront droit à un montant supplémentaire égal au dividende déclaré à l’égard de ces actions. Ceci permettrait de calculer quel serait le gain en capital hypothétique qui aurait été réalisé lors d’une disposition de l’action à la JVM immédiatement avant le dividende en tenant compte des hypothèses mentionnées à l’alinéa 55(2.1)c) L.I.R. Ceci est une question d’évaluation sur laquelle l’ARC ne se prononce pas dans une situation hypothétique.

Selon les faits mentionnés ci-dessus, le revenu protégé en main (« RPEM ») des actions échangées lors du gel était de 700 000 $ et le gel s’est effectué sur une base de roulement. Ainsi, selon la position de longue date de l’ARC, le RPEM de 700 000 $ attribuable aux actions échangées serait transféré aux actions privilégiées de gel.

En plus du 700 000 $ de RPEM qui contribue au gain en capital hypothétique sur les actions privilégiées de gel (selon les hypothèses de l’alinéa 55(2.1)c) L.I.R.), il faudrait établir s’il y a du RPEM gagné ou réalisé par la société depuis le gel et jusqu’avant le moment de détermination du revenu protégé qui contribuerait au gain en capital hypothétique sur les actions privilégiées de gel. À cette fin, il n’est pas suffisant d’établir le montant de revenu protégé généré dans l’année du dividende puisque, par exemple, ce montant pourrait être réduit en raison d’une perte subie au cours d’années antérieures depuis le gel ou pourrait être augmenté du revenu protégé gagné ou réalisé au cours d’années antérieures depuis le gel. De même, ce montant de revenu protégé gagné dans l’année et celui gagné ou réalisé depuis le gel au cours d’années antérieures pourraient ne pas contribuer au gain en capital hypothétique sur les actions privilégiées de gel (selon les hypothèses de l’alinéa 55(2.1)c) L.I.R.).

La question de déterminer si un montant de RPEM contribue au gain en capital hypothétique sur les actions privilégiées de gel, calculé selon les hypothèses de l’alinéa 55(2.1)c) L.I.R., est une question de fait. Si le dividende de 80 000 $ n’était pas supérieur au RPEM de la société qui contribue au gain en capital hypothétique sur les actions privilégiées de gel (le montant de 700 000 $ transféré au moment du gel qui pourrait avoir été réduit en raison de dividendes antérieurs ainsi que le RPEM qui s’est accumulé depuis le gel s’il contribue au gain en capital hypothétique sur les actions privilégiées), l’alinéa 55(2.1)c) L.I.R. et le paragraphe 55(2) L.I.R. ne s’appliqueraient pas. Le dividende de 80 000 $ réduirait d’abord le RPEM de la société depuis le moment du gel s’il contribuait au gain en capital hypothétique sur les actions privilégiées de gel et ce, jusqu’à concurrence du moindre de ce revenu protégé qui contribue au gain en capital hypothétique sur les actions privilégiées de gel ou du montant du dividende. La différence entre le montant du dividende et ce montant de réduction du RPEM de la société depuis le moment du gel, s’il y lieu, réduirait le RPEM de 700 000 $ qui est rattaché spécifiquement aux actions privilégiées de gel (moins toute réduction antérieure).

Selon les circonstances, il se pourrait que le seul RPEM qui contribue au gain en capital hypothétique sur les actions privilégiées de gel soit le montant du 700 000 $ moins toute réduction antérieure de ce revenu protégé. Si le montant du dividende de 80 000 $ n’était pas supérieur audit RPEM, l’alinéa 55(2.1)c) L.I.R. et le paragraphe 55(2) L.I.R. ne s’appliqueraient pas. Dans un tel cas, le RPEM de 700 000 $ (moins toute réduction antérieure) serait diminué du montant de dividende.

Sylvie Labarre

(613) 670-9014

Le 7 octobre 2016

2016-065300

All rights reserved. Permission is granted to electronically copy and to print in hard copy for internal use only. No part of this information may be reproduced, modified, transmitted or redistributed in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, or stored in a retrieval system for any purpose other than noted above (including sales), without prior written permission of Canada Revenue Agency, Ottawa, Ontario K1A 0L5

© Her Majesty the Queen in Right of Canada, 2016

Tous droits réservés. Il est permis de copier sous forme électronique ou d'imprimer pour un usage interne seulement. Toutefois, il est interdit de reproduire, de modifier, de transmettre ou de redistributer de l'information, sous quelque forme ou par quelque moyen que ce soit, de facon électronique, méchanique, photocopies ou autre, ou par stockage dans des systèmes d'extraction ou pour tout usage autre que ceux susmentionnés (incluant pour fin commerciale), sans l'autorisation écrite préalable de l'Agence du revenu du Canada, Ottawa, Ontario K1A 0L5.

© Sa Majesté la Reine du Chef du Canada, 2016