Timbercreek

Structure

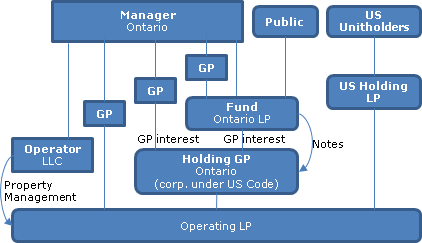

The Fund subscription proceeds described below are used by the Fund to subscribe for a general partner interest in a subsidiary general partnership (Holding GP) with the other general partner (Holding GP) being an Ontario corporation owned by the Manager. The Fund General Partner also is owned by the Manager. The Fund may also subscribe for interest-bearing notes of Holding GP.

A Delaware limited partnership (US Holding LP) raises money on a private placement of LP units with US investors (to close concurrently with the public offering and the Canadian private placement referred to below). Holding GP and US Holding LP invest jointly in another Delaware LP (Operating LP). US Holding LP has received a commitment from the Operator (see below) to subscribe for US$5M of US Holding LP units.

4-year program

Operating LP will acquire apartment buildings in the south-eastern U.S. over the following two years (i.e., this is a blind pool offering). The Fund has a term of four years (subject to a single one-year extension at the discretion of the general partner.) The Fund will "seek to exit an investment promptly upon completion of the renovation and repositioning program in order to maximize returns for investors" (p. 41).

Unit offerings

The prospectus will qualify an offering by the Fund of Class A and B units, each for $10 per units, for aggregate proceeds of between $25M and $75M. Distributions on the Class A units bear a trailer fee (referred to as the Service Fee) of 0.5% p.a. The units will not be listed.

Canadian private placement financing

The Manager (described below), which has made an equity commitment of $2.5M of which a minimum of $1M will be invested at closing, and certain other investors subscribe for Class C units of the Fund at the same price on a private placement basis. The Manager also subscribes for equity in the general partner corp's.

Debt financing

The Fund will target a 65% loan to value ration on a consolidated basis (non-recourse mortgages only).

Distributions

Targeted quarterly disributions of 95% of (net) free cash flow from operations (expected to generate a yield of 4% to 5%) plus 100% of net proceeds of property sales. Manager has a carry (paid as a fee) of 25% of the pre-tax annual return in US dollars in excess of 8% p.a. (cumulative), plus a further 10% of any excess over 14%. Taxable income is allocated among the three unit classes as at the end of each month in proportion to distributions paid.

Management

The Manager, which employs 90 professionals in its Toronto head office, will delegate property management to the Operator, a third-party Florida-based LLC.

Canadian taxation

The SIFT taxation rules are not expected to apply as there will be no Canadian business. The Fund expects substantially all gains from property dispositions to be on income account. Foreign income taxes paid by the partnerships (including US federal income taxation of Holding GP as a result of electing to be a corporation for purposes of the Code) will be allocated to the Fund partners. The August 27, 2010 foreign tax credit generator proposals, respecting where a holder's share under US tax law of partnership income which is subject to US tax is less than its share under the Canadian Act, are not expected to apply.

"[I]f the Fund is allocated losses from Operating LP (indirectly through Holding GP) that are limited by the 'at-risk' rules, such losses may not be available to the Fund and, therefore, allocable to Holders...." (see 31 May 2012 T.I. 2012-0436521E5).

Fund units are not RRSP-eligible (no listing).

US taxation

Holding GP will elect to be classified as a corporation for Code purposes. As a foreign corporation that derives effectively-connected income from a partnership engaged in a US trade or business (i.e., Operating LP), it will be subject to 35% withholding under Code s. 1446 on distributions made to it by Operating LP, and will be required to file a federal return reporting its allocable share of Operating LP income on distributions made by it. As a foreign corporation owning a US real property interest, Holding GP will be subject to corporate tax on gains arsing on sales of the Operating LP properties. If withholding is made on gains distributions by Operating LP under Code s. 1446, no withholding will be required under Code s. 1445 on gains from the dispositions of the properties. The s. 1446 withholding will be allowed as a credit against US tax shown on Holding GP's federal income tax return.

The Fund will elect to be classified as a partnership for purposes of the Code. However, it does not expect to have any effectively-connected income. Interest on any note owing by Holding GP to the Fund should not be subject to US withholding tax provided that the Fund unitholders are able to establish that such interest is exempt under the Canada-US Convention or under the portfolio interest exemption. Deductibiity of interest on these notes (which are intended to be respected as debt and to be allocable to Holding GP's interest in Operating LP) may be limited inter alia by the earnings strippings rules in Code s. 163(j).