Canada Revenue Agency Quarterly Financial Report For the Quarter ended June 30, 2020

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

Canada Revenue Agency Quarterly Financial Report

For the quarter ended June 30, 2020

Statement outlining results, risks and significant changes in operations, personnel and program

Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act in the form and manner prescribed by the Treasury Board. This report should be read in conjunction with the Main Estimates.

Further details on the Canada Revenue Agency's (CRA) program activities can be found in the Departmental Plan and Main Estimates.

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the CRA's spending authorities granted by Parliament and those used by the CRA consistent with the Main Estimates for the 2020-2021 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation of statutory spending authority for specific purposes.

The CRA uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

This quarterly report has not been subject to an external audit or review.

Highlights of fiscal quarter and fiscal year to date (YTD) results

Impact of the pandemic on authorities available for use

Due to the COVID-19 pandemic and limited sessions in the spring for Parliament to study supply, the Standing Orders of the House of Commons were amended to extend the study period into the fall. As a result, the CRA's 2020-2021 quarter 1 authorities reflect interim supply of the Main Estimates, which includes 9/12 (approximately 75%) of Vote 1 and Vote 5, 100% of authorities available for use from the prior fiscal year, and 100% of statutory authorities. This corresponds to a decrease of $886 million in authorities available for use. The Treasury Board Secretariat is working to provide full supply (100%) to departments for the 2020-2021 Main Estimates in December 2020.

Although the duration and full impact of the COVID-19 outbreak is unknown at this time, the CRA continues to be well positioned to respond to this evolving situation. The CRA moved from operating under a critical services mode, which prioritized critical services, to a phased transition to full business resumption on June 26, 2020. The CRA's business resumption is being closely monitored, assuring employee health and economic recovery.

Analysis of Authorities

This report reflects the results for the current fiscal year in relation to the Main Estimates for which interim supply was released on March 13, 2020 and authorities available for use from the prior fiscal year.

As shown in the Statement of Authorities, the CRA's total Budgetary Authorities available for use have increased by $2,677 million, from $4,664 million in 2019-2020 to $7,341 million in 2020-2021.

As noted above, the CRA does not yet have full supply of its Main Estimates. If full supply had been released, the CRA's total Budgetary Authorities would be $8,227 million, an increase of $3,563 million. The impacts of the limited supply are primarily seen in the Vote 1 Gross Operating Expenditures Authority.

The components of the Vote 1 Gross Operating Expenditures Authority, Vote 5 Capital Expenditures Authority, and Budgetary Statutory Authorities are outlined below.

The Vote 1 Gross Operating Expenditures Authority decreased by $820 million, from $3,996 million in 2019-2020 to $3,176 million in 2020-2021. If full supply had been released the Vote 1 Gross Operating Expenditures Authority in 2020-2021 would be $4,142 million, an increase of $146 million from 2019-2020.

This increase in authorities, assuming full supply had been released, is mainly due to:

- an increase in authorities available for use from the prior fiscal year;

- an increase in authorities related to the settlement of the Professional Institute of the Public Service of Canada, Audit, Financial and Scientific (PIPSC-AFS) collective agreement;

- a net increase in authorities for the implementation and administration of measures that pertain to compliance, cracking down on tax evasion, combatting tax avoidance, enhancing tax collections, improving client services, and the federal carbon pollution pricing system announced in previous federal budgets; and

- an increase in authorities to fulfill CRA's administrative responsibilities in support of the Canada Pension Plan (CPP) and Employment Insurance (EI) program.

In 2020-2021, the CRA expects to spend $391 million to fulfill its administrative responsibilities in support of the CPP and EI program, compared to $364 million in 2019-2020, an increase of $27 million. The increase in Vote 1 Gross Operating Expenditure Authority is offset by an equivalent increase in revenues recovered from the CPP and EI Accounts. Due to interim supply, the CRA currently has authorities of $293 million for the program, a decrease of $71 million, until full supply is released.

The Vote 5 Capital Expenditures Authority increased by $8 million, from $57 million in 2019-2020 to $65 million in 2020-2021. If full supply had been released the Vote 5 Capital Expenditures Authority in 2020-2021 would be $74 million, an increase of $17 million from 2019-2020.

This increase in authorities, assuming full supply had been released, is mainly due to an increase in authorities available for use from the prior fiscal year and an increase in authorities for the implementation and administration of measures that pertain to compliance, cracking down on tax evasion, combatting tax avoidance, enhancing tax collections, improving client services, and the federal carbon pollution pricing system announced in previous federal budgets.

Total Budgetary Statutory Authorities increased by $3,417 million, from $975 million in 2019-2020 to $4,392 million in 2020-2021. The CRA has received full supply of its Budgetary Statutory Authorities. The increase in authorities is attributable to the following:

- $3,405 million in new payments for the Climate Action Incentive (CAI);

- $24 million in increased payments under the Children's Special Allowances Act;

- $7 million in decreased contributions to employee benefit plans; and

- $5 million in decreased spending of revenues received primarily attributable to initiatives administered on behalf of the provinces of Ontario and Alberta.

The forecast of the expected payments for the Canada Emergency Wage Subsidy (CEWS) will be reflected in the Quarterly Financial Report once they are presented in Supplementary Estimates B.

Analysis of Expenditures

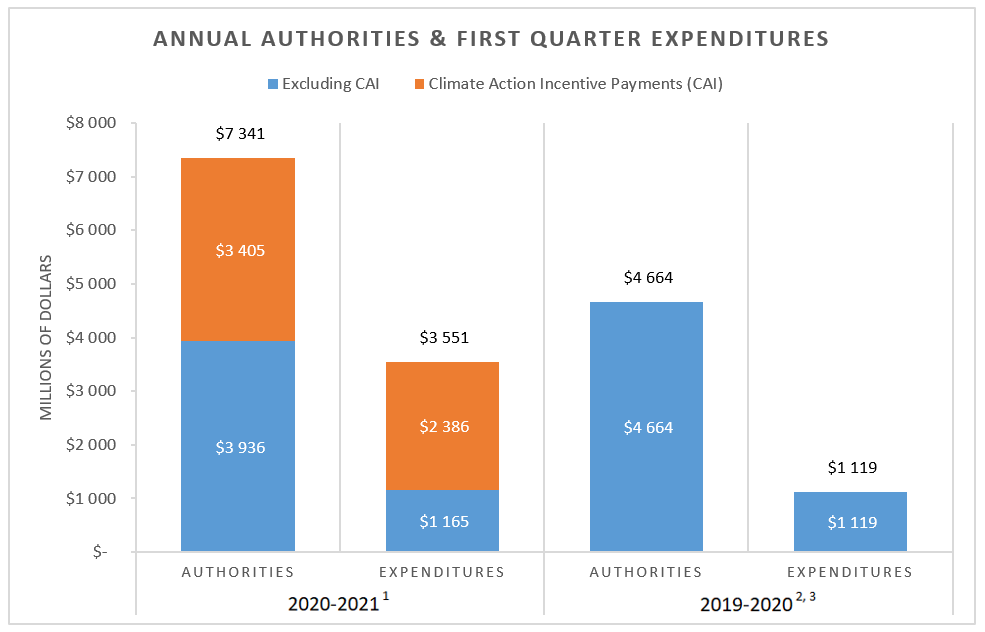

A two-year comparison of the CRA's annual net authorities available for use against first quarter net expenditures as at June 30 is presented in Figure 1.

Certain components of the quarterly year-over-year expenditure variances are attributable to timing differences in invoices and payments, which will be resolved by the end of the fiscal year, as well as to the status of major project investments.

This graphic provides a two-year comparison of the Agency’s annual authorities available for use as of June 30 against first quarter expenditures for 2020-2021 and 2019-2020. In 2020-2021, the Agency’s annual authorities available for use are $7,664M while first quarter expenditures are $3,551M. In comparison, 2019-2020 annual authorities available for use were $4,664 M, while first quarter expenditures were $1,119M. This graphic also shows the portion of authorities and expenditures related to Climate Action Incentive (CAI) payments. In 2020-21, $3,405M of the authorities and $2,386M of the expenditures are related to CAI payments. In comparison, there were no CAI payments in 2019-2020.

| 2020-2021 1 | 2019-2020 2, 3 | ||

|---|---|---|---|

Table 1 Notes

|

|||

| Authorities - Excluding CAI | 3,936.0 | 4,664.0 | |

| Authorities - Climate Action Incentive Payments (CAI) | 3,405.0 | - | |

| Expenditures - Excluding CAI | 1,165.0 | 1,119.0 | |

| Expenditures - Climate Action Incentive Payments (CAI) | 2,386.0 | - | |

A) Expended in the First Quarter by Authority

As displayed in the Statement of Authorities, the first quarter expenditures have increased by $2,432 million, from $1,119 million in 2019-2020 to $3,551 million in 2020-2021. The components of this year-over-year change are presented below.

The CRA's first quarter net Vote 1 Operating Expenditures have increased by $39 million, or 4%, from $893 million in 2019-2020 to $932 million in 2020-2021. The increase is partially the result of the settlement of the PIPSC-AFS collective agreement in 2019-2020, which has increased salary expenditures by approximately $15 million.

An additional $10 million of the increase is a combination of incremental salary costs as a result of the tax filing season extension, new benefit programs, and overtime to support the COVID-19 Economic Response Plan. A decrease in spending on travel and professional services, which was offset by additional spending on acquisition of equipment and postage, as a result of COVID-19, is also reflected in this amount.

The majority of the remaining $14 million increase results from the implementation and administration of measures that pertain to compliance, cracking down on tax evasion, combatting tax avoidance, enhancing tax collections, improving client services, and the federal carbon pollution pricing system announced in previous federal budgets.

The CRA's first quarter Vote 5 Capital Expenditures have increased by $3 million, from $7 million in 2019-2020 to $10 million in 2020-2021, an increase of 36%. This increase is primarily tied to expenditures of $2 million for development work to support the COVID-19 Economic Response Plan, and $1 million in capital goods, including office and video equipment, and automobiles.

The CRA's first quarter Budgetary Statutory Authorities have increased by $2,389 million, from $219 million in 2019-2020 to $2,608 million in 2020-2021. Almost the entire increase, $2,386 million, is attributable to the new payment for the CAI. The remaining $3 million variance can be explained by an increase in payments under the Children's Special Allowances Act of $18 million, offset by a decrease in the spending of revenues of $15 million. The decrease in the spending of revenue is related to the timing of invoicing, for which fluctuations throughout the year are normal. These timing differences will be resolved by year-end.

B) Expended in the First Quarter by Standard Object

As illustrated in the Departmental Budgetary Expenditures by Standard Object table, the CRA's personnel expenditures have increased by $36 million, or 4%, from $904 million in 2019-2020 to $940 million in 2020-2021. As noted above, the increase is a result of the settlement of the PIPSC-AFS collective agreement, the extension of the tax filing season, new benefit programs, and overtime as part of the response to COVID-19, and the implementation and administration of measures announced in previous federal budgets.

Transportation and communications expenditures have decreased by $3 million, or 8%, from $36 million in 2019-2020 to $33 million in 2020-2021. This change is primarily due to a decrease in travel expenditures of $8 million, primarily related to the CRA's compliance and collection activities, offset by an increase in postal services expenditures of $5 million. Both variances in spending are the result of the impact of COVID-19 on the CRA's operations.

Professional and special services expenditures have decreased by $7 million, or 8%, from $84 million in 2019-2020 to $77 million in 2020-2021. The variance is primarily attributable to a $4 million reduction in training, consultants and legal services expenditures, as a result of the impact of COVID-19 on the CRA's operations.

Another $2 million of the decrease is a result of an extension to the deadline for payment of professional accounting dues as a result of COVID-19. The remaining $1 million decrease is attributable to a decrease in Shared Services Canada billing, for which fluctuations throughout the year are normal. These timing differences will be resolved by year-end.

Acquisition of machinery and equipment expenditures have increased by $11 million, from $7 million in 2019-2020 to $18 million in 2020-2021. This is a result of the purchase of office equipment, primarily computer equipment, as the CRA has expanded remote working capabilities to support the COVID-19 Economic Response Plan.

Transfer payments have increased by $2,404 million, from $87 million in 2019-2020 to $2,491 million in 2020-2021. Almost the entire increase, $2,386 million, is attributable to the new payment for the CAI. The remaining increase of $18 million is due to increased payments under the Children's Special Allowances Act.

Risks and Uncertainties

The CRA maintains an annual Corporate Risk Profile (CRP) that outlines the direction and decisions on the potential risks that could affect its ability to meet its strategic priorities and objectives. In light of the current pandemic, the Agency also put in place a new monitoring regime, including dashboard reporting, designed to provide timely information to senior management on emerging issues, their potential impacts on existing CRP risks, and mitigation activities. Some of the top tier risks being closely monitored include employee health, well-being, and safety, service experience, public image, cybersecurity, protection of taxpayer information, and business continuity.

COVID-19

On March 11, 2020, the World Health Organization confirmed COVID-19 as a pandemic. Due to the emergency measures enacted by the Government of Canada, the CRA was unable to operate at full capacity during the first quarter. To mitigate the risks to operations, the CRA prioritized critical services according to its National COVID-19 Business Continuity Plan (BCP), and more recently, began its phased transition to full business resumption as outlined in its National Business Resumption Plan (NBRP).

The BCP was created to provide national direction for coordinated implementation at the local level and outlines the Agency's prioritization of services. It was reviewed on a regular basis and incrementally adjusted to ensure the Agency carried out priority activities in support of the economic well-being of Canadians, while safeguarding the health, safety and security of employees. In the case of non-critical services, the CRA ensured there was no negative impact on taxpayers.

The NBRP details the stages of the resumption of various program and corporate activities and operations that did not resume during the Agency's critical services phase under the BCP. The NBRP is being reviewed on a regular basis to systematically resume services in a thoughtful and phased approach that takes into consideration both the health and safety of employees and the needs of Canadian taxpayers.

The financial impacts related to the Agency's contributions to the response and supporting the workforce are being monitored closely.

Service experience

As part of the Government of Canada's response to the COVID-19 pandemic, a number of federal relief measures were put into place such as the Canada Emergency Response Benefit (CERB) and CEWS. The CRA was charged with the responsibility of promptly delivering these benefits to millions of Canadians. The service experience risk is closely being monitored to ensure the CRA continues to successfully deliver benefits while simultaneously delivering its broader mandate of tax administration.

Cybersecurity

The cybersecurity risk was assessed as the CRA's top enterprise risk in the CRA's 2020-2021 CRP. This risk has shown a consistent upward trend in risk exposure for the past five years. This is due to the increased prevalence and sophistication of cyber threats, as well as the emergence of new threats. The CRA continues to take action to ensure that its cyber security posture keeps pace with the changing environment.

Protection of taxpayer information

The protection of taxpayer information was also assessed as a top-tier risk in the 2020-2021 CRP. This risk results from the CRA's vast information holdings and associated linkages to cybersecurity, as well as the increasing number of external incidents occurring in the private sector, and to some extent, the public sector, of which some have led to identity theft to access emergency relief measures. Over the past few years, the CRA has invested in several programs and initiatives to protect data under its responsibility, including taxpayer information, in order to manage this risk appropriately.

The CRA currently has a rigorous security program in place and has recently implemented an additional funding envelope for smaller IT security sustainability initiatives. A Privacy Management Framework, which articulates the CRA's vision, objective, and commitment to privacy, including how the CRA handles and protects personal information, has been recently developed and implemented.

Additionally, continued participation in international forums such as the International Public Sector Fraud Forum allows the CRA to learn about Five Eyes best practices and share potential mitigation strategies.

Significant changes in relation to operations, personnel, and programs

The COVID-19 pandemic and resulting emergency measures to combat the spread of the virus have had significant impacts on the CRA's operations. The Agency continues to contribute to the broader Government of Canada response, especially as it relates to assisting individuals and businesses in coping with the economic impacts of the pandemic.

Critical services were prioritized according to the BCP, leading to some non-critical programs and services being temporarily impacted. A large number of employees were reassigned to administer and respond to public enquiries related to the Government of Canada's COVID-19 Economic Response Plan. The CRA processed 15 million CERB and 1 million Canada Emergency Student Benefit (CESB) applications on behalf of Employment and Social Development Canada. Approximately 0.7 million CEWS applications have also been processed, which will support millions of employee wages across Canada.

In order to continue to deliver on these and other emergency measures, the CRA is seeking funding for CERB, CESB, CEWS, and the 10% temporary wage subsidy.

To ensure CRA programs and services continue to be delivered to Canadians, while keeping staff safe, the CRA has expanded remote working capabilities significantly and as of the end of the quarter, 87% of the workforce was working remotely, while another 10% was on-site at CRA buildings.

A transition towards full business resumption began at the end of the quarter as outlined in the CRA's NBRP, restoring all programs and services administered by the Agency. The CRA continues to work on setting the right conditions to resume the full operational capacity of the Agency in a timely and appropriate manner, while ensuring the health and safety of personnel.

Approval by Senior Officials

Approved by:

[original signed by]

________________________

Bob Hamilton, Commissioner

[original signed by]

_____________________________

Janique Caron, Chief Financial Officer

Ottawa, Canada

Date: August 25, 2020

| Total available for use for the year ending March 31, 2021table 2 note 1 | Used during the quarter ended June 30, 2020 |

Year to date used at quarter-end | |

|---|---|---|---|

Table 2 Notes

|

|||

| Vote 1 - Operating expenditures | |||

| Gross Operating expenditures | 3,176,336 | 1,030,205 | 1,030,205 |

| Revenues netted against expenditures | (293,024) | (97,739) | (97,739) |

| Net Vote 1 - Operating expenditures | 2,883,312 | 932,466 | 932,466 |

| Vote 5 - Capital expenditures | 65,370 | 10,148 | 10,148 |

| Budgetary Statutory Authorities | |||

| Contributions to employee benefit plans | 451,936 | 112,984 | 112,984 |

| Children's Special Allowance payments (Children's Special Allowances Act) | 361,000 | 105,162 | 105,162 |

| Climate Action Incentive payments | 3,405,000 | 2,386,311 | 2,386,311 |

| Spending of revenues received through the conduct of its operations pursuant to section 60 of the Canada Revenue Agency Act | 174,160 | 3,463 | 3,463 |

| Minister's salary and motor car allowance | 89 | 22 | 22 |

| Court awards - Supreme Court | - | 3 | 3 |

| Court awards - Tax Court of Canada | - | 369 | 369 |

| Spending proceeds from the disposal of surplus Crown Assets | - | - | - |

| Energy Cost Benefit | - | (2) | (2) |

| Refunds of previous years revenue | - | - | - |

| Total Budgetary Statutory Authorities | 4,392,186 | 2,608,312 | 2,608,312 |

| Total Budgetary Authorities | 7,340,868 | 3,550,926 | 3,550,926 |

| Total available for use for the year ending March 31, 2020table 3 note 1 | Used during the quarter ended June 30, 2019 |

Year to date used at quarter-end | |

|---|---|---|---|

Table 3 Notes

|

|||

| Vote 1 - Operating expenditures | |||

| Gross Operating expenditures | 3,996,267 | 981,995 | 981,995 |

| Revenues netted against expenditures | (363,797) | (89,034) | (89,034) |

| Net Vote 1 - Operating expenditures | 3,632,470 | 892,961 | 892,961 |

| Vote 5 - Capital expenditures | 57,047 | 7,445 | 7,445 |

| Budgetary Statutory Authorities | |||

| Contributions to employee benefit plans | 458,824 | 112,848 | 112,848 |

| Children's Special Allowance payments (Children's Special Allowances Act) | 337,000 | 87,059 | 87,059 |

| Climate Action Incentive payments | - | - | - |

| Spending of revenues received through the conduct of its operations pursuant to section 60 of the Canada Revenue Agency Act | 178,954 | 18,061 | 18,061 |

| Minister's salary and motor car allowance | 88 | 22 | 22 |

| Court awards - Supreme Court | - | - | - |

| Court awards - Tax Court of Canada | - | 591 | 591 |

| Spending proceeds from the disposal of surplus Crown Assets | - | 47 | 47 |

| Energy Cost Benefit | - | 0 | 0 |

| Refunds of previous years revenue | - | 27 | 27 |

| Total Budgetary Statutory Authorities | 974,866 | 218,655 | 218,655 |

| Total Budgetary Authorities | 4,664,383 | 1,119,061 | 1,119,061 |

| Planned expenditures for the year ending March 31, 2021table 4 note 1 | Expended during the quarter ended June 30, 2020 | Year to date used at quarter-end | |

|---|---|---|---|

Table 4 Notes

|

|||

| Expenditures: | |||

| Personnel | 2,900,732 | 940,326 | 940,326 |

| Transportation and communications | 176,090 | 32,642 | 32,642 |

| Information | 5,010 | 1,789 | 1,789 |

| Professional and special services | 452,739 | 76,718 | 76,718 |

| Rentals | 211,649 | 80,609 | 80,609 |

| Purchased repair and maintenance | 50,243 | 411 | 411 |

| Utilities, materials and supplies | 26,566 | 3,217 | 3,217 |

| Acquisition of machinery and equipment | 44,624 | 17,924 | 17,924 |

| Transfer payments | 3,766,000 | 2,491,472 | 2,491,472 |

| Other subsidies and payments | 240 | 3,557 | 3,557 |

| Total Gross Budgetary Expenditures | 7,633,892 | 3,648,665 | 3,648,665 |

| Less: Revenues netted against expenditures | 293,024 | 97,739 | 97,739 |

| Total Net Budgetary Expenditures | 7,340,868 | 3,550,926 | 3,550,926 |

| Planned expenditures for the year ending March 31, 2020 | Expended during the quarter ended June 30, 2019 | Year to date used at quarter-end | |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 3,570,341 | 904,171 | 904,171 |

| Transportation and communications | 188,152 | 35,560 | 35,560 |

| Information | 4,415 | 2,494 | 2,494 |

| Professional and special services | 506,345 | 83,577 | 83,577 |

| Rentals | 279,800 | 80,312 | 80,312 |

| Purchased repair and maintenance | 71,158 | 1,365 | 1,365 |

| Utilities, materials and supplies | 29,346 | 3,528 | 3,528 |

| Acquisition of machinery and equipment | 41,423 | 6,459 | 6,459 |

| Transfer payments | 337,000 | 87,059 | 87,059 |

| Other subsidies and payments | 200 | 3,570 | 3,570 |

| Total Gross Budgetary Expenditures | 5,028,180 | 1,208,095 | 1,208,095 |

| Less: Revenues netted against expenditures | 363,797 | 89,034 | 89,034 |

| Total Net Budgetary Expenditures | 4,664,383 | 1,119,061 | 1,119,061 |

Page details

2020-08-28