The Canada child benefit

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

The Canada child benefit

What is the Canada child benefit?

The Canada child benefit (CCB) is a tax-free monthly payment made to eligible families to help them with the cost of raising children under 18 years of age.

You only have to apply once to find out if you are eligible.

- To continue getting your payments, you need to do your taxes every year, even if your income is tax exempt or you had no income at all. If you have a spouse or common-law partner, they will also have to do their taxes each year.

- The CRA uses the information from your income tax and benefit return to calculate your payment amounts.

- After you apply for the CCB and once your tax return is assessed, the CRA will send you a notice telling you how much you will be receiving. CCB payments are issued on or about the 20th of each month.

How much could your family get?

You could get up to $6,639 annually for each child under 6 and $5,602 for each child aged 6 to 17.

Use the child and family benefits calculator to estimate your CCB payments.

Did you know?

You can get the CCB payments for past years. You have to apply once for the CCB and do your taxes for those years, if you did not already do them, so the CRA can calculate your payment amounts.

If you have taxable income, getting the CCB won’t affect your tax refund or any tax you may owe. It’s a benefit paid to eligible families with children under 18 and you can get it even if you filed a return with zero income.

Doing your taxes will not impact your tax exemption under Section 87 of the Indian Act.

Need help doing your taxes?

You may be able to get your taxes done for free through the Community Volunteer Income Tax Program if you have a modest income and a simple tax situation. Find a tax preparation clinic near you at canada.ca/taxes-help.

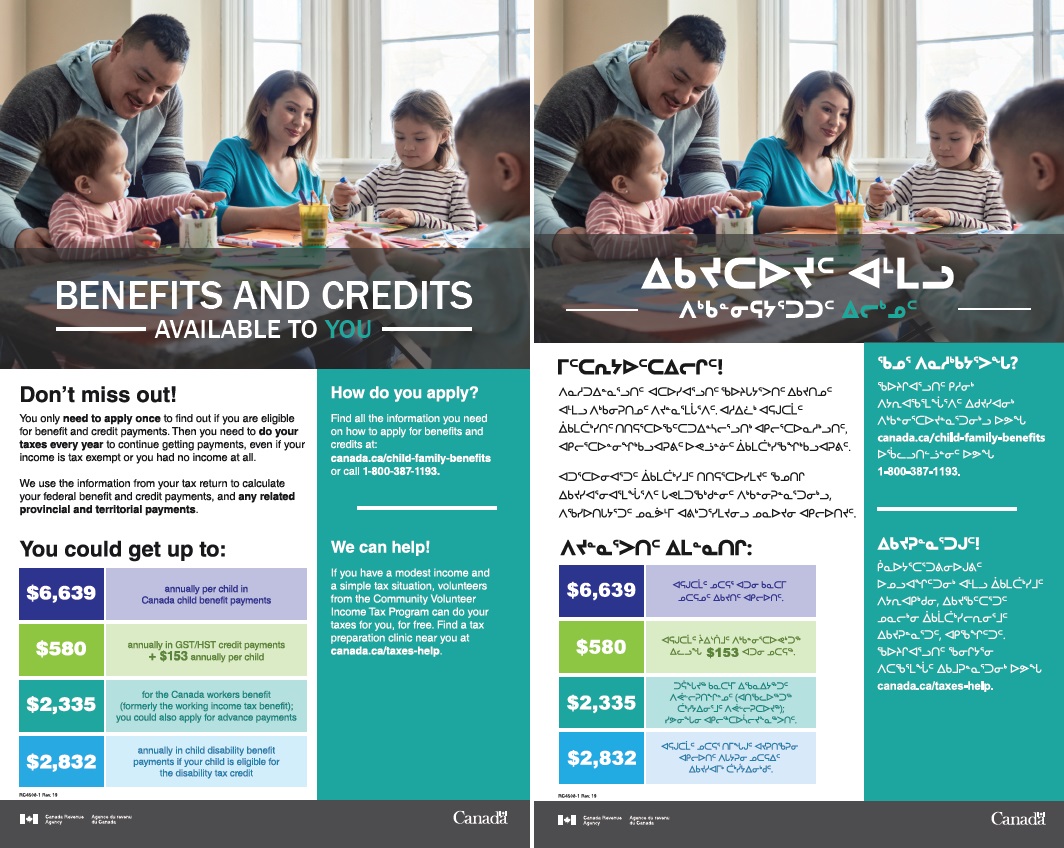

This is an image of a poster about benefits and credits distributed in Indigenous communities in both English and Inuktitut.

On the left of the image is the English version of the poster. At the top of the poster there is an image of an Indigenous family. Over the image is the title of the poster: Benefits and Credits available to you. Below are two columns with text.

In the left column is the following text: “Don’t miss out! You only need to apply once to find out if you are eligible for benefit and credit payments. Then you need to do your taxes every year to continue getting payments, even if your income is tax exempt or you had no income at all. We use the information from your tax return to calculate your federal benefit and credit payments, and any related provincial and territorial payments.”

Below is a table with the title “You could get up to:”The first row in the table indicates “$6,639 - annually per child in Canada child benefit payments”. The second row indicates “$580 - annually in GST/HST credit payments + $153 annually per child.” The third row indicates: “$2,335 - for the Canada workers benefit (formerly the working income tax benefit); you could also apply for advance payments”. The fourth indicates “$2,832 - annually in child disability benefit payments if your child is eligible for the disability tax credit”.

In the turquoise column on the right of the English page of the poster the following text is seen: “How do you apply? Find all the information you need on how to apply for benefits and credits at canada.ca/child-family-benefits or call 1-800-387-1193. We can help! If you have a modest income and a simple tax situation, volunteers from the Community Volunteer Income Tax Program can do your taxes for you, for free. Find a tax preparation clinic near you at canada.ca/taxes-volunteer.”

On the right of the English poster is the same poster with information written in Inuktitut.

- Date modified:

- 2021-03-11