Aurora/ CanniMed

Overview

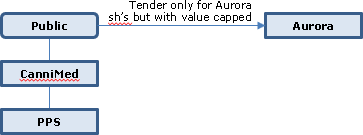

The Aurora share-for-share offer for CanniMed (another TSX-listed cannabis company, 38% of whose shares have been locked up) is capped at a value per CanniMed share of $24.00, so that if there is appreciation in the Aurora shares above this cap, the exchange ratio will be reduced accordingly. This does not affect the availability of the s. 85.1 rollover.

Aurora

Aurora’s common shares (the “Shares”) are listed on the TSX and OTCZX. Its principal market is patients who use medical cannabis in Canada.

CanniMed

CanniMed is a Canadian TSX-listed based plant biotechnology company. Since 1988, when its subsidiary PPS was incorporated, the Offeror has been involved in plant biotechnology research, product development and production of plant based materials for biopharmaceutical, agricultural and environmental market applications. CanniMed has produced medical marijuana since 2000.

Exchange terms

Pursuant to the Offer of Aurora, a holder of CanniMed Shares will receive, for each CanniMed Share, 4.52586207 common shares of the Offeror (the "Aurora Shares"), subject to a maximum of $24.00 (the "Cap Price") in Aurora Shares. If, on the earlier of the Offer expiry time and the date on which all conditions of the Offer have been satisfied, the 20-day volume weighted average price of the Aurora Shares ("Calculation Date VWAP") traded on the TSX is greater than $5.30 per Aurora Share, the number of Aurora Shares that a holder of CanniMed Shares will receive for each CanniMed Share will be calculated by dividing the Cap Price of $24.00 by the Calculation Date VWAP.

CanniMed’s Newstrike Resources bid

On November 14, Aurora issued a press release acknowledging that it had delivered a proposal to CanniMed for a business combination. On November 17, 2017, the date Aurora's proposal expired, CanniMed announced that it had entered into a definitive agreement to acquire Newstrike Resources Ltd. Aurora’s Offer is subject to the condition that the proposed acquisition of Newstrike Resources shall not have proceeded, and any acquisition agreement for such acquisition shall have been terminated.

Lock-up

Aurora has entered into Lock-up Agreements with CanniMed Shareholders holding 38% of the currently outstanding CanniMed Shares.

Canadian tax consequences

A Resident Holder who exchanges CanniMed Shares for Aurora Shares in a Direct Exchange will, in general terms, be deemed to have disposed of such CanniMed Shares under a tax-deferred share-for-share exchange pursuant to s. 85.1 unless such Resident Holder chooses to recognize a capital gain (or capital loss) on the exchange.

U.S. tax consequences

The determination of whether the Offer will qualify as a tax-deferred "reorganization" within the meaning of s. 368(a) of the Code (a "Reorganization") depends on the resolution of complex issues and facts, some of which will not be known until the closing of the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction, and as a result, it is uncertain as to whether the Offer will qualify as a Reorganization or a fully taxable transaction. Subject to the passive foreign investment company rules, a U.S. Holdco who holds CanniMed Shares as a capital asset will not recognize gain or loss on the exchange of its CanniMed Shares for Aurora Shares pursuant to the Offer if the exchange constitutes a Reorganization.

Goldcorp/Osisko

Offer

Holders of common shares of Osisko are offered C$2.26 in cash and 0.146 of a Goldcorp common share for each share. The offer is conditional, inter alia, on 66 2/3% of the issued and outstanding Osisko shares (calculated on a fully-diluted basis) being tendered. No part of the consideration paid will be allocated to the SRP Rights (which will be deemed to be deposited with the related shares). Goldcorp expects to issue approximately 65M shares under the offer.

Osisko

Osisko is a CBCA corporation listed on the TSX and Frankfurt exchanges, and its shares are traded on the OTC Pink Current Information Marketplace. Its flagship asset is a Quebec mine. It has approximately 438M shares outstanding plus options on a further 23M shares.

Goldcorp

Goldcorp (an OBCA corporation with various gold properties in the western hemisphere) is listed on the TSX and NYSE. It has approximately 812M shares outstanding plus options on a further 17M shares.

Compulsory Acquisition/ Subsequent Acquisition Transaction

If 90% of the shares (other than those held by Goldcorp and affiliates) are taken up, Goldcorp intends to acquire the balance on the same terms as under the offer. If there instead is a Subsequent Acquisition Transaction, Goldcorp intends that the consideration offered would be the same as under the offer, and that the shares acquired under the offer would be voted in favour of such transaction.

Canadian tax consequences

The tendering of Osisko shares will not occur on a rollover basis (no s. 85(1) (or (2) election procedure is provided.)

Having regard to Goldcorp having non-resident subsidiaries, the tax disclosure:

is not applicable to a person that (i) is a corporation resident in Canada and (ii) is, or becomes as part of a transaction or event or series of transactions or events that includes the Offer, controlled by a non-resident corporation for the purposes of the foreign affiliate dumping rules in section 212.3….

No opinion expressed on a Subsequent Acquisition Transaction. Standard taxable Canadian property disclosure for non-residents.

U.S. Tax Consequences

[from Summary]. "[Such]… consequences of the Acquisition…to an Osisko Shareholder who is a citizen or resident of the United States for tax purposes will depend upon whether the Acquisition will be treated as a tax-deferred reorganization… . It is uncertain whether the Acquisition and certain related transactions will be treated as a tax-deferred reorganization because the availability of such treatment will depend upon (1) a number of factors that cannot be predicted currently (including the number of shares to be tendered to the Offer), and (2) whether certain other transactions occur after the Acquisition and, if so, whether the Acquisition and such other transactions may be characterized as a single, integrated transaction or as separate transactions…. In addition, the US federal income tax analysis with respect to each Osisko Shareholder will depend in part upon whether Osisko is treated as a PFIC with respect to such Osisko Shareholder. … Osisko has indicated in a public filing that it believes that it was a PFIC in prior years. Unless Osisko amalgamates with a subsidiary of Goldcorp following the offer or a Subsequent Acquisition Transaction, the transaction generally will be taxable. If such an amalgamation occurs, the disposition of Osisko shares for Goldcorp shares and/or cash may be treated as an exchange pursuant to a reorganization per s. 368(a) of the Code provided that the exchange transaction and the subsequent amalgamation are treated as a single integrated transaction. If so, a U.S. holder will realize gain on the exchange transaction only to the extent of the U.S. dollar value of any cash received (up to the amount of gain computed on ordinary principles)."

Alamos/Aurizon

Offer

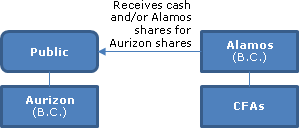

Each holder of common shares of (TSX- and NYSE-listed) Aurizon may elect to receive $4.65 per share in cash or 0.2801 of an Alamos share for each Aurizon share deposited under the offer (which is conditional, inter alia, on 66 2/3% of the issued and outstanding Aurizon shares (calculated on a fully-diluted basis) being tendered), except that the total amount of cash available under the offer is limited to $305M, and the total number of Alamos shares issuable under the offer is limited to 23.5M shares. Assuming that all shareholders tender to the cash alternative, or all tender to the Alamos share alternative, each Aurizon shareholder will receive $2.04 in cash and 0.1572 of an Alamos for each Aurizon share. The offer represents a premium of approximately 40%. Aurizon shareholders can elect to receive payment in U.S. dollars.

Unless an Aurizon shareholder receives only Alamos shares or only cash, an Aurizon shareholder will be deemed to have received a proportionate amount of shares and cash consideration for the tendered Aurizon shares.

Toehold

At the time of the offer, Alamos has acquired a toehold of approximately 16%, mostly through agreements entered into with fund managers.

Compulsory Acquisition/ Subsequent Acquisition Transaction

If 90% of the shares (other than those held by Alamos and affiliates) are taken up, Alamos intends to acquire the balance on the same terms as under the offer. If there instead is a Subsequent Acquisition Transaction, Alamos intends that the consideration offered would be the same as under the offer, and that the shares acquired under the offer would be voted in favour of such transaction. Alamos believes that the U.S. going-private transaction rule (Rule 13e-3) would not be applicable.

Canadian tax consequences

The s. 85.1 rollover will be available to an Aurizon shareholder who receives only Alamos shares (unless gain or loss is reported on the disposition). Alamos generally will elect jointly with an Aurizon shareholder under 85(1) (or (2)) if the election form is provide within 60 days. "Eligible Holders" for purposes of being eligible to make the election are non-exempt residents, and non-residents whose shares are taxable Canadian property and not treaty-protected property.

Having regard to Alamos having non-resident subsidiaries, the tax disclosure:

is not applicable to a person that (i) is a corporation resident in Canada and (ii) is, or becomes as part of a transaction or event or series of transactions or events that includes the acquisition of Alamos Shares, controlled by a non-resident corporation for the purposes of the foreign affiliate dumping rules in proposed [sic] section 212.3….

No opinion expressed on a Subsequent Acquisition Transaction. Standard taxable Canadian property disclosure for non-residents.

U.S. Tax Consequences

Unless Aurizon amalgamates with a subsidiary of Alamos following the offer or a Subsequent Acquisition Transaction, the transaction generally will be taxable. If such an amalgamation occurs, the disposition of Aurizon shares for Alamos shares and/or cash may be treated as an exchange pursuant to a reorganization per s. 368(a) of the Code provided that the exchange transaction and the subsequent amalgamation are treated as a single integrated transaction. If so, a U.S. holder will realize gain on the exchange transaction only to the extent of the U.S. dollar value of any cash received (up to the amount of gain computed on ordinary principles).

The consequences would differ if Aurizon were a PFIC. According to public filings, it does not believe it was a PFIC for its 2011 year.

First Quantum/Inmet

Offer

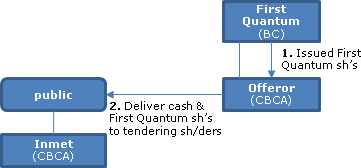

FQM (Akuba) Inc. (the "Offeror"), which is a CBCA wholly-owned subsidiary of First Quantum (which is a TSX-listed and LSE-admitted BCBCA company), is offering to each shareholder of Inmet (which is a TSX-listed CBCA company) the following consideration for each share of Inmet (conditional inter alia on at least 66 2/3% of the Inmet shares on a fully-diluted basis being deposited):

• $72 in cash;

• 3.2967 common shares of First Quantum; or

• $36 in cash and 1.6484 common shares of First Quantum.

However, the total cash consideration and First Quantum shares to be provided under the offer and a second-stage transaction will not exceed $2,531,212,776 and 115,901,421 shares (and is fixed at these amounts?). An Inmet shareholder is required to deposit one shareholder rights plan right with each deposited Inmet share. (The shareholders' rights plan was adopted by Inmet following the initial First Quantum overture but without the plan being ratified by shareholders or approved by the TSX.) The cash consideration will be reduced for any Inmet dividends, with such dividends otherwise being required to be paid to the Offeror. (Inmet has $1.9B of cash.) The offer represents a 33% premium to the Inmet closing price on November 23, 2012.

Compulsory Acquisition/Subsequent Acquisition Transaction

If 90% acceptance, First Quantum will acquire the balance of the Inmet shares under a Compulsory Acquisition Transaction "on the same terms as…under the Offer – and otherwise under a Subsequent Acquisition Transaction. The Offeror expects that a Subsequent Acquisition Transaction would be a "business combination" under MI 61-101.

"The Offeror currently intends (x) that the consideration offered per Inmet Share under any Subsequent Acquisition Transaction proposed by it would be equal in value to and in the same form as the consideration paid to Shareholders under the Offer, (y) that such Subsequent Acquisition Transaction will be completed no later than 120 days after the Expiry Date and (z) to cause any Inmet Shares acquired under the Offer to be voted in favour of any such transaction and, where permitted by MI 61-101 to be counted as part of any Minority Approval required in connection with any such transaction."

Canadian tax consequences

No rollover for Canadian residents. No specific (but in terrorem) disclosure re a Subsequent Acquisition Transaction. Standard taxable Canadian property disclosure for non-residents.

Robert Willens, "Canadian Rollovers are Hard to Come By"

, Tax Notes International, 8 April 2013, p. 145: After describing the First Quantum bid and noting the absence of a rollover under s. 85.1, he then stated:

[I]f the tender offer and amalgamation — as seems highly likely — are treated as part of an integrated plan, U.S.shareholders of Inmet should be entitled to partake of the benefits of reorganization treatment of that integrated transaction as long as the value of the First Quantum shares conveyed in the transaction is at least 40 percent of the value of the aggregateconsideration conveyed to the Inmet shareholders. An acquisition of stock coupled with an upstream or sideways asset movement will be viewed as a direct acquisition of the target's properties by the issuing corporation (or by a subsidiary thereof) if the steps,when analyzed as a one-step transaction, constitute a reorganization. See Rev. Rul. 2001-46, 2001-1 C.B. 321. Assuming the First Quantum stock represents the requisite proportion of the aggregate consideration conveyed to the Inmet shareholders, the transaction, when viewed as a direct acquisition by First Quantum of the properties of Inmet by means of a merger (the amalgamationis analogized to a merger), constitutes a reorganization within the meaning of section 368(a)(1)(A). For purposes of section 368(a)(1)(A), a statutory merger is a transaction effected under the necessary statutes and in which, as a result of the operationof those statutes, all the assets and liabilities of each member of one or more combining units become the assets and liabilities ofone or more members of one other combining unit and the transferor unit ceases its separate legal existence, which happened here. See reg. section 1.368-2(b)(1)(ii).

Hecla/US Silver

Offer by Hecla (NYSE) for all the outstanding common shares of U.S. Silver (TSX, US OTCQX, Frankfurt) and all its outstanding warrants for a cash price of Cdn.$1.80 per share and Cdn.$0.205 per warrant, with U.S. Silver equity thereby being valued at Cdn.$112 million. Accordingly, it is recommended that U.S. Silver shareholders vote against the RX Gold arrangement. Offer price represents a 23% premium to the closing price on July 24, 2012. Conditions of offer include 66 2/3% of both the U.S. Silver common shares and warrants being tendered, the RX Gold arrangement not being approved, and no increase in break fees. An offer is not made for employee stock options.

Canadian taxation

A disposition of U.S. Silver shares or warrants under the offer will occur on a taxable basis. Discussion of potential Subsequent Acquisition Transactions includes a general discussion of an amalgamation and redemption transaction.

U.S. taxation

It is believed that U.S. Silver (a Canadian corporation) likely is or has been a United States real property holding corporation. However, a sale of shares of U.S. Silver to Hecla by a non-US holder should not be subject to US tax (assuming, as appears likely, that the shares of U.S. Silver are considered "regularly traded" on an established securities market within the meaning of s. 897 of the Code) unless such shareholder has directly or indirectly or constructively owned more than 5% of the interests in U.S. Silver (including stocks and options) at any time during the shorter of (a) the five-year period ending on the date of the sale, and (b) the period of ownership.

However, it is believed that the regularly traded test would not be satisfied for a Subsequent Acquisition Transaction, so that a non-US holder could recognize a gain even if the 5% test was not satisfied. In these circumstances, U.S. Silver would be required under Code s. 1445 to withhold 10% of the amount paid without regard to whether the 5% test was satisfied.