The excluded loan provisions in draft s. 15(2.01) help but are not a complete fix

S. 15(2.01) of the August 12, 2024 draft legislation proposes to exclude, from the application of s. 15(2), a loan the debtor of which is

- a corporation resident in Canada (CRIC), a foreign affiliate of the particular corporation referred to in s.15(2), or a foreign affiliate of a person resident in Canada with which such particular corporation does not deal at arm’s length; or

- a partnership, each member of which is a person described above, or another partnership of such persons or partnerships.

These amendments do not appear to address some situations, such as this example:

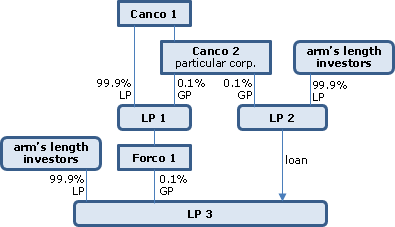

- Canco 1 is the 99.9% limited partner of LP 1, and its subsidiary, Canco 2, is the 0.1% general partner of LP 1 and LP 2; and LP 1 in turn wholly-owns the 0.1% general partner (Forco 1) of LP 3. The limited partners of LP 2 and LP 3 are arm’s length persons.

- LP 2 makes a loan to LP 3 to fund LP 3’s business.

- Canco 2 is the particular corporation, while Canco 1 is its shareholder. LP 3 does not deal at arm’s length with Canco 1 because Canco 1 controls its general partner. Therefore, LP 3 is connected with Canco 1, a shareholder of the particular corporation. Furthermore, Canco 2 is a member of LP 2, which advanced the loan. Therefore, a partnership (LP 3) which is connected with the shareholder (Canco 1) of the particular corporation has received a loan from a partnership (LP 2) of which the particular corporation (Canco 2) is a member. The conditions in s. 15(2.01) are not met, so that the s. 15(2) rules apply.

If the limited partners of LP 2 and LP 3 instead were Canco 1 and LP 1, respectively, the s. 15(2.01) exception would be satisfied since the loan recipient (LP 3) is a partnership whose only members are Forco 1 (an FA of LP 1, a resident person for s. 96 income computation purposes with whom the particular corporation does not deal at arm’s length and whose partners are all CRICs) and LP 1 (a partnership each member of which is a CRIC).

Neal Armstrong. Summary of Sam Li, “The Revised Shareholder Loan Rules,” International Tax Highlights, Vol. 3, No. 4, November 2024, p. 9 under s. 15(2.01).