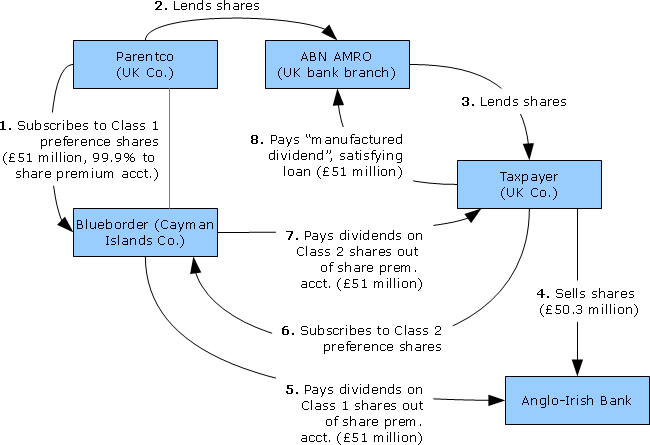

The taxpayer, in cooperation with two banks, a Cayman Islands corporation and its parent, implemented the following series of transactions:

The subscription proceeds for preference shares of a Caymans company ("Blueborder") were substantially in excess of the nominal or par value of the shares, with the excess being credited to its share premium account (transaction 6). The deductibility of a manufactured dividend paid by the UK taxpayer (transaction 8) turned on whether a dividend paid to the taxpayer out of Blueborder's share premium account (transaction 7) was an income or capital payment. Before finding that it was an income payment because it was a dividend under Caymans law (i.e., a distribution of profits from the issuance of shares for more than their par value - see para. 15), Moses L.J. stated (at para. 10):

The jurisprudence is well-established. Payments made by a company in respect of shares are either income payments, or, if the company is not in liquidation, by way of an authorised reduction of capital. The courts have recognised no more than that dichotomy. The distinction has depended upon the mechanics of distribution. If the payments are made by deploying the mechanisms appropriate for reduction of capital, then they are payments of capital. Such mechanisms can be readily identified as designed to protect the capital of a company. If the payments are not made by such mechanisms but are made by way of dividend, they are income payments.

The fact that the payment of the dividend out of the share premium account reduced the capital that would have been distributable on a winding-up of Blueborder was not relevant as "it is the form by which the payments are made which determines their character" (para. 25).