Financial tables

Disclaimer

We do not guarantee the accuracy of this copy of the CRA website.

Scraped Page Content

Financial tables

Financial tables

| (in dollars) | 2017-18 Forecast | 2018-19 Planned | 2019-20 Planned | 2020-21 Planned |

|---|---|---|---|---|

| Total Main Estimates |

4,162,899,574 | 4,204,725,760 | 4,218,428,531 | 4,177,018,310 |

| Taxpayers' Ombudsman included in Main Estimates above | (3,183,760) | (3,132,365) | (3,141,688) | (3,146,233) |

| Supplementary Estimates | ||||

| Funding for the implementation and administration of various measures to continue efforts to crack down on tax evasion and combat tax avoidance (Budget 2017) | 50,985,647 | |||

| Funding related to Government advertising programs | 1,000,000 | |||

| Funding to implement the taxation regime for cannabis | 7,014,489 | |||

| Funding for operational pressures related to the Government of Canada’s pay system - Phoenix | 1,544,316 | |||

| Reimbursement as a result of a reduction in accommodation requirements | 11,700,000 | |||

| Other Adjustments: | ||||

| Adjustment to the respendable non-tax revenues | 4,006,864 | |||

| Adjustments associated with the implementation and administration of federal legislation to enhance the Canada Pension Plan | 911,632 | |||

| Adjustments associated with the administration costs recoverable by the CRA from the Canada Pension Plan and Employment Insurance Accounts | (652,752) | |||

| Anticipated compensation adjustments | 51,981,812 | |||

| Funding for the reimbursement of salary advances and overpayments incurred by the CRA in 2016-17 as a result of issues with the government pay system | 8,903,205 | |||

| Planned Base Spending | 4,297,111,027 | 4,201,593,395 | 4,215,286,843 | 4,173,872,077 |

| Taxpayers' Ombudsman | 3,183,760 | 3,132,365 | 3,141,688 | 3,146,233 |

| Items not yet included in outer years' planned spending | ||||

| Carry-forward from 2016-17 | 203,651,392 | - | - | - |

| Maternity and severance payments | 316,500,000 | - | - | - |

| Total Planned SpendingFootnote 1 | 4,820,446,179 | 4,204,725,760 | 4,218,428,531 | 4,177,018,310 |

| Respendable non-tax revenues pursuant to the Canada Revenue Agency Act | (169,727,126) | (159,856,226) | (153,747,478) | (152,050,870) |

| Cost of services received without charge | 502,510,776 | 449,900,714 | 451,711,382 | 449,025,223 |

| Total CRA Spending | 5,153,229,829 | 4,494,770,248 | 4,516,392,435 | 4,473,992,663 |

| Human Resources (Full-Time Equivalents) | ||||

| Canada Revenue Agency | 40,509 | 39,904 | 39,962 | 39,189 |

| Taxpayers' Ombudsman | 31 | 31 | 31 | 31 |

| Total Full-Time Equivalents |

40,540 | 39,935 | 39,993 | 39,220 |

CRA Planned Spending and Full-Time Equivalents

| (in dollars) | 2017-18 Forecast |

2018-19 Planned | 2019-20 Planned | 2020-21 Planned |

|---|---|---|---|---|

| Tax |

3,151,651,179 | 2,793,270,920 | 2,819,226,312 | 2,784,245,038 |

| Benefits |

503,214,849 | 482,609,132 | 474,246,261 | 477,744,586 |

| Internal Services |

1,162,061,511 | 925,713,343 | 921,814,270 | 911,882,453 |

| Taxpayers' Ombudsman |

3,518,640 | 3,132,365 | 3,141,688 | 3,146,233 |

| Total Planned SpendingFootnote 1 |

4,820,446,179 | 4,204,725,760 | 4,218,428,531 | 4,177,018,310 |

| Respendable non-tax revenue pursuant to the Canada Revenue Agency Act |

(169,727,126) | (159,856,226) | (153,747,478) | (152,050,870) |

| Cost of services received without charge |

502,510,776 | 449,900,714 | 449,025,223 | |

| Total CRA Spending |

5,153,229,829 | 4,494,770,248 | 4,516,392,435 | 4,473,992,663 |

| Human Resources (Full-Time Equivalents) |

40,540 | 39,935 | 39,993 | 39,220 |

CRA spending trend (dollars)

| 2015-16 |

2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

|---|---|---|---|---|---|---|

| Actuals |

Forecast Spending | Planned Spending | ||||

| Statutory |

1,034,149,642 | 936,635,156 | 942,479,230 | 916,610,222 | 913,826,933 | 911,597,459 |

| Voted |

3,112,837,652 | 3,453,312,607 | 3,877,966,949 | 3,288,115,538 | 3,304,601,598 | 3,265,420,851 |

| Total |

4,146,987,294 | 4,389,947,763 | 4,820,446,179 | 4,204,725,760 | 4,218,428,531 | 4,177,018,310 |

In fiscal year 2018-19, Planned Spending is identical to expenditure levels presented in the Main Estimates.

The spending trend figure shows all parliamentary appropriations (Main Estimates and Supplementary Estimates) and revenue sources provided to the CRA for: policy and operational initiatives arising from various federal budgets and economic statements, transfers from Public Services and Procurement Canada for accommodations and real property services, disbursements under the Softwood Lumber Agreement, children's special allowance payments, as well as the implementation of initiatives to improve efficiency.

Actual and forecast spending for fiscal years 2015-16 to 2017-18 also includes technical adjustments such as the CRA's carry-forward from the previous year and funding for maternity and severance benefits. In the 2017-18 fiscal year, a significant portion of the increase in spending is associated with the cash out of severance benefits upon resignation or retirement for employees represented by the Public Service Alliance of Canada (PSAC) bargaining unit.

Over the period 2015-16 to 2020-21, the CRA's voted appropriations show an increase primarily as a result of funding received to implement and administer various measures announced in the federal budgets, transfers from Public Services and Procurement Canada for accommodation and real property services, as well as wage settlements. The 2016-17 and 2017-18 fiscal years also reflect higher spending as a result of retroactive payments associated with collective bargaining increases for employees represented by the PSAC and Professional Institute of the Public Service of Canada bargaining units, including amounts set aside in anticipation of wage settlements for the period under the operating budget freeze.

The above increases have been partially offset by planned decreases in funding for the upgrade of the individual income tax processing system and the administration of the Softwood Lumber Agreement, as well as other miscellaneous items such as decreases in Government advertising programs and the transfer of CRA training programs to the Canada School of Public Service.

Over the period 2015-16 to 2020-21, the CRA's statutory authorities show a decrease primarily due to a reduction in disbursements to the provinces following the expiration of the Softwood Lumber Agreement and changes in employee benefit plan rates. These decreases have been partially offset by increases for children's special allowance payments.

CRA activities

Description of image

Description of image

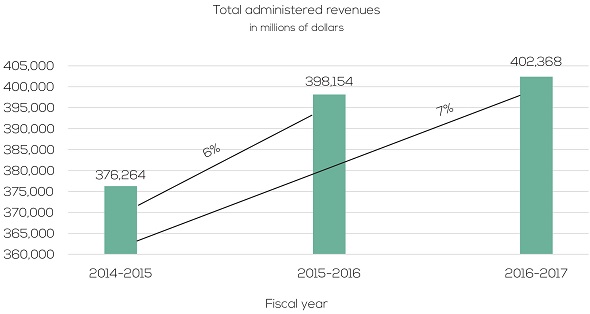

This chart demonstrates how there has been an increase of 7 per cent in total administered revenues for the CRA from 2014-2015 to 2016-2017.

At the top of the chart are the words Total administered revenues in millions of dollars. At the bottom are the words Fiscal year.

To the left of the chart, in descending order, are the following numbers, representing amounts in millions of dollars: 405,000; 400,000; 395,000; 390,000; 385,000; 380,000; 375,000; 370,000; 365,000; and 360,000.

Within the chart are three rectangular columns, each representing a fiscal year. The column on the left represents the year 2014-2015, the middle column 2015-2016, and the column on the right 2016-2017.

The column on the left extends upward to a position somewhere between the 375,000 and 380,000 numbers on the left of the chart, and above the column is the number 376,264, which indicates the amount of total administered revenues for the CRA during 2014-2015.

The middle column extends upward to a position somewhere between the 395,000 and 400,000 numbers on the left of the chart, and above the column is the number 398,154, which indicates the amount of total administered revenues for the CRA during 2015-2016.

The column on the right extends upward to a position somewhere between the 400,000 and 405,000 numbers on the left of the chart, and above the column is the number 402,368, which indicates the amount of total administered revenues for the CRA during 2016-2017.

A diagonal line connects the left-hand column with the middle column and above this line is the figure 6 per cent, which indicates the percentage by which total administered revenues for the CRA increased between 2014-2015 and 2015-2016.

A second diagonal line connects the left-hand column with the column on the right and above this line is the figure 7%, which indicates the percentage by which total administered revenues for the CRA increased between 2014-2015 and 2016-2017.

| Fiscal year | 2014-2015 | 2015-2016 | 2016-2017 |

|---|---|---|---|

| in millions of dollars | |||

| Total administered revenues | 376,264 | 398,154 | 402,368 |

Description of image

Description of image

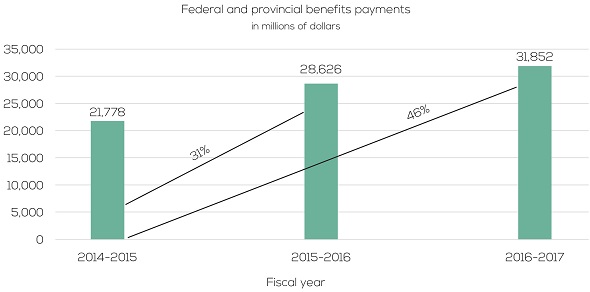

This chart demonstrates how there has been an increase of 46 per cent in federal and provincial benefit payments processed by the CRA from 2014-2015 to 2016-2017.

At the top of the chart are the words Federal and provincial benefit payments in millions of dollars. At the bottom are the words Fiscal year.

To the left of the chart, in descending order, are the following numbers, representing amounts in millions of dollars: 35,000; 30,000; 25,000; 20,000; 15,000; 10,000; 5,000; and 0.

Within the chart are three rectangular columns, each representing a fiscal year. The column on the left represents the year 2014-2015, the middle column 2015-2016, and the column on the right 2016-2017.

The column on the left extends upward to a position somewhere between the 20,000 and 25,000 numbers on the left of the chart, and above the column is the number 21,778, which indicates the amount of federal and provincial benefit payments processed by the CRA during 2014-2015.

The middle column extends upward to a position somewhere between the 25,000 and 30,000 numbers on the left of the chart, and above the column is the number 28,626, which indicates the amount of federal and provincial benefit payments processed by the CRA during 2015-2016.

The column on the right extends upward to a position somewhere between the 30,000 and 35,000 numbers on the left of the chart, and above the column is the number 31,852, which indicates the amount of federal and provincial benefit payments processed by the CRA during 2016-2017.

A diagonal line connects the left-hand column with the middle column and above this line is the figure 31 per cent, which indicates the percentage by which federal and provincial benefit payments processed by the CRA increased between 2014-2015 and 2015-2016.

A second diagonal line connects the left-hand column with the column on the right and above this line is the figure 46%, which indicates the percentage by which federal and provincial benefit payments processed by the CRA increased between 2014-2015 and 2016-2017.

| Fiscal year | 2014-2015 | 2015-2016 | 2016-2017 |

|---|---|---|---|

| in millions of dollars | |||

| Federal and provincial benefits payments | 21,778 | 28,626 | 31,852 |

The CRA's work volume has increased, as demonstrated in the graphic. Over the course of the last two years, there has been an increase of 7% in total administered revenues and 46% in benefit payments processed.

Service standards

Service standards support the CRA's commitment to Canadians for transparency, management accountability, and citizen-focused service. The full list of service standards is available on the CRA website: www.canada.ca/en/revenue-agency/services/about-canada-revenue-agency-cra/service-standards-cra.html

CRA staffing principles

| CRA staffing principles | |

|---|---|

| Staffing principles related to a successful staffing program: | |

| Adaptability | Staffing is flexible and responsive to the changing circumstances and to the unique or special needs of the organization. |

| Efficiency | Staffing is planned and carried out taking into consideration time and cost, and it is linked to business requirements. |

| Fairness | Staffing is equitable, just and objective. |

| Productiveness | Staffing results in the required number of competent people being appointed to conduct the CRA’s business. |

| Transparency | Communications about staffing are open, honest, respectful, timely and easy to understand. |

| Staffing principles related to an effective workforce: | |

| Competency | The workforce possesses the attributes required for effective job performance. |

| Non-partisanship | The workforce and staffing decisions must be free from political and bureaucratic influence. |

| Representativeness | The composition of our workforce reflects the labour market availability of employment equity designated groups. |

Sustainable development

The Canada Revenue Agency (CRA) is committed to carrying out its mandate in a way that will protect the well-being of Canadians by working to reduce the environmental effects of CRA programs, services, and operations. The 2017-20 Departmental Sustainable Development Strategy outlines the CRA's mandatory responsibilities under the Low-Carbon Government goal outlined in the 2016–19 Federal Sustainable Development Strategy.

To continue reducing greenhouse gas emissions from its operations, the CRA has committed to modernizing its vehicle fleet, procuring green products and services, and promoting sustainable travel practices and other sustainable development information to its employees. In addition, the CRA's strategy goes beyond its Federal Sustainable Development Strategy requirements by identifying additional opportunities to integrate sustainable development into its programs, services, and operations.

Footnote

- Footnote 1

-

Over the planning period (from $4.205 billion in 2018-19 to $4.177 billion in 2020-21), the CRA's appropriations show a slight reduction primarily as a result of planned decreases in funding received to implement and administer various measures announced in the federal budgets as well as in funding for the upgrade of the individual income tax processing system. These reductions have been partially offset by increases associated with adjustments to accommodation and real property services and increases to the CRA's statutory authorities for children's special allowance payments.

Forecast spending in the 2017-18 fiscal year includes a significant increase associated with the cash out of severance benefits upon resignation or retirement for employees represented by the Public Service Alliance of Canada (PSAC) bargaining unit. The 2017-18 fiscal year also reflects higher spending as a result of retroactive payments associated with collective bargaining increases for employees represented by the PSAC and Professional Institute of the Public Service of Canada bargaining units, including amounts set aside in anticipation of wage settlements for the period under the operating budget freeze.

Page details

2018-04-03