Please note that the following document, although believed to be correct at the time of issue, may not represent the current position of the CRA.

Prenez note que ce document, bien qu'exact au moment émis, peut ne pas représenter la position actuelle de l'ARC.

PRINCIPAL ISSUES: Formula to allocate safe income on corporate reorganization

POSITION: See document

REASONS: See document

XXXXXXXXXX

2021-087644

Marc Ton-That

(819) 327-3357

January 14, 2021

Dear XXXXXXXXXX,

Re: Safe income allocation on corporate reorganization

This is in response to your letter of January 4th, 2020 in which you requested our views on the situations described below.

Unless otherwise stated, all statutory references herein are to the Income Tax Act (Canada).

In light of our response to Question 3 of the 2020 Canadian Tax Foundation (“CTF”) conference Round Table (document 2020-086103), where a formula was provided for allocating safe income of a corporation (Opco) that undergoes a tax-free reorganization in which assets are transferred to another corporation (Newco), you asked us to consider the following example:

Opco is an operating corporation that has the following assets and liabilities:

Opco has realized safe income (direct safe income or “DSI”) of $400. Your question is what formula should be used for the allocation of safe income in the following circumstances:

Situation 1

Opco is wholly-owned by Holdco 1.

The ACB in the shares of Opco held by Holdco 1 is $500. The safe income of Opco that contributes to the gain on the shares held by Holdco 1 is $400.

All Business 2 assets and $100 of liabilities of Opco are to be transferred to Newco that will be wholly-owned by Holdco 1, for a net value of $1,100. The transfer will be done on a pure rollover basis in the following manner:

- Holdco 1 transfers 50% of the shares of Opco to Newco on a rollover basis in consideration for shares of Newco.

- Opco transfers Business 2 assets to Newco in consideration for an assumption of $100 of liabilities of Opco by Newco and an issuance of $1,100 of shares of Newco to Opco. The transfer will be on a rollover basis.

- Shares held between Opco and Newco are cross-redeemed for a note and the notes are cross-cancelled.

- No safe income will be capitalized prior to the reorganization.

- Either paragraph 55(3)(a) or paragraph 55(3)(b) will apply to the reorganization.

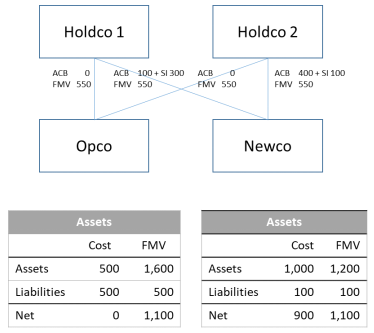

Situation 2

Opco is owned equally by 2 unrelated shareholders: Holdco 1 and Holdco 2. The ACB in the shares of Opco held by Holdco 1 is $100. The safe income of Opco that contributes to the gain on the shares held by Holdco 1 is $300.

The ACB in the shares of Opco held by Holdco 2 is $400. The safe income of Opco that contributes to the gain on the shares held by Holdco 2 is $100 (Holdco 2 became a 50% shareholder of Opco by investing $400 in the shares of Opco at the time Opco was worth $400 and the safe income realized by Opco prior to that time was $200, which was allocated to Holdco 1).

All Business 2 assets and $100 of liabilities of Opco are to be transferred to Newco that will be owned equally by Holdco 1 and Holdco 2, for a net value of $1,100. The transfer will be done on a pure rollover basis in the following manner:

- Holdco 1 and Holdco 2 transfer 50% of the shares of Opco owned by them to Newco on a rollover basis in consideration for shares of Newco.

- Opco transfers Business 2 assets to Newco in consideration for an assumption of $100 of liabilities of Opco by Newco and an issuance of $1,100 of shares of Newco to Opco. The transfer will be on a rollover basis.

- Shares held between Opco and Newco are cross-redeemed for a note and the notes are cross-cancelled.

- No safe income will be capitalized prior to the reorganization.

- Paragraph 55(3)(b) will apply to the reorganization.

This technical interpretation provides general comments about the provisions of the Act and related legislation. It does not confirm the income tax treatment of a particular situation involving a specific taxpayer but is intended to assist you in making that determination. The income tax treatment of particular transactions proposed by a specific taxpayer will only be confirmed by this Directorate in the context of an advance income tax ruling request submitted in the manner set out in Information Circular 70-6R10 – Advance Income Tax Rulings and Technical Interpretations.

Situation 1

In this situation, the DSI of Opco to be allocated post-reorganization between Opco and Newco is based on the following formula:

DSI on the shares of Newco: DSI of Opco prior to reorg * net cost amount of assets transferred to Newco / total net cost amount of assets of Opco prior to reorg

DSI on the shares of Opco after reorg: DSI of Opco prior to reorg * net cost amount of assets retained by Opco / total net cost amount of assets of Opco prior to reorg

Under such formula, the DSI to be allocated to Newco should be $400 (400*900/900) and the DSI remaining in Opco should be 0 (400*0/900).

The situation after the reorganization would be as follows:

Because of the misalignment of inside and outside ACB (see discussion in Question 1 of the 2020 CTF conference Round Table – document 2020-086099), Holdco 1 should stream the ACB in the shares of Opco and transfer all such ACB to Newco on the reorganization.

With streaming of ACB, the post-reorganization situation would be as follows:

Situation 2

In this situation, the DSI of Opco to be allocated post-reorganization between Opco and Newco is based on the following formula:

DSI on the shares of Newco: DSI of Opco prior to reorg * net cost amount of assets transferred to Newco / total net cost amount of assets of Opco prior to reorg

DSI on the shares of Opco after reorg: DSI of Opco prior to reorg * net cost amount of assets retained by Opco / total net cost amount of assets of Opco prior to reorg

Under such formula, the DSI to be allocated to Newco should be $400 (400*900/900) and the DSI remaining in Opco should be 0 (400*0/900).

The split of safe income between Holdco 1 and Holdco 2 in each corporation would be based on their respective ratio of safe income that they had in Opco prior to the reorganization.

Therefore, since the safe income of $400 is allocated to Newco post-reorganization, the share of Holdco 1 and Holdco 2 in such safe income is as follows:

DSI on the shares of Newco held by Holdco 1: DSI allocated to Newco post-reorg * DSI on shares of Opco held by Holdco 1 pre-reorg / total DSI of Opco pre-reorg

DSI on the shares of Newco held by Holdco 2: DSI allocated to Newco post-reorg * DSI on shares of Opco held by Holdco 2 pre-reorg / total DSI of Opco pre-reorg

Therefore,

the DSI on the shares of Newco held by Holdco 1 post-reorg would be 400 * 300/400 = 300, and

the DSI on the shares of Newco held by Holdco 2 post-reorg would be 400 * 100/400 = 100.

The situation after the reorganization would be as follows:

In this situation, because of the misalignment of inside and outside ACB, Holdco 1 and Holdco 2 should stream the ACB in the shares of Opco and transfer all such ACB to Newco on the reorganization.

With streaming of ACB, the post-reorganization situation would be as follows:

We trust the above comments to be of assistance.

Yours truly,

Stephane Prud’homme

Director

Reorganizations Division

Income Tax Rulings Directorate

Legislative Policy and Regulatory Affairs Branch

All rights reserved. Permission is granted to electronically copy and to print in hard copy for internal use only. No part of this information may be reproduced, modified, transmitted or redistributed in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, or stored in a retrieval system for any purpose other than noted above (including sales), without prior written permission of Canada Revenue Agency, Ottawa, Ontario K1A 0L5

© Her Majesty the Queen in Right of Canada, 2021

Tous droits réservés. Il est permis de copier sous forme électronique ou d'imprimer pour un usage interne seulement. Toutefois, il est interdit de reproduire, de modifier, de transmettre ou de redistributer de l'information, sous quelque forme ou par quelque moyen que ce soit, de facon électronique, méchanique, photocopies ou autre, ou par stockage dans des systèmes d'extraction ou pour tout usage autre que ceux susmentionnés (incluant pour fin commerciale), sans l'autorisation écrite préalable de l'Agence du revenu du Canada, Ottawa, Ontario K1A 0L5.

© Sa Majesté la Reine du Chef du Canada, 2021