Sierra/Cautivo Mining -- summary under Ss. 84(4.1)(a) and (b) distributions of proceeds

Overview

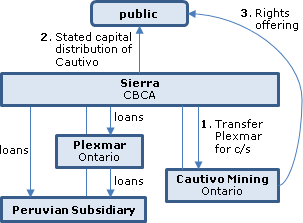

Sierra is proposing to effect a stated capital distribution of a Newco subsidiary (i.e., Cautivo Mining, which indirectly holds a Peruvian exploration company) to its shareholders in reliance primarily on the exception in ss. 84(4.1)(a) and (b) from deemed dividend treatment, although a nod is also given to the s. 84(2) exception. The disclosure relies on the proposition that the Newco shares will be issued to Sierra immediately before the distribution in exchange for transferring Sierra’s existing subsidiary to Newco, so that what will be distributed will represent proceeds of disposition. Newco will be making a rights offering immediately after the distribution in order to raise cash from its new shareholders.

Sierra

A CBCA mining company producing (through subsidiaries) precious and base metals from its Yauricocha Mine in Peru, and its Bolivar Mine and Cusi Mine in Mexico. Its common shares (the ”Sierra Shares”) trade on the Lima Stock Exchange and the TSX.

Cautivo Mining

The Corporation was incorporated under the OBCA on December 6, 2016. Its head office is in Lima Peru. Following the Reorganization (described below), Plexmar will hold 99.99% of the shares of Sociedad Minera San Miguelito S.A.C., being a Peruvian corporation holding the Las Lomas Project, located in the Department of Piura in northern Peru.

Plexmar

A wholly-owned Ontario subsidiary of Sierra holding 99.99% of the shares of Sociedad Minera San Miguelito S.A.C. (Peru).

Reorganization

Immediately prior to the Distribution Record Date, Sierra will transfer to Cautivo Mining all of the outstanding shares of Plexmar and loans owing to it by Plexmar and its subsidiary.

Capital distribution of (Cautivo Mining) Distributed Shares

Sierra is distributing to holders (other than Ineligible Holders as described below) of its common shares (the "Sierra Shares") of record as at 4:59 p.m. (Toronto time) on ●, 2017 (the "Distribution Record Date"), as a return of capital (the "Distribution"), all of the common shares (the "Distributed Shares") of its wholly-owned subsidiary, Cautivo Mining. The Distributed Shares will be distributed on the basis of one Distributed Share for every ● Sierra Shares held on the Distribution Record Date. Sierra Shares will begin trading on an ex-distribution basis on the the TSX two trading days before the Distribution Record Date, meaning that persons who acquire Sierra Shares on or after such date will not be entitled to receive the Distribution.

Rights offering to new holders of (Cautivo Mining) Distributed Shares

Immediately following the Distribution, the Corporation will issue to holders of its Distributed Shares (other than Ineligible Holders) at 5:00 p.m. (Toronto time) on the Distribution Record Date, being the "Rights Offering Record Date"), ● rights for each Distributed Share held (the "Rights Offering"). For each whole right (a "Right") held, a holder will be entitled to subscribe for one common share of the Corporation (a "Share") at a price of $● per Share (the "Subscription Price") at any time from ●, 2017 to 5:00 p.m. (Toronto time) (the "Rights Expiry Time") on ●, 2017 (the "Rights Expiry Date"). Holders who exercise their Rights in full are entitled to exercise additional Rights to acquire, at the Subscription Price, “Additional Shares” of Cautivo Mining on a pro rata basis (but subject to proration) (the “Additional Subscription Privilege.”) The aggregate number of Additional Shares available for subscription under the Additional Subscription Privilege will be the difference, if any, between the total number of Shares issuable upon exercise of Rights and the total number of Shares subscribed and paid for pursuant to the exercise of the basic subscription privilege.

Standby Agreement

The “Standby Purchasers” (Arias Resource Capital Fund II L.P. and Arias Resource Capital Fund II (Mexico) L.P.) have agreed, severally and subject to stipulated conditions, that each of the Standby Purchasers will purchase its respective percentage of the shares that are not subscribed under Rights Offering.

Listing

The Corporation has applied to list its Shares on the CSE.

Sale of Shares of Ineligible Holders

Sierra has made arrangements to have the those holders who are resident in a jurisdiction that would require the filing of a registration statement , prospectus etc. (“Ineligible Holders”) respecting the Distribution to have their ineligible shares and Rights (“Ineligible Securities”) issued to Computershare as custodian for the Ineligible Holders and has further arranged for the sale of such securities, and the net cash proceeds thereof, if any, to be distributed by Computershare to the Ineligible Holders on whose behalf such Ineligible Securities were issued.

Canadian tax consequences

S. 84(2) distribution

S. 84(2) provides, in effect, that a distribution made on a "winding up, discontinuance or reorganization of its [Sierra's] business", will not be taxed as a dividend so long as the amount or value of the funds or property distributed does not exceed the amount by which the PUC of the relevant shares is reduced on the distribution. It is noted that the Distribution is being made by Sierra as part of a number of potential changes, including the Reorganization, that are contemplated in order to maximize the overall value of the Sierra assets for Sierra Shareholders.

S. 84(4.1) distribution

S. 84(4.1) applies in certain circumstances to deem a return of capital by a public corporation (such as Sierra) to be a dividend. However, s. 84(4.1) does not apply to the Distribution provided that: (i) the Distribution can reasonably be considered to have been derived from proceeds of disposition realized by Sierra from a transaction that occurred outside the ordinary course of the business of Sierra but within the period that commenced 24 months before the Distribution; and (ii) no other amount that may reasonably be considered to have derived from such proceeds was paid by Sierra as a reduction of PUC prior to the Distribution. Management of Sierra has determined that the Distribution will be paid as a direct result of the proceeds of disposition that Sierra received on the sale of the outstanding Plexmar shares and loans to the Corporation in exchange for Shares under the Reorganization, that such transaction was outside of the ordinary course of Sierra's business, and that no amount that may reasonably be considered to have derived from such proceeds will have been paid by Sierra as a reduction of PUC prior to the Distribution. Therefore, the Distribution should be treated as a tax-free return of PUC (subject to any negative ACB issues) and not as a deemed dividend pursuant to s. 84(4.1).

Rights Offering

Generally, no amount will be required to be included in computing the income of a Resident Holder as a consequence of acquiring Rights under the Rights Offering..

Exercise of Rights

The exercise of Rights will not constitute a disposition of property for purposes of the Tax Act and, consequently, no gain or loss will be realized by a Resident Holder upon the exercise of Rights. Shares acquired by a Resident Holder upon the exercise of Rights will have a cost to the Resident Holder equal to the aggregate of the Subscription Price paid plus the adjusted cost base (if any) to the Resident Holder of the Rights exercised to acquire such Shares.