Killam -- summary under Domestic REITs

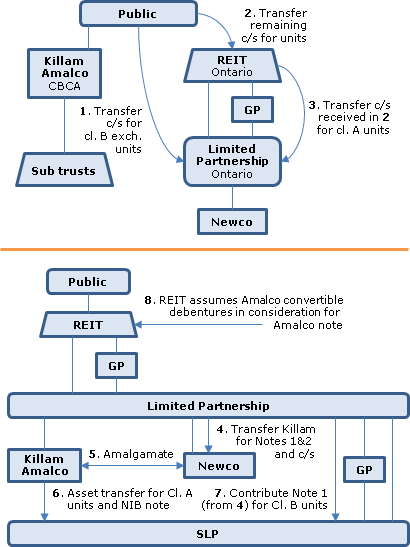

Overview. Killam will effectively be converted to a REIT. Most of its shareholders will exchange their shares for units of the REIT on a taxable basis. However, up to 20% of the shares may instead be exchanged on a s. 97(2) rollover basis for exchangeable units of a subsidiary LP into which Killam will be dropped, with the REIT backstopping the exchange obligations of the LP under an Exchange Agreement. In order that the subsidiary LP will be an "excluded subsidiary" (i.e., within a safe harbour from the SIFT rules), those electing rollover treatment must be taxable Canadian corporations (or certain other qualifying entities) - so that individuals wishing to elect would need to transfer their shares first to a holding company. Killam will then be transferred to a Newco for consideration including an interest-bearing note, followed by their amalgamation, in order to shelter the rental income of the properties now held by Killam through a lower-tier LP. Convertible debentures of Killam (bearing interest of around 5.5%) will be assumed by the REIT in consideration for the issuance of a note to it by Killam.

Killam. A TSX-listed CBCA corporation and one of Canada's largest residential landlords, owning, operating and developing multi-family apartments and manufactured home communities. It has issued two sets of convertible debentures bearing interest at 5.65% and 5.45%. It holds properties directly (registered in nominees) and through sub trusts.

The REIT. An Ontario unit trust.

Limited Partnership. Killam Apartment Subsidiary Limited Partnership, a subsidiary Ontario LP of the REIT of which it is a limited partner and a wholly-owned subsidiary (Killam Apartment General Partner Ltd.) is the general partner.

Newco. Killam SLP Acquisition Inc., a corporation to be incorporated under the CBCA.

SLP. Killam Apartment Subsidiary Limited Partnership, which will become an indirect subsidiary LP of Limited Partnership, with SLP GP as its general partner.

CBCA Plan of Arrangement.

- Each of Killam, Killam KFH (180 Mill St.) Inc., Killam KFH (Kanata Lakes) Inc., Killam KFH (1355 Silver Spear Road) Inc. and Redwood Cable Corp. will be amalgamated under the CBCA to form Killam Amalco.

- Each Common Share held by a validly dissenting shareholder will cease to have any rights as a Shareholder other than the right to be paid its fair value.

- Each Common Share held by an Shareholder who has validly elected to receive Exchangeable Units will be transferred to the Limited Partnership in consideration for one Exchangeable Unit of the Limited Partnership, and for the “Ancillary Rights” attached to such Exchangeable Units (mostly the embedded right granted to the holders of the Exchangeable Units to cause the Limited Partnership to exchange each Exchangeable Unit for one REIT Unit as supported by the Exchange Agreement, as well as special voting units of the REIT with no economic entitlement); a maximum of 20% of all Common Shares outstanding may be exchanged for Exchangeable Units, with pro ration occurring if this limit is engaged, and shareholders excluded from making the election include individuals, corporations other than taxable Canadian corporations and non-residents.

- Each remaining Common Share will be deemed to be transferred to the REIT in consideration for one REIT Unit.

- The REIT Unit held by the initial Unitholder will be cancelled for $10.00.

- Each Common Share held by the REIT will be transferred to the Limited Partnership in consideration for Class A LP Units valued at $1.00 per unit.

- The Limited Partnership's Common Shares will be transferred to Newco in consideration for an interest-bearing 10-year subordinated note and a non-interest-bearing subordinated note (Newco Note 2 and 1, respectively) and Newco common shares.

- Killam Amalco and Newco will be amalgamated under the CBCA to form Killam Amalco 2.

- Killam Amalco 2 will transfer its assets to SLP in consideration for Class A SLP Units (valued at $1.00 per unit), the assumption of liabilities and a subordinated, non-interest bearing, demand promissory note issued by SLP to Killam with a principal amount equal to the amount obtained (if positive) when the aggregate principal amount of the assumed liabilities is deducted from the aggregate cost amount of the transferred assets.

- The Limited Partnership shall subscribe for Class B SLP Units valued at $1.00 per unit, and in satisfaction of the aggregate subscription price, the Limited Partnership will contribute the Newco Note 1 to SLP.

- The initial Class A SLP Unit that was issued to Killam will be redeemed by SLP for $1.00.

- The REIT will assume all of the obligations under the Convertible Debentures in consideration for the issuance by Killam Amalco 2 to it of a subordinated note with equivalent principal and with other terms to be agreed.

- Each RSU will be continued.

Exchange Agreement. On Closing, the REIT, the Limited Partnership and the General Partner will enter into the Exchange Agreement, pursuant to which each holder of Exchangeable Units will be granted the right to require the Limited Partnership to exchange each Exchangeable Unit for one REIT Unit, subject to customary anti-dilution adjustments. In accordance with the Exchange Agreement, the REIT is required to deliver REIT Units to the Limited Partnership to assist the Limited Partnership in satisfying its obligations to the holders of Exchangeable Units.

Compulsory Exchange Right. The REIT and the Limited Partnership each have the right to compel an exchange (generally on a one-for-one basis) of all of the Exchangeable Units held at any time for REIT Units (or, at the option of the REIT, the cash equivalent thereof, based on the current market price), and with the corresonding Special Voting Units being cancelled.

Unit redemption feature. Upon receipt of the redemption notice by the REIT, all rights the REIT Units tendered for redemption shall be surrendered and the holder thereof will be entitled to receive a price per REIT Unit (the "Redemption Price") equal to the lesser of: (a) 90% of the "Market Price" of a REIT Unit calculated as of the date on which the Units were surrendered for redemption (the "Redemption Date"), being the weighted average trading price of a REIT Unit on its principal exchange during the period of 10 consecutive trading days ending on such date; and (b) 100% of the "Closing Market Price" on the Redemption Date, being an amount equal to the weighted average trading price of a REIT Unit on the principal exchange on that date. To the extent a Unitholder is not entitled to receive cash upon the redemption of REIT Units in light of a $50,000 monthly cap, the balance of the Redemption Price for such REIT Units will be paid and satisfied by way of the issuance to such Unitholder of "Redemption Notes."

DRIP. Upon Closing, Killam's current DRIP will be amended and restated to become the "New DRIP"), with the REIT assuming all of Killam's obligations under the DRIP. Pursuant to the New DRIP, Unitholders may elect to have all cash distributions of the REIT automatically reinvested in additional REIT Units at a price per REIT Unit calculated by reference to the weighted average of the closing price of REIT Units on the TSX for the five trading days immediately preceding the relevant Distribution Date. Unitholders who so elect will receive a further distribution of REIT Units equal in value to 3% of each distribution that was reinvested by the Unitholder.

Canadian tax consequences. Taxable exchange. A Shareholder who exchanges Common Shares for REIT Units pursuant to the Arrangement will be considered to have disposed of such Common Shares for proceeds of disposition equal to the fair market value at the Effective Time of such REIT Units acquired by the Shareholder.

Rollover exchange. An Electing Shareholder who elects to receive Exchangeable Units in exchange for Common Shares under the Arrangement will also receive the Ancillary Rights. Such Electing Shareholder will be required to account for these Ancillary Rights in determining the proceeds of disposition of such Common Shares and, where the Electing Shareholder files a Tax Election Form, the cost under the Tax Act of the Exchangeable Units received in consideration therefor. Killam is of the view that the Ancillary Rights have a nominal fair market value. There can be no assurance that the derivative exchange rules will apply to the exchangeable units. It will be the sole responsibility of each Electing Shareholder who wishes to make such an election to obtain the appropriate federal, provincial or territorial election forms and to duly complete and submit such forms to the Limited Partnership by the Election Deadline which is three business days prior to the shareholders' meeting and to subsequently file such elections. Detailed information regarding the filing deadlines will be posted on Killam's website at www.killamproperties.com/investorrelations/reit-information.

REIT/SIFT rules. It is assumed that each direct and indirect subsidiary of the REIT will be an excluded subsidiary entity and that the REIT will qualify under the REIT rules.