TitanStar

Overview

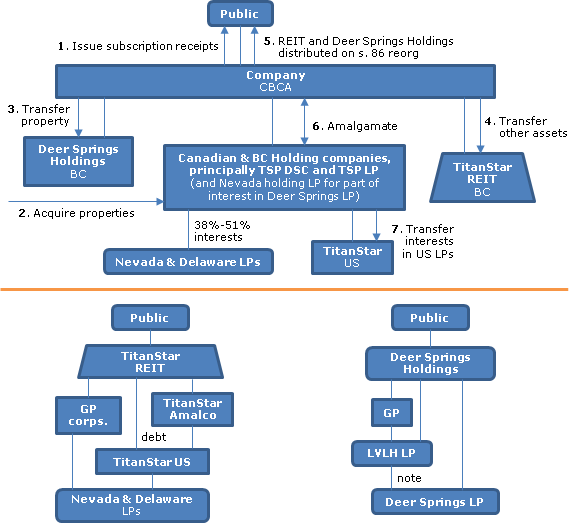

Under a CBCA Plan of Arrangement, the Company will transfer its assets other than its interest in a non-rental Nevada property (the Deer Springs property held through Deer Springs LP, a Nevada LP) to a newly-formed unit trust (TitanStar REIT), and then will transfer its interests in Deer Springs LP to a new B.C. holding company (Deer Springs Holdings). Its units of TitanStar REIT and its shares of Deer Springs Holdings will then be distributed to its shareholders under a s. 86 reorg. Deer Springs Holdings will not be listed and will have the same board and management as TitanStar REIT. "TitanStar REIT units are expected to provide an enhanced ability for TitanStar REIT to access the Candian equity capital markets, given that most publicly traded real estate entities in Canada are REIT structures or high yielding corporate structures."

The Company

Is listed on the TSXV and holds interests in U.S. retail shopping centres and the Deer Springs property through Nevada or Delaware LPs (with interests therein ranging from approximately 38% to 51%) held by it directly (in the case of that portion of an interest in Deer Springs LP which is held through a holding Nevada LP) or through Canadian or BC holding companies (principally, TSP DSC and TSP LP Holdings).

Preliminary Steps (1 to 3), Plan of Arrangement (steps 4 to 9) and post-Arrangement Steps (steps 10 to 12)

- TitanStar REIT was settled with the Company as its beneficiary as a B.C. unit trust.

- the Company has entered into purchase agreements for further U.S. asset acquisitions to be funded out of the equity raised in 3 below and with debt financing from Barclays Bank plc.

- an offering of subscription receipts pursuant to a short form prospectus (to raise between $20M and $45M) will be completed pursuant to which Preferred Shares of the Company will be issued on the basis of one preferred Share for each subscription receipt.

- the Company will transfer to Deer Springs Holdings its beneficial interest in the Deer Springs Property (comprised of its interests in Deer Springs LP and in a Nevada holding LP) in exchange for, among other things, Deer Springs Holdings Shares and Deer Springs Holdings Options;

- the Company Common Shares held by dissenting shareholders will be repurchased by the Company and cancelled;

- the Company will transfer all of its assets and liabilities to TitanStar REIT, excepting its shares in Deer Springs Holdings. In consideration, TitanStar REIT will agree to assume all of the Company's liabilities including its Debentures, and will issue TitanStar REIT Units to the Company.

- each outstanding TitanStar Option will be exchanged for a TitanStar REIT Option to acquire a TitanStar REIT Unit and a Deer Springs Holdings Option to acquire a Deer Springs Holdings Share;

- all of the Outstanding Shares of the Company (both Preferred Shares and common shares) will be purchased by the Company from the Company Outstanding Shareholders for cancellation, in exchange for the transfer by the Company per each Outstanding Share of: (a) one TitanStar REIT Unit; and (b) one Deer Springs Holdings Share per outstanding common share. Simultaneously with the cancellation of the Outstanding Shares, TitanStar REIT will subscribe for one common share for nominal consideration;

- the TitanStar REIT Units will be consolidated on a basis of one "new" TitanStar REIT Unit for the lesser of that number of "old" TitanStar REIT Units that is: (a) allowable under TSXV policies; and (b) $4 divided by the market price of the Common Shares as determined in accordance with Section 1.11(1) of Multilateral Instrument 62-104 TakeOver Bids and Issuer Bids), and the exercise price of each TitanStar REIT Option will be adjusted accordingly.

- The Company, TSP DSC and TSP LP Holdings will amalgamate to form TitanStar Amalco;

- TitanStar REIT will transfer its interest in three Nevada LPs (TSPLP I, TSP LP II and Blue Springs LP) to TitanStar Amalco; and

- TitanStar Amalco will transfer its interest in those LPs to TitanStar US.

Resulting structure

TitanStar REIT will have equity and debt interests in TitanStar Amalco, debt interests in TitanStar US and hold two GP corporations. Non-resident ownership of TitanStar REIT will be limited to 49%. The TitanStar REIT units will be redeemable for the lesser of their closing market price and 95% of the 10-day average immediately following the redemption date.

Securities considerations

The TitanStar REIT units and Deer Springs Holdings shares will be received in reliance on the s. 3(a)(10) rule. Shareholder approval is required by a 2/3 majority.

Canadian tax consequences

Asset transfers. The various transfers to TitanStar REIT and Deer Springs Holdings will result in capital gain. However, this is anticipated to be offset by available capital losses. Subsequent transfers of the various limited partnership interests by TitanStar REIT to TitanStar Amalco and from TitanStar Amalco to TitanStar US will not result in a capital gain.

SIFT rules

Following the Arrangement, TitanStar REIT's property will be its shares of TitanStar Amalco, TitanStar GP and Blue Springs GP, which will be portfolio investment entities.

FAPI

TitanStar US is a "foreign affiliate" and a CFA of TitanStar Amalco. It is expected that income earned by TitanStar US will be foreign accrual property income.

S. 86 exchange

The fair market value of the distributed Deer Spring Holdings shares is not expected to exceed the paid-up capital of the Company common shares, so that no deemed dividend should arise on the exchange of the Company common shares for TitanStar REIT units and Deer Spring Holdings shares. S. 86 will apply to such exchange so that a holder of the Company common shares will be considered to have disposed of its shares for the greater of their adjusted cost base and the fair market value of the Deer Spring Holdings shares and TitanStar REIT units received on the exchange.

Dissenters

Disposition will give rise to a deemed dividend to the extent that the amount received (excluding any interest award) exceeds the paid-up capital of the common shares.

Deer Springs Holdings

Deer Springs Holdings is expected to comply on a continuous basis with the ownership and dispersal of share requirements described in Reg. 4800, and to elect to be a "public corporation" in its first return.