Corporate Sub s. 132.2 Merger

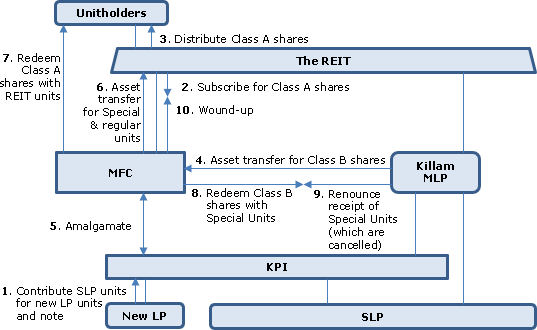

Killam REIT/ KPI

Overview

At the beginning of 2016, Killam Properties Inc. (KPI) effectively converted to a REIT under a Plan of Arrangement pursuant to which most of its shareholders exchanged their KPI shares for units of the REIT on a taxable basis, but with some electing to receive rollover treatment by transferring their shares on a s. 97(2) rollover basis for exchangeable units of a subsidiary LP (Killam MLP) - into which the REIT also contributed the KPI shares acquired by it on a taxable basis.

Starting with 2003-0053981R3, CRA issued various rulings permitting an income fund or REIT to eliminate a corporate subsidiary by creating a mutual fund corporation (MFC) through a distribution of shares of the MFC, having a nominal value, to its unitholders, then amalgamating the corporate subsidiary with the MFC to form Amalgamated MFC, and then effecting a s. 132.2 merger of Amalgamated MFC into the income fund or REIT.

On October 11, 2024, CRA issued a ruling letter confirming the tax consequences of transactions of this general character for the elimination of KPI, including the application of the s. 132.2 rules, and the REIT is now proposing to implement. A complicating factor is that KPI is held by the REIT through Killam MLP rather than directly. Accordingly, the proposed transactions include a renunciation by Killam MLP of the receipt of redemption proceeds for its 99.999%+ shareholding in Amalco MFC, somewhat similar to that ruled on in 2016-0660321R3.

The REIT

An Ontario open-ended unit trust based in Halifax with an indirect $5.3 billion portfolio of apartments and manufactured home communities.

Killam MLP

Killam Apartment Limited Partnership, an Ontario limited partnership which serves as a holding company and whose only limited partners are the REIT (holding Class A LP units) and the holders of its Exchangeable LP units.

Killam GP I

Killam Apartment General Partner Ltd., wholly-owned by the REIT, and the OBCA general partner of Killam MLP.

KPI

A CBCA corporation, which was the predecessor entity to the REIT and which is wholly-owned by Killam MLP and holds the Class A LP units of Killam SLP.

Killam SLP

Killam Apartment Subsidiary Limited Partnership, an Ontario limited partnership holding Canadian real property directly and through subsidiary trusts, and whose only limited partners are Killam MLP and KPI.

Killam GP II

Killam Properties SGP Ltd., the OBCA general partner of Killam SLP and of Killam Apartment Subsidiary II Limited Partnership (“Killam Sub II LP”), and wholly-owned by Killam MLP.

Killam MFC

A CBCA corporation that was incorporated on October 9, 2024 by the REIT with a view to it qualifying as a mutual fund corporation for purposes of ITA s. 131(8) and facilitating the Arrangement transactions.

New LP

Killam Apartment Subsidiary 2024 Limited Partnership, an Ontario LP formed on October 10, 2024 solely to facilitate the Arrangement transactions.

Transactions

Steps 2 to 13 below will occur pursuant to a CBCA Plan of Arrangement:

- KPI will contribute its Class A units of SLP to New LP in consideration for a note (the New LP Note) and units of New LP.

- Dissenting units will be transferred to the REIT.

- The REIT will contribute to Killam MLP the $101M note owing to it by KPI.

- KPI will transfer the New LP Note (from 1) to Killam MLP in partial or full repayment of the $362M note owing by it to Killam MLP and, if there is any excess, in partial repayment of the $101M note from 3 above.

- The REIT will subscribe for that number of Class A preferred shares of Killam MFC equal to the number of outstanding REIT units for a cash subscription price of $0.01 per share.

- The Class A preferred shares from 5 will be distributed by the REIT pro rata to its unitholders as a return of capital (with applicable tax under s. 218.3(2) being remitted by it).

- Killam MLP will transfer all the shares of KPI and the notes acquired by it in 3 to Killam MFC in consideration for 100 Class B preferred shares of Killam MFC.

- Killam MFC and KPI will amalgamate to form Killam Amalco MFC.

- Killam Amalco MFC will transfer its assets (being the units of New LP and the cash subscription proceeds from 5) to the REIT in consideration for 100 Special Units having an FMV and redemption amount equal to the FMV of the transferred New LP units and in consideration for REIT units having an FMV equal to the redemption amount of the Class A preferred shares issued in 5 (with the REIT units being deemed to subordinate their entitlements to distributions on the REIT units to the Special Units).

- Killam Amalco MFC will redeem all the Class A preferred shares through a pro rata distribution of the REIT units acquired in 9.

- Killam Amalco MFC also will redeem all the Class B shares through a transfer of its 100 Special Units.

- However, concurrently with the transfer of such Special Units, Killam MLP will be deemed to have renounced its right to receive the Special Units, and those units will be cancelled for no consideration.

- The outstanding REIT units will be consolidated such that their number will be restored to that before the Arrangement.

- New LP and Killam MFC will be wound up.

Canadian tax considerations

On October 11, 2024, CRA issued a ruling letter confirming the tax consequences of the transactions including the application of the s. 132.2 rules including in relation to the renunciation. There are essentially no tax consequences to the REIT unitholders nor adverse consequences to the REIT or KPI.

Crombie REIT

Overview

Crombie REIT held the units and notes of a subsidiary unit trust (Crombie Subsidiary Trust), whose principal asset was most of the partnership interests, other than exchangeable LP units held by the Empire group, in a subsidiary LP (“Crombie LP”), which held real estate and a corporate subsidiary (“CDL”).

In a 2017 reorganization, the REIT first eliminated Crombie Subsidiary Trust by setting up a unit trust (“MFT”), having Crombie Subsidiary Trust transfer its assets to MFT under s. 107.4, distributing just enough units of MFT to its unitholders for MFT to qualify as a mutual fund trust, and then instigating a s. 132.2 merger of MFT into the REIT.

The REIT also did not want CDL to be subject to potential corporate income tax. Had the REIT now held CDL directly, this would have been accomplished by incorporating a subsidiary (“MFC”), distributing relatively modest shareholdings in MFC to its unitholders sufficient to qualify MFC as a mutual fund corporation, amalgamating MFC and CDL so that Amalco also qualified as a mutual fund corporation, and then instigating the merger of Amalco into the REIT under s. 132.2 – so that the former assets of CDL were now held directly by the REIT.

A complicating factor was that, as noted, CDL was held by a partnership (Crombie LP). Accordingly, Crombie LP first transferred its CDL shares to MFC under s. 85(2) in consideration for most of the shares of MFC (so that CDL could then be vertically amalgamated with MFC to form Amalco). On the s.132.2 merger of Amalco into the REIT, Crombie LP renounced the receipt of the REIT units that otherwise would be receivable by it on the redemption of its Amalco shares. CRA ruled that Crombie LP was not required to include any amount in its income as a result of the exercise of its right of renunciation.

Current structure

Crombie holds its Class A LP units of Crombie Limited Partnership (“Crombie LP”) through a subsidiary unit trust (Crombie Subsidiary Trust). ECL Developments Limited, an indirect wholly-owned subsidiary of Empire Company Limited (“Empire”), holds Class B exchangeable LP units of Crombie LP. By virtue of holding special voting units of Crombie and Units of Crombie, the Empire group controls 41.15% of the voting rights respecting the outstanding Crombie Units. Crombie LP holds all the shares of CDL.

Purpose

The purpose of the proposed reorganization (the “Reorganization”) is to modify the organizational structure of Crombie to eliminate Crombie Subsidiary Trust and CDL. The elimination of Crombie Subsidiary Trust simplifies the structure and will allow Crombie to hold its investment in Crombie LP directly. Similarly, the elimination of CDL will further simplify the structure and will eliminate potential income tax expense that could be incurred by CDL

Formation of MFT

MFT will be an unincorporated open-ended trust established under the laws of the Province of Ontario pursuant to the MFT Declaration of Trust. The sole trustee of MFT will be an individual resident in Canada. MFT will qualify as a “unit trust” pursuant to the Tax Act on the basis that its units are redeemable on demand by the holder thereof. The units will also be redeemable by MFT.

Formation of MFC

MFC will be a corporation governed by the laws of Canada. The articles of MFC will provide that its only undertaking will be activities described in s. 131(8)(b) of the Tax Act. The authorized share capital of MFC will consist of an unlimited number of common shares, Class A Preferred shares and Class B Preferred shares.

Ruling

Crombie has applied for an advance income tax ruling from CRA in connection with the Reorganization (see 2016-0660321R3). Crombie will not complete the Reorganization without receiving a favourable ruling.

Reorganization steps

- Opco and a newly-incorporated subsidiary of Opco (GP II) will form a general partnership (the “Partnership”), with Opco transferring real estate to Partnership on a s. 97(2) rollover basis.

- Partnership will then be converted to a limited partnership, with no significant changes to the rights and obligations of the partners other than Opco becoming a limited partner.

- After the settling of a new unit trust (“MFT”), having redeemable retractable units, by a Canadian-resident third party, Crombie subscribes for MFT units for nominal cash consideration and the unit of the settlor is redeemed.

- Crombie Subsidiary Trust will transfer all its assets to MFT for no consideration, and will be terminated.

- Crombie will distribute a certain number of its MFT Units to Crombie Unitholders, having a nominal value, as a distribution of capital (with s. 218.3(2) withholding being made).

- The Declaration of Trust of Crombie will be amended to provide for the consolidations in 10 and 20 below, for the in specie redemption of Crombie units through distribution of securities of a Crombie subsidiary including MFT Units and adding the Right of Renunciation utilized in 19 below.

- Pursuant to a transfer agreement between Crombie, MFT and an agent for the MFT Unitholders, MFT will transfer its assets to Crombie in consideration for Crombie Units.

- MFT will redeem all of the MFT Units except for one MFT Unit held by Crombie. The redemption price will be satisfied by the transfer by the MFT agent of the Units it holds to the holders of the redeemed Units.

- Crombie will cancel the Units so received by it.

- Immediately thereafter the outstanding Crombie Units are consolidated so as to result in the same number as before.

- A joint s. 132.2 election will be made by Crombie and MFT.

- Ultimately, MFT will be wound up.

- Crombie will incorporate MFC, subscribe for five MFC Common Shares and 95 (non-voting redeemable retractable) MFC Class A Shares for $0.01 per share, list the MFC Class A Shares on the Exchange and subscribe for further MFC Class A Shares such that the total outstanding number of shares will now equal the number of outstanding Crombie Units.

- Crombie LP will transfer all of its shares of Crombie Developments Limited (“CDL”) together with a note owing by CDL (the “Note”) to MFC in consideration for MFC Class B Shares (having similar attributes to the MFC Class A Shares), with the s. 85(2) election to be filed by Amalco and Partnership.

- Crombie will distribute to Crombie Unitholders, as a return of capital, all of its MFC Class A Shares and, in due course, remit any applicable s. 218.3(2) withholding tax.

- MFC and CDL will amalgamate, with the CDL Shares and Note being cancelled on the amalgamation and the outstanding shares of MFC being converted on the amalgamation into the equivalent number of Amalco Class A, Class B and Common Shares.

- Amalco will transfer all of its assets to Crombie in consideration for the assumption of its liabilities and Crombie’s agreement to issue Crombie Units to the agent for the holders of the Amalco Class A and B Shares in satisfaction of the redemption price for their shares (see 17 below).

- Immediately after the transfer in 17, Amalco will redeem the Amalco Class A and B Shares and thereupon the agent for the holders of the Class A Shares will transfer a portion of the Units its holds to the holders of the Amalco Class A Shares.

- Crombie LP will renounce all of its interest in Crombie, so that rather than receiving Crombie Units, they will be cancelled.

- The outstanding Crombie Units will be consolidated, so that the number outstanding will be the same as before the reorganization.

- A joint s. 132.2 election will be made by Crombie and Amalco.

- Crombie will contribute its Partnership Units and its shares of GP II and Amalco to Crombie LP, with a joint s. 97(2) election being filed.

- Partnership will be wound-up under s. 98(3).

- GP II will sell its undivided interest in each property received by it in 23 to Crombie LP for fair market value consideration and then will be wound up.

Canadian tax consequences

Transfer of Property to the Partnership

Provided that the necessary election is filed, the transfer by CDL of its properties to the Partnership will occur on a tax-deferred basis.

Transfer by Crombie Subsidiary Trust to MFT

Provided that the necessary election is filed, the transfer of assets by Crombie Subsidiary Trust to MFT will be characterized as a “qualifying disposition” for purposes of section 107.4 of the Tax Act such that the assets will be transferred to MFT for proceeds of disposition equal to the tax cost of such assets. In such circumstances, there should be no taxable income or gain to Crombie Subsidiary Trust arising from such transfer.

Transfer by MFT to Crombie

Provided that the necessary election is filed, the transfer or assets by MFT to Crombie and the redemption by MFT of the MFT Units as described in 8 above will constitute a “qualifying exchange” as defined in section 132.2 of the Tax Act, thereby allowing each of the assets of MFT to be transferred to Crombie on a tax-deferred basis. In addition, MFT will not realize a gain or loss on the transfer of the Units to its Unitholders on the redemption of MFT Units. As a consequence of these transactions, among other things: each of Crombie and MFT will have a deemed taxation year end; unrealized losses in property of Crombie will be deemed to have been realized prior to such deemed year end, and unrealized gains may be treated as having been realized if Crombie elects to file the appropriate designation with CRA; loss carryforwards of Crombie in respect of taxation years beginning before the qualifying exchange may not be deducted in computing taxable income for a subsequent taxation year,…

Acquisition and Distribution of Preferred Shares of MFC

Crombie will subscribe for Class A Preferred shares of MFC for nominal cash consideration. Upon distribution of Class A Preferred shares to Unitholders, Crombie will be considered to have disposed of such Class A Preferred shares for proceeds of disposition equal to the fair market value of such Class A Preferred shares.

Transfer by Crombie LP to MFC

Provided that the necessary election is filed, no taxable income should be realized as a result of the transfer by Crombie LP of its common shares of CDL, and the Note, to MFC.

Amalgamation of MFC and CCL

No taxable income will be realized by Crombie, MFC or CDL because of the amalgamation of MFC and CDL to form Amalco.

Transfer by Amalco to Crombie

Provided that the necessary election is filed, the transfer of Amalco’s assets to Crombie, Crombie’s issuance of Units, the redemption of shares by Amalco and the renunciation by Crombie LP of its interest in Crombie, as contemplated in 17 to 19 above, will constitute a “qualifying exchange” as defined in s. 132.2, thereby allowing the assets of Amalco to be transferred to Crombie for proceeds of disposition equal to the tax cost of such assets. In such circumstances, there should be no taxable income to Amalco arising from such transfer. In addition, Amalco will not realize a gain or loss on the transfer of the Units to its shareholders on the redemption of its Class A Preferred shares. Crombie LP will not be required to include any amount in its income as a result of the exercise of its right of renunciation. As a consequence of these transactions, among other things: each of Crombie and Amalco will have a deemed taxation year end; unrealized losses in property of Crombie will be deemed to have been realized prior to such deemed year end, and unrealized gains may be treated as having been realized if Crombie elects to file the appropriate designation with CRA; loss carryforwards of Crombie and Amalco in respect of taxation years beginning before the qualifying exchange may not be deducted in computing taxable income for a subsequent taxation year.

Return of Capital on the Distribution of MFT Units

A Unitholder will not be required to include in computing income for the year the value of the MFT Units received from Crombie as a return of capital on its Units in Step 8. A Unitholder will be required to reduce the adjusted cost base of its Units by the fair market value of the MFT Units received by that Unitholder.

Disposition of MFT Units in Exchange for Units

A Unitholder holding MFT Units will not realize a capital gain or capital loss as a result of the receipt of Units on the redemption of MFT Units in Step 8.

Consolidation of Units

The consolidation of the Units in Steps 10 and 20 will not be considered to result in a disposition of Units.

Return of Capital on the Distribution of MFC Shares

A Unitholder will not be required to include in computing income for the year the value of Class A Preferred shares of MFC received from Crombie as a return of capital on its Units in Step; 15. A Unitholder will be required to reduce the adjusted cost base of its Units by the fair market value of the Class A Preferred shares received by that Unitholder.

Disposition of Class A Preferred shares in exchange for Units

A Unitholder holding Class A Preferred shares will not realize a capital gain or capital loss as a result of the receipt of Units on the redemption of Class A Preferred shares in Step 18.

Part XIII.2 tax

Since a Non-Resident Unitholder will generally not be subject to Canadian income tax under Part I of the Tax Act or Canadian withholding taxes under Part XIII of the Tax Act on the nominal value of the MFT Units distributed as a return of capital on Crombie Units, such Non-Resident Unitholder will generally be subject to Part XIII.2 withholding tax on such distribution. Crombie will remit, on behalf of the Non-Resident Unitholders, the amount of such tax – and similarly respecting the nominal value of the Class A Preferred shares distributed as a return of capital on Crombie Units.

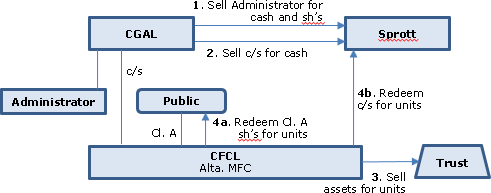

MFC Conversion to MFT

Central Fund/Sprott

Overview

CFCL is a mutual fund corporation holding gold and silver bullion that has an accrued gain of approximately Cdn.$1.7 billion. It is controlled by the Spicer family, who control its 40,000 common shares, and its 252M Class A shares are mostly held by the public. Before Sprott overtures commenced, its Class A shares had been trading on the TSX at a 7% discount to the underlying bullion value.

In order for Sprott to effectively purchase the Spicer management business and for CFCL to be converted into a mutual fund trust, it is proposed that under an Alberta Plan of Arrangement,

- the common shares will be sold to Sprott for cash consideration reflecting the value of their voting rights (there is no coattail),

- the shares of a “New Administrator” will be sold to Sprott for $85M in cash and 7M Sprott shares plus an earnout, and

- CFCL will be merged under s. 132.2 into a trust newly-formed by Sprott (Sprott Physical Gold and Silver Trust). Under the exchange terms, the Common and Class A shares will be treated as having equal values, so that after the merger Sprott will hold 0.016% of the Trust units, implying that it paid a 2900% premium for the common shares.

In addition to the Trust units being redeemable for cash equalling 95% of the lesser of their NAV and 5-day VWAP, larger blocks of units may be redeemed in specie, which is expected to largely eliminate the trading discount. Using bullion to redeem units in one’s capital is not a sale or other trading transaction, and the bullion held by the Trust is expected to be capital property, given that significant sales of bullion to honour cash redemption demands is not anticipated. Gains realized on an in specie redemption will be allocated to the redeemed unitholder.

The Trust will be a PFIC.

CGAL

The Central Group Alberta Ltd., whose shareholders are Philip M. Spicer and J.C. Stefan Spicer.

CFCL

CFCL is an Alberta (ABCA) mutual fund corporation. Its dual class share structure has been in place since 1961. The Class A Shares, which are non-voting and retractable at 80% of NAV, have been listed on the TSX since 1965 and are also listed on the NYSE American. In accordance with TSX rules, the articles of CFCL do not contain any takeover protective provisions or "coattails." The Spicer family currently have legal and effective control of CFCL through their ownership of all of the issued and outstanding shares of CGAL and indirect ownership of 49.5% of CFCL's issued and outstanding Common Shares.

CFCL Common Shares

As at October 26, 2017 there were 252,116,003 Class A Shares and 40,000 Common Shares outstanding. Unlike the Class A Shares, the CFCL Common Shares have voting rights (of one vote per share) in all circumstances, including the right to elect the CFCL Board, and therefore collectively control CFCL. The Common Shares are also not listed for trading on any stock exchange. Except for a Class A Share priority that is applicable when the NAV is under $3.00, they participate equally on a per-share basis with the Class A Shares as to dividends and on liquidation. The cash offer price payable under the Arrangement is C$500 per Common Share.

The Trust

The Trust was established on October 26, 2017 under Ontario law pursuant to a trust agreement between the Trust's settlor, Sprott Asset Management LP (the "Manager") and RBC Investor Services Trust ("RBC Investor Services" or the "Trustee"), as trustee. The Trust was created to participate in the Arrangement and to subsequently invest and hold substantially all of its assets in physical gold and silver bullion. Assuming that there are no Dissenting Shareholders, former Class A Shareholders are expected to hold approximately 252,116,003 Trust Units, representing 99.984% of the issued and outstanding Trust Units and Sprott is expected to hold approximately 40,000 Trust Units, representing 0.016% of the issued and outstanding Trust Units.

New Administrator

2070140 Alberta Ltd.

Sprott

Sprott Inc. is a TSX-listed corporation engaged in asset management (including of exchange-listed funds) and making private resource investments.

Reasons for conversion

Over the past three years, the Class A Shares have traded at an average discount of approximately 7.1% to their NAV. Given that the Trust will have redemption features similar to those of Sprott's current physical bullion trusts, including a physical redemption feature, it is expected that the Trust Units should trade closer to their underlying NAV than has been the case with the Class A Shares.

Cash redemption right

The cash redemption value of the Trust Units is based on 95% of the lesser of: (i) the volume weighted average trading price of the Trust Units traded on NYSE Arca for the last five trading days for the month in which the redemption request is processed and (ii) the NAV of the redeemed Trust Units as of 4:00 p.m. (Toronto time) on the last day of such month.

Physical redemption right

A Trust Unitholder may only redeem Trust Units for physical gold and silver bullion, provided the redemption request is for at least the Minimum Bullion Redemption Amount (being, generally, for 100,000 Trust Units). The quantity of physical gold and silver bullion a redeeming Trust Unitholder is entitled to receive is determined by the Manager by allocating the Redemption Amount (based on the net asset value) between the applicable bullion Redemption Amounts and the makeup of the Trust's inventory of physical gold and silver bullion. Any portion of gold or silver bullion not available at the time of redemption will be paid in cash at a rate equal to 100% of aggregate value of the NAV per Trust Unit of such unavailable amount.

Trust allocation of gains to redeemed Unitholders

The Trust will have the authority to distribute, allocate and designate any income or taxable capital gains of the Trust for the purposes of the Tax Act to the Trust Unitholder who has redeemed Trust Units during a year in an amount equal to the taxable capital gains or other income realized by the Trust as a result of distributing physical bullion to such Trust Unitholder, and any taxable capital gain or income realized by it before, at or after the redemption by virtue of the Trust being required to sell bullion in order to fund the payment of the cash redemption proceeds to such Trust Unitholder, or such other amount that is determined by the Trust to be reasonable.

Plan of Arrangement

- The Administration Agreement shall be assigned to, assumed by and novated to the New Administrator.

- The common shares in the capital of the New Administrator shall be assigned by CGAL to Sprott in exchange for the CGAL Aggregate Consideration, being cash of $85 million plus 6,997,387 Sprott Shares.

- Each of the Class A Shares in respect of which Dissent Rights have been validly exercised shall be transferred in exchange for a debt claim against the Trust.

- Each Common Share shall be transferred to Sprott in exchange for the Common Share Consideration of $500 cash per share ($20M in aggregate).

- CFCL shall transfer to the Trust all its assets other than the Administration Agreement.

- In consideration, the Trust shall assume all of CFCL’s liabilities other than under the Administration Agreement and issue to CFCL Trust Units equalling the aggregate number of Class A Shares and Common Shares.

- The Unit held by Sprott Asset Management LP as settlor of the Trust shall be cancelled without any payment in respect thereof.

- Each Class A Share and each Common Share shall be redeemed and cancelled by CFC in exchange for one Trust Unit.

Earnout Agreement

In addition to the C$85 million in cash to be paid by Sprott to CGAL and the 6,997,387 Sprott Shares to be issued by Sprott to CGAL as consideration for the sale of all of the outstanding shares of the New Administrator pursuant to the Plan of Arrangement under __, Sprott will also pay CGAL an earnout amount, being the greater of: (a) C$5 million; and (b) an amount based on a formula related to the legacy assets of CFCL held by the Trust on the first anniversary of the Arrangement.

Canadian tax consequences

Qualifying exchange

The Arrangement is expected to include a "qualifying exchange" as defined in s. 132.2 of the Tax Act. Provided that this is the case, all of the assets of CFCL being transferred to the Trust will be deemed to be transferred for proceeds of disposition that will generally equal their cost amount. Where a Class A Shareholder disposes of Class A Shares to CFCL in exchange for Trust Units on the repurchase of Class A Shares pursuant to the Arrangement, the CFCL Shareholder's proceeds of disposition for the Class A Shares disposed of, and the cost to the Class A Shareholder of the Trust Units received in exchange therefor, will be deemed to be equal to the adjusted cost base to the Class A Shareholder of the Class A Shares immediately prior to their disposition.

Part XIII tax

If the Trust treats distributed gains as being on capital account and the CRA later determines that the gains were on income account, then Canadian withholding taxes would apply to the extent that the Trust has distributed the gains to non-resident Trust Unitholders and Canadian resident Trust Unitholders could be reassessed to increase their taxable income. Any taxes borne by the Trust itself would reduce the NAV and the trading prices of the Trust Units;

Accrued gain on CFCL bullion

The average cost base for tax purposes of the bullion held by CFCL is considerably below its current market value resulting in a significant unrealized capital gain and, in the event of the sale of bullion for cash or the delivery of physical bullion to Trust Unitholders who exercise the enhanced redemption provision, a potential tax on such gain. The aggregate unrealized gain is currently estimated at approximately Cdn.$1.7 billion.

Treatment by Trust of bullion as capital property

In the view of Canadian counsel, the holding by the Trust of physical gold and silver bullion with no intention of disposing of such bullion except in specie on a redemption of Trust Units likely would not represent an adventure in the nature of trade so that a disposition, on a redemption of Trust Units, of physical gold and silver bullion that previously had been acquired with such intention would likely give rise to a capital gain (or capital loss) to the Trust. As the Manager intends for the Trust to be a long-term holder of physical gold and silver bullion and does not anticipate that the Trust will sell its physical gold and silver bullion (otherwise than where necessary to fund expenses of the Trust), the Manager anticipates that the Trust generally will treat gains (or losses) as a result of dispositions of physical gold and silver bullion as capital gains (or capital losses), although depending on the circumstances, the Trust may instead include (or deduct) the full amount of such gains or losses in computing its income.

SIFT trust rules

The mere holding by the Trust of physical gold and silver bullion as capital property (or as an adventure in the nature of trade) would not represent the use of such property in carrying on a business in Canada and, therefore, would not by itself cause the Trust to be a SIFT trust.

U.S. tax consequences

Exchange

The exchange of Class A Shares for Trust Units pursuant to the Arrangement should be treated as one step in a series of integrated transactions that, considered together, qualify as a reorganization for U.S. federal income tax purposes. A U.S. Holder that exchanged Class A Shares for Trust Units pursuant to the Arrangement generally would not recognize gain or loss on the exchange.

PFIC status

The Trust expects to be a PFIC, which may have adverse U.S. federal income tax consequences to U.S. Holders who do not make certain elections. A U.S. Holder that makes a QEF Election with respect to his, her or its Trust Units may be required to include amounts in income for United States federal income tax purposes if any holder redeems Trust Units for cash or physical gold and silver bullion.

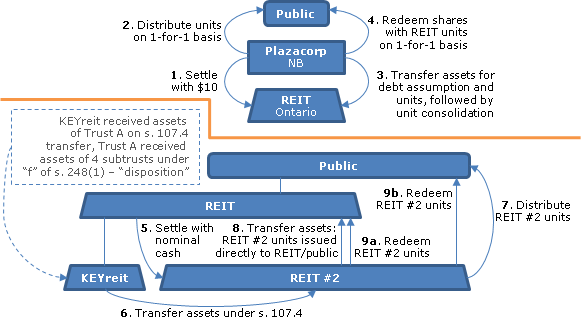

Plazacorp

Background

Plazacorp, which is a TSX-listed mutual fund corporation in the business of retail property ownership and development, wishes to convert under a New Brunswick plan of arrangement to a s. 108(2)(a) mutual fund trust (so that following the conversions transactions occurring effective January 1, 2014, its remaining assets will be nominal) and to eliminate subsidiary (non-personal trust) subtrusts, including KEYreit (a REIT previously acquired by it) and Plazacorp Operating Trust and four "Direct Subtrusts." Plazacorp converted on December 11, 2002 into a mutual fund corporation from a normal public corporation.

Transaction overview

Plazacorp will settle a new trust (REIT) with modest assets, and distribute the units of REIT to its public shareholders, who thus will now hold assets of a "good" mutual fund trust, albeit with nominal assets. Next, Plazacorp will merge into REIT under s. 132.2, so that REIT is now the successor to substantially all its assets. However, it will not be released under its covenant under convertible debentures, although they also will be assumed by REIT. In order to eliminate the Direct Subtrusts, KEYreit and Plazacorp Operating Trust, the Direct Subtrusts will transfer their assets to Trust A (a new subtrust of Plazacorp) in reliance on the no-disposition rule in s. 248(1) – disposition, (f), and then there will be s. 107.4 transfers of assets by Trust A to KEYreit, and (following the 1st merger) by KEYreit to a further new subtrust of REIT (REIT #2), followed by a de minimis distribution of REIT #2's units by REIT to the REIT unitholders (in order to qualify REIT #2 as a mutual fund trust). REIT #2 then will be merged into REIT under s. 132.2. The same steps will then be repeated to first eliminate Plazacorp Operating Trust, then a subtrust of Plazacorp Operating Trust.

For more detailed summary, see above under MFC Conversion to MFT.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Other - Conversions - MFC to MFT | Conversion of Plazacorp Operating Trust from MFC to REIT under internal s. 132.2 merger | 985 |

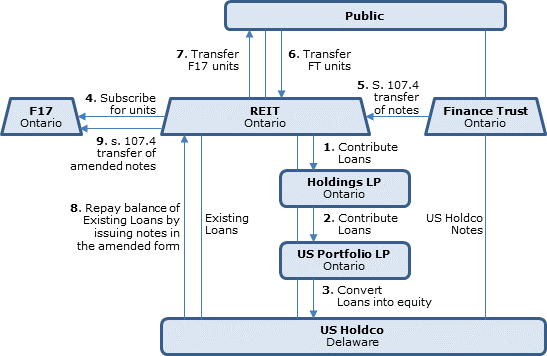

Restapling

H&R REIT

Overview

The units of the REIT are stapled to those of Finance Trust. Finance Trust holds notes of the indirect U.S. subsidiary of H&R REIT (“U.S. Holdco”). Finance Trust is intended to qualify as a fixed investment trust for Code purposes, so that its unitholders are treated as if they held such notes directly. This avoids the U.S. earnings stripping limitations on the level of permitted interest deductions by U.S. Holdco as well as to a significant extent accessing the U.S. portfolio interest exemption from U.S. withholding tax. U.S. acquisitions by U.S. Holdco were funded with loans from H&R REIT. In order that much of this additional debt can access the benefits of the stapled structure, the REIT and Finance Trust are proposing an Alberta Plan of Arrangement under which Finance Trust will make a s. 107.4 transfer of its notes of U.S. Holdco to the REIT and, following the replacement of those notes and some of the newer debt with amended notes, and the distribution to the unitholders of units of a new fixed investment trust with nominal assets (the “F17 Trust”), the amended notes will be transferred by the REIT under s. 107.4 to the F17 Trust. Thus, there will be a replacement stapled structure similar to what was there before, except that the new Finance Trust (F17 Trust) will hold more U.S. Holdco debt. The repayment of a “significant amount” of the existing loans owing by U.S. Holdco to H&R REIT through the issuance of the additional notes in amended form is anticipated to generate a significant FX gain, but not so as to produce a result which is out of line with 2016, when significant capital gains also were pushed out to the H&R REIT unitholders. Implementation of this Arrangement is conditional on receiving rulings from CRA.

See full summary under Other – Releveragings.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Other - Releveragings | 4363 |

Subtrust Elimination.

Calloway AIF

See also Calloway REIT elimination of subtrust through s. 107.4 transfer and s. 132.2 merger (including diagram)below.

Overview

Calloway currently is a listed open-end mutual fund trust holding rental limited partnerships through a subsidiary trust ("Holdings Trust"). To facilitate "Exchangeable Securities" (including exchangeable LP units held in the subsidiary LPs as well as "development options") not being characterized as debt for accounting purposes, Calloway wishes to convert to a closed-end fund. However, to so qualify under s. 108(2)(b), Calloway must get rid of Holdings Trust, which it intends to do in 2014. Eliminating Holdings Trust presumably would increase the rental revenues which are allocated to Calloway for gross REIT revenue purposes.

Elimination of Subtrust

Accordingly, Holdings Trust will transfer its assets under s. 107.4 to a newly-formed subsidiary unit trust ("MFT") of Calloway, with 3% of MFT's units then being distributed to the Calloway unitholders in order to qualify MFT as a mutual fund trust. MFT then will be merged into Calloway under s. 132.2. These transactions are not discussed other than very elliptically in Calloway's AIF and instead are disclosed in a 1 November 2013 OSC Order for Exemptive Relief respecting Calloway, summarized and diagrammed further below. Immediately below we quote relevant extracts from Calloway's February 2014 AIF for its 2013 year.

Tax Ruling

Calloway intends to eliminate Holdings Trust in order to enhance Calloway's flexibility to comply with the restrictions governing its income trust status as a REIT (the "Reorganization"). To effect the Reorganization, Calloway has obtained the Tax Ruling [dated August 13, 2013]. Calloway intends to implement the Reorganization in 2014 in accordance with the Tax Ruling.

Potential debt character of Exchangeable Securities

Under IFRS, it was possible that, without certain amendments to the terms thereof including the exchange provisions, the various Exchangeable Securities of Calloway LP, Calloway LP II and Calloway LP III (i.e. the various series of Class B and Class D limited partnership units of Calloway LP, Calloway LP II and Calloway LP III that are convertible or exchangeable directly for Units without the payment of additional consideration therefor) would be considered debt instead of equity (as they are currently classified since they are intended to be the economic equivalent of Units).

Addition of Calloway option and potential conversion to closed-end fund

Consequently, in order to negate that impact on Calloway's financial statements, Calloway and SmartCentres agreed to amend the exchange provisions relating to certain of the Exchangeable Securities. The exchange procedure for certain of the Exchangeable Securities now provides that Calloway shall have the option (…the "Calloway Option") to make a cash payment to the holder of certain Exchangeable Securities in lieu of delivering Units, in an amount equal to the market value of the Units such holder would otherwise be entitled. The holder of the Exchangeable Securities shall have the right to accept or reject the determination by Calloway to make a cash payment to the holder in lieu of the delivery of Units. In the event that Calloway does not elect to exercise the Calloway Option, or the holder of the Exchangeable Securities rejects the determination by Calloway to pay cash in lieu of the delivery of Units, Calloway shall undertake all necessary and required actions, including of a regulatory nature, in order to effect a conversion from an open-end to a closed-end mutual fund trust (…the "Conversion Process"). Such actions shall include… obtaining an advanced tax ruling from the Canada Revenue Agency confirming that the conversion from an open-end to a closed-end mutual fund trust does not result in a disposition of Units. The exchange procedure shall be deferred until completion of the Conversion Process. In addition to the completion of the exchange of Exchangeable Securities for Units on the completion of the Conversion Process, Calloway may also be required to make a cash payment to the holder on the Exchangeable Securities in the event that the market value of Units falls over the time required to effect the Conversion Process. The Calloway Option provisions may be terminated by Mitchell Goldhar at any time. Upon receipt of a termination notice, Calloway shall immediately initiate a Conversion Process.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Other - Conversions - Open-End to Closed-End Fund | Conversion of Calloway REIT to a closed-end fund entailing the elimination of its subtrust | 135 |

Calloway OSC order

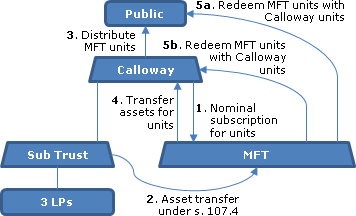

Current structure

Calloway is an open-end REIT, with a market cap of $2.8B, whose units trade on the TSX. It owns all the units of Calloway Holdings Trust ("Sub Trust") which, in turn, holds Class A units of three subsidiary LPs. Third parties also hold units of the three LPs including exchangeable units.

Transaction overview

In order to effectively wind-up Sub Trust on a rollover basis:

- its assets will be transferred to a newly-formed subsidiary unit trust of Calloway ("MFT") under s. 107.4

- Calloway will distribute MFT units to Calloway unitholders in barely sufficient numbers for MFT to qualify as a mutual fund trust

- MFT will be merged into Calloway under s. 132.2

The transactions do not require approval of unitholders and will be described to them in a press release.

Proposed transactions

- All amounts owed by Sub Trust to the three LPs or Calloway or amounts owed by them to Sub Trust will be repaid in cash or by the issuance of additional securities of the debtor.

- Calloway will subscribe for units of MFT.

- Immediately before the transfer of assets in 5 below, Sub Trust will transfer its assets (namely Class A units of the three LPs, shares of the related GPs and cash) to MFT for no consideration, and Sub Trust will be wound up.

- Calloway will distribute a certain number of its MFT Units (approximately 3% of the total) to its unitholders on a pro-rata basis as a distribution of capital so that MFT can qualify as a mutual fund trust.

- MFT will transfer its assets (the same as in 3) to Calloway in consideration for Calloway units having a fair market value equal to the transferred assets.

- Immediately thereafter, MFT will redeem all of the issued and outstanding MFT Units held by Calloway and the MFT unitholders of the Filer (except for one MFT Unit which Calloway will continue to hold until 8), with the redemption price satisfied by the transfer of Calloway REIT units.

- The number of outstanding Calloway units will be consolidated back to the previous number.

- Subsequent to the filing of the necessary tax elections, MFT will be wound up.

Canadian tax consequences

To unitholders. "There will not be any Canadian tax payable by unitholders of the Filer [i.e., Calloway] in respect to the Proposed Transaction other than the immaterial amount of withholding tax that will be payable by non-resident unitholders of the Filer on the distribution of MFT Units. The Filer will pay and remit to the Receiver General, on behalf of each unitholder of the Filer that is non-resident, an amount equal to the amount required by the Tax Act to be withheld on behalf of non- resident unitholders of the Filer."

Objective

"The Proposed Transaction is being undertaken in order to ensure that the Filer continues to qualify as a ‘real estate investment trust' under the Tax Act."

Similar ruling.