Choice/CREIT -- summary under REIT Mergers

Overview

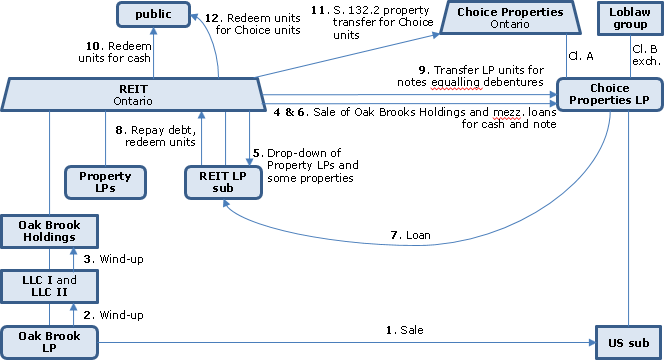

The proposed acquisition of the REIT (which is a closed-end REIT holding most of its properties directly or through subsidiary LPs) by Choice Properties - which is an Ontario REIT holding a partial interest in a property-holding LP (Choice Properties LP) - would occur for aggregate consideration of approximately $1.7B in cash and Choice Properties units valued at around $2.1B. REIT unitholders would have a choice between receiving cash or Choice Properties units, subject to proration. Those unitholders whose election for units was accepted would participate in a s. 132.2 merger of the REIT into Choice Properties.

Resident REIT unitholders whose units will be redeemed for cash by the REIT (funded with a loan from Choice Properties LP) will be indifferent to the quantum of capital gains distributions allocated to their cash redemption proceeds. Accordingly, the REIT will engage in transactions at the commencement of the Plan of Arrangement to deliberately trigger gains on units in subsidiary partnerships or perhaps land, in order to achieve a basis step-up. As with other such merger transactions, the REIT is seeking CRA permission to have short fiscal periods for the LPs transferred by it, so that those pre-merger gains realized at lower levels can still effectively be allocated to the cash-redeemed unitholders. The LP to which properties will be dropped down by the REIT was not formed until after January 1, so that there will be some overall loss of CCA.

Another preliminary step is to amend the REIT declaration of trust to make its units redeemable, having regard to the subsequent redemptions of its units for cash and on the s. 132.2 merger.

REIT

A TSX-listed Ontario unit trust that was a closed-end (s. 108(2)(b)) units trust and REIT. It holds its Canadian assets through nominee corporations or LP structures. Two management subsidiaries manage most of its assets. In addition to retail, industrial and office properties, it invests in mortgages though mezzanine and co-owner financing structures. Oak Brook Holdings indirectly owns and operates a retail property in Chicago (representing about 1% of the REIT’s total leasable area and being the only non-Canadian property.) On March 8, 2018, there were issued and outstanding 73,409,979 of its units (the “Units”), $125,000,000, $100,000,000, $100,000,000 and $125,000,000 of principal amount of Series A, B, C and D Debentures, respectively. It has $1.7B in mortgage debt.

Choice Properties and Choice Properties LP

Choice is an Ontario unit trust listed on the TSX that holds the Class A LP units of Choice Properties LP. Subsidiaries of Loblaw Companies Limited hold exchangeable Class B LP units of the LP and Class C LP units. At the time of preparing this summary, its units (the “Choice Properties Units”) traded at $11.60 per unit.

REIT LP subsidiary

CPH Master LP, an Ontario LP established by the REIT for the purposes of participating in the transactions.

CREIT GP

CREIT Eastern GP Inc., an Ontario corporation.

Oak Brook Holdings

Oak Brook Place Shops Inc., an Illinois corporation and a wholly-owned subsidiary of the REIT that holds Oak Brook LP through two LLC subsidiaries (Oak Brook LLC I and II).

Oak Brook LP

The Shops at Oak Brook Place Limited Partnership, an Illinois limited partnership.

Distributions

Choice Properties’ current intention is to maintain its current distribution of $0.74 per Choice Properties Unit on an annual basis. To the extent Unitholders receive Choice Properties Units under the transaction, the annual distribution on the 4.2835 Choice Properties Units received for each Unit would represent an increase of approximately 70% over the current annual distribution on a Unit.

Proration of consideration

Under the Transaction, the aggregate Consideration will be comprised of approximately 58% in Choice Properties Units and 42% in cash. The maximum amount of cash, which will be funded by Choice Properties, payable to Unitholders by the REIT on the Cash Redemption will be $1,651,532,198. In addition, the REIT expects that approximately 183 million Choice Properties Units will be delivered by the REIT to Unitholders, based on the fully diluted number of Units outstanding as of the date of the Arrangement Agreement. If Unitholders elect, in the aggregate, to receive cash that is more or less than the Aggregate Cash Consideration, the actual amount of cash to be paid, and the actual number of Choice Properties Units to be issued, to each Unitholder will be subject to proration. The May 4, 2018 Press Release announcing the completion of the CREIT/Choice merger stated:

Unitholders that elected to receive Choice Properties units will not be subject to proration. Unitholders that elected to receive cash, or were deemed to have elected to receive cash, will receive Choice Properties units in respect of approximately 49% of their CREIT units as a result of proration.

Debentures

On completion of the Transaction, the Debentures will remain outstanding and become debentures of Choice Properties, ranking equally with existing Choice Properties unsecured debentures.

Plan of Arrangement

- At 10:00 p.m. on the Business Day immediately preceding the date of the Arrangement (the “Effective Date”), the REIT shall cause Oak Brook LP to sell the Oak Brook Property to a U.S. direct or indirect subsidiary of Purchaser.

- Thereafter, the REIT shall cause Oak Brook LP to repay an internal mortgage loan in full to Oak Brook Holdings.

- Commencing at the effective time of the Plan of Arrangement (the “Effective Time”) a succession of steps shall occur, the first of which is the cancellation of the REIT’s Unitholder Rights Plan,

- The Declaration of Trust shall be amended to permit the redemption of Units as contemplated in the steps in 18, 19, 21 and 22 below and the allocation of income on the cash redemptions in 18 and 19 below.

- The REIT shall transfer to a direct or indirect subsidiary of the Purchaser (“Eastern GP Parentco”) all of the issued and outstanding shares in the capital of CREIT GP in exchange for the issuance by Eastern GP Parentco of one common share in its capital.

- The REIT shall cause Oak Brook LP to be liquidated, and its net assets to be distributed to Oak Brook LLC I and Oak Brook LLC II who, in turn, will be liquidated into Oak Brook Holdings, with Oak Brook Holdings repaying a loan owing to the REIT.

- The REIT shall transfer to Choice Properties LP the shares of Oak Brook Holdings for a cash payment and a note.

- The REIT shall transfer to REIT LP Subsidiary the REIT Investments (i.e., LP interests and other securities in subsidiaries designated in a Pre-Closing Notice) for a demand non-interest bearing promissory note and the issuance to the REIT of a number of REIT LP Subsidiary units.

- The REIT shall transfer to Choice Properties LP its mezzanine loan receivables for a cash payment.

- The REIT shall repay in full third-party debt designated in the Pre-Closing Notice.

- Choice Properties shall pay out, if applicable, a special distribution on the Choice Properties Units, an amount (paid in cash and Choice Properties Units) equal to its bona fide best estimate, as set forth in the Pre-Closing Notice, of the amount, if any, of its taxable income (as reduced by s. 104(6)) for the short year resulting under s. 132.2.

- The REIT shall pay out as applicable a similarly determined special distribution on its Units.

- Choice Properties LP shall make a loan to REIT LP Subsidiary having a principal amount equal to the Aggregate Cash Consideration.

- REIT LP Subsidiary shall repay in full to the REIT the note issued in 8 and other internal debt.

- REIT LP Subsidiary shall use the remaining amount of the cash proceeds from 13 to purchase a number of REIT LP Subsidiary Units for cancellation.

- The REIT shall transfer, to Choice Properties LP, REIT LP Subsidiary Units with a value equaling the amount owing by the REIT under the Debentures in consideration for promissory notes of Choice Properties LP.

- Choice Properties, or a Person designated by Choice Properties shall subscribe for one (REIT) Unit for a subscription price equal to the Cash Consideration.

- Each Dissenting Unit shall be redeemed by the REIT in exchange for a debt claim.

- Each Unit in respect of which a Unitholder is entitled to receive Cash Consideration shall be redeemed. A portion of the cash payment shall be designated by the REIT as being paid from the Taxable Income of the REIT for that taxation year.

- Pursuant to s. 132.2, the REIT shall transfer to Choice Properties all of its property excluding the cash subscription proceeds received in 17 above in exchange for the issuance of Choice Properties Units, and the assumption by Choice Properties of all liabilities and obligations of the REIT including the Debentures.

- The REIT shall redeem each Unit then outstanding for the Non-Cash Consideration of 4.2835 Choice Property Units per Unit.

- The REIT shall redeem each Restricted Unit for such Non-Cash Consideration.

- CREIT GP will be wound-up into Eastern GP Parentco.

Canadian tax consequences

MFT/REIT status

Each of the REIT and Choice Properties has represented in the Arrangement Agreement that it has qualified as a “mutual fund trust” and a “real estate investment trust”.

REIT Asset Transfer

The Arrangement Agreement contemplates that, prior to the Effective Date, the REIT will transfer, pursuant to one or more purchase and sale agreements, certain property to REIT LP Subsidiary in consideration for the assumption of certain liabilities and the issuance of one or more promissory notes by REIT LP Subsidiary, and limited partnership units of REIT LP Subsidiary (the “REIT Asset Transfer”). The REIT will realize a resulting capital gain (or capital loss). Although the REIT Asset Transfer may result in recapture of capital cost allowance, the REIT and Choice Properties have agreed that it is their mutual intention that no recapture of depreciation or other amounts treated as ordinary income will be realized by virtue of the REIT Asset Transfer, except to the extent of available losses.

Any capital gains realized by the REIT as a consequence of the REIT Asset Transfer will be included in the income allocated on the Cash Redemptions and will be allocated to Unitholders who receive the Cash Consideration, and Dissenting Unitholders entitled to receive fair value for their Dissenting Units, under the Plan of Arrangement.

Capital gains on internal drop-down transactions

The Arrangement Agreement provides that the REIT may (or may cause its Subsidiaries to) undertake such further pre-closing reorganization transactions as may be agreed between the REIT and Choice Properties. Such transactions may include transfers of properties by one or more of the REIT’s Subsidiary partnerships to a newly formed limited partnership for additional limited partnership interests in such limited partnership. Assuming CRA approval for shortened fiscal periods for such Subsidiary partnerships, any income or capital gains realized by such Subsidiary partnerships will be allocated to the REIT for its current taxation year. The parties have agreed not to recognize recapture of depreciation from such transactions.

FAPI on pre-merger transactions

The U.S. Property Transactions and each of the other pre s. 132.2 merger transactions may give rise to income or capital gains to the REIT. In particular, the REIT will be required to take into account in computing its income (a) any “foreign accrual property income” net of any “foreign accrual tax” deduction and (b) any capital gain (or capital loss) in respect of each capital property transferred or disposed of by the REIT in connection with such transactions. However, no income is expected to be allocated to Unitholders as a result as it is expected that these amounts will be offset by available losses and other deductions or attributes.

S. 132.2 exchange and redemption

The REIT and Choice Properties have agreed in the Arrangement Agreement that the s. 132.2 election will be completed with a view to minimizing tax payable by the REIT and the Unitholders, and that it is intended that gain on the transfer of the transferred assets in step 20 will be realized only to the extent of available losses or other deductions available to shelter such gain. The REIT will not realize a gain or loss on the transfer of Choice Properties Units to Unitholders on the “QE Redemption” (step 21) or “RU Redemption” (step 22).

CRA approval of short LP fiscal periods

The REIT and Choice Properties are seeking approval of the CRA to change the fiscal period and taxation year end of certain subsidiary LPs in order to ensure, to the extent possible, that substantially all of the income and net taxable capital gains earned by them up to and including the Effective Date will be allocated to Unitholders in the current taxation year of the REIT, as part of the income allocation respecting the cash redemption in steps 18 and 19.

TSX sale

A disposition of a Unit on the TSX will generally result in a capital gain (or a capital loss) to a Resident Holder.

Special distribution

The tax treatment to Resident Holders of the special distribution in step 12 will be determined in a manner similar to the tax treatment that applies to other distributions that have been paid or payable by the REIT to Resident Holders.

Loss of CCA due to short REIT LP Subsidiary fiscal period

The REIT will not be entitled to claim any CCA on properties disposed of on the REIT Asset Transfer (step 8). The CCA claimable by the REIT LP Subsidiary on such properties is expected to be materially less than the amount of CCA which could have been claimed by the REIT but for the proposed transactions.

Cash redemption

A Resident Holder receiving the Cash Consideration for Units will generally be required to include the income which is allocated and paid on the redemption. Provided that appropriate designations are made by the REIT, that portion of the REIT’s net taxable capital gains that is paid to such a Resident Holder will effectively retain its character. The non-taxable portion of any net capital gains of the REIT that is paid to such a Resident Holder will not be included in computing the holder’s income for the year.

Rollover on s. 132.2 redemption

The exchange of Units for 4.2835 Choice Property Units in step 21 will occur on a rollover basis.

Non-residents

Taxable capital gains allocated to non-resident holders will be subject to the TCP gains balance rules (subject to the 5% exception) in s. 132. In addition, a non-resident holder will generally be subject to Part XIII.2 tax of 15% on any distribution that is not otherwise subject to Part XIII (or I) tax. Thus, in effect, the entire amount will generally be subject to Canadian withholding tax. TSX sales of Units that are not taxable Canadian property will not be subject to tax.