Sirius XM -- summary under Exchangeable Share Acquisitions

Overview

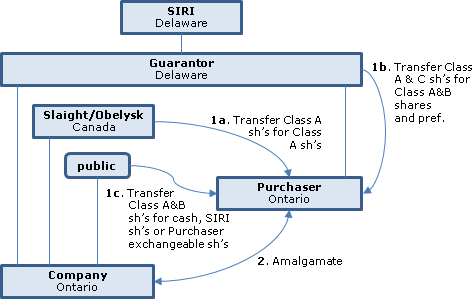

A Delaware subsidiary (the “Guarantor”) of SIRI holds approximately a 37% equity interest in the “Company (some of it in the form of non-voting shares to address CRTC non-resident control issues) and two Canadian corporations (Slaight and Obelysk), together have approximately a 22.4% equity interest in the Company. It is proposed that the Company shareholders (who also include the CBC, with a 10% equity interest, and the public) will transfer their shares under an OBCA Plan of Arrangement to the Purchaser. Slaight and Obelysk will together hold 67% of the voting interests and 30% of the equity of the Purchaser at the time of implementing the Plan, with the Guarantor holding the balance of the voting interests and equity. Public shareholders will be offered cash or shares of SIRI for their Company shares, subject to proration based on a maximum share consideration. Shareholders who wish rollover treatment are being offered exchangeable shares of the Purchaser, subject again to potential proration. The Purchaser’s obligations are guaranteed by the Guarantor. Slaight, Oblelysk and the Guarantor will receive only shares of the Purchaser as their sale consideration (much of it in the form of non-voting prefs in the case of the Guarantor.)

Consideration for Company Shares

Under an OBCA Arrangement, holders of Company Shares will be entitled to receive from the Purchaser at its election for each Class A Share: (i) $4.50 in cash ("Class A Cash Consideration"); (ii) 0.898 of a share of SIRI common share ("SIRI Share"); or (if the holder is an “Eligible Holder and so elects) (iii) 0.898 of an exchangeable share of the Purchaser (the "Exchangeable Share"), or a combination thereof (collectively, the "Class A Share Consideration"). In the case of a Class B Share of the Company, the corresponding consideration will be (i) $1.50 in cash ("Class B Cash Consideration"); (ii) 0.299 of a SIRI Share; or (iii) 0.299 of an Exchangeable Share (collectively, the "Class B Share Consideration." However, the maximum number of SIRI Shares and Exchangeable Shares that may be issued is 35,000,000, so that elections made by holders of Company Shares will be subject to proration. An Eligible Holder is a Canadian resident who is not exempt from tax (or a partnership with such a partner), or a non-resident whose shares are taxable Canadian property and not treaty-protected property.

Company

An Ontario corporation whose Class A Shares are listed on the TSX and which has no operations independent of its wholly-owned subsidiary Sirius XM Canada Inc., through which it holds the only broadcasting licence to provide subscription-based satellite radio services in Canada. Through such subsidiary, the Company offers satellite subscription digital audio radio services under the XM and Sirius brands pursuant to two exclusive licence agreements with the Guarantor. There is a significant likelihood that the royalty rates paid by the Company to SIRI under these licences will increase materially upon expiry and extension of such agreements. On April 25, 2016, the Company received a demand letter from the Guarantor for an additional US$33.9 million as "activation fees" under one of the licences owed from 2005 to the end of January, 2016. The Company disagrees with this demand.

SIRI

A NASDAQ-listed Delaware corporation.

Guarantor

A wholly-owned Delaware subsidiary of SIRI.

Purchaser

An Ontario incorporated company. As of the Effective Time (being 12:01 on the effective date of the Arrangement), Slaight and Obelysk will together hold 67% of the voting interests and 30% of the equity of the Purchaser, with the Guarantor holding the balance of the voting interests and equity. The holders of the Exchangeable Shares (if any) will also own non-voting shares in the capital of the Purchaser. As of the Effective Time, a majority of the directors of the Purchaser will be resident Canadians and the Purchaser will be eligible under the CRTC Direction (respecting non-eligibility of non-Canadians) to control the Company.

Obelysk

Obelysk Media Inc., which is controlled by John Bitove.

Slaight

Slaight Communications Inc.

Callco

2517836 Ontario Ltd., a direct or indirect subsidiary of SIRI.

Company Class A, B and C Shares

The Company had outstanding 104,813,543 Class A Shares, 30,729,510 Class B Shares and 13,638,527 Class C Shares. The percentage of aggregate voting rights attached to each class of shares as of the Record Date is approximately 77.3% in the case of the Class A Shares and approximately 22.7% in the case of the Class B Shares. There are no voting rights attached to the Class C Shares and the Class A and B Shares have one vote per share. A Class B Share is entitled to receive 1/3 of the dividends declared and paid on a Class A Share and is convertible into Class A Shares on a 3-for-1 basis. Class A and Class C Shares are inter-convertible on a 1-for-1 basis and particpate equally in dividends.

Company ownership

| Principal Shareholder | Type of Ownership | Number of class A Shares assuming conversion of Class B and Class C Shares | Percentage of Class A Shares Outstanding assuming conversion of Class B and Class C Shares | Voting Interest represented by # of Voting Shares | Percentage of Votes |

|---|---|---|---|---|---|

| Obelysk | Direct | 12,982,135 | 10.09% | 23,154,901 | 17.08% |

| Guarantor | Direct | 47,324,180 | 36.77% | 33,685,653 | 24.85% |

| CBC | Direct | 13,056,787 | 10.15% | 13,056,787 | 9.63% |

| Slaight | Direct | 15,856,787 | 12.32% | 26,170,361 | 19.31% |

Obelysk holds its interest in the form of 15,259,149 Class B Shares and 7,887,307 Class A Shares. Guarantor holds its interest in the form of 33,685,653 Class A Shares and 13,638,527 Class C Shares. CBC holds its interest in the form of 13,056,787 Class A Shares. Slaight holds its interest in the form of 10,700,000 Class A Shares and 15,470,361 Class B Shares.

Conditions for Exchangeable Share consideration

The payment of consideration in the form of Exchangeable Shares pursuant to the Plan of Arrangement is subject to obtaining an order from the applicable Canadian securities regulatory authority and Company Shares being exchanged for Exchangeable Shares having an aggregate equivalent value of at least $25,000,000.

CRTC approval

Prior approval of the CRTC is required for (i) the temporary insertion of the Purchaser as a controlling shareholder of the Company pending the amalgamation of the Purchaser with the Company to form Amalco; (ii) each of Obelysk and Slaight increasing their ownership interests to 33.5% of the voting interests of Amalco; and (iii) the Guarantor increasing its ownership interest to more than 50% of the common shares (i.e. those shares entitled to participate in the residual equity) of Amalco.

Exchangeable Shares

The Exchangeable Shares represent securities of a Canadian issuer having economic rights that are substantially equivalent to those of SIRI Shares, so that they have the same dividend and liquidation entitlement. The exchangeable shares are retractable by their holders on a one-for one basis for SIRI shares, subject to Callco exercising its "Retraction Call Right" to purchase the retracted shares in exchange for SIRI shares (which presumably would occur in order to avoid Part VI.1 tax to Company). Holders have no right to vote at SIRI (or, generally, Purchaser) meetings. On the 5th anniversary of issue of the Exchangeable Shares (or earlier if fewer than 2,000,000 are outstanding or certain specified extraordinary events occur), the Company will redeem all such shares through the delivery of SIRI Shares, subject to SIRI exercising its call right. In a Support Agreement, SIRI agrees not to pays dividends on SIRI Shares without corresponding dividends being paid on Exchangeable Shares, and not to engage in potentially dilutive transactions without approval of the Exchangeable Shareholders.

Plan of Arrangement

- Each Company Option shall be deemed to be unconditionally vested and shall be deemed to be transferred to the Company for a cash payment.

- Each Company RSU shall be cancelled by the Company in exchange for a cash payment.

- 1,666,667 Class A Shares held by each of Slaight and Obelysk shall be transferred to the Purchaser in exchange, in each case, for 1,666,667 Purchaser Class A Shares.

- All Class A Shares and Class C Shares of the Guarantor shall be transferred to the Purchaser in exchange for 1,641,791 Purchaser Class A Shares, 6,135,987 Purchaser Class B Shares and 177,958,942 Purchaser Preferred Shares.

- Each issued and outstanding Class A Share, other than a share (an “Exchangeable Elected Share” which has elected to receive Exchangeable Shares and other than Company Shares held by Dissenting Shareholders) held by a Company Shareholder will be exchanged with the Purchaser for: (i) Class A Cash Consideration; (ii) Class A SIRI Share Consideration; or (iii) a combination thereof in accordance with the election or deemed election of such Company Shareholder and subject, in each case, to proration.

- Each Class A Exchangeable Elected Share shall be exchanged with the Purchaser for: (i) Cash Consideration; (ii) Class A Exchangeable Share Consideration; or (iii) a combination thereof; in accordance with the election or deemed election of such Company Shareholder and subject, in each case, to proration.

- And similarly for the Class B Shares.

- Each Class A Share held by a Dissenting Shareholder shall be transferred to the Purchaser.

The Purchaser and the Company will be amalgamated immediately following the Effective Time to form Amalco.

Guarantee

The Guarantor has unconditionally guaranteed in favour of the Company the due and punctual performance by the Purchaser of the Purchaser's obligations under the Arrangement Agreement.

Canadian tax consequences

Exchange and call rights

The Company is of the view that the exchange rights (“Ancillary Rights”) have a nominal fair market value. A Resident Holder who receives Exchangeable Shares and the Ancillary Rights under the Arrangement will grant the Call Rights to Callco. The Company is of the view that the Call Rights have only a nominal fair market value and accordingly no amount should be allocated to the Call Rights.

Taxable exchange

A transfer of Company Shares to the Purchaser for Cash Consideration or SIRI Shares will occur on a taxable basis.

Exchangeable Shares

A Resident Holder who is an Eligible Holder and who exchanges Company Shares ("Eligible Shares") with the Purchaser under the Arrangement for Exchangeable Shares or a combination of Exchangeable Shares and Cash Consideration may make a valid joint election with the Purchaser under s. 85(1) (or s. 85(2) in the case of a Canadian partnership). The election forms must be submitted to the Company within 90 days following the Effective Date. On a redemption (including a retraction) of an Exchangeable Share by the Purchaser, the holder will be deemed to have received a dividend equal to the amount, if any, by which the fair market value of the proceeds received on the redemption exceeds the paid-up capital of the Exchangeable Share, which will be determined by reference to the aggregate elected amounts under the elections. On the exchange of an Exchangeable Share by the Resident Holder with Callco for SIRI Shares, the holder will generally realize a capital gain (or a capital loss).