Brookfield (BPY)/BPO

Overview

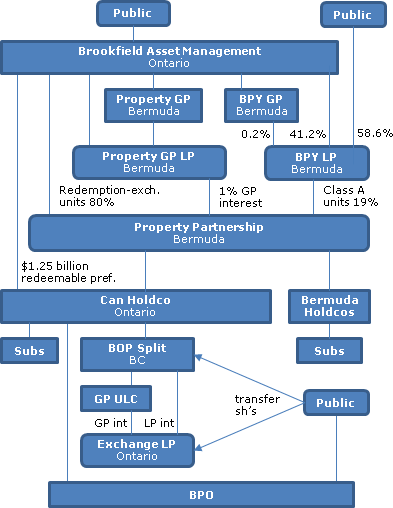

BPY, which "beneficially owns" approximately 49% of the common shares of BPO, and two of its indirect subsidiaries ("Brookfield Office Properties Exchange LP, or "Exchange LP;" and Brookfield Property Split Corp., or "BOP Split"), are making an "any or all" offering for the remaining common shares of BPO, in consideration for BPY units or cash subject to the overall mix of consideration being fixed at around 67% units and 33% cash. Canadian taxable shareholders of BPO (including individuals) can elect to receive their units consideration in the form of exchangeable LP units ("Exchange LP Units") of "Exchange LP," i.e., such units will be retractable for BPY units subject to an overall call right of BPY, but there will be no direct exchange right against BPY. The acquired BPO common shares which are not acquired by Exchange LP will be held by BOP Split, which is a B.C. subsidiary of an indirect Canadian subsidiary of BPY (i.e., CanHoldco described below) and the limited partner of Exchange LP. Exchange LP will qualify as a Canadian partnership due to its Canadian direct ownership.

The Offer

Each shareholder of BPO may elect to receive for each BPO Common Share tendered by such shareholder, one BPY Unit or $20.34 in cash, subject to pro-ration (which is stated to be likely). The total number of BPY Units that may be issued under the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction shall not exceed 186,230,125 and the total amount of cash available under the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction shall not exceed $1,865,692,297, which equates to approximately 67% and 33%, respectively, of the total number BPO Common Shares to be acquired under the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction. Shareholders who tender to the Offer but do not make an election between BPY Units and cash will be deemed to have elected to receive BPY Units. Canadian Shareholders can elect to receive, in lieu of BPY Units, Exchange LP Units.

Brookfield Property Partners ("BPY")

BPY is a TSX and NYSE listed Bermuda exempted limited partnership which has a 19% interest (in the form of Managing GP Units) in another Bermuda partnership (Brookfield Property L.P., or "Property Partnership"). The public hold 58.6% of the LP units of BPY and Brookfield Asset Management Inc. ("Brookfield Asset Management") holds 41.3% of the BPY LP units (for a total of 102M units). Brookfield Asset Management also has an 80.1% LP interest in Property Partnership in the form of 432M Redemption-Exchange Units. BPY "beneficially owns" [i.e., indirectly holds after treating the Redemption-Exchange Units of Brookfield Asset Management in Property Partnership as if they had been exchanged for BPY units, and ignoring preferred shares described below] 49.2% of the common shares of BPO (249M shares), its largest asset, and has an aggregate voting interest in BPO of 50.5%.

Property Partnership/CanHoldco

Property Partnership owns, directly or indirectly, all of the common shares or equity interests, as applicable, of the "Holding Entities" including Brookfield BPY Holdings Inc. ("CanHoldco"). Brookfield Asset Management holds $1.25 billion of redeemable preferred shares of CanHoldco, which it received as partial consideration for causing Property Partnership to directly acquire substantially all of Brookfield Asset Management's commercial property operations. In addition, Brookfield has subscribed for $5 million of voting preferred shares of each of CanHoldco and four wholly-owned subsidiaries of other Holding Entities.

BPO

BPO is a CBCA corporation which is listed on the TSX and NYSE and is focused on premier office properties in the U.S., Canada, Australia and the U.K. BPO owns an approximately 83.3% aggregate equity interest in Brookfield Canada Office Properties, a Canadian real estate investment trust that is listed on the TSX and the NYSE, and an approximately 84.3% interest in the U.S. Office Fund, which consists of a consortium of institutional investors and which is led and managed by Brookfield Office Properties.

BOP Split

BOP Split, a B.C. corporation, was incorporated on December 9, 2013 as a wholly-owned subsidiary of CanHoldco for the purpose of being an issuer of preferred shares and owning the Offerors' additional investment in BPO Common Shares.

Exchange LP

Exchange LP, an Ontario LP, was established on December 16, 2013 by BOP Split, as limited partner, and BOP Exchange GP ULC (‘‘GP ULC''), as general partner, for the sole purpose of the Offer. GP ULC is an indirect subsidiaries of BPY.

Exchange LP Units

Holders:

- Exchange right. Will be entitled at any time to retract any Exchange LP Units held by them and to receive in exchange one BPY Unit, plus all unpaid distributions.

- Overriding BPY call right. However, BPY will have the right to purchase all but not less than all of the units covered by the retraction request.

- Liquidation right (LP redemption right). Have a comparable liquidation right (and are subject to a right of Exchange LP to redeem after seven years, or earlier in certain circumstances), subject also to an overriding BPY call right.

- Voting. Generally have no voting rights.

- Preference. Will be entitled to a preference over holders of limited partnership units of Exchange LP respecting distributions including liquidating distributions.

- Distributions. Will be entitled to receive distributions economically equivalent to the distributions on BPY Units.

Exchange LP Support Agreement

BPY will covenant that it will:

- not declare or pay any distribution on the BPY Units unless: (i) on the same day Exchange LP declares or pays, as the case may be, an equivalent distribution on the Exchange LP Units; and (ii) Exchange LP has sufficient assets available to enable the timely payment of an equivalent distribution on the Exchange LP Units;

- advise Exchange LP sufficiently in advance of the declaration of any distribution on the BPY Units; and

- take all actions reasonably necessary to enable Exchange LP to pay the liquidation amount or retraction price, as applicable, of the Exchange LP Units.

BPO Preferred Shares

Brookfield Property Partners is not currently intending to make a concurrent offer for any of the BPO Preferred Shares, which will be unaffected by the Offer. If Brookfield Property Partners acquires 100% of the BPO Common Shares, it is Brookfield Property Partners' current intention to (i) provide holders of the outstanding convertible BPO Preferred Shares with the right to convert their shares for BPY Units rather than BPO Common Shares, (ii) make an offer (full or partial) to such holders to exchange up to $100 million of their shares for equivalent shares of another subsidiary of Brookfield Property Partners, or (iii) pursue other alternatives. The non-convertible BPO Preferred Shares will remain outstanding following the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction.

Options and Other Share Based Compensation Awards

If Brookfield Property Partners acquires 100% of the BPO Common Shares, it is intended that:

(a) Vested in-the-money Options then remaining be redeemed for a cash payment equal to the in-the-money value.

(b) Unvested in-the-money Options then remaining be exchanged for unvested BPY Options on a basis that preserves the in-the-money value at the time of the exchange with the BPY Options having expiry dates and vesting terms consistent with the unvested Options exchanged.

(c) Each outstanding out-of-the-money Option (whether vested or unvested) be exchanged for a BPY Option with a strike price equal to the value of a BPY Unit at the time of the exchange and expiry dates and vesting terms consistent with the Options to be exchanged.

(d) DSUs and BPO restricted shares (‘‘RSs'') be exchanged for awards in respect of BPY such that the fair market value is the same immediately before and after such exchange and other terms and conditions be substantially the same before and after such exchange.

Second stage transaction

If the Offerors take up and pay for a number of BPO Common Shares that constitute at least a majority of the BPO Common Shares that can be included for the purposes of ‘‘minority approval'' under MI 61-101, the Offerors will undertake a Compulsory Acquisition or Subsequent Acquisition Transaction to acquire any BPO Common Shares not deposited under the Offer for the same consideration as was paid by the Offerors under the Offer, subject to pro-ration.

Canadian tax consequences

S. 97(2) rollover. For BOP Canadian Shareholders who elect to receive Exchange LP Units, GP ULC, the general partner of Exchange LP, will make the necessary s. 97(2) elections with such Canadian Shareholders. The electing holder must provide the relevant information to GP ULC at http://www.brookfieldpropertypartners.com/bpotaxelection on or before the day that is 85 days following the date on which the exchange occurs. The resident holder will be solely responsible for executing its portion of the election and submitting it to CRA. An exchange for BPY units will occur on a non-rollover basis.

Exchange LP SIFT tax

GP ULC expects that Exchange LP will be a ‘‘SIFT partnership'' for each of its taxation years but it does not expect that Exchange LP will be liable for any material amount of SIFT Tax for any taxation year based on taxable dividends on Exchange LP's BPO common shares being essentially its only source of income.

Subsequent acquisition transaction

It currently is expected that on a Subsequent Acquisition Transaction, a BPO shareholder would receive a deemed dividend based on the paid-up capital per BPO share of C$8.91.

Non-residents

Non-residents who do not dispose of their BPO Common Shares pursuant to the Offer are cautioned that BPO Common Shares that are not listed on a ‘‘designated stock exchange'' at the time of their disposition will be considered ‘‘taxable Canadian property'' if at any time within the 60-month period immediately preceding the disposition, more than 50% of the fair market value of the BPO Common Shares was derived directly or indirectly from Canadian real property etc.

Qualified

investments. Exchange LP Units will not be qualified investments for RRSPs etc.

U.S. tax consequences

S. 721(a) exchange. An exchange by a BPO Shareholder of BPO Common Shares for BPY Units pursuant to the Offer is expected to qualify as an exchange to which Code s. 721(a) applies, i.e., a tax-free exchange in which no gain or loss is recognized. In particular, Torys considers that, under s. 7704, BPY (which has elected to be classified as a partnership) is not a publicly traded partnership that should be treated as a corporation and BPY should not be treated (under s. 721(b)) as a partnership that would be an ‘‘investment company'' if it were incorporated.

It is uncertain whether a U.S. Holder who receives a combination of cash and BPY Units in exchange for its BPO Common Shares pursuant to the Offer will be permitted to specifically identify the BPO Common Shares that are treated as sold for cash and the BPO Common Shares that are treated as transferred to Brookfield Property Partners in exchange for BPY Units. If such specific identification is ineffective, such U.S. Holder will be treated as having sold a single undivided portion of each BPO Common Share exchanged by such Shareholder pursuant to the Offer (equal to the percentage that the amount of the cash consideration received by such shareholder in exchange for its BPO Common Shares pursuant to the Offer bears to the fair market value of the total consideration (that is, cash plus the fair market value of BPY Units) received by such holder in exchange for its BPO Common Shares pursuant to the Offer), and to have contributed to Brookfield Property Partners in exchange for BPY Units the remaining single undivided portion of each BPO Common Share exchanged by such shareholder pursuant to the Offer.

Built-in gain

A former BPO Shareholder that is a U.S. taxpayer could be required under s. 704(c)(1) or 737 to recognize part or all of the ‘‘built-in gain'' in such Shareholder's BPO Common Shares exchanged for BPY Units pursuant to the Offer if BPY (i) sells or otherwise disposes of, in a taxable transaction at any time following the Offer, such BPO Common Shares, (ii) distributes such BPO Common Shares acquired from such Shareholder to another BPY Unitholder within seven years following the Offer, (iii) distributes any BPY property (other than money or BPO Common Shares acquired from such Shareholder) to such BPY Unitholder within seven years of the Offer, or (under s. 707(a)) (iv) makes any distribution (other than an ‘‘operating cash flow distribution'') to such former Shareholder within two years following the Offer. The BPY General Partner intends to use commercially reasonable efforts to ensure that a Shareholder that is a U.S. taxpayer is not required to recognize part or all of the ‘‘built-in gain'' in such Shareholder's BPO Common Shares deferred as a result of the Offer, in the event that Brookfield Property Partners undertakes any of the foregoing transactions.

BPY UBTI

The BPY General Partner intends to use commercially reasonable efforts to structure the activities of BPY and Property Partnership to avoid generating income connected with the conduct of a trade or business (which income generally would constitute unrelated business taxable income (‘‘UBTI'') to the extent allocated to a tax-exempt organization).