Resverlogix/RVX Therapeutics

Overview

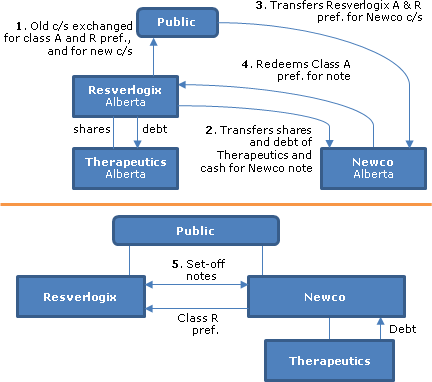

Pursuant to an Alberta Plan of Arrangement, Resverlogix is effectively spinning-off Newco to its shareholders. Newco will hold Therapeutics as well as Royalty Preferred shares of Resverlogix, which will participate in a percentage of licensing revenue generated by Resverlogix from a particular pharmaceutical product in development (but with a reduction for the Part VI.1 tax of Resverlogix). In order to accommodate these Royalty preferred shares in the final structure, the spin-off is done in a somewhat similar manner to a butterfly, although it is not a butterfly reorganization. Newco will not be listed "in view of the early stages of development of the Spin-Off Assets."

Resverlogix

Resverlogix is a TSX-listed clinical stage cardiovascular Alberta company which is developing RVX-208, a small molecule for the treatment of atherosclerosis. RVX-208 is in clinical trials. Resverlogix will continue this focus following the Arrangement. It owns all the shares of Therapeutics, also an Alberta company.

Plan of Arrangement

Under the Plan of Arrangement:

- Common shares of Resverlogix held by dissenting shareholders are surrendered to Resverlogix

- Resverlogix New Common Shares (common shares with one vote per share), Resverlogix Class A Preferred Shares and Resverlogix Royalty Preferred Shares are added to the capital of Resverlogix and the existing common shares are given two votes per share

- each existing common share of Resverlogix is exchanged for a Resverlogix New Common Share, a Resverlogix Class A Preferred Shares and a Resverlogix Royalty Preferred Share – with the stated capital of the Resverlogix common shares be allocated 1st to the Resverlogix Class A Preferrred Shares (as to their fair market value), 2nd as to a nominal amount to the Resverlogix Royalty Preferred Share and as to the balance to the Resverlogix New Common Shares

- Newco (whose one common share is held by Resverlogix) acquires the "Therapeutics Assets" (cash, and debt and shares of Therapeutics) in consideration for a promissory note

- each Resverlogix Class A Preferred Share and Resverlogix Royalty Preferred Share is acquired by Newco in exchange for one Newco share

- Resverlogix redeems all the outstanding Resverlogix Class A Preferred Shares for a promissory note

- each promissory note is repaid by the transfer of the other

- the incorporator's share of Newco is cancelled for no consideration

Related steps

Concurrently with the (s. 86) share exchange under the Plan of Arrangement, existing options and warrants will be replaced with new options on Resverlogix and Newco; and RSUs also will be exchanged. Due Bill trading procedures will be used in connection with the distribution of the Newco shares. A Resverlogix officer will specify a dollar amount for the Resverlogix Class A Preferred Shares for purposes of s. 191(4) effective concurrently with their issuance

Attributes of Resverlogix Royalty Preferred Shares

- non-voting

- entitled to semi-annual dividends based on a sliding percentage of revenues from the ApoA-1 pharmaceutical agent multiplied by a tax factor intended to ensure that Newco bears the burden of Resverlogix's Part VI.1 tax on such dividends

- the sliding royalty percentage increases from 6% of annual net revenues of less than US$1 billion to 12% of annual revenues greater than US$5 billion

US securities laws

Reliance on the s. 3(a)(10) exemption.

Canadian tax consequences

S. 86 exchange. S. 86 will apply to the exchange of the old Resverlogix common shares for Resverlogix New Common Shares, Resverlogix Class A Preferred Shares and Resverlogix Royalty Preferred Shares. The adjusted cost base of an old Resverlogix common share will be allocated among the three new shares in proportion to their relative fair market values, it being assumed that the fair market value of the Resverlogix Class A Preferred Shares will be equal to the fair market value of the Therapeutics assets transferred to Newco. Resverlogix will post its estimate of the proportionate allocation.

Exchange of Resverlogix Class A and Roylaty shares

The exchange of Resverlogix Class A shares and Resverlogix Royalty Preferred Shares for Newco shares will occur on a rollover basis under s. 85.1 unless a shareholder chooses to recognize a capital gain or loss on the exchange.

Dissenters

Will (subject to s. 55(2)) be deemed to receive a dividend to the extent that the amount received (excluding an award of interest) exceeds the paid up capital of the Resverlogix common shares of the dissenter.

Qualified investments

It is not anticipated that Newco will be listed following the Arrangement. "Newco should be a public corporation at the Effective Time provided the The Resverlogix Class A shares (which will not be listed) will be qualified investments provided that the Resverlogix common shares are listed on the TSX or other designated stock exchange.

Non-residents

Will not be subject to income tax or s. 116 withholding as a result of the Arrangement.

US tax consequences

Classification of Arrangement. It is assumed that the Arrangement will be treated as a tax deferred exchange by Resverlogix shareholders of their Resverlogix common shares for Resverlogix New Common Shares either under Code s. 1036 or s. 368(a)(1)(e), and a distribution of the Newco shares under Code s. 301.

PFIC rules

Resverlogix believes that is was a PFIC for prior taxable years and expects that it and Newco will be a PFIC for the current taxable year. Detailed disclosure of consequences under PFIC rules of Arrangement.