Slate Retail/SUSO 3

Overview

SUSO 3 will be merged into the REIT under s. 132.2, with the former SUSO 3 unitholders receiving 7.5M Class U Units of the REIT and with U.S. holders of 207K exchangeable Class B units of its indirect Delaware holding partnership (Slate U.S. Opportunity (No. 3) Holdings L.P.) receiving exchangeable LP units of the corresponding Delaware holding LP for the REIT or its subsidiary Delaware LP. The number of units so received in each case is subject to a potential working capital adjustment. The number of class U units received will correspond to the relative net subscription prices for the various SUSO 3 units issued at the time of its September 2013 IPO. The REIT and LP units to be issued collectively represent approximately 30.72% of the outstanding REIT Units before the transaction on a non-diluted basis but including the outstanding Class B LP2 units (being exchangeable units in an indirect REIT LP.)

SUSO 3

An unlisted mutual fund trust holding a portfolio of U.S. grocery-anchored retail rental properties through an Ontario LP which, in turn, holds a Delaware holding LP (Slate U.S. Opportunity (No. 3) Holdings L.P.).

SLAM

. Slate Asset Management, the Toronto-based manager of SUSO 3 and the REIT.

Slate Retail Unit Classes

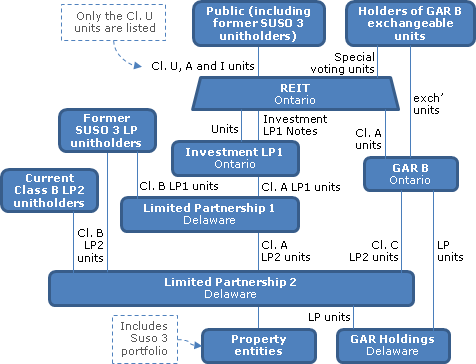

The Class A Units of the REIT were offered in Canadian dollars solely for the convenience of Unitholders wishing to pay the subscription price in Canadian dollars and receive distributions in Canadian dollars representing the equivalent of the U.S. dollar distributions on the other units. The Class U and Class I Units were offered in U.S. dollars and distributions paid in U.S. dollars. Class A and Class U Units were offered through a public offering, while Class I Units were offered through a private placement. Rights and characteristics of each Class I Unit are identical to those for each Class A Unit and Class U Unit, except that each Class I Unit was not required to pay agents' fees. Only the Class U units are listed on the TSX.

Current REIT structure

The REIT holds notes and units of an Ontario LP ("Investment LP1") which is a foreign corporation for Code purposes, which holds all the units (Class A LP1 Units") of a Delaware LP ("Limited Partnership 1"), which hold units ("Class A LP2 Units") of another Delaware LP ("Limited Partnership 2"). Some U.S. unitholders hold exchangeable units of Limited Partnership 2 ("Class B LP2 Units"). Unitholders of an Ontario LP ("GAR B") hold GAR B Exchangeable Units. GAR B holds LP Units of GAR Holdings (a Delaware LP directly or indirectly holding retail properties) and Class C LP2 Units of Limited Partnership 2. Each Class C LP2 Unit, taken together with the units of GAR Holdings held by GAR B, will, in all material respects, be economically equivalent to ownership of Class U Units of the REIT, subject to adjustment in respect of U.S. corporate income taxes paid by REIT and/or certain subsidiaries of the REIT.

Proposed transactions

In connection with the implementation of the Transaction:

- SUSO 3 will acquire the shares of the GP of its immediate Ontario subsidiary LP from SLAM.

- SUSO 3 will distribute any remaining cash as a distribution of taxable income or capital as determined by it.

- Any remaining taxable income of SUSO 3 for its deemed s. 132.2(3)(b) year end will be paid through the issuance, at least one business day prior to closing, of Vendor Units of the appropriate class.

- The Vendor will amend its Declaration of Trust to accommodate the redemption of the Vendor Units.

- SUSO 3 will arrange for the transfer of the LP interest in the SUSO 3 GP from the current holders thereof to an affiliate of the REIT in consideration for Class B Units of Limited Partnership 1 or 2 and agree to file any elections which could cause this to occur on a tax deferred basis.

- The REIT will acquire all of the assets of SUSO 3 in consideration for Class U units.

- SUSO 3 will redeem all SUSO 3 Units (except for any SUSO 3 Units acquired by the REIT) by delivering Class U units to SUSO 3 Unitholders.

- A reorganization will rationalize the resulting structure.

The number of units to be issued by the REIT and Limited Partnership 1 will be adjusted based on any changes in SUSO 3 working capital five days before closing as compared to the current estimate.

Canadian tax consequences

S. 132.2 merger. Provided that a joint s. 132.2 election is made on a timely basis, there should be no resulting net income to SUSO 3 or tax liability to its unitholders as a result of the transaction, which will constitute a qualifying exchange.

SIFT rules

The REIT and its subsidiary partnerships currently do not own any non-portfolio properties.

FTCG rules

No assurance is given respecting the Foreign Tax Credit Generator rules.

U.S. tax consequences

ECI taxation. The REIT, Investment LP1 and GAR B have elected to be corporations under the Code and they each will be considered to have a permanent establishment in the U.S. Accordingly, Investment LP1 and GAR B (as foreign corporations) will be subject to U.S. corporate income taxation on the net rental income which they derive (through subsidiary Holdings LP) from a U.S. trade or business and on gains from the sale of U.S. real properties that are allocable to them or on the sale of subsidiary investments. Income or gains of subsidiary LPs allocable to them generally will be subject under Code s. 1446 to withholding at a 35% rate, which generally will also apply in lieu of any FIRPTA withholding requirements, with such withholding being allowed as a credit on their U.S. federal income tax returns. Investment LP and GAR B also will be liable for a 5% branch profits tax (subject to the $500,000 Treaty exemption) on their after-tax earnings.

Interest

The REIT and Investment LP1 intend to treat the Investment LP1 Notes held by the REIT as debt. The earnings stripping rules (Code s. 163(j)) may apply. Interest received by the REIT on the Investment LP1 Notes will be subject to 0% withholding by virtue of the Canada-U.S. Treaty.