Threshold Power

Overview

The Trust will be an Ontario unit trust listed on the TSX. It will indirectly acquire interests in nine operating wind projects (with a purchase price of US$120 million) from US tax shelter investors - and expects to purchase further such interests. It will rely on not holding non-portfolio property; and on US co-investors in the wind projects not being considered to be investors in it for purposes of the US inversion rules.

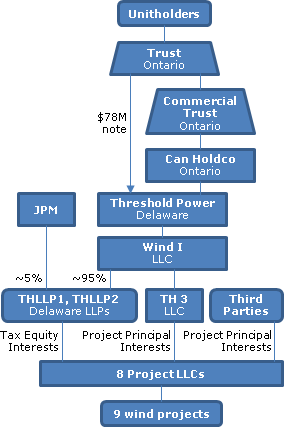

Overall structure

The Trust will hold all the units of a subsidiary Ontario unit trust ("Commercial Trust") which, in turn, will hold all the shares of an Ontario holding company ("Can Holdco"). Can Holdco will hold all the shares of a Delaware holding corporation ("Threshold Power") and the Trust will hold a note of Threshold Power (the Threshold Power Note) for C$78M bearing interest at 7.5%.

Trust structure

Computershare will be the Trustee. The Trust Indenture empowers the Trustee to delegate most of the responsibilities regarding the governance of the Trust to the Administrator, which it has done. The Administrator shareholder (namely, the Administrator CEO who thus is the Threshold CEO) has agreed to elect all of the Administrator directors at the direction of the Unitholders.

LLP structure

An LLC subsidiary of Threshold Power (Wind I) will hold 100% of one subsidiary LLC (TH3), and a partnership interest in two subsidiary Delaware limited liability partnerships (THLLP1 and THLLP2). The other partner in THLLP1 and THLLP2 will be a subsidiary of JPM Capital Corporation (JPM). THLLP1 and THLLP2 will hold all of the Tax Equity Interests (described below) in the project LLCs, and TH3 will hold a Project Principal Interest (also described below) in one of the project LLCs. Under the LPA for THLLP1, Wind I will be entitled to 95% of the cash distributions and 1% "of tax benefits and profits" to the end of 2017, and thereafter will be entitled to 87.5% of both cash distributions and such tax benefits and profits. Under the LPA for THLLP2, Wind I will be entitled to 95% of the cash distributions and 1% of tax benefits and profits to the end of 2015, and thereafter will be entitled to 95% of all such distributions, attributes and profits. Wind I will enter into a credit agreement with Union Bank, N.A. with a committed amount of U.S.$100M.

Project structure

Wind I and a JPM subsidiary will jointly fund THLLP1 and THLLP2, which will then purchase "Tax Equity Interests" in project LLCs from the US Vendors, which in the case of THLLP1 will be JPM. These project LLCs utilize a "flip" structure under which: in Stage 1 the project owners/operators (Project Principals), who also are the managing members of the project LLCs, receive 100% of the cash flow on the LLC interests and "Tax Equity Investors" receive substantially all the tax attributes (e.g., tax credits and depreciation); in Stage 2 the Tax Equity Investors receive substantially all the tax flow and tax attributes; and Stage 3 where the Project Principals receive between 75% and 95% of the cash distributions and most of the tax attributes. The Tax Equity Interests acquired in the project LLCs will mostly be close to the beginning of Stage 2. The management committee of THLLP1 and THLLP2 consists of one representative of each of Wind I and JPM. TH3 will purchase its Project Principal Interest directly from a Vendor for US$3.5M.

Closing transactions

- The Trust will settle Commercial Trust, and apply substantially all the proceeds of the offering to subscribe for additional units

- Commercial Trust will apply these proceeds to subscribe for Can Holdco shares

- Can Holdco will use a portion of these proceeds to subscribe for Threshold Power shares and lend the balance of Cdn.$78M for the Threshold Power Note

- Can HOldco will distribute the Threshold Power Note to Commercial Trust, which will distribute it to the Trust

- Threshold Power will contribute most of its funds to subscribe for additional membership interests in Wind I

- Wind I will fund THLLP1, THLLP2 and TH3 in order to complete the purchase of the (mostly Tax Equity) Interests in the Project LLCs

Immediately following closing, private placement investors will transfer 4.14M of their units of Commercial Trust to the Trust in exchange for 425,781 Trust units, and redeem 130K of their Commercial Trust units for $130K of cash.

Distributions

Quarterly, expected to be over 60% tax-deferred for 2013. Pro forma (based on the year ended March 31, 2013) net loss and total cash distributions from the project LLCs are estimated as U.S.$7.0M and U.S.$51.9M, with cash distributions to Wind I being U.S.$18.0. After deduction of expenses of U.S.$2.6M, cash available for distribution would be U.S.$15.4M (C$16.1M), of which C$11.8M would be distributed representing a payout ration of 72.8%. The Threshold group will hedge at least 12 monts of anticipated Trust distributions.

Canadian tax

It is assumed that the Trust will not be subject to SIFT tax on the basis that it will not hold non-portfoio property.

No opinion is given as to whether foreign accrual property income will be generated to Can Holdco or as to whether dividends paid to it by Threshold Power will come out of exempt surplus or taxable surplus. It is expected that Can Holdco will designate the dividends paid by it as eligible dividends to the extent that it was entitled to deductions under s. 113 for dividends received from Threshold Power.

US Tax

. The Trust. The Trust will elect to be a corporation. It expects to be eligible for Treaty benefits, so that interest on the Threshold Power Note should not be subject to withholding. As the FATCA rules do not apply to payments under an obligation that is outstanding on January 1, 2014 and was not thereafter materially modified, there also should be no FATCA withholding tax on interest on the Threshold Power Note.

US inversion tax

It is not expected that Code s. 7874 wil apply to the Trust. None of the Vendors will hold an interest in it, and it will not initially acquire substantially all the interests in the project LLCs (although s. 7874 could apply if the Trust later were considered to have acquired substantially all the interests of the project LLCs as part of the same plan, and the Vendors acquired Trust units). Even though the Trust is not expected to acquire substantially all of the interests in the project LLCs (given the Project Principal Interests therein), it could be treated as a US corporation for purposes of Code s. 7874. The Vendors could be viewed as holding interests in the Trust if their distribution rights with respect to the project LLCs were substantially similar in all material respects to the distribution rights attributable to interests in the Trust. However, the distribution rights with respect to the project LLCs will be substantially different in material respects from those in respect of the Trust.

Although the JPM subsidiary will have certain rights with respect to the transfer of its partnership interests such as a right to retract for fair market value; and a purchase option of Wind I, such rights will not be determined by reference to, and will not be dependent on, any transfer or other rights at the Trust level; and any consideration to be paid to the JPM subsidiary will not be calculated in any way by reference to the Trust. Accordingly, neither JPM nor its subsidiary should be deemed to hold interests in the Trust by virtue of a rule that stock or other interest of an entity (other than an acquiring non-US corporation) may be treated as stock of such acquiring non-US corporation if such interests provide the holder with distribution rights (dividend, redemption and liquidation rights) which are substantially similar in all material respects to the distribution rights provided by stock of the acquiring non-US corporation.

Commercial Trust

Will elect to be disregarded as an entity separate from the Trust.

Can Holdco

Is expected to be treated as a Canadian-resident corporation eligible for Treaty benefits, so that distributions from Threshold Power will be treated first as dividends subject to 5% withholding. Discussion of consequences if presumption that Threshold Power is a USRPHC is not rebutted.

Threshold Power Note

Baker & McKenzie will provide an opinion (supported by interest rate and debt feasibility studies) to the underwriters that the Threshold Power Note is debt. Such studies will also support the interest rate being an arm's length rate. The earnings stripping rules in s. 163(j) limit the deduction of interest paid to related non-US persons exempt from US federal income tax (as determined under Code s. 267(b) or 707(b)(1)) in years that the corporation's debt-to-equity ratio is more than 1.5:1, and that its "net interest expense" (interest expense minus interest income) is no more than 50% of its "adjusted taxable income" (taxable income before the deduction of certain items, including net interest expense). Threshold Power expects to have an initial debt-to-equity ratio of approximately 1.8:1, and it and the Trust likely will be related, so that the deductibility of interest payments may be so limited.