Rio Alto/Sulliden -- summary under Shares for Shares and Nominal Cash

Overview

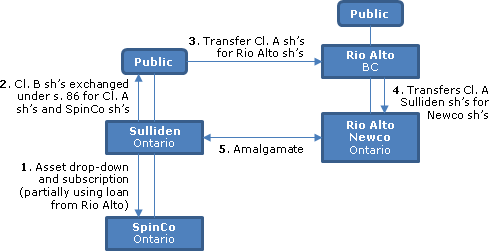

Following the spin-off of SpinCo on a s. 86 reorg of Sulliden on the basis of 0.10 of a SpinCo Share for each (common) Sulliden Share, all of the outstanding Sulliden Shares will be exchanged for (common) Rio Alto Shares on the basis of 0.525 of one Rio Alto share for each Sulliden Share. Sulliden, upon amalgamation with Rio Alto NewCo, will become a wholly-owned subsidiary of Rio Alto. Rio Alto expects to issue Rio Alto Shares, equal in number to 86.5% of the non-diluted Rio Alto Shares outstanding immediately prior to the Circular date, thereby requiring Rio Alto shareholder approval. The reorganization may qualify as a Code s. 368(a) reorg in light inter alia of SpinCo representing less than 10% of Sulliden's net assets.

See full summary under Mergers & Acquisitions – Mergers – Share-for-share.

| Locations of other summaries | Wordcount | |

|---|---|---|

| Tax Topics - Public Transactions - Mergers & Acquisitions - Mergers (mostly Plans of Arrangement) - Share-for-Share | S. 86 spin-off of Quebec property of Sulliden, and its acquistion on share-for share exchange by Rio Alto and amalgamation with Rio Alto subsidiary as a s. 368(a) reorg | 1759 |