Erdene/Advanced Primary Materials -- summary under Shares for Shares and Nominal Cash

Current structure

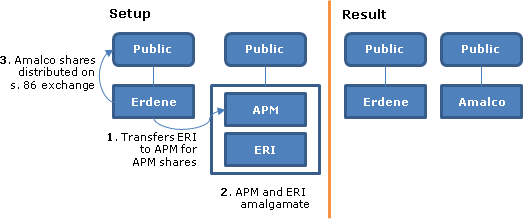

Erdene is a TSX-listed corporation holding Cape Breton coal assets through its wholly-owned subsidiary, Erdene Resources Inc. ("ERI"), and also indirectly holding mineral exploration and development assets in Mongolia. Erdene also holds approximately 60% of APM, whose shares are listed on the TSXV.

Plan of Arrangement

A CBCA Plan of Arrangment is intended to result in two separately-held public companies, holding the Mongolian and coal assets, respectively:

- Erdene will transfer all its shares of ERI to APM in consideration for APM common shares

- APM and ERI will (vertically) amalgamate to continue as Morien Resources Corp. ("Amalco"), with each APM shareholder (including Erdene) receiving one Amalco common share for every 7.85 APM common shares

- Each outstanding Erdene common share (which previously was redesignated as an Erdene Class A common share) shall be exchanged for ½ of an Erdene New Share (being a common share) and ½ of one Amalco common share owned by Erdene

- Every 7.85 options to acquire APM common shares shall be exchanged for one option to acquire an Amalco common share, with the exercise price price multiplied by 7.85

- Each option to acquire an Erdene common share shall be exchanged for ½ of an option to acquire an Erdene New Common share and ½ of an option to acquire one Amalco common share. The aggregate exercise price of the replacement options equals that for the Erdene options which they replace; and the aggregate exercise price is allocated based on the VWAP of the Erdene and Amalco shares following the Arrangement, provided that the exercise price for the Amalco common shares will not be less than $0.265 per share.

Canadian tax consequences

No deemed dividend is expected to arise on the exchange of Erdene Class A common shares for Erdene New Shares and Amalco common shares based on the paid-up capital of the Erdene Class A common shares. The s. 86(1) rules generally will apply to this exchange. However:

Resident Holders who acquired their Erdene Common Shares as "flow-through shares" are deemed to have an adjusted cost base of nil in respect of such Erdene Common Shares. Unless the Resident Holder also owns Erdene Common Shares which are not "flow-through shares" with which the adjusted cost base is averaged, a Resident Holder whose Erdene Common Shares are "flow-through shares" is expected to realize a capital gain equal to the fair market value of the Amalco Shares.

Standard taxable Canadian property disclosure for non-residents.