Slate No. 2 -- summary under Foreign Asset Income Funds and LPs

Structure

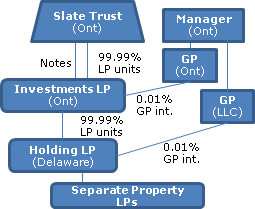

Slate Trust (an Ontario trust) will use the offering proceeds (of up to U.S.$50M) to invest in the units and interest-bearing notes (the "Investment LP Notes") of an Ontario LP ("Investment LP") which, in turn, will invest in the units of a Delaware LP ("Holdings LP"). Holdings LP will (on a blind pool basis) use the offering proceeds and mortgage financing to invest in US commercial real estate rental properties with a focus on anchored retail properties (and with each property being held in a special purpose subsidiary LP). Corporations controlled by the Toronto-based manager (Slate Properties Inc., or the "Manager") will be the general partners of Investment LP and Holdings LP with a 0.01% GP interest (but with a 20% carry over the 8% p.a. minimum return in the case of the Holdings LP general partner.)

Units and listing

Slate Trust will issue different classes of units (some on a private placement basis) in order to reflect different fee structures, and currency (Canadian dollars or US dollars) for the quarterly distributions and redemption amounts. The units initially will not be listed. However, the Manager intends to complete a liquidity event by September 30, 2018: a listing of the units or an exchange of the units for listed units; or a sale of the units or assets.

There is a standard 49% non-resident-ownership restriction, notwithstanding that the contemplated structure does not entail Slate Trust holding significant taxable Canadian property.

Redemption rights

Where the units are not listed, they will be retractable based on 95% of the most recent quarter-end value of the units held in Holdings LP prior to retraction. If monthly redemptions exceed $100,000, or if total redemptions in any 12-month period exceed 1% of the aggregate unit subscription proceeds, the redemption price shall be paid by way of an in specie distribution of property or distribution of unsecured subordinated notes of the Slate Trust, as determined by the trustees in their sole discretion.

Distributions

To be paid quarterly.

Management fees

The Manager will be paid annual fees of 1.5% of the gross subscription proceeds plus a 0.75% acquisition fee on each property acquisition.

Canadian tax treatment

The summary assumes that Slate Trust will qualify as a mutual fund trust (and the risk factors disclosure implies that there are expected to be at least 150 unitholders acquiring whole blocks under the offering.) A s. 132(6.1) election will be made by Slate Trust for it to be deemed to be a mutual fund trust from its settlement date to the date it actually so qualifies.

Slate Trust's investment restrictions prohibit it from holding any non-portfolio property.

There will be pro rata designations of net taxable capital gains and foreign source income allocated to Slate Trust by Investment LP so that inter alia each partner's share of business income taxes and non-business-income taxes paid in the U.S. potentially will be creditable. However, no assurance can be given that the August 27, 2010 foreign tax credit generator proposals will not apply.

Although the disclosure addresses "maximizing disposition proceeds," the risk factors indicate that Canadian capital gains treatment is expected on property dispositions (so that the US tax rate on such dispositions would be higher than the Canadian rate).

U.S. tax treatment

Slate Trust and Investment LP will elect to be corporations under the Code. Accordingly, Investment LP (as a foreign corporation) will be subject to U.S. federal income tax at the highest applicable rate (35%) on the income it derives (through Holdings LP) from a U.S. trade or business. Income or gains of Holding LP allocable to Investment LP (including from any sale of U.S. real property owned by the special purpose LPs or a sale of such LPs) will be subject under Code s. 1446 to withholding at the 35% rate in lieu of any FIRPTA withholding requirements, with such withholding being allowed as a credit on Investment LP's U.S. federal income tax return. Investment LP also will be liable for a 5% branch profits tax (subject to the $500,000 Treaty exemption) on its after-tax earnings.

Slate Trust and Investment LP intend to treat the Investment LP Notes as debt allocable to Investment's LP's interest in Holding LP for Code purposes. The earnings stripping rules (Code s. 163(j)) may apply. Interest received by Slate Trust on the Investment LP Notes will be subject to 0% withholding by virtue of the Canada-U.S. Treaty.