25 November 2021 CTF Roundtable

This provides the text of written questions that were posed, and summaries of the CRA oral responses, at the CRA Roundtable webinar hosted on 25 November 2021 by the Canadian Tax Foundation. The presenters from the Income Tax Rulings Directorate were:

Yves Moreno, Acting Director, International Division

Stéphane Prud'Homme, Director, Reorganizations Division

The questions were orally presented by Cheryl Gibson (Dentons) and Stefanie Morand (McCarthy).

Q.1 – Indemnities and Subsection 87(4)

- Pursuant to subsection 87(4), shareholders of a predecessor corporation receive rollover treatment on an amalgamation only if the consideration they receive for the disposition of those shares consists solely of shares of the capital stock of the new corporation

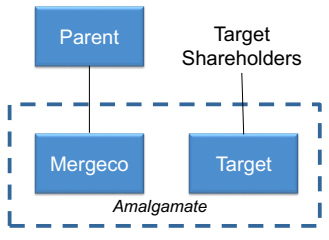

- Certain corporate transactions are often effected pursuant to triangular mergers under subsection 87(9)

- Parties may provide indemnities to one another for representations, warranties and potential liabilities that exist at the time of closing

- Where such indemnities are provided, are the conditions of subsection 87(4) still satisfied?

- Base Case:

- Parent agrees to acquire shares of Target by way of triangular merger

- Both are taxable Canadian corporations

- Parent incorporates Mergeco, which will amalgamate with Target pursuant to subsection 87(9)

- Target shareholders dispose of their shares of Target in exchange for shares of Parent

- Scenario 1: Target Shareholders agree to indemnify Parent for breaches of representation, warranties, etc. Indemnity claims are to be satisfied by way of cash payment to Parent.

- Do subsections 87(2) and 87(4) continue to apply?

- Scenario 2: Rather than provide for cash payment, some of the Parent shares issuable to the Target shareholders are placed in escrow during the indemnity period. If no indemnity claim arises, the shares will be released from escrow. If an indemnity claim is made by Parent, Parent can repurchase shares from escrow for $1 and cancel them. The repurchased shares would have a value equal to the amount of the indemnity claim.

- Would the CRA ascribe the value of the indemnity claim that is satisfied as an amount “paid by the corporation” for purposes of paragraph 84(3)(a), such that a deemed dividend may arise if the amount paid is in excess of the paid-up capital of such shares?

- Scenario 3: Parent agrees to indemnify Target shareholders for breaches of representation, warranties, etc. Indemnity claims are to be satisfied by way of cash payment to Target shareholders.

- Would this be consideration other than shares of Parent for purposes of subsection 87(4)?

- Scenario 4: Parent agrees to indemnify Target shareholders for breaches of representation, warranties, etc. Indemnity claims are to be satisfied by way of a subsequent issuance of Parent shares to Target shareholders.

- Would this continue to be in accordance with the provisions of section 87(4)?

Preliminary Response

Prud'Homme: A payment’s tax-treatment depends mainly on the legal nature of the payment.

The main question here is whether a payment pursuant to representations and warranties in an M&A type of transaction can be considered as payment for the settlement of such indemnities, or as proceeds of disposition of shares being disposed of in such a transaction.

This is, of course, a mixed question of fact and law but, where the reps and warrantees are bona fide reps and warranties that are usually encountered in M&A transactions, the payment of indemnities to settle claims is normally made quite some time after a transaction itself, and would normally not be considered to be part of the proceeds of disposition of the property that is the subject of the M&A transaction.

Scenario 1

Prud'Homme: Before discussing s. 87(4), it must first be determined whether s. 87(1) is satisfied. If the cash payment is made by the Target shareholder to Parent, we do not see why the conditions in s. 87(1)(a) would not be respected in that situation.

Even if the cash payment were made by the corporation that results from the amalgamation or by Parent, we would presume that such payment is made quite some time after the amalgamation, once it is established that not all representations and warranties have been respected or satisfied. This payment therefore would not be normally be made on the amalgamation or be part of the amalgamation. Therefore, the 87(1)(a) condition would be met – all property of the predecessor corporation becomes property of the new corporation by virtue of the amalgamation.

Now we turn to s. 87(4).

Of course, the question of whether Parent could benefit from the application of 87(4) is only relevant when Parent owns shares of a predecessor corporation that has an ACB lower than fair market value. The approach is similar to the previous scenario. The payment of an indemnity that is made quite some time after the amalgamation, regarding bona fide representations and warranties, would not normally be thought of as consideration received for the disposition of shares of a predecessor corporation.

Scenario 2

Prud'Homme: In this situation, of course, the reduction in value of the shares held by the Target shareholders is made as consideration for the settlement of the indemnity claim. In our view, when looking at s. 84(3), the amount considered to be paid for the repurchase shares under s. 84(3) should be equal to the amount of the settlement of the indemnity claim.

Scenario 3

Prud'Homme: It is the same general approach again. A cash payment that would be made by Parent to the Target shareholders to settle indemnity claims would normally not be viewed as consideration received by the Target shareholders for disposition of shares of a predecessor corporation.

Scenario 4

Prud'Homme: If Parent issues additional shares to Target shareholders to settle indemnity claims, such issuance would, again, normally not be viewed as consideration for the disposition of shares of a predecessor corporation. In such a situation, the value of the shares issued by Parent to Target shareholders would represent the amount paid to such shareholders to settle the indemnity claim and would be taxed accordingly.

Official Response

25 November 2021 CTF Roundtable Q. 1, 2021-0911841C6 - Indemnities and subsection 87(4)

Q.2 – Subsection 15(2) Shareholder Loans and TOSI

- Taxpayer (X) has an amount included in his or her income under subsection 15(2)

- The amount is also subject to tax under subsection 120.4(2) (TOSI)

- X is entitled to a deduction under paragraph 20(1)(ww) for the income subject to TOSI, and this amount will be equal to the amount included in X's income under subsection 15(2)

- In a subsequent taxation year, X repays the shareholder loan

- Does claiming the paragraph 20(1)(ww) deduction preclude X from subsequently claiming the paragraph 20(1)(j) deduction when the loan is repaid?

- Paragraph 20(1)(j) provides:

- (j) such part of any loan or indebtedness repaid by the taxpayer in the year as was by virtue of subsection 15(2) included in computing the taxpayer’s income for a preceding taxation year (except to the extent that the amount of the loan or indebtedness was deductible from the taxpayer’s income for the purpose of computing the taxpayer’s taxable income for that preceding taxation year), if it is established by subsequent events or otherwise that the repayment was not made as part of a series of loans or other transactions and repayments; [Emphasis added]

Preliminary Response

Prud'Homme: As provided in our answer to Question 32 of the CPA Provincial Roundtable, s. 20(1)(ww) provides a deduction in computing income, whereas the bracketed phrase contained in 20(1)(j) only applies to the deductions in computing taxable income. Consequently, the fact that X claimed the paragraph 20(1)(ww) deduction should not preclude X from subsequently claiming the paragraph 20(1)(j) deduction when the loan is repaid.

This appears to be the right policy result.

Official Response

25 November 2021 CTF Roundtable Q. 2, 2021-0911831C6

Q.3 – Section 86.1

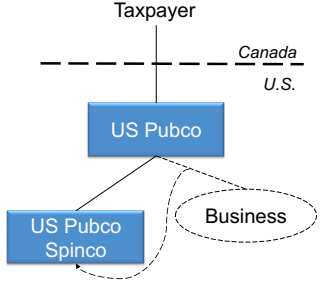

- A Canadian resident individual (the Taxpayer) owns shares of US Pubco

- US Pubco is incorporated in the US, and its shares are listed and traded on a US stock exchange

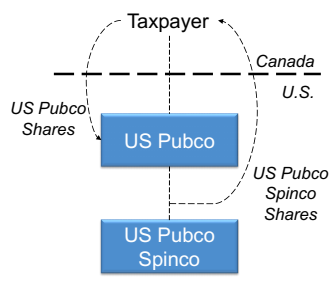

- US Pubco wants to package (pursuant to a Canadian butterfly) one of its businesses into a new US corporation (US Pubco Spinco), and intends to spin out all of the common shares of US Pubco Spinco to the common shareholders of US Pubco pursuant to an exchange offer (the Exchange Transaction)

- US Pubco will offer its shareholders the option to exchange their US Pubco shares for US Pubco Spinco shares on a pro rata basis

- The disposition by the Taxpayer of common shares of US Pubco is an essential condition for receipt of the shares of US Pubco Spinco.

- The Exchange Transaction does not contemplate a distribution by US Pubco of the US Pubco Spinco common shares as a dividend in kind

- If the Taxpayer accepts the offer and participates in the Exchange Transaction, will section 86.1 apply?

Preliminary Response

Moreno: S. 86.1(1)(a) provides that the amount of an eligible distribution received by a taxpayer is not to be included in the income of the taxpayer.

The present scenario deals with an exchange – there is a disposition of the shares of US Pubco and, as consideration, shares of Spinco are received. There is no accommodation in s. 86.1(1)(a) for the resulting income on the disposition of the US Pubco shares. Therefore, the exchange illustrated in the example is not a type of eligible distribution that is contemplated by s. 86.1.

Official Response

25 November 2021 CTF Roundtable Q. 3, 2021-0912101C6 - 86.1 exchange of shares

Q.4 – “Liable to Tax” and Territorial Taxation

- Generally, a person must be “liable to tax” in a “Contracting State” to be “resident” in that state under Canada’s bilateral tax treaties

- Per the CRA, a person must be subject to the most comprehensive form of taxation as exists in that Contracting State to be liable to tax therein - this generally refers to full tax liability on a worldwide basis

- In applying the “liable to tax” standard to jurisdictions with “territorial tax systems”, the CRA has stated: “In order to qualify as a resident [of a] contracting state which has territorial tax system, a taxpayer will generally have to be subject to as comprehensive a tax liability as is imposed by the particular state.” (See CRA Document No. 9822230)

- Can the CRA provide additional guidance in respect of that determination?

Preliminary Response

Moreno: The residence Article of the applicable treaty generally provides that, in order to be resident of another contracting state (and therefore have the benefit of the treaty), the person must be “liable to tax” in one of the contracting states according to certain criteria. Generally, the criteria are residence, place of management, domicile or other criteria of a similar nature.

Where the treaty country has a territorial tax system, the chances are that residence may not be a central element in determining the liability of a person to tax in that state, and that liability might turn on either the existence of a source of income in that state or the receipt of income in that state. That creates an interpretive issue.

The resolution of that issue would need to be done on a textual, contextual, and purposive basis, taking into account the intention of the parties to the treaty. That determination would also take into account surrounding circumstances and context, such as the applicable domestic tax legislation, or secondary authoritative sources such as the OECD Model Convention or the Commentary, and the intention of the signing states.

The CRA was asked to comment on a situation where the corporation was incorporated under the laws of Singapore: would the corporation be viewed as a resident of Singapore for the purposes of the Treaty? Typically, Singapore taxes income that is sourced in Singapore, or remitted to Singapore.

CRA’s conclusion was that the corporation in that file was a resident of Singapore, and could therefore benefit from the Singapore-Canada Treaty, provided that the central management and control of the corporation was in Singapore at all relevant times.

Residence determinations are largely factual, and relevant circumstances must be taken into account. When dealing with a corporation where treaty-residence is at stake, we would consider ruling requests and providing comfort.

Official Response

25 November 2021 CTF Roundtable Q. 4, 2021-0912111C6 - Liable To Tax & Territorial Taxation

Q.5 – Corporate Attribution in a Tiered Corporate Structure

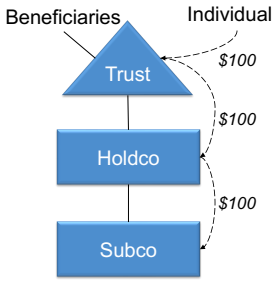

- Individual transfers $100 to Trust

- Trust uses $100 to subscribe for Holdco shares

- Holdco uses $100 to subscribe for Subco shares

- Subco uses $100 to acquire investments

- Beneficiaries include minors who are “designated persons” viz. Individual

- Trust agreement prohibits distribution from Trust to minors

- Individual is neither a beneficiary of Trust nor a shareholder of Subco or Holdco, and Subco is not a SBC

- Assuming that subsection 74.4(2) does not apply to the transfer of the $100 to Holdco in light of subsection 74.4(4), will subsection 74.4(2) or subsection 74.5(6) apply to the transfer of $100 to Subco?

- Subsection 74.4(2) – Attribution Rule:

- Applies to a direct or indirect transfer or loan of property by an individual to a corporation

- But only where it can reasonably be considered that one of the main purposes of the transfer or loan is to reduce the income of the individual and to benefit a designated person in respect of that individual (the Purpose Test)

- Subsection 74.4(5):

- “Designated person” includes, inter alia, a child (under the age of 18 years old) of the individual that makes the transfer or the loan to the corporation

- Subsection 74.4(4) – Exception to Purpose Test:

- the only interest that the designated person has in the corporation is a beneficial interest in the shares of the corporation held through a trust;

- the terms of the trust provide that the designated person may not receive or otherwise obtain the use of any income or capital while the person is a designated person in respect of the individual; and

- the designated person has not received or obtained the use of any of the income or capital of the trust, and no deduction has been made by the trust under subsection 104(6) or (12) in respect of amounts paid or payable to, or included in the income of, that person while being a designated person in respect of the individual

- Subsection 74.4(2) – Requirement for Application in a Particular Taxation Year:

- to the extent that the Purpose Test is met, subsection 74.4(2) will apply to the individual in a taxation year that includes a period after the transfer throughout which all of the following three conditions are met:

- the individual was resident in Canada;

- the corporation was not a small business corporation (defined in subsection 248(1));

- the person is a designated person in respect of the individual and would have been a specified shareholder of the corporation if the definition of “specified shareholder” in subsection 248(1) were read without reference to paragraphs (a) and (d) and if the reference therein to “any other corporation that is related to the corporation” were read as a reference to “any other corporation (other than a small business corporation) that is related to the corporation”

- to the extent that the Purpose Test is met, subsection 74.4(2) will apply to the individual in a taxation year that includes a period after the transfer throughout which all of the following three conditions are met:

Preliminary Response

Prud'Homme: S. 74.4(2), is a corporate attribution rule with very broad application so we always need to be careful with that provision. The question of whether it is reasonable to consider that one of the main purposes of the transfer of property is to reduce the income of the individual and to benefit either directly or indirectly his or her minor children is a question of fact that must be resolved in light of all the circumstances and particulars of each case.

Here, unfortunately we do not have any facts relating to the purposes of the transfers, so we are unable to conclude on the purpose test.

Now let us deal with the exception in s. 74.4. S. 74.4(4) was introduced to ensure that, in certain estate planning circumstances, s. 74.4(2) would not apply. Specific conditions are stated in ss. 74.4(4)(a) to (c). S. 74.4(4)(a) requires that the only interest that the designated person has in the corporation is a beneficial interest in the shares of the corporation which are held through a trust. In this situation “the corporation” is Subco. The minor children here had a beneficial interest in the Trust that only owned the shares of Holdco – the Trust does not own any shares of Subco. Therefore, technically the condition is not met, and 74.4(4) will not apply to prevent the application of 74.4(2) to the indirect transfer of property which we have here by the individual to Subco.

To the extent of course that the purpose test is met, 74.4(2) will apply to the individual if all of the following conditions are met: there must be an individual who is resident in Canada; there must be a corporation that is not a small business corporation; and the person is a designated person in respect of the individual (i.e., the individual’s children), and would have been a specified shareholder under the modified definition of “specified shareholder” in 74.4(2)(a).

In this scenario, Subco is not a small business corporation. Holdco is not a small business corporation, and the individual is a Canadian resident, so that we are getting closer to the application of 74.4(2). With respect to minor children, they are clearly designated persons, but are they specified shareholders of Subco? Answering that question would require a review of the relevant documents to conclude on whether paragraph (e) of the definition of “specified shareholder” is met in this case, because there is no mention in the question as to whether the trust is discretionary. Assuming we are dealing here with a discretionary trust, paragraph (e) of the definition of “specified shareholder” would be met, even if the children are not entitled to any income or capital of the trust while they are minors. The final result is that the minor children would be deemed to own the shares of Holdco, and Holdco is a corporation related to Subco, so the minor children would be specified shareholders of Subco in addition to being designated persons.

Official Response

26 November 2021 CTF Roundtable Q. 5, 2021-0911821C6 - Corporate Attribution

Q.6 – Subsection 143.4(1) and the “right to reduce”

- A “right to reduce” is defined in subsection 143.4(1) as follows: “right to reduce” means a right to reduce or eliminate an amount in respect of an expenditure at any time, including, for greater certainty, a right to reduce that is contingent upon the occurrence of an event, or in any other way contingent, if it is reasonable to conclude, having regard to all the circumstances, that the right will become exercisable.

- In CRA Document No. 2016-0628741I7, the CRA appears to have taken the position that where, in a particular year, a debtor and its creditors enter into a plan of arrangement pursuant to which interest will be forgiven and the plan is not implemented until a subsequent year, subsection 143.4 would apply in the year the plan was approved by the creditors

- Assume that CCAA procedures commence in a particular year (Year 1), creditors approve the plan the following year (Year 2) and the plan is implemented in a subsequent year (Year 3)

- At what stage of the process will a “right to reduce” arise for purposes of section 143.4?

Preliminary Response

Prud'Homme: The question here is when the “right to reduce”, as defined in 143.4(1), arises when an interest is forgiven under a plan of arrangement in proceedings under the CCAA.

In general, when a right to reduce arises under s. 143.4(1) will require a determination of when the legal right, albeit contingent, arises, and whether it is reasonable to conclude that the right will be exercisable. That is easy to say, but it raises issues when applied to a fact pattern. This determination will depend on a review of all the facts and circumstances and, in the case of an interest that is forgiven under a CCAA proceeding, this will include a review of the plan of arrangement and the terms of the contingencies contained in such a plan. We will need to assess whether that right of the debtor, to settle for less than the full amount of the obligation, will be exercisable in the circumstances.

In our view, this review and assessment can only be done in the context of a ruling request when all the information regarding the CCAA proceedings is available.

Official Response

25 November 2021 CTF Roundtable Q. 6, 2021-0912011C6 - Application of section 143.4

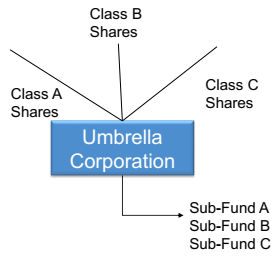

Q.7 – Sub-funds and the Tracking Interest Rules

- Assume:

- A taxpayer owns shares of a non-resident umbrella corporation contemplated by the tracking interest rules in subsections 95(8) to (12)

- The assets/liabilities are segregated into various sub-funds

- The umbrella corporation is a foreign affiliate of the taxpayer

- The shares are a tracking interest in respect of the umbrella corporation and the shares held by the taxpayer are shares of a tracked class2

- Illustration:

- Three classes of shares (A, B and C), each of which tracks to a corresponding sub-fund

- Properties segregated in a particular sub-fund are not identical to properties segregated in any other sub-fund

- Assume a Canadian shareholder (Canco) owns:

- Scenario 1: 90% of the Class A Shares, but no other shares

- Scenario 2: 90% of the Class A Shares and 10% of the Class B Shares

- Scenario 1: Please confirm that the separate corporation contemplated by subsection 95(11) is deemed to own only the properties of the sub-fund and the notional shareholders are the holders of the shares.

- Scenario 2: Is the result the same if the taxpayer owns shares tracking two sub-funds? Are there two “separate corporations” (i.e., one in respect of each sub-fund) or is there only one “separate corporation” deemed to own the properties of the two sub-funds and the notional shareholders are the holders of the two classes of shares of the umbrella corporation?

Preliminary Response

Scenario 1

Moreno: S. 95(8) defines a “tracking interest.” In this example, the Class A shares derive all their value from the Sub-Fund A properties. Presumably, the Class A shares also give rights to all the income or other rights related to ownership of the properties in Sub-Fund A. Under s. 95(8), the “tracking interest” would be the Class A shares held by the shareholders (Canco, in this example) and the “tracked property and activities” is Sub-Fund A.

S. 95(11) creates a presumption, for the purposes of computing the income of the taxpayer under s. 91(1), or the deduction for foreign taxes or for foreign tax-reporting purposes under a T1134, that there is a separate notional corporation that is deemed to own the tracked property. Again, that property is that of Sub-Fund A, and the presumption extends to the shares of that notional corporation held by the Class A shareholders of the umbrella corporation.

In this example, Canco would own its participating aggregate interest in the corresponding fraction in the number of shares, corresponding to the fraction of its interest in the umbrella corporation.

Therefore, the answer to Scenario 1 is that there would be a corporation with a separate pool of property.

Scenario 2

Moreno: This is a variation of Scenario 1. Canco holds 90% of the Class A shares, and also holds 10% of the Class B shares.

Basically, everything said about the Class A shares also holds for the Class B shares. The treatment of the Class A shares would proceed exactly as in Scenario 1; in addition, everything said about the Class A shares and Sub-Fund A would also apply to the Class B shares and Sub-Fund B.

There would, thus, be two separate corporations, owning their respective sub-properties through their respective sub-funds, and each class of Umbrella Corporation shareholders would be shareholders of the notional new corporations.

S. 95(8) always turns on the pool of property – referred to as the “tracked property and activities.” Once those properties are identified, and reading the provision from that perspective, everything falls into place and we can see clear support for the conclusion that there are two separate corporations.

One of the difficulties in reading this provision comes from s. 95(11)(e)(ii), which refers to tracking classes when referring to shares - and it’s the only place in the provision that uses the plural.

The purpose of that subparagraph is to deal with another situation: suppose, in the above scenario, there were also Class D shares, and both Class C and Class D shares tracked Sub-Fund C. As mentioned, the provisions turn on the pool of property, which is Sub-Fund C. With that in mind, s. 95(11)(e)(ii) still operates in accordance with the presumed existence of a notional corporation, holding Sub-Fund C property, and the shareholders of that corporation would be the group of Class C and D shareholders in the umbrella corporation, on a pro-rata basis.

Official Response

25 November 2021 CTF Roundtable Q. 7, 2021-0911871C6 - Sub-funds and TrackRules Sub 95(8) (12)

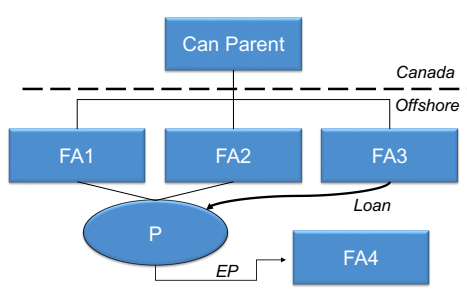

Q.8 – Loan from a FA to a Partnership held by two FAs

- Can Parent have a number of wholly-owned foreign affiliates (FAs)

- FA1 and FA2 are the sole members of a partnership (P)

- P uses the proceeds of an interest-bearing loan from FA3 to purchase shares of FA4 that are excluded property (EP)

- Subsection 93.1(4) deems P to be a non-resident corporation for the purpose of applying clause 95(2)(a)(ii)(D), such that interest paid by P to FA3 will be included in computing the income or loss from an active business of FA3. P is not, however, deemed to be a non-resident corporation for purposes of section 15.

- Subsection 15(2.2) provides that subsection 15(2) does not apply to indebtedness between non-resident persons. Subsection 15(2.1) provides an exception to subsection 15(2) in respect of certain foreign affiliates that are debtors. Possible technical concern re subsection 15(2) (and, therefore, FAPI), since it is unclear that an exception to subsection 15(2) is met where the borrower is a partnership. However, the application of subsection 15(2) would appear to undermine the purpose of the foreign affiliate rules and subsection 93.1(4).

- Can CRA comment on whether it believes subsection 15(2) would apply in this situation?

Preliminary Response

Moreno: The concern is understandable – because of the nature of the partnership, the exception in s. 15(2.1) would not be applicable, and there is a possibility that s. 15(2) might apply.

When looking at ss. 15(2) and (2.1), there are a number of places where the provisions specifically extend their application to partnerships, and indicates who the members of the partnerships are, where relevant. There is similar language in the preamble to s. 15(2.1), but there is only a reference to a person, and not the partnership, when dealing with the carve-outs in ss. 15(2.1)(a) and (b) regarding dealings with foreign affiliates.

In this situation, the answer is that this is a policy concern that should be brought to the attention of the Department of Finance. We have informed the Department of the concerns that were expressed in this question.

Official Response

25 November 2021 CTF Roundtable Q. 8, 2021-0911881C6 - ss 15(2) and FA rules

Q.9 – Work-Space-in-the-Home Expenses

- Form T2200: Employers are responsible for determining if the conditions of employment entitle the employee to deduct work-from-home expenses under subsection 8(13)

- Post-COVID, hybrid work arrangements are expected and tracking whether an employee is required to work principally from home may be difficult

- Can the CRA provide guidance to employers as to how they should determine if an individual is required to principally perform their duties away from the office of the employer?

Preliminary Response

Prud'Homme: Generally, an employee may deduct home office expenses under s. 8(1)(i)(iii) if the condition in that provision and those in ss. 8(10) and (13) are satisfied. The Act allows for the deduction of home workspace expenses when the employee was required by the contract of employment to supply and pay for those expenses. The expenses must be reasonable, and the employee must not have been reimbursed for these expenses. It is the general position of the CRA that, when an employer and an employee have entered into a formal work arrangement, the employee is then required by contract of employment to provide a workspace in their home and pay for some additional costs associated with providing this workspace. While the actual agreement can take many different forms, for example, a verbal agreement, email, or formal written agreement, what is critical here is that the details of the work arrangement are agreed and clearly understood by both the employee and the employer.

The Act provides that expenses which are otherwise deductible cannot be deducted as workspace-in-the-home expenses unless the workspace is where the employee principally (that is, more than 50%) performs their duties of employment. The Act also requires that form T2200 be completed and signed by the employer to certify the conditions of employment. However, a signed form does not provide an employee with any assurance that the expenses incurred are deductible since the Act contains other requirements that the employee must satisfy.

With regard to the completion of Form T2200, Question 10 on the form asks that an employer approximate the percentage of the employee’s duties of employment that were performed at a workspace in the home. However, an employer is not asked to certify whether this workplace was the place where the employee principally performed their duties of employment.

And finally, and most importantly, as the nature of work arrangements and the manner in which they are documented will dictate, any employer should use the method which best aligns with its practices and procedures to collect the information needed to respond to question 10 on Form T2200.

Official Response

25 November 2021 CTF Roundtable Q. 9, 2021-0911851C6 - Work-Space-In-The-Home Expenses

Q.10 – Regulation 100(4)(a) and Payroll Deductions and Remittances

- Per Reg. 100(4)(a) and T4001 Employer's Guide, where an employee is not required to report for work at any establishment of the employer, the employee is deemed to report for work at the establishment from which the employee’s salary and wages are paid

- Generally, this means the location of the payroll department or payroll records

- Example:

- Large national company with centralized payroll department in Ontario

- Mr. Y lives in PEI and works for the company

- Pre-pandemic, Mr. Y reported to work at the company’s office in PEI; post-pandemic, Mr. Y and his team are fully remote

- Mr. Y has no authority to contract on behalf of the company

- Mr. Y’s job function remains unchanged; still serves Atlantic region and the Company maintains a permanent establishment in PEI

- Current guidance suggests Mr. Y will be employed in Ontario post-pandemic

- Given the trend of remote working, will the CRA consider a change to its position so that Mr. Y's province of employment will be PEI?

Preliminary Response

Moreno: Reg. 102(1) provides that the withholding is to be based on the province where the employee reports to work at an establishment of the employer.

Where there is no establishment to which the employee reports, Reg. 100(4)(a) defaults to the establishment from which the remuneration is paid.

Reg. 100(4) is applicable to the example provided, and the withholding would have to be based in Ontario.

Official Response

25 November 2021 CTF Roundtable Q. 10, 2021-0911861C6 - Regulation 100(4)(a) and Payroll Deductions

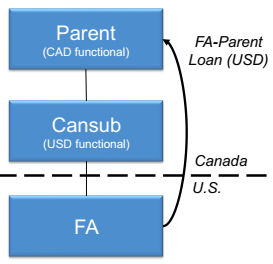

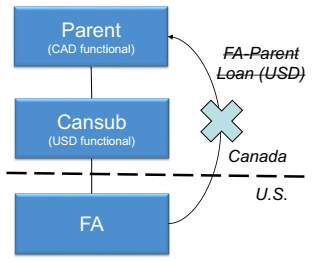

Q.11 -Subsection 261(21), Loan to FA and Excluded Property

- From CRA Doc No. 2017-0691211C6:

- Canadian resident Parent computes its Canadian tax results in CAD

- Cansub has made a USD functional currency election

- FA carries on an active business in the U.S. and uses USD as its “calculating currency” for purposes of the Canadian foreign affiliate rules

- FA makes an upstream loan to Parent (FA-Parent Loan) denominated in USD

- Parent enters into a 3rd party hedging arrangement to hedge its FX exposure on the FA-Parent Loan

- The FA-Parent Loan is not “excluded property” of FA

- Parent realizes an FX loss on the repayment of the FA-Parent Loan, and an offsetting FX gain on the settlement of the hedge

- Per CRA:

- Pursuant to subsection 261(6.1), FA is deemed to have elected to determine its Canadian tax results in USD for purposes of determining its FAPI in respect of Cansub, and any amount relevant to that determination

- Based on the FA-Parent Loan giving rise to FAPI and the context of subsection 261(6.1), subsection 261(21) applied to the FA-Parent Loan, such that Parent’s FX loss was effectively denied

- Assume instead:

- The “specified transaction” is a loan from Parent to FA (Parent-FA Loan)

- The gain or loss that is derived from the settlement of this loan is deemed, pursuant to paragraph 95(2)(i), to be a gain or loss from the disposition of an excluded property of FA (not giving rise to FAPI)

- Does the CRA agree that subsection 261(21) should not apply in respect of the Parent-FA Loan?

Preliminary Response

Moreno: Basically, s. 261(21) denies a foreign exchange gain or loss by deeming that the fluctuation in the foreign exchange rates that created the reduced gain or increased loss did not exist.

There are three conditions for the application of s. 261(21), which appear in s. 261(20). First, there must be a transaction between a taxpayer and a related corporation. Second, the taxpayer and related corporation must have different tax reporting currencies. Third, it must be reasonable to consider the exchange-rate fluctuation between those currencies would have had an incidence on the computation of the income, gains, or losses of the taxpayer.

In this example, we have a transaction between related parties (the Parent-FA loan), and the loss incurred by Parent results from the fluctuation in the US/ Canadian dollar exchange rate. The central question on these facts is whether Parent and FA have a different tax reporting currency.

Parent did not make an election, so that its tax reporting currency is the Canadian dollar. No amount would be entered in the determination of FA’s FAPI in respect of Cansub on the settlement of the Parent-FA loan, on the basis that the Parent-FA loan is excluded property.

There is no indication in the question that there are any other Canadian tax results to FA. On that basis, FA does not have Canadian tax results, it therefore would not have a tax reporting currency either, and so that condition in s. 261(20) is not met. Therefore, s. 261(21) is not applicable to cancel the loss in Parent.

Our answer turns on the facts and assumptions in this question. For different circumstances, we would entertain ruling requests where taxpayers are dealing with a potential application of s. 261(21) and would like to have certainty from CRA.

Official Response

25 November 2021 CTF Roundtable Q. 11, 2021-0911941C6 - 261(21), Loan to FA and Excluded Property

Q.12 – Remission Orders and Fees

- Fees charged by the CRA for providing Rulings and Pre-ruling Consultations are governed by the Service Fees Act

- Per Service Fees Act, s.7, a reduction of a fee (a remission) is required where the CRA considers that a service standard has not been met

- A. Can the CRA describe how a remission will be determined with respect to the fees charged for Rulings and Pre-ruling Consultations?

- B. Can the CRA confirm whether the hourly rate charged for Rulings and Pre-ruling Consultations is expected to change?

Preliminary Response

Prud'Homme: Our rulings and pre-rulings consultations have service targets. If we miss these targets, our clients are entitled to a remission of the service fees. This process is set out in Appendix H of CRA’s IC70-6, and the remission of those service fees will be applicable for all ruling requests or pre-ruling consultations that are received after April 2021.

We are also changing our fee structure. We are supposed to be operating on a cost-recovery basis. The fee structure of our Directorate was last updated in 2000. Over the next two years, we will phase in a fee change that will bring our billings in alignment with the actual cost of delivering our services. Beginning April 2022, the base rate for a ruling or pre-ruling consultation will be $221 per hour and on April 2023, the base rate will increase to $281 per hour, and these amounts will be adjusted afterwards in accordance with the consumer price index.

Official Response

25 November 2021 CTF Roundtable Q. 12, 2021-0912081C6 - ITR Remissions and Fees

Q.13 – Income Tax Rulings Directorate

- We understand that the Income Tax Rulings Directorate recently underwent an internal evaluation process

- Can the CRA provide us with some information about the results?

Preliminary Response

Prud'Homme: CRA’s program evaluation area interviewed employees, tax industry representatives, officials of other jurisdictions and our clients, and they issued a report that is available and has been published on Canada.ca. Two main recommendations were made.

First, while clients were generally very satisfied with our staff and the quality of the interpretative positions that were issued, the timeliness of our products can be of concern. We hope to address this. The Directorate is reviewing its service model right now, and reviewing its priorities for options to reduce the turnaround time in files.

Second there was a recommendation that we change our performance measurement practices to enhance transparency, and in order to do that, we will basically take all the information and make that information available again in the Information Circular, so it will be easier for everybody to be able to find that information by going automatically to the Information Circular.

We will also be reintroducing post-engagement surveys when we issue rulings and technical interpretations. We intend to restart that practice next spring.

Official Response

25 November 2021 CTF Roundtable Q. 13, 2021-0912071C6 - ITRD Internal Evaluation process

Q.14 – Failure to Properly File a T1135 and Section 233.

- Form T1135 advises taxpayers not to include shares of the capital stock or indebtedness of a “foreign affiliate”

- Form T1135 does not indicate that the term “foreign affiliate” for purposes of subsection 233.4 (and therefore Form T1135) has a different, much narrower meaning, than that term has for other purposes of the ITA3

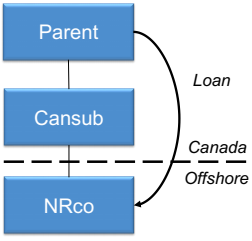

- NRco is a “foreign affiliate” of both the Canadian Parent and Cansub under the definition of “foreign affiliate” that applies generally for the purposes of the ITA

- However, under the restricted definition of “foreign affiliate” that applies for purposes of section 233.4, NRco is a foreign affiliate of Cansub only

- Therefore, if Parent held indebtedness owing by NRco, it would have to report the indebtedness on the T1135

- Where a taxpayer (e.g., Parent) has failed to file a T1135 or has failed to include an amount on the T1135 because the taxpayer relied on the wording of the T1135 (which does not reflect the more narrow exclusion for foreign affiliates) will the CRA pursue the taxpayer for penalties in respect of the failure?

Preliminary Response

Moreno: S. 220(3.1) provides the Minister with discretion to eliminate, waive or cancel penalties or interest in some circumstances. There are additional guidelines to the exercise of that discretion in IC-071R1.

Applications for cancellation or waiver of interest or penalties for taxpayers that were misled by the wording of T1135 would be entertained by CRA. CRA also encourages taxpayers to voluntarily correct their tax affairs by submitting adjustments to correct past filing errors, or through the application of the voluntary disclosure program.

Official Response

3 November 2021 CTF Roundtable Q. 14, 2021-0911951C6 - Failure to properly file a T1135

Q.15 – “Current Use” Approach and Clauses 95(2)(a)(ii)(B) and (D)

- Where one foreign affiliate (FA Finco) of a taxpayer makes a loan to another foreign affiliate, clauses 95(2)(a)(ii)(B) and (D) are often relied upon to deem interest earned by FA Finco to be income from an active business.

- Please describe how the “current use approach”, developed by the courts in the context of interpreting subparagraph 20(1)(c)(i), would apply in the following two examples.

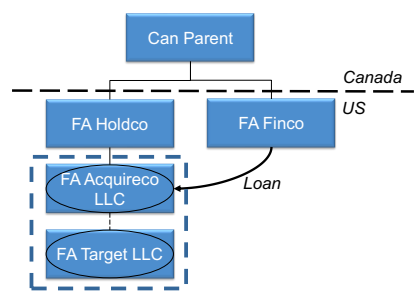

- Example 1:

- FA Finco lends money to FA Acquireco LLC, which uses the money to purchase all of the shares of FA Target LLC from an arm’s length vendor

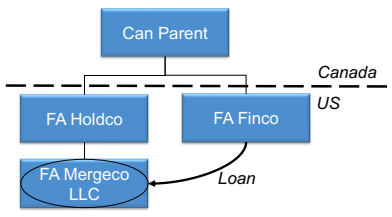

- FA Target LLC merges into FA Acquireco LLC (the survivor), which is then renamed FA Mergeco LLC

- FA Mergeco LLC only earns active business income

-

- The shares of FA Acquireco LLC and FA Target LLC are excluded property and all of the properties of FA Acquireco LLC and FA Target LLC are excluded property

- FA Mergeco LLC, FA Acquireco LLC, and FA Target LLC have not elected to be taxed as corporations for U.S. tax purposes

- FA Holdco is a corporation formed in Delaware and taxed as a corporation for US tax purposes

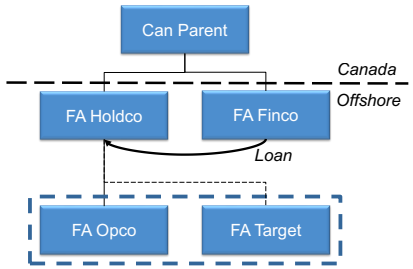

- Example 2:

- FA Finco lends money to FA Holdco, which uses the money to purchase all of the shares of FA Target from an arm’s length vendor

- Shares of FA Target are not excluded property

- FA Target subsequently merges into FA Opco to create FA Mergeco

-

- On merger, FA Holdco receives shares of FA Mergeco, replacing its shares of FA Target and FA Opco

- After merger, all or substantially all of the properties of FA Mergeco are excluded property

Preliminary Response

Example 1

Moreno: After the merger of FA Acquireco and FA Target LLC, interest will be payable by the Mergeco to Finco. The question here is whether the interest that is paid by Mergeco to Finco would qualify for the active business income recharacterization under s. 95(2)(a)(ii)(B) (“Clause B”). The condition in Clause B is that the interest must be deductible by Mergeco LLC in computing its earnings. Reg. 5907 indicates that, because Mergeco is a disregarded entity for US tax purposes, the earnings are to be calculated under Part I as if the corporation were resident in Canada and its business were carried on in Canada.

This brings us to s. 20(1)(c), and the question is whether interest is deductible on the loan. In interpreting s. 20(1)(c), the courts have found that the current use, rather than the original use, is relevant in determining whether the borrowing is used to generate property or business income.

The courts have also found that there must be a link between the money that was borrowed and the current use – the “current use approach.”

In this scenario the interest is deductible (and thus recharacterized under Clause B) to the extent that the loan can be linked to a current eligible use. In this case, the example indicates that the property in FA Mergeco would be used in an active business. The interest should, therefore, be deductible in these circumstances.

Example 2

Here, Clause D is relevant. It requires that the borrowing by FA Holdco from FA Finco be used for the purpose of gaining income from property that is shares of a foreign affiliate in respect of which a taxpayer has a qualifying interest and which is excluded property to FA Holdco.

Generally, the use of money borrowed for the purposes of Clause D is to be determined based on the principles that apply under s. 20(1)(c). In this case, prior to the merger, FA Holdco used money that was borrowed to purchase the shares of FA Target. After the merger, FA Holdco received shares of Mergeco in replacement of the FA Target shares.

A reasonable argument could be made here that, for the purposes of Clause D, the current use of borrowed money is linked to the shares of Mergeco and, to the extent that there is a reasonable expectation that FA Holdco will receive dividends on the shares of Mergeco, that the shares of Mergeco are excluded property at all relevant times; and that FA Mergeco will be a foreign affiliate of the taxpayer, and the rule under Clause D would probably apply; and the purpose and use test would be met after the merger.

Official Response

25 November 2021 CTF Roundtable Q. 15, 2021-0911921C6 - Curr Use & 95(2)(a)(ii)(B) & (D)

Q.16 – Convertible Debentures and Part XIII Withholding Tax

- 2010: Joint Committee on Taxation makes a submission re Part XIII withholding tax and convertible debentures

- May 2013 - CRA analysis on the issue was substantially advanced but needed to consult with the Department of Finance

- November 2013: General update from CRA but no additional certainty given the broad circumstances in which convertible debentures may be issued

- November 2021: ???

- Given your experience over the last eight years, can the CRA provide any further guidance regarding withholding tax in the context of convertible debentures?

Preliminary Response

Prud'Homme: There is not a huge volume of business on this subject. In November 2013, we encouraged issuers and holders of convertible debts to request a ruling if they had concerns about the application of Part XIII, but we only received one additional ruling request since then. We also issued a letter of amendments in 2014 regarding a 2012 ruling.

The letter of amendments provided two additional rulings and one opinion on this subject.

The first such ruling provided that, for the purpose of 212(1)(b), any amount deemed to be a payment of interest on the convertible note under s. 214(7) as a result of the conversion of the convertible note into common shares would not be participating debt interest.

The second ruling provided that, in that situation, any amount deemed to be a payment of interest would not be subject to Part XIII withholding tax, provided of course that the issuer and the non-resident creditor were dealing at arm’s length.

The opinion dealt with the event of a disposition of a convertible note by a non-resident to a person resident in Canada, other than the issuer, for proceeds of disposition payable in cash. The question was: what about the amount deemed to be a payment of interest on a convertible note under s. 214(7) in such a situation? We confirmed that it would not constitute participating debt interest.

We also granted issued similar rulings in 2014, and the rulings given were also applicable to the payment of make-whole amounts.

In response to Q.12 at the May 2009 IFA Roundtable, the CRA stated that, where there is a conversion of a traditional convertible debenture by its original holder for common shares of the capital stock of the issuer, there would generally be no excess under s. 214(7). However, since then, there has been additional information to be considered. For example, in 2010, there was a letter of submissions by the Joint Committee that stated that, in such a situation, the conversion premium realized on conversion or sale of a convertible debenture would constitute an excess.

The Federal Court of Appeal’s decision in Agnico-Eagle Mines has also forced us to review our position. Unfortunately, we were unable to complete our review in time for this Roundtable. We will provide our views to the CTF when they are ready, and any changes will be applied on a prospective basis only.

Finally, the CRA is still of the view that the deemed payment of interest on convertible debentures under s. 214(7) arising on a transfer or assignment of the convertible debentures by a non-resident to a person resident in Canada does not generally constitute participating debt interest, assuming the parties are dealing at arm’s length.

Official Response

25 November 2021 CTF Roundtable Q. 16, 2021-0911911C6 - Convertible Debentures