Banro -- summary under Debt into common equity

Overview

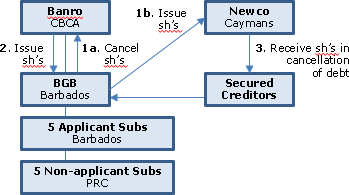

Banro is a CBCA holding company with two mines in the Democratic Republic of Congo held though indirect DRC subsidiaries. It, along with its direct and indirect Barbados subsidiaries, filed for protection under the CCAA on December 22, 2017 and was then delisted from the TSX and NYSE American. The secured debt (of U.S.$233M) to be compromised is owed at the level of a Barbados subsidiary held directly by Banro (BGB). This will permit Banro to effectively emigrate to the Cayman Islands as part of the proposed Plan of Compromise and Reorganization.

In particular, Banro’s shares of BGB will be cancelled, BGB will issue shares to a newly-formed Caymans company (Newco) for nominal consideration, and the secured creditors will receive shares of Newco in satisfaction of their secured claims against BGB – except that 25% of their claims will instead be treated as unsecured claims. The unsecured creditors will receive nothing other than sharing pro rata in a nominal sum ($10,000), and the Banro shareholders will receive nothing at all. The DIP lenders will receive 74% of the equity of Newco and all the voting rights, and the other secured creditors will receive 26% of that equity in the form of non-voting shares, subject to dilution by warrants.

The U.S. tax characterization of the reorganization is stated to be unclear.

Banro

Banro Corporation is a Canadian gold mining company focused on production from the Twangiza and Namoya mines, which began commercial production in September 2012 and January 2016 respectively. Through BGB, it holds five Barbados holding companies (which are included as applicants). Each such applicant subsidiary in turn holds a DRC subsidiary (a "Non-Applicant Subsidiary" - see below).

Newco

An exempted company organized under the laws of the Cayman Islands.

BGB

Banro Group (Barbados) Limited, which is wholly-owned by Banro.

Non-Applicant Subsidiaries

Banro Congo Mining S.A., Namoya Mining S.A. (“Namoya DRC”), Lugushwa Mining S.A., Twangiza Mining S.A., and Kamituga Mining S.A.

DIP Lenders

Baiyin and Gramercy (lenders under the Interim Facility).

Interim Facility (DIP loan)

A senior secured super priority (debtor-in-possession) interim, non-revolving credit facility up to a maximum principal amount of US$20,000,000 dated as of December 22, 2017. The Circular does not appear to disclose whether the borrower was Banro or BGB, but presumably it was the latter in order to avoid structural subordination.

Baiyin

Baiyin International Investment Limited and affiliates thereof within the direct or indirect control of Baiyin Nonferrous Group Company, Limited.

Gramercy

Gramercy Funds Management LLC, as agent for and on behalf of the funds and accounts for which it acts as investment manager or advisor;

Secured Notes

The 10% Secured Notes due March 1, 2021 in the principal amount of US$197.5 million, for which Banro Group (Barbados) Limited is the obligor and the other Banro parties are guarantors.

Doré Loan

A loan in the total principal amount of US$10.0 million advanced pursuant to a letter agreement dated July 15, 2016 between Baiyin International Investment Ltd and Twangiza Mining SA.

Affected Secured Claims

75% of the proven claim amounts for the Secured Notes, the Doré Loan and Namoya Forward II Agreement, being 75% of US$203,506,170, US$10,247,120 and US$20,000,000, respectively.

Equity effect of restructuring

The restructuring contemplates an equitization of 75% of all Affected Secured Claims pursuant to the Plan, pro-rata with their claim values, into 100% of the Class A and B Shares (“New Equity”) of Newco (subject to subsequent dilution on account of the Stream Equity Warrants and the New Secured Facility Warrants). The balance of 25% of the Affected Secured Claims will participate in and be compromised with the recognized unsecured creditors. It is anticipated that immediately following the Implementation Date, Baiyin will hold approximately 34.07% of the total outstanding equity of Newco (i.e. both Class A Common Shares and Class B Common Shares), Gramercy will hold approximately 40.28%, and the remaining Affected Secured Creditors will hold approximately 25.65% (subject to dilution for third parties down to 23.1% of the New Equity in the event that the Stream Equity Warrants and the New Secured Facility Warrants are exercised at full value). Baiyin and Gramercy will hold, between them, 100% of the voting equity of Newco in the form of Class A Common Shares.

Recapitalization steps

- All of BGB's shares held by Banro will be cancelled. BGB will simultaneously issue 100 common shares to Newco;

- as consideration for the Stream Amendments, the Stream Purchaser for the Twangiza Streaming Agreement and for the Namoya Streaming Agreement will receive penny warrants exercisable into an equity stake of up to 4.553% and 3.447%, respectively of the Newco common equity;

- all of the issued and outstanding equity interests in Banro will be cancelled and Banro will issue 100 common shares to BGB;

- concurrently with 5 and 6 below. each of Baiyin and Gramercy, as holders of Affected Secured Claims, will be entitled to receive a distribution (pro rata as between the two of them) of the Class A Common Shares of Newco in settlement of their Affected Secured Claims;

- Each other holder of Affected Secured Claims will be entitled to receive a pro rata distribution of the Class B Common Shares of Newco in settlement of its Affected Secured Claims;

- New Equity received by an Affected Secured Creditor will be applied first to the payment of principal rather than to the payment of accrued and unpaid interest;

- Each proven unsecured creditor will be entitled to receive a pro rata distribution from a cash pool of $10,000;

- the intercompany Claims will be treated as determined by the Applicants;

- the Interim Facility will be replaced by a new secured facility; and

- Newco will issue warrants on the common shares of Newco (the “New Secured Facility Warrants” to the DIP Lender.

Effect of Recapitalization

Upon completion of the Recapitalization, Affected Secured Creditors will become shareholders of Newco, Banro, will, in turn, be an indirect, wholly owned subsidiary of Newco and BGB will be a direct, wholly-owned subsidiary of Newco. The Applicants (other than Banro) and the Non-Applicant Subsidiaries will remain as direct and indirect subsidiaries of BGB. The Gold Streams, the Twangiza Forward I Agreement and the Namoya Forward I Agreement will remain in effect.

Canadian tax consequences

Disposition by Secured Noteholders

A Resident Holder of Secured Notes will be considered to have disposed of its Secured Notes upon the exchange of Secured Notes for New Equity and the Resident Holder's pro rata share of the Affected Banro Unsecured Cash Pool (collectively the "Secured Note Consideration") on the Implementation Date.

Allocation first to interest

Under the Plan, the aggregate fair market value of the Secured Note Consideration received by an Affected Creditor in exchange for Secured Notes will be allocated first to the principal amount of the Secured Notes and the balance, if any, to the accrued and unpaid interest on the Secured Notes….Consequently, it is not expected that any amount of interest accrued on the Secured Notes will be paid or satisfied under the Plan.

U.S. tax consequences

The U.S. federal income tax treatment of the exchange of Proven Affected Secured Claims for New Equity by U.S. Holders pursuant to the Plan is unclear, due in part to the uncertainty regarding the formal steps of the exchange. One possibility is that the Plan could be implemented by means of the New Equity being deemed to be transferred, directly or indirectly, by Newco to BGB, and such New Equity then being deemed to be transferred by BGB to the Holders in satisfaction of their Claims. In this scenario, a U.S. Holder would treat the exchange as a taxable transaction in which it generally recognizes gain or loss for U.S. federal income tax purposes in an amount equal to the difference between (a) the fair market value of the New Equity, and (b) the U.S. Holder's adjusted tax basis in the Claim surrendered in the exchange. In light of the fact that the Secured Notes have been treated as contingent payment debt instruments for U.S. federal income tax purposes, any gain on the exchange of a Proven Secured Notes Claim would be treated as ordinary income and any loss on such a claim would be treated as ordinary loss to the extent of prior inclusions of original issue discount ("OID"), with any excess loss a capital loss.

It is also possible that the U.S. Holders of Proven Affected Secured Claims could be treated as exchanging their Claims directly with Newco for the New Equity. In that case, the U.S. federal income tax consequences to a U.S. Holder would depend in part on whether the Claims surrendered in the exchange constitute "securities" for U.S. federal income tax purposes.

If a U.S. Holder of a Proven Affected Secured Claim is treated as exchanging its Claim directly with Newco for the New Equity and such Claim is not treated as a "security," the U.S. Holder would be required to recognize gain (but not loss) on the exchange in an amount equal to the difference between (a) the fair market value of the New Equity, and (b) the U.S. Holder's adjusted tax basis in the Claim surrendered in the exchange. If, on the other hand, the Proven Affected Secured Claim is treated as a "security," a U.S. Holder generally would not recognize gain or loss on the exchange, provided that a U.S. Holder owning 5% or more of the total voting power or total value of the stock of Newco immediately after the exchange may be required to recognize gain (but not loss) unless it enters into a gain recognition agreement with the IRS.