Central Fund/Sprott -- summary under MFC Conversion to MFT

Overview

CFCL is a mutual fund corporation holding gold and silver bullion that has an accrued gain of approximately Cdn.$1.7 billion. It is controlled by the Spicer family, who control its 40,000 common shares, and its 252M Class A shares are mostly held by the public. Before Sprott overtures commenced, its Class A shares had been trading on the TSX at a 7% discount to the underlying bullion value.

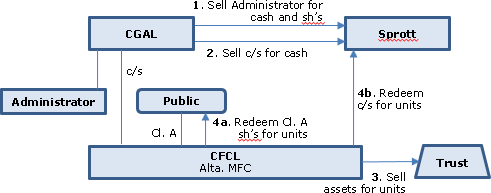

In order for Sprott to effectively purchase the Spicer management business and for CFCL to be converted into a mutual fund trust, it is proposed that under an Alberta Plan of Arrangement,

- the common shares will be sold to Sprott for cash consideration reflecting the value of their voting rights (there is no coattail),

- the shares of a “New Administrator” will be sold to Sprott for $85M in cash and 7M Sprott shares plus an earnout, and

- CFCL will be merged under s. 132.2 into a trust newly-formed by Sprott (Sprott Physical Gold and Silver Trust). Under the exchange terms, the Common and Class A shares will be treated as having equal values, so that after the merger Sprott will hold 0.016% of the Trust units, implying that it paid a 2900% premium for the common shares.

In addition to the Trust units being redeemable for cash equalling 95% of the lesser of their NAV and 5-day VWAP, larger blocks of units may be redeemed in specie, which is expected to largely eliminate the trading discount. Using bullion to redeem units in one’s capital is not a sale or other trading transaction, and the bullion held by the Trust is expected to be capital property, given that significant sales of bullion to honour cash redemption demands is not anticipated. Gains realized on an in specie redemption will be allocated to the redeemed unitholder.

The Trust will be a PFIC.

CGAL

The Central Group Alberta Ltd., whose shareholders are Philip M. Spicer and J.C. Stefan Spicer.

CFCL

CFCL is an Alberta (ABCA) mutual fund corporation. Its dual class share structure has been in place since 1961. The Class A Shares, which are non-voting and retractable at 80% of NAV, have been listed on the TSX since 1965 and are also listed on the NYSE American. In accordance with TSX rules, the articles of CFCL do not contain any takeover protective provisions or "coattails." The Spicer family currently have legal and effective control of CFCL through their ownership of all of the issued and outstanding shares of CGAL and indirect ownership of 49.5% of CFCL's issued and outstanding Common Shares.

CFCL Common Shares

As at October 26, 2017 there were 252,116,003 Class A Shares and 40,000 Common Shares outstanding. Unlike the Class A Shares, the CFCL Common Shares have voting rights (of one vote per share) in all circumstances, including the right to elect the CFCL Board, and therefore collectively control CFCL. The Common Shares are also not listed for trading on any stock exchange. Except for a Class A Share priority that is applicable when the NAV is under $3.00, they participate equally on a per-share basis with the Class A Shares as to dividends and on liquidation. The cash offer price payable under the Arrangement is C$500 per Common Share.

The Trust

The Trust was established on October 26, 2017 under Ontario law pursuant to a trust agreement between the Trust's settlor, Sprott Asset Management LP (the "Manager") and RBC Investor Services Trust ("RBC Investor Services" or the "Trustee"), as trustee. The Trust was created to participate in the Arrangement and to subsequently invest and hold substantially all of its assets in physical gold and silver bullion. Assuming that there are no Dissenting Shareholders, former Class A Shareholders are expected to hold approximately 252,116,003 Trust Units, representing 99.984% of the issued and outstanding Trust Units and Sprott is expected to hold approximately 40,000 Trust Units, representing 0.016% of the issued and outstanding Trust Units.

New Administrator

2070140 Alberta Ltd.

Sprott

Sprott Inc. is a TSX-listed corporation engaged in asset management (including of exchange-listed funds) and making private resource investments.

Reasons for conversion

Over the past three years, the Class A Shares have traded at an average discount of approximately 7.1% to their NAV. Given that the Trust will have redemption features similar to those of Sprott's current physical bullion trusts, including a physical redemption feature, it is expected that the Trust Units should trade closer to their underlying NAV than has been the case with the Class A Shares.

Cash redemption right

The cash redemption value of the Trust Units is based on 95% of the lesser of: (i) the volume weighted average trading price of the Trust Units traded on NYSE Arca for the last five trading days for the month in which the redemption request is processed and (ii) the NAV of the redeemed Trust Units as of 4:00 p.m. (Toronto time) on the last day of such month.

Physical redemption right

A Trust Unitholder may only redeem Trust Units for physical gold and silver bullion, provided the redemption request is for at least the Minimum Bullion Redemption Amount (being, generally, for 100,000 Trust Units). The quantity of physical gold and silver bullion a redeeming Trust Unitholder is entitled to receive is determined by the Manager by allocating the Redemption Amount (based on the net asset value) between the applicable bullion Redemption Amounts and the makeup of the Trust's inventory of physical gold and silver bullion. Any portion of gold or silver bullion not available at the time of redemption will be paid in cash at a rate equal to 100% of aggregate value of the NAV per Trust Unit of such unavailable amount.

Trust allocation of gains to redeemed Unitholders

The Trust will have the authority to distribute, allocate and designate any income or taxable capital gains of the Trust for the purposes of the Tax Act to the Trust Unitholder who has redeemed Trust Units during a year in an amount equal to the taxable capital gains or other income realized by the Trust as a result of distributing physical bullion to such Trust Unitholder, and any taxable capital gain or income realized by it before, at or after the redemption by virtue of the Trust being required to sell bullion in order to fund the payment of the cash redemption proceeds to such Trust Unitholder, or such other amount that is determined by the Trust to be reasonable.

Plan of Arrangement

- The Administration Agreement shall be assigned to, assumed by and novated to the New Administrator.

- The common shares in the capital of the New Administrator shall be assigned by CGAL to Sprott in exchange for the CGAL Aggregate Consideration, being cash of $85 million plus 6,997,387 Sprott Shares.

- Each of the Class A Shares in respect of which Dissent Rights have been validly exercised shall be transferred in exchange for a debt claim against the Trust.

- Each Common Share shall be transferred to Sprott in exchange for the Common Share Consideration of $500 cash per share ($20M in aggregate).

- CFCL shall transfer to the Trust all its assets other than the Administration Agreement.

- In consideration, the Trust shall assume all of CFCL’s liabilities other than under the Administration Agreement and issue to CFCL Trust Units equalling the aggregate number of Class A Shares and Common Shares.

- The Unit held by Sprott Asset Management LP as settlor of the Trust shall be cancelled without any payment in respect thereof.

- Each Class A Share and each Common Share shall be redeemed and cancelled by CFC in exchange for one Trust Unit.

Earnout Agreement

In addition to the C$85 million in cash to be paid by Sprott to CGAL and the 6,997,387 Sprott Shares to be issued by Sprott to CGAL as consideration for the sale of all of the outstanding shares of the New Administrator pursuant to the Plan of Arrangement under __, Sprott will also pay CGAL an earnout amount, being the greater of: (a) C$5 million; and (b) an amount based on a formula related to the legacy assets of CFCL held by the Trust on the first anniversary of the Arrangement.

Canadian tax consequences

Qualifying exchange

The Arrangement is expected to include a "qualifying exchange" as defined in s. 132.2 of the Tax Act. Provided that this is the case, all of the assets of CFCL being transferred to the Trust will be deemed to be transferred for proceeds of disposition that will generally equal their cost amount. Where a Class A Shareholder disposes of Class A Shares to CFCL in exchange for Trust Units on the repurchase of Class A Shares pursuant to the Arrangement, the CFCL Shareholder's proceeds of disposition for the Class A Shares disposed of, and the cost to the Class A Shareholder of the Trust Units received in exchange therefor, will be deemed to be equal to the adjusted cost base to the Class A Shareholder of the Class A Shares immediately prior to their disposition.

Part XIII tax

If the Trust treats distributed gains as being on capital account and the CRA later determines that the gains were on income account, then Canadian withholding taxes would apply to the extent that the Trust has distributed the gains to non-resident Trust Unitholders and Canadian resident Trust Unitholders could be reassessed to increase their taxable income. Any taxes borne by the Trust itself would reduce the NAV and the trading prices of the Trust Units;

Accrued gain on CFCL bullion

The average cost base for tax purposes of the bullion held by CFCL is considerably below its current market value resulting in a significant unrealized capital gain and, in the event of the sale of bullion for cash or the delivery of physical bullion to Trust Unitholders who exercise the enhanced redemption provision, a potential tax on such gain. The aggregate unrealized gain is currently estimated at approximately Cdn.$1.7 billion.

Treatment by Trust of bullion as capital property

In the view of Canadian counsel, the holding by the Trust of physical gold and silver bullion with no intention of disposing of such bullion except in specie on a redemption of Trust Units likely would not represent an adventure in the nature of trade so that a disposition, on a redemption of Trust Units, of physical gold and silver bullion that previously had been acquired with such intention would likely give rise to a capital gain (or capital loss) to the Trust. As the Manager intends for the Trust to be a long-term holder of physical gold and silver bullion and does not anticipate that the Trust will sell its physical gold and silver bullion (otherwise than where necessary to fund expenses of the Trust), the Manager anticipates that the Trust generally will treat gains (or losses) as a result of dispositions of physical gold and silver bullion as capital gains (or capital losses), although depending on the circumstances, the Trust may instead include (or deduct) the full amount of such gains or losses in computing its income.

SIFT trust rules

The mere holding by the Trust of physical gold and silver bullion as capital property (or as an adventure in the nature of trade) would not represent the use of such property in carrying on a business in Canada and, therefore, would not by itself cause the Trust to be a SIFT trust.

U.S. tax consequences

Exchange

The exchange of Class A Shares for Trust Units pursuant to the Arrangement should be treated as one step in a series of integrated transactions that, considered together, qualify as a reorganization for U.S. federal income tax purposes. A U.S. Holder that exchanged Class A Shares for Trust Units pursuant to the Arrangement generally would not recognize gain or loss on the exchange.

PFIC status

The Trust expects to be a PFIC, which may have adverse U.S. federal income tax consequences to U.S. Holders who do not make certain elections. A U.S. Holder that makes a QEF Election with respect to his, her or its Trust Units may be required to include amounts in income for United States federal income tax purposes if any holder redeems Trust Units for cash or physical gold and silver bullion.